Register for free to join our community of investors and share your ideas. You will also get access to streaming quotes, interactive charts, trades, portfolio, live options flow and more tools.

Those are the SAME MM Codes I have.

I think 1 might just be abbreviated for 100 shares.

NOBODY BUYS 1 SHARE OF A PENNY STOCK - Even with a discount broker it would probably cost at least $4.95 for the trade.

Awsome thanks for that info on MM smoke signals!

Awsome thanks for that info on MM smoke signals!

GM all! I've noticed, for example, VFIN on the ask with one share at the very bottom. I've seen this on several stocks with different MMs. I've asked several different boards and no one knows.

nice post dude. everybody here should start working in concert.

There are 5 others that are commonly used:

153 - I'm hungry. Need soup and a half tuna sandwich

249 - Are there any MMs out there single? Need a date.

387 - I forgot the signals please re-email them.

591 - Today is my birthday. I like ice cream cake.

787 - Why use signals? Anybody hear of a cell phone?

Nice bit of info. The MMs are changing their codes as we speak

Thanks friend very interesting read. I'll keep this for reference.

Alright, this is interesting information. So how can little fish like us use these signals to mess with their (the MM's) heads? Surely a few of us taking turns sending false signals could cause some confusion? Or do they only 'communicate' with known MMs with whom they've made 'deals?'

thnx, hope we go higher today

I've seen that list buy this is the first time I've seen the 111 signal. I happened in PMCM this afternoon.

Since wee are in and out of sub penny what does 10,000 share trade mean?

I really don't know what that could be...

hfields,

I am in a stock right now that 834 shares have gone off a few times in the last weeks and the trade value is only around $3.08.....

Do you know what this could mean, its happened several times on a sub penny stock... doesnt make sense

any ideas whats going on would help a lot

CONGRATS...Guess I will be seeing you at the strip club...

http://seekingalpha.com/article/869411-halliburton-110-upside-potential

Halliburton Company (HAL) is one of the top providers of oil services, from pressure pumping to drilling. Over time, Halliburton has integrated its services into a single solution. Thanks to this policy, customers can obtain increased well performance, and reduce nonproductive time, by standardizing with Halliburton's services rather than combining services from several service providers. Thus, the company provided all-in-one solution to its partners. Halliburton is a global company. In 2011, 58% of the company's revenues came from North America while the rest was attributed to international ventures.

As of September 15, Halliburton stock was trading at around $37, with a 52-week range of $26.28-$40.60. It has a market cap of $35.7 billion. The trailing twelve-month P/E ratio is 11.04, and the forward P/E ratio is 10.67. P/B, P/S, and P/CF ratios stand at 2.5, 1.3, and 10.4, respectively. Its operating margin is 18%, whereas net profit margin is 10.7%. Halliburton has minor debt issues thanks to a low debt/equity ratio of 0.3.

Halliburton pays stable dividends - the trailing yield of 0.99% is the same as the forward one. Over the last five years, the company has been paying the same quarterly dividend at 9 cents per share, amounting to 36 cents annual dividend. Consequently, the quarterly dividend is expected to be 9 cents in the coming year as well. While, the dividend yield is low, five-year dividend history suggests that Halliburton is a regular dividend payer.

Halliburton has a four-star rating from Morningstar. Out of eight analysts covering the company, all eight have a "buy" rating. Wall Street has a largely positive outlook for the company's future. The average five-year annualized growth forecast estimate is 21.30%. What is the fair value of Halliburton given the forecast estimates? We can estimate Halliburton's fair value using discounted earnings plus equity model as follows.

Discounted Earnings Plus Equity Model

This model is primarily used for estimating the returns from long-term projects. It is also frequently used to price fair-valued IPOs. The methodology is based on discounting the present value of the future earnings to the current period:

V = E0 + E1 /(1+r) + E2 /(1+r)2 + E3/(1+r)3 + E4/(1+r)4 + E5/(1+r)5 + Disposal Value

V = E0 + E0 (1+g)/(1+r) + E0(1+g)2/(1+r)2 + … + E0(1+g)5/(1+r)5 + E0(1+g)5/[r(1+r)5]

The earnings after the last period act as a perpetuity that creates regular earnings:

Disposal Value = D = E0(1+g)5/[r(1+r)5] = E5 / r

While this formula might look scary for many of us, it easily calculates the fair value of a stock. All we need is the current-period earnings, earnings growth estimate, and the discount rate. To be as objective as possible, I use Morningstar data for my growth estimates. You can set these parameters as you wish, according to your own diligence.

