Register for free to join our community of investors and share your ideas. You will also get access to streaming quotes, interactive charts, trades, portfolio, live options flow and more tools.

Wishing you and your family member nothing but the best Spec…. God willing we will be here for you when you return.

Re: GSPE, I keep buying more on the discount. It’s either going to really pay off or be really dumb. Time will tell which it is.

As GulfSlope continues to strive toward success, so will I

Unfortunately, life events require my attention and focus

I have made a command decision to step away from posting and most of my trading account is off the table and in cash (has been for a few months)

I maintain a significant position in only a very short list of equities and only one is a higher risk/massive potential stock, GSPE

This one I fully intend to hold through fruition

Our days on Earth are numbered and usually we have no idea how many grains are left in the hourglass

All we can do is make every grain meaningful and I will be there for a family member who has been given a peek into his hourglass to discover it nearly empty

A humble farmer, father, husband, and just a great soul who is good to the core

I’m proud to help him and our family reflect on a life well lived

Greatness comes in many flavors, his type flies under the radar

But everyone close to him knows exactly where his next stop will be

As far as market dynamics and the economy, I maintain that this is a 100 year storm event and urge caution

Wishing you all success, especially with GSPE

spec out

That Tetris ref. cracked me up. Dates those that get it, still funny enough to steal and use on occasion.

Someone dropping blocks like it’s a game of Tetris

2M T-trade settlement at the close

Was it a broker-assisted sell, or accumulation?

I always win either way

Game isn’t over yet

Not by a longshot

spec

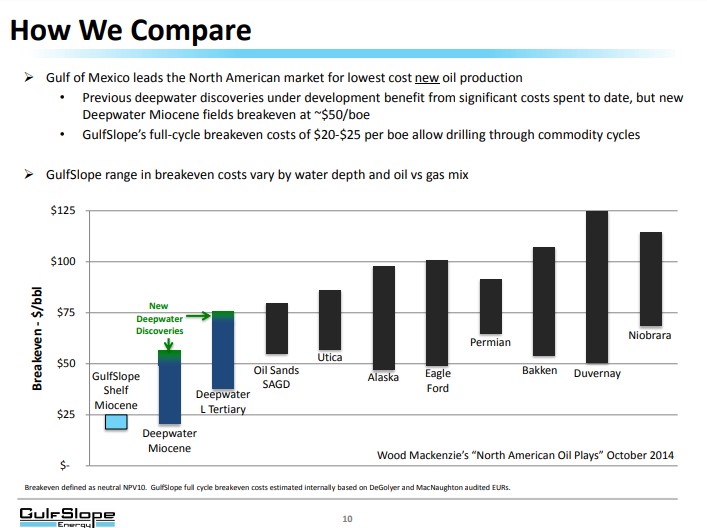

There is more positive news for the GOM.

A recent report from the National Ocean Industries Association (NOIA) reveals that greenhouse gas intensity of US oil production, particularly in the US Gulf of Mexico, is significantly lower compared to most other regions around the world.

Highlights from the report:

* Total US oil production has a carbon intensity 23% lower than the international average.

* The US Gulf of Mexico has a carbon intensity 46% lower than the global average.

* Using the API Gravity of 37.5 of typical GOM crude, results in a 50% reduction in the average international carbon intensity.

Excerpts of comments by Erik Milito, President of NOIA:

* The US Gulf of Mexico energy production sets the standard for oil and gas production worldwide.

* The Gulf of Mexico produces a massive amount of energy with a remarkably small footprint.

* This study validates the importance of the US Gulf of Mexico as a source of energy with demonstrably lower carbon intensity barrels.

Link to the report and article for more information on the value and favorable economics of oil and gas production in the US GOM:

https://www.noia.org/wp-content/uploads/2023/05/NOIA-Study-GHG-Emission-Intensity-of-Crude-Oil-and-Condensate-Production.pdf?utm_source=Mailchimp&utm_medium=email&utm_campaign=ICF+study+emissions+

https://www.offshore-mag.com/regional-reports/us-gulf-of-mexico/article/14293916/report-us-gulf-of-mexico-production-has-lower-ghgs-than-most-other-oilproducing-regions

Mrs. Smith

Here is what I believe is going on…. For Whatever It Is Worth.

A lender was due to be paid back for monies provided. Gulfslope, being short of cash, has paid them back with stock shares. This transaction was not required to be reported, so no 8-K. Those shares are being converted in to cash.

It is not in the lender’s best interest to harm the share price, so much of this is happening after hours and as negotiated trades between principals. It should be ending soon. It is all in the minutiae of the SEC filings.

