Register for free to join our community of investors and share your ideas. You will also get access to streaming quotes, interactive charts, trades, portfolio, live options flow and more tools.

Medallion Resources Ltd changed to Gabo Mining Ltd and a one for 7 reverse split:

https://otce.finra.org/otce/dailyList?viewType=Symbol%2FName%20Changes

Finally heard from Management, this was his reply to my inquiry about ACDC.

"ACDC is progressing well. ASX IPO schedules have blown out due to the volume of work and lack of staff"

Australian authorities are more nazi like with covid controls and have the entire country backed up like crazy. Long story short, we should be hearing good news very shortly.

Moderate volume, no news bump. Any word on ACDC?

All; https://www.wisfarmer.com/story/news/2021/09/28/china-halts-phosphate-exports-fertilizer-prices-expected-soar/5907300001/

Monzanite sands are a source of Phosphate for fertilizers and rare earths.

https://pubs.usgs.gov/circ/1953/0237/report.pdf

Same. Enough to be interesting.

Will the new board members provide contacts that will result in a pilot plant start up??

Bon Jovi; I have a minimal position in MLLOF so its not to hard to watch the up and downs. Always difficult if you have larger holdings.

News out today, 8/18/2021

https://finance.yahoo.com/news/medallion-resources-adds-daniel-mamadou-100000189.html

(I took info from Medallion site which had this info up, but was not there when I looked at it again. The story does show on Yahoo. More share dilution at a pretty low exercise price, but more operating funds.

Will the new board members provide contacts that will result in a pilot plant start up??

------------------------------------------------------------------

Vancouver, BC – Medallion Resources Ltd. (TSX-V: MDL; OTCQB: MLLOF; Frankfurt: MRDN) –

"“Medallion” or the “Company”), is pleased to announce the addition of Daniel Mamadou and Gabriel Alonso-Mendoza to the Board of Directors (the “Board”). Both Daniel and Gabriel are long term, active participants and investors in the rare earth element industry, and bring extensive commercial and financial experience to the Medallion team.

“The addition of Daniel Mamadou and Gabriel Alonso-Mendoza to the Medallion Board is a key moment for the Company, providing a new level of financial and commercial capacity” said Mark Saxon, President and CEO. “Both Daniel and Gabriel have impressive records, and their contributions to Medallion’s strategy and growth are highly anticipated.”

Daniel Mamadou is the founder and executive director of Welsbach Holdings, a Singapore-based firm investing in the discovery and development of the metals and materials that are critical to the global energy transition. Prior to the formation of Welsbach, Daniel co-founded Talaxis Ltd, a subsidiary of Noble Group focused on the development of supply chains of technology metals and materials. He was the director of Talaxis from 2015 until December 2020. In addition, Daniel’s professional career has included senior roles at Deutsche Bank in London and Hong Kong, Goldman Sachs in London and as Head of the Corporate Solutions and Financing for Nomura Securities for the Asia-Pacific region. Daniel holds an MSc in International Securities and Banking from the ICMA Centre University of Reading and a BA in Business Management from ESIC-Valencia.

Gabriel Alonso-Mendoza co-founded Amvest Capital Inc. to support companies seeking growth capital within the natural resource sector. Throughout his career, Gabriel has raised and invested over $1 billion for companies in the mining and metals, oil and gas, and agriculture industries. Before forming Amvest Capital, Gabriel worked on the buy and sell-side ranging from analyst to junior partner. Gabriel graduated from the University of Miami with a degree in International Finance and Marketing.

Furthermore, Medallion announces the grant of 500,000 stock options to directors which are exercisable into common shares of Medallion at a price of $0.17 per common share in accordance with TSX Policy 4.4, and subject to the rules of the TSX Venture Exchange and the Company’s Stock Option Plan. The options have a term of five years and will expire on August 18, 2026.

Medallion is focused on commercialization of proprietary technologies that enable the sustainable extraction and separation of rare earth elements (“REE”) with minimum environmental footprints. This includes a proprietary method to utilize mineral sand monazite as a low cost REE source for which the positive findings of a Techno-Economic Assessment (“TEA”) were recently published; and the patented Ligand Assisted Displacement (“LAD”) Chromatography process for solvent-free REE separation."

I'm hoping!

