Register for free to join our community of investors and share your ideas. You will also get access to streaming quotes, interactive charts, trades, portfolio, live options flow and more tools.

Thank you WG, another great playlist and I really feel the vibe “diamonds taking shape” ![]()

Oil and gas trends are upward on China economic headlines (do we really trust the accuracy there?)

Mixed metrics here so volatility is the watchword

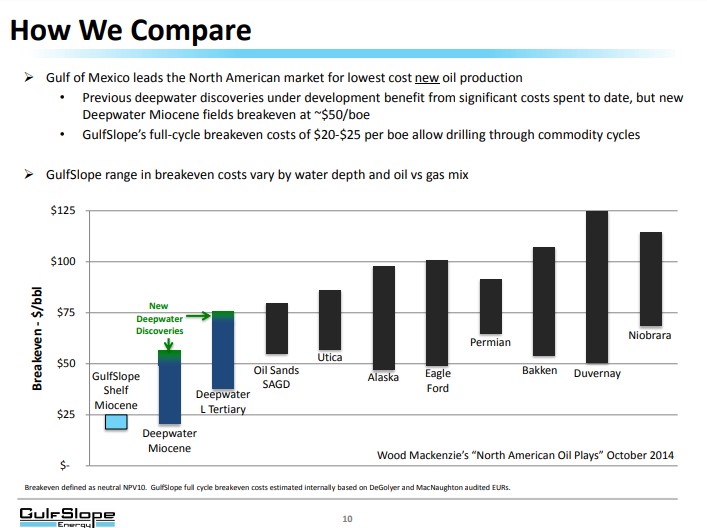

GulfSlope is still in a great position for investments into domestic oil & gas exploration

Isn’t this the M&A season?

If GSPE is going to bid on leases, I think they will almost certainly hit a disclosure threshold for an 8-K definitive agreement before the auction

Tick tock (the sound, not the malware app)

Cheers

spec

GSPE I’m having one of those special weeks where a gorgeous butterfly from the D Butterfly Garden might end up landing on my forehead just so it can give me a light kiss. You might receive a gentle kiss too if you stand right next to me ![]() Yep it never felt so gooood!

Yep it never felt so gooood!

WTI drifts higher ~$77 Nat gas continues to rise from the extreme lows

GSPE gets just a few more ticks on the clock. bid-whacking a tiny amount just gets soaked up

Float appears locked up tightly and rational views on energy issues are being spoken

Enough with words

Drill Tau2

Cheers

spec

Runup to the lease sale?

March 29

BOEM GOM lease sale #259

WTI remarkably flat mid $70’s

Nat Gas bouncing off record lows Henry Hub currently $2.60 ish

Geopolitics smoking hot and less than cordial, watch your 6 at any critical infrastructure (just my take on current trends on risks)

spec

Peeking out of the shadows for a few moments.

From my perspective, the ‘challenge’ to GSPE shareholders is in the volume, not the price. The company however may prefer a higher share price because it reduces the potential costs of securing partners and financing. On Friday, we got a taste of both. And it tasted good.

Low volumes (whether buys or sells), and the prices that accompany them, are mostly meaningless in the overall scale, scope, and scheme of a company with 1.27 billion shares outstanding. But they do still have negative impacts by deterring interest from new investors.

Low volumes are bad for everyone, and low prices are not favorable for creating investor interest either. This is undesirable because, without actively participating investors, traders are reduced to ‘chipping’ away at each other. Recognize that investors are more critical to the future of the stock than traders. You decide if there is a benefit to driving them away. Or to damaging the stock.

Since many low volume trades are sacrificial moves meant to lower the share price, they are destined to lose money. The preferred trade is one of ‘fewer shares = less loss’. This results in even less interest from new investors. Show of Hands, which of us engages in this to LOSE money on purpose? Anyone???

Is this a rational strategy for ethical traders to embrace? The math simply does not work for making MONEY if measuring profit by counting dollars. Is the point of doing this for dollars, or to count minor trading victories?

All shareholders have different reasons for owning this stock. But none of us bought it for the outstanding earnings and financial performance.

I personally own it due to the potential for an explosion in the share price when oil is discovered. It will positively shake things up…. G-!!!!!-A-!!!!!-I-!!!!!-N.

Meetings, discussions, and interested people? An absolute probability. I may be talking to the wrong crowd or situated in the wrong location, but I have personally heard no ‘buzz’. Yet. Among traders I wonder if our buzz is focused on the correct topics to pique or hold the interest of an investor?

