Register for free to join our community of investors and share your ideas. You will also get access to streaming quotes, interactive charts, trades, portfolio, live options flow and more tools.

20 days with no trades. Whens the last time any of you guys bought?

GTG guys here's the link

Muzak to my beerzzzz

Haven't had time to read the darn thing but there you go such is life off to the salt mines. Seems like things are finally starting to perk been a long hot summer but for the better I think. We didn't have the draw in the doldrums to carry any trivial news IMHO. Things are definitely showing signs of life finally see you soon

http://www.cnq.ca/Storage/1065/94288_CNQ_Monthly_Review_-_August_2006.pdf

GLTA longs

Best...Rich

Little birdy chirping in my ear

Saying we are about to be featured in CNQ for their entire market to see. Sounds like good exposure we could all use but I can't find anything yet.

If you find it please post?

Thanks...Rich

If you missed the PDF

Glenbriar Lists on Frankfurt Stock Exchange WATERLOO, ON, August 8, 2006 — Glenbriar Technologies Inc. (CNQ:GBRT) today announced that its shares have been listed for trading on the Frankfurt Stock Exchange WKN: A0J3HK; ticker symbol: G1Q. Glenbriar retained the services of Baltic Investment Group of Hamburg, Germany to provide assistance with the application and listing. “Glenbriar’s listing on the Frankfurt Stock Exchange will significantly increase Glenbriar’s profile to European investors, and enable Glenbriar to broaden its shareholder base with increased liquidity," says Robert Matheson, CEO.

About Baltic Investment Group Baltic Investment Group is a leading European consulting company which specializes in identifying and covering undervalued small and microcap companies listed in North America for the benefit of European investors. Baltic specializes in attractive and promising investment opportunities which meet the conservative investment strategies favoured by German investors and tax law. Baltic has a strong institutional following in both the US and Europe.

About Glenbriar Glenbriar Technologies Inc. (CNQ:GBRT; Frankfurt:G1Q) provides leading-edge business-driven technology. Glenbriar’s Peartree Software Inc. division develops Web-based software solutions for specific market verticals. Glenbriar adds post-carrier business VoIP, call centres and support services to deliver complete technology management solutions. Glenbriar has locations in Alberta, British Columbia and Ontario. See www.glenbriar.com for more details.

Forward-looking statements This document contains forward-looking statements relating to Glenbriar's financial performance, operations, or the environment in which it operates, which are based on Glenbriar's operations, estimates, forecasts, and projections. These statements are not guarantees of future performance and involve risks and uncertainties that are difficult to predict, or are beyond the company's control. A number of important factors could cause actual outcomes and results to differ materially from those expressed in these forward-looking statements. These factors include those set forth in the Glenbriar’s corporate filings (posted at www.sedar.com). Consequently, readers should not rely on such forward-looking statements. In addition, these forward-looking statements relate to the date on which they are made. Although the forward-looking statements contained herein are based upon what management believes to be reasonable assumptions, Glenbriar cannot be certain that actual results will be consistent with these forward-looking statements, and Glenbriar disclaims any intention or obligation to update or revise any forward-looking statements, whether as a result of new information, future events, or otherwise. The CNQ has not reviewed and does not accept responsibility for the adequacy and accuracy of this information.

For further information call: Robert D. Matheson Christoph Haase Glenbriar Technologies Inc. Baltic Investment Group +1 (403) 233-7300 x117 +49 (172) 413 0932

Finally getting moved in here

Hopefully more time to post been very busy. Keratas great post I agree whole heartedly management buy with one reason only same reason we are here LOL!

One other point which may go without saying for some, but were we not looking for German financing a while back with all kinds of fanfare... So why all of a sudden a FRANKFURT exchange , is this sounding routine to you for a fledgling Canadian company?

I'm thinking there must be a connection here. In other words this must be about to bust wide open with our fabled financing finally.

FLIP an egg keratas sure FUN huh? ![]()

Thanks bud been so busy I might have missed this.

Cheers...Rich

GLENBRIAR LISTS ON FRANKFURT STOCK EXCHANGE

Glenbriar Technologies Inc.'s shares have been listed for trading on the Frankfurt Stock Exchange, WKN: A0J3HK, ticker symbol: G1Q. Glenbriar retained the services of Baltic Investment Group of Hamburg, Germany, to provide assistance with the application and listing.

"Glenbriar's listing on the Frankfurt Stock Exchange will significantly increase Glenbriar's profile to European investors, and enable Glenbriar to broaden its shareholder base with increased liquidity," says Robert Matheson, chief executive officer.

We seek Safe Harbor.

====================================================================

We should be getting more exposure now by listing on the FSE, and should reflect the stock price positively in the near future...

Another positive that I've noted is that since the beginning of this year the 2 biggest individual buyers of GBRT shares have been the CEO and CFO of the company..... That, for me, is a great sign.......... There's many reasons why insiders might SELL shares, but only one reason why they BUY shares.......

Ego eimai keratas

betman be glad they're not IMHO

If GBRT was pumping this with fluff PR's this time of year quite honestly I'd be a lot more worried. It's a bad time for anything but earth shattering announcements and even then no guarantees. Better to await return of the market volume come the fall in my experience.

We are smack dab center in the slowest period of the trading season don't let these gremlins get to you okay? Hang in there ![]()

Cheers...Rich

Way to go I.R. One whole week and no trades. Is this what 5000.00 Per month brings us ?

Here come the BIG boys

http://www.cio.com/blog_view.html?CID=23086

Seem to remember we got Microsoft Certified. Can't be sure if this is good news or bad...