So, the company is still strong with support and in possession of a viable future. Shareholders are not the driving force behind these sales. What a relief. We will survive with only a scare. The share price will rebound.

Whoever it is that is buying these shares heard something, sees something, or knows something. And is not afraid to make a financial commitment to get a seat at the table. A noteworthy observation.

Do not give up on Gulfslope Energy. While we may be unaware of what is brewing behind the scenes, this is the fire providing that smoke everyone is seeing.

A wild guess says that Gulfslope has been beating the bushes very hard and has awakened someone’s interest and attention. We need to hang together and see what shakes out.

As was mentioned in T’s recent post, the GSPE management team continues to fight. Since I believe that too, I am standing by them.

Perhaps the best play for us all is to remember the demand for oil and gas is not diminished. And drilling in the GOM is surging.

This is not happening in secret, so there will be others wanting to participate. And Gulfslope is ready and willing to accommodate.

This is a guess. Nothing more than that. And you are welcome to do with it what you will….

Mrs. Smith

They continue to keep fighting… so this is either a very expensive hobby or we have some fight left! Let’s goooooooo!!!!

Thanks as always @Spec!

The 10-Q has been filed

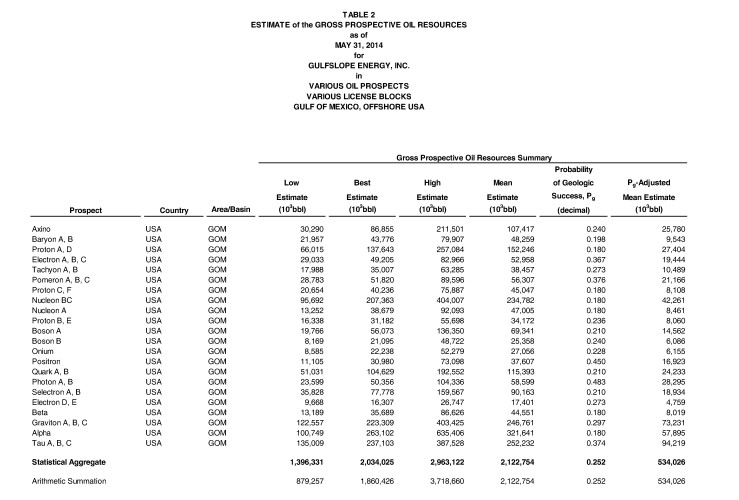

We have developed a significant pipeline of potential acquisition opportunities with the following characteristics: (i) strong cash flow, (ii) inventory of low-risk capital projects, and (iii) manageable plugging and abandonment liabilities. In addition to asset acquisitions, we are also evaluating the combination of GulfSlope with other GOM oil and gas companies. Any merger or acquisition is likely to be financed through the issuance of debt and equity securities.

Any good news in the sector is positive

Let’s see some in the Q (which is due today)

Current valuation has GSPE market cap under $4mil

The cash value of the NOL alone is higher than that, FWIW

Cheers

spec

Good news is here again.

The U.S. Total GOM Rig Count is the highest it has been since Biden took office. Back up to Trump levels. Perhaps this is a favorable sign for GOM drillers.

https://www.dnr.louisiana.gov/assets/TAD/data/drill_weekly/WeeklyRigCountUpdate.pdf

https://www.dnr.louisiana.gov/assets/TAD/data/drill_weekly/ogj_rig_count.pdf

Mrs. Smith

As the world turns….

We sort of understand where those that are selling GSPE shares are coming from. The economy and the impact on the stock market is the first thing that comes to mind. As previously stated on this board, that concern is no problem, it can happen with any of us. So, no need to cover this ground again.

No, today what I have on my mind is, “who is it that is willing to buy?” Of course, it not possible for me to know. But one obvious reason is to buy it @ .004, and sell it @ .008. Definitely in a recent trading range for GSPE stock. And a 100% return.

But might it also be that some are anticipating an upward move for the stock? Common sense says that if the stock is expected to move lower in price, WHY buy a lot of it Today at a Higher Price? A very good question…. Who will do this? As in the past, if the stock price is expected to rise, more shares is more profits.

Up to now, the GSPE total average volume is around 60 million shares for 6 months (VWAP @ .0042). Yet, it is already about 30 million shares for the most recent 1 month period (VWAP @ .0039).

We may not know what is causing it, but one thing is for sure, the trading volume is certainly up, so no lack of ‘BUYING’. And these are not the common 5k share trades favored by manipulators.

