Register for free to join our community of investors and share your ideas. You will also get access to streaming quotes, interactive charts, trades, portfolio, live options flow and more tools.

New Jersey Mining Co (NJMC)

0.308 ? -0.017 (-5.23%)

Volume: 56,400 @06/29/21 2:57:42 PM EDT

Bid Ask Day's Range

0.32 0.3338 0.308 - 0.3346

NJMC Detailed Quote

New Jersey Mining Co (NJMC)

0.36 ? 0.01 (2.86%)

Volume: 516,116 @05/26/21 3:52:33 PM EDT

Bid Ask Day's Range

0.34 0.37 0.2977 - 0.37

NJMC Detailed Quote

About New Jersey Mining Company

Headquartered in North Idaho, New Jersey Mining Company is the rare example of a vertically integrated, operating junior mining company. NJMC produces gold at the Golden Chest Mine and recently consolidated the Murray Gold Belt (MGB) for the first time in over 100-years. The MGB is an overlooked gold producing region within the Coeur d'Alene Mining District, located north of the prolific Silver Valley. In addition to gold, the Company maintains a presence in the Critical Minerals sector and is focused on identifying and exploring for Critical Minerals (Rare Earth Minerals) important to our country's defensive readiness and a low-carbon future.

New Jersey Mining Company possesses the in-house skillsets of a much larger company while enjoying the flexibility of a smaller and more entrepreneurial corporate structure. Its production-based strategy, by design, provides the flexibility to advance the Murray Gold Belt and/or its Critical Minerals holdings on its own or with a strategic partner in a manner that is consistent with its existing philosophy and culture.

NJMC has established a high-quality, early to advanced-stage asset base in four historic mining districts of Idaho and Montana, which includes the currently producing Golden Chest Mine. Management is stakeholder focused and owns more than 15-percent of NJMC stock.

The Company's common stock trades on the OTC-QB under the symbol "NJMC."

For more information on New Jersey Mining Company go to www.newjerseymining.com or call:

Monique Hayes, Corporate Secretary/Investor Relations

Email: monique@newjerseymining.com

(208) 699-6097

#2 $NJMC New Jersey Mining Company Drills Double Gold Veins in Paymaster Shoot

Mon, May 24, 2021, 6:00 AM

https://finance.yahoo.com/news/jersey-mining-company-drills-double-130000724.html

COEUR D'ALENE, ID / ACCESSWIRE / May 24, 2021 / New Jersey Mining Company (OTCQB:NJMC) ("NJMC" or the "Company") is pleased to announce additional high-grade results from its core drilling program at the Golden Chest. These gold intercepts come from the recent 2020-2021 exploration drilling program in the Paymaster Shoot ("Paymaster"). All reported intervals are the true thickness of the vein. This drill program is designed to further delineate the Paymaster as well as "pull together" the known Paymaster and Skookum (location of current production) ore shoot boundaries.

GC 21-187 intercepted 1.8 meters of 10.9 gpt gold (including 0.6 meters of 29.2 gpt gold) in the upper vein and 2.1 meters of 4.2 gpt gold (including 1.2 meters of 7.2 gpt gold) in the lower vein.

Drill hole GC 21-187 continues to expand the Paymaster ore shoot, both down dip and along strike. This hole encountered both an upper and lower vein, and border a monzonite sill, which is characteristic of the Paymaster area. GC 21-187's upper vein (0.6 meters of 29.2 gpt gold) continues to show high gold grades similar to GC 20-183 (0.9 m of 14.7 gpt Au) and GC 21-184 (0.9 meters of 26.7 gpt Au). Both veins in GC 21-187 are approximately 52 meters from the same vein intercepts in GC 20-183 and 47 meters from the veins in GC 21-184.

NJMC's VP of Exploration, Rob Morgan commented, "This reinforces our plans to drill ever deeper holes, on 50-meter centers in all our ore shoots. GC 21-187 was targeted to expand the northern flank of the Paymaster ore shoot. This hole's success gives both good grades and pushes the northern boundary of the Paymaster's ore shoot out even further. This is significant because as we drill to the north, we naturally get closer to the current underground development infrastructure in the Skookum. In short, while conducting development, if we can mine ore (revenue that helps offset expenses) instead of mining all waste rock (which is largely an expense) it could result in a positive overall impact on timing and economics."

Story

The next series of NJMC drill holes will test the area between the Skookum and Paymaster ore shoots. We plan to evaluate ramp development to the south once all the drilling data has been collected and interpreted. The Paymaster area is attractive because there are two very distinct high grade gold veins approximately 30 meters apart allowing for the mining of multiple headings.

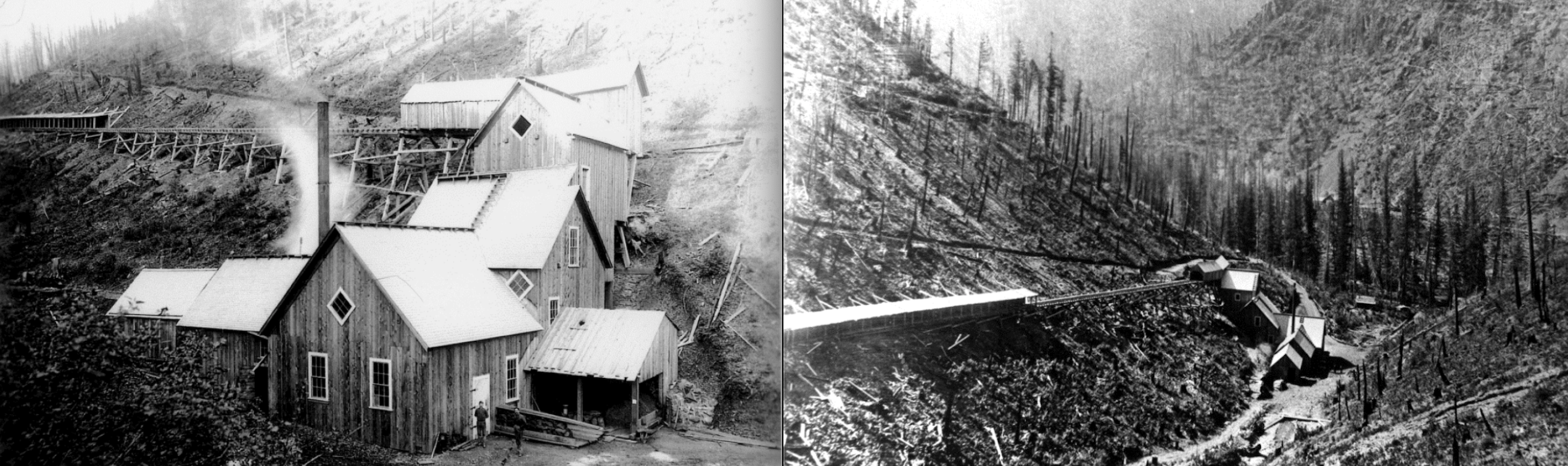

The Paymaster claim, established in 1883, has the honor of being the first hard rock lode claim in the Coeur d'Alene Mining District and predates the discovery and establishment of the world-class Silver Valley.

Qualified person

NJMC's Vice President of Exploration, Robert John Morgan, PG, PLS is a qualified person as such term is defined in National Instrument 43-101 and has reviewed and approved the technical information and data included in this press release.

About New Jersey Mining Company

Headquartered in North Idaho, New Jersey Mining Company is the rare example of a vertically integrated, operating junior mining company. NJMC produces gold at the Golden Chest Mine and recently consolidated the Murray Gold Belt (MGB) for the first time in over 100-years. The MGB is an overlooked gold producing region within the Coeur d'Alene Mining District, located north of the prolific Silver Valley. In addition to gold, the Company maintains a presence in the Critical Minerals sector and is focused on identifying and exploring for Critical Minerals (Rare Earth Minerals) important to our country's defensive readiness and a low-carbon future.

New Jersey Mining Company possesses the in-house skillsets of a much larger company while enjoying the flexibility of a smaller and more entrepreneurial corporate structure. Its production-based strategy, by design, provides the flexibility to advance the Murray Gold Belt and/or its Critical Minerals holdings on its own or with a strategic partner in a manner that is consistent with its existing philosophy and culture.

NJMC has established a high-quality, early to advanced-stage asset base in four historic mining districts of Idaho and Montana, which includes the currently producing Golden Chest Mine. Management is stakeholder focused and owns more than 15-percent of NJMC stock.

The Company's common stock trades on the OTC-QB under the symbol "NJMC."