And be assured, I share my own buzz. “More (shares) is Better!” and so forth. So do I get partial credit?

Also, management is full-time beating the bushes for a partner. Just as many appointments as they can set up and as often as they can. Trust in it.

These people will also have contacts with others. So the word gets out. Among them, there is likely to be some with money enough to take personal positions. Especially when it appears the stock price might be strengthening.

These partner discussions are happening. So, wait for an announcement. We should then see .02 with no sweat. Drilling begins at +.04. You know the rest….

Please note…. If these low volume, low demand gyrations become the prevalent trend with GSPE stock, they might eventually kill our ride due to lack of interest. It will be difficult to jump-start and get going again. So we will then need to sit and wait. Or walk….

Yes, ‘challenge’ is the right word.

In conclusion, just a fun little ‘ditty’ set to the theme song from an old TV western re-run with Clint Eastwood (see link):

Churning, Churning, Churning….. Keep those shares a-churning….. Stir it up! Shake it up! Spit it out! Skim it off! Slap that Ask!... And keep going, going, going… on, and on, and ‘oh-oh’….. Sorry.

But I do find the use of a whip interesting to get volumes moving. Perhaps we could refer to it as ‘whipping the ask’, lol.

GSPE I’m almost ready to hop into Spring. How ‘bout you? I have a brilliant beyond brilliant idea, maybe I won’t hop at all. Change of plans. Let’s side aerial into Spring okie dokie? I’ve got you ![]()

Here comes the sun!

Me sharing my weekend playlist

Dollar volume is low for sure, but those bigger blocks today were all slaps on the ASK

The bid has been mildly bullish trending for a few weeks and the cheapest shares have been soaked up

Somewhere there is an appetite that isn’t satisfied

Cheech and Chong munchies?

Or Whales feeding?

It’s nothing yet, except that it’s the preferred direction ![]()

Insiders are loaded from early on and don’t need to be front running material news and risking the legal consequences

Just meetings or discussions can spur interested people who have no idea WHAT was discussed

Grab a few mil on a good vibe or a smile when they left the lobby? they’re cheap, no foul

If it’s more, hang on!

![]()

Have a great weekend!

spec

It’s still not really that much buying. Less than $10,000 traded today.

What’s most impressive to me is no one is willing to give up cheap almost free shares anymore.

God I hope there is some insider accumulation happening in advance of an announcement on the horizon!

If so that will make today’s 48% gain look like a rounding error.

Good luck everyone!!!!

I wonder where this buying is coming from.

GSPE up 50% to just short of a penny

An emerald in the Red Sea

Billowing smoke, sure looks like there’s a fire hidden somewhere

Penny candy anyone?

spec

8’s are gone, .006 x .009 is the spread

and as fast as I tapped this message …

there appears a tiny 10k ASK at .008

Sooo tempted

spec

Hmmmmm, a slap on that lovely ASK sends it to crazy 8 land

Wasn’t me

![]()

spec

Mixed metrics are all the rage and expectations are overpowering the current “deep dive” data points

Cherry picking the data can paint a colorful image of the robust American National GDP and consumption projections

The optimistic me says to see beyond the short term and grasp the incentive to navigate through these near field challenges (most notably the war on fossil fuel sentiment)

In the GSPE market space a notable event with the CENAQ SPAC from a while back - now trading as Verde VGAS

Somewhere, someone bungled an algorithm and the tape was gonzo, trading temporarily froze when L2 went off the rails

Take a look, it was crazy for a while and nothing except the expected ticker change a few days ago to explain the swings

It triggered a few alerts and one small sell for me

I have similar set of alerts on GulfSlope

One will trigger my favorite playlist

Living for that day ![]()

spec

A push to the right and no noise on a selloff in the broader market … could be a lot worse

The bid finally developed a glimmer of light but for most of the day a nearly 50% spread with no significant numbers showing at the ASK

WTI sideways mid $70’s and Nat Gas record lows ~$2.10

For the moment, vinyl chloride is getting more hate than oil and gas

Hedgehog mode until some uncertainty is resolved is my status

Well, that and a few dreams ![]()

GLTA

spec

Casual 48% gain on the day!

Enjoy your weekend everyone!

HOD close, .007 nice ![]()

Bond is back!

