Register for free to join our community of investors and share your ideas. You will also get access to streaming quotes, interactive charts, trades, portfolio, live options flow and more tools.

Thanks for the data and your comments

I need to look at it a little closer in a bit because something looks amiss in this part

* Forecast for U.S. crude oil production (million bpd) in 2023 and 2024 is 12.54 and 12.75, respectively. For the years 2021 and 2022 it was 11.25 and 11.88, respectively.

* Forecast for U.S. liquid fuels consumption (million BPD) in 2023 and 2024 is 20.36 and 20.69. For the year 2022 it was 20.28.

Yes, should Gulfslope acquire oil production it will be a good thing for the shareholders, the company, and the economy. The EIA stated the key driver for oil production is the “price of oil”. I guess we will see in 2023….

Primary excerpts from the EIA’s Short-term Energy Outlook released yesterday:

* Forecast for WTI ‘average’ spot price per barrel for the 3rd and 4th Quarter of 2023 is $81 and $80, respectively.

* Forecast for U.S. crude oil production (million bpd) in 2023 and 2024 is 12.54 and 12.75, respectively. For the years 2021 and 2022 it was 11.25 and 11.88, respectively.

* Forecast for U.S. liquid fuels consumption (million BPD) in 2023 and 2024 is 20.36 and 20.69. For the year 2022 it was 20.28.

* Forecast for U.S. dry natural gas production (billion CFD) in 2023 and 2024 is 100.87 and 101.58, respectively. For the year 2022 it was 98.11.

* Forecast for U.S. natural gas consumption (billion CFD) in 2023 and 2024 is 87.37 and 86.12, respectively. For the year 2022 it was 88.53.

* North America continues to lead non-OPEC liquid fuels production growth: In our forecast, U.S. liquid fuels production increases from 20.2 million b/d in 2022 to a record 21.6 million b/d in 2024, led by crude oil production increases from the Permian shale region in western Texas and eastern New Mexico.

Links:

https://www.eia.gov/outlooks/steo/report/BTL/2023/04-nonOPEC/article.php

https://www.eia.gov/outlooks/steo/tables/pdf/1tab.pdf

Excerpt from the EIA’s Annual Energy Outlook:

* High international demand leads to continued growth in U.S. production…. allows the United States to remain a net exporter of petroleum products and natural gas through 2050 in all AE 2023 cases.

In my estimation, if there is confidence in these EIA Reports, one can be assured that oil and gas production in the USA will remain robust and prosperous through 2050.

Mrs. Smith

WTI continues to inch higher, currently $83

Could WTI average more than $80/bbl for the remainder of 2023? Perhaps.

Could WTI average more than $80/bbl for the remainder of 2023? Perhaps.

Considering refinery capacity will continue to be limited for many years to come with supplies remaining tight for the foreseeable future, strong, stable, and secure demand should support prices in the mid-eighties.

A big focus for the intergrated oil majors continues to be growth in production, and strengthening of their shareholder base through acquisitions, increased dividends, and stock buybacks.

Even the smaller independents are getting in on the action. Thus once again, I point out that the Gulfslope focus on acquiring producing assets is the right call.

In the 1st Quarter of 2023, “Arena Energy, a leading independent oil and gas exploration company focused on the Gulf of Mexico Shelf, announced it has closed on the acquisition of Cox Operating, LLC's interest in two fields located in the shallow waters of the Gulf of Mexico.”

So the clouds are starting to break up over the GOM and the blue sky and sunshine is radiating through. Always a good omen for the aspirations of Gulfslope Energy.

Mrs. Smith

The bid drew some energy from somewhere ![]()

Might have been “gotta start nowhere”

GSPE at .005 with WTI inching up over $81 is pretty much starting from nowhere

There seems to be a market for everything for sale in this range

Cheers,

spec

GSPE thinking of U ![]()

A quickie ![]()

Those that held their long positions in the oil industry are still smiling. A big bounce back in price, a dividend, and a hedge against inflation. How is that inflation treating your dollars?

Interest in U.S. production is moving along and picking up the pace perhaps. Rumor has it Exxon may purchase Pioneer Natural Resources. “Texas-based Pioneer is claimed to be the leading oil producer in the Permian Basin and generated $8.4bn in cash surplus last year.” I see this as an indication that Exxon recognizes the future stability of WTI, or there would be no interest in a multi-billion dollar deal. This will transfer to the GOM as well.