It's been a rough trend down this year, pretty much back to where we were when he joined as CEO in 2020.

Jon Bovi; Sounds like it, so yah, pretty Sure!

v

CEO is from AU right?

An Honours BSc graduate in Geology from the University of Melbourne, a Fellow of the Australasian Institute of Mining and Metallurgy and the Australian Institute of Geoscientists, Mr. Saxon has also received a Graduate Diploma of Applied Finance and Investment through the Financial Services Institute of Australasia.

nowwhat2; Vancouver, BC – Medallion Resources Ltd. (TSX-V: MDL; OTCQB: MLLOF; Frankfurt: MRDN) – “Medallion” or the “Company”), is pleased to announce the signing of a non-binding letter of intent (“LOI”) with Australian private company ACDC Metals Pty Ltd (“ACDC”) to form a partnership to utilize Medallion’s proprietary process to extract rare earth elements from monazite (the “Medallion Monazite Process”) in southeastern Australia.

The Medallion Monazite Process is a proprietary method that enables sustainable extraction of rare earth elements (“REE”) from mineral sand monazite. Monazite is a rare earth phosphate mineral globally available as a by-product from heavy mineral sand mining operations. Medallion recently published the positive findings of a Techno-Economic Assessment (“TEA”) which provides the engineering and economic foundation for commercializing the Medallion Monazite Process. This includes seeking both operational and licencing opportunities with qualified partners in mineral sand monazite rich jurisdictions.

ACDC is securing the right to acquire three historical non JORC/NI43-101 compliant mineral sand resource properties and other exploration assets in Victoria (Australia), to potentially underpin a supply of monazite suitable for the Medallion Monazite Process. ACDC is planning to complete an Initial Public Offering (“IPO”) upon the Australian Stock Exchange (“ASX”) within 12 months.

ACDC Managing Director Mr. Andrew Shearer commented, “ACDC recognizes the potential value add available to shareholders and stakeholders by the extraction of rare earth elements from mineral sand monazite. In partnering with Medallion Resources, we believe we have accessed the right technology at the right time, allowing us to be fast to market as REE prices rise and the market expands. We are excited to play a role to improve supply security and reduce environmental impact of rare earth element production.”

... snip "In compensation, Medallion shall receive a significant allocation of pre-IPO shares of ACDC, transferable rights to contribute funding to ACDC at seed and IPO stages, milestone payments and a royalty on successful operation of the refinery. Medallion will issue additional press releases related to the final legal and commercial structure within the Binding Contract as it becomes available. The Binding Contract is subject to regulatory approval. Investors are cautioned that the LOI is non-binding, and there is no guarantee that the parties will enter into the Binding Contract, or that the transactions contemplated in this press release will be completed."

more at link.

https://medallionresources.com/2021/07/loi-partnership-medallion-monazite-process-se-australia/

ACDC does not have the properties and will need to raise money. Some portion of the IPO e money will be directed to Medallion.

Would be a clearer path for revenue and growth.

From their 2020 year end.

Cash consists of $1,528,686 (March 31, 2020 - $138,104) available in the bank accounts of the

Company at December 31, 2020.

Agreed. But I was being a bit flippant - I think we all know and that is why the stock price is down since that announcement. Dilution is coming, that much is pretty obvious.

MasterSalix; That would be a good question for Mark Saxon!

https://medallionresources.com/

I guess this begs the question: Where they going to get the $34M?

Jon Bovi: News Technical, Financial Viability for Monazite Process;

Medallion says Techno Economic Assessment showed Technical, Financial Viability for Monazite Process; Up 10.4% in Frankfurt Trading

BY MT Newswires

— 9:17 AM ET 07/14/2021

09:17 AM EDT, 07/14/2021 (MT Newswires) -- Medallion Resources Ltd. ( MLLOF

Loading... Loading...

) on Wednesday reported the results of an independent Techno-Economic Assessment for the company's process that enables sustainable extraction of rare earth elements from mineral sand monazite.

The company, which rose 3.9% in Canada yesterday, climbed 10.4% in Frankfurt trading as at 2:47 pm CEST on Wednesday.

The assessment has demonstrated the technical and financial viability of the Medallion Monazite Process at this scale, the company said. Engineering was completed at an assumed 7,000 tons per annum scale.

