Register for free to join our community of investors and share your ideas. You will also get access to streaming quotes, interactive charts, trades, portfolio, live options flow and more tools.

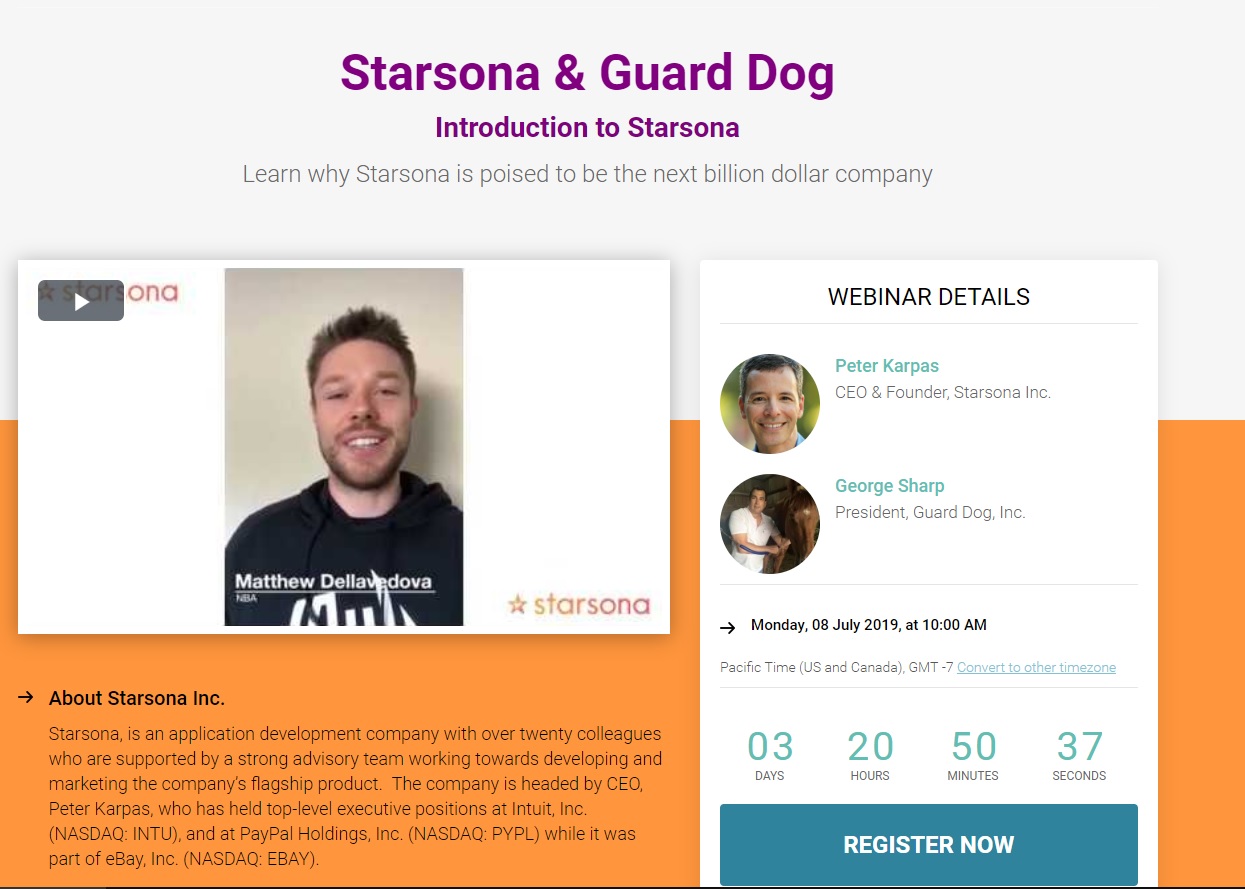

Lets not forget the Starsona fiasco and how the HMBL warrants only made coin for George to pocket!

$FORW look at the beginning chart, the low was 0.005 and now 0.0096 (yesterday we even saw $0.0115. That's over 100% increase and profit since the low, maybe the $FORW chart will now form an upward trend and then there will be a wonderful upward trend and then there will be news or an update and then it will really get going. We'll see)

https://www.stockscores.com/charts/charts/?ticker=forw

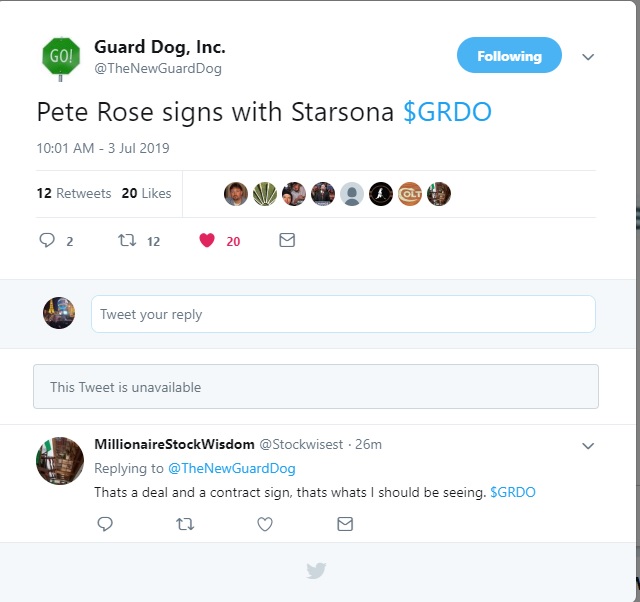

Nothing more reliable than a post Twitter from Sharp. LMAO!