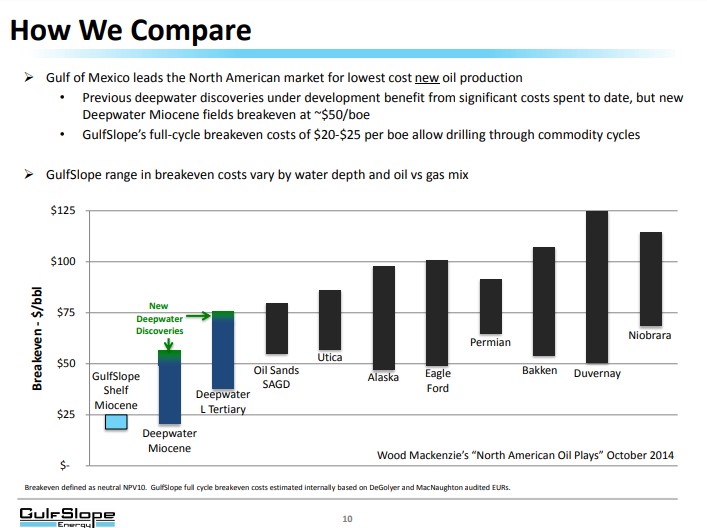

Reminder, profitability for shale drillers is around $60/bbl. This is largely due to the fracking costs. But, offshore shallow GOM is noticeably lower. So the Gulfslope focus on buying current GOM production appears to be a good call.

Bottom line, the EIA’s forecast through 2050 predicts: crude oil and natural gas will continue to play a major role in the energy mix, EVs will occupy a minor portion of the transportation market, and natural gas will still maintain it’s position as a critical source for electricity generation (which includes the 1,000% increase in the reliance on solar for electricity generation). So, the future of oil drillers is assured by the forecast of their biggest opponent.

The time interval of a trade for many on this board is preferred to be short. The shorter the better. And that is okay. It is just that ‘short’ will happen to be the size of profit on that trade too. And although many here know of my disdain for ‘penny ante’, it really should not bother me if it does not bother anyone else.

Link to Exxon article:

https://www.offshore-technology.com/news/exxon-pioneer-natural-resources-deal/

Mrs. Smith

Oil & Gas getting a little bit warmer, weak bid for GSPE though

Nobody throwing blocks at the bid fortunately

Spring has sprung and there’s some “green” in the energy sector as it rebounds off the bottom

I hope GSPE didn’t get planted too deep to sprout when the time comes

My hope is that dirt bids get filled, not tilled

Cheers

spec

Enjoy your Easter weekend starting now ![]()

That’s an order!

Also, a request for everyone to be a force of peace and unity in the world

That which unites the universe is mightier that that which divides us

Strength through freedom and prosperity

Prosperity through abundant, affordable energy

It’s not the answer for everything

But it’s a key part of every viable pathway to prosperity and lasting peace

Cheers

spec

At the time of Easter, an article such as this seems very appropriate. Yes, the oil and gas industry is poised for new life and a rebirth.

‘It’s Not Just Willow: Oil and Gas Projects Are Back in a Big Way’

Link to chart and article:

https://www.nytimes.com/2023/04/06/climate/oil-gas-drilling-investment-worldwide-willow.html

Mrs. Smith

Super quiet on the GSPE tape

The full moon is upon us again, her light and the attractive pull of gravity have guided society with regularity from the beginning of time

Spring Equinox marks a milepost in our seasonal cycle

Time to plant seeds from which we reap a bountiful harvest in due time

Wise men observed the cyclical nature of life

Wise women convinced them to plant some corn

Drill Tau2

spec

Another tick sideways for GSPE

WTI hanging on $80, Nat Gas just over $2

A down day and energy sector was hit even after OPEC came out with the clear signal to keep prices up

There’s just no stability on either supply or demand

I know for sure that in the long run, demand will be unstoppable, especially in developing economies

Food, clothing, shelter, all essential

All have big energy inputs

Just need GSPE to get swept into the mix of opportunities in the GOM

spec

Informative, but not as entertaining as Deadliest Catch

Clearly a dangerous operation

Experienced crew are getting harder to find, new workers outnumbered by retirees

Going to be another big up cycle for producers and there will be shortages of labor and steel to overcome

If crude heads north of $80 with some confidence, it’ll turn on a few more domestic exploration plays

That’s what I think will be happening

spec

While on the subject of drill pipe, I recall a trip to a manufacturing plant. I was miserable. It was hot, noisy, stuffy, stinky, sweaty, and the air had particulate floating around in it. I did not want to breathe any of that air, but sadly, had no choice. That facility really needed better ventilation.

Our tour was escorted to a machine involved in something called ‘inertia welding’. I had never heard of it, was not interested in it, and was ready to leave just as soon as possible. The tour guide explained that a ‘tool joint’, or the threaded part of a joint of drill pipe, was to be be welded to the body of the drill pipe. They were using the inertia welding process to increase productivity and lower costs of production.

So two separate pieces of pipe were butted up against each other and then one was spun at maybe 2,000 rpm’s (?). The machine applied friction pressure to the ends of the pipes during the rotation. After only a few seconds, the butt ends of both sections of pipe were glowing bright red hot from the friction and appeared to be welded together. I was amazed. And impressed. I will never forget it. Welding without a welder or a welding machine!

Then we were able to finally leave that place. And as miserable as it was, I am glad to have had that experience and witnessed that demonstration. I am still in awe of the engineering mind.