The report showed that such a facility would deliver about 870 tons per annum of neodymium and praseodymium oxide in cerium-depleted mixed carbonate form. Other products from the Medallion Monazite Process include cerium oxide and trisodium phosphate.

Further, the company reported a capital cost estimate of US$34 million.

Price: 0.2700, Change: +0.0100, Percent Change: +3.85

MT Newswires does not provide investment advice. Unauthorized reproduction is strictly prohibited.

The closer they get to getting their processing facility running the better. It moves hard on volume.

My bullish stance on a weak US dollar would make me think that more expensive imports of REE would make processing locally more attractive.

I was also coupling the thought of infrastructure plan money finding it's way to developing these types of long term strategic resources.

Bearish may be that with weak dollar liquidity moves from this sector to easier plays over the next few months

Thanks for the reminder - Their chart looks SO primed !

Any idea what effect the Dollars' value could have on the project ?

https://investorshub.advfn.com/boards/read_msg.aspx?message_id=164581943

Quite the 2 week pull-back (to .30)!....wow

If the US gets serious about local or friendly sourced REE this process should be helpful for years to come.

BonJovi, Chico, Douginil, Thanks! From your article:

“Research and development is generally a slow and progressive process. It is not often we get to witness firsthand the fast pace of an emerging disruptive technology,” said Mark Saxon, CEO and President. “It is less than 2 months since we started working with the LAD process at Purdue and already high-purity Nd and Pr carbonates have been separated from a monazite-sourced leach solution. By keeping the REE in solution from end to end, our cost, environmental footprint and recovery efficiency can all be optimized.”

The LAD Chromatography method was developed by Linda Wang, PhD, the Purdue Maxine Spencer Nichols Professor of Chemical Engineering at Purdue University. Her team's stated goal was to create "an environmentally sound technique for REE separation."

All: Yahoo Article: MLLOF Results of Warrent and Options exercise

https://finance.yahoo.com/news/medallion-receives-792-000-warrant-110000571.html

MLLOF

-2.13%

VANCOUVER, British Columbia, March 09, 2021 (GLOBE NEWSWIRE) -- Medallion Resources Ltd. (TSX-V: MDL; OTCQB: MLLOF; Frankfurt: MRDN) – (“Medallion” or the “Company”), reports that since January 1, 2021 the Company has received funds for the exercise of 4,249,014 warrants and options for gross proceeds of approximately $792,000. The warrants and options were priced between $0.09 and $0.40 with an average exercise price of $0.19 per share. Medallion is in a strong position with over $2,000,000 of working capital, with research and engineering programs underway on both the extraction and separation of rare-earth elements (REE).

“We are very pleased and thankful to receive the continuing support of shareholders with the exercise of almost $800,000 in warrants and options,” said Mark Saxon, CEO and President. “With a strong cash position, we can now make commitments to longer term research and corporate development.”

Rare-Earth Element Separation Technology Acquisition - Update

In addition to Medallion’s long-term investment in a proprietary process for the sustainable extraction of REEs from mineral sand monazite, the Company recently acquired an exclusive license to a portfolio of technology, patents, and knowhow for ligand-assisted displacement (LAD) chromatography from Purdue University. The license enables Medallion to deploy the LAD technology in the separation and purification of rare-earth elements for all minerals, mineral processing by-products and mining waste feedstock, excluding coal-sourced materials. Medallion has begun discussions with third parties to sub-license the LAD technology and provide much sought-after and low-environmental impact REE separation.

The LAD system, developed by Linda Wang, PhD, the Purdue Maxine Spencer Nichols Professor of Chemical Engineering, was selected for investment by Medallion following extensive review of the REE separation industry. The green engineering and design principles applied by Dr Wang were recognized through the publication of her research in the Journal Green Chemistry in 2020. LAD chromatography is an aqueous (water based) process that does not depend upon petrochemical industry solvents to function. The technology is built upon a platform that is widely used in the pharmaceuticals industry and provides an environmentally sound method for REE separation with low technology risk and holds tremendous promise.

Covid really is messing with a lot of industries. Not outrageous projections.

6 Months for build makes me think they will find a warehouse type building and that's just to put the production line together.