For more information on New Jersey Mining Company go to www.newjerseymining.com or call:

Monique Hayes, Corporate Secretary/Investor Relations

Email: monique@newjerseymining.com

(208) 699-6097

Forward Looking Statements

This release contains "forward-looking statements" within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended that are intended to be covered by the safe harbor created by such sections. Such statements are based on good faith assumptions that New Jersey Mining Company believes are reasonable, but which are subject to a wide range of uncertainties and business risks that could cause actual results to differ materially from future results expressed, projected or implied by such forward-looking statements. Such factors include, among others, the, the risk that the mine plan changes due to rising costs or other operational details, an increased risk associated with production activities occurring without completion of a feasibility study of mineral reserves demonstrating economic and technical viability, the risks that development does not encounter ore and offset development costs and hazards inherent in the mining business (including risks inherent in developing mining projects, environmental hazards, industrial accidents, weather or geologically related conditions), changes in the market prices of gold and silver and the potential impact on revenues from changes in the market price of gold and cash costs, a sustained lower price environment, risks relating to widespread epidemics or pandemic outbreak including the COVID-19 pandemic; the impact of COVID-19 on our workforce, suppliers and other essential resources and what effect those impacts, if they occur, would have on our business, including our ability to access goods and supplies, the ability to transport our products and impacts on employee productivity, the risks in connection with the operations, cash flow and results of the Company relating to the unknown duration and impact of the COVID-19 pandemic as well as other uncertainties and risk factors. Actual results, developments and timetables could vary significantly from the estimates presented. Readers are cautioned not to put undue reliance on forward-looking statements. NJMC disclaims any intent or obligation to update publicly such forward-looking statements, whether as a result of new information, future events or otherwise.

SOURCE: New Jersey Mining Company

View source version on accesswire.com:

https://www.accesswire.com/648705/New-Jersey-Mining-Company-Drills-Double-Gold-Veins-in-Paymaster-Shoot

New Jersey Mining Company Drills Double Gold Veins in Paymaster Shoot

Mon, May 24, 2021, 6:00 AM

https://finance.yahoo.com/news/jersey-mining-company-drills-double-130000724.html

New Jersey Mining Co (NJMC)

0.289 ? -0.021 (-6.77%)

Volume: 88,671 @04/16/21 3:54:10 PM EDT

Bid Ask Day's Range

0.2509 0.29 0.271 - 0.3099

NJMC Detailed Quote

Couldn’t agree more magoo.

Elevator going down in PPS- big volume selling today. Jersey sliding and could end up back to .20-.25 this week and who knows where it’s going too. We’ll see. It was dropping on light trading volume last week as well. Not much interest looks like, which is really interesting, to myself anyway. Looks like people played the pump up and sold off.

New PR 2 days ago is what it is. But I thought PPS was going to rightfully decline after run up last month and sure did erode and we’re declining into the .28’s now and likely going lower.

It’s too bad too, but real no volume or bid support seems to be Achilles heel with jersey for many many years. Sure it’s doubled since Swallow came on, but the imo vague PR in March while it was great to see Mgmt’s possible direction - none of it is concrete. Hence the price PPS spike and slow burn rest of March and now eroding into .20’s.

I am very curious as to if they do move to a higher OTC tier or the Big 3 exchanges - how do they propose getting to $1.00 for 90 days? RS on way? Or...?

I’m a big fan of the jersey - but casting an eye toward the imo vagueness of that PR that spiked PPS.

They also said it’s just a discussion about what they brought up - but there is no guarantee they reach either 20,000 oz’s, execute any spin off or even move to a Senior exchange. Pretty vague PR in many ways.

They need capital for NJMC & develop rare earth REE in central Idaho. The senior exchange they mentioned could be the top tier of OTC - which is OTCQX. Which they require for 90 consecutive days the stock price at $1.00 or higher - amongst other conditions. They also do not allow stock promoters at that level. The difference is there is no market order executions such as on AMEX, NYSE, NAS. The OTCQX broker dealers instead accumulate shares and sell/buy between each other in their OWN network- through an OTC LINK. Currently their considered a business venture with the OTCQB.

I have been here for many many years and know firsthand the local area where mine is located.

I would like to hear more specific information from the company in a form of a press release indicating which specific exchange they are discussing and also what exchange will spin off be on as well plus if we’re getting shares in a potential spin off - how many are we getting. I ALSO would like to know including if there is ANY reverse spilt in their plans to achieve that $1.00 minimum stock price to qualify. If not - what’s their plans release PR’s to boost and capture attention and market interest? I feel like while it is appreciated they discussed in a PR- however it would be ideal if they provided a clearer understanding to shareholders. If they are doing a reverse split or If they choose to stay quiet on that - then after being a long time shareholder —I’ll likely sell off. I’m watching very closely. If it looks their going down that road with a RS- I’m out.

I do not want to see dilution either that will hurt shareholders so I’m very keen on seeing how they go about securing financing as well and any term sheet they sign. Reverse splits usually have a tendency to fall after they occur, usually like the Titanic. I’ll move to protect my own investment capital if that occurs, by jettisoning it.

Today the PPS showed a little weakness and we’ll see if it declines back down to .20’s - this company usually IMO doesn’t move too fast, so hard to tell how long this will all take. Right now in the .30’s I’m possibly selling some off take some profit. I saw the options sold as well that were set up and filed.

I am up as well - double +.

$NJMC VS Bitcoin (BTCUSD)$55,080.85 ? $878.70 (1.62%)Volume: 15,152.905 @03/23/21 2:28:28 PM UTC

Bid Ask Day's Range

$55,078.79 $55,080.85 $53,000.00 - $55,478.42

BTCUSD Detailed Quote

The idea to list on a senior exchange concerns me if that exchange requires a $1 plus share price. That would require a reverse split of more than 1:5.

That would make me a seller.

I do not believe NJMC has the following to support the higher price at this status of their development: 20,000 ounce producer at $1.80 share price. I do NOT think so.

I would expect the price to fall after a reverse split.

I bought shares in this gold mine, and all I got was a stupid T-shirt.

Just kidding.

Not much following. I found this one on my own.

I bought in Jan. 2017 as they made first gold pour at my average of $.1273.

This is one of the few gold stocks I own that has never gone negative.

IMO, if they can grow to 100K annual ounces, the price could get to $1.

Another thing I like about NJMC is they do not pay the outrageous executive salaries of most gold miners.

But when the price jumped to 60 cents, recognize that a few weeks prior the insiders exercised stock options at 42 to 45 cents. Somehow they got the price up so they could sell. That 60 cent price increase dropped back down the same day.

There’s a possibility the upper part of the mountain they have been blowing outside and removing ore last couple years and trucking it down the dirt access road above the adits, might be cutting back eventually. IMO the companies direction is ramping up back deep underground, with the infrastructure being implemented.

Over time, we’ll all see the updates on what their doing in the Murray.

The PR while it was informative, imo, I didn’t think it was earth shattering. There was some speculative PPS increases - for a few days - however- it has decreased and trading last week was choppy with a slightly downward trending pattern.

The potential for a spin off is potentially interesting on the rare metal plays- possible another trading symbol coming? Not enough info on that to hang hat on, however- we’ll maybe here more possibly

But, the Jersey is doing pretty good overall. Some PR’s are always better than others. But the PPS has increased annually lately. That I approve of.

WILL $NJMC TURN TO DIGITAL MINING TOKENS ????? DIGITAL CURRENCY ?????

$NJMC WILL GET ITS DUE ONE DAY

PR 03-05-21 wow YUGH read my friend 'New Jersey Mining Co. (NJMC)' & possible spinoff !!!!!

New Jersey Mining Company Evaluates Potential for 20,000 Oz/Year Gold Production at Golden Chest Mine & Possible Spin-out of Rare Earths Subsidiary to its Shareholders

COEUR D'ALENE, Idaho, March 5, 2021 (ACCESSWIRE) --

New Jersey Mining Company (OTCQB: NJMC) (“NJMC” or the “Company”)

is pleased to provide a “big picture” update,

including a preliminary discussion in regard to up-listing to a

senior exchange in concert with our plans to increase production at

the Golden Chest Mine and the potential for the spin-out of its rare earth subsidiary to shareholders.

NJMC President and CEO John Swallow stated,

“As business owners, fellow investors and community stakeholders

(and substantial NJMC shareholders),

we believe it is important to understand how or what a person

(or company) thinks, especially with regard to anticipating and adjusting to the multitude of macro and micro inputs.

As discussions continue to evolve (and subject to change),

and as the initial results of our drill program are received,

we felt that communication from management in regard to the

various paths being contemplated would be appreciated

– such as a recap and possible positioning of our Rare Earths subsidiary,

potential for increased gold production and eventually working toward

a senior exchange listing.”

CONCEPTUAL PLAN FOR UP TO 20,000 OZ/YR GOLD PRODUCTION AT GOLDEN CHEST

Conceptual Plan – Preliminary Economics

Preliminary internal estimates and the conceptual plans are based

on firsthand corporate experience with development,

mining,

exploration,

milling and

other knowledge gained from NJMC operations.

Budgeting for personnel,

equipment, and

underground development have been considered in this evaluation.

Subject to adjustments, the company is working with preliminary

AISC estimates in the $1,100/ounce - $1,200/ounce range for gold,

at a 20,000 ounce/year run rate.

