Register for free to join our community of investors and share your ideas. You will also get access to streaming quotes, interactive charts, trades, portfolio, live options flow and more tools.

Another small but positive day

As far as can be detected from L2, the float is locked up tight!

Almost entirely buys on the tape today and nothing on the ASK

…. except a few light slaps …

Lotta smoke

Almost farenheit 451

I double and triple-checked, I have no classified government documents

spec

My crystal ball is leaving me with the perception that the stock price should ‘stabilize’ between .007 and .01…..

Trading activity could slow due to reduced volume. The stock might come under pressure from manipulations trying to push the price lower.

The silver lining is this will be an opportunity to purchase shares at a reduced cost. But, unfortunately, not much volume to take advantage of.

So ‘dirt bids’ will likely not be tested. With the limited shares available to be purchased, it will be ‘first come, first served’.

Once again, there is no Path to remarkable levels of Personal Profit following that Plan. You can hold me to it.

As in the past, there are many that intend to hold their positions and perhaps add more shares. But buying is not so much dependent on the price. Depends on the volume.

Expect that higher share volumes will cost a premium. But some will get more shares anyway, before any news breaks. This may be the time for ‘better early than late’.

But please note, I advise no one to sell, to buy, or take actions of any kind. Caveat emptor.

Still waiting for the show to start. And I wish I knew the starting time. That would make it all much easier.

Mrs. Smith

The GSPE Elon poll results came in. The Yeps have it!!!

Your Tuesday GSPE vibe ![]()

Interesting open with a half million share slap on the ASK

- highest trade price in 4 months ![]()

green crickets

spec

I got a partial fill buy right before close today. If and when we ever get good news we will all be wishing we bought this under a Penny

Still only a whisper of volume but holding onto the uplift

WTI holding at $81

Nat gas low $3’s and making big % swings

GSPE - crickets …. but at least they’re green crickets

![]()

spec

Yep, I think it’s inevitable

![]()

spec

I’ll soon be canopied by the clear blue sky. Before I take off, I’d like to do a GSPE Elon poll.

Did the odds of GSPE’s ASK being lightly slapped go up today? Me first ![]()

Yep

Nope

By the way, I failed to mention that there are (10) GOM lease sales proposed in the latest 5 year BOEM lease plan.

See links for details:

https://www.boem.gov/sites/default/files/documents/oil-gas-energy/national-program/2023-2028_Proposed%20Program_July2022.pdf

https://www.boem.gov/oil-gas-energy/national-program/national-ocs-oil-and-gas-leasing-program-2023-2028

Mrs. Smith

I find solace in the expectation that the BOEM may hold as many as (3) GOM oil and gas lease sales in 2023. The (2) Biden stalled 2022 GOM lease sales, 259 and 261 from the 2017-2022 National Oil and Gas Leasing Program are now scheduled for the end of March and September of this year. Then there is the (1) scheduled 2023 GOM OCS lease sale, 262 from the 2023-2028 “Proposed” National Oil and Gas Lease Sale Program. This is how we will be able to determine if the administration will comply with the law and uphold it’s duty to the country to ensure the energy supply is secure.

I was not surprised that there was only “one” bid for the December 2022 Cook Inlet (offshore Alaska) lease sale, since the last BOEM Cook Inlet lease sale was back in June of 2017. By the way, the BOEM only has (1) other scheduled Cook Inlet lease sale, 267 on the 2023-2028 “Proposed” National Oil and Gas Lease Sale Program, which is in 2026.

