Register for free to join our community of investors and share your ideas. You will also get access to streaming quotes, interactive charts, trades, portfolio, live options flow and more tools.

“Repeat a lie often enough and it becomes the truth”, is a law of propaganda often attributed to the Nazi Joseph Goebbels. Among psychologists something like this known as the "illusion of truth" effect..--- gov't (FDA) propaganda.

The time was, when talk about waning was taken for granted to refer to a vaccine's efficacy over even short periods of time. Now, waning refers to the body's immune response, in terms of less effective antibodies being produced. But, are there any serious proponents advocating for a third mRNA jab, especially in light of all the serious adverse events apparently resulting from a third jab?

The only serious option is to use lenz in lieu of a third mRNA jab.

"Exploratory analysis for the effect of lenzilumab on SWOV (Survival Without Ventilation, primary endpoint) was conducted by the CRP baseline quartile. Response to lenzilumab was observed in the first through third quartiles of baseline CRP with the greatest lenzilumab treatment effect observed in the first quartile (CRP <41 mg/L; HR: 8.20; 95% CI 1.74 to 38.69; p=0.0079).

see pg 3/11, next to the last paragraph:

https://thorax.bmj.com/content/thoraxjnl/78/6/606.full.pdf

with all those shares you have you can do whatever you want pontious.

The address of this company has changed too. so why is it still paying $1336/month for a mail box in some business centre in some office share building?

I wonder about that? I don’t understand the incessant posting, but the facts are there and validated by someone going through the filings almost line by line.

Pontious Pilot doesn’t know who to crucify at this point.

Clinical stage 3 is the last FDA stage before approval for commercialization.

The question is the LENZI molecule even work or effective in commercial use for blood cancer or preventing corvid virus immune system boost? this drug like many drugs have many uses. one is blood cancer another is boosting immune system.