Best...Rich

I hope this is not too personal...

Have you ever been vished before?

http://news.bbc.co.uk/2/hi/technology/5187518.stm

16 khz?? perty darn fine

Don't yah thangggk? http://slashdot.org/articles/06/07/17/154230.shtml

Today we had several sucessful calls using the Speex wideband 16khz audio codec. We tested a party to party call, a conference call with combinations of 8k and 16k callers and a call to the mod_rss Text-To-Speech news reader. This gives us validation that using flexible formulas rather than hard coding 8khz values was a good idea!

http://www.freeswitch.org/

Change of T/A (from PDF)

"Glenbriar Announces Change of Transfer Agent

CALGARY, AB, June 27, 2006 — Glenbriar Technologies Inc. (CNQ:GBRT) has appointed Valiant

Trust Company as its registrar and transfer agent. Effective July 1, 2006, Valiant Trust Company will

replace CIBC Mellon Trust Company as registrar and transfer agent for Glenbriar’s common shares.

From that date forward, all inquiries and correspondence relating to shareholder records, transfer of

shares, lost certificates, or change of address should be directed to Valiant Trust Company as follows:

Valiant Trust Company

310, 606 – 4 St SW

Calgary, Alberta

Canada T2P 1T1

Phone +1 (403) 233-2801

Toll Free +1 (866) 313-1872

Fax +1 (403) 233-2857

E-mail inquiries@valianttrust.com

Web www.valianttrust.com

About Valiant Trust

Valiant Trust Company is a non-deposit taking specialty trust company providing corporate trust,

stock transfer and employee plan services to public and private corporations. Valiant Trust has

offices in Alberta and British Columbia, and is a subsidiary of Canadian Western Bank."

Well I'll BE!

Hello ragtrade your still hanging in also huh? Thought you had flown the coop LOL!

Thanks for the kind words been busier than a cut cat! Hopefully I'll be getting some spare time once I get relocated so far all coming together rather nicely. Good things take time, take care rags good to see you ![]()

RichieBoy, great to see you back!

Cheers

Frank

Slowly getting back to half normal...

"Proceeds will be used to fund corporate awareness media and investor relations."

You don't need to do that unless you need to get a message out.

Apologize for the long absence been very difficult getting things on an even keel but looking personally like it was all for the better.Hopefully will be able to afford more time on thread now and with any luck planning to upgrade this site mostly refreshing corporate info business strategy etc. Very busy right now trying to purchase a new place between work and househunting I already need a vacation LOL!

Anyway thanks betman interesting point you make about the Germans and bang on they are buy and hold type investors for sure. Bodes well ![]()

Best...Rich

Baltic Investment Group gets a pp at .105 for 290,000 shares. They will be interesting German investors in our stock. We may see the stock price rise as Germans tend to hold their stock for three years.

thanks for this keratas

very intriguing, have not been able to post since March with any luck that's about to change...

Insiders, including the CEO and CFO

have been buying shares on the open market for at least the last 2 months at prices ranging from 6 cents to 10.5 cents........ Apprx. 150,000 shares have been bought up so far........

It's always a good sign, no, VERY GOOD sign, when the 2 "top guns' of the company are buying shares on the open market........ My biggest complaint last year when GBRT was trading as low as 4 cents was exactly this;;;;; Why weren't the big boyz buying up cheap shares?

So I guess now they're a lot more confident in themselves and their company, investing their personal dough, and putting their money where their mouth is............. As a shareholder that sure raises my confidence level up one notch............

Keep on buying, Brian Tijman, and Robert Matheson!!!!!! Things can only get better..............

Ego eimai keratas

We haven't traded in 15 days. Nice job IR.

Ciao for now

Richie going offline for a while well a fair while actually I'm back to work and then a move, so no telling how long frankly. Best of luck with all your portfolio catch you on the flip side...Rich

CNQ NOT supported Online

You have to phone it in and it's only 43 dohahhahollars. Hold it I'm getting a little choked up here...

I'll be okay really

Maybe you can just give me a minute or two...

OT: RBC Action Direct

I think I'll stay with Action Direct they have a frequent trader promotion now $9.95 per trade and free real time quotes. Pretty decent layout in the platform also once you use it a while, like all others it becomes second nature.

I am on hold to find out if they trade CNQ stocks not sure yet. They do offer free real time for NYSE AMEX OTC & OTCBB plus TSE & Montreal will update about CNQ but I have to say a pretty good deal from a Canadian broker for a nice change. The rest are so restrictive and fussy MY GOD it pains me to think how many trade opportunities I lost with AmeriTrade Canada at least now that is being dovetailed into GreenLine. High time they did something pretty much useless other wise. BMO InvestorLine will not touch pinks unless you call them in.

Later ...Rich

Depends Jim

Ebay owns Skype now they also own PayPal which is very security intensive encryption encryption which is what they would need to go on a business trunk line with Skype.

Wireless for business is nothing new either and as is only gets more common business naturally will want that too.

http://www.dlmag.com/954/connect-any-phone-to-skype-including.html

http://www.sci-tech-today.com/news/Skype-Takes-Internet-Calls-to-the-Street/story.xhtml?story_id=031...

will this help gbrt? if they are on top of it they should be intergrating sykes into their voip system for small bisness

jim

Any techies out there?

My new cell phone plan includes always on data so I was wondering how I could hack Skype for use on my cell phone?

