Register for free to join our community of investors and share your ideas. You will also get access to streaming quotes, interactive charts, trades, portfolio, live options flow and more tools.

Ask if the one who put it there is willing to remove.

So what about the last 6 posts here today by s/k and h/b about horse racing...is that really on topic, even for a stock board???

Is that something other members here want to see???

very weird to have a banner like that on a stock board......Go for it

It would have to be removed by the mod who posted it.

Sorry to interrupt the 6 posts about horse racing but could you get this removed from the board intro....seriously????

"NEWS!!!!!!! George is currently pumping his stock portfolios because that's what

George does best! He is nothing more than an ambulance chaser and will

ALWAYS look out for George and only George!"

Up $25. Horse could not hold the lead.

Logical Myth scratched in a $500,000 race. Curious as to why. I don't believe the horse had a chance. HMMMM MM

First race at Oaklawn. # 2, US Army, George's horse, 1st time on Lasix. With only a six horse field, may be a good bet.

$50 across.

Where?

Oaklawn Park - 3/30/2024

Race Race PP ($1.00) Race Type Breed Purse Surface Horse Jockey

1 Allowance Optional Claiming TB $150,000 Dirt U. S. Army Cristian Torres

9 Oaklawn Mile Stakes (Gr. 3) TB $500,000 Dirt Logical Myth Francisco Arrieta

https://www.equibase.com/profiles/Results.cfm?type=People&searchType=O&eID=2019898&rbt=TB

He has four entered for the day.

surfkast

Member Level

Re: None

Friday, March 29, 2024 8:47:48 AM

Post#

170553

of 170567

Anyone living near Oaklawn Park in Hot Springs AR can visit George tomorrow and ask him questions to his face! Two major races!

Oaklawn Park - 3/30/2024

Race Race PP ($1.00) Race Type Breed Purse Surface Horse Jockey

1 Allowance Optional Claiming TB $150,000 Dirt U. S. Army Cristian Torres

9 Oaklawn Mile Stakes (Gr. 3) TB $500,000 Dirt Logical Myth Francisco Arrieta

US Army may have a chance in a very tough field.

Logical Myth looks like a real longshot against this tough field. I would toss and look elsewhere.

Speaking of facts, Sharp had his entry claimed at Oaklawn Thursday, Look Sharp.

Horse went off at 1/5, it was a monster drop in class but hey George won one. He gave the horse away, entering him that far below his punching weight.

But when his shareholders in his collective trifecta of worthless shells basically bought all his racehorses, well it makes more sense.

He has two entries I've seen so far studying the DRF PP for tomorrow, it's Arkansas Derby day which is a formidable card, with great purses for almost all races.

Sharp is in a bit over his head, again, with his

entries tomorrow so far from what I've analyzed. Only thru 7 of 13 races so far yet.

I'll be in the infield in a suit enjoying the gorgeous women and great company - Sharp, well, I don't think he will be ringing the bell in the winners circle again tomorrow...

So true.

They and their handlers live in perpetual fear that Mr Sharp will outwit them once again to their financial detriment.

The group is obviously of foreign origin as they tend to use what their ESL teachers told them were insults decades ago.

Thus archaic terms such as carnie, clown, moron, etc etc etc appear over and over again.

Their posts were amusing in a sad sort of way for a while, but now they’ve just grown tiresome.

If they were actually native speaking North Americans they would grasp that the entire board is laughing AT them, certainly not WITH them.

Either way their effect on investors is negligible, as they primarily speak to fellow employees.

O11

No, you have it all wrong.

Carnies like yourself should keep buying all the way into oblivion.

The way they get it done is by not attacking the company...no....the way they do it is by attacking all the shareholders and members on a given stock board. It really gets ugly sometimes but you know....I guess shareholders like me need to be scared off from OTC stocks

I am paid with the great reward of exposing OTC scams. Nothing better than to bring down these serial scammers.

It seems you enjoy losing money to the scammers.

In looking at your posting history you follow Sharp on all of his scams.

So far the true believers have lost their ass on WNFT, SRNW and GVSI - and FORW is down 99%

IG

Can you do any real DD? Don't like facts? LOL

Wow! I'm impressed!!!! 37 posts in the last 24 hours!! Do you get paid in Pesos?