Ain’t gonna complain about that at all

“grumble …grumble…. no dang volume … grumble”

If it was just static noise, there would be something bigger than that very thin ASK

Enjoy your long weekend

Cheers

spec

Thanks! I see them in there now. The bid / ask were so wide it all looked blank to me. Had to scroll up and down to see it.

A tiny sliver of bright green against a backdrop of the Red Sea

GSPE up 27% on 10K shares total for the day so far

An oasis?

Or a mirage?

Thirsty?

Yes!

007 in the house on the ASK (just a tiny amount showing)

Fossil fuels still under attack, now directors are being sued by climate activist organizations

spec

(Question- is anyone else having issues with ihub latency for months now? Seems like every click takes 15 seconds to load)

I have been using the mobile app for TDAmeritrade and thinkorswim

Desktop thinkorswim gives a better view

But yeah, it’s looking poised to launch

No shares shaking loose

spec

PS -WTI dipping into the $75’s and gas down to $2.30’s currently

@Spec, where do you go for Level 2 data for GSPE? I used to use this site and now it looks like it will cost me 4k per year to access the bid / ask market depth.

https://www.otcmarkets.com/stock/GSPE/quote#level-2

I can’t see level 2 market depth on TOS or Etrade

Ask currently at .01

LFG!!!!!

If we get some volume, it’ll get loud really quickly

As I look at that sentence again, it makes total sense ![]()

But seriously, L2 has my attention on that super thin ASK

Everything is in place and just needs a tangible nugget of progress to light the fuse for GulfSlope

Cheers

spec

![]()

Nice!

I’m gettin’ ready for a big adventure!!

GSPE in case you didn’t already know I really hope your weekend is special!!!

It’s a vibe thing ![]()

Good morning, I wanted to get a chance to chew on a few bits

But my read on it is - the three bids still active

Market seems to be showing a firm bottom

spec

Todays 10-Q, Under recent developments they mention evaluating 10 producing properties and bidding on 4, we were aware of that from past filing. Makes mention of one seller stating GSPE bid not competitive on one of the submissions. Question... last sentence. "The Company is currently engaged in seeking debt and equity financing for the remaining opportunities".

Do you read that as referencing the other three that were bid on, or the remaining 6 that were not?

Super quiet with just a few small trades

No GSPE chatter detected elsewhere

The ASK is still super thin so no significant quantity of shares are getting shaken loose

WTI holding $79

Nat gas still in the mid 2’s at $2.60

Tick tock

spec

A one-pinky slap took out the .005 ASK

Super thin ASK

Half-penny is the bid now

Volume is only a whisper

WTI - $80 again but Nat gas still $2.50

spec

GSPE wishing you a golden week!

Yep I was groovin’ to this earlier ![]()

Thoughts on Thursday - Energy Supercycle Averted?

Snooze alert, long-winded market perspective ahead

There's a crackling fire in the woodstove, rain pattering on the roof, the ice is too thin for fishing, and I have 1 bar of cellular signal .....

Is the energy supercycle a myth?

was it side-lined? .... is it finished?? Is that all there was?

Has Covid changed the fundamental nature of mankind so much that past records can no longer be relied upon to project trends at all?

Nope, the changes recently sweeping throughout the globe are transformative, but Covid is just a small (and recent) chunk of the crap-tide

The 800-pound gorilla that nobody wants to look directly in the eye ....

... the inflamed boil, a pustule that's only going to get worse ....

... and will eventually either burst (in the most repulsive way possible) or cause the demise of the host ...

... is the weaponization of climate science and various additional societal fears (insert EVERY campaign topic here)

... all for political power which has become the slush fund for career politicians (and everyone in their orbit)

We're "three legs deep" in a proxy war (actually several, but one dominates the checkbook and headlines) and cornpop has nukes

.... just things to keep an eye on ...

Time to chop some wood and hope that our society can lance this boil in every affected country

We can steer a path that empowers everyone to live a better, more secure life

Defund the swamp, decentralize power, Drill Tau2

Cheers

spec

A bit of a lift for crude and nat gas today

… must be a sudden discovery that the supply side has far more instability as compared with the inevitable demand growth globally

Well, that’s my idle attempt at sarcasm

Cruise, snooze, or booze till there’s news

spec

COP got kneecapped on their Willow project

A change in late-stage project permitting injects additional costs and reduces the breadth of potential targets

So, the effect is - “sure, you have an approval just as long as you only drill a portion of the locations”….