On a drilling rig, three joints of drill pipe are ‘made up’ (tightened) together into something called a ‘stand’. Each stand is 90-100’ in length. When drilling a well, a bit is placed on the bottom of the drill pipe and the hole is drilled. When almost all the drill pipe is in the drilled hole, another stand of drill pipe is ‘picked up’ and the connections are tightened to the one in the hole. And the drilling continues another 100’ deeper. Then repeat. This is the full extent of my knowledge on drill pipe.

It all sounds so simple. But I do not think it is. There seems to always be many complications. Like those we have experienced.

I often think back to that day, and rejoice that I have the option to not work at that place.

Here are a couple of links about the drilling process that I found to be informative for those of us with limited or no exposure to drilling.

Currently I am trying to learn more about the drilling mud. I found this aspect of drilling highly interesting. And very complicated.

In fact, the entire offshore drilling process is highly complicated and I have heard it mentioned, that next to space launches, it is the most challenging of engineering activities.

The OPEC 48th Meeting of the Joint Ministerial Monitoring Committee (JMMC) took place via videoconference on Monday, 03 April 2023.

The Committee reviewed the crude oil production data for the months of January and February 2023 and noted the overall conformity for participating OPEC and non-OPEC countries of the Declaration of Cooperation (DoC).

The Members of the JMMC reaffirmed their commitment to the DoC which extends to the end of 2023 as decided at the 33rd OPEC and non-OPEC Ministerial Meeting (ONOMM) on 5th of October 2022, and urged all participating countries to achieve full conformity and adhere to the compensation mechanism.

The Meeting noted the following voluntarily production adjustment announced on 2 April 2023 by Saudi Arabia (500 thousand b/d); Iraq (211 thousand b/d); United Arab Emirates (144 thousand b/d); Kuwait (128 thousand b/d); Kazakhstan (78 thousand b/d); Algeria (48 thousand b/d); Oman (40 thousand b/d); and Gabon (8 thousand b/d) starting May until the end of 2023. These will be in addition to the production adjustments decided at the 33rd OPEC and non-OPEC Ministerial Meeting. The above will be in addition to the announced voluntary adjustment by the Russian Federation of 500 thousand barrels per day until the end of 2023, which will be from the average production levels as assessed by the secondary sources for the month of February 2023.

Accordingly, this will bring the total additional voluntary production adjustments by the above-mentioned countries to 1.66 million b/d.

The Meeting noted that this is a precautionary measure aimed at supporting the stability of the oil market.

The Committee thanked the OPEC Secretariat for their contribution to the meeting.

The next meeting of the JMMC (49th) is scheduled for 4th of June 2023.

Mrs. Smith

WTI pops $80 like a rocket

I’m shocked, I tell ya!

OPEC says… not just NO ….

…” [bad word] NO!!! We’re not going to do anything except what we want to do”

… and then did it

They have the ball now and we can get it back

GSPE, just add financing and permits

spec

I have been reading articles to try and get a feel for the Global Drill Pipe Market. Let me sum it all up by saying that the experts, those people that get paid to know the right answers, estimate that the global market for drill pipe will increase by 70% between now and 2031. By the way, North America is the largest regional market for Drill Pipe.

They are way over my head, as I am no expert, but the bottom line is there appears to be plenty of interest in drilling. How does any of this affect Gulfslope Energy?

Just saying that with this much interest in exploration and drilling activities, it is only a matter of time before an investment desire meets up with an opportunity waiting. And when this happens the support will be there for Tau 2.

Keep it turning to the right.

Mrs. Smith

Aloha GSPE

My next adventure begins on a full moon ![]()

Wishing you and yours a gorgeous April!

Another low volume GSPE tape but at least there’s a little support in the .005 zone

WTI over $75 Nat Gas around $2.20

USA jumps the shark in political theatrics …

Is it true that even as the Roman Empire crumbled, the Senate debated for weeks on the question of what gender are angels?

America needs strong domestic fossil fuel production to be the leader of the free world

The world needs a strong USA

… with a strong leader

That’s a rising tide that will lift ALL ships

… and drive the rats back into the sewer

GLTY

spec

Just a small amount of selling wiped the bid clean

There is a little support at .005 but anyone’s guess on the depth of it

The lease auction bids were at levels that indicate optimism

Especially good to see that in the face of tightening credit since majors rely on leverage in all of the big field developments

The war on fossil fuels might just get bitten by the Big Dogs, Texas style venture capital that eagerly stares down the ESG/woke climate cult

as they should

Can’t fight physics and math with “feelings”

Districts represented by the fools that are trying to shut down domestic energy companies might find that trucking and rail companies suddenly “call in sick” and are unable to deliver some of their fuel and food supplies

That would be somewhat childish but would make a point

Considering the tactics currently in play, it’s pretty mild

Might get lost in the chaos though, plenty of catastrophes in any given week it seems

Probably going to be “sideways at best” for GulfSlope until news

There’s some really good people working to make things better

They have my support ![]()

And a hat tip to Smith199 for pointing out that Delek couldn’t bid. …. sheesh, I should’ve remembered that

It’s just that my genius-sized cranium is packed so full of knowledge (and charm) it’s inevitable that something will be overwritten

Cheers ![]()

spec

a very attractive prospect, and a raft of data/knowledge

Lease sale 259 had no bid from GulfSlope or Delek

It had been announced before my earlier post but I hadn’t seen it yet

Sooooo ….