Conceptual Plan – Preliminary Capex

The Company is developing a plan to build a 360 tonne per day (tpd) flotation mill at the Golden Chest Mine in Murray, Idaho

in order to increase gold production up to 20,000 ounces per year.

Budgetary cost estimates are made for the major items in this plan including mine development,

construction of the mill,

land acquisition,

resource in-fill drilling at the mine,

and exploration drilling at the Alder Gulch property ¸

two miles west of the mine.

Current trucking of ore to the existing New Jersey mill is roughly $12/tonne.

At just 50,000 tonnes per year, the potential annual savings from

just this one component is estimated at $600,000.

Expansion of the existing underground mine would be undertaken with production coming from the Skookum Shoot of 50,000 tonnes per year

and the Paymaster Shoot of 36,000 tonnes per year.

An additional 30,000 tonnes per year will be sourced from an existing surface stockpile.

Currently, the Skookum is the only area in production.

Gold grades in the Skookum are expected to be about same as they

are now at 6.5 gram per tonne (gpt) gold ¸

while the Paymaster gold grade will require more drilling to determine accurately,

the existing drilling indicates two narrower,

but higher-grade veins with a diluted grade

(2-meter mining width) of 8.5 gpt gold.

The Paymaster veins are separated by an intrusion of quartz monzonite (15 to 30 meters thick)

which is where the access ramp would be placed.

Finally, the surface stockpile grade is well established from blasthole sampling at 1.09 gpt gold.

NJMC’s 2021 drill plan is based on its “Deep Rooted” ore shoot model.

Recent deeper drilling at the Golden Chest is showing deeper and

better grade continuity of the Joe Dandy and Paymaster shoots ¸

while Skookum core logging is still underway ¸

core holes in this area also intercepted the mineralized Idaho Fault.

Initial positive results and preliminary analysis have accelerated

the potential for a significant increase of gold production per

year at the Golden Chest and the evaluation for a new mill at the Golden Chest.

New Jersey Mining Company ? 201 N. 3rd Street ? Coeur d’Alene, Idaho 83814

Using these tonnages,

gold grades, and

metallurgical recoveries from current milling data,

an annual production of approximately 20,000 ounces is indicated.

Table 1 below lists the preliminary budgetary capital cost estimates

for the conceptual plan to increase annual production at the Golden Chest up to 20,000 ounces per year.

The costs are preliminary in nature and detailed engineering is still required to determine the final costs, with some costs listed coming from the mine cost handbook.

This information is for discussion purposes only to allow for better understanding of management and other corporate goals.

The timing of capital expenditure for a new mill and mine expansion

will likely occur in phases while remaining flexible with the disposition of some non-core assets and an eye on shareholder dilution.

Table 1

Capital Item Mine Development

Main Access Ramp Ventilation Raise Mining Equipment

Flotation Mill

Paste Backfill Plant

Land Acquisition (in-process) Electrical Service Upgrade Golden Chest Infill Drilling Murray Gold Belt Drilling Total

Drilling Highlights at the Golden Chest

$ USD

$ 3,600,000 $ 800,000 $ 1,500,000 $ 6,000,000 $ 2,000,000 $ 1,500,000 $1,000,000 $ 2,500,000 $ 1,500,000 $20,400,000

• Six identified ore shoots - Katie Dora, Klondike, Skookum, Golden Chest, Paymaster and Joe Dandy.

• 2020/2021 drill program is testing down-dip extensions of the six recognized ore shoots. Focused on

preliminary production/mine-life potential of each individual ore shoot.

• Drill program began with high-grade intercept of 0.2 meters of 74.6 grams per tonne gold (gpt), true

thickness, in the Katie Dora.

• In the Paymaster, a significant additional vein assaying 104 gpt gold over 0.4 meters was encountered in

hole GC 21-184. This intercept is located 47 meters above the Idaho Fault.

• Also, from the Paymaster, GC 21-184 intercepted 1.5 meters of 20.1 gpt gold (including 0.9 meters of

26.7 gpt gold) in the upper vein and 1.4 meters of 3.8 gpt gold in the lower vein.

• GC 20-183 (Paymaster) intercepted 0.9 meters of 14.7 gpt gold in the upper vein.

• Followed by a new discovery in the Joe Dandy, the southernmost ore shoot, with 7.3 meters that assayed

11.5 gpt gold (including 2.3 meters of 19.5 gpt, true thickness).

• Current underground production is from Skookum Shoot – growth from 5,000 ounces to 10,000+/-

ounces per year production run rate from the Skookum over next 12 months.

New Jersey Mining Company ? 201 N. 3rd Street ? Coeur d’Alene, Idaho 83814

NJMC’s RARE EARTH ELEMENT (REE) SUBSIDIARY

Company management believes that NJMC’s REE holdings represent a significant unrealized value for shareholders.

And while concrete plans are not yet in place,

the company is evaluating a spin-out of its REE subsidiary to NJMC shareholders,

possibly at or near the timing of up-listing to a senior exchange.

• Permitting underway for drill programs at Diamond Creek and Roberts.

Diamond Creek REE Project

The REE bearing veins of the Diamond Creek area are on the short list

of the well-recognized and studied occurrences in the United States.

In 1979, M.H. Staatz, of the U.S. Geological Survey (USGS) estimated

an overall probable resource at Diamond Creek of approximately 70,800 metric tonnes of total rare-earth oxides,

using an average grade of 1.22 percent.

Reported sample assays show REE oxide contents ranging from 0.59 to 5.51 percent.

Additionally,

three samples cut across one of the larger veins were assayed for gold,

and contained 0.5, 2.4 and 11.9 grams per tonne (0.017, 0.07, and 0.348 ounces per ton).

The Diamond Creek REE Project covers approximately 421 hectares

(1,040 acres) and is comprised of 52 unpatented mining claims.

It is located in the Eureka Mining district, approximately 13 kilometers (8 miles) north-northwest of the town Salmon, Idaho.

Roberts REE Project

Recent sampling by Company geologists returned grades in excess of

12% combined Rare Earths Elements, with gold values up to 8.8 grams per tonne and Niobium as high as 0.50%.

At the Roberts, one carbonatite occurrence can be found in a northwest trending seam which measures approximately 400 meters long and 90 meters wide.

The second occurrence is a small carbonatite plug measuring about 200 meters in diameter.

Studies conducted by A.T. Abbott (1954) and A.L. Anderson (1958) from the Idaho Geological Survey (IGS),

and E.P. Kaiser (1956) with the U.S. Geologic Survey (USGS) pioneered recognition of these unusual deposit types in the Mineral Hill District.

The unusual carbonatite seam and intrusive plug occurring on the

Roberts property are characterized by an impressive REE concentration.

Abbott reported cutting a 2.5’ sample across the Roberts lode which returned 21.5% combined rare earth oxides

and thoria. NJMC personnel believe that Rare Earth Elements like Neodymium, Praseodymium and Samarium occur on the property in abundance.

The Roberts REE Project is comprised of 12 unpatented mining claims covering an area of approximately 219 acres.

This project is located within the Mineral Hill Mining District, approximately 30 miles northwest of the town of Salmon, Idaho.

• NJMC’s Rare Earth Element properties resources are already listed as part of the United States’ Rare Earth Element national inventory, as identified in IGS and USGS publications.

• The presence of “at-risk” rare earth elements such as Neodymium, Praseodymium, Dysprosium, Yttrium, and Niobium have been confirmed through NJMC’s sampling at the Diamond Creek and Roberts properties.

At Diamond Creek, the gold and REE’s occur within the same veins,

but it is not clear if the gold is genetically related to the REE mineralization.

Some of the mineral pulses have gold,

thorium, uranium, niobium, yttrium and REE’s.

[NIOBIUM VERY VALUABLE R.E.E.]

Niobium and gold are possible by-products that would add

greatly to the economics of Diamond Creek.

The REE mineralization at Diamond Creek is found in quartz veins

over a large area approximately 3.2 km (2 mi) long and 0.8 km (0.5 mi) wide.

New Jersey Mining Company ? 201 N. 3rd Street ? Coeur d’Alene, Idaho 83814

The Principal Rare Earth Elements Deposits of the United States

– A Summary of Domestic Deposits and a Global Perspective

– USGS Scientific Investigations Report 2010-5220

CONCLUSION AND COMMENTARY Mr. Swallow concluded,

“We realize that there is a lot to ‘unpack’ in this press release,

however we believe it is important to have an understanding of the Company.

In addition to the above-mentioned conceptual plans,

management is also evaluating up-listing to a senior exchange in

an effort to increase the Company’s exposure to mainstream equity investors,

portfolio managers,

and other groups.

Because the company and operations have shown substantial growth

and operational viability,

we have a good understanding of how a phased approach fits into the more modest capex requirements of an established producer.

NJMC is a small operating company working to become a larger company.

There are no guarantees in this business

- or any other

- and everything is subject to change.

We also realize that discussing potential plans/thinking is somewhat unconventional,

however we find it easier and more honest to converse with folks

if we are both substantially on the same page.