You really don't understand securities law.

And the S-1 isn't old news as it is extremely important - especially since the SEC hasn't reviewed the S-1 and posted comments.

It looks like FORW will never pass comments.

IG

It technically is new as the SEC still has not declared the filing to be in effect.

Old news Dimmer!!!

Can you cut and paste some new material?

But the little pumper girls are claiming that it is effective, but George is withholding it!

They can call posters names, but they have no comprehension.

Georgs can't hide or withhold anything. Once the SEC declares the S - 1 effective, it hits the filings the next day..

All the theories, are just unfounded bullshit theories to try and pump this POS up.

I will post the SEC link again. So sad!

Notifications of effectiveness for Securities Act registration statements and post-effective amendments (other than those that become effective automatically by law) are now posted to the EDGAR system the morning after a filing is determined to be effective. The new EDGAR form type for these notices is EFFECT.

https://www.sec.gov/edgar/searchedgar/edgarsearchupdates.htm#:~:text=Notifications%20of%20effectiveness%20for%20Securities,for%20these%20notices%20is%20EFFECT.

EDGAR Search

https://www.sec.gov/cgi-bin/browse-edgar?company=Forwardly&match=&CIK=&filenum=&State=&Country=&SIC=&owner=exclude&Find=Find+Companies&action=getcompany

LMAO! Sharp will never deliver little pumper boy.

Odd that the SEC hasn't reviewed the S-1 and still no comments.

"Form S-1 SEC Comment Period

Approximately two weeks after the filing of an S-1 Registration Statement the SEC completes its review. It then sends comments to the issuer and/or its securities attorney concerning the disclosures made."

You are clueless about securities law - and you are just another bottom feeding pumper-boy.

IG

You are one sick puppy by spending your day watching every trade of FORW. LMAO!!! Well, at the very least you'll be ready for the loonie farm once GS delivers. They might even give you a position as the trash door entrance guard. I hear it pays a peso an hour. Imagine that? They might even pay you in FORW shares, so you feel whole again.

Too funny!!!

The S-1 was filed on 12/19/23 - that has been 3 months and 10 days and still no comments from the SEC.

"Form S-1 SEC Comment Period

Approximately two weeks after the filing of an S-1 Registration Statement the SEC completes its review. It then sends Comments to the issuer and/or it's securities attorney concerning the disclosures made."

It is obvious that there is a problem with the S-1.

I doubt the SEC will ever deem the S-1 effective.

IG

You don't seem to understand that Sharp hasn't filed a 15c - it has been 3 years and Sharp hasn't accomplished anything!

But you have proven that you are just a Sharp paid pumper - that is clueless about securities law and investing in general.

IG

This is too funny - a desperate shareholder jumped the Ask to $0.0123 for 5000 shares. Oh wow, $60 to try and dupe the Sharp cult and novice investors.

It's been over 5 years that Sharp has been the CEO of FORW and he still hasn't accomplished anything of value.

IG

Go back to your Mexican looney house where there's always room for one more. LMAO!

Oh, BTW I disagree with your assessment. SRNW is so shovel-ready that it won't take much to get something very significant off the ground. Why anyone would try to scam a sure bet is just not smart and hence not Israeli. Patience will pay off with this one.

JMHO

I was following a very sophisticated scam - and I called every move they made and it was an Israeli company - the management vanished and the SEC takes a hard look at all things Israeli on the OTC.

The only thing brewing is more Sharp pumping and you being his biggest cheerleader.

How did the 2 assets Sharp brought into FORW work out - the answer is that they were both scams (Ligand and Maverick).

Let me quess - Sharp is really going to do something great and he really means it this time.

There aren't any deals - just your insane pumping.

IG

When you're dealing with Israelis, they, who pretty much wrote the rules also know how to move the goal posts. All I can say is that I'm pretty confident that something very significant is brewing and all we mortals can do is 'wait and see' what happens. At the end of the day, it's how this game has always been played.

What about the FORW S-1 do you think is sensitive info? Perhaps the offering price?