Response from Medallion

These are my questions:

From you interview yesterday it sounds like you will enter execution phase in 2022.

1) Do you have a target when you will start to build the process on site?

2) How long will it take to build a site.

3) Do you expect to start producing /selling REE in 2022 or is it 2023?

RESPONSE:

We are aiming for all the critical decisions to be made before or during 2022. This is scale of the operation;

location;

funding;

monazite sourcing;

off take…..etc. The key one there is the location and the associated permitting.

We are looking at a range of permitting alternatives. It is hard to give fixed timelines until we deeply engage with one site and understand the requirements.

Building will be around 6 months, subject to the lead time for any equipment. COVID has blown equipment timelines out of the water.

Selling is more likely to be into 2023.

With best regards

Mark Saxon

CEO & President

Medallion Resources Ltd

Correction to my last post LED should be. ligand-assisted displacement (LAD). The Medallion system is 2 steps

1) Medallion process extracts the REEs from the Monazite sand.

2) LAD process separates those REE into individual elements for sale.

ALSO

I sent email to Medallion asking for more detail on timeline to production. I will post and response if I get it

I would expect that as they complete each phase towards production there will be some reward to price. Hopefully faster than you think.

In the video presentation they asked when will the Mediallion and LED process but put together and put out for market. Answer hopefully later this year. So I would expect production next year.

Do you have any info that would show it to be further out than that?

from their presentation:

Medallion has built an industrially relevant, near term business model that enables the Company to execute on key partnerships within the US and global rare earth element supply chain

Investment Case

•Expertise and proprietary technology in monazite processing. Monazite is already a key source of magnet metals NdPrglobally

•Fast to market strategy by accessing by-product from mineral sand mining. Opportunities both with US and elsewhere.

•Minimal technical risk –modern, efficient continuous metallurgical process utilizing all material and a “no tailings” plant

•Potential to produce 2,000 tpaREO in US (global market: 150,000 tpa) very soon

•Very low capex –~10-15% of hard-rock mining / processing

•Growth can be implement incrementally –modular design

•Near-term NdPrproduction from substantially de-risked business mode

Looking good but it's going to take years to get to production with many

dilutions along the way. Dead money for a long while.

Listened to the presentation this afternoon. Looking good. Going to require a lot of waiting for them to get to production but they are getting it done step by step. Sounds like their process will be best available and should be quite profitable once they get it going. Like how efficient and scalable and mobile it is. Lots of advantages that should ensure success.

Needed to be registered to see it.

Looks like a promising year to come.

ALL

https://medallionresources.com/2021/03/medallion-receives-792000-from-warrant-and-option-exercise/

"Vancouver, BC – Medallion Resources Ltd. (TSX-V: MDL; OTCQB: MLLOF; Frankfurt: MRDN) – “Medallion” or the “Company”), reports that since January 1, 2021 the Company has received funds for the exercise of 4,249,014 warrants and options for gross proceeds of approximately $792,000. The warrants and options were priced between $0.09 and $0.40 with an average exercise price of $0.19 per share. Medallion is in a strong position with over $2,000,000 of working capital, with research and engineering programs underway on both the extraction and separation of rare-earth elements (REE).

“We are very pleased and thankful to receive the continuing support of shareholders with the exercise of almost $800,000 in warrants and options,” said Mark Saxon, CEO and President. “With a strong cash position, we can now make commitments to longer term research and corporate development.”

Rare-Earth Element Separation Technology Acquisition – Update

In addition to Medallion’s long-term investment in a proprietary process for the sustainable extraction of REEs from mineral sand monazite, the Company recently acquired an exclusive license to a portfolio of technology, patents, and knowhow for ligand-assisted displacement (LAD) chromatography from Purdue University. The license enables Medallion to deploy the LAD technology in the separation and purification of rare-earth elements for all minerals, mineral processing by-products and mining waste feedstock, excluding coal-sourced materials. Medallion has begun discussions with third parties to sub-license the LAD technology and provide much sought-after and low-environmental impact REE separation.