Valuation

Historically, the average return of the DJI has been around 11% (including dividends). Therefore, I will use 11% as my discount rate. In order to smooth the results, I will also take the average of ttm EPS along with the mean EPS estimate for the next year.

E0 = EPS = ($3.39 + $3.51) / 2 = $3.45

Wall Street holds diversified opinions on the company's future. While analysts tend to impose subjective opinions on their estimates, the average analyst estimate is a good starting point. Average five-year growth forecast is 21.3%. Book value per share is $15.70. The rest is as follows:

Fair Value Estimator

V (t=0)

E0

$3.45

V (t=1)

E0 (1+g)/(1+r)

$3.77

V (t=2)

E0((1+g)/(1+r))2

$4.12

V (t=3)

E0((1+g)/(1+r))3

$4.50

V (t=4)

E0((1+g)/(1+r))4

$4.92

V (t=5)

E0((1+g)/(1+r))5

$5.38

Disposal Value

E0(1+g)5/[r(1+r)5]

$48.88

Book Value

BV

$15.70

Fair Value Range

Lower Boundary

$75.02

Upper Boundary

$90.72

Minimum Potential

100.44%

Maximum Potential

142.39%

(You can download FED+ Fair Value Estimator, here.)

I decided to add the book value per share so that we can distinguish between a low-debt and debt-loaded company. The lower boundary does not include the book value. According to my five-year discounted-earnings-plus-book-value model, the fair-value range for Halliburton is between $75 and $91 per share. At a price of $37, Halliburton stock is excessively undervalued; the stock has at least 100% upside potential to reach its fair value.

Peer Performance

While there are many companies in the oil and gas services industry, Baker Hughes (BHI) is probably the closest competitor of Halliburton. To assess how much profit companies generate on the money shareholders have invested, we consider return on equity. Halliburton has a trailing twelve-month ROE of 22.6%, while Baker's rate is twice as low. Obviously, Halliburton has a relatively strong advantage in terms of profitability However, Baker's stock is also extremely undervalued these days, as its stock has at least 130% upside potential to reach its fair value. Over the last five years, Halliburton and Baker Hughes have been offering steadfast dividends, amounting to $0.09 and $0.15, respectively. However, in terms of dividend yield, Baker Hughes looks more attractive to investors.

Another competitor, Schlumberger Limited (SLB) also has an underpriced stock with 22% upside potential to reach its fair value. However, SLB's ttm P/E ratio of 19.45 is far above that of Halliburton. In contrast to both BHI and Halliburton, SLB pays a superior dividend of $0.275 per share.

The chart below shows Halliburton's performance against its main competitors over the last five years:

HAL data by YCharts

Current Economic Outlook

Halliburton's involvement in the Gulf of Mexico oil spill may be a cause of concern for investors. However, the evidence and public records suggest that the company had little to do with the oil spill. The company expects margins from North America to improve by the start of 2013. What further strengthens this forecast is the $1,105,200 investment into shares, made by the company director, Murray Gerber. This is by far the clearest sign that the insiders have strong expectations for the company's growth in the future, and should be welcome news to investors.

The company expects to have an EPS of $3.50 and revenues of up to $26.9 billion in 2013. When compared to 2011's EPS of $3.08 on sales of $24.8 billion, the stock seems like a bargain. Furthermore, many gas producers are shifting to oil production to take advantage of better commodity prices. The extensive nature of oil exploration puts Halliburton's services in greater demand.

Summary

When it comes to stocks, there is a rule of thumb: if the price has not yet caught up with the strong earnings growth, that stock is a "must-buy." Halliburton's strong revenue, operating margins, stable EPS and continued payment of dividends ensure that the company does indeed have strong earnings.

However, based on my FED+ valuation, Halliburton stock has not reached its fair value and this stock has at least 110% upside potential to reach its fair minimum. The earnings uptrend is more likely to pull up the undervalued stock. This is why now would be a smart time to obtain Halliburton stock, before the stock achieves its eventual fair value. The stock has not performed well over the last 5 years. However, if analysts' estimates hold, Halliburton might just become one of the best buys in the current market.