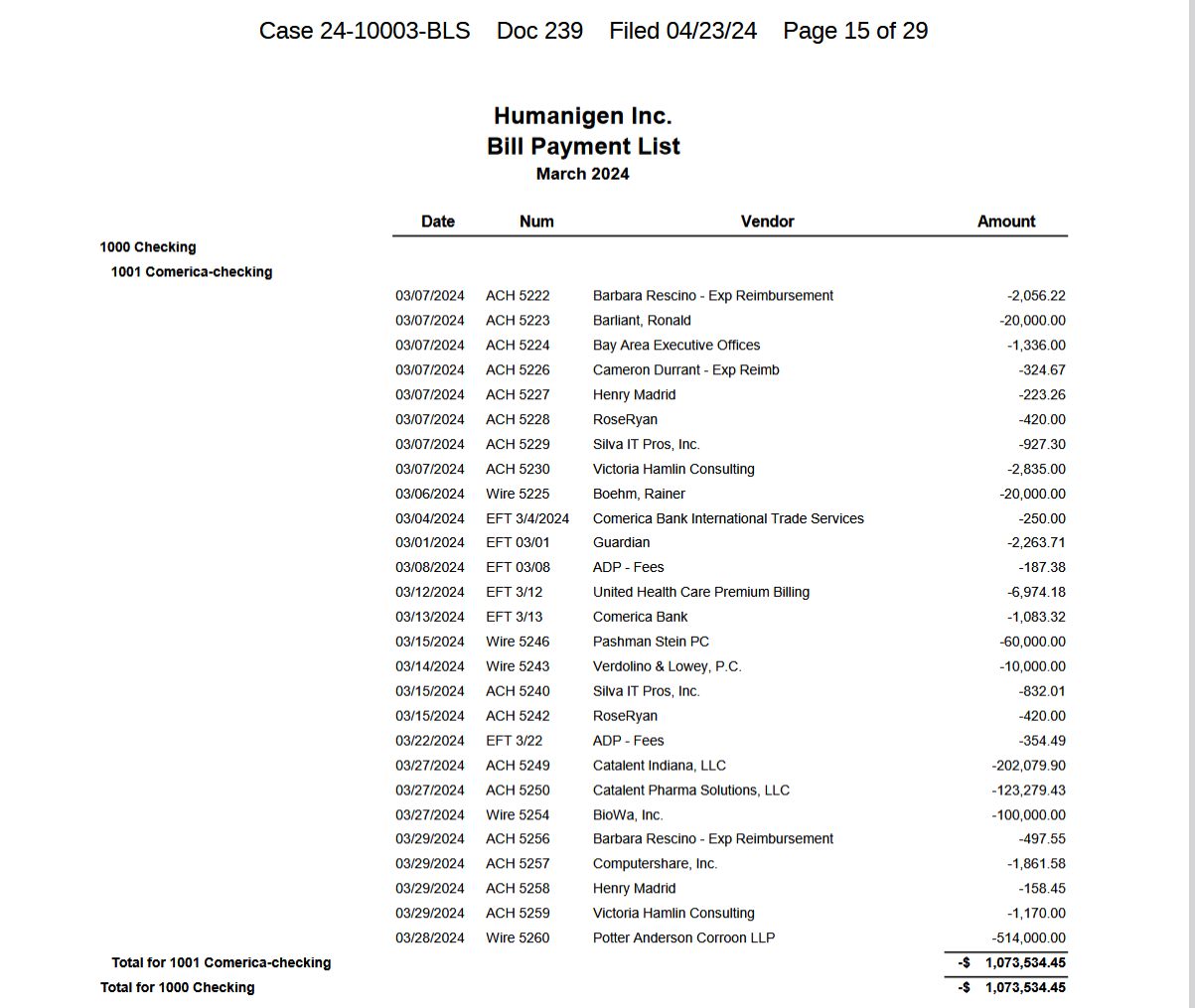

anyways. the company has no intention of getting approval and could have sabotage their FDA submission so they don't get approved. why pay catalent, biowa, any money because they are doing work on the LENZ molecule and Taran if they want their services have to pay. Taran owns the 90% of hgenq shares that is why they are not selling. the company use third party companies to do all the work and manufacturing of the drug. and it's tcompanies like biowa, pathogen, catalents who do all the paperwork for submission to FDA. the company is just owner of the lenzi patent and has no other assets. the employees and board of directors of the company or liabilities and why are they still not fired. and still paying $40,000/month to two useless Board of directors for doing nothing of value. but instead ripping existing shareholder value and embezzling corporate assets.

ronald barliant

rainer boehm

who are just board of directors were paid over $40,000 for doing nothing of value

they have other jobs and this job is plum job for doing nothing but writing checks to the lawyers.

these two guys are just hire hands and front man to give the impression they represent the shareholders of interest of hgenq but from what I see they are part of the plan to embezzle assets to taran and liquidate assets of the corporation and rip off the ipo investors who were sold ove 150 million in shares.

they don't even have to be paid for anything as there is no business to run or manage in chapter 11

Before the bankruptcy humanigen had over 5 million in cash and equivalent assets not including the ip patents and only 2 million in liabilities. That 5 million in cash and equivalent didn't include the ip lenz patent tht was generating 2.5 million licensing fees just from Austalian subsidiary.. of the 44.10 million in fake creditor claims only 1-2 million was real debt owed. the rest was fraudulent creditor claims. as no company would give credit that much and no bank will lend money to humanigen as they had no collateral and no revenue. The company could have just went to the market to raise additional investment and didn't need the bank loans. so no bank would lend money to humanigen as an unsecured lender.

The Chime and and pathogen just two 'disputed' claim which was breach of contract lawsuit was like 37 million dollars of the 44.10 million 'creditor claim and because of the lawsuits the company was not able to raise capital by issueing any equity as most biotech would do. but that was the plan. to go bankrupt and wipe out existing ipo investor equity. by auction assets in sham auction that was sold for nothing in rigged fraudulent sham auction.

The plan is to dry and bleed every dollar out of this company before dissolving the company.