So is there a contradiction in the buying and the falling share price? It does seem so.

And while I am not happy about the price struggles, considering the market conditions, it is not exactly unexpected. Perhaps others see it this way as well, so the price is less of a concern as long as the volume is there. That is one point of view supported by the facts.

Mrs. Smith

Ummmmm… this is not great. Back down to .0025

WTI up a tiny bit to $73

GSPE ASK is .004 and nobody is slapping

10-Q deadline is next Monday

Not a peep about OTC from anyone I know, was hoping to hear their thoughts on the near term permitting changes currently in the legislature

Grouper season is open so y’all get a reprieve from my rants for a while as I try for a personal best for black grouper

I’m still waiting for news and I will chime in with anything I come across that might be useful

Cheers

spec

Here is a link to an article from this morning's WSJ. It's a nice follow-up to Ms Smith's latest post. You have to believe that the oil companies will find their way back to the GOM (shallow) sooner rather than later!

https://www.wsj.com/articles/warren-buffett-oil-stocks-berkshire-hathaway-charlie-munger-2c8b12b8?mod=hp_lead_pos3

Some perspective to keep in mind.

While over the short-term things may get a little choppy for the economy, GSPE shares, and the stock market, does this mean anything more than we might have a bouncy ride?

History shows that at some point, there is always a REBOUND. So using past history as a guide, look for the market to bounce back just as fast as it dropped.

Yes, definitely something to keep in mind….

ABB2024 (Anybody but Biden),

Mrs. Smith

A faster way to increase oil production….

https://oilprice.com/Geopolitics/Middle-East/Iran-Seizes-Second-Oil-Tanker-In-Arabian-Gulf.html

Oil Tankers may want to consider being equipped with self-defense drones. When these attack boats show up, sink them.

In our past history, the USA was very effective in fighting off pirates. It would not take very long to sink Iran’s fleet of fast boats.

I wonder if Joe is getting his 10%?

We could always default to the D’s precedent of delivering a pallet of cash. That should show them.

Mrs. Smith

Crude (WTI) bounced off a low of $68 at the noon whistle

Well, it bounced like a wet meatball that rolled off the table

It’s good for lower cost of products, but if the driving force is global slowdown….

GSPE valuation is hovering around $4 and that hurts most via new shares issued if/when GSPE drops into first gear

GLTA

spec

PS Chairman Powell made sure to emphasize “The banking system is JUST FINE now”

I have a full day ahead, and not that much time. But I want to take some of that time to reply to your post.

I am an investor following the vision of the opportunity offered by Gulfslope Energy. That is unchanged.

What has changed is the current administration, it’s attack on fossil fuels, and it’s attack on the country’s economy (inflation).

You are wearing an ‘investor’ hat. But if you put a ‘trader’ hat on, perhaps this all becomes more clear.

In my opinion, Brokers and Market Makers are negotiating these larger trades. So it is most likely not any of the traders from this board. You are right though probably a liquidation, perhaps forced.

But if we are not careful, we can still negatively affect what is going on. For example, assume for a moment that there is a group, unnamed in this discussion, with the desire to take advantage of the situation.

The reason is simple. Manipulating the share price lower provides the opportunity to purchase shares really cheaply. The idea being to get them as cheap as possible, then attempt to manipulate the share price higher, and higher again. Sales provide the profits.

You already know how this works. I know this from some of the terms used on the board. Dirt bid. Scalper. Whacking the bid. Slap the ask. Etc.

What makes it all the more risky at this time is that other investors are also already nervous. What if something was to trigger a big downward move? Reminds me of the term ‘avalanche’.

And that is the danger of ‘the game’ being played. These are not normal days. And reactions may not be normal either. An opportunity to sell higher may not ever come if the bottom falls out. This can easily be the fire providing that smoke you are worried about.

So the players accumulating cheap shares might only end up with a worthless pile in the end. Because they failed to see the damage that can be caused in the wake of the game. This is not a time to play the game. This is a time to support the stock, the company, and shareholders. Play later.

Thinking of trying to liquidate your position? Getting a few fractions of a penny is better than nothing? Think about it some more.

You are right to worry. That move is what starts the avalanche. Anyone with large numbers of shares can kick it off. What is the likelihood that we can all sell our GSPE holdings without negative effects?

Nope. We may only crash it. And if we do, it may not ever return. This is one of the reasons I still hold my shares in hopes that Gulfslope is allowed the opportunity to succeed. Hopefully these sales are nervous investors selling off. And if it holds to that, we escape with only a scare.