Yah I know off topic somewhat and perhaps a nutbar suggestion but hey you never know there might be a way you can patch in to Skype with a standard cell phone especially if it has a 24/7 flat fee data access? Can't see why not and if I could hack in somehow I'd be looking at always on long distance instead of the ridiculous fees the big boys still ding you. After all the cell phone is just a mini-computer seems like a natural, I already can IM and email on the cell phone, so voice shouldn't be so hard to attain....RIGHT?

Well that's the idea at least if anyone has any suggestions I'll be very interested , thank you... Rich

Bell South gets swallowed up

For a paltry 67 BILLION goodness I hope Rob is not that greedy when he gets taken out I might blush...

http://xtramsn.co.nz/businessandmoney/0,,13273-5489415-300,00.html

Scarcely a ripple

Recent Trades - Last 1

Time Ex Price Change Volume Buyer Seller Markers

13:15:46 C 0.10 +0.015 8,000 36 Latimer 33 Canaccord

2006 1ST QUARTER RESULTS & UPDATE

Well this one got by me...somehow

Dated Feb 15th like NINE DAYS AGO???

Anywho boyz dah numbahs.

Glenbriar earns $86,721 in Q1

2006-02-15 19:18 ET - News Release

Mr. Robert Matheson reports

GLENBRIAR RELEASES 2006 1ST QUARTER RESULTS & UPDATE

Glenbriar Technologies Inc. has released its unaudited financial results for the three months ended Dec. 31, 2005.

Revenue for the prior year quarter included a gain on sale of gas properties of $101,070 and net gas revenue of $21,038. When this is factored out, information technology revenue for the first quarter rose from $1,123,673 in fiscal 2005 to $1,221,449 in fiscal 2006. Cost of goods sold increased in line with sales volumes, while margins improved due to a higher mix of IP telephony and new software sales.

Continued focus on enterprise management software and Internet telephony solutions signalled an increase in equipment and software sales over the period, as consulting revenue from automotive parts manufacturing customers declined in conjunction with reduced demand in the North American auto parts industry, which has traditionally made up a significant portion of Peartree's services revenue.

In January, 2006, Glenbriar attained gold certified status in the Microsoft partner program with dual competencies in Microsoft advanced infrastructure solutions and networking infrastructure solutions, recognizing Glenbriar's expertise and impact in the technology marketplace.

In the second quarter, Glenbriar announced a joint venture marketing agreement with an Internet service provider (ISP) to deliver Glenbriar's business IP telephony solutions to that ISP's growing base of fixed and wireless broadband customers located in small and rural communities throughout Southern Alberta. Glenbriar and the ISP will work jointly to deliver best-of-breed voice over IP solutions to businesses and public authorities served by the ISP's network, which extends the reach of the Alberta Supernet. This agreement does not affect the ISP's residential VoIP subscriber base.

Peartree's office lease in Kitchener expires in the next few months. Peartree expects to relocate to new premises in neighbouring Waterloo in the third quarter of fiscal 2006.

Glenbriar arranged to allocate a portion of its line of credit to establishing a performance bond in the first quarter. To facilitate this allocation and assist in maintaining working capital margining ratios, officers advanced $160,000 to Glenbriar, with an additional $105,000 being subscribed for by third parties. Glenbriar completed a non-brokered private placement for these amounts at market in the second quarter.

STATEMENTS OF EARNINGS

AND RETAINED EARNINGS

For the three months ended Dec. 31

2005 2004

Revenue

Information

technology

management $651,967 $716,324

Equipment and

software sales 567,097 401,700

Gas sales -- net - 21,038

Gain on disposal

of assets - 101,070

Interest and

other income 2,385 5,649

--------- ---------

1,221,449 1,245,781

Expenses

Information

technology

management 461,802 537,354

Cost of

goods sold 419,896 346,508

General and

administrative 217,350 222,841

Depreciation,

depletion

and amortization 25,623 34,155

Gas production - 4,794

Interest and

bank charges 5,524 3,698

Foreign exchange

loss 4,533 7,639

--------- ---------

1,134,728 1,156,989

--------- ---------

Earnings before

income tax 86,721 88,792

Provision for

future income tax - -

--------- ---------

Net earnings 86,721 88,792

========= =========

Retained

earnings,

beginning

of year 172,949 22,814

--------- ---------

Retained

earnings,

end of year $ 259,670 $ 111,606

========= =========

Net earnings

per share 0.003 0.003

Keratas not sure I agree entirely

I was looking at the ask and the bid earlier. Pretty typical bidding pattern seeing as no news is expected for the foreseeable future perhaps till the fall GOOD GRIEF, I hope GBRT has some rabbits to pull from the hat before then.

I don't think your as bored so much as frustrated and on that I for one certainly see nothing abnormal in it this is slow progress.

Some eternal optimist wants a quarter million @ 2 cents and someone wants to dump 152,000 through Latimer for a paultry 11.75 cents ( roughly). Both are playing the Glenbriar lottery game they both are so out of line IMHO , directly because there is no quantitative news.

There is a fiduciary responsibility of management to propel the PPS up for investors. I hope that fact is not lost on management who IMHO are a little prone to duck's disease when it comes to expansion. If there is not some tangible progress made before the Brazil negotiations then we could well be witness to a very anemic stock in terms of trading and price fluctuation. Sorry to depress anyone merely stating the obvious this stock is to benign to attract interest right now and I don't think it's thefault of the exchange we are on either.

ALL you realize keratas ? JMVHO GLTY

Best...Rich

Not 1 single trade in 2 weeks.........

No one's dumping.......

No one's buying......

No one's talking........

Nothing's happening........

It shows I'm bored, doesn't it? LOL......