"George Sharp - Advocate for truth in the OTC

@GeorgeASharp

15h

Well, the vetting in search of legitimate assets for $SRNW $WNFT $FORW and $GVSI continues. So much for my retirement this year. But I continue to sift through the inquiries."

Let's see Sharp filed a S-1 over 10 months ago and the SEC still hasn't granted it effective.

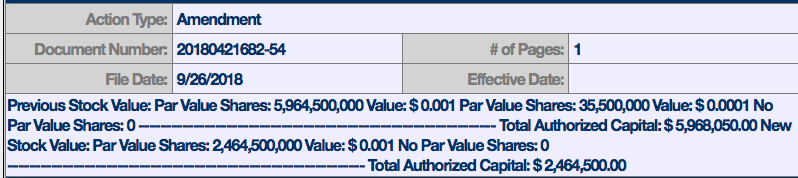

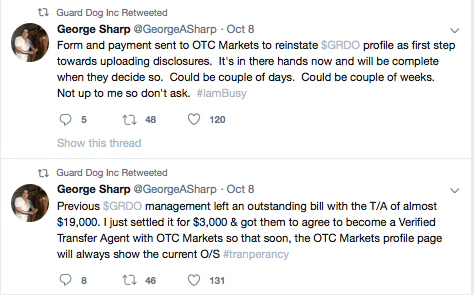

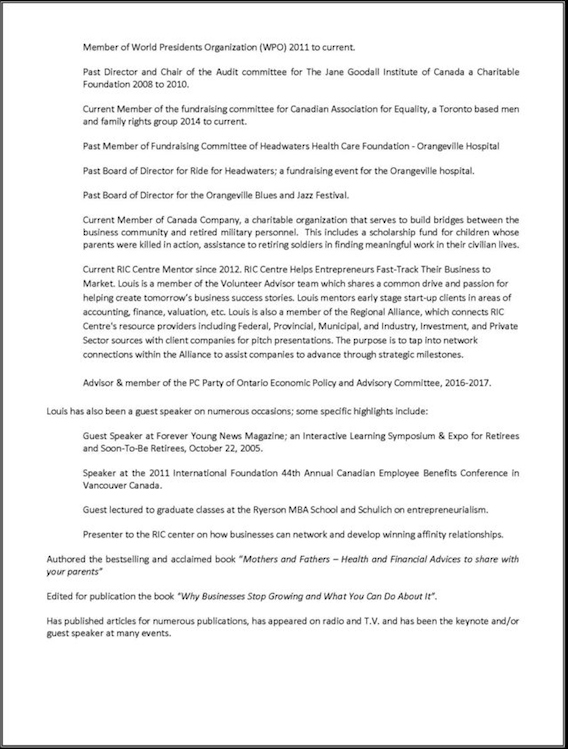

Sharp hasn't filed a Form 211 for GVSI, SRNW and WNFT. And FORW is an old Bill Schaefer scam GRDO - and there never was any detail released about how Sharp gained control of the shell - but you can bet the SEC wants to know and that is why it has been over 10 months since the S-1 was filed.

Sharp filed a Form 15 on WNFT and deregistered the stock and stopped all SEC filing Obligations.

Sharp had over 3 years to vet legitimate assets - but Sharp vetted 2 companies for FORW and they were both scams (Ligand and Maverick) - Sharp's incompetence in vetting companies - Sharp just isn't very bright.

He can only intimidate the true believers - those are the only people he can bully.

IG

George is a pos, who cares. Most people are down so much from that clown.

He's never retiring, nobody wants to do business with a creep like him period.

Let’s go George we believe!

George says he is still working-for-us! Twitter-post- "Well, the vetting in search of legitimate assets for $SRNW $WNFT $FORW and $GVSI continues. So much for my retirement this year. But I continue to sift through the inquiries."

Just another Sharp scam dude.

YW. I try to post good DD based on facts. Enjoy and be well.

There is nothing to say about Ligand Innovation Global and its VitaCaeli G1. The FDA denied their application and as far as I can tell they never got FDA approva and FORW declared their investment impaired..

The Company was notified that the FDA has rejected the application for Emergency Use

Authorization and will continue to focus on the full application to the FDA and on exploring

alternate jurisdictions for approval of the LifeAirG1

On May 26, 2020, the Company and Ligand Innovation Global, a Canadian Corporation

(“Ligand”) entered into an Exclusive Distributor Agreement (“Distributor Agreement”).

