$HVCW

CHINO, CA / ACCESSWIRE / December 7, 2022 / Harrison, Vickers & Waterman, Inc. ("HVCW"),

through its operating subsidiary, Pacific Energy Network LLC, d/b/a Modern Pro Solutions ("MPS"),

(together the "Company") (OTC PINK:HVCW) has been named a Bronze winner

in the Fastest Growing Company of the Year-

Medium Category in Best in Biz Awards, the only independent business awards

program judged each year by prominent editors and reporters from top-tier

publications in North America.

The 12th annual program saw fierce competition among more than 700 entries from

public and private companies of all sizes and representing all industries and regions i

n the U.S. and Canada,

ranging from some of the most iconic global brands to the most innovative start-ups and resilient local companies.

This year's judges highlighted the winning companies' visionary leadership,

innovative strides in the use of new technologies,

laudable employee diversity and inclusion programs and workplace best practices,

and many winners' continued community involvement and monetary

and time investments in their environment and corporate social responsibility programs.

Since the program's inception in 2011, winners in Best in Biz Awards have been

determined based on scoring from independent judging panels assembled each year

from some of the most respected national and local newspapers,

TV and radio outlets, and business, consumer, technology and trade publications in

North America.

Thanks to the impressive diversity of represented outlets and the unparalleled

experience and expertise of the editors and reporters serving as judges,

Best in Biz Awards judging panels are uniquely suited to objectively determine the best

of the best from among the hundreds of competitive entries.

The 2022 judging panel included, among others,

writers from AdWeek,

Computerworld,

Forbes,

The Globe & Mail, Inc.,

The Oregonian and Portland Tribune.

Story continues

Best in Biz Awards 2022 honors were conferred in 100 different categories,

including Company of the Year,

Fastest-Growing Company,

Most Innovative Company,

Best Place to Work,

Customer Service Department,

Executive of the Year,

Marketing Executive,

Most Innovative Service,

Enterprise Product,

Best New Product,

App,

CSR Program,

Environmental Program,

Website and Film/Video of the Year.

For a full list of gold, silver and bronze winners in Best in Biz Awards 2022, visit: http://www.bestinbizawards.com/2022-winners.

About Modern Pro Solutions

Founded in 2016, Pacific Energy Network LLC, d/b/a Modern Pro Solutions,

has quickly become one of the largest and most successful home services

companies in the nation with a footprint across multiple states.

With a focus on customer satisfaction and strategic business planning,

MPS has grown into a multi-product business that has increased revenue

year over year and expanded its reach into new markets across the United States.

For further information, please visit the Modern Pro Solutions website at

http://www.joinmps.com.

About Best in Biz Awards

Since 2011, Best in Biz Awards has been the only independent business awards

program judged by a who's who of prominent reporters and editors from top-tier

publications from North America and around the world.

Over the years, judges in the prestigious awards program have ranged from Associated Press

to the Wall Street Journal and winners have spanned the spectrum,

from blue-chip companies that form the bedrock of the global economy to some

of the world's most innovative start-ups and nimble local companies.

Each year, Best in Biz Awards honors are conferred in two separate programs:

North America and International, and in 100 categories, including company, team,

executive, product, and CSR, media, PR and other categories.

For more information, visit: http://www.bestinbizawards.com.

Safe Harbor Statement under the Private Securities Litigation Reform Act of 1995

The statements contained in this news release which are not historical facts may be "forward-looking statements" that involve risks and uncertainties which could cause

actual results to differ materially from those currently anticipated.

For example, statements that describe MPS's hopes, plans, objectives, goals, intentions, or expectations are forward-looking statements.

The forward-looking statements made herein are only made as of the date of this news release.

Numerous factors, many of which are beyond HVCW and MPS's control, will affect actual results.

HVCW and MPS undertake no obligation to publicly update such forward-looking statements to reflect subsequent events or circumstances.