Ego eimai keratas

Jim RE: NIR

I don't know the company from Adam but for GBRT's string of bad luck recently many a company would surely have closed their doors for good.

NIR's website is not up they are already clearly warning about a rollback no assurances they will be able to perform the turnaround and a few other crimson red flags beauties in fact. Aye yaye YAYE! Tread carefully is all I can say NIR sounds like a completely different type of investment.

I'm in GBRT because I trust management to bring the company back to profitability despite the enormous hits they have had they still come back up swinging. Not sure if I could say the same for NIR. Best of luck Jim, but I wouldn't bet the ranch on NIR, to be sure!

ALL you realize jim greco? JMVHO GLTY

Cheers...Rich

Ok Jim

Just a personal tip when you type in Large Cap all to often PEOPLE TEND TO THINK YOUR SHOUTING AT THEM...?

aaaahhhhhh

Thanks for the headsup will check that one out. As for GBRT I have not spoken with Rob for the simple fact the PR's are speaking for themselves. He (though he likely will never admit this) is gearing up for a major push here in my estimation. It might be Q3 as management guidance previously indicated but you never know it might come sooner no telling really...

Hang in there all the best....Rich

I MUST HAVE SAID THAT WRONG ABOUT THE PRICE. THE WAY THE NEWS RELEASE WAS STATED IS THEY WOULD SECURE FINANCING ISSUE OF STOCK AT 60 CENTS. I PAID 14CENTS, NORMALLY PRIVATE PLACEMENTS ARE PRICED AT A LOWER PRICE THAN THE CURRENT SHARE PRICE SO 60 CENTS WOULD HAVE UPPED THE VALUE BUT AS THEY SAY IF ITS TO GOOD TO BE TRUE THEN IT ISNT. THANKS A LOT FOR THE PROMPT REPLY.

I GOT GRBT WITH CIBC AND THEY DO NOT RECOGNIZE THE CNQ EXCHANGE. I,LL HAVE TO CALL THEM. TAKE A LOOK AT NIR ON VANCOUVER EXCHANGE THEY ARE INTERESTING. CAME OUT OF BANKRUCPTCY NO MORE DOWN SIDE AND NEW MANAGEMENT THAT'S INSIDE BUYING, HAVE EXPERIENCE IN COATINGS BUSINESS. THEY HAVE EVERTHING TO LOSE IF IT DOESN'T WORK NOT LIKE THE OLD MANAGEMENT WHO WERE JUST GRABBING MONEY.

CHEERS JIM

Look I'm no Tech Guru

But looking at these MSN certifications...

Networking Infrastructure Solutions Competency Microsoft Gold Certified Partners enrolled in the Networking Infrastructure Solutions Competency have proved their competency in implementing technology solutions based on the Microsoft Windows ServerTM 2003 operating system, with a particular focus on Windows Small Business Server 2003. These implementations may include crafting solutions that connect Windows-based servers, PC locations and the Internet; installing a server farm; or building a small-business Windows Server stand-alone solution that includes file and print capabilities.

As one of the requirements for attaining Gold Certified Status, Glenbriar had to declare a Microsoft Competency. Microsoft Competencies are designed to help differentiate a partner’s capabilities with specific Microsoft technologies to customers looking for a particular type of solution. Each competency has a unique set of requirements and benefits, formulated to accurately represent the specific skills and services that partners bring to the technology industry. Glenbriar was recognized by Microsoft as having dual competencies, Networking Infrastructure Solutions and Advanced Infrastructure Solutions, with specialization in Active Directory and Identity Management.

Advanced Infrastructure Solutions Competency The Advanced Infrastructure Solutions Competency is designed for partners with proven expertise in designing and/or implementing complex infrastructure solutions such as Active Directory ®-based and Microsoft Integration Server design and deployment solutions, or Microsoft Exchange Server migration or deployment solutions. Because customers are increasingly asking to do more with less, partners with the Advanced Infrastructure Solutions Competency can identify their unique skill in helping customers access management solutions, improving operational efficiency and reducing security risks.

=================================================================

Now go back to the previous PR about that other JV company working on the Supernet in Alberta... now go back further to a PP in the PR previous to the above.

Doesn't is sound to you like GBRT is laying the groundwork for some major work in that country with all the nuts? MSN certification, PP and a company who can work alongside GBRT down south. Not to mention a major financing in the works overseas. Some of you guys have owned your own successful companies doesn't this sound like a company gearing up for a serious push into a new market?

Sure does to me and I have trouble turning on my four slice toaster...? All those buttons you know I get too excited with gadgetry they tell me...

Most welcome Jim

Gosh glad you posted I hope no one else is left in the dark. Good question, obviously your pretty disgusted can't say I blame you. In all honesty I don't see this as any ruse or any intentional headfake , shakeout however you wish to label it I just see this as a necessary business move. I talked to the people at Clearly Canadian whom I have invested with before for example, they were in almost the same boat as GBRT. They found the CNQ very cooperative and were equally impressed with CNQ management but tantamount to there restructuring were very considerable savings being on the CNQ listing as opposed to the Venture Exchange. Same goes for GBRT who is to say GBRT won't go back on Venture it's strictly a dollars and cents priority CNQ is filling a growing need here for sensibility and moderation when it comes to listing fees.

I'm holding now until Q3 at least Jim that looks to be the best time for any substantial gains I like the sound of Brazil, it's coming along nicely. There could be more to this SuperNet JV and the MSN certification won't be clear cut but that to is bound to bring us more revenue.