Bummer that there wasn’t some activity tied to either company name

Still have one active lease, a very attractive prospect, and a raft of data/knowledge from the seismic and drilling so far

(Edit - I should also include the processed seismic and graded prospects that GSPE has on other lease blocks that might be active leases that are available in other farm-in possibilities)

No news …..

…is not good news in this case

But I am still in

… deflated a bit .. but holding

spec

Disclaimer duly noted. Cannot be too cautious.

There will be bids in this GOM lease sale, several from the big oil majors. But I am not expecting Gulfslope to make a show at this time.

Indications are the primary focus is on securing “funding for the purchase of production” and “drilling Tau 2”. Sounds like a full load for a small staff.

Oil prices are lower and more stable, which is a much better environment for successfully purchasing producing properties.

And those building fires and stoking the flames do need to be wary of the smoke, the heat, the cinders, and recognize there is always the danger of being caught in an inferno if the wind changes in direction and intensity.

But “professional arsonists” will certainly know that. No one’s head is buried that deep in the sand. I only hope they remember there is also a line in that sand. And that they know where it is.

Because even “great firefighters” may not be able get control of a wildfire. Sometimes those just need to burn themselves out.

So Joe, You have already suffered the fall,

Your legacy is now known to all.

Just please hurry and go,

We know all we need to know.

Someone Somewhere Still Needs You,

There is Nothing More to Do.

It Is Just Someone Somewhere Else,

Even if I say it Myself….

Mrs Smith

The bid opened weak and a few small whacks easily knocked it down to an even weaker level

What’s the possibility for a no-show, no-bids at the lease?

Might stir things up even more

All of the GOM operators could get their point across “we can’t invest in leases you won’t let us drill, you say you want us to invest but block every move we make and it’s causing value destruction for us, job losses for energy sector workers, and higher energy costs for everyone”

WTI and Nat Gas both wobbling sideways at $73 and $2 respectively

It’s anyone’s guess how this GOM lease sale goes …

The planets are aligned (except the 7th, the place where politicians come from)

spec

Link back to the livestream on HR-1 discussion (replay is available)

The whole 45 min or so is very worthwhile but if you want a quick summary the 37 min mark to the end is pretty informative

This bill and the debt ceiling showdown are going to be loud and hot

Bring it, I’m ready for full afterburners

Fossil fueled, as they should be

![]()

Flame on!

spec

PS - all references to arson, afterburners, and flames are simply words on a screen, don’t anyone do anything destructive ….

Sheesh, it’s a weird world that makes me feel like I should include that disclaimer

My favorite part of the discussion on H.R. 1 was when it was pointed out that the two most significant flaws of the Biden Administration Energy Policy are physics and math (Bruce Westerman, Chairman House Natural Resources Committee).

This aligns perfectly with my own conclusions. He must have also read the EIA report.

Mrs. Smith

I would not be so uneasy if I had any confidence in their ‘crisis management’ skills.

Points of view of members of the House of Representatives on USA energy….

Link to video. Starts about 4 minutes in.

I am a very happy GSPE shareholder today. It is because I have already acquired all the GSPE shares I need. I may considered adding more shares at some point, because nothing ventured….

Taking progressives at their word, and accepting that they ‘might’ be accurate in their assessment of about 20% of vehicles sold in 2050 will be EVs.

Think about it some. So if EVs are so great, what is restricting the demand for them 27 years from now? I think progressives protest too much about the demise of gasoline and diesel powered vehicles. I am not in the market for an EV. And it appears I am not the only one.

Then you have the ‘leadership’ of GM proudly proclaiming that, by 2035, GM will only make and sell electric vehicles. If only 1 out of 5 vehicles sold in 2050 is electric, then I suppose GM management expects there will be no competition in that slice of the market in 2035.

Because if there is, how does GM propose to stay viable and avoid bankruptcy selling maybe 20% of EVs in a marketplace where only 20% (or fewer) of vehicles sold are electric?

Perhaps they can get another government bailout. Wait! I want to see the terms of that government bailout in 2008. Will Government Motors be given tax exemptions? Or allowed to dump union jobs, pay, and benefits? Did the Feds get any GM stock for the $50 billion in the bailout? Just asking, not saying. Something is missing from these calculations.

Regardless, today I will make the prediction that, by 2035, FEW of the current management at GM will still be employed there. Or else the company will be almost insolvent after undergoing layoffs and restructure.

Sell GM stock now and buy GSPE shares today. By 2035 you will be glad you did.