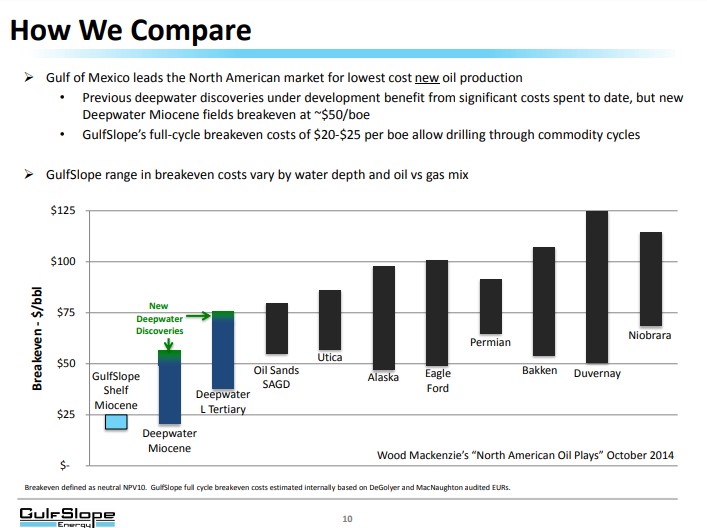

For now, it is a good thing Gulfslope is focused on the purchase of oil and gas production rather than on the purchase of oil and gas leases. Reminder, U.S. crude oil production (million barrels per day) was 11.25 in 2021 and 11.86 in 2022. The EIA forecast U.S. crude oil production (million barrels per day) to be 12.41 and 12.8 in 2023 and 2024, respectively.

So, the trend is with us, and I am holding on to it tightly.

Mrs. Smith

Yes, the appointees across the board are simply campaign chips to be played

sadly, another case where managing expectations (downward) is currently my only defense against the insanity

I do sense some optimism of improvement in the upstream environment, but still no juice has been squeezed to fill the empty chalice of hope for domestic oil production

That would take some evidence of results in permitting

The Lease sale that was court-mandated to take place before the end of 2022 .... was held on Dec 30th, had exactly one company bid .... on one lease block

WTI low $80's is a lot less painful for the general public than $100, some stability would be welcome

Where's the next curveball going to come from?

spec

Well looking at the bio of the new Director of the BOEM, I predict that she will fit right in among the other unqualified members of this administration and will also be able to contribute to their incompetence at a high level.

But considering that it is Joe, no surprise that any of the appointments of his appointees would be of any higher caliber than he himself.

Just to refresh our memories, check out this link on the cause and effect of virtue signaling. And so, does this mean the signal is no virtue?

https://www.realclearenergy.org/articles/2023/01/19/the_biden_administration_finally_admits_its_mistake_in_canceling_the_keystone_xl_pipeline_876557.html

Signing off for lunch break.

Mrs. Smith

Looking at the policy end of the market environment - new BOEM director

No indication of anything resembling a realistic stance on domestic energy production from fossil fuels

sigh

WTI hangs at $80 Nat Gas still in the gutter low $3’s because where do you put it if you oversupply?

I’d be a buyer here if I had a LNG tank

M&A uptick in …. 3 …. 2. …. 1

spec

I took note of that, Well done. So Mrs. Smith may want to reconsider the dessert! Pre mkt. looked like something might be brewing.

That was only 3 trading days ago

“sniff …. sniff” I smell smoke

No sign of Willie Nelson or Snoop Dogg but something is going on

looking at L2, bid swelling

and that ASK is so thin ….

will there be a swoosh and a bunch of firm slaps on that ASK??

….. waiting impatiently…

The bid today is a welcome confirmation of a tide shift

Headlines are broadly bullish on the economic resilience of Americans and China reopening

Energy, and oil in particular are hot topics with Saudi Arabia opening to crude contracts denominated in currencies other than $USD

Domestic energy independence will REQUIRE a huge upstream investment in GOM oil production

… and GulfSlope is a small, but likely, conduit between investment $$$cash and huge potential returns through exploration/development/production

… gotta play to win

![]()

spec

WTI -solidly over $80 currently $82ish

Yep, daily volume still isn’t enough to get excited about

… but the tape is not looking bad at all

Just a spark, a tangible nugget

That’s all we need to turn the smoke into a blaze

spec

Let’s goooo. .0052, back above a half cent baby!!!!!

Better leave the scalping to the professionals

If you have the wahoo sashimi, desert will be forgotten

If you mention GulfSlope along with your gratuity, you might soon be regarded as the smartest person in the room

Then again, it’s likely to be the case already

I know it can be a blessing and a burden too

I deal with it all the time

Cheers

spec

Well, I miscalculated. There are costs for TWO trades. One for the sale, but also one for the buy. After deducting those costs and the tax, the profit is less than $20…. My entree will cost $28, plus my beverage, and my desert, if I have one (probably not), and the tip. So disappointed. Not worth the effort. Maybe if I can do 200,000….., lol.

Signing off with sadness.

Mrs. Smith

I am thinking of finally trying it out. I am invited to a luncheon on Friday. Tomorrow if I can buy 100,000 shares for 0.0045, I can try to sell for 0.0050 on Wednesday. If successful, my net after tax profit minus my trading fee should pay for my lunch entree ordered off the lunch menu on Friday. I am so excited.