Fortunately, someone is buying. So somebody has a vision for a brighter future. Someone with big bucks to commit. But if we join in the selling, mayhem may follow…. The only things I plan to follow are the whales.

Again, you are right to worry. Some players do not care about the company. Or other shareholders. They only focus on running the price lower and accumulating cheaper shares. When they finally see it coming, it may well be too late for them.

The short-term may be challenging. There is nothing we can do about it. This die was cast a long time back. And the only long-term play I see is to wait it out, and start over.

The good news is none of this will diminish the need or demand for oil and gas. The GSPE product will still be viable and valuable in locating new GOM shallow offshore accumulations. A new day will dawn. Perhaps hard to visualize at this time, but it will come nonetheless.

None of us created any of this. We are not accountable. We only failed to act in a timely enough manner. And we did not fully appreciate the dangers to the oil and gas industry and the economy brought to us courtesy of incompetent politicians swimming in waters over their heads, with ideas that appear to not be well thought out.

That may not be accurate. They likely thought about it quite a bit. And then decided the damage is acceptable if they get to take over the government and hold all the power. This might be the “fundamental change” that was promised.

Ask Joe and the other politicians about it, if you ever see them. Although I doubt any of them are smart enough to realize what damage their efforts actually caused. And, in any case, I am certain they will be unwilling to admit their role.

After all, from their perspective, they are immune from accountability. Any fault lies with Trump and the Russians, evidently the only true powers in the world. Ironic. Those two are the ones not involved in creating this mess.

The bottom line is, this great country was founded by great men with greater ideas, and we should not lose site of this. In fact, we should endeavor to pass on those ideals while we move forward in life.

I am certain this is what Gulfslope Energy plans to do. And they have my full support.

Mrs. Smith

Real talk GSPE getting to that dirt cheap level again. Was this just as simple as a 1.5 million share liquidation of about $5,000 or is there some actual smoke here? As much hope as I want to put in GSPE, when the stock gets this low I get nervous this is the beginning of the end. I haven’t sold a single share but weeks like we have been having make me real nervous.

Typo Correction! “The world continues to spin and 92% of it’s energy is supplied by fossil fuels.”

It seems that no matter how hard I try, I cannot avoid these mistakes.… apologies. An affliction I am not able to shake. Perhaps I need to slow down. Fewer distractions may help also. And maybe some editing.

Talk about pulling your head out…. I need to practice what I preach.

Mrs. Smith

The world continues to spin and 92% if it’s energy is supplied by fossil fuels.

The truth is oil and gas will be produced, and deals will be made. And you can trust in this. No prayers required.

Oh, and another inconvenient fact, those three bank failures came out of blue states. Two from CA and one from NY. Need I say more.

Okay, I will.

Over the past couple of weeks, many (most ?) U.S. banks are “opposing” the resolution requiring winding down of NEW fossil fuel financing, citing other efforts to achieve net-zero by 2050.

In addition, Major U.S. banks are “removing” the Paris Agreement requirement that phase-out plans be aligned with the International Energy Agency’s 2050 net-zero scenario.

Citi Bank’s CEO recently stated “we simply don't yet have affordable alternatives at the scale and reliability that is required to move national economies off of fossil fuels.”

Apparently bank management and other executives see the light too, and are pulling their heads out….

So the struggle continues. And now is the right time to shine the light on these ‘back door’ attempts to prevent the use of fossil fuels by government fiat.

We have a presidential election coming up, so make this an issue. Instead of “Joe” doing it, let the voters decide. In this country it is still their right. So far, anyway.

Mrs. Smith

A trickle on the tape, another bank crumples (I am shocked), smuggler’s tanker Pablo had a mishap (probable gas explosion) losing a few crew lives

I’m guessing it’s a case of an uninspected vessel, unsafe handling of ship to ship transfer at anchor (both factors linked to it being a smuggling operation)

“Boom” said the cargo tanks when the static electricity discharged

Sanctions (economic weapons) have given rise to the smuggler’s heyday for crude and refined products to circumvent trade sanctions imposed on several countries

Then, on the bank failure, top dog of JPM puts excessive emphasis on “everything is fine now after we bought the unladen carcass of First Republic Bank”

“Everything is FINE now”

Color me skeptical

This type of volatility crushes microcaps and venture capital

Sentiment sinks lower

More important than the money or oil is the lives lost or crushed by the multiple conflicts raging around the globe

Prayers for all affected, strength and resilience have their limitations

Domestically produced energy is on the “solutions” end of the spectrum, not the “problem” side (as some might claim)

Hopefully, GSPE gets to shine

spec

Just a bit of a change of topics. We are constantly being bombarded about needing EVs and renewable energy to combat “climate change”. As a supporter of oil and gas and Gulfslope Energy, there are a few comments I want to make on the subject.