This news release should be read in conjunction with HVCW's most recent financial reports and other filings posted with the OTC Markets and/or the U. S. Securities and Exchange Commission by HVCW.

For More Information Contact

Investor Relations

investorrelations@joinmps.com

909-757-7641

SOURCE: Harrison Vickers and Waterman, Inc.

Review 11-29-2022

i did review of share structure $HVCW share structure 2021 08-21-21 vs 2022 07-08-22 & 11-28-22 dilution A.S.25,000,000,000 was 5,000,000,000 2021 https://www.otcmarkets.com/stock/HVCW/security HVCW SECURITY DETAILS Share Structure Market Cap Market Cap 4,622,821 11/28/2022 Authorized Shares 25,000,000,000 was 5,000,000,000 2021 & was 6,564,838,949 2022 11/09/2022 Outstanding Shares 7,704,701,400 was 3,001,563,774 2021 & was 6,564,838,949 2022 11/09/2022 Restricted 100,003,867 about the same as 2021 was 100,003,867 2021 & was Restricted 100,003,867 about the same as 2021 11/09/2022 Unrestricted 7,604,697,533 was 2,901,559,907 2021 & was 6,464,835,082 2022 11/09/2022 Held at DTC 7,228,225,533 11/09/2022 CEO KEEPING HIS WORD 11-08-2022

Harrison, Vickers & Waterman, Inc.

Common Stock

0.0007

0.0001

16.67%

0.0006 / 0.0007 (1 x 1)

Real-Time Best Bid & Ask: 11:42am 11/08/2022

Delayed (15 Min) Trade Data: 11:26am 11/08/2022

Overview

Quote

Company Profile

Security Details

News

Financials

Disclosure

Research

FILINGS AND DISCLOSURE

OTC Disclosure & News

ActiveInactiveAll

PUBLISH DATE TITLE PERIOD END DATE STATUS

11/08/2022 Annual Report - Annual Report 06/30/2022 A

05/11/2022 Quarterly Report - Quarterly Report 03/31/2022 A

02/14/2022 Quarterly Report - Quarterly Report 12/31/2021 A

Courtesy of ceo Reg A will be amended for .0015-.0025, $5m

4:44 PM · Oct 19, 2022

Bobby Tetsch

@bobby_tetsch

$hvcw more details in formal announcement,

Reg A was a condition of closing w/HVCW.

All parties agree to waive that requirement.

We are operationally cash flow positive & want to access capital if we find future opportunity for growth.

Reg A will be amended for .0015-.0025, $5m

4:44 PM · Oct 19, 2022

https://twitter.com/bobby_tetsch/status/1582880291588186112 new website is up and running, it looks fantastic and really well done. $HVCW https://modernprosolutions.com INC 5000 - BEST WORK PLACES VOTED #1 SOLAR INSTALLER AWARD RECIPIENT - 2021 DOTCOM MAGAZINE NO.87 - INC 5000 Wow Values $HVCW courtesy of $HVCW is way more than just a solar company. They will be able to take half the trade fees for new construction homes with all their businesses.

$100,000,000 just in Solar. What do you think the other trades will allow $hvcw to get?

They are in 5 states with 5 more on the way

[-chart]pbs.twimg.com/media/FeePqCBWYAExyLf?format=jpg&name=small[/chart]

7:13 AM · Oct 7, 2022

10-02-2022 excerpt

Courtesy of SOLAR BABCOCK RANCH , florida MAJOR test hurricane IAN Max Hedgeroom @MaxHedgeroom Micro grids.  [-chart]pbs.twimg.com/card_img/1576480112324681729/eHI5s602?format=jpg&name=small[/chart] https://www.cnn.com/2022/10/02/us/solar-babcock-ranch-florida-hurricane-ian-climate/index.html

[-chart]pbs.twimg.com/card_img/1576480112324681729/eHI5s602?format=jpg&name=small[/chart] https://www.cnn.com/2022/10/02/us/solar-babcock-ranch-florida-hurricane-ian-climate/index.html 09-28-2022

courtesy of bobby Bobby Tetsch

@bobby_tetsch

Blessed to work with great leaders! Our Chief Sales Officer throwing down golden nuggets to new sales folks in LA…

training on why Solar is a HUGE value proposition in this economy!