Mrs. Smith

Joe’s Information on Energy for the USA has stayed on my mind after spending all those hours trying to ascertain exactly what was being proposed in the latest EIA report.

I was particularly surprised by the report’s emphasis and reliance on those ‘anticipated future developments’, none of which currently exist.

I was shocked that our government, a major part of our government, the leadership of our government, is willing to go forward and bet the futures of All the Citizens in this Country on the “hope” that the “change” all works out.

The report did not address the risks of failure, what the failure would look like, the consequences of failure, or how to mitigate the failure. A wishful thinking case of out of sight, out of mind?

Typical of the unaccountable in the bubble, especially since they appear to not be concerned about any consequences, as they expect to be insulated from the turmoil of the aftermath.

What happens if the giant batteries that do not currently exist for storing the excess solar electricity generated are never perfected? Or they turn out to be Unaffordable? Unreliable? Unsafe? All of the above? I think I require more objective reassurances that we are on the best path.

Is there a Plan B? I would like to know the economics of it all and study the risk matrix. How about you? Interested?

Want a hint? Look at what is happening now in the energy failure of South Africa. There was a time this country was in parity with other prospering countries.

Then their leaders chose renewables for electricity rather than to update the aging coal fired generating plants. This appears to be a common denominator in the failures of many countries.

The USA should probably take a hard look at this since they want to follow that same model.

The voters too.

Looking at it as objectively as possible, I suspect the judgment of those in the ‘Joe’ administration is clouded to a great degree by their desire to quickly implement as much of their progressive agenda as possible. This should not be the top priority of governing…. Perhaps a good thing for progressives, but not a good thing for the country.

I would not be so uneasy if I had any confidence in their ‘crisis management’ skills. But there is no reason to believe the expertise for any of that is available to them.

Indeed, I suspect that when things heat up, the plan is for them to just resign, and head home.

That could be the best outcome for everyone.

Mrs. Smith

https://hotair.com/jazz-shaw/2023/03/25/the-african-power-grid-collapse-is-spreading-n539215

FYI only…. From the website IssuesInsights.com:

https://issuesinsights.com/2023/03/28/evs-are-the-yugo-of-the-21st-century/

‘EVs Are The Yugo Of The 21st Century’

Way back in the mid-1980s, communist Yugoslavia exported the Yugo, a compact car that sold for around $4,000. It was so poorly made that bumping into a pole at 5 mph could total it.

Fast forward to today, and a new class of cars has a similar problem. A minor accident can cause a total loss, even if the car’s been driven only a few miles. The only difference is that these cars aren’t cheap imports from some godforsaken socialist state. These are state-of-art electric vehicles that come with an average sticker price of $55,000.

Why are insurance companies totaling low-mileage EVs that have been in a fender bender?

For the same reason you could total a new Yugo when backing out of a parking spot. The cost of repair is exorbitant.

As Reuters reported recently, “For many electric vehicles, there is no way to repair or assess even slightly damaged battery packs after accidents,” which means the only viable option is to replace the battery, which represents about half the cost of the car.

A replacement battery for a $44,000 Tesla Model 3 can cost up to $20,000.

One expert told Reuters that Tesla’s Model Y has “zero repairability” because its battery is built into the structure of the car.

As a result, drivers are finding that even a minor accident ends up with their shiny new EVs being hauled away to the junkyard.

Reuters’ search of EV salvage sales in the U.S. and Europe found a large number of low-mileage EVs made by Tesla, Nissan, Hyundai, and others being scrapped.

“At Synetiq, the UK’s largest salvage company, head of operations Michael Hill said over the last 12 months the number of EVs in the isolation bay – where they must be checked to avoid fire risk – at the firm’s Doncaster yard has soared, from perhaps a dozen every three days to up to 20 per day,” Reuters reports.

Insuring an electric car is already 27% more expensive, on average, than a gasoline-powered one. If insurers keep totaling new EVs with minor damage, those rates will only go up.

This won’t be a problem just for EV owners. You can bet that the environmentalists pushing electric cars will soon start complaining that insurance companies are “discriminating” against EVs and demanding that they spread those costs around more widely – forcing owners of conventional cars to subsidize EVs.

EV advocates say not to worry. Car makers, they say, are designing batteries to be more modular and replaceable. They promise that repair costs will eventually come down, and all will be well.

Maybe so, but that’s why force-feeding this technology is so reckless.

In a normal market, carmakers would work out such kinks before mass producing a vehicle, much less converting their entire fleets over to a new and relatively untested technology. If they couldn’t resolve problems of affordability, reliability, and repairability to consumers’ satisfaction, automakers would scrap the effort and move onto something else.

But our elites think they know better. And they want new cars to be 100% electric within a decade. So, carmakers feel like they have little choice but to plow ahead.

Which brings up another way that today’s EVs are like the Yugos of yesteryear.

One auto critic said of the Yugo that it “had the distinct feeling of something assembled at gunpoint.”