I aim to average down in the summer when all is quiet and boring as can be! :) Wow chowed down on 60 cent shares eh? OUCH gotta be discouraging , it's your money but I would tend to hold now that we appear to have a good chance on rising from the ashes. I tell you one thing you have a lot of respect from me in just being able to admit you made such a costly error , obviously you couldn't know ahead of time c'est la guerre. Lesser men wouldn't be able to own up they made a mistake good on yah!

As far as I can tell thus far Action Direct will trade CNQ stocks online for me. I have heard of other cheaper deals but in all fairness I'd stick with the bigger names there are hooks in these supposedly cheap brokers that end up costing you about the same anyway. BEFORE signing up though get clear assurances IN WRITING that whatever bank you choose will trade your CNQ stocks. That will save you a lot of wrangling if they back out.

I had Nesbitt Burns back out on me because of the pinks they wanted to distance themselves, so when the my broker of 9 years moved on absolutely NO ONE would take up the slack in my account at Nesbitt Burns I was unceremoniously DUMPED. It cost me a lot of money and hassles extraordinaire so get clear commitment before signing up for any new broker. I should think Scotia TD or RBC should be fine online but check FIRST Jim. BMO InvestorLine will make you trade pinks ( and I suspect CNQ also here) over the phone which obviously is totally unsatisfactory in this day and age. Also check with the CNQ they should be able to steer you straight.

Good Luck Jim I don't know if we'll hit 60 cents again who can say, but I'd be inclined to let the mess sit and appreciate until fall see what parts of the jigsaw Rob can piece together for us all. That way you won't get fleeced near as bad at least is my present day thinking here.

Thank you for posting Jim chances are if you got sandboxed so did others still wrestling with the "what next?" scenario they now face.

ALL you realize jim greco? JMVHO sir GLTY!

Best...Rich

THANK YOU RICHIEBOY FOR THE EFFORT YOU PUT IN TO KEEP OTHERS IMFORMED. I BOUGHT IN WHEN THE .60 CENT FINANCING NEWS RELEASE CAME OUT AND GBRT WAS ON VANCOUVER EXCHANGE. THE FINANCING SEEMS TO BE A CON JOB THAT I GOT TAKEN INTO AND I DONT KNOW WHAT TO DO. COULD YOU GIVE ME YOUR OPINION OF THE REASONS FOR ME TO HANG ON LONGER AND IF I CHOOSE TO SELL HOW DO I DO IT ON THIS NEW EXCHANGE

There's an MSN PR here too guys

That may sound ho-hum about MSN but believe me if it's anything like my buddy's company he works for they thought exactly the same thing ho-hum but my point is it AIN'T :) You have to clear a very high bar to qualify for MSN certification. Well done GBRT!

I'll try and get to that MSN PR tomorrow late here but seems like things are starting to percolate in earnest if not mistaken.

ALL you realize? JMVHO GLTA

Best...Rich

Super ![]()

Glenbriar and Platinum Enter VoIP Marketing Agreement

CALGARY, AB, February 3, 2006 — Glenbriar Technologies Inc. (CNQ: GBRT) and Platinum Communications Corp. (TSX-V: PCS) today announced that they have entered into a joint venture marketing agreement to deliver Glenbriar’s business IP telephony solutions to Platinum’s growing base of fixed and wireless broadband customers located in small and rural communities throughout southern Alberta.

Under the agreement, Glenbriar and Platinum will work jointly to deliver best-of-breed VoIP solutions to businesses and public authorities served by Platinum through its network, which extends the reach of the Alberta Supernet. The deployment allows businesses to optimize VoIP solutions within their organizations, while adding the ability to use either traditional PSTN and T1 lines for outside trunks, or to add Internet-based SIP and VoIP trunks through another of Platinum’s partners, the ZGroup North America. This agreement does not affect Platinum’s residential VoIP subscriber base.

“Deploying a quality VoIP solution is much more complicated for commercial organizations than for residential customers,” notes Robert Matheson, President of Glenbriar. “The ability to include an IP call centre, treat multiple sites as a single cohesive system, extend full functionality to mobile and teleworkers, integrate with corporate applications and networks, large-scale conferencing, save on local trunk and long distance charges, and Web-based management are but a few of the additional productivity enhancements available to an enterprise from a properly designed business VoIP platform. We look forward to working with Platinum to deliver these solutions to their commercial client base.”

“We have worked closely with Glenbriar over the years, and are very pleased to be able to offer their business VoIP solutions to our growing base of industrial, commercial, and municipal subscribers,” notes Al Stretton, Platinum’s Chief Operating Officer. “Glenbriar’s solutions are first rate, proven, costeffective and rapidly deployable. They are a great enhancement for our business customers and provide a strong incentive to sign up for Platinum’s broadband offerings.”

About Glenbriar Glenbriar Technologies Inc. (CNQ: GBRT) provides leading-edge business-driven technology. Glenbriar’s Peartree Software Inc. division develops Web-based software solutions for specific market verticals. Glenbriar adds post-carrier IP telephony, call centres and support services to deliver complete technology management solutions. Glenbriar has locations in Alberta, British Columbia and Ontario. See www.glenbriar.com for more details.

About Platinum Platinum Communications Corp. (TSX-V: PCS) is a rapidly expanding Calgary based highspeed Internet Service Provider (ISP) focusing primarily on under-served rural areas and communities in Alberta employing both wireless and cable Internet equipment as well as deploying off the Alberta SuperNet. In addition, Platinum supplies Internet services to condominiums, other multiple dwelling units and commercial customers. Platinum also provides telephony services employing VoIP technology.