@modernprosol

enrolls homeowners through education and options! $HVCW

[-chart]pbs.twimg.com/media/FdwRHPYVQAA1aca?format=jpg&name=small[/chart]

09-24-2022

CEO HVWINC

@HVWINC1

https://twitter.com/bobby_tetsch HVWINC

@HVWINC1

$HVCW STRONG in ALL geographic areas. Growth over 24% month over month. $HVCW. #Modernprosolutions. #Solar #solarpanels #Sustainable

accesswire.com

HVCW Announces Growth Strategy for 2022

10:54 AM · Sep 22, 2022

https://twitter.com/hashtag/Modernprosolutions?src=hashtag_click https://twitter.com/JumpnJackSlap/status/1572944078995689478 https://twitter.com/HVWINC1/status/1573007797222244352 https://twitter.com/hashtag/Solar?src=hashtag_click 09-23-2022 $HVCW 8k filing, the Company also confirms that Jeff Canouse has stepped down and is no longer affiliated with the Company. https://www.otcmarkets.com/stock/HVCW/disclosure PUBLISH DATE TITLE PERIOD END DATE STATUS 05/11/2022 Quarterly Report - Quarterly Report 03/31/2022 A 02/14/2022 Quarterly Report - Quarterly Report 12/31/2021 A 11/22/2021 Quarterly Report - Quarterly Report 09/30/2021 A 11/16/2021 Attorney Letter with Respect to Current Information - Attorney Letter with Respect to Current Information 06/30/2021 A 11/12/2021 Notification of Late Filing - Notification of Late Filing 09/30/2021 A 09-23-2022 CEO UPDATE; https://www.accesswire.com/716954/HVCW-Announces-Growth-Strategy-for-2022 Courtesy of $HVCW HVCW Announces Growth Strategy for 2022

Thursday, September 22, 2022 9:30 AM

Share this Article

Share on Twitter

Share on Facebook

Share on Linkedin

Topic:

Company Update

CHINO, CA / ACCESSWIRE / September 22, 2022 / Harrison, Vickers & Waterman, Inc. ("HVCW"), through its operating subsidiary,

Pacific Energy Network LLC, d/b/a Modern Pro Solutions ("MPS"),

(together the "Company") announced today its growth strategy for 2022.

With a focus on expansion of its solar business into new geographic areas,

the Company has already seen results.

This summer (May-August), the Company has had sales growth (jobs sold) of over 24% month over month.

"We continue to see strong demand in all geographic areas.

In addition, with the current energy issues combined with incentives from the Inflation Reduction Act,

we expect the opportunities to increase," stated Bobby Tetsch, CEO of MPS.

The overall expansion strategy focuses on regional centers that serve as hubs for surrounding areas/states.

The existing corporate hubs include Southern California, Central California, Northern California, and Missouri.

In addition, corporate hubs that are planned in the near term include Texas (Dallas Ft. Worth), Florida and Mid-Atlantic.

At each corporate hub, the company will invest in infrastructure - so that it maximizes revenue and gross margin and relies less on third party providers.

Central and Northern California

Launched earlier this year, Central and Northern California are a natural

extension of the Company's Southern California base.

Significant investment has already been made in these markets, which include Fresno, Bakersfield and San Jose.

Installation numbers have exceeded expectations and continue to grow.

Missouri/Mid-West

Launched earlier this year, Kansas City, Missouri is a natural hub for the

Mid-West area.

In addition to Missouri, this location will also service Indiana and Illinois

(both top 10 states,

in terms of new solar generation added in 2021) in the future.

