Register for free to join our community of investors and share your ideas. You will also get access to streaming quotes, interactive charts, trades, portfolio, live options flow and more tools.

Huobi Acquires a Controlling Stake in Pantronics Holdings Ltd – Huobi has quietly bought a 73.73% stake in Pantronics Holdings. Pantronics filed shareholding disclosures on August 21, 2018 to the Hong Kong Stock Exchange. The filing transferred over 221 million regular shares to the Chairman of Huobi Group. The acquisition is a reverse takeover that seeks to recognize Huobi on the HKSE. Such a reverse takeover is oftentimes referred to as a backdoor listing. The deal is valued at $77 million with an average of $0.35 per share. However, Huobi is yet to offer an official statement regarding the reports. The move adds Huobi to a growing list of companies that are planning IPOs. Earlier this week, Bitmain, Canaan Creative and Ebang Holdings revealed plans to go public. Read more: https://marketexclusive.com/huobi-acquires-a-controlling-stake-in-pantronics-holdings-ltd/2018/08/

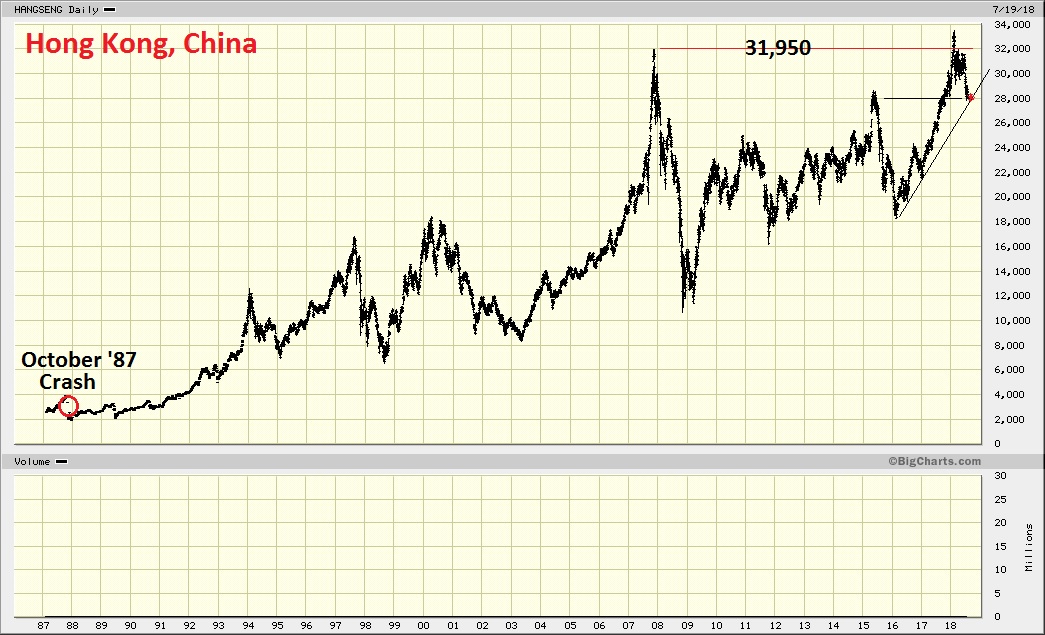

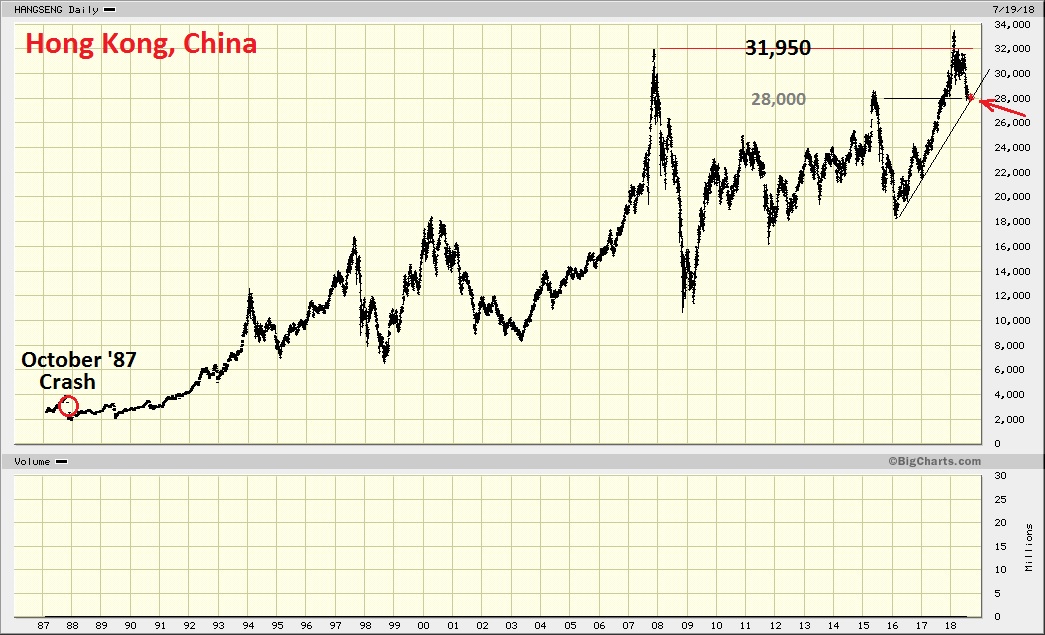

Hong Kong Update :

Hong Kong last week : (28,000)

28,000

Hong Kong last night : The 31,950 (6 months ago), coincided with the top of the Dow, etc.

Now we are HERE ; (at 28,000)

The size of the arrows reflect what look like the odds (to me)...

Last night the Red was slightly larger.

If it ventures Up tonight ?.....I'll make that Red smaller !

Last night it closed at 28.010 heading into Friday !

What has an unbelievably fraudulent history ?

.

.

Here's its' correlation with the S&P :

Just wouldn't be surprised if it coincided with an upcoming global selloff !

.

Swell charts of yours' there by the way