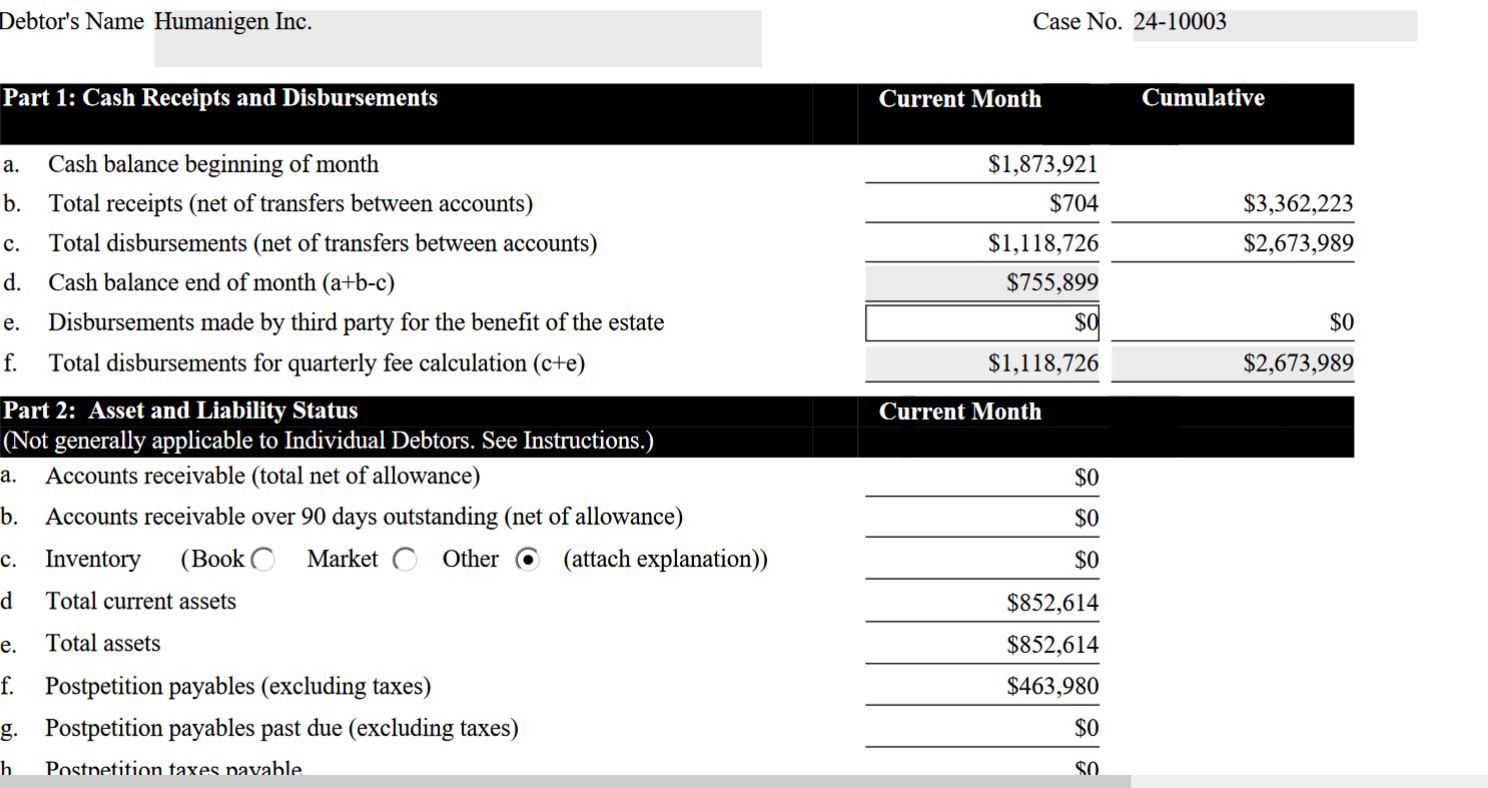

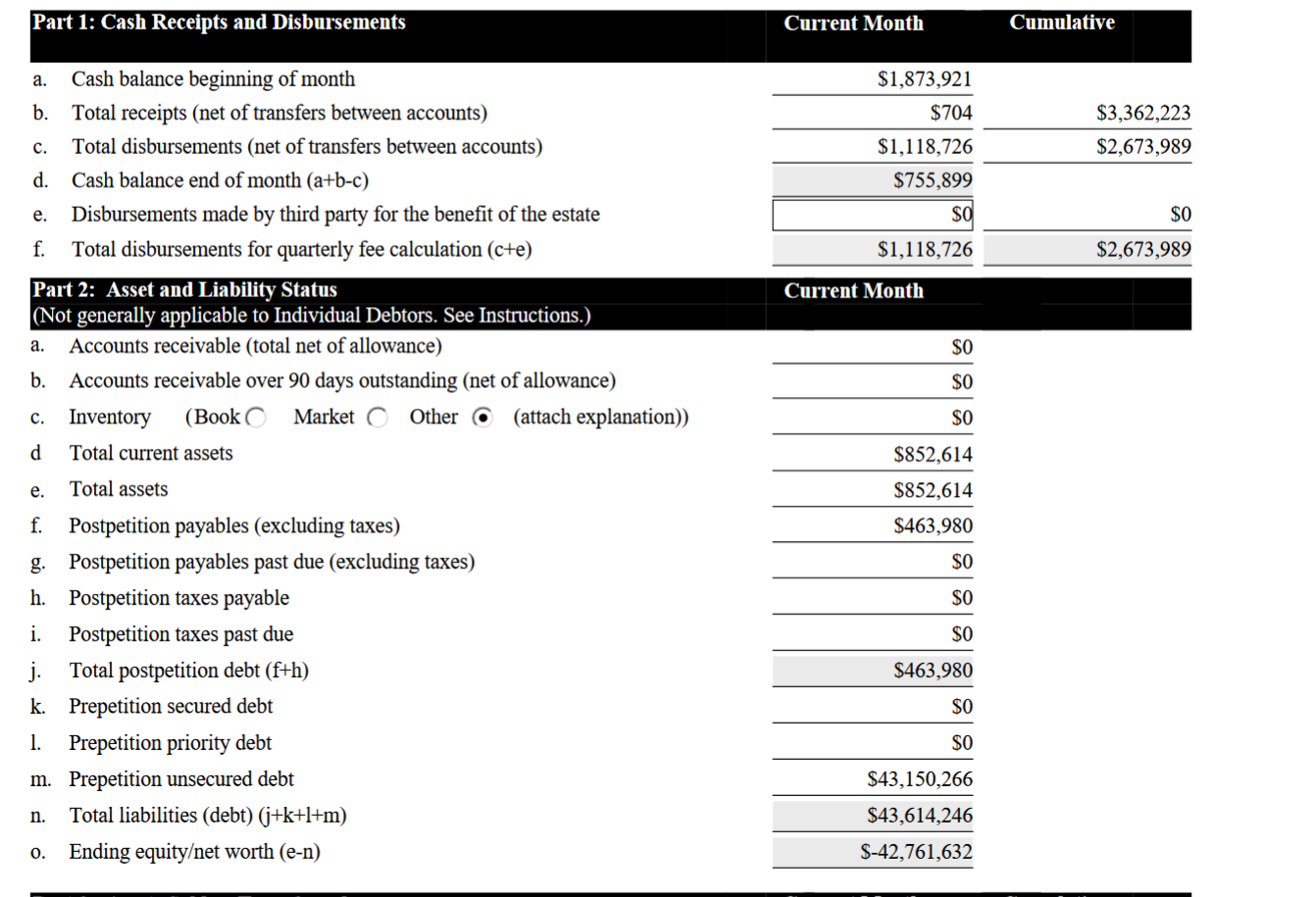

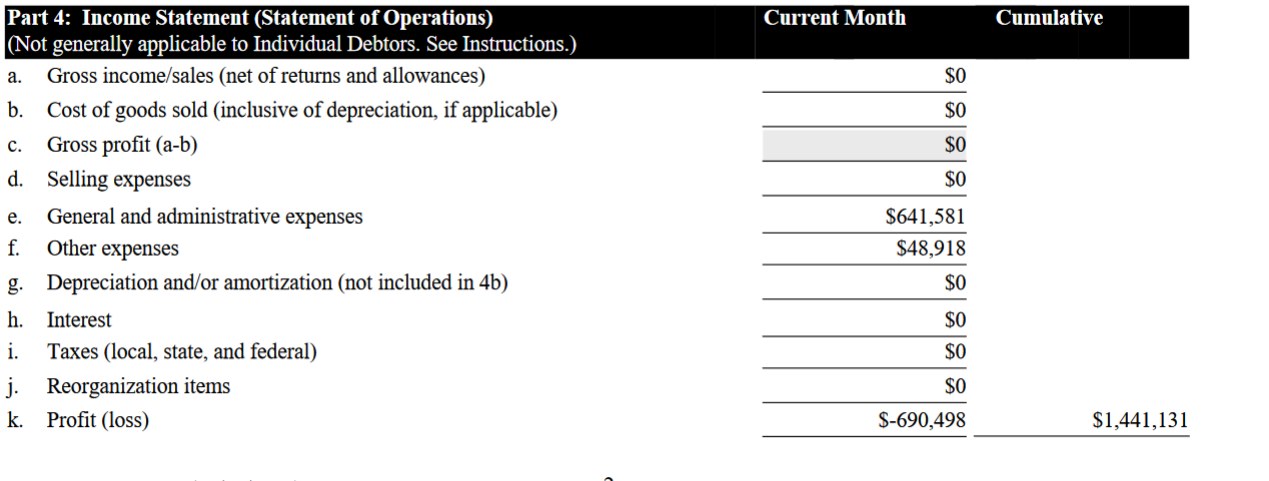

As of march 31 thee was a total of $755,899 cash balance.

you cannot dissolve a company with that much assets. As for the $463,980 post bankruptcy debt the 40 million pre bankruptcy debt was fake so is the $463,980 debt. why pay fraudulent creditor claims?

Why is this company still wiring over $400,000 to Biowa and Catalent? its in chapter 11 so it doesn't have to pay any of the creditors. Are those companies own by Taran? and same with over 1 million in legal fees for chapter 11. Chapter 11 is basic legal process, there is no need for all this paper work.

some bot had verbal diarrhea today. relax it will be back to 0 tomorrow

Technical BREAKOUT it closed at .0067? on no volume 2000 shares is only $13.40? who is messing around ?

gap from .0001 to .0067 no sellers between .0001 and .0067 that is how illiquid this stock is. and some autobot is still short 39,987 shares. as for march 28 , 2024?

Was this some an autobot or human?

What is going on with $HGENQ. I would appreciate if someone makes me a resume.

another crime is the insurance fraud, the company bought the $5 million dollar management liability insurance from some company and paid over $100,000/year in premiums// only fraudulent companies would buy that insurance. they know they well be sued or bought insurance and commit some crimes and get sued and claim the insurance payment for management being sued. none of the management being sued is even fired.