Texas

With an expected launch in the Dallas Ft. Worth Metroplex (DFW) by Spring 2023, MPS will be entering the largest solar market in the country.

Adding an additional 6060 MW in 2021, Texas far exceeds California as the

top market for annual solar installation.

From its DFW hub, the Company expects to service other major markets including Austin and Houston.

Florida

Slated to launch by Spring 2023, entering the Florida market allows the

Company to add

the 3rd and 5th largest (Georgia) in the country (in terms of annual solar installation added in 2021).

"If we are going to achieve our goal of being a national solar company,

we must be in the Southeast," stated Tetsch.

Mid-Atlantic

Expected in Spring 2023, the Mid-Atlantic region includes Virginia and North Carolina,

the 4th and 7th largest (in terms of annual solar installation added in 2021).

As previously disclosed in an 8k filing,

the Company also confirms that Jeff Canouse has stepped down and

is no longer affiliated with the Company.

About Modern Pro Solutions

Founded in 2016, Pacific Energy Network LLC, d/b/a Modern Pro Solutions, has quickly become one of the largest and most successful home services companies in the nation with a footprint across multiple states. With a focus on customer satisfaction and strategic business planning, MPS has grown into a multi-product business that has increased revenue year over year and expanded its reach into new markets across the United States.

For further information, please visit the Modern Pro Solutions website at www.joinmps.com.

Safe Harbor Statement under the Private Securities Litigation Reform Act of 1995

The statements contained in this news release which are not historical facts may be "forward-looking statements"

that involve risks and uncertainties which could cause actual results to differ materially from those currently anticipated.

For example, statements that describe MPS's hopes, plans, objectives, goals, intentions, or expectations are forward-looking statements.

The forward-looking statements made herein are only made as of the date of this news release.

Numerous factors, many of which are beyond HVCW and MPS's control,will affect actual results.

HVCW and MPS undertake no obligation to publicly update such forward-looking statements to reflect subsequent events or circumstances.

This news release should be read in conjunction with HVCW's most recent financial reports and other filings posted with the OTC Markets and/or the U. S. Securities and Exchange Commission by HVCW.

For More Information Contact:

Investor Relations

TEN Associates

Tom Nelson

480-326-8577

SOURCE: Harrison Vickers and Waterman, Inc.

Topic: Company Update 09-11-2022

$HVCW courtesy of $HVCW

megamuch

@megamuch

The residential solar market installed 1,358 MWdc in Q2 2022, setting another record for quarterly installations. CA, FL & TX again led the way with CA

and TX reaching record quarterly deployments. $HVCW in all 3 states. Solar Market Insight Report 2022 Q3

[-chart]pbs.twimg.com/card_img/1566377979822866432/FKWemmIN?format=jpg&name=small[/chart]

https://www.seia.org/research-resources/solar-market-insight-report-2022-q3 09-06-2022

team members $HVCW https://modernprosolutions.com/team === 37 members

REWARDS to CEO $HVCW

courtesy of $HVCW

$HVCW

??CEO Bobby Tetsch was awarded Most Influential Leader in Energy Management 2020

??Awarded DotCom Magazine 2021 Impact company of the year

??er84/status/1565604492456116224?t=tSW2i6GMw5IL8bO8FjJ8AA&s=19Ranked #87 on Inc. 5000 Fastest growing Co of America list, 4906% growth

??States A+ rating, #1 Solar Installer, Best work place

4/7

[-chart]pbs.twimg.com/media/Fboj0SlaIAAtnNP?format=png&name=small[/chart]

12:36 AM · Sep 2, 2022·Twitter Web App

https://twitter.com/shawonsark chart 09-02-2022

fer $HVCW 50ma & 200ma crossed @ 0.0003 /\ in dis run

https://stockcharts.com/c-sc/sc?s=HVCW&p=D&b=5&g=0&i=t0687851942c&r=1662130128745 $HVCW some answers https://newsfallout.com/financial-markets/penny-stock/solar-stocks-to-watch-this-week-hvcw-stock/ Meanwhile, Tetsch is operating so as to add extra services and products to MPS’ portfolio together with integrating

and mobilizing development knowledge accrued from IOT-connected gadgets, development inspections, repairs consulting,

keep an eye on and tracking instrument, inexperienced mortgages and bringing shopper financing.