I have heard a lot about climate change over the last 15 years or so. I have read much about the theory and the consequences. I have seen many politicians ranting about the end of our civilization if climate change is not addressed.

This is the same thing that used to be known as “global warming”, although that moniker was dropped when the globe failed to warm at the predicted rate. In fact, it got cooler. So the term evolved into climate change. Now it is not warming, only changing. How convenient.

So we are now stuck with climate change. They try to use weather to convince us the climate is changing, but not the same things. And we have all seen a lot of protests about climate change and why we need to turn our entire civilization and standard of living upside down to combat the effects before it destroys us.

But, the one thing we have not seen is any ‘PROOF’ that ‘man-made’ climate change actually exists. All we have are dire predictions based on political forecasts and demands that the progressives be given the power to save us from climate change.

“Sorry Charlie”, as my father says.

Lacking peer reviewed evidence that man-made climate change exists, and with no convincing arguments that the proposed solutions are the best approach, I feel I am being asked for too much commitment on only blind faith. Especially since I have little faith in the climate change cause. I will save the comments on ‘trust’ for a future post.

To completely change our country, our lifestyles, and our standard of living, based mostly on the political desires of one group of suspiciously manipulative politicians, is too large of a leap of faith for me.

No Sale.

Mrs. Smith

I appreciate the thought but I’m just not able to attend this one due to a time conflict

Let me know what day you will be there, and I will get an extra ticket. For safety’s sake, you might also consider not wearing a name tag.

OTC is the Offshore Technology Conference and it’s a huge trade show for everything oil, subsea hardware, ROV, AUV, cable laying, research publications, etc….

May 1-4 in Houston

https://2023.otcnet.org/

It’s always well attended by the oil sector and it is highly probable that key players for most of the operators will be there

It’s global in attendance draw but GOM companies are dominant in presenting and purchasing

I’ve been to previous events but unfortunately can’t attend this one

Lots of sales contracts are finalized at these events because it brings reps from all sides together in one place

I suspect M&A activity and partnerships are inked at a higher tempo for the same reason

We know they’re working on it

Cheers

spec

Okay I've been gone for a while and not up to speed. I haven't even been watching the price of GSPE for maybe a month. What convention are you referring? to and when and where? And will GulfSlope be there for sure?

I am looking forward to OTC…. the convention. I will be the blonde with the ‘Smith199’ name tag. When I get near the Gulfslope booth, I will need to remove it. If John sees it, he might call security.

Let me know what day you will be there, and I will get an extra ticket. For safety’s sake, you might also consider not wearing a name tag.

I think I do hear that echo you mentioned, it must be just you and I here.

Mrs. Smith

WTI and nat gas headed north $76 and $2.40

Exxon, Chevron, and Valero all post good Q1 numbers but only Exxon’s chart looking decent

Iran nabbed a Chevron tanker near the straits of hormuz, is it just a shakedown for $$ ?

A bid for 1M GSPE shares was showing in the mid .003 range

It got blasted at the close

OTC in Houston coming up, anyone going?

…

….

Bueller?

Bueller?

Echo

spec

API reports crude draw yesterday, crude price slides

EIA reports big crude draw today, crude price swoons

WTI $74

Crazy mixed indicators/metrics

I’m not “wasting” gas in my truck today

I’m “enjoying” it with gusto …

Zoom ![]()

Cheers from the echo chamber

spec

And maybe it’s just me

But my FBI vocal stress analyzer (bullshit detector) just about throws a giggle fit when the talking heads start over emphasizing how “the banking system is just fine”

… just a few bad eggs

Nothing to worry about… move on

But…. The physics of the monetary disruption can’t be ignored

There is a price to be paid …

There’s certainly algorithms or automated trades being executed regularly

It’s a bit annoying when every trade submission is bested by one tick in a nanosecond

But true AI will “learn” to tunnel into every data source and instantly move on every swing in a supply/demand balance

Then again, true AI might spoof bad data to a competitor

It’ll be new dimensions in both good and evil

The tape today was a let down

1.3 M shares vaporized every bit of bid in the .004’s

We’ll see pretty soon if there’s still some accumulation to put a floor in

In general the energy sector got a little lift today

Our looming debt ceiling battle is the stage for GOP efforts to end the crippling regulatory chokehold on upstream oil and gas

All talk so far

But gathering momentum

Cheers ![]()

spec

I think AI already controls the commodity markets as it relates to trading options…as well as the stock market. I would say it was the first industry to truly get taken over by AI to be honest. The hedge fund algorithm engineers have been at it for years perfecting their tricks. May not coincide with what you were implying Spec but I think we are already there!