insurance fraud, they wanted to get sued. why anyone want to sell those management liability insurance. because these lawsuits can go unlimited high and that is the problem where management intentionally does some investor fraud and wants get sued so go bankrupt.

as for the insurance companies, they are making big bucks in premiums as the people buying is the corporation not the individuals. essentially management is not personal liable for investor fraud or mismanagement.

before filing for bankruptcy chapter in 2022, the company received over 2.5 million australian licensing for the lenzi patents. FDA is just for US market, other countries have their regulatory approval. and hgenq license to Australia they could have made millions in licensing if australia drug regulatory agency approves it. but since the patents are sold for 'free' to taran who bought it for free. hgenq gets nothing. and its now being dissolved. basically, this is classic case stock fraud. and embezzlement of corporate assets via fake chapter 11 or bankrutpcy fraud, and creditor claim fraud.

With secure creditors like bondholders, they can seize assets of the company if you miss just one payment or break loan convenants ie . getting delisted from stock market, sales fall below revenues, this bankruptcy was voluntary by hgen controlling shareholder, it didnt' have to file for chapter 11 because there is nothing the unsecured creditors can do. the 3 million dollar payment was not a ' conviction' by the juror that the company was liable. HGENQ management settled and agreed to pay the company cash of 3 million to the lawsuit because it bought 'insurance' for $5 million. the company paid close to $500,000 in insurance premiums and got paid $5 million in insurance pay out.so it settled. 2 million for legal fees and 3 million to the .047share settlement on condition - legal fees.

hgenq has NO SECURE creditors, and according to the plan it needs no approval from any non-secure creditor to dissolve the company. The decision to dissolve the company is solely on the entity that controls 90% of hgenq shares which is why there is no shares for sale under .01/cent.

"I don't get this need creditor approval to liquidate hgenq for what?"

Friday's filing by Durrant of Exhibit A was in regards to the, "...monetizing and distributing contingent assets such as the Milestone Payments..." This amendment obviously reflects a belief that either Durrant, the Creditors, or all of them, anticipate either a BLA or foreign regulatory approval of lenz. That's what it would take to monetize the Milestone Payments.