Mrs. Smith

While smelling the smoke, I was thinking the same thing about Gulfslope bidding on a producing GOM property they suspect has some unidentified subsalt potential.

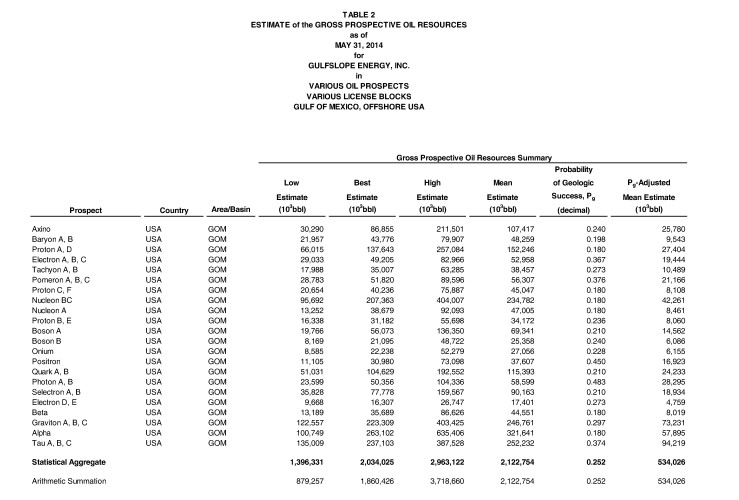

Yes, buy a property that is already producing, do a new seismic survey with those proprietary imaging tools, identify new drilling targets, drill the well(s), and increase production. Maybe by a lot.

I have no information that indicates this is the case, but considering the company’s primary focus and expertise, it does make a lot of sense. I would be very surprised to learn that Gulfslope management had not thought of it.

What an exciting new approach to attracting investment money for future projects as well as for Tau, Corvette, et al, to say nothing of the big bounce in the stock price from the production.

I was also happy about the renewed focus on oil and gas, energy independence, and increasing capex by the new GOP representatives. About time that it is acknowledged there is no realistic path to energy independence through windmills and solar collectors, which cannot be utilized until after the 35th of Nevuary in 2050.

Mrs. Smith

Did you hear that Wyoming is considering the phasing out of sales of electric vehicles by 2035? This is to ensure the stability of the state’s oil and gas industry.

Awesome! How cool is that?

https://www.teslarati.com/wyoming-phase-out-evs-2035/

Mrs. Smith

No shortage of promising words from the swamp, but as you, I am looking for the actions

I did like that the “energy independence” angle is featured so prominently by many of the newly empowered GOP representatives

The only way to get there is to cure the hole (underinvestment) in upstream and midstream capex

It’s going to be crucial to our economic health, and for our allies

GOM oil and gas will certainly be a recipient of a chunk of that investment and I think the GulfSlope team is determined to seize the opportunity

No ink yet on financing or rig contract but you don’t go shopping for properties without a pretty good sense of how much cash is within your reach

The market seems to be indicating some stability in the oil supply chain considering the projections for China’s demand are pretty widely scattered

Global tensions are high and volatility rules the market

If GSPE can pick up an operating property with a subsalt prospect to explore …..

… that’d be awesome

Nantucket sleigh ride

spec

I agree with everything in your 3 posts, except I don’t find Joe’s words “soothing” lol

Yes, I too smell smoke. But it is not the smoke you would smell with Willie or Snoop. The smoke I smell is from the fire that is building under GSPE.

Or, to state it another way, once this company gets rolling, the KEY Element to Wealth will be the number of shares one owns.

Eventually we ‘minnows’ will stop trying to make $0.0005 cents profit per share on a trade and take advantage of this gift of abnormally low prices. Looking forward, one can make the argument that these share purchases below 1 cent are an absolute bargain.

These million GSPE share buys we are seeing tells me there are those out there that are waking up to that idea too, and realize that right now is the best time to buy these shares at rock-bottom prices. ‘Swoosh’ time is definitely approaching, so traders wishing to exit this stock should be getting ready.

And I am suspecting that these shares are being removed from the ‘trading pool’ and will be held on to for the long game to come. This may become a ‘boring’ stock to watch for a time as the share price stabilizes while the company moves forward.