Every drop of oil that is produced, refined, piped, shipped, and eventually consumed…

… is counted

Someone has every bit of that data in real time

I wish I had all of the data (heck, even a little bit in real time would have great value)

My question-

How long before AI controls the market of all commodities?

Geopolitics is the biggest pressure that is being exerted on markets in general in today’s world

Trade sanctions = economic weapons

AI could outplay that hand easily

It’s going to get interesting and fossil fuels get whipped into the mix every time we have geopolitical problems

There’s a few hot spots around the globe today

A long time ago I said we’re in an energy super cycle unlike anything in our lifetime

GulfSlope only needs to snag a ripple to ride the wave

I hope to be hangin 10 on that wave

Maybe 11

![]()

spec

Interesting development today with Delek

A deal has been announced to take NewMed Energy private

NewMed energy, formerly named Delek Drilling, a subsidiary of Delek Group

BP and Abu Dhabi National Oil are collectively purchasing 50% of outstanding shares at a >70% premium over the trade price at the announcement

My takeaway is that Delek finds the macro environment for partnership with UAE to be acceptable but currently has not stepped forward with continuation of investment in GOM due to hostile regulatory and financing hurdles

Pressures to unleash domestic oil and gas seem to be getting more traction in the slippery swamp

Yet still no rumbles from GSPE on the hunt for a pathway to production

WTI $78

Cheers

spec

GSPE and WTI down

Starship up, up, and boom!

Probably not connected …

…different rocket man

![]()

spec

“Tap, tap, tap… is this thing on?”

Zippo on the tape today, WTI slips about 2% to $79 on “renewed recession fears” even with a draw on crude stockpiles

If only there was a repeating pattern to discover ….

Bigger wave coming, but as I said, I do believe that the oil & gas sector will be solid

spec

Summer Oil Market Outlook - OPEC Featured Article 4/13/2023

In 1Q23, world oil demand is estimated to have grown by a healthy 2.1 mb/d y-o-y, on the back of a strong rebound in China’s oil demand, as well as solid oil demand data in other non-OECD regions, particularly the Middle East and Asia. Looking ahead, world oil demand is expected to grow by around 2.4 mb/d y-o-y in 2Q23, 2.5 mb/d y-o-y in 3Q23 and 2.3 mb/d y-o-y in 4Q23.

In terms of products, global demand for gasoline and diesel is forecast to increase by 0.6 mb/d and 0.5 mb/d, y-o-y, respectively, in 2Q23. In 3Q23, demand for these two products is forecast to improve further, with global gasoline demand growth forecast at 0.7 mb/d and diesel at 0.6 mb/d, y-o-y.

In the OECD, heightened mobility in the upcoming driving season in the US is expected to provide the usual additional demand for transportation fuels. However, any weakening in the economy on the back of ongoing monetary tightening measures by the US Fed may offset some of this seasonal dynamic. Overall, OECD Americas is forecast to lead demand growth in the region at an average of around 160 tb/d y-o-y in 2Q23 and 3Q23. The demand in OECD Europe is likely to continue to be challenged, amid slowing economic activity, leading to a slight projected y-o-y decline in 2Q23 and 3Q23 on average. OECD Asia Pacific is expected to show y-o-y growth of around 50 tb/d on average over 2Q23 and 3Q23.

In the non-OECD countries, China is projected to drive oil demand, supported by a pickup in mobility and industrial activity, growing by almost 1.0 mb/d y-o-y in 2Q23 and 0.8 mb/d y-o-y in 3Q23. Similarly, India oil demand is forecast to grow by 0.3 mb/d y-o-y, on average over 2Q23 and 3Q23. Other Asia and the Middle East are also expected to see healthy growth of between 0.3 mb/d-0.4 mb/d on average over 2Q23-3Q23, with requirements for air-conditioning in the summer months adding additional support.

It should be noted that potential challenges to global economic development include high inflation, monetary tightening, stability of financial markets and high sovereign, corporate and private debt levels.