…. “and those are still pending our final review of these new additional carbon/climate calculations that you must provide”

These actions are impeding the upstream investment that is so desperately needed …

By our entire nation

GulfSlope is in a perfect location to be the channel of investment to that goal

Currently though, the tide is slack

spec

Recap the past several days -

The bid began to falter on Friday and hasn’t been strong enough since then to maintain momentum

Without volume there is no solid direction …

…just filling the tax sale divot

Market is jittery, especially the energy sector

One solid ground truth to fact-check the market manipulators - -

-the juggernaut of global oil demand WILL NOT BE TAMED by more government intervention

spec

Indeed, this will be our year

ASKs will get slapped and shorts will get burned

No worries, I know first aid ![]()

Thanks for the great playlist

hoping to see this rumble turn into a bigger push higher as markets digest the performance projected for the fossil fuel sector

For many, plays like GSPE are "spillover" plays when you've got the energy sector generally covered but you're looking for a bit of high risk/reward exposure

If GOM exploration gets some easing of permitting (in actions, not words) we could get really crazy, really fast

WTI $79

Nat Gas falls further to $2.60

OPEC+ leaves quotas unchanged

Cheers,

spec

I’ve got an audio alarm set too for my GSPE ASK.

STOP DROP & ROLL

Big market slide into the red today

WTI slides under $78

Nat gas in the gutter $2.70

GSPE hasn’t shaken loose many shares considering the recent upward push

ASK is still extremely thin but I only was able to glance a few times

I’ve got a custom alert set for GSPE with volume and price settings

If it triggers, an audio alarm goes off …

…it’s the sound of a fishing reel screaming “hooked up!”

Hoping to hear that sound soon ![]()

Cheers

spec

Much appreciated. My sincere ‘Thank You’ for the support and well wishes. I will be back before you know it.

In my absence, remember the Mantra, Many More shares Matters Most!

Up, up and away. Leaving on my beautiful GSPE balloon.

Mrs. Smith

Good luck with whatever you’re tending to Mrs Smith

GSPE wishing you a cozy Sunday ![]()

I may be MIA for a while. Not sure yet, but likely. So keep an eye out for el Mucho Lurko in case he has a question.

Spec will be fine without my presence. I will be back as soon as possible.

Until then,

Mrs. Smith

My Perception was that the Participant’s Performance was conducted Professionaly while Palavering about Popular energy Policies, and they did not disrespect the Platform. They seemed knowledgeable and I did not hear anything too objectionable. But it was +2 hours long.

One of the key points made is that between now and 2050 natural gas will stay a critical component of U.S. energy.

Super Yikes! Now we are cooking with GAS. The molecules of US energy independence. From GOM production too, I trust. So bring it on and drill Tau 2.

Mrs. Smith

That's a very worthwhile dialog to understand and frame our current energy market climate and forecasts

Edit - this is the roundtable meeting video post that I refer to

https://investorshub.advfn.com/boards/read_msg.aspx?message_id=171048417

One caveat - Since it is a televised congressional committee hearing, it is subject to the usual political circus priorities, sound bites, gotcha's, touche's, lies, and ignorance

In between it is laced with nuggets of wisdom and valuable observations, mostly from the real-world experts, just a few from House members

I do love it when a Rep tries to get a YouTube snippet of a dig on some aspect of the energy industry and the response is quick, truthful, and just BODY SLAMS the Rep in his face ![]()

Folks, don't let the congressional clown show (and embedded lies) distract you, observe the important stuff in between

That video is a good update on the tone of our relevant sector policies

Some very encouraging dialog and the upstream sector is feeling the tide rising

WTI started strong, topped $82, and has already fallen to $80

Nat Gas falls below $3

spec

A January 26th Roundtable on American Energy Security by the Energy and Commerce Subcommittee on Energy, Climate, & Grid Security.

A video of your government in action. Enlightening throughout.

‘On the road to a healthier offshore industry’, released January 23, 2023.

https://www.workboat.com/viewpoints/on-the-road-to-a-healthier-offshore-industry

Excerpt:

“Barclays’ 38th annual E&P Spending Survey calls for a healthy onshore spending increase with an upside bias, but importantly they see offshore spending increasing at twice 2022’s rate of increase (24% vs. 12%). This should be welcomed news for offshore contract drillers and their support providers, especially as producers are stepping up deepwater drilling in addition to more shallow-water work. Hunting elephant oil deposits in deepwater is becoming a higher priority for producers assessing long-term global oil industry supply/demand dynamics and their production profiles, especially as the prolific U.S. oil shale basins offer limited growth opportunities.”