Like I said already, GS is probably holding it up on some minor technicality. If I was in his shoes and planning a strong re-entry, I'd certainly hold all of my 'powder' until I was ready to fire. GS is no fool. He's not going to repeat the GVSI pre-announcement mistake again.

JMHO

It was not effective and still is not. PS..They don't approve, they make it effective.I have posted a quote from the SEC website.

Notifications of effectiveness for Securities Act registration statements and post-effective amendments (other than those that become effective automatically by law) are now posted to the EDGAR system the morning after a filing is determined to be effective. The new EDGAR form type for these notices is EFFECT.

https://www.sec.gov/edgar/searchedgar/edgarsearchupdates.htm#:~:text=Notifications%20of%20effectiveness%20for%20Securities,for%20these%20notices%20is%20EFFECT.

EDGAR Search

https://www.sec.gov/cgi-bin/browse-edgar?company=Forwardly&match=&CIK=&filenum=&State=&Country=&SIC=&owner=exclude&Find=Find+Companies&action=getcompany

I'm not surprised to hear that the S-1 was approved back in January. There just wasn't any hard evidence in favor of a decline. The fact that it hasn't been posted officially also doesn't surprise me. I'm sure GS has found some minor technicality to stall the SEC from publishing it.

...which leads me to believe that GS is prepping for a very determined re-entry with a deal that not even his angriest opponents will be able to derail.

I'm of the belief that GS (with the advise of his Israeli partners) orchestrated an ugly scenario to achieve two goals. First, they had to get rid of the unruly OTC retail shareholders/flippers. They had become a liability for any deal and had to go. So far it appears by the reduced number of messages on this board and others that he's removed the undesirables. Second, he's opened up his SPAC to the would be investors to pick up some cheap shares. As DrugDoctor noted on the SRNW board recently, the accumulation numbers for SRNW have increased notably in the past few weeks. By redistributing shares from weak hands to stronger ones, GS can close an awesome deal, especially with SRNW, since its float is a mere 50m shares. Any rise in SRNW will also affect FORW.

JMHO

I'm not surprised to hear that the S-1 was approved back in January. There just wasn't any hard evidence in favor of a decline. The fact that it hasn't been posted officially also doesn't surprise me. I'm sure GS has found some minor technicality to stall the SEC from publishing it.

...which leads me to believe that GS is prepping for a very determined re-entry with a deal that not even his angriest opponents will be able to derail.

I'm of the belief that GS (with the advise of his Israeli partners) orchestrated an ugly scenario to achieve two goals. First, they had to get rid of the unruly OTC retail shareholders/flippers. They had become a liability for any deal and had to go. So far it appears by the reduced number of messages on this board and others that he's removed the undesirables. Second, he's opened up his SPAC to the would be investors to pick up some cheap shares. As DrugDoctor noted on the SRNW board recently, the accumulation numbers for SRNW have increased notably in the past few weeks. By redistributing shares from weak hands to stronger ones, GS can close an awesome deal, especially with SRNW, since its float is a mere 50m shares. Any rise in SRNW will also affect FORW.

JMHO

No. The SEC will upload the document once effective

Is it possible that FORW's S-1 was actually marked effective on 1/24/2024? And it' being kept confidential

Notifications of effectiveness for Securities Act registration statements and post-effective amendments (other than those that become effective automatically by law) are now posted to the EDGAR system the morning after a filing is determined to be effective. The new EDGAR form type for these notices is EFFECT.

https://www.sec.gov/edgar/searchedgar/edgarsearchupdates.htm#:~:text=Notifications%20of%20effectiveness%20for%20Securities,for%20these%20notices%20is%20EFFECT.

EDGAR Search

https://www.sec.gov/cgi-bin/browse-edgar?company=Forwardly&match=&CIK=&filenum=&State=&Country=&SIC=&owner=exclude&Find=Find+Companies&action=getcompany

This is great new information and I learn something new every day and because I'm not from America, I find it very interesting how things are going in your country and I think you are right and I have noticed that $FORW has shown very good strength in the last few days and does not want to go down! ........ The tendency is rather that this stock $FORW wants to go up. There are definitely some reasons running in the background, so I think we have an exciting time ahead of us and the patient ones will be the winners.