On the refining side, intakes have been on a declining trend since the post pandemic high level seen in November 2022 at 80.8 mb/d. In addition, the start of heavy refinery maintenance around February further weighed on intakes in recent months with some 2.1 mb/d of capacity offline in February and 400 tb/d in March. Although US refiners have recently started returning online, ongoing strikes in France, and impending peak refinery maintenance in Asia are likely to keep intakes suppressed in the weeks ahead. Moreover, the impact of the recent reopening of China has still not been sufficient to reverse the declining trend in global refinery intakes.

On inventories, OECD commercial inventories have been building in recent months, and product balances are less tight than seen at the same time a year ago.

Given these uncertainties surrounding current oil market dynamics, several countries in the Declaration of Cooperation (DoC) have announced additional voluntary adjustments as of May 2023 and until the end of the year, and this was in support of the ongoing relentless and determined DoC effort to support the stability of the oil market.

Mrs. Smith

I am not a bonafide historian on the history of Exxon, but a while back I read an article that mentioned the “greatest” period of profitability growth for Exxon started during the depression era in 1931 and continued until about 1958.

I was not there to personally observe the sources for this growth, but perhaps it was partly due to investors of the time needing to find a safe investment that would pay a good return.

And just maybe things have not changed so much. Considering all the current stresses in the economy of today, would you rather invest in a new tech company or in a new energy company?

And I would point out that there have been many financial challenges over the past 100 years and most of the energy companies seem to have weathered them all and prospered.

The underinvestment in oil and gas energy over the recent past is now recognized by almost everyone and is considered to offer a multitude of unique global investment opportunities.

The GOM is going to be high on that list, and Gulfslope should get a close look by the principals searching for USA energy investments.

At this time, “steady as she goes” is the order of the day. After all, nautical terms seem appropriate for offshore use.

Mrs. Smith

I had a fascinating discussion today and the topic of foreign investment (as partners) in upstream oil and gas came into the convo (not specific to GOM)

Strong consensus that even a severe recession is likely to see increased participation due to a rebound from “green delusion” renewables lacking in delivering the hyped results

In short, even in tough times, we will see energy sector strength

Currently WTI is holding on at $81

Cheers to the tax man (don’t need more of them)

spec

There is that humor again. And thank you. Envy.

As far as equities, this is to be expected. We all knew this was coming. Very predictable with Joeflation and Bidenomics in play.

The effects on equities will be similar to the effects on other aspects of our economy. And the best remedy is a change of leadership, which in another few months should be assured.

But oil investments typically do better than many other equities in times of inflation, and financial managers know this. The industry, as a whole, will proceed ahead without being impeded and drillers will not be seriously obstructed. After all, in tough times, one must go where there is money to be made. And all of us here know of one good place.

I am a believer in the sentiment that “Frontier exploration is suddenly being reemphasized which will benefit the offshore industry” as quoted in the workboat.com article.

I am on my mark and set, waiting only for the command to “GO”….

I will see you at the finish line.

Mrs. Smith

Sane politicians ….

The offset to some of this is the summer driving season is rapidly approaching, and gasoline inventories are below the 5 year average. Demand for gasoline will surely increase as will prices. Crude oil production must follow, or we will all spend the summer in gas lines trying to fill our vehicles. Sane politicians will wish to avoid this at all costs.

I think it probably needs to get ugly for the banking system. It has been mismanaged as much as anything else has. Maybe it is time to clean house. And the bottom line for the banks is, in order to stay solvent, they will need to continue to make money (loans). Perhaps the two perfect storms of banking reorganization and energy demand will merge together to the benefit of both. Obviously, trying to finance EVs will not save either.

Just another perspective.

It appears that the cat is finally out of the bag as pertains to renewables and profits. I am including excerpts from a really good article from the publication Workboat.com.

“Recently, the CEOs of two mega-majors – BP and Shell – have rediscovered the critical role of oil and are backing away from their headlong rush into renewable energy. Money talks and the poor returns from renewables are hurting financial performance. Moreover, the fantasy of a world powered exclusively by renewable energy is being exposed every day. Shell’s CEO Wael Sawan told the Wall Street Journal, “I fundamentally believe in the role of oil and gas for a long, long time to come.” Importantly, he said Shell will not use its oil and gas profits to support renewable investments.”

“Importantly, oil and gas exploration and development worldwide continue to receive the lion’s share of the global oil industry’s capital expenditures. Mergers would add assets to be exploited quickly, given the years of industry underinvestment and the pressing need for more oil supply to meet growing demand. Frontier exploration is suddenly being reemphasized which will benefit the offshore industry.”