The LAD system, developed by Linda Wang, PhD, the Purdue Maxine Spencer Nichols Professor of Chemical Engineering, was selected for investment by Medallion following extensive review of the REE separation industry. The green engineering and design principles applied by Dr Wang were recognized through the publication of her research in the Journal Green Chemistry in 2020. LAD chromatography is an aqueous (water based) process that does not depend upon petrochemical industry solvents to function. The technology is built upon a platform that is widely used in the pharmaceuticals industry and provides an environmentally sound method for REE separation with low technology risk and holds tremendous promise.....more at link"

Medallion Receives $792,000 from Warrant and Option Exercise

VANCOUVER, British Columbia, March 09, 2021 (GLOBE NEWSWIRE) -- Medallion Resources Ltd. (TSX-V: MDL; OTCQB: MLLOF; Frankfurt: MRDN) – (“Medallion” or the “Company”), reports that since January 1, 2021 the Company has received funds for the exercise of 4,249,014 warrants and options for gross proceeds of approximately $792,000. The warrants and options were priced between $0.09 and $0.40 with an average exercise price of $0.19 per share. Medallion is in a strong position with over $2,000,000 of working capital, with research and engineering programs underway on both the extraction and separation of rare-earth elements (REE).

“We are very pleased and thankful to receive the continuing support of shareholders with the exercise of almost $800,000 in warrants and options,” said Mark Saxon, CEO and President. “With a strong cash position, we can now make commitments to longer term research and corporate development.”

Rare-Earth Element Separation Technology Acquisition - Update

In addition to Medallion’s long-term investment in a proprietary process for the sustainable extraction of REEs from mineral sand monazite, the Company recently acquired an exclusive license to a portfolio of technology, patents, and know how for ligand-assisted displacement (LAD) chromatography from Purdue University. The license enables Medallion to deploy the LAD technology in the separation and purification of rare-earth elements for all minerals, mineral processing by-products and mining waste feedstock, excluding coal-sourced materials. Medallion has begun discussions with third parties to sub-license the LAD technology and provide much sought-after and low-environmental impact REE separation.

The LAD system, developed by Linda Wang, PhD, the Purdue Maxine Spencer Nichols Professor of Chemical Engineering, was selected for investment by Medallion following extensive review of the REE separation industry. The green engineering and design principles applied by Dr Wang were recognized through the publication of her research in the Journal Green Chemistry in 2020. LAD chromatography is an aqueous (water based) process that does not depend upon petrochemical industry solvents to function. The technology is built upon a platform that is widely used in the pharmaceuticals industry and provides an environmentally sound method for REE separation with low technology risk and holds tremendous promise.

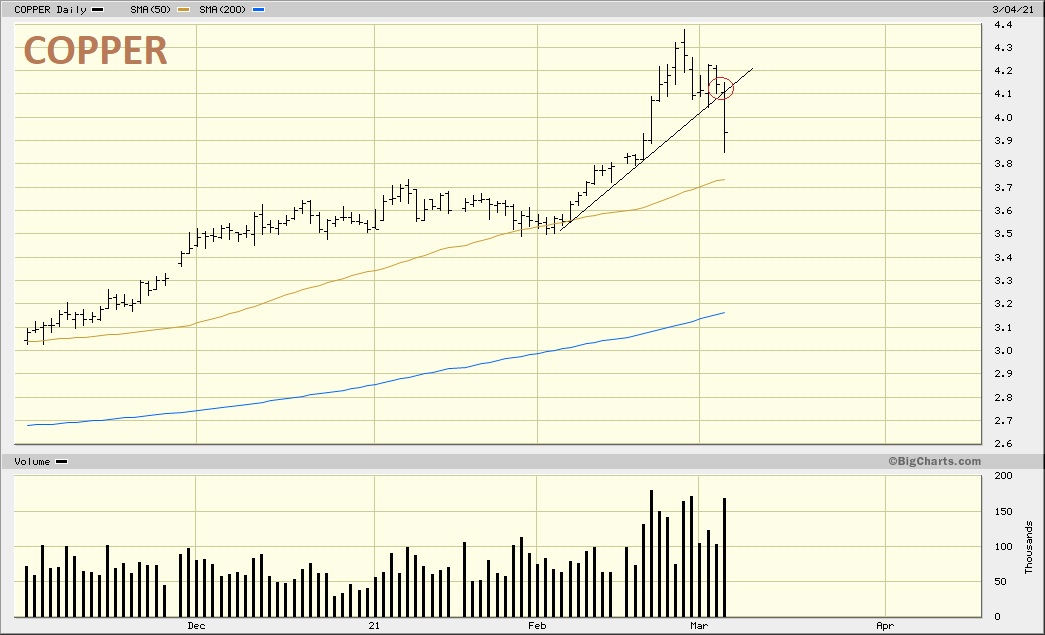

Trading anything like copper ?