It appears that Gulfslope plans to both buy producing properties and drill new wells. It is a proven fact that many GOM operators will skim the cream off the top of their production, then sell off what is left. It happens on land properties too.

The new company comes in with new ideas, new management, new technology, new drilling plans, lower overhead, and turns everything around, making fortunes in the process. This has happened often in the past. Perhaps history repeats itself here once again with Gulfslope.

A recent example of this is the rumor about Exxon and Denbury Resources. Exxon sold Denbury all their mature East Texas oil assets 25 years ago. At the time, Denbury shares were less than $5. Recently, it was over $100. And now it is rumored that Exxon is interested in buying these properties back once again.

Who can predict how the pendulum swings over time? But it looks like Denbury shareholders should do better than just OK. And GSPE is a much better opportunity, since it is not yet a mature asset, and still has all that growth to undergo.

My 2023 Wealth Plan. Stay the course with GSPE stock and do not be easily influenced to give up my position. Take advantage of these prices offered up by the ‘investing gods’ while they last, and buy even more shares with New Money. Hold on to them. Prosper.

I am a ‘whale watcher’….. And indeed, I am also looking forward to a Happy New Year in 2023.

Mrs. Smith

Fossil fuels will continue to hold the most prominent seat at the energy table.

https://www.forbes.com/sites/roberthart/2023/01/12/outrageous-conflict-of-interest-the-worlds-biggest-climate-summit-just-named-an-oil-exec-to-run-it/?sh=3d1b72445377

While on the subject, the EIA’s latest ‘Monthly Crude Oil and Natural Gas Production’ analysis reflects that the Federal Offshore Gulf of Mexico significantly OUTPACED the national average in crude oil and natural gas production,10% vs 7% (oil) and 13% vs 5% (gas). Many have projected a decade of growth in the oil and gas sector beginning in 2023.

https://www.eia.gov/petroleum/production/#ng-tab

It might also be noted, the Gulf of Mexico (GOM) rig count increased by approximately 19% from the prior week. A great start to the new year.

http://www.dnr.louisiana.gov/assets/TAD/data/drill_weekly/WeeklyRigCountUpdate.pdf

https://www.workboat.com/offshore/louisiana-texas-to-see-increase-in-oil-and-gas-industry-job-opportunities

https://www.naturalgasintel.com/talos-strikes-oil-natural-gas-from-two-discoveries-in-deepwater-gom/

Additional articles of interest.

https://www.api.org/news-policy-and-issues/news/2023/01/12/api-applauds-bipartisan-ferc-approval-of-pipeline-expansion-project

https://www.utilitydive.com/news/ferc-transco-gas-pipeline-new-jersey-bpu-regional-energy/640362/

https://www.naturalgasintel.com/emerging-u-s-pipeline-bottlenecks-cast-shadow-on-otherwise-positive-long-term-outlook-for-natural-gas/

Mrs. Smith

Joe spouts soothing words, but actions show his true intent.

Joe stated he intended to refill the Strategic Petroleum Reserve (SPR) as he depleted it in a political move aimed for the midterm election. Now, it turns out that no oil can be purchased at the price Joe wants to pay. So the SPR has been drained of 266,000,000 barrels of oil and counting, exposing the country to a potentially dire risk.

Way to be consistently “irresponsible”, Joe.

With WTI currently forecast to “average” around $80/bbl in 2023, this administration has stated it has no intention of accepting bids at prices that high, even though prices could go even higher. So the risk to the country continues on unabated and grows with time. And bonus, the salt caverns where the oil was stored are also damaged.

A bit of positive news, the U.S. House in a bipartisan vote (331 to 97) just passed bill ‘H.R. 22’ forbidding future sales of oil from the SPR to China.

Now, if the senate will also pass it and Joe will sign it. Any takers?

https://hotair.com/jazz-shaw/2023/01/09/biden-doe-rejects-bids-to-restock-oil-reserve-n522553

https://www.congress.gov/bill/118th-congress/house-bill/22/text

Mrs. Smith

“sniff …. sniff” I smell smoke

No sign of Willie Nelson or Snoop Dogg but something is going on

looking at L2, bid swelling

and that ASK is so thin ….

will there be a swoosh and a bunch of firm slaps on that ASK??