Hey MrSmith18, I got curious and found something interesting. Per this the OTC Updates Twitter handle, 141m shares were added to FORW float on 1/24/2024. This is the approx. the same number of shares that was registered in the FORW S-1 (~138m).

ChatGPT says: Yes, when an S-1 registration statement is marked effective by the SEC, the newly registered shares are typically added to the company's float. The float refers to the number of shares actually available for trading by the public. Once the SEC declares the S-1 effective, the company can issue the registered securities, and these shares can then be traded on the open market, thereby increasing the float.

Is it possible that FORW's S-1 was actually marked effective on 1/24/2024? And it' being kept confidential because it in some way reveals the SRNW merger? Thoughts? Thanks!

Hey MrSmith18, I got curious and found something interesting. Per this the OTC Updates Twitter handle, 141m shares were added to FORW float on 1/24/2024. This is the approx. the same number of shares that was registered in the FORW S-1 (~138m).

ChatGPT says: Yes, when an S-1 registration statement is marked effective by the SEC, the newly registered shares are typically added to the company's float. The float refers to the number of shares actually available for trading by the public. Once the SEC declares the S-1 effective, the company can issue the registered securities, and these shares can then be traded on the open market, thereby increasing the float.

Is it possible that FORW's S-1 was actually marked effective on 1/24/2024? And it' being kept confidential because it in some way reveals the SRNW merger? Thoughts? Thanks!

Absolutely agree, I really like that we are going up 10% every day without any news and as far as I'm concerned it can continue like this or someone is quietly collecting in the background, so the chart is crying out for a breakout and with every little news or update $FORW flies

imho

$FORW keeps creeping back up... with no NEWS... someone knows something...

Yep, and it's going to hit at any time now! Got shares? You know I do!

Correct. My point is that I don't believe it was approved. Remember it was filed on December 18, 2023. The usual response time is 4 weeks for SEC comments. Based on other filings, I believe due to the time frame, there are issues.

SEC's response will become publicly available after the completion of the securities offering but not earlier than 20 business days following the effective date of the registration statement.

If the S 1 was approved the SEC would have filed a NOTICE OF EFFECTIVENESS statement.

SRNW and FORW are joined at the hip. As long as FORW holds unexpired SRNW warrants, the pps will follow that of SRNW. As of January the ratio appears to be as follows: For every $0.17 that SRNW rises or falls, FORW moved a penny. The ratio is based on historic data and could change due to external factors plus the two warrant's respective expiration dates.

All that said...

I'm guessing that the S-1 has been approved. There's no reason for it not to. GS is probably waiting on an approval deadline to either close a deal or continue negotiating. The basis for my guess was basically taken from the same playbook for GVSI where GS set a date and allowed for an extension. The difference being this time is that he's working this deal behind the scenes to avoid a calamity similar to March 15. Just as a guess, maybe that date in question is March 31 or April 1. Knowing GS's cynical humor, I'd take the latter for April Fool's Day.

JMHO

My bad. Since it is not listed on the OTCM page I did not see it. I see it now on the EDGAR site.

. Interesting that it has now been over three months and no update. Based on seeing years of filings posted, there apparently are SEC issues that need to be resolved.

Yeah, the S-1 shows up on EDGAR so it definitely got filed. However there are no public filings after that.

|

Followers

|

1055

|

Posters

|

|

|

Posts (Today)

|

0

|

Posts (Total)