Forward-looking statements This document contains forward-looking statements relating to Glenbriar's financial performance, operations, or the environment in which it operates, which are based on Glenbriar's operations, estimates, forecasts, and projections. These statements are not guarantees of future performance and involve risks and uncertainties that are difficult to predict, or are beyond the company's control. A number of important factors could cause actual outcomes and results to differ materially from those expressed in these forward-looking statements. These factors include those set forth in the Glenbriar’s corporate filings (posted at www.sedar.com). Consequently, readers should not rely on such forwardlooking statements. In addition, these forward-looking statements relate to the date on which they are made. Although the forward-looking statements contained herein are based upon what management believes to be reasonable assumptions, Glenbriar cannot be certain that actual results will be consistent with these forward-looking statements, and Glenbriar disclaims any intention or obligation to update or revise any forward-looking statements, whether as a result of new information, future events, or otherwise. The CNQ and TSX-V have not reviewed and do not accept responsibility for the adequacy and accuracy of this information.

For further information call: Glenbriar: Robert D. Matheson Robin M. Sundstrom Glenbriar Technologies

Inc. Ciris Investor Relations (403) 233-7300 x117 (416) 368-8770 x223

Platinum: Allen Stretton Platinum Communications Corp. (403) 301-4591

Phew! one hectic thread

How I manage to keep up is beyond me...

Best...Rich

Brutal Truth

Finally managed to scrounge up some info for you please check your inbox. Thank you.

Cheers...Rich

From the CNQ PDF*

Glenbriar Reports 2005 Year End Results CALGARY, AB, January 5, 2006 — Glenbriar Technologies Inc. (CNQ:GBRT) today released its audited financial results for the year ended September 30, 2005: Glenbriar Technologies Inc. Year ended September 30 2005 2004 Revenue $4,886,338 $5,018,879 Total assets 4,241,798 4,078,265 EBITDA* 354,439 184,908 Earnings 150,135 18,875 Earnings per share $0.006 $0.001 Average Common Shares outstanding 25,789,928 25,789,928 *EBITDA = Earnings before interest, taxes, depreciation, depletion and amortization

Glenbriar arranged to allocate a portion of its line of credit to establishing a performance bond in connection with a potential contract, the outcome of which is not expected to be known until the third quarter. To facilitate this allocation and assist in maintaining working capital margining ratios, certain officers and directors advanced $160,000 to Glenbriar in December 2005. Glenbriar anticipates that all of these advances will be converted to common shares before the end of January 2006. This transaction is subsequent to the annual financial statements. **Additional private placements may take place in coming periods.**

About Glenbriar Glenbriar Technologies Inc. (CNQ:GBRT) provides leading edge business-driven technology. Glenbriar’s Peartree Software Inc. division develops Web-based software solutions for specific market verticals. Glenbriar adds post-carrier IP telephony, call centres and support services to deliver complete technology management solutions. Glenbriar has locations in Alberta, British Columbia and Ontario. See www.glenbriar.com for more details. The CNQ has not reviewed and does not accept responsibility for the adequacy and accuracy of this information. For further information call: Robert D. Matheson Robin M. Sundstrom Glenbriar Technologies Inc. Ciris Investor Relations (403) 233-7300 x117 (416) 368-8770 x223

I guess the real question here is...

How much further does management intend to dilute before this (assumed) contract closes in Q3? Okay sure a miniscule buyback has been achieved through this last PR but arguably more crucial at a dilution factor of around 14%.

Right now those new shares are made to look as though they will be tightly held but things can change. I get the feeling Rob is angling at a major financing to make an entrance with this Q3 PR as the "glitter". But hey I was wrong once...ONCE guys

Latest PR

This to me sounds like Bridge Financing but Rob tells me it was insisted on by the bank. They had to post a letter of creditor performance bond that won't even officially exist until Q3. Okay Mr. Matheson still sounds like Bridge Financing to this mushroom...

Brazil must look promising but to be perfectly candid I found Rob a little rough around the edges and quickly on the defensive for some reason today. I probably started off wrong by immediately stating to the news this was dilution I protested because I was disappointed because THIS IS DILUTION. He defended by countering it was straight cash, no options or sweetheart deals STRAIGHT CASH. Something about they could have sold at 25% below market instead , okay fine DILUTION anyway you slice it sorry I'm less than elated with this PR.

Obviously it was necessary to move forward but dilution into a flagging PPS is daunting to any long investor, onto brighter topics. Cirus has supplied some interesting contacts and GBRT is now looking at some potential acquisitions namely IT SUPPORT and/or SOFTWARE companies. The software company was in Kitchener the rest was IT SUPPORT in VANCOUVER, CALGARY TORONTO and possibly OTTAWA. Again Rob is "looking" so please don't read into this any more than necessary. He did add a Toronto IT SUPPORT company acquisition would be the most advantageous of all. So we are "looking".

GBRT is gunning for 3-10 Million dollars from that pursuit of major financing. Germany has been in contact lately ( last two weeks) but as Rob explained there approach is over years they only have to report every 6 months not every quarter like Canadian companies so they look at things with more pain threshold for preamble. UPSHOT they take a lot longer to get anything accomplished but when closed it generally is long term financing lasting longer than what we are used to here in NA. Still the same pretty much with Germany business as usual they are waiting for Germany to approach them and getting on with day to day obligations but the door is still open.