Again:

https://document.epiq11.com/document/getdocumentsbydocket/?docketId=1075977&projectCode=HUM&docketNumber=235&source=DM

this is an abandon stock, abandon market. untradeable ticker in many tickers.

you know it's bad when even the Autobots have abandon this stock and not trading it. zero volume nothing on the ask and nothing on the bid.

all the autobots have abandon this stock too.

only an autobot would short 100 shares at .0001 or trade 100 shares of a .0015 stock.

you know that there is ZERO volume, nobody selling below .01/share

yet one entity owns 110 million shares. why is that guy who owns 110 million shares not selling his worthless shares?

there is a 1 million dollar sell order at .01 cent.

lol , management has about 15% of shares

dtg and pontious pilot have as many

these shares of hgenq could worth something if fundamental change but fundamentally at this moement in time, the shares are fundamentally worthless if assets are liquidated and liquidating 'trust' owns everything which is nothing. at this moment in time, hgenq has no assets and nothing to liquidate or sell other than some promissory schmuck insurance if LENZI ever gets commercialization and even that is being stolen or liquidated.

an asset with no bid is worthless at that particular moment in time, technically speaking.

even forex and crypto the value is derivatives ,the value can be calculated. a country currency is based on GDP and crypto the value is based on the assets which is cash. to say crypto or bitcoin 'value' is based on supply and demand is naive.

you should accept the fact the current shares are 'worthless' shares ware worth what the company 'shares' or equity is worth. the equity has no value other than promissory note and even that is being liquidated to pay the creditors. the lawyers want it so old shareholders get nothing. the company has no 'secured' creditors and doesn't need 'unsecured' creditors vote so why as for vote. 44,100,000 million of the debt or claim is 'disputed' this company was not even bankrupt. and without that lawsuits and millions in legal cost. this company could easily raise additional shares assuming LENZI patent had any value, another issue is the LENZ ip could be fake too. and worthless. if the assets are worthless the shares are worthless.

the new company from chapter in some cases issues NEW shares to past shareholders like 1% of NEW company with NEW shares. old shares are worthless and anyone short those shares don't need to cover.

if the shares are cancelled and deregistered as 'worthless', the naked short positions don't have to cover.

Market makers or brokers don't have to cover if they are NAKED short positions which is only available to brokers or market makers or market maker privilleges and don't pay borrowing fees and never have to cover. Retail traders have to cover all their short positions in the open market and pay borrowing fees and limited shares to short. where as market makers can short as many shares as they want as they are naked shorts.

I know. It was 92%, and I think the shares they sold to DTG may have dropped them down to 89%.

management does not hold 90% of shares sorry

Humanigen's most valuable resource is management's holding of ~90% of the company's Outstanding Shares. I built a database capable of tracking Cede shares. I will give it to management, or I will do the data entry myself, if they give me the Transfer Agent's journal. I would not charge them for that service. I would sign a Non-Disclosure Agreement, as well, to protect shareholders' identities. I would only want to report on the number of shares in circulation. The data I compiled previously was solid, and showed just cause for enabling me to subpoena the Electronic Blue Sheets from FINRA, which I did. Also, if there was any question in regards to the ownership of the shares in the SEC's case against Dale's entities, this database would provide a clear trail of possession. My motivation for the work I did previously was to prove the SEC's culpability. That would be true in this case, as well, except the cast of despicable characters would be expanded to include NIAID, the NIH, the CDC, and the FDA, and their intentional roles in permitting each and every preventable death, including my wife's. All management has to do is ask.

I hope the recall of Humanigen's loaned shares does happen. I can't accept that the existing HGEN shares will just somehow dissolve. I suspect the shares will be transferred to Taran in a stock-for-stock purchase. Not only do I think that needs to happen, Durrant can use the windfall profits from a short squeeze to further his reorganization objectives.

The debtor seeks the approval of this human court to grant approval for this theft and transfer assets to the theives.

The lawyers and fake creditor committe has total control and possessing the assets of this debtor and can sell all assets and don't need the court or the debtor permission to shut down this sham court trial of this human court. which has no authority to rule or make judgement of this theft of the American investor and public.

Ain’t happening, no need to, Durrant has what he needs already.

"DiegoRiv_

@diegaturp

·

9h

Isn't it going to disappear?"

cowtown jay

@cowtown_jay

·

51m

I wonder if Taran will issue 119,080,135 shares, and then offer HGEN a stock-for-stock buyout. Or might Taran issue 595,400,650 shares, and offer HGEN a 1:5 stock buyout. That could also allow 238,160,270 shares for a second stock-for-stock merger.