This press release discusses the thoughts of management and hopefully allows people to analyze whether or not NJMC aligns with their own investment criteria.

New Jersey Mining Co. has been (and will be) an example of building

as you go and has experienced success where others have failed.

There will always be choppiness in our results on both sides of the ledger and I would expect more of the same as our ‘up and to the right’ path continues.”

Quality assurance/quality control

All of the samples were analyzed by American Analytical of Osburn, Idaho,

an ISO certified laboratory.

Samples were analyzed using lead collection fire assay with a gravimetric finish.

A series of known assay standards are submitted with each drill hole

as part of a quality assurance-quality compliance program.

Qualified person

NJMC's Vice President, Grant A. Brackebusch, P.E. is a qualified

person as such term is defined in

National Instrument 43-101 and has reviewed and approved the technical information and data included in this press release.

New Jersey Mining Company ? 201 N. 3rd Street ? Coeur d’Alene, Idaho 83814

New Jersey Mining Company Evaluates Potential for 20,000 Oz/Year Gold Production at Golden Chest Mine & Possible Spin-out of Rare Earths Subsidiary to its Shareholders

COEUR D'ALENE, Idaho, March 5, 2021 (ACCESSWIRE) -- New Jersey Mining Company (OTCQB: NJMC) (“NJMC” or the “Company”) is pleased to provide a “big picture” update, including a preliminary discussion in regard to up-listing to a senior exchange in concert with our plans to increase production at the Golden Chest Mine and the potential for the spin-out of its rare earth subsidiary to shareholders.

NJMC President and CEO John Swallow stated, “As business owners, fellow investors and community stakeholders (and substantial NJMC shareholders), we believe it is important to understand how or what a person (or company) thinks, especially with regard to anticipating and adjusting to the multitude of macro and micro inputs. As discussions continue to evolve (and subject to change), and as the initial results of our drill program are received, we felt that communication from management in regard to the various paths being contemplated would be appreciated – such as a recap and possible positioning of our Rare Earths subsidiary, potential for increased gold production and eventually working toward a senior exchange listing.”

CONCEPTUAL PLAN FOR UP TO 20,000 OZ/YR GOLD PRODUCTION AT GOLDEN CHEST

Conceptual Plan – Preliminary Economics

Preliminary internal estimates and the conceptual plans are based on firsthand corporate experience with development, mining, exploration, milling and other knowledge gained from NJMC operations. Budgeting for personnel, equipment, and underground development have been considered in this evaluation. Subject to adjustments, the company is working with preliminary AISC estimates in the $1,100/ounce - $1,200/ounce range for gold, at a 20,000 ounce/year run rate.

Conceptual Plan – Preliminary Capex

The Company is developing a plan to build a 360 tonne per day (tpd) flotation mill at the Golden Chest Mine in Murray, Idaho in order to increase gold production up to 20,000 ounces per year. Budgetary cost estimates are made for the major items in this plan including mine development, construction of the mill, land acquisition, resource in-fill drilling at the mine, and exploration drilling at the Alder Gulch property ¸ two miles west of the mine. Current trucking of ore to the existing New Jersey mill is roughly $12/tonne. At just 50,000 tonnes per year, the potential annual savings from just this one component is estimated at $600,000.

Expansion of the existing underground mine would be undertaken with production coming from the Skookum Shoot of 50,000 tonnes per year and the Paymaster Shoot of 36,000 tonnes per year. An additional 30,000 tonnes per year will be sourced from an existing surface stockpile. Currently, the Skookum is the only area in production. Gold grades in the Skookum are expected to be about same as they are now at 6.5 gram per tonne (gpt) gold ¸ while the Paymaster gold grade will require more drilling to determine accurately, the existing drilling indicates two narrower, but higher-grade veins with a diluted grade (2-meter mining width) of 8.5 gpt gold. The Paymaster veins are separated by an intrusion of quartz monzonite (15 to 30 meters thick) which is where the access ramp would be placed. Finally, the surface stockpile grade is well established from blasthole sampling at 1.09 gpt gold.

NJMC’s 2021 drill plan is based on its “Deep Rooted” ore shoot model. Recent deeper drilling at the Golden Chest is showing deeper and better grade continuity of the Joe Dandy and Paymaster shoots ¸ while Skookum core logging is still underway ¸ core holes in this area also intercepted the mineralized Idaho Fault. Initial positive

results and preliminary analysis

have accelerated the potential for a significant increase of gold production per

year at the Golden Chest and the evaluation for a new mill at the Golden Chest.

New Jersey Mining Company ? 201 N. 3rd Street ? Coeur d’Alene, Idaho 83814

Using these tonnages, gold grades, and metallurgical recoveries from current milling data, an annual production of approximately 20,000 ounces is indicated.

Table 1 below lists the preliminary budgetary capital cost estimates for the conceptual plan to increase annual production at the Golden Chest up to 20,000 ounces per year. The costs are preliminary in nature and detailed engineering is still required to determine the final costs, with some costs listed coming from the mine cost handbook.

This information is for discussion purposes only to allow for better understanding of management and

other corporate goals. The timing of capital expenditure for a new mill and mine expansion will likely occur in

phases while remaining flexible with the disposition of some non-core assets and an eye on shareholder dilution.

Table 1

Capital Item Mine Development

Main Access Ramp Ventilation Raise Mining Equipment

Flotation Mill

Paste Backfill Plant

Land Acquisition (in-process) Electrical Service Upgrade Golden Chest Infill Drilling Murray Gold Belt Drilling Total

Drilling Highlights at the Golden Chest

$ USD

$ 3,600,000 $ 800,000 $ 1,500,000 $ 6,000,000 $ 2,000,000 $ 1,500,000 $ 1,000,000 $ 2,500,000 $ 1,500,000 $20,400,000

• Six identified ore shoots - Katie Dora, Klondike, Skookum, Golden Chest, Paymaster and Joe Dandy.

• 2020/2021 drill program is testing down-dip extensions of the six recognized ore shoots. Focused on

preliminary production/mine-life potential of each individual ore shoot.

• Drill program began with high-grade intercept of 0.2 meters of 74.6 grams per tonne gold (gpt), true

thickness, in the Katie Dora.

• In the Paymaster, a significant additional vein assaying 104 gpt gold over 0.4 meters was encountered in

hole GC 21-184. This intercept is located 47 meters above the Idaho Fault.

• Also, from the Paymaster, GC 21-184 intercepted 1.5 meters of 20.1 gpt gold (including 0.9 meters of

26.7 gpt gold) in the upper vein and 1.4 meters of 3.8 gpt gold in the lower vein.

• GC 20-183 (Paymaster) intercepted 0.9 meters of 14.7 gpt gold in the upper vein.

• Followed by a new discovery in the Joe Dandy, the southernmost ore shoot, with 7.3 meters that assayed

11.5 gpt gold (including 2.3 meters of 19.5 gpt, true thickness).

• Current underground production is from Skookum Shoot – growth from 5,000 ounces to 10,000+/-

ounces per year production run rate from the Skookum over next 12 months.

New Jersey Mining Company ? 201 N. 3rd Street ? Coeur d’Alene, Idaho 83814

NJMC’s RARE EARTH ELEMENT (REE) SUBSIDIARY

Company management believes that NJMC’s REE holdings represent a significant unrealized value for shareholders. And while concrete plans are not yet in place, the company is evaluating a spin-out of its REE subsidiary to NJMC shareholders, possibly at or near the timing of up-listing to a senior exchange.

• Permitting underway for drill programs at Diamond Creek and Roberts.

Diamond Creek REE Project

The REE bearing veins of the Diamond Creek area are on the short list of the well-recognized and studied occurrences in the United States.

In 1979, M.H. Staatz, of the U.S. Geological Survey (USGS) estimated an overall probable resource at Diamond Creek of approximately 70,800 metric tonnes of total rare-earth oxides, using an average grade of 1.22 percent. Reported sample assays show REE oxide contents ranging from 0.59 to 5.51 percent. Additionally, three samples cut across one of the larger veins were assayed for gold, and contained 0.5, 2.4 and 11.9 grams per tonne (0.017, 0.07, and 0.348 ounces per ton).

The Diamond Creek REE Project covers approximately 421 hectares (1,040 acres) and is comprised of 52 unpatented mining claims. It is located in the Eureka Mining district, approximately 13 kilometers (8 miles) north-northwest of the town Salmon, Idaho.

Roberts REE Project

Recent sampling by Company geologists returned grades in excess of 12% combined Rare Earths Elements, with gold values up to 8.8 grams per tonne and Niobium as high as 0.50%.

At the Roberts, one carbonatite occurrence can be found in a northwest trending seam which measures approximately 400 meters long and 90 meters wide. The second occurrence is a small carbonatite plug measuring about 200 meters in diameter. Studies conducted by A.T. Abbott (1954) and A.L. Anderson (1958) from the Idaho Geological Survey (IGS), and E.P. Kaiser (1956) with the U.S. Geologic Survey (USGS) pioneered recognition of these unusual deposit types in the Mineral Hill District.