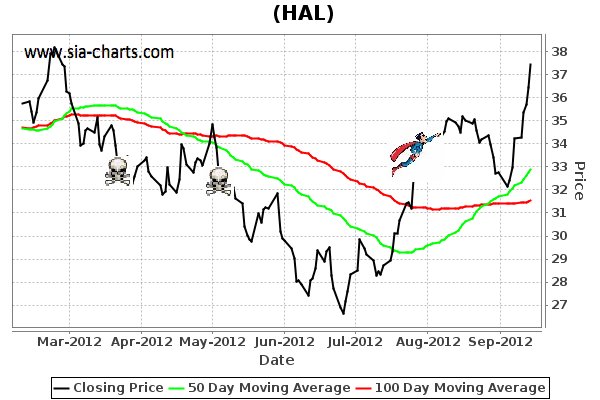

Congratulations on your wedding, here is your gift = SIA Chart on HAL : Very Bullish, Besides having a superman show up, which happens when the stock goes 5% above its 100 day moving average. We also have a super cross show up which means that the 50 day moving average has broken above the 100 day moving average, which is also very bullish and means that buyers are coming in big time.

CONGRATS hfields on tying the knot -

$HAL: Looks like a big reverse head and shoulders could play out here, and push it to a mid $40's price target.

Hey Bud,

Getting married this weekend. Been doing a lot of wedding planning this summer, and not much trading.

I do like Haliburton, though. I have been long this stock since about April, and finally it's coming to fruition. Been accumulating while it went down, and seeing if I can get $40+ on it.

Hope you been well!

H

Fields, have you looked at KMAG?

Fields, have you looked at KMAG?

$HAL: Hourly looks good for next move up here soon.

Move you fucking pos!!!! North!

$HAL: Added a few more ave is $34.06

$HAL: Added today ave. @ 34.21

HAL: Took a starter @ 34.61

$ANR: Out @ 17.74 from $16.19 +1.55 +9.6%

$ANR: Starting to move. Let's see if it's for real...looking for a move to $18 to $20 pps....

ANR: Might have entered too early.

$ANR: In starter @ 16.19

Hey Jaxie...hope you been well...yes, I am joining the club and being taken off of the market! lol

Ha! Ha! My fiance and I are going to another celebration this evening with her family in Hollywood.

$X: Yes, it definitely has some more upside potential, and I might re-enter next week on X or another steel company...I just felt like I needed to take profits on today's pop...I am trying to take profits @ 5% per trade on these set-ups...I am also looking at another potential nat gas play...I recently traded upl and chk for @ %5 gains, and might re-enter those as well.

Good to hear from you, and you are welcome to stop by more often!

H

I don't know Hank, looks like this could have a lot more upside long term.

Nice to take profits of course, but sure looks like this was trading much higher for a long time.

BTW, congrats big guy, looks like your joining the club, lol.

$X + $JRCC = @ +%14 on the week

$X: Out @ $26.85 +1.43 +5.7%

$JRCC: Out 5.86 +.41 + 7.9%

CHARTS. CHARTS. AND MORE CHARTS. FEEL FREE TO LOOK AROUND AND USE ANYTHING I POST HERE FOR YOUR OWN RESEARCH.

WE WILL FOCUS ON STOCHASTIC, TRENDLINE, AND DIVERGENCE SET-UPS HERE. WE LOOK FOR STOCKS TO PUT IN HIGHER LOWS AS STOCH'S PULLBACK INTO OVERSOLD AREA. THIS IS A BULLISH SET-UP. WE ALSO UTILIZE TRENDLINES TO GET INTO AND OUT OF TRADES.

THIS BOARD WILL FOCUS ON HIGH QUALITY STOCK TRADE SET-UPS BASED ON TECHNICAL ANALYSIS. NO PINKS!

DAX: GERMANY'S EQUIVALENT TO US DOW MARKET. TOP 30 GERMAN COMPANIES MAKE OF THE INDEX.

The DAX Exchange trades from 2:00 a.m. until 1:00 p.m. EST in the winter. With daylight savings that changes from 3:00 a.m. until 2:00 p.m. EST.

F2MX - MDAX (MINI-DAX FUTURES CONTRACT)

| MDAX Futures | F2MX | Eurex | OVERNIGHT MARGIN: €3,550.00 | DAYTRADING MARGIN: $1,500.00 |

**JUST BECAUSE I POST A CHART AND ANNOTATE IT, DOES NOT MEAN I AM IN THE STOCK. I POST THESE CHARTS SET-UPS FOR POTENTIAL ENTRIES AND EXITS.**

| Volume | |

| Day Range: | |

| Bid Price | |

| Ask Price | |

| Last Trade Time: |