With buyers bullish on Tetsch’s management, it’s price noting that Tetsch is now HVCW’s sole director and officer after being appointed by way of Jeffery Canouse as his successor in his ultimate act ahead of resigning. Under this new management, HVCW inventory may well be on course to develop into some of the easiest sun shares to spend money on. cCourtesy of $HVCW $HVCW 8 wall down trading nicely today, MACD curling

Quote Tweet

Angry Red

@AngryRed316

· 5h

$HVCW

-Awarded DotCom Magazine 2021 Impact company of the year award

-Ranked #87 on Inc. 5000 Fastest growing companies of America list, 4906% growth

-CEO was awarded Most Influential Leader in Energy Management 2020 CA

-States A+ rating BBB, #1 Solar Installer, Best work places

PR update; 08-23-2022

$HVCW /\ CHINO, CA / ACCESSWIRE / August 23, 2022 / HVCW would like to address all shareholders on the progress, vision and overall trajectory of the company.

This report will include details on the company's name change, growth, and current objectives.

HVCW recently merged with Modern Pro Solutions. With a focus on the solar industry, we believe that this merger adds significant value to the company and its shareholders.

Due to the global energy crisis, combined with the pending Inflation Reduction Act that provides significant incentives to homeowners who add solar,

we feel this is the right time and the right place for our company.

Formed in 2018, Modern Pro Solutions (MPS) launched with the goal of making our mark in the renewable energy sector by aligning qualified homeowners with

zero out of pocket programs designed to lower their cost of living while significantly reducing our planet's carbon footprint through clean, renewable energy.

Since MPS's launch, we have accomplished that mission in addition to launching ambitious vertical integration efforts.

The motivation behind our initial launch was a response to the minimal market penetration and room for exponential growth.

Our early efforts have been greatly rewarded and have resulted in the expansion of Modern Pro Solutions territory and partnerships.

The rebranded name, Modern Pro Solutions, is a reflection of not how we started, but instead where we plan to be in the near future.

We believe our current expansion targets will result in a significant increase in installations on a monthly and annual basis.

Our plans include scaling the company's manufacturing and distribution capabilities to combat inconsistencies in the

supply chain in addition to adding a range of services from building inspections, green mortgages, HVAC, roofing and maintenance consulting.

Multiple businesses inside the business of MPS. In addition, our long-term strategy is to bring consumer financing in house and expand authorized dealer relationships.

https://finance.yahoo.com/news/hvcw-provides-shareholder-130000427.html About Modern Pro Solutions

Modern Pro Solutions provides comprehensive home services programs to assist homeowners with lowering energy bills.

We offer services in the categories of residential solar, roofing, batteries and HVAC.

Currently located in Chino, CA we have customers and market penetration in Missouri as well as in Northern, Central and Southern California.

We expect to add additional markets in the near future including Texas, and we currently employ over 110 people.

For more information contact:

Investor Relations

TEN Associates

Tom Nelson

480-326-8577

SOURCE: Harrison Vickers and Waterman, Inc.

View source version on accesswire.com:

https://www.accesswire.com/713172/HVCW-Provides-Shareholder-Update Courtesy of $HVCW 08-23-2022

$HVCW Bobby on why he started Modern Pro Solutions you can just tell how passionate he is about the company

“When you can say your company is able to change the lives of your customers and team members alike while helping save the planet its truly something to be proud of”

[-chart]pbs.twimg.com/media/Fa0eSyvXoAU_8Dr?format=jpg&name=medium[/chart]

https://twitter.com/AngryRed316/status/1561937957153538050/photo/1 HOT HOT HOT

$HVCW courtesy of $HVCW

Thread

See new Tweets

Conversation

Super Robot ??