The unusual carbonatite seam and intrusive plug occurring on the Roberts property are characterized by an impressive REE concentration. Abbott reported cutting a 2.5’ sample across the Roberts lode which returned 21.5% combined rare earth oxides and thoria. NJMC personnel believe that Rare Earth Elements like Neodymium, Praseodymium and Samarium occur on the property in abundance.

The Roberts REE Project is comprised of 12 unpatented mining claims covering an area of approximately 219 acres. This project is located within the Mineral Hill Mining District, approximately 30 miles northwest of the town of Salmon, Idaho.

• NJMC’s Rare Earth Element properties resources are already listed as part of the United States’ Rare Earth Element national inventory, as identified in IGS and USGS publications.

• The presence of “at-risk” rare earth elements such as Neodymium, Praseodymium, Dysprosium, Yttrium, and Niobium have been confirmed through NJMC’s sampling at the Diamond Creek and Roberts properties.

At Diamond Creek, the gold and REE’s occur within the same veins, but it is

not clear if the gold is genetically related to the REE mineralization. Some of the mineral pulses have gold,

thorium, uranium, niobium, yttrium and REE’s. Niobium and gold are possible by-products that would add

greatly to the economics of Diamond Creek.

The REE mineralization at Diamond Creek is found in quartz veins

over a large area approximately 3.2 km (2 mi) long and 0.8 km (0.5 mi) wide.

New Jersey Mining Company ? 201 N. 3rd Street ? Coeur d’Alene, Idaho 83814

The Principal Rare Earth Elements Deposits of the United States – A Summary of Domestic Deposits and a Global Perspective – USGS Scientific Investigations Report 2010-5220

CONCLUSION AND COMMENTARY

Mr. Swallow concluded, “We realize that there is a lot to ‘unpack’ in this press release, however we believe it is important to have an understanding of the Company. In addition to the above-mentioned conceptual plans, management is also evaluating up-listing to a senior exchange in an effort to increase the Company’s exposure to mainstream equity investors, portfolio managers, and other groups. Because the company and operations have shown substantial growth and operational viability, we have a good understanding of how a phased approach fits into the more modest capex requirements of an established producer. NJMC is a small operating company working to become a larger company. There are no guarantees in this business - or any other - and everything is subject to change. We also realize that discussing potential plans/thinking is somewhat unconventional, however we find it easier and more honest to converse with folks if we are both substantially on the same page. This press release discusses the thoughts of management and hopefully allows people to analyze whether or not NJMC aligns with their own investment criteria. New Jersey Mining Co. has been (and will be) an example of building as you go and has experienced success where others have failed. There will always be choppiness in our results on both sides of the ledger and I would expect more of the same as our ‘up and to the right’ path continues.”

Quality assurance/quality control

All of the samples were analyzed by American Analytical of Osburn, Idaho, an ISO certified laboratory. Samples were analyzed using lead collection fire assay with a gravimetric finish. A series of known assay standards are submitted with each drill hole as part of a quality assurance-quality compliance program.

Qualified person

NJMC's Vice President, Grant A. Brackebusch, P.E. is a qualified person as such term is defined in National Instrument 43-101 and has reviewed and approved the technical information and data included in this press release.

New Jersey Mining Company ? 201 N. 3rd Street ? Coeur d’Alene, Idaho 83814

intraday ????? $.60 ah share wow wee !!!!! $njmc Volume: 347,879 @03/04/21 3:05:05 PM EST

Bid Ask Day's Range

0.345 0.36 0.345 - 0.6

NJMC Detailed Quote

hey worth $$$$$ look @ assets veins deep wide & long, i said the GOLDEN CHEST WAS OVER $5.00 IN DA 1980'S ON SPOKANE NAT'L EXCHANGE !!!!!!

TODAY EVEN MORE VALUABLE

https://www.otcmarkets.com/stock/NJMC/news/New-Jersey-Mining-Makes-New-Discovery-at-Golden-Chest?id=288769

OTC DISCLOSURE & NEWS SERVICE

New Jersey Mining Makes New Discovery at Golden Chest

Press Release | 02/04/2021

Drills 7.3 Meters of 11.5 grams per tonne (gpt) Gold, Including 2.3 Meters of 19.5 gpt Gold - True Thickness

COEUR D'ALENE, ID / ACCESSWIRE / February 4, 2021 /

New Jersey Mining Company (OTCQB:NJMC) ("NJMC" or the "Company") is pleased to announce that its current core drilling program at the

Golden Chest has intercepted 7.3 meters that assayed 11.5 grams per tonne (gpt) gold (including 2.3 meters of 19.5 grams per tonne true thickness) in drill hole (GC 21-193) on the southern end of the

property in the area known as the Joe Dandy.

The Joe Dandy area is the southernmost of the six named ore shoots currently identified at the Golden Chest Mine.

The true thickness of the vein is estimated to be 6.3 meters.

GC 21-193 is a vertical hole that intercepted the vein at a depth of 158.5 meters and demonstrates the deepest intercept of the vein this

far south in exploration drilling completed to date at the Golden Chest.

This intercept is very significant as it shows high-grade, thick sequences of the vein and is more than 400 meters south and 125 meters below the current underground mining area (stopes).

See Golden Chest Long Section below.

NJMC's 2021 drill plan is based on its "Deep Rooted" ore shoot model.

By drilling these deeper holes in the farthest flanking extents of the property,

NJMC is showing deeper and better grade continuity of the Joe Dandy

and the other five gold-bearing ore shoots.

This new discovery in the underexplored Joe Dandy ore shoot follows-up on a drill intercepts from 2012 exploration drilling.

NJMC President and CEO John Swallow stated,

"We are following a very logical narrative based on current production goals in the Skookum Shoot and assuming similar potential for all six identified ore shoots at the Golden Chest.

At this stage of our growth and as we transition from both open pit

and underground mining to increased underground mining,

the 30,000-foot view of our program is more than just a cursory evaluation.

The possibility of a new mill near the mine is not only based on

our continued success with early-stage exploration in the

Murray Gold Belt

- the potential for up to 10,000 ounces of production from each of the six individual ore shoots is quickly becoming a reality."

NJMC's VP of Exploration, Rob Morgan explains,

"We feel that through this program the importance of these results

in the Joe Dandy brings us closer to the source of Golden Chest mineralization.

With two drills turning, the drill program began

with a high-grade intercept

(GC 20-182T: 0.2 meters of 74.6 grams per tonne gold, true thickness)

in the northernmost ore shoot, the Katie Dora,

and because of weather we moved that drill to the Paymaster.

The second drill has been on the Joe Dandy and will continue to delineate this high-grade section of vein.

Following the Joe Dandy drilling, this rig will move to probe below current stope levels in the Skookum area and then test increasing

depths in the Paymaster area. A total of 5,000 meters of drilling are planned to be completed before spring."

Mr. Morgan continues, "The southern area of the Golden Chest region is where the Thompson Pass Fault, Murray Peak Fault, and Idaho Fault all intersect forming a structural knot.

Mineralization is spatially related to the Idaho Fault, and the large vein system was encountered just below the Idaho Fault and sills of quartz monzonite and lamprophyre.

Visible gold grains were found in immediate contact with the intrusive rocks and some of the mineralization is interpreted to be related to igneous activity.

The igneous rocks are related to the Murray Stocks

and this deposit type is orogenic gold-quartz veins with an igneous association.

The granitic rocks are conspicuously absent from the surface and are mostly seen by subsurface drilling."

Whatever you are doing it's working!

[-chart]www.stockscores.com/chart.asp?TickerSymbol=njmc&TimeRange=180&Interval=d&Volume=1&ChartType=CandleStick&Stockscores=1&ChartWidth=830&ChartHeight=500&LogScale=&Band=&avgType1=&movAvg1=&avgType2=&movAvg2=&Indicator1=None&Indicator2=None&Indicator3=None&Indicator4=None&endDate=&CompareWith=&entryPrice=&stopLossPrice=&candles=redgreen[/chart]

TEN YR;$NJMC

[-chart]www.stockscores.com/chart.asp?TickerSymbol=NJMC&TimeRange=10000&Interval=m&Volume=1&ChartType=CandleStick&Stockscores=1&ChartWidth=1100&ChartHeight=480&LogScale=None&Band=None&avgType1=None&movAvg1=&avgType2=None&movAvg2=&Indicator1=RSI&Indicator2=None&Indicator3=None&Indicator4=None&endDate=&CompareWith=&entryPrice=&stopLossPrice=&candles=redgreen[/chart]

New Jersey Mining Co (NJMC)

0.3003 ? -0.0047 (-1.54%)

Volume: 128,667 @03/01/21 3:59:10 PM EST

Bid Ask Day's Range

0.305 0.32 0.2801 - 0.31

NJMC Detailed Quote

Please share it.

worth ????? imho $$$$$ land 'New Jersey Mining Co. (NJMC)' in ibox update

i found lots of good information over da wkend 'New Jersey Mining Co. (NJMC)'

This may have just woke up!