Pursuant to the Distributor Agreement, the Company is appointed the exclusive distributor for

all portable ventilator product lines, including, but not limited to, all models, variations,

generations and upgrades to the product currently identified as LifeAir G1, and any similar

product lines under different names (“Product”) in the United States of America (“Territory”).

The Distributor Agreement shall continue in perpetuity unless terminated earlier and may be

terminated for breach if any party defaults in the performance of any material obligation in the

Distributor Agreement, for insolvency, by Ligand for lack of performance should the Company

in two years after approval by the United States Food and Drug Administration no sell at least

1,000 units, and under which the Company agreed to issue 2,000 shares of Series D Preferred

Stock upon Ligand’s ventilators receiving FDA approval for commercial use and an option to

purchase 10 million shares of the Company’s common stock for a 12 month exercise period

upon such FDA approval as well as availability of the ventilators for sale by the Company.

The Company was notified that the FDA has rejected the application for Emergency Use

Authorization and will continue to focus on the full application to the FDA and on exploring

alternate jurisdictions for approval of the LifeAirG1.

On April 8, 2021, Ligand and the Company entered into a Share Purchase Agreement (the

“SPA”) whereby the Company has agreed to purchase 33.33% of Ligand for $1,000,000 which

is equal to 1,304,152 shares of Ligand stock. The Company will be the largest individual

shareholder in Ligand but does not exercise any operational or financial control of Ligand. The

Company will account for this investment under the guidance of ASC 321. The Company has

elected to apply the measurement alternative discussed in ASC 321-10-35-2, and as a result

will measure the investment at cost and adjust to fair value if impaired or upon observable

prices. The Company determined to impair the investment at June 30, 2022.

The Ligand resuscitator has been pumped since 2016 and by Sharp since 2020. It was pumped during Covid and Sharp has posted at least 3 times about the FDA fast tracking the Nigerian Doctor's resuscitator. Surf knows a great deal about Ligand - hopefully he jumps in.

"Boulder City, Nevada--(Newsfile Corp. - August 31, 2020) - George Sharp, President and CEO of Forwardly, Inc. (OTC PINK: FORW), announced today that it has already received funding commitments of $500,000 of an anticipated total of $1.3 million in financing and will itself fund Ligand Global Innovation's ("Ligand") development of its latest prototype of the LifeAir G1 Portable... As announced in a June 15, 2020 press release, Forwardly, through its wholly owned subsidiary, Breathe Medical Devices, Inc., has obtained the exclusive US distribution rights to the LifeAir line of ventilator products."

IG

Come on George, believe in you

Make this SEC compliant & Merge that medical device (may it be a home run) here...

Make this the 1st of your four horses to run wild...

Then draw out the Hammer of the Gods ⚡️ and knock the other 3 also out of the park (along with all the painfully obvious shills that post here)

Let's go Go GO

You have been yammering about accumulation since 2021 - here is a post about 2021.

"Drugdoctor

Tuesday, 09/07/2021 11:09:50 AM

We have reached equilibrium after todays weak hands panicked and left...

Now we likely have a steady accumulation starting until filings start hitting SEC...."

You have less than zero credibility.

IG

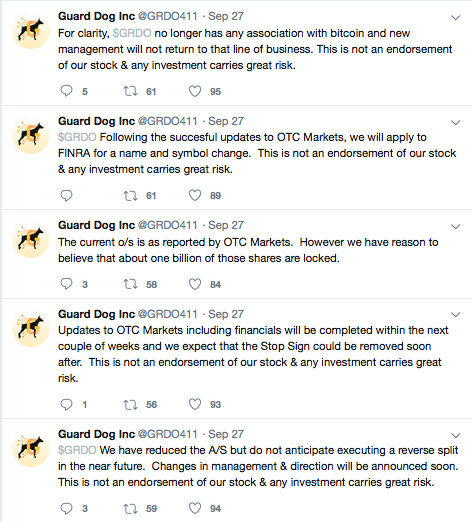

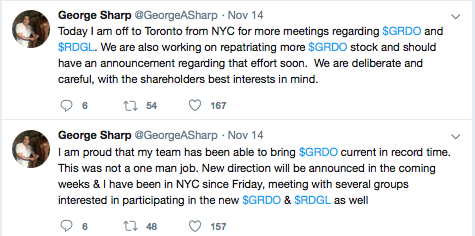

6 years of failed promises by Sharp.

"BOULDER CITY, Nev., Oct. 12, 2018 (GLOBE NEWSWIRE) -- via OTC PR WIRE – Guard Dog, Inc. (PINKSHEETS: GRDO) has unveiled a new management team led by well-known microcap analyst, George Sharp, who will act as President and CEO of the company"

So Bill Schaefer named Sharp the CEO. LMAO!

It