That was probably literally true in the case of the Yugo. But it is essentially the situation with EVs today. Consumers aren’t banging on dealership doors demanding EVs. Ford reported last week that its e-car division is losing billions of dollars a year.

Car companies are pouring money into electric cars only because the government is holding a gun to their heads, saying build EVs or die.

Mrs. Smith

Thank you for the link to the livestream

I might have to check it out for a bit because HR-1 is going to a very hot topic on energy issues

Thanks for the EIA cliff notes too, just like school daze, the notes are good enough for me ![]()

GSPE is little changed as WTI rebounds into the low $70’s (currently $72)

Maybe we can get through a few days without a bank failure

Other than that, Ms Lincoln is probably having a great day

![]()

spec

Put this in your calendar. Should be interesting and informative….

H.R.1 Energy Roundtable Discussion

STREAMING LIVE

Tuesday, March 28, 2023

11:15 Am ET

Link to Live Stream:

https://americafirstpolicy.com/latest/h.r.1-energy-roundtable-discussion

Mrs. Smith

I ran across something very interesting. It is called The Environmental Quality Index. Attached link for you. It is worth the read, even if you will not need to debate John Kerry. For the record, I totally agree with the conclusion that it is much better for the environment for oil and gas to be produced in countries with high standards (USA).

https://www.instituteforenergyresearch.org/wp-content/uploads/2023/02/IER-EQI-2023.pdf

This 2nd link is for those that like to keep a close eye on the travails of John Kerry and how he seeks to undermine you.

https://www.foxnews.com/politics/climate-czar-john-kerry-says-biden-impose-more-mandates-go-farther-inflation-reduction-act

Mrs. Smith

I do find it curious that some people professing to be all about the human condition, as one of the highest priorities, have no difficulty turning a blind eye if it supports their pursuit of power. Nothing tells a more true story than actions. Yes, the ‘words’ are to seek favor from certain groups. But the actions show the priority is putting the political ideology in power and keeping it there. Nothing is more important to them.

I think EVs are appropriate for use in high density urban environments. But they may not work as well for mainstream transportation. And I think the cost of ownership is a deal killer. You pay a premium price to purchase, then 7 years later, you junk it when the battery needs replacing. An expensive disposable car!

I have a great many concerns about solar power too. Near the top is just how cheap is solar? No, I am not talking about a solar panel made in China.

I refer to a solar energy electrical generation system providing ‘primary power’ to the population of the USA. What does that cost? Mind boggling I am certain. That much money may not exist. Printing more inflation for Joe debt?

We already know it is an intermittent power source, but exactly how inefficient and expensive will solar energy actually be? And since we will need solar energy 24/7/365 what are the challenges? Will it be reliable? Affordable? Safe? Is it really where we want to invest the wealth and well-being of all? Solar supporters, I promise an open mind, so convince me if you can.

Otherwise, I detect electricity rationing in our evenings in the future after the sun sets. How will the batteries in millions of EVs get charged? Looks as if we will not only need home battery chargers for the EVs, we will need home generators for the electricity as well. Who knew? Oh, yes. The benefits of cheap solar energy.

To the progressives, that money is only tax dollars. And those trillions can be replaced with more tax increases, right? Plan A I am sure.

Except you cannot tax earnings that do not exist after the economic collapse of the country. And billionaires will only relocate to another place where electricity is from nuclear power or coal. What irony. Want to see what happens to an economy without electricity? Check out what is happening in South Africa right now.

Sadly, there is little in this report that makes anything better for anyone in this country, except progressive politicians and their acolytes. Anything else besides natural gas, nuclear, or coal as primary sources are, at this time, suspect.

Wind and solar are fine as supplements to these, but I cringe when I hear of plans to make them primary. They have yet to prove we can trust in them and there is much at risk on a gamble.

We had better drill Tau 2. And every other prospect that can be identified. That is the best way to keep energy plentiful, prices affordable, and the power on.

Mrs. Smith

In addition to major environmental waste issues with old / defective batteries I am hearing that many EVs who have even slight damage to their batteries are getting totaled out by Insurance companies instead of repairing them.

Additionally I have seen horrific atrocities being committed to low paid workers in the Congo mining cobalt where women and children are working in deplorable conditions along with dangerous risks of mines collapsing.

It’s unbelievable how the narrative of “climate change” ignores horrific human rights violations as well as ignores a much much worse environmental problem they are all creating.

The new EIA Annual Energy Outlook was released March 16th (It took me this long to read it all).

And you can be confident this is the correct report, because it has been verified and double checked.

I struggle to find any value in this report. Reading the details reveals that this may only be a sales pitch for climate change from Joe’s perspective.

For example, even with the financial support of the huge Inflation Reduction Act (IRA), the 2050 market share of light-duty EVs as a percentage of sales, projects the increases to be around 6% (low oil price) and 22% (high oil price). This seems to indicate that those EVs may not be catching on as well as the progressive politicians had hoped, depending on the fuel price. So, is all the money being spent in support of them justified?