New Jersey Mining Co (NJMC)

0.305 ? 0.0348 (12.88%)

Volume: 280,034 @02/26/21 3:56:21 PM EST

Bid Ask Day's Range

0.3 0.305 0.2703 - 0.305

NJMC Detailed Quote

-'New Jersey Mining Co. (NJMC)' OTC DISCLOSURE & NEWS SERVICE

https://www.otcmarkets.com/stock/NJMC/news/New-Jersey-Mining-Company-Provides-Preliminary-High-Grade-Drill-Results-and-Year-End-Exploration-Update?id=284505

New Jersey Mining Co. (NJMC)'

[looks to be huge company as i said wide veins & thick veins ]https://www.otcmarkets.com/stock/NJMC/news/New-Jersey-Mining-Company-Provides-Preliminary-High-Grade-Drill-Results-and-Year-End-Exploration-Update?id=284505

New Jersey Mining Company Provides Preliminary High-Grade Drill Results and Year-End Exploration Update

Press Release | 12/24/2020

The Golden Chest Mine, Murray Gold Belt and

the Diamond Creek Rare Earth Element Property

COEUR D'ALENE, ID / ACCESSWIRE / December 24, 2020 /

New Jersey Mining Company (OTCQB:NJMC) ("NJMC" or the "Company") is pleased to provide drill and sampling highlights,

a year-end exploration update for the Golden Chest Mine,

the Murray Gold Belt, and the Diamond Creek Rare Earth Element (REE) property.

NJMC President and CEO John Swallow stated,

"As we close out the year, recent months have revealed a subtle,

and not insignificant,

trend of more frequent high-grade assays from both surface and underground mine operations

- something we didn't see as much in prior years. In addition to the surface and underground sampling highlights and opportunities for expanded mine development,

we are also pleased to announce a few high-grade drill results from

the recently completed step-out drillhole in the Katie-Dora, the northern-most of the six identified ore shoots."

Mr. Swallow continued,

"With over 7,800 blast holes, 431 muck samples and 523 longhole assays in our database,

the amount of "exploration" conducted in support of operations cannot be understated.

As is common with most surface and underground operations;

mine development,

drilling of holes,

sampling,

assaying and blasting are all standard operating procedure.

By contrast, with most non-producing "exploration only"

entities of our size,

these endeavors exist only in non-revenue producing,

theoretical mine models and detailed feasibility studies."

Highlights for 2020 Exploration and Drilling Programs:

Golden Chest

The Katie-Dora drillhole was completed to 220 meters

(20 meters below historic production levels)

and intercepted three different veins which correspond to the historic Popcorn,

Katie and Dora veins.

While these veins were all relatively narrow,

with average thickness of 20 centimeters (cm),

visible gold was seen in the core at all three vein intervals

and had high-grade gold assays of 75 grams per tonne (gpt), 15 gpt,

and 10 gpt gold. The results from this step-out drillhole are encouraging because the vein intercepts are on strike and 600 meters north of current underground mining stopes and indicate a strong gold mineralized system is present at the Golden Chest.

Follow-up drilling is already planned for this area in the spring.

The 2020/21 exploration program is based on NJMC's increasingly predictive exploration and mining ore shoot model constructed

from the reinterpretation of area's geology and structure by

Company geologists.

In order to complete the down-dip exploration of six ore shoots in

a timely manner,

NJMC has retained the services of an outside drill contractor to work along-side the company drill rig.

The contracted drilling is expected to begin mid-January 2021 with

step-out targets at the southern-most Joe Dandy ore shoot.

This rig will also aim to extend the down-dip and strike projections of each identified ore-shoot.

In the meantime, the Company drill rig was moved to a lower elevation

to begin work on exploration targets in the Paymaster ore shoot as a follow-up on some of the high-grade gold intercepts identified in

NJMC's earlier drill programs.

Underground Highlights

Recent highlights from the underground operations at the Golden Chest mine include

- completion of the 836 Level, starting the 888 Level and advancing

the development of the spiral ramp downward deeper into the mine.

Upon reaching the 836 Level, NJMC's underground team has attained

the deepest elevation ever mined at the Golden Chest. T

The 836 ‘South Cut' is in a unique area where the vein system is

wide enough to take two side by side mining drifts.

This allows for additional tonnage without the costs of more development.

Highlights from the 836 Level included an average stope grade 6.79 gpt Au for the 836 North heading,

with select vein samples assaying up to 21.1 gpt Au, and higher-grade samples of select sulfide clusters in the second cut of the 836 South heading assayed up to 145 gpt.

Mining operations began on the 888 level of the mine in October 2020. This is in the upper portion of the Skookum orebody that has not yet been mined.

Highlights from the 888 Level have been muck samples that assayed 8.23 gpt Au with vein samples up to 49.95 gpt Au.

Additionally, NJMC's underground crews are advancing the spiral ramp downwards to even lower levels of the mine.

This development heading, which includes a secondary escape-way bore raise, is projected to be at the vein system in February 2021.

Murray Gold Belt (MGB)

After consolidating the MGB land package in early 2020,

NJMC has continued advancing this world-class property package.

By completing a number of first-time geologic baseline tasks,

such as geological mapping, geophysics and a lidar survey,

the stage is clearly set for the next phase of exploration.

In Alder Gulch, this season's geophysical (magnetics) work outlined

a persistent magnetic low coincident with a fault, with a magnetic high

to the west and a magnetic low to the east of this north-south geologic structure.

As a result of running magnetic lines across known gold bearing occurrences, the fault was extended to the Buckskin on the north

and to the Evan's Dike on the south.

Isoline contour maps display a lineament that appears to connect the underground and

surface workings at Buckskin where sampling has shown grades up to 12 gpt Au) to the Evans Telluride dike where surface samples assayed up

to 7 gpt Au.

At the Buckskin,

Evans and Big Ledge our detailed mapping and sampling program

identified favorable target areas for second-phase trenching

and drill programs.

And the continued application of modern geophysical exploration methods, especially magnetics,

should reveal more information on the rocks and fault structures

beneath the gravels.

We continue to believe there may be a buried alkaline intrusion in

this area based on gold-bearing dikes with associated telluride mineralization typical of areas with promising gold potential.

Mineralization on the Buckskin appears to extend south under the historic gravels of the newly purchased lands based on historical

and recent observations.

Similarly, the gold-telluride bearing sill on the Evans extends north and disappears under gravel cover.

These are important discoveries critical to the advancement of these property packages.

Diamond Creek - Rare Earth Elements (REE's)

Following addition of the Diamond Creek and Roberts REE properties

in 2020,

the Company developed (and presented to Idaho Senator Risch's office)

a three-phase plan to develop a reliable/mineable resource at Diamond Creek.

Phase 1 includes a detailed mapping and sampling program ahead of determining drill targets.

A staged 10-hole core drilling program has already been developed

for the Diamond Creek project,

with the purpose of expanding and to further clarify the REE resource outlined by the USGS in 1979.

Drilling will target the Diamond Creek Fault as well as the associated REE vein occurrences.

The phase 1 drill plan has been submitted to the USFS for review.

The Company recently secured drill core from prior step-out drilling

at the Diamond Creek property package.

The review of this core will aid in future planning and geologic interpretation.

Mr. Swallow concluded,

"Although we are all thankful to put 2020

behind us, it has revealed some important shortfalls from past

national leadership decisions that we expect will only gain attention throughout 2021 and beyond.

The increasing awareness that our country's answer to any economic hardship is to print more money,

only elevates the need for hard-asset stores-of-value.

Furthermore, our reliance on China (and other foreign sources)

for the majority of critical minerals essential to our country's national defense is a huge risk that has only begun to be leveraged.

And finally, the inevitable and widespread adoption of low-carbon,

green technologies are highly dependent on many critical minerals,

of which the future demand is expected to far exceed current supply."

Qualified Person

NJMC's Vice President of Exploration, Robert John Morgan,

PG, PLS is a qualified person as such term is defined in National Instrument 43-101 and has reviewed and approved the technical information and data included in this press release.

About New Jersey Mining Company

Headquartered in North Idaho, New Jersey Mining Company is the

rare example of a vertically integrated, operating junior mining company.

NJMC produces gold at the Golden Chest Mine and recently consolidated the Murray Gold Belt (MGB) for the first time in over 100-years.

The MGB is an overlooked gold producing region within the Coeur d'Alene Mining District,

located north of the prolific Silver Valley.

In addition to gold,

the Company maintains a presence in the Critical Minerals sector

and is focused on identifying and exploring for Critical Minerals

(Rare Earth Minerals) important to our country's defensive readiness

and a low-carbon future.

New Jersey Mining Company possesses the in-house skillsets of a

much larger company while enjoying the flexibility of a smaller

and more entrepreneurial corporate structure.

Its production-based strategy,

by design, provides the flexibility to advance the Murray Gold Belt and/or its Critical Minerals holdings on its own or with a strategic partner in a manner that is consistent with its existing philosophy

and culture.