|

344073

|

|

Created

|

05/17/06

|

Type

|

Free

|

| Moderators Drugdoctor surfkast Huggy Bear al19 SmellMyFinger | |||

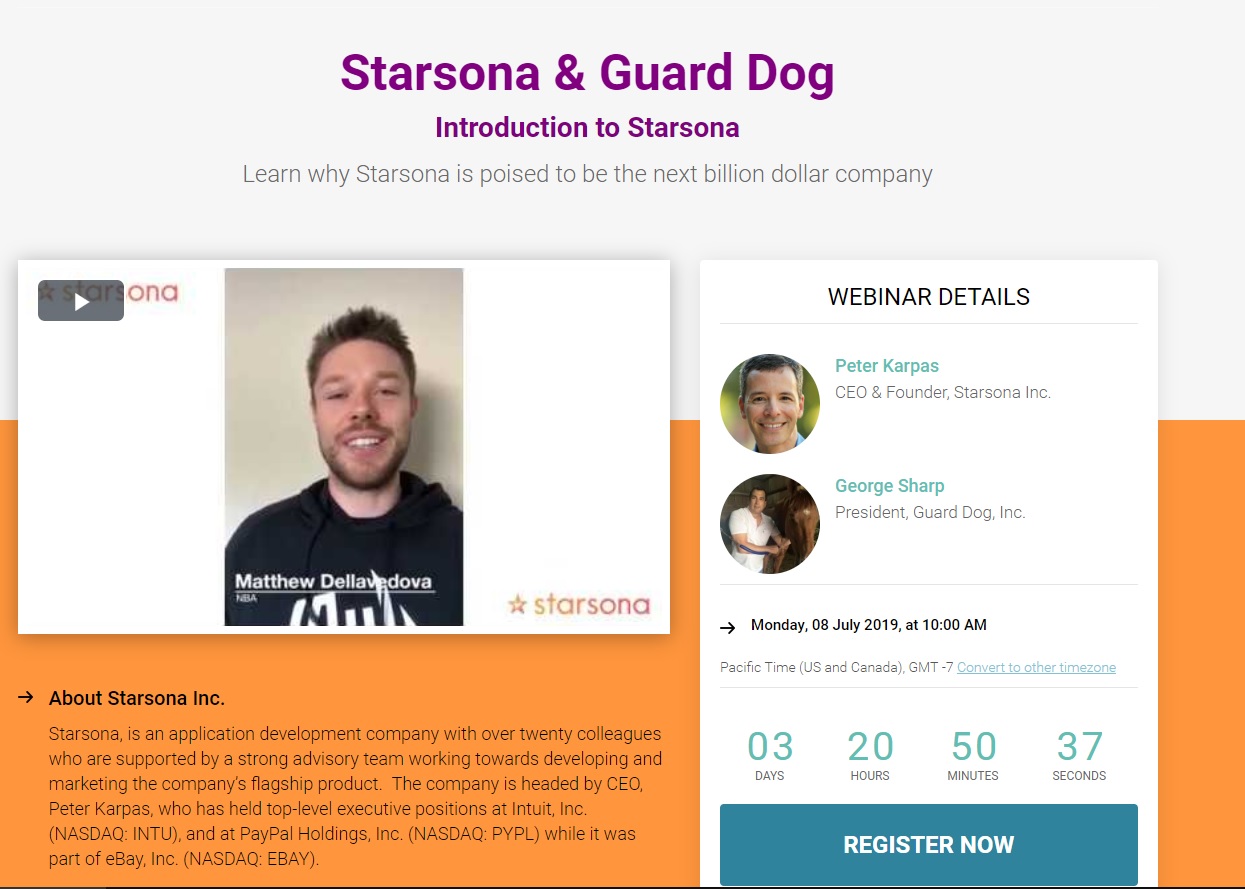

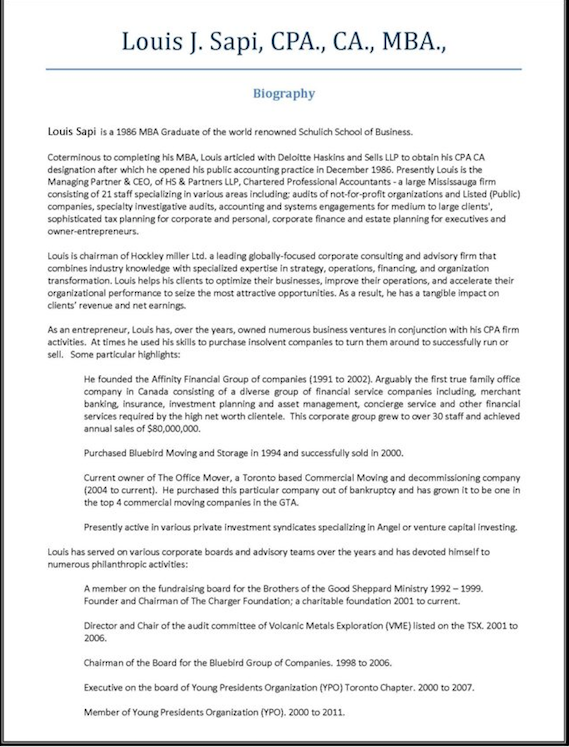

George A. Sharp

George Sharp is an experienced businessman with a diverse background in information technology and growth companies.After studying at Canada’s University of Waterloo, George joined the Engineering Department of the City of Calgary’s Electric System. There, George engineered a software application to more accurately examine the physical stresses on electrical wood poles. That effort garnered him recognition at the 1983 Stanford University Congress of Electrical Engineers. George was then recruited to join Northern Telecom in Bramalea, Ontario as a software engineering consultant. In the early 1990s, George founded Progressive Microsystem Designs to develop a series of business software applications for the emerging microcomputer market. The centerpiece of PMD was one of the first Human Resources Administration software products designed for microcomputers. Eventually, George relocated PMD to Southern California in order to better service the bulk of its clients. Since 2002, after being a victim himself, George has dedicated himself to eradicating stock market fraud, specifically in the micro-cap genre. He has become a well-known and outspoken activist against penny stock fraud and has appeared on television and as an expert witness in litigation. His work has launched or contributed to investigations by the United States Securities and Exchange Commission (SEC), the