Typical of efforts to obscure inconvenient facts, some of this is not found in the text. It is in the charts. Pitiful Progressive Pie-in-the-sky Politics?

If one attended a meeting to secure funding for a project and offered predictions with ranges similar to those proposed in this report, that individual might encounter resistance. Then after also recommending to incur an outrageously large loan for funding the project, the individual might expect to be excused. But, then again, this is Joe’s real-world government, so maybe things are different for them.

The report indicates generating capacity for electricity will more than double by 2050. So to mostly rely on a 1000% increase in solar generating capacity between now and 2050, as is indicated in the graph, is simply concerning and implies that this will not be a good thing for any of us. If solar fails to deliver, we will not have enough power in some areas and we will consistently have rolling blackouts in some places. Perhaps in many places.

Solar energy will be challenging, inefficient, expensive, and intermittent. Not a winning combination in my estimation. This is mostly just a flawed and immature plan based on a political ideology rather than real-world mechanics, physics, knowledge, infrastructure, and economics.

Many of the assumptions regarding future energy outlooks are viewed through the prism of progressive hope and anticipated future developments, none of which are assured.

So what happens if they implement their grand plan and it all crumbles and fails? I cannot say. This was not addressed.

The Secretary of Energy and the EIA Staff obviously put forth a lot of effort to ‘sugar-coat’ the message.

To me this report just says ’This is what we hope happens. We could also possibly be wrong. But we are still willing to spend an enormous amount of money anyway’ (since it is really all about climate change, renewables, and not energy, then no problem). Another presentation for the naive and unaware.

Despite the hopes and desires of progressives, these projections do predict that oil and gas will still remain very relevant through 2050, with even minor increases in tolerance. In fact, this report states that, “The United States remains a net exporter of petroleum products and of natural gas through 2050…. ”.

I find myself in the position of looking forward to OPEC’s 2023 World Oil Outlook, because I expect it to be more informative.

In conclusion, I do not know where to begin. It is difficult to remain objective when dealing with the products of politicians. Especially progressive ones. Is glorifying a minor advancement in an industrial sector, which only represents 1% of U.S. energy usage, an example of misdirection?

So remember, this is their agenda, their charts, their assumptions, and their perspective. There is a persuasive argument to be made against every point being claimed. Relax. I am not going to address it here.

My final comment is ‘Drill Tau 2’. We are going to need it.

https://www.eia.gov/outlooks/aeo/

Mrs. Smith

Thanks!

Seeing GSPE everywhere ![]()

Whoops! It must have been the blonde hair. But probably it was due to burning the candle at both ends, trying to post between business calls. I should know better. My apologies for posting an older report. Thank you for the head’s up spec. The actual report is due out March 29. And I will try again.

Mrs. Smith

Whether investing or trading, “Face Value” is often not a reliable strategy. This is likely why several of us comment on the GSPE board.

We offer our best opinions regarding how the things happening can affect the GSPE share price. And although there are moments of light-hearted humor, we do not often participate in the ‘drive by drivel’.

Instead, we spend much time on research attempting to stay informed. And we put effort towards communicating our findings and thoughts in a timely manner. Most days there is at least one post submitted for the scrutiny and comments of other readers.

This is done so readers stay abreast of new developments, and can perhaps better judge what best suits their own needs in these developing circumstances.

And this process helps all of us to have a better awareness of our perceptions, more confidence in our expectations, and trust in our own insights.

All points of view help, and without the involvement and contributions of the readers, this board and our comments would suffer. I believe the more perspectives considered, the better the message becomes.

Sometimes we are right. Sometimes we are not. But this is not the point. The point is that we have the discussion and exchange of ideas. Informed readers can then make up their own minds to discern what a post is, and what it is not.

Your participation makes a difference and adds value. Thank you all for joining in, whether through reading or posting. Please keep it up….

Mrs. Smith

Buckle up and hang on

It’s fear being sold in buckets, piling on the headlines for banks failing

There’s three types of people (in general)

Makers (you and me, the ones who contribute to society in some valuable way)

Takers (everyone else except the breakers, I put politicians in this group)

Breakers (those who destroy things)

Used to be that the breakers were the military

GulfSlope hanging on ![]()

Drill Tau2, it’s the best place for investment to produce high value for decades

spec

WTI tanking to $68

US airstrike in Syria

I dislike that it appears as if I approve but, considering the lack of news for GSPE stock, I do understand the low trading volumes.

Also, the seeming strength in the share price indicates that remaining shareholders may be growing immune to the various invitations to sell their shares at a discount.

Images in the crystal ball are again both fuzzy and intermittent, but indeed, a majority of the shareholders appear quite willing to wait it out.

To me, the overall impression is that, until the value of the stock rises to the point that sales do not result in discouraging losses, many shareholders might choose to move forward with GSPE stock and hopes of getting a drilling or production deal together. My perspective exactly.

To them this is a more desirable outcome than making a trade for a meaningless pittance and accepting the loss of principal.