I wasn’t expecting that but looks to be the case based on the filings…this one’s going to hurt!

I really thought there would be a chance to recoup my investment, but that’s the breaks in taking a risk on a BK trade.

This EM crap kills any speculation on BK plays….oh well, probably for the good I guess.

the stock looks like it can be deregistered and cancelled for what. the creditors want to own a worthless shell company? pfff

Without the support, money and hard work of the SEC, American judicial system ,and lawyers, retail brokerages, social media advertising, news media propaganda, corrupt FDA etc this stock scam, Federal reserve interest rates at 0% forcing money into speculative assets with high liquidity, the fleecing of American retail naive investors would not be possible.

The liquidation 'PLAN' is to liquidate, dissolve the corporation but why? and shares cancelled, and shared delisted from OTC.

As for the short position or borrowed shares that someone here talkinga bout, those are NAKED short position who shorted 119 million shares either by market makers who didn't borrow the shares. If it was borrowed shares from broker, the broker would charge borrowing fee which is a percentage of the value of the shares and so high, shorting is not feasible for retail traders where as market makers can short naked any stock even a stock trading at .00001 and pay no borrowing fee. Is this fair. where market makers have trading privilleges and have 'advantages' over retail traders.? The market is not fair, no orderly, and corrupt. which the SEC has been unable to enforce. The SEC and justice system or US judicial system is enabling ans assisting criminals to rob the American public investor legally.

_Stock_Message_Board_InvestorsHub.png)

the only loser is the ipo investors and retail investors who thought they were investing in a real investment opportunity. even the ip lenzi could be fake and faked FDA clinical applications as the FDA is not trustworthy either. FDA could be part of this scam.

i guess the hgenq shares will be liquidated, delisted from the OTC and everyone gets nothing. this entire chapter 11 was a waste of time, the judges time, if the public is paying for his time, SEC time, DA time in this fake trial.

I don't get this need creditor approval to liquidate hgenq for what?

all the assets are sold and hgenq owns no assets. other the promissory from taran .

Why waste the 'OFFICIAL committe time with these legal paper work and bill the creditors more legal fees for nothing. and you need to let the judge know how much you are billing the clients.

Consider the Milestone Events:

+First (1st) FDA approval of a BLA

relating to Lenzilumab for CMML in

the United States, provided such

approval is granted within five (5)

years following the Closing Date.

The next three (3) FDA approvals of

a BLA relating to Lenzilumab for any

follow-on indication to CMML in the

United States provided such

approval(s) is granted within seven

(7) years following the Closing Date.

First (1st) Regulatory Approval of

any HGEN Product for a particular

Therapeutic Indication for

Lenzilumab in the United Kingdom,

Germany, France, Italy, Spain or

Australia (each, an “Approved

Country”), provided such approval is

granted within five (5) years

following the Closing Date."

There are a few other Milestone Events related to various net sales totals.

The Milestone Events can be seen on pages 55 and 56/95, linked here.

https://document.epiq11.com/document/getdocumentsbydocket/?docketId=1061258&projectCode=HUM&docketNumber=155&source=DM

What would it take to monetize these Milestone Events? It would take receiving a BLA from the FDA for CMML, and related indications in the US. I think Sanofi, with their deep pipeline of oncology products and processes, would be an excellent partner for us in oncology, once they complete the spin-off of their healthcare division in the coming months.

In other parts of the world, Regulatory approval of lenz from any Approved Country would qualify as a Milestone Event. I think SAMHRI will be of invaluable assistance to us in Australia.

How likely is it that Humanigen will get Regulatory authorization or approval to qualify for these Milestone Events?

The Creditors' Committee must think that not only is this likely, Humanigen may even accomplish more than currently indicated.

"The settlement amended the APA to, among other things, significantly expand the events that will trigger the contingent “Milestone Payments” and increase the amount of those payments under the APA."

page 4/5

https://document.epiq11.com/document/getdocumentsbydocket/?docketId=1075977&projectCode=HUM&docketNumber=235&source=DM

Any news of regulatory authorization or approval, or news regarding our restructuring, will signal Humanigen to recall their loaned shares.

you think that if the shares are 'worthless' why that ONE guy or one entity who owns 100 million shares is not selling any of his shares?

there is no shares for sale under .01. odd because he wants to go bankrupt by keeping his controlling shares. odd that he would not sell it for tax loss selling or capital loss.