Financial Industry Regulatory Industry (FINRA), the United States Department of Justice/FBI and the Alberta Securities Commission, many of which have resulted in criminal and civil charges. A former consultant to OTC Markets Group, George now provides services to publicly traded small companies seeking management advice; routes, including financing, towards progress; and, looking to stay onside of regulations.

******

******

The following info is for the WRONG Leonard Harris:

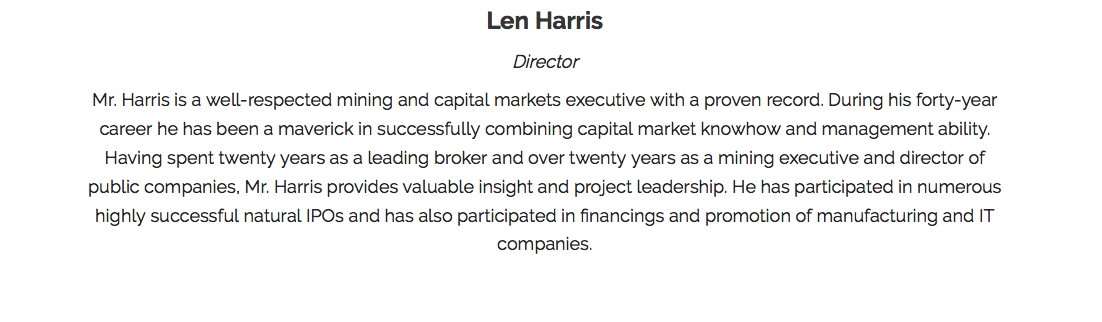

Leonard Harris - Director:

Leonard Harris Mr. Harris is a professional engineer with Metallurgy diploma and 50 years’ experience in all aspects of mineral processing and mining operations worldwide, a significant part of which has been in South America. Mr. Harris spent 16 years with Cerro de Pasco Corporation before joining Newmont Mining Corporation, where he served as President and General Manager of Newmont Peru Limited and Vice-President and General Manager of Newmont Latin America. Mr. Harris was General Manager (involved in construction and operation) of the Minera Yanacocha gold mine in Peru. Since 1995, Mr. Harris has been a consultant and director of several small capitalized mining companies including Glamis Gold Ltd., Solitario Resources Inc., Alamos Gold Inc., Corriente Resources Inc., Endeavour Silver Corp. and Cardero Resource Corp. In such roles, he has had extensive experience with the review and understanding of the accounting principles relevant to the financial statements of public natural resource companies, including companies comparable to the Company.