….. waiting impatiently…

spec

A million shares dropped on the bid and hardly a jiggle

WTI looking firmer $75

Nat Gas crumbling $3.60 (that's going to impact shale as well as the portion of thermal use that is flexible/agnostic)

Crude sanctions on Russia just starting to bite

Every single variable in the energy sector is like scabble tiles in a hamster wheel ....

and trying to make sense of the words that fall out

I do know this ....

"bids on four producing properties" suggests that there is sufficient and credible capacity to raise the $$ required to make good on that bid

Can't hang a hat on that,

but it's something worth considering

spec

Feels like the tide is rising a bit

Bid showing some potential and that ASK is …

![]()

spec

Nothing different today, negligible volume and some jiggles of bid building

So, just a hammock-induced speculation on ripples in the GOM assets

Global operators are currently under huge social pressures to make “green noises”, posturing for social acceptance, anything to deflect from the vitriolic narrative that has attacked the fossil fuel sector

Shell says “our production has peaked” and several majors are pouring $Billions into low-carbon, carbon capture, hydrogen, yada … yada …. yada

All to “please” those who attack, and especially those who can TAX

Cue the EU “windfall profit tax” theme song ….

One of the maneuvers to trim production is divestment of non-core assets …

…. like smaller producing properties

…. GOM assets in that category are exactly what GulfSlope is shopping for

The market for those properties can’t be very broad due to entry barriers inherent to the sector

Generally, I think it is fair to consider that the relevant dynamic SHOULD be shifted towards a “discount” pricing environment or a “buyer’s market” type situation

So, while rig lease and overall well costs appear to remain on the higher end, lease and property acquisition costs could be trending in a favorable direction

Big incentives to get GulfSlope active again and it is clear that the lights are on and the mission remains alive

If my Mega Millions ticket wins tonight I will call GulfSlope and light the fuse myself

BTW, I jumped too many time zones yesterday, it was actually the 3rd day of the circus and today is day 4

Maybe there will be a Speaker elected soon so that a few important issues can be rectified

Cheers

spec

Groundhog Day - rerun of yesterday

Little bump, little dump

Insignificant volume still but that seems to be the norm at this stage of waiting

WTI bouncy day but still low $70’s, Nat Gas low $4

Pretty much where it would be expected to trend in a stable, well supplied market

That’s not where the market is

No direction on policies due to the stalemate in the election of the new Speaker of the House (circus day 2)

Yup

Just another day

spec

A little spark but it didn’t get a supporting follow-up move before a seller whacked the bid

Bumpy but better than a week ago

WTI down $73

Nat Gas hangs at just above $4

Swamp circus reminds us that old bad habits are hard to cure

Still, there is a light ahead ![]()

spec

Oil took a lot of heat today on the gloomy economic headlines

GSPE bright green and a close b/a of .0044/.005

Alas, just a whisper of volume

WTI slips to close @ $77 and everyone is warm enough to keep nat gas @ $4

If anyone sees movement in permitting reform or other critical developments, please post us a link here

![]()

spec

Yes indeed, the miocene reservoir at Tau has a kitchen that serves up the high grade, low-sulfur, crude the fetches the premium price

The evidence so far today suggests that the fall from .005 was driven almost entirely by tax selling

Until there is solid good news it’s going to be a little unsteady, I think

Good things ahead and fossil fuels are vitally important to us all

Some folks just don’t see it yet

Confident in a bright future for domestic oil & gas production

spec

By the way spec, Louisiana Light Sweet crude (LLS) is still over $80 (lol).

As forecast, integrated oil majors returning to Permian and GOM. Exploration will become a priority in 2023.

https://oilprice.com/Energy/Energy-General/Oil-Majors-Exxon-And-Chevron-Shift-Focus-To-Americas.html

Mrs. Smith

New Year and goodbye to the energy crisis!

Well, probably not ….

WTI slipping to $78 again and Nat Gas to FOUR $ ….. what?????

You would think it’s all solved

But the swamp battles are just getting lined up on the 2023 grid

Thankfully, the US is in pretty good shape as far as resilience and capacity as compared to many other nations

It’s not going to be easy or smooth, but I hope the affordability of energy takes front stage because it underpins most of the strengths and opportunities ahead for us all

Peace, Love, and Prosperity ahead in 2023

Drilling Tau2 will be an excellent contribution to that goal ![]()

Cheers,

spec

Loved seeing the 67% increase in share price today! Made my “Whale Light” purchases under .0035 look like Warren Buffett! LOL The majority of my shares were purchased north of .03 though, so still need to see some meaningful moves higher but a small moral victory is a great way to close the year! Thanks to all of you for your words of wisdom in here. Cheers to a great 2023 for all of you!