24 January Annual Report is due.

March 2nd is the AGM ,location was unspecified at time of phone call. I prodded for a webcast or at the very least a conference call ~ 800 phone in capability for shareholders to ask important questions from management. He tried to duck with it's kind of expensive which admittedly I nearly blew my cool at that answer. A VOIP IT company can't afford a conference call for the AGM COME ON ROB !!!??? I was ready to eat nails my molars were powdering. I guess the silence sunk in because he swiftly quipped we would need enough callers to make it feasible.

So guys if you want to express your views questions at the AGM on a conference call then you will have to tell Rob you want this laid on for shareholders without fail. I can guarantee if not enough S/H's express there desire for a conference call then IT WON"T HAPPEN. Trust me the CEO is playing that idea luke warm for the second year in a row so I'll leave it with you. If you care about this company then TELL ROB WE WANT A CONFERENCE CALL FOR THE AGM WITHOUT FAIL. Otherwise he will duck it again your voice will go unheard and there has been enough arm's length from the company already IMHO. Often late breaking developments quickly make email questions irrelevant so this is why I stress voice communication to give us a chance to be heard.

Okay some bones were thrown my way it was not all  the conversation was amicable but I have to say "frostier than Rob's normal demeanour". Maybe I just caught him on an off day not sure but his answers were guarded and somewhat more evasive than I would have liked perhaps that's a good thing...leave that up to you.

the conversation was amicable but I have to say "frostier than Rob's normal demeanour". Maybe I just caught him on an off day not sure but his answers were guarded and somewhat more evasive than I would have liked perhaps that's a good thing...leave that up to you.

Sao Paulo is germinating nicely anticipate more developments there sooner as opposed to later. Company cash is holding this back right now the Brasilians are very VERY enthusiastic down there. Also there have been inquiries received by the company from other private investors (he implied Canadian) so Cirus is definitely producing some promising leads. Finally look for "Good Stuff" coming in "Q3 and Q4". Don't ask me, he did not elaborate and I was pushed for time so there you have it boys.

I cannot stress enough others need to talk with Rob express an interest and develop a better rapport between management and shareholders. "MHO here" but the whole wilsmere charade appears to have made the CEO a little gunshy about telling all to anyone so if you care enough to call he will help you but I'd advise a phone call is by order of magnitude far more congenial than some anonymous impersonal email.

Overview I sense we are in a general uptrend this year finally! How strong will depend on the rate of more capital infusion. You have to spend money to make money. I think GBRT has lots of work forecast but it takes a lot more moolah we no got...YET.

Patience Gentlemen somehow sense we are close to additional financing that is pending.

ALL you realize GBRTers? JMVHO GLTA

Cheers...Rich

Re: News Out

Thanks kayashima I have been in contact with Rob and will be posting a summation of that phone call.

I would like to stress however the value of independent DD. I have posted Rob's contact info below his photograph for this purpose. I'd like to encourage all LONG shareholders to become more interactive with the company and where prudent PLEASE SHARE.

Pushed for time right now guys will post later tonight if possible.

Best...Rich

News out

Glenbriar Technologies arranges $265,000 financing

2006-01-11 13:56 ET - News Release

Mr. Robert Matheson reports

GLENBRIAR ANNOUNCES PRIVATE PLACEMENT

Glenbriar Technologies Inc. has arranged a non-brokered private placement of 3,312,500 common shares at eight cents per share, for gross proceeds of $265,000. The last closing price prior to this announcement was eight cents per share. There are no discounts, commissions, finders' fees, warrants or options in connection with the private placement. Proceeds will be used for general corporate purposes.

All of the shares have been subscribed for by Glenbriar's officers. Certain officers have agreed to sell freely trading shares to third parties and to obtain replacement shares through the private placement. These third parties include investors introduced to Glenbriar by Oriel Partners Ltda. of Sao Paulo, Brazil, or personally known to the officers. The net result after closing will be that the holdings of Glenbriar's officers will increase by two million common shares, with an additional 1,312,500 common shares being held by the third parties. Glenbriar's officers' ownership position will increase from 57.1 per cent to 57.5 per cent. Closing is anticipated to occur on or before Jan. 31, 2006.

Happy New Year

Don't ask me why I might be psychic but I just get the feeling that update went over like a lead balloon. Am I jumping to conclusion here boys?

OK thanks Brutal

I do appreciate your DD and opinions here. On chatting with Rob on Brazil he was very optimistic about Brazil so much of the US which you might think would be his target market is already wired for a lot of what he is providing Brazil? ZIPPO! They don't even know what an RV is!

The point is Brazil NEEDS the product and doesn't have the previosuly installed infrasturcture to fall back on. They need what Rob is providing and they need it quite badly to catch up with the rest of the world. So you can imagine what a captive audience he has down there he is getting great feedback from Brazil be absolutely certain. It takes time as you can imagine to install systems down there get the PearTree software running etc. the economy is not exactly a poster child for IT in many ways very antiquated. He told me they were very gungho about Glenbriar's Technology and were firmly embracing it.

OK thanks BT will check my inbox Merry Christmas!

Cheers...Rich

Richie - check your yahoo email as I sent you a more detailed response regarding Glenbriar's prospects!

Re: Glenbriar Dec 8th update

You know, I don't mind at all that there's no hint of a buyout at the moment. Nor do I mind that the key financing is bleak. The key here is that Glenbriar is a company with a strong enough business plan to consistently pull in a profit with decent enough management that tells it how it is. A company like this will EVENTUALLY get rewarded with financing or a buyout. While the market is building a bubble with its Amazons, Netflixes, and Starbucks ready to burst at any time and half the garbage on the Venture can't even pull a profit, this company is quietly making its money quarter-in and quarter-out.