Link to full article:

https://www.workboat.com/viewpoints/will-oil-industry-deals-upset-the-offshore-recovery

One thing in the very, very back of my mind is what are the chances of Gulfslope being an acquisition target somewhere down the road. I hope it does not happen. I am here to be a Gulfslope shareholder, not one for a bigger company like Shell, Exxon, or BP.

Mrs. Smith

A little tiny bid, a bigger ASK

They’d look better 1:1

Any way you dice it, the next move will require financing

And maybe it’s just me

But my FBI vocal stress analyzer (bullshit detector) just about throws a giggle fit when the talking heads start over emphasizing how “the banking system is just fine”

… just a few bad eggs

Nothing to worry about… move on

But…. The physics of the monetary disruption can’t be ignored

There is a price to be paid, it’s probably going to get ugly

GSPE will be (back) in a safe zone the minute they execute a contract to proceed towards production

Chart of the day, look at the wild ride for Henry Hub Natural Gas on a 5yr chart

Gas is quick and gas is easy (to find and produce)

Gas is probably going to stay on the cheaper end despite the ramping of LNG exports

spec

We should all get used to the idea. Any news at all and the GSPE stock could rise beyond one cent with no problem.

Assuming that Gulfslope’s plan comes to fruition, the first announcement will be some form of financial or partnership news.

Afterwards, the next order of business may conceivably be;

… purchasing producing properties,

… announcing a spud date for a well to be drilled,

… announcing a successful well,

… announcing a second drill well,

… and then another and another.

Supposing that this effect continues after each of these milestones, we will all be the better off because of it. This is the precise reason most of us bought this stock in the first place.

It is clearly evident you see the big picture. Thank you for pointing this out.

Regardless of our age, the inviolability of crude oil will remain throughout our lifetimes.

Mrs. Smith

Pretty funny how a $475 buy at .0057 pushed GSPE’s market cap up $2 million (up 42% from 5 million to 7+ million lol)

My naps in English class may be almost a century ago but I’m never too old….

Just what the doctor ordered …..

… for a good night’s sleep …

Data and tables,

… tables and tables of data …

Slept like a log ![]()

I haven’t slept that well since English class my senior year of high school

Seriously though, I thank you for putting these relevant publications at our fingertips

I see where the missing part of my apples to oranges disparity was

Natural gas liquids is the component of the pie that I had not figured correctly

And of course NGL isn’t LNG

In any case, I slept soundly with visions of the elusive GSPE barrel # 000001

That’s the one that I want to see the most

Cheers

spec

My naps in English class may be almost a century ago but I’m never too old to learn something new from smart people

Nothing would please me more than to be able to take credit for the numbers in that post. However, I lack the resources to be able to collect all the data necessary to compile the numbers, populate the tables, and draw the graphs.

So, I must confess that all the data, numbers, graphs, comparisons, and conclusions are the product of the Department of Energy via the EIA staff. Still the conclusions are valid as long there is confidence in the data.

I am attaching a more ‘detailed’ forecast on U.S. petroleum and other liquids supply, and consumption for 2023-24, which can be reviewed if there is a desire for more information regarding those numbers. This will provide the information you seek.

As a backup, I am also including the EIA’s forecast on ‘Total World’ production and consumption for 2023-24. This forecast reflects global production and consumption to rise as well.

Therefore, you should be able to relax and enjoy driving your truck for a long time to come.

One area of concern, the forecast does not show the SPR being refilled over the short-term (2023-24). In fact, it is still being drawn down. So we will not have that to rely on in a time of crisis. Hopefully your truck has dual tanks, lol.

U.S. Forecast Numbers:

https://www.eia.gov/outlooks/steo/tables/pdf/4atab.pdf

Global Forecast Numbers:

https://www.eia.gov/outlooks/steo/tables/pdf/3atab.pdf

Mrs. Smith

I just thought that with crude being refined into the various products, liquid fuels would be a big part of that pie

And I thought our import/export of both crude and refined products was roughly balanced

So I thought that liquid fuel consumption numbers would be something approaching the breakdown % of fuels we get from a barrel of crude

I don’t doubt your numbers, they just look different than what I pictured

It happens to the very best of us, it was just your turn.

|

Followers

|

91

|

Posters

|

|

|

Posts (Today)

|

0

|

Posts (Total)

|

8092

|

|

Created

|

06/11/14

|

Type

|

Free

|

| Moderators spec machine NorOilGuy1 | |||

| Volume: | 9,202 |

| Day Range: | 0.0001 - 0.0001 |

| Last Trade Time: | 12:11:11 PM EDT |

| Volume | |

| Day Range: | |

| Bid Price | |

| Ask Price | |

| Last Trade Time: |