As for liquidation, it allows the theives to walk clean and walk free. 'legally'

|

Followers

|

326

|

Posters

|

|

|

Posts (Today)

|

0

|

Posts (Total)

|

43436

|

|

Created

|

01/31/13

|

Type

|

Free

|

| Moderators cowtown jay | |||

Humanigen, Inc. is a clinical-stage biopharmaceutical company developing its portfolio of next-generation cell and gene therapies for the treatment of cancers via its novel, GM-CSF neutralization and gene-knockout platforms. As a leader in GM-CSF pathway science, we believe that we have the ability to transform CAR-T therapy and a broad range of other T-cell engaging therapies, including both autologous and allogeneic cell transplantation. There is a direct correlation between the efficacy of CAR-T therapy and the incidence of life-threatening toxicities (referred to as the efficacy/toxicity linkage). We believe that our GM-CSF neutralization and gene-editing platform technologies have the potential to reduce the inflammatory cascade associated with serious and potentially life-threatening CAR-T therapy-related side effects while preserving and potentially improving the efficacy of the CAR-T therapy itself, thereby breaking the efficacy/toxicity linkage. Clinical correlative analysis and pre-clinical in vivo evidence points to GM-CSF as the key initiator of the inflammatory cascade resulting in CAR-T therapy’s side-effects. Pre-clinical in vivo data on the neutralization of GM-CSF using antibody or gene KO indicates that it is not required for CAR-T cell activity. Our strategy is to continue to pioneer the use of GM-CSF neutralization and GM-CSF gene knockout technologies to improve efficacy and prevent or significantly reduce the serious side-effects associated with CAR-T therapy.

We believe that our GM-CSF pathway science, assets and expertise create two technology platforms to usher in next-generation CAR-T therapies. Lenzilumab, our proprietary Humaneered® anti-GM-CSF immunotherapy, has the potential to be used in combination with any FDA-approved or development stage CAR-T therapy, as well as in combination with other cell therapies such as HSCT, to make these treatments safer and more effective. In addition, our GM-CSF knockout gene-editing platform has the potential to create next-generation CAR-T therapies that may inherently avoid any efficacy/toxicity linkage, thereby potentially preserving the benefits of the CAR-T therapy while altogether avoiding its serious and potentially life-threatening side-effects.

The company’s immediate focus is combining FDA-approved and development stage CAR-T therapies with lenzilumab, the company’s proprietary Humaneered® anti-human-GM-CSF immunotherapy, which is its lead product candidate. A clinical collaboration with Kite, a Gilead Company, was recently announced to evaluate the use of lenzilumab with Yescarta®, axicabtagene ciloleucel, in a multicenter clinical trial in adults with relapsed or refractory large B-cell lymphoma. The company is also focused on creating next-generation combinatory gene-edited CAR-T therapies using strategies to improve efficacy while employing GM-CSF gene knockout technologies to control toxicity. The company is also developing its own portfolio of proprietary first-in-class EphA3-CAR-T for various solid cancers and EMR1-CAR-T for various eosinophilic disorders. The company is also exploring the effectiveness of its GM-CSF neutralization technologies (either through the use of lenzilumab as a neutralizing antibody or through GM-CSF gene knockout) in combination with other CAR-T, T cell engaging, and immunotherapy treatments to break the efficacy/toxicity linkage including the prevention and/or treatment graft-versus-host disease (GvHD) in patients undergoing allogeneic HSCT. The company has established several partnerships with leading institutions to advance its innovative cell and gene therapy pipeline.

June 15, 2020

Phase 3 Study to Evaluate Efficacy and Safety of Lenzilumab in Hospitalized Patients With COVID-19 Pneumonia

https://clinicaltrials.gov/ct2/show/NCT04351152

Anti-GM-CSF antibodies expected to show better effect in Covid-19 than cytokine-specific targets

July 27, 2020

https://discoverysedge.mayo.edu/2021/06/22/cancer-to-covid-19/

| Volume | |

| Day Range: | |

| Bid Price | |

| Ask Price | |

| Last Trade Time: |