@SuperRobotOTC

$HVCW DD ??

SOLAR MERGER ????

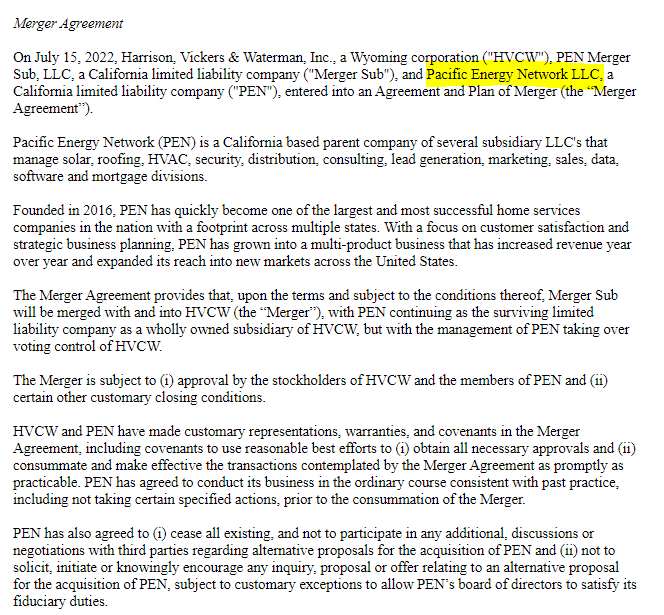

? Merger closed w/

@modernprosol

aka Pacific Energy Network

? Estimated revenues up to $49M annually

? $100M total sales since 2016

? 51-200 employees

? Merger confirmed by company

? Solar install, semiconductor manufacturing

UPDATE; 08-14-2022

$HVCW courtesy of $HVCW

Pavilion Investments

@Pav_ilion

$HVCW Has there ever been a triple zero reverse merger where the merging company has a proven minimum $23 million annual revenue? Seriously, anybody know of another scenario like this?

3:30 PM · Aug 13, 2022

UPDATE; 08-12-2022

courtesy of $HVCW

Super Robot ??

@SuperRobotOTC

$HVCW DD ??

SOLAR MERGER ????

? Merger closed w/

@modernprosol

aka Pacific Energy Network

? Estimated revenues up to $49M annually

? $100M total sales since 2016

? 51-200 employees

? Merger confirmed by company

? Solar install, semiconductor manufacturing

UPDATE: 08-02-2022

COURTESY of $HVCW

courtesy of $HVCW

Super Robot ??

@SuperRobotOTC

$HVCW DD ??

SOLAR MERGER ????

? Merger closed w/

@modernprosol

aka Pacific Energy Network

? Estimated revenues up to $49M annually

? $100M total sales since 2016

? 51-200 employees

? Merger confirmed by company

? Solar install, semiconductor manufacturing

[-chart]pbs.twimg.com/media/FZKLP0YWAAAwq3o?format=png&name=small[/chart]

[-chart]pbs.twimg.com/media/FZKK2i7XEAM8gXm?format=png&name=900x900[/chart]