Mrs.Smith

A quote by Secretary of Energy Jennifer Granholm on January 23, 2023.

“Yeah, so, first, with respect to LNG, we know that our liquefied natural gas exports have been a significant help to our allies.”

“And it’s an important — it’s very important to make sure that they have the means. We are fortunate in that we have an abundance, obviously, of natural gas in this country. Our prices are low. But during times of challenge, we want to help our allies as well.”

“We want to make sure it’s the cleanest natural gas, which is one of the reasons why the Inflation — excuse me — the Bipartisan Infrastructure Law really invested in carbon capture strategies and storage strategies.” (Inflation? Was that a Freudian slip?)

“So, that’s an ongoing issue and an ongoing conversation we’re having with industry…. Unquote.

Below is a link to an EIA article titled, ‘Pipeline projects announce to expand Permian natural gas capacity’.

https://www.eia.gov/todayinenergy/detail.php?id=53319#

Mrs. Smith

While investing, one may rarely get to ‘beyond a reasonable doubt’, but we can still make good decisions by following the ‘preponderance of the evidence’ rule. If you look closely, the power and strength of these stock moves is towards higher prices.

We might soon have new folks attending our party. From the totals at some popular sites, there are about twice as many following GSPE now as was following it several months ago. Just thought that observation might be of significance to some.

Whale watching is turning out to be more interesting than was expected. Feels more secure too. This might be the sweet spot. I will wait it out from here.

“… I am just sittin’ on the stock every day, waitin’ time ……” (Otis Redding lyrics paraphrased).

Mrs. Smith

The 118th Congressional Bill, H.R. 22 (Protecting America’s Strategic Petroleum Reserve from China Act) has been passed by the House. An update.

“NJ Democrat, Frank Palone said he plans to take advantage of the open rule to offer as an amendment a measure he sponsored that would create an ‘Economic Petroleum Reserve’, through which the Energy Department would purchase oil at a low price and sell when prices are high to address high pump prices.”

Palone failed to move his Congressional Bill, H.R. 8989, (The establishment of an Economic Petroleum Reserve) beyond the ‘Introduction’ stage in the 117th Congress under Pelosi’s control. So basically he still wants to sell the Strategic Petroleum Reserves to China at will (using the ‘waiver’ clause in H.R. 8989). Good luck with all this gibberish in the 118th Congress. Thankful for House Rs.

The first flaw I see with his plan is, that in order to be successful, you first need low prices. By the way, at today’s prices, Joe will not even refill the Strategic Petroleum Reserve (SPR) with the 266 million barrels he now owes it. The second flaw is that Palone is somewhat vague about how the profits will be used. This portion of his plan needs to be further developed before it can even be considered.

Some Ds would love to split the Strategic Petroleum Reserves in to two categories, the (SPR) and the (EPR). Again, good luck with that. Sanctimonious, Slippery little Suckers. Got to watch these guys, they are trying to both control the price AND create another revenue stream to fund their liberal agenda. Neither of which promotes national security in time of crisis.

Mrs. Smith

For the folks who are not seeing L2 in real time …

007 has left the building

Bid is 4 lanes wide from .006 to .0066 (edit - 5 wide now)

Tiny ASK is a pair of 8’s

Just ASKing for a slap

.. but all is quiet ….

…shhhhh

spec

Hickory .... Tanzanite .... Mahogany .... all blockbuster subsalt plays in the GSPE "sweet spot" of the shelf

blockbusters in their earliest days with crude in the $20's and $30's

GSPE had a successful capital raise with crude in the low $50's

.... Tau2 and WTI $80's ??

that'll make big numbers

The treasure map is just as enticing and the treasure is real

Poland Popped Putin's Pipelines? .... Perhaps

Someone knows who did it and archived satellite photos have most likely confirmed who was conducting surface operations over those exact coordinates at some time in the preceeding months

I spy .007 in the house again today, 10K on the ASK

Cheers

spec

Loving this price action

|

Followers

|

91

|

Posters

|

|

|

Posts (Today)

|

0

|

Posts (Total)

|

8006

|

|

Created

|

06/11/14

|

Type

|

Free

|

| Moderators spec machine smith199 | |||

| Volume | |

| Day Range: | |

| Bid Price | |

| Ask Price | |

| Last Trade Time: |