http://investorshub.advfn.com/boards/read_msg.aspx?message_id=23586067

Thanks

20,199.02 -129.84 -0.64%

as of 04:10 AM EDT on 08/21/2009 (FOREX Delay: 15 mins.)

Previous Close 20,328.86

Today's Open 20,288.56

Change -40.30

52-Wk Low —

52-Wk High —

Range —

Day Low 20,002.7812:13 AM EDT

Day High 20,439.4210:33 PM EDT

Range 436.64

$SSEC closed at 6030.09 above 6000 as noted that the market has a lot room to grow as it is relatively young and growing for which we could see it over 10,000 in a few years.

Hang Seng Hong Kong and Bombay Sensex also performed exceptionally well gaining 2-3%. Hang Seng closed with new high 59540.78. Sensex regained all its loss during the last week closing at 19058.67 with a new high.

Futures and Euro markets are mixed at the moment.

Good luck

^SSEC Shanghai Composite 6,030.09 3:00AM ET Up 126.82 (2.15%) Chart, More

^HSI Hang Seng 29,540.78 4:01AM ET Up 702.41 (2.44%) Components, Chart, More

^BSESN BSE 30 19,058.67 6:28AM ET Up 639.63 (3.47%) Chart, More

^JKSE Jakarta Composite 2,638.21 Oct 11 Up 46.73 (1.80%) Components, Chart, More

^KLSE KLSE Composite 1,375.25 Oct 12 Down 8.36 (0.60%) Components, Chart, More

^N225 Nikkei 225 17,358.15 3:00AM ET Up 26.98 (0.16%) Chart, More

^NZ50 NZSE 50 4,325.09 12:31AM ET Up 19.48 (0.45%) Components, Chart, More

^STI Straits Times 3,862.02 5:05AM ET Up 4.77 (0.12%) Components, Chart, More

^KS11 Seoul Composite 2,035.39 5:03AM ET Up 8.95 (0.44%) Components, Chart, More

^TWII Taiwan Weighted 9,518.45 1:46AM ET Up 21.98 (0.23%) Chart, More

Euro Market intra

ASIAN Market intra

International Markets

Asian Markets Trading at or near Resistance.

Will they they take the lead or mimick US markets earning season's jitters? Judged from the past the second case is more likely.