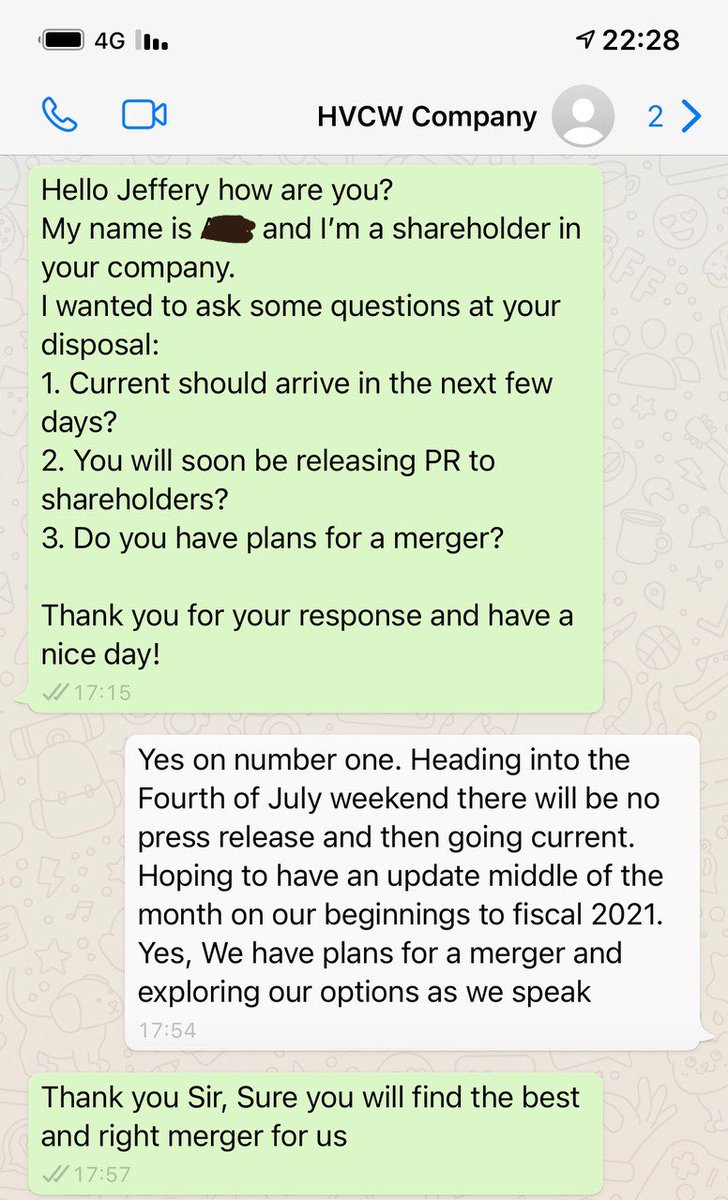

HVCW is a shell company, owned by turn-around King Jeff Canouse.

Most all but $600,000 or so of legacy debt has been serviced in thid transaction.

Jeff Canouse is actively persuing a Reverse Merger with a Revenue Generating entity that wishes to go Public without the excessive IPO fees.

It's just that simple

A shareholder update can drop at any time effective today through the end of next week.

If an actual PR, as many shareholders have been pining for, gets dropped,

it's lights out for short sellers and a good opportunity for existing debt holders to monetize on their shares until they are out.