How high will the share price need to rise to turn this around? I cannot in good conscience make a prediction. There is just no way to know with any credible level of certainty.

In my own estimation, based on the value of the proprietary software, the GOM lease, etc., I will say the current share price is still undervalued with room to roam.

I have no clues as to where many shareholders are willing to start trading. Some, such as myself, may even intend to hold out for prices much higher than this. I am trying to come to grips with the presumption that what we are experiencing now may become the new normal until then.

Partner news will easily get GSPE shares over the ‘increased prices’ threshold. Traders really should rally behind this outcome.

Which, as far as I can tell, returns us to the idea of ‘patience and perseverance’. And thoughts of the barrels of black gold at the end.

It has also occurred to me that, with the majority of remaining shareholders on the sidelines, current trades could be trader vs trader….

I find this interesting and look forward to witnessing how that interaction works out. My best guess is these groups are tougher targets than an uninformed investor. So, probably not helping out on either volumes or prices.

No one ever said it would be easy. Or quick.

Mrs. Smith

Another beautiful playlist and a perfect vibe as we wait for actionable, tangible information from GulfSlope

Thank you WG ![]()

The sky full of stars on a crisp clear night

We ponder with humility how small we are

Billions of beautiful points of light

Bound by invisible, inescapable forces

Into one grand and complex design

Our ticket to ride is the greatest gift ever

We are all ships in the harbor

Doing the best we can

![]()

spec

PS - Do the swamp creatures always act like they’re from the 7th planet?

After completely examining my motives for being a GSPE shareholder, I must admit that I have come to the realization that I am, in fact, a trader.

A support trader. Not one that follows the chart trends, but one that takes a longer term outlook on an investment. This is actually a vital and necessary requirement to being a successful shareholder of a drilling oriented company such as Gulfslope Energy.

The drilling process is often a long and convoluted path. This is true for even the largest of the integrated oil companies. They have many more drilling prospects than they have rigs under contract. Their drilling budgets are well defined and enforced.

So all their prospects are reviewed and prioritized. It is not uncommon for a prospect to take two or three years, or even longer, from concept to having a rig on location.

And this is with organizations having a budget readily available, with rigs on contract, and staffs with the mandate to execute the approved drilling plans.

I have to keep reminding myself of this whenever I start getting impatient. It occurred to me that maybe others could also use a reminder regarding the complicated activities Gulfslope is engaged in. I know this is not news for many of you, but for others, this could be the first drilling experience.

So my message to them is, do not despair. While things appear to be moving forward slowly for Gulfslope, this may not be unexpected for a start up driller, having to raise funds of a significant amount, in a financial market roiled by government interventions and ‘Joe’ economics.

The thing to keep focused on is that oil and gas production is a requirement for our society and for all those in the rest of the world as well. The economic and political outlooks and beliefs do not matter.

Unless they live in such an undeveloped state that they can heat their hut with a wood fire and walk everywhere they need to go, their existence requires fuel for transportation, fuel for manufacturing, fuel for electricity, fuel for food, fuel for heat, and so on.

So, regardless of the political will of some, the demand will not diminish any time soon. It is but a matter of time before our turn comes.

Fuel for thought.

Mrs. Smith

spec wanna run your ideas by me one more time ![]()

Exactly, LOL

Another low volume day, about $3K on the tape

Plenty of flight-to-safety in broader markets

Fed 25 BP hike in line with expectations of a lighter hit than the 50 BP expected a week

Fear is the trade

GSPE still had a firm bid all day even following a block sold

Several MMs on the bid too ![]()

Continued accumulation is my interpretation

I’m ready for the tide to return to the broader markets before I dip in again but holding my GSPE

Cheers

Decentralize power

Grow a big garden this year

Drill Tau2

spec

Other than that, how was the play Mrs. Lincoln?

A little bump up in the bid, a few at .0076

A few jumped over a bid at .007 earlier (to .0075) and no sellers have whacked it

WTI heads up a tad $68, nat gas falls back to the bottom $2.20

Crude is where the analysts said it should be in a stable, well supplied market

Other than a major war, teetering on banks collapsing, some saber-rattling NK launches, and rumors of an indictment regarding a prominent president candidate ….

Yeah, other than that, everything is cool

spec

Spring is here! ![]()

So much market turmoil and anxiety

Bank bailouts and potential charges against former president and leading GOP nominee

WTI still bumping along around $66

Buy antacids manufacturers

Drill Tau2

![]()

spec

GSPE guess who’s not wearing any green? I really adore leprechauns ![]()

A teeny part of my weekend playlist

|

Followers

|

91

|

Posters

|

|

|

Posts (Today)

|

0

|

Posts (Total)

|

8052

|

|

Created

|

06/11/14

|

Type

|

Free

|

| Moderators spec machine smith199 | |||

| Volume | |

| Day Range: | |

| Bid Price | |

| Ask Price | |

| Last Trade Time: |