The Hang Seng Index (abbreviated: HSI) is a capitalization-weighted stock market index in the Hong Kong Stock Exchange. It is used to record and monitor daily changes of the largest companies of the Hong Kong stock market and as the main indicator of the overall market performance in Hong Kong. These 39 companies represent about 65% of capitalization of the Hong Kong Stock Exchange.

HSI was started on November 24, 1969, compiled and maintained by HSI Services Limited, which is a wholly owned subsidiary of Hang Seng Bank, the second largest bank listed in Hong Kong in terms of market capitalisation. It is responsible for compiling, publishing and managing the Hang Seng Index and a range of other stock indexes, such as Hang Seng Composite Index, Hang Seng HK MidCap Index, etc.

Statistics

When the Hang Seng Index was first published, its base of 100 points was set equivalent to the stocks' total value as of the market close on July 31, 1964. Its all-time low is 58.61 points, reached retroactively on August 31, 1967, after the base value was established but before the publication of the index. The Hang Seng passed the 10,000 point milestone for the first time in its history on December 6, 1993 and, 13 years later, passed the 20,000 point milestone on December 28, 2006. Its all-time highs, set on July 24, 2007, are 23,534.38 points in trading and 23,472.88 points at the close.

On January 2, 1985, four subindices were established in order to make the index clearer and to classify constituent stocks into four distinct sectors. There are totally 40 Hang Seng Index Constituent Stocks since 13 September 2007 and they are namely:

Hang Seng Finance Index

* 0005 HSBC Holdings plc

* 0011 Hang Seng Bank Ltd

* 0023 Bank of East Asia, Ltd

* 0388 HKEx Limited

* 0939 China Construction Bank

* 1398 Industrial and Commercial Bank of China

* 2318 Ping An Insurance

* 2388 BOC Hong Kong (Holdings) Ltd

* 2628 China Life

* 3328 Bank of Communications Ltd

* 3988 Bank of China Ltd

Hang Seng Utilities Index

* 0002 CLP Holdings Ltd

* 0003 Hong Kong and China Gas Company Limited

* 0006 Hong Kong Electric Holdings Ltd

Hang Seng Property Index

* 0001 Cheung Kong (Holdings) Ltd

* 0012 Henderson Land Development Co. Ltd

* 0016 Sun Hung Kai Properties Ltd

* 0083 Sino Land Co Ltd

* 0101 Hang Lung Properties Ltd

Hang Seng Commercial & Industrial Index

* 0004 Wharf (Holdings) Ltd

* 0008 PCCW Ltd

* 0013 Hutchison Whampoa Ltd

* 0017 New World Development Co. Ltd.

* 0019 Swire Pacific Ltd 'A'

* 0066 MTR Corporation Ltd

* 0144 China Merchants Holdings (International) Co Ltd

* 0267 CITIC Pacific Ltd

* 0291 China Resources Enterprise, Ltd

* 0293 Cathay Pacific Airways Ltd

* 0330 Esprit Holdings Ltd

* 0386 Sinopec Corp

* 0494 Li & Fung Ltd

* 0551 Yue Yuen Industrial (Holdings) Ltd

* 0762 China Unicom Ltd

* 0883 CNOOC Ltd

* 0906 China Netcom Group Corporation (Hong Kong) Ltd

* 0941 China Mobile (Hong Kong) Ltd

* 1038 Cheung Kong Infrastructure Holdings Ltd

* 1199 COSCO Pacific Ltd

* 2038 Foxconn International Holdings Ltd

In the future, the number of constituent stocks will be increased to 50 in order to reflect the performance of Hong Kong stock market more accurately.

The Hang Seng Composite Index Series (恒生綜合指數) was launched on October 3, 2001, targeting on providing a broad standard of the performance of the Hong Kong stock market. Comprising the top 200 listed companies in terms of market capitalisation, it is composed of the geographical series and the industry series. The market capitalization of these companies accounts for about 97% of the total capitalization of the stocks in Hong Kong. To ensure fairness in its activities, the HSI Services established the Independent Advisory Committee to give advice on issues regarding the management of HSI. The Committee keeps reviewing the constituent stocks of HSI. Usual changes are expected.

Another new HSI Services approved stock market index is the FTSE/Xinhua China 25 Index (a joint venture between the FTSE Group and Xinhua Finance) which was launched on October 25, 2004, targeting Chinese red chip (listed in Hong Kong but with Chinese controlling shareholders) companies.