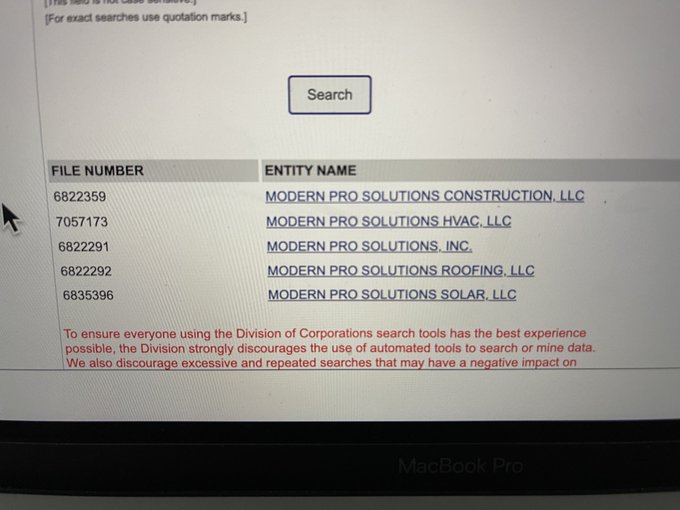

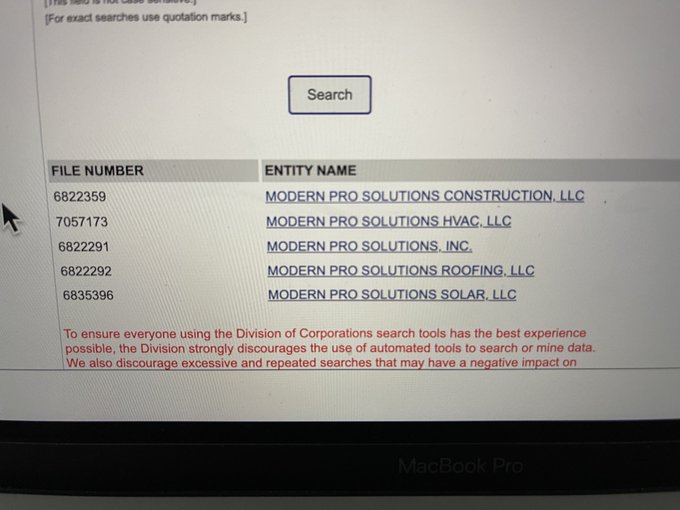

Texts like the one below were received right before the 4th of July, so we are in the profit zone shortly  https://www.otcmarkets.com/stock/HVCW/overview https://www.otcmarkets.com/stock/HVCW/quote https://www.otcmarkets.com/stock/HVCW/profile https://www.otcmarkets.com/stock/HVCW/security

https://www.otcmarkets.com/stock/HVCW/overview https://www.otcmarkets.com/stock/HVCW/quote https://www.otcmarkets.com/stock/HVCW/profile https://www.otcmarkets.com/stock/HVCW/security new 08-02-2022

https://www.otcmarkets.com/stock/HVCW/security Share Structure

Market Cap

1,969,452

08/01/2022

Authorized Shares

25,000,000,000 - 07/08/2022

Outstanding Shares

6,564,838,949

07/08/2022

Restricted 100,003,867

07/08/2022

Unrestricted 6,464,835,082

07/08/2022

Held at DTC 6,088,363,082

07/08/2022

$HVCW $HVCW SECURITY DETAILS MKT CAP 3,751,955

Share Structure

Market Cap Market Cap 3,751,955

08/12/2021

Authorized Shares...5,000,000,000

07/16/2021

Outstanding Shares.3,001,563,774

07/16/2021

Restricted....................100,003,867

07/16/2021

Unrestricted..............2,901,559,907

07/16/2021

Held at DTC...............Not Available

Float...........................Not Available

Par Value..............................0.0001

https://www.otcmarkets.com/stock/HVCW/news https://www.otcmarkets.com/stock/HVCW/financials https://www.otcmarkets.com/stock/HVCW/disclosure

02-07-2021

DISCLAIMER: ONLY FOR MICK

https://investorshub.advfn.com/boards/profilea.aspx?user=1012

*The Board Monitor and herewithin , are not licensed brokers and assume NO responsibility for actions,

investments,decisions, or messages posted on this forum.

CONTENT ON THIS FORUM SHOULD NOT BE CONSIDERED ADVISORY NOR SOLICITATION

AUTHORS MAY HAVE BUYS OR SELLS WITH THE COMPANIES MENTIONED IN TRADING POSTERS SHOULD DUE DILIGENT BUYING OR SELLING.

ALL POSTING SHOULD BE CONSIDERED FOR INFORMATION ONLY. WE DO NOT RECOMMEND ANYONE BUY OR SELL ANY SECURITIES POSTED HEREWITHIN.

ANY trade entered into risks the possibility of losing the funds invested.

• There are no guarantees when buying or selling any security.Any

courtesy of $HVCW

courtesy of $HVCW