******

******

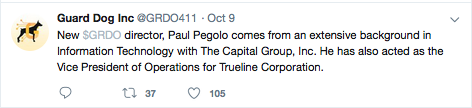

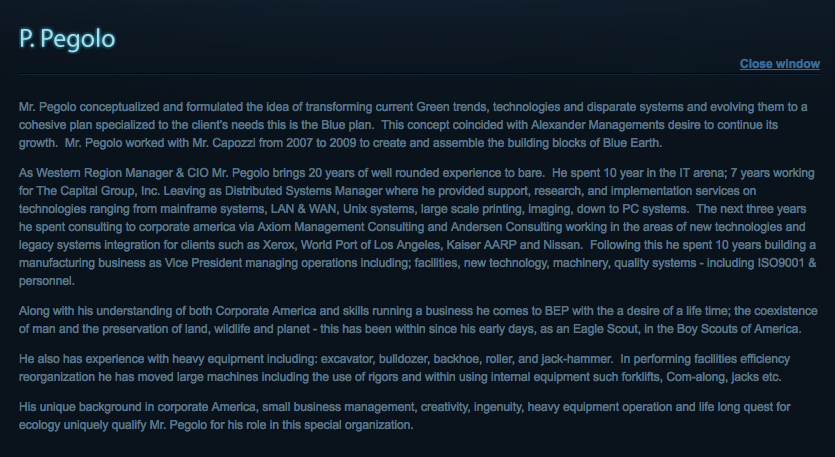

Paul Pegolo - Director:

“As Western Region Manager & CIO Mr. Pegolo brings 20 years of well rounded experience to bare. He spent 10 year in the IT arena; 7 years working for The Capital Group, Inc. Leaving as Distributed Systems Manager where he provided support, research, and implementation services on technologies ranging from mainframe systems, LAN & WAN, Unix systems, large scale printing, imaging, down to PC systems. The next three years he spent consulting to corporate america via Axiom Management Consulting and Andersen Consulting working in the areas of new technologies and legacy systems integration for clients such as Xerox, World Port of Los Angeles, Kaiser AARP and Nissan. Following this he spent 10 years building a manufacturing business as Vice President managing operations including; facilities, new technology, machinery, quality systems - including ISO9001 & personnel.”

BOULDER CITY, Nev., Sept. 23, 2019

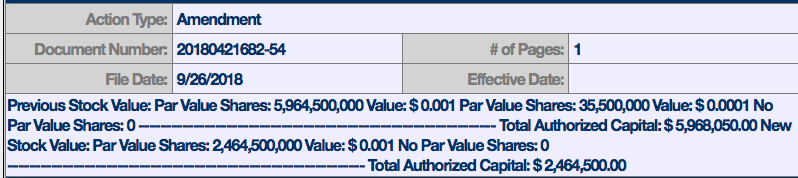

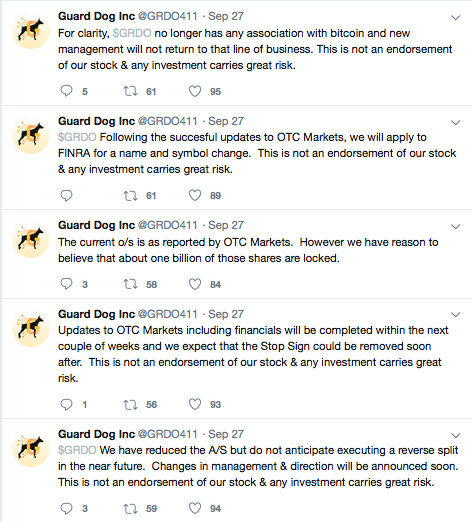

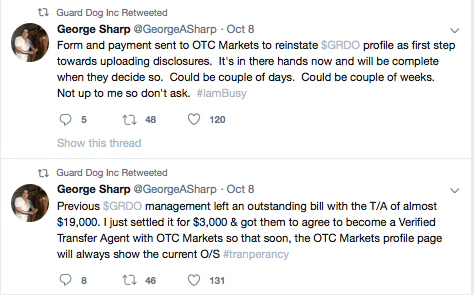

BOULDER CITY, Nev., Oct. 25, 2019 (GLOBE NEWSWIRE) -- via OTC PR WIRE – George Sharp, President of Guard Dog, Inc. (PINKSHEETS: GRDO) announced today that the company’s securities counsel is continuing to work with Nevada’s office of the Secretary of State to unwind and correct past corporate actions, which if left as is would have made it impossible for the corporation to move forward with its plans. As a result of these past corporate actions, some going back as far as when the corporation was formed, the more recent actions initiated by current management also had to be unwound. Shareholders may notice a series of temporary changes to the number of authorized and outstanding shares, but once the required and proper corporate actions have been completed, these numbers will return to their expected state and the company will resume its application to FINRA for a name change and one for eight reverse split. Management expects all of this to be completed at some time during November.