Wo.....That's a full "back-test" there alright.

Wo.....That's a full "back-test" there alright.

Copper hit 4.37 and now has "pulled back" to under $4......Low today 3.85 - Closed 3.94

Wo.....MDL's a full "back-test" here alright........and THEN some !

Just gotta hope for another break above the overhead........line.

It was. Looks like it wants to head back up.

Buying opportunity? A nice and reasonable pullback this morning.

AREC is a parallel application of LAD technology for coal and coal-sourced waste materials, REE magnets and batteries.

MDL is from different sources like mineral sands.

Licenses for 2 different markets.

Chart is juicy.

Yes I really like this play financially BUT it really feels good

to invest in REE, something so important to USA so we are not totally dependent on other countries.

ha - oh wow - yeah - okay.....

Thanks for that clarification

But still.....

Coal vs monazite (sands) (which I'd never even heard of)....

Until this 1946 publication https://www.onemine.org/document/abstract.cfm?docid=9435&title=Technology-And-Uses-Of-Monazite-Sand

Anyways, bottom-line is that it all sounds rather awesome !

How the times they are a changing !

Use of word exclusive is puzzling. However AREC

processes coal... Medallion uses monazite sand.

Thus Medallion has exlusive rights thusly

The license, acquired through Hasler Ventures LLC, provides Medallion with a portfolio of technology, patents, and knowhow for ligand-assisted displacement (LAD) chromatography to deploy in the separation and purification of rare earth elements (REE). The rights assigned by Hasler Ventures and granted by Purdue are exclusive and global for use with all minerals, mineral processing by-products and mining waste feedstock, excluding coal-sourced materials.

Hi Medallion Board - Congrats - So - Hmmmmm - I don't get it :

Medallion struck a deal which sounds exactly like the same deal that American (AREC) struck with Purdue ?

How would THAT work ?...How can both companies possess the same exclusive rights ? Or DO they ?

Anyways, chart's awfully stunning, isn't it ?

i did! will have 100k here soon.

To be expected- up 100%+ this week alone - needs a day off to consolidate- should continue higher next week. JMHO

Not liking this sell off on volume. Hope some will benefit and buy the dip.

I do too.

Before the news it was headed to this range ... if AREC can almost triple with the same news, we could see more upside.

|

Followers

|

15

|

Posters

|

|

|

Posts (Today)

|

0

|

Posts (Total)

|

322

|

|

Created

|

09/07/10

|

Type

|

Free

|

| Moderators | |||

To provide material for the increasing clean energy demands in transportation and energy production–Medallion has a smart plan for magnet metals production outside of China. Our plan is to source rare-earth mineral available as a by-product from current mining operations or existing stockpiles.

An investment in Medallion provides excellent upside by exposure to:

The Medallion Monazite Process does not require additional mining to produce REEs, utilizes a high-grade by-product mineral that typically goes to waste, makes use of Process Intensification design practice that maximizes energy and reagent re-use, and produces zero liquid waste output. The climate change and other environmental impact benefits of the process will be quantified by the LCA. As the Medallion Monazite Process is both scalable and transferable it can be implemented at ideal locations and scales to maximize profitability and minimize the carbon dioxide impact of long-distance feedstock and reagent transport.

Rare-earth element demand growth is linked to low-carbon emitting technologies, including wind energy and electromobility where efficiency is enabled by high-strength REE permanent magnets. Many industrial customers in these fields, such as automakers, seek to make the most sustainable purchasing decisions for REEs and battery materials, and the data-driven approach of an LCA with ISO-compliance provides them the highest degree of transparency and customer confidence.

Contact(s):

Mark Saxon, President & CEO

Donald Lay, Director & Strategic Advisor

+1.604.681.9558 or info@medallionresources.com

| Volume | |

| Day Range: | |

| Bid Price | |

| Ask Price | |

| Last Trade Time: |