NJMC has established a high-quality,

early to advanced-stage asset base in four historic mining districts

of Idaho and Montana,

which includes the currently producing Golden Chest Mine.

Management is stakeholder focused and owns more than 15-percent of NJMC stock.

The Company's common stock trades on the OTC-QB under the symbol "NJMC."

For more information on New Jersey Mining Company go to http://www.newjerseymining.com or call:

Monique Hayes, Corporate Secretary/Investor Relations

Email: monique@newjerseymining.com

(208) 625-9001

Forward-Looking Statements

This release contains "forward-looking statements" within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended that are intended to be covered by the safe harbor created by such sections.

Such statements are based on good faith assumptions that New Jersey Mining Company believes are reasonable,

but which are subject to a wide range of uncertainties and business risks that could cause actual results to differ materially from future results expressed, projected or implied by such forward-looking statements.

Such factors include, among others, the risk that high grade intercepts or follow on drill success may not result in mineable widths,

increased production or a larger resource, the risk the mine plan changes due to rising costs or other operational details,

an increased risk associated with production activities occurring without completion of a feasibility study of mineral reserves demonstrating economic and technical viability,

the risks and hazards inherent in the mining business

(including risks inherent in developing mining projects,

environmental hazards, industrial accidents, weather or geologically related conditions),

changes in the market prices of gold and silver and the potential

impact on revenues from changes in the market price of gold and cash costs, a sustained lower price environment,

risks relating to widespread epidemics or pandemic outbreak including the COVID-19 pandemic;

the impact of COVID-19 on our workforce, suppliers and other essential resources and what effect those impacts,

if they occur, would have on our business, including our ability to access goods and supplies,

the ability to transport our products and impacts on employee productivity,

the risks in connection with the operations, cash flow and results

of the Company relating to the unknown duration and impact of the

COVID-19 pandemic as well as other uncertainties and risk factors.

Actual results, developments and timetables could vary significantly from the estimates presented. Readers are cautioned not to put undue reliance on forward-looking statements.

NJMC disclaims any intent or obligation to update publicly such forward-looking statements,

whether as a result of new information, future events or otherwise

SOURCE: New Jersey Mining Company

View source version on http://www.accesswire.com:

https://www.accesswire.com/622250/New-Jersey-Mining-Company-Provides-Preliminary-High-Grade-Drill-Results-and-Year-End-Exploration-Update

Back to News Headlines

Other Financial Information

Recent News & Disclosure Filings

Recent SEC Filings

OTCQB Member Since 02/2015

OTCQB

OTCQB Venture

Verified Profile 01/2021

Penny Stock Exempt

Transfer Agent Verified

DAILY ADVANCERS

FLCX

+ 193.54 %

EWLU

+ 82.50 %

CWSFF

+ 80.03 %

KNEOF

+ 70.00 %

QTRRF

+ 52.25 %

Subscribe to Our Newsletter

Stay up to date on the latest company news, industry trends and regulatory changes that affect our markets and learn about membersof our community.

Enter your email

SIGN UP

#2 https://www.otcmarkets.com/stock/NJMC/news/New-Jersey-Mining-Makes-New-Discovery-at-Golden-Chest?id=288769

OTC DISCLOSURE & NEWS SERVICE

New Jersey Mining Makes New Discovery at Golden Chest

Press Release | 02/04/2021

Drills 7.3 Meters of 11.5 grams per tonne (gpt) Gold, Including 2.3 Meters of 19.5 gpt Gold - True Thickness

COEUR D'ALENE, ID / ACCESSWIRE / February 4, 2021 /

New Jersey Mining Company (OTCQB:NJMC) ("NJMC" or the "Company") is pleased to announce that its current core drilling program at the

Golden Chest has intercepted 7.3 meters that assayed 11.5 grams per tonne (gpt) gold (including 2.3 meters of 19.5 grams per tonne true thickness) in drill hole (GC 21-193) on the southern end of the

property in the area known as the Joe Dandy.

The Joe Dandy area is the southernmost of the six named ore shoots currently identified at the Golden Chest Mine.

The true thickness of the vein is estimated to be 6.3 meters.

GC 21-193 is a vertical hole that intercepted the vein at a depth of 158.5 meters and demonstrates the deepest intercept of the vein this

far south in exploration drilling completed to date at the Golden Chest.

This intercept is very significant as it shows high-grade, thick sequences of the vein and is more than 400 meters south and 125 meters below the current underground mining area (stopes).

See Golden Chest Long Section below.

NJMC's 2021 drill plan is based on its "Deep Rooted" ore shoot model.

By drilling these deeper holes in the farthest flanking extents of the property,

NJMC is showing deeper and better grade continuity of the Joe Dandy

and the other five gold-bearing ore shoots.

This new discovery in the underexplored Joe Dandy ore shoot follows-up on a drill intercepts from 2012 exploration drilling.

NJMC President and CEO John Swallow stated,

"We are following a very logical narrative based on current production goals in the Skookum Shoot and assuming similar potential for all six identified ore shoots at the Golden Chest.

At this stage of our growth and as we transition from both open pit

and underground mining to increased underground mining,

the 30,000-foot view of our program is more than just a cursory evaluation.

The possibility of a new mill near the mine is not only based on

our continued success with early-stage exploration in the

Murray Gold Belt

- the potential for up to 10,000 ounces of production from each of the six individual ore shoots is quickly becoming a reality."

NJMC's VP of Exploration, Rob Morgan explains,

"We feel that through this program the importance of these results

in the Joe Dandy brings us closer to the source of Golden Chest mineralization.

With two drills turning, the drill program began

with a high-grade intercept

(GC 20-182T: 0.2 meters of 74.6 grams per tonne gold, true thickness)

in the northernmost ore shoot, the Katie Dora,

and because of weather we moved that drill to the Paymaster.

The second drill has been on the Joe Dandy and will continue to delineate this high-grade section of vein.

Following the Joe Dandy drilling, this rig will move to probe below current stope levels in the Skookum area and then test increasing

depths in the Paymaster area. A total of 5,000 meters of drilling are planned to be completed before spring."

Mr. Morgan continues, "The southern area of the Golden Chest region is where the Thompson Pass Fault, Murray Peak Fault, and Idaho Fault all intersect forming a structural knot.

Mineralization is spatially related to the Idaho Fault, and the large vein system was encountered just below the Idaho Fault and sills of quartz monzonite and lamprophyre.

Visible gold grains were found in immediate contact with the intrusive rocks and some of the mineralization is interpreted to be related to igneous activity.

The igneous rocks are related to the Murray Stocks

and this deposit type is orogenic gold-quartz veins with an igneous association.

The granitic rocks are conspicuously absent from the surface and are mostly seen by subsurface drilling."

https://www.otcmarkets.com/stock/NJMC/news/New-Jersey-Mining-Company-Intersects-High-Grade-Gold-Veins-Down-Dip-in-Paymaster-Shoot?id=290413

excerpt;

OTC DISCLOSURE & NEWS SERVICE

New Jersey Mining Company Intersects High-Grade Gold Veins Down-Dip in Paymaster Shoot

Press Release | 02/18/2021

COEUR D'ALENE, ID / ACCESSWIRE / February 18, 2021 / New Jersey Mining Company (OTCQB:NJMC) ("NJMC" or the "Company") is pleased to announce further high-grade results from its core drilling program at the Golden Chest.

These high-grade gold intercepts are from recent exploration drilling in the Paymaster Shoot ("Paymaster").

All reported intervals are the true thickness of the vein.

GC 21-184 intercepted 1.5 meters of 20.1 gpt gold (including 0.9 meters of 26.7 gpt gold) in the upper vein and 1.4 meters of 3.8 gpt gold in the lower vein.

GC 20-183 intercepted 0.9 meters of 14.7 grams per tonne (gpt) gold in the upper vein and 0.2 meters of 6.3 gpt gold in the lower vein.

NJMC President and CEO John Swallow commented,

"The methodology and success ratio of this drill program is impressive.

And with the high-grade intercepts from both the Joe Dandy and the Paymaster,

we are watching in real-time as our ‘production-supported ore shoot model' transforms from a highly confident geologic theory into a drill-proven and geologic reality."

Mr. Swallow continued, "Along with the results stated above, a significant additional vein assaying 104 gpt gold over 0.4 meters was encountered in hole GC 21-184.

This intercept is located 47 meters above the Idaho Fault and may represent a promising supplementary mineralizing control.

At this time the true thickness is unknown."

NJMC's VP of Exploration, Rob Morgan states,

"This 2021 ore shoot drill program is focused on our ‘Deep Rooted' ore shoot model and designed to prove vertical continuity by intercepting deeper ore grades in each of our six identified ore shoots.

These drill intercepts step out approximately 100 meters along strike from previous 2018 high-grade exploration intercepts in holes GC 18-176/GC 18-177 and 45 meters down dip from 2012 ore-grade exploration intercepts in holes GC 12-123/GC 12-130.