The company’s Starsona investment remains in the company’s plans and a Definitive Agreement is expected to be executed once the company’s corporate structure and capitalization has been finalized.

NOTE 5 – CONVERTIBLE PROMISSORY NOTES The Company entered into promissory notes as follows as of June 30, 2020 and December 31, 2019: Principal Accrued Interest Principal Accrued Interest August through September 2019 $300,000 Notes convertible into common stock at $0.0032 per share, 15% interest, due one year from issuance (August through September 2020) with issuance of 46,875,000 warrants with a term of three-years and an exercise price of $0.0064 per share $ 300,000 $ 37,336 $ 300,000 14,959 Total Convertible Notes Payable, Net $ 300,000 $ 37,336 $ 300,000 $ 14,959 Less: Debt Discount (22,321) - (85,396) - $ 277,679 $ 37,336 $ 214,604 $ 14,959 Interest expense for the six months ended June 30, 2020 amounted to $22,377 and accrued at June 30, 2020 was $37,356. Amortization of the debt discount for the six months ended June 30, 2020 was $63,075.

Dubbed the LifeAir G1, Sapi said the emergency ventilator was initially designed to be sold for about $1,000 U.S., making it more affordable for poor and remote hospitals and clinics in the developing world.

The business group recently received $150,000 in funding from an American seed money startup accelerator called Y Combinator, which Sapi said has helped finalize the prototype and get the emergency ventilator closer to Health Canada for possible certification.

Sapi said the group is about three to four weeks away from having its prototype tested to World Health Organization (WHO) parameters. He said the finalized design is now with Health Canada for certification.

https://www.ligandglobal.com/our-team

FORW recently secured exclusive US distribution rights to LifeAir, a patent pending, non-invasive ventilator currently under development by Ligand Innovation Global, a Canadian corporation. A newer iteration of the LifeAir ventilator is currently being engineered for a summer 2020 submission to the US Food and Drug Administration (“FDA”) and Canada Health in the hopes of obtaining fast track approval. In June the Company filed its application to raise up to $15 million under Regulation A+. More recently FORW received funding commitments of $500,000 of an anticipated total of $1.3 million in financing and will itself fund Ligand Global Innovation’s development of its latest prototype of the LifeAir G1 Portable Ventilator.

| PUBLISH DATE | TITLE | PERIOD END DATE | STATUS |

|---|---|---|---|

| 11/18/2020 | Quarterly Report - Amended Report for Period Ending 9-30-2020 | 09/30/2020 | A |

| 09/29/2020 | Attorney Letter with Respect to Current Information - Attorney Opinion Letter Re: Annual Report Ending December 31, 2019 | 12/31/2019 | A |

| 09/27/2020 | Quarterly Report - Second Amended Report for Period Ending 3-31-2020 | 03/31/2020 | A |

| 09/27/2020 | Annual Report - Amended Annual Report for Year Ending 12-31-2019 | 12/31/2019 | A |

| 07/31/2020 | Quarterly Report - Quarterly Report - Amended Report for Period Ending 6-30-2020 | 06/30/2020 | A |

| 11/11/2019 | Quarterly Report - Amended Report for Period Ending 9-30-2019 | 09/30/2019 | A |

| 08/12/2019 | Attorney Letter with Respect to Current Information - Attorney Letter with Respect to Current Information | 12/31/2018 | A |

| 08/02/2019 | Quarterly Report - Quarterly Report | 06/30/2019 | A |

| 04/30/2019 | Quarterly Report - Quarterly Report for Period Ending March 31, 2019 | 03/31/2019 | A |

| Volume | |

| Day Range: | |

| Bid Price | |

| Ask Price | |

| Last Trade Time: |