Right now the only thing we suffer is a liquidity premium and lack of recognition and I'll take those over Enron candidates any day. All I can say to any Glenbriar doubters out there, compare this:

http://www.sedar.com/csfsprod/data59/filings/00813984/00000001/C%3A%5Cfilings%5Cglenbriarfinancials0...

to one of my former holdings in the industry before I dumped it in favour of Glenbriar, Nuvo Networks:

http://biz.yahoo.com/ccn/051129/200511290299521001.html?.v=1

Trying to use the smoke and mirrors of a 30% gain in revenue through acquisitions (which only is now comparable to Glenbriar's revenue to market cap despite Nuvo losing something like 70% of its market cap this year) to disguise their HUGE loss. And you can go up and down the Venture and you will see the same thing over and over again.

Glenbriar may not have impressive growth this year, but that shows to me that they are NOT willing to sacrifice the bottom line JUST for growth, and that revenue growth isn't everything. While I'm somewhat contradicting myself, the fact that the company is looking to expand in Brazil is something that I strongly approve of. Even if costly, Brazil I beleive has much more potential than China on a per capita basis and developing ties to this country is very, very smart. Choose quality, not quantity like Nuvo.

|

Followers

|

6

|

Posters

|

|

|

Posts (Today)

|

0

|

Posts (Total)

|

338

|

|

Created

|

12/13/04

|

Type

|

Free

|

| Moderators | |||

Corporate financing is being pursued which could signal a return to trading on the TSE.V GBRT is also mulling over possible acquisition targets in Toronto specifically an up and running VOIP firm or related infrastructure that will compliment PearTree market penetration. GBRT has recently entered into working agreements with several firms Tekhead and Peer1 dramatically increasing it's client base and potential new customers.

VOIP (Voice Over Internet Protocol) can save businesses literally many thousands of dollars in saved phone bills often recouping the initial installation charges in the first year of operation. The growth of VOIP is forecast to ratchet up approximately 100% per year for the next TEN-TWELVE years by some analysts. (R.O.B. TV) (2004) While installation is lucrative, so also is the constant maintenance of these networks which is further fuelling GBRT's growing revenues.

Unbridled bashing, vulgarity, threats , spam will not be tolerated, so keep it civil please folks or you WILL! be asked to leave.

Kindly post relevant information pertinent to GBRT business of the day. E.G. CNQ evolvement and PearTree software developments, or VOIP emerging tech discussion IS ENCOURAGED.

Glenbriar is carving out a nice little niche for itself in the burgeoning new field of business VOIP telecom. There are other irons in the fire (business management software) too new to talk about yet here but will update. Currently located in Vancouver Calgary and Kitchener Calgary has just done a significant expansion. Any corporate move into the Toronto area and/or closed financing, I believe will seriously get this party started.

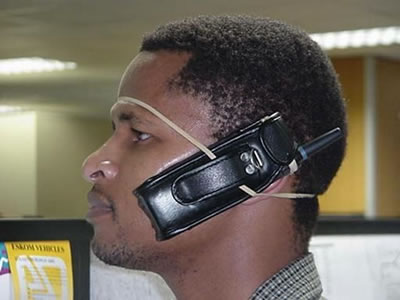

Meet the CEO Mr. Robert "Rob" Matheson

Corporate financing is being pursued which could signal a return to trading on the TSE.V GBRT is also mulling over possible acquisition targets in Toronto specifically an up and running VOIP firm or related infrastructure that will compliment PearTree market penetration. GBRT has recently entered into working agreements with several firms Tekhead and Peer1 dramatically increasing it's client base and potential new customers.

VOIP (Voice Over Internet Protocol) can save businesses literally many thousands of dollars in saved phone bills often recouping the initial installation charges in the first year of operation. The growth of VOIP is forecast to ratchet up approximately 100% per year for the next TEN-TWELVE years by some analysts. (R.O.B. TV) (2004) While installation is lucrative, so also is the constant maintenance of these networks which is further fuelling GBRT's growing revenues.

Unbridled bashing, vulgarity, threats , spam will not be tolerated, so keep it civil please folks or you WILL! be asked to leave.

Kindly post relevant information pertinent to GBRT business of the day. E.G. CNQ evolvement and PearTree software developments, or VOIP emerging tech discussion IS ENCOURAGED.

Glenbriar is carving out a nice little niche for itself in the burgeoning new field of business VOIP telecom. There are other irons in the fire (business management software) too new to talk about yet here but will update. Currently located in Vancouver Calgary and Kitchener Calgary has just done a significant expansion. Any corporate move into the Toronto area and/or closed financing, I believe will seriously get this party started.

Meet the CEO Mr. Robert "Rob" Matheson  301, 401 - 9 Ave SW

Calgary Alberta CANADA

T2P 3C5

Phone 403-233-7300 x117 (CEO)

Fax 403-234-7310

Email inquiries@glenbriar.com

Last but not least ...A WARM WELCOME to the GBRT thread and Good Luck ! Cheers... Rich :)

Board started December 12, 2004 by "RichieBoy"

301, 401 - 9 Ave SW

Calgary Alberta CANADA

T2P 3C5

Phone 403-233-7300 x117 (CEO)

Fax 403-234-7310

Email inquiries@glenbriar.com

Last but not least ...A WARM WELCOME to the GBRT thread and Good Luck ! Cheers... Rich :)

Board started December 12, 2004 by "RichieBoy"

| Volume | |

| Day Range: | |

| Bid Price | |

| Ask Price | |

| Last Trade Time: |