The Hang Seng Stock Classification System

The Hang Seng Stock Classification System is a comprehensive system designed for the Hong Kong stock market by HSI Services Limited. It reflects the stock performance in different sectors. It caters for the unique characteristics of the Hong Kong stock market and maintains the international compatibility with a mapping to the FTSE Global Classification System, which is compiled and administered by FTSE International Limited.

General Classification Guidelines:

i) The sales revenue arising from each business area of a company is the primary parameter of stock classification, and the net profit will also be taken into consideration to determine whether that company's business runs well.

ii) A company will be classified into different sectors according to its majority source of sales revenue.

iii) Re-classification of a stock's Industry Sector will occur once the company's business has undergone a major change, such as, substantial merger or acquisition.

Industry Sectors:

* Oil & Resources (資源礦產業)

* Industrial Goods (工業製品業)

* Consumer Goods (消費品製造業)

* Services (服務業)

* Utilities (公共事業)

* Financials (金融業)

* Properties & Construction (地產建築業)

* Information Technology (資訊科技業)

* Conglomerates (綜合企業)

Source of Information

The classification of each stock is based on the information available to the public, for examples the annual reports and company announcements.

http://en.wikipedia.org/wiki/Hang_Seng_Index

Hi Andy, good alert, thanks. Hang Seng is breaking out.

Mainland Investors Allowed to Buy Hong Kong Stocks Under Pilot Program

By Claudia Blume

Hong Kong

27 August 2007

http://www.voanews.com/english/2007-08-27-voa6.cfm

Beijing has announced a pilot program that will allow Chinese citizens to invest in the Hong Kong stock market and New Zealand says it will take Australia to the World Trade Organization over a ban on apple imports. Claudia Blume at VOA's Asia News Center in Hong Kong has more on these and other business stories from the region.

The Chinese government will allow mainland investors to buy Hong Kong shares. Hong Kong, unlike mainland China, allows the free flow of money in and out of its financial markets.

Stephen Green is a senior economist for Standard Chartered Bank in Shanghai. He says Beijing wants to make it easier to shift funds overseas because there is too much cash pouring into the country, causing pressure on the currency to appreciate. Another reason, he says, is that at the moment Chinese investors have limited options for investing their money.

"It's basically put it on deposit at the bank, buy a house or invest in a very volatile - albeit very good in the last few months - stock market," he said. "And so it's part of an effort to allow them to diversify their exposure to various assets, which will hopefully increase their return in the long term and also reduce some of the risks involved for them."

China's central bank raised interest rates for the fourth time this year. The bank's main lending rate will go up by 18 basis points to 7.02 percent. The benchmark deposit rate will rise 27 basis points to 3.6 percent.

Beijing has raised interest rates several times this year in an effort to slow the rapidly growing economy and to control inflation, which reached its highest level in over a decade last month.

New Zealand will take Australia to the World Trade Organization over a dispute about apple exports. Canberra banned the import of apples from New Zealand 86 years ago to prevent a plant disease from spreading to Australia. Years of effort to resolve the issue bilaterally failed. Wellington says it hopes the WTO can persuade Australia to lift the ban, which it calls a barrier to free trade.

"The percentage of apple exports to Australia in the short term is not all that significant," said Jim Anderton, New Zealand's minister for agriculture. It is really the principle of gaining access to the market and being able to build on a secure base the future of our market access."

Filipino men have some catching up to do: Women far outnumber them at the top of the corporate ladder. While there were 2.5 million female executives in the Philippines in 2004, only 1.6 million executive jobs were held by men. The Philippines' Department of Labor says the ratio of women holding top posts is the world's best. Ninety-seven percent of businesses in the country have women in senior management positions.

Hang Seng has retraced 100%

http://investorshub.advfn.com/boards/read_msg.asp?message_id=22396961

|

Followers

|

2

|

Posters

|

|

|

Posts (Today)

|

0

|

Posts (Total)

|

17

|

|

Created

|

08/19/07

|

Type

|

Free

|

| Moderators | |||

| Volume | |

| Day Range: | |

| Bid Price | |

| Ask Price | |

| Last Trade Time: |