A great turn of events!

The market reaction was very positive and as smith199 mentioned, the vast majority of shares remain locked up tight

at the close, there was less than $50 showing on the sell side under .01 and a Benjamin-size market order might have slapped it to a penny

The bid was broad for the last few days but as it became apparent that there was little offloading for tax reasons, the ASK got a few well-deserved slaps today

Todays tape will trigger lots of scans and we should add new eyes to the GulfSlope ticker (might see a few new folks here too)

The 10-K had enough new narrative to stoke my confidence while still balancing the need to see actual, tangible changes in regulations and policy (as practiced, not just rhetoric) to spur investment in domestic fossil fuel production

The treasure is still there .....

.... waiting

WTI ticks up to $80 to close a turbulent year

Happy New Year for everyone and thank you for your participation, opinions, data, support for others, and good spirits

Here's to living life well and being with family and loved ones whenever you can

If you haven't see your footsteps glow on the beach at night ....

... you simply haven't been looking enough

... at the beach

... at night

a magical light that infuses your soul with wonder

Hi GSPE

Popped in to see what’s up and to wish my favorite moderator Happy New Year!

Thanks for all your efforts on the GSPE board. You’re truly awesome!!!

GSPE’s mood

Interesting tape today

I will wait till after the close before I comment more

Don’t want to disturb the flow that I am seeing

spec

Last day for tax selling

Prices didn’t get slashed for the day … yet

Bid has been building stronger and broader for the past 3 sessions

ASK is thin and a leap away

GSPE trading near 52 week lows still

WTI sideways at $79ish

Tau2 (or other prospects/production) in 2023 is coming into view

spec

TB7 (aka WL7), you called it! Yes, just a little bit of good news and your recent GSPE share purchases will payoff like a slot machine.

Making a couple of assumptions and doing some math exercises shows that, @ $100/bbl, for every thousand barrels of production per day for an offshore platform, the GSPE stock could rise to as much as 2-1/2 to 3 cents per share.

That is a gross number, without taking out costs and overhead. But still, it is a very healthy return for a cost basis of .0024, .0033, .0055, or even .01.

And while fantasizing, there are three properties under consideration. What if all three make only a thousand barrels per day each? And then the well(s) are drilled. Are we to $2 yet?

So there is the formula for wealth. And do not despair. Even though you did not make $100 for each 100,000 shares traded, by holding your shares while the production plan develops, your net worth is, as you predicted, now ‘unreal’.

And bonus, each time we go through a period of good news, the cycle repeats. The difference is that each time, instead of making $100, we are making $100,000, and perhaps much more as it is cumulative. And more shares equals higher wealth.

That is the moral to the story. And most people miss it, because they do not stick around for the finale. That is the approach used by the whales and the reason why oil is called ‘black gold’. And just because Joe wants everyone to drive EVs is not going to change it.

Yes, we are more likely to get good news than not. And if you happen to get caught ‘out of the stock’ on days the news breaks, there is also a formula to calculate the amount of money you do not make. And buying back in again? Costly.

Follow the money.

Mrs. Smith

Recent developments-

Evaluation of 10 producing properties

Bids on 4

Note 12 - $650k in CD SPA

And of course the NOL’s (Noel …. Noel … it’s a seasonal thing?)

Seems like I have been getting subliminal messages about Noel in every mall that I have been in recently

Hmmmmm

spec

10-K filed AH

Haven’t opened it yet

Always the optimist, I will be searching for Tau2 and anything else that might be helpful

Chime in if something lights your shorts on fire

spec

Permission granted

Okay. In that case, with your permission, we will fondly refer to you as ‘whale-light7’.

Mrs. Smith

|

Followers

|

91

|

Posters

|

|

|

Posts (Today)

|

0

|

Posts (Total)

|

8052

|

|

Created

|

06/11/14

|

Type

|

Free

|

| Moderators spec machine NorOilGuy1 smith199 | |||

| Volume | |

| Day Range: | |

| Bid Price | |

| Ask Price | |

| Last Trade Time: |