To date, this process has proven successful and demonstrated the Paymaster and Joe Dandy Ore shoots both improve in gold grade down-dip from previous high-grade intercepts encountered in our 2012 and 2018 exploration programs, respectively."

Mr. Morgan continues, "Drill holes GC 20-183 and GC 21-184 targeted down dip extensions of gold bearing quartz veins in the Paymaster Shoot.

These holes now represent the deepest ore intercepts in the Paymaster Shoot to date and show further vertical continuity of the ore shoot system at the Golden Chest (see Golden Chest Long Section below).

The drill holes encountered both upper and lower veins which flank a monzonite sill and are characteristic of the Paymaster area.

The Paymaster claim, established in 1883, has the honor of being the first hard rock lode claim in the Coeur d'Alene Mining District and predates the discovery and establishment of the world-class Silver Valley."

The Golden Chest deposits are similar to the deposits of the Coeur d'Alene District, in that the vertical extents of the ore shoots are often greater than the horizontal.

The two districts may or may not be genetically related, but there are definitely structural similarities. At NJMC, we consider the Murray Gold Belt to represent the gold zone adjacent to the greater Coeur d'Alene District silver-lead-zinc zone.

FRIDAY CLOSING IS RARE CLOSED AT H.O.D.T.'ING New Jersey Mining Co. (NJMC)'

New Jersey Mining Co. (NJMC)'LOOKS TO ME DOLLARLAND BEFORE EASTER IMHO

I THINK MOST RARE EARTH COMPANIES HAVE EVEN STARTED ESPECIALLY New Jersey Mining Co. (NJMC)'

i called it $MOLY dis is da one my friend huge lithium etc rare earth elements Molycorp.Inc. (fka MCPIQ)

https://investorshub.advfn.com/MolycorpInc-(fka-MCPIQ)-17612/

New Jersey Mining Co (NJMC)

0.305 ? 0.0348 (12.88%)

Volume: 280,034 @02/26/21 3:56:21 PM EST

Bid Ask Day's Range

0.3 0.305 0.2703 - 0.305

NJMC Detailed Quote

http://www.theresourceinvestor.com/RI-pdf/RI-0221.pdf#page=1

[MAYBE WE MAKE IT HERE ONE DAY]

GOOD REPORE' THANK YOU $NJMC

GOOD REPORE' THANK YOU $NJMC

Not true? Rare Earth mining fizzled and maybe bankruptcys occured years ago when China and others could produce much cheaper. The Trump and now Biden administrations have decided to try and pull production back to the US, so that strategic production is not held hostage by foriegn power and that supply chain is easier controlled. Even though production may cost more, this will help prevent the likes of current supply chain problems being felt by car manufacturers waiting for computer chips as an example.

New Jersey Mining Co. (NJMC) not true by dis guy Expanding on my previous conment,

today the new Energy Secretary was speaking on NPR specifically about

advancing Rare earth properties in America which have not been mined.

one went bankrupt yrs. ago

huge assets too.

Expanding on my previous conment, today the new Energy Secretary was speaking on NPR specifically about advancing Rare earth properties in America which have not been mined.

huge assets 'New Jersey Mining Co. (NJMC)'

|

Followers

|

39

|

Posters

|

|

|

Posts (Today)

|

0

|

Posts (Total)

|

664

|

|

Created

|

01/11/05

|

Type

|

Free

|

| Moderators | |||

PR 03-05-21 wow YUGH read my friend 'New Jersey Mining Co. (NJMC)' & possible spinoff !!!!!

New Jersey Mining Company Evaluates Potential for 20,000 Oz/Year Gold Production at Golden Chest Mine & Possible Spin-out of Rare Earths Subsidiary to its Shareholders

COEUR D'ALENE, Idaho, March 5, 2021 (ACCESSWIRE) --

New Jersey Mining Company (OTCQB: NJMC) (“NJMC” or the “Company”)

is pleased to provide a “big picture” update,

including a preliminary discussion in regard to up-listing to a

senior exchange in concert with our plans to increase production at

the Golden Chest Mine and the potential for the spin-out of its rare earth subsidiary to shareholders.

NJMC President and CEO John Swallow stated,

“As business owners, fellow investors and community stakeholders

(and substantial NJMC shareholders),

we believe it is important to understand how or what a person

(or company) thinks, especially with regard to anticipating and adjusting to the multitude of macro and micro inputs.

As discussions continue to evolve (and subject to change),

and as the initial results of our drill program are received,

we felt that communication from management in regard to the

various paths being contemplated would be appreciated

– such as a recap and possible positioning of our Rare Earths subsidiary,

potential for increased gold production and eventually working toward

a senior exchange listing.”

CONCEPTUAL PLAN FOR UP TO 20,000 OZ/YR GOLD PRODUCTION AT GOLDEN CHEST

Conceptual Plan – Preliminary Economics

Preliminary internal estimates and the conceptual plans are based

on firsthand corporate experience with development,

mining,

exploration,

milling and

other knowledge gained from NJMC operations.

Budgeting for personnel,

equipment, and

underground development have been considered in this evaluation.

Subject to adjustments, the company is working with preliminary

AISC estimates in the $1,100/ounce - $1,200/ounce range for gold,

at a 20,000 ounce/year run rate.

Conceptual Plan – Preliminary Capex

The Company is developing a plan to build a 360 tonne per day (tpd) flotation mill at the Golden Chest Mine in Murray, Idaho

in order to increase gold production up to 20,000 ounces per year.

Budgetary cost estimates are made for the major items in this plan including mine development,

construction of the mill,

land acquisition,

resource in-fill drilling at the mine,

and exploration drilling at the Alder Gulch property ¸

two miles west of the mine.

Current trucking of ore to the existing New Jersey mill is roughly $12/tonne.

At just 50,000 tonnes per year, the potential annual savings from

just this one component is estimated at $600,000.

Expansion of the existing underground mine would be undertaken with production coming from the Skookum Shoot of 50,000 tonnes per year

and the Paymaster Shoot of 36,000 tonnes per year.

An additional 30,000 tonnes per year will be sourced from an existing surface stockpile.

Currently, the Skookum is the only area in production.

Gold grades in the Skookum are expected to be about same as they

are now at 6.5 gram per tonne (gpt) gold ¸

while the Paymaster gold grade will require more drilling to determine accurately,

the existing drilling indicates two narrower,

but higher-grade veins with a diluted grade

(2-meter mining width) of 8.5 gpt gold.

The Paymaster veins are separated by an intrusion of quartz monzonite (15 to 30 meters thick)

which is where the access ramp would be placed.

Finally, the surface stockpile grade is well established from blasthole sampling at 1.09 gpt gold.

NJMC’s 2021 drill plan is based on its “Deep Rooted” ore shoot model.

Recent deeper drilling at the Golden Chest is showing deeper and

better grade continuity of the Joe Dandy and Paymaster shoots ¸

while Skookum core logging is still underway ¸

core holes in this area also intercepted the mineralized Idaho Fault.

Initial positive results and preliminary analysis have accelerated

the potential for a significant increase of gold production per

year at the Golden Chest and the evaluation for a new mill at the Golden Chest.

New Jersey Mining Company ? 201 N. 3rd Street ? Coeur d’Alene, Idaho 83814

Using these tonnages,

gold grades, and

metallurgical recoveries from current milling data,

an annual production of approximately 20,000 ounces is indicated.

Table 1 below lists the preliminary budgetary capital cost estimates

for the conceptual plan to increase annual production at the Golden Chest up to 20,000 ounces per year.

The costs are preliminary in nature and detailed engineering is still required to determine the final costs, with some costs listed coming from the mine cost handbook.

This information is for discussion purposes only to allow for better understanding of management and other corporate goals.

The timing of capital expenditure for a new mill and mine expansion

will likely occur in phases while remaining flexible with the disposition of some non-core assets and an eye on shareholder dilution.

Table 1

Capital Item Mine Development

Main Access Ramp Ventilation Raise Mining Equipment

Flotation Mill

Paste Backfill Plant

Land Acquisition (in-process) Electrical Service Upgrade Golden Chest Infill Drilling Murray Gold Belt Drilling Total

Drilling Highlights at the Golden Chest

$ USD

$ 3,600,000 $ 800,000 $ 1,500,000 $ 6,000,000 $ 2,000,000 $ 1,500,000 $1,000,000 $ 2,500,000 $ 1,500,000 $20,400,000

• Six identified ore shoots - Katie Dora, Klondike, Skookum, Golden Chest, Paymaster and Joe Dandy.

• 2020/2021 drill program is testing down-dip extensions of the six recognized ore shoots. Focused on

preliminary production/mine-life potential of each individual ore shoot.

• Drill program began with high-grade intercept of 0.2 meters of 74.6 grams per tonne gold (gpt), true

thickness, in the Katie Dora.

• In the Paymaster, a significant additional vein assaying 104 gpt gold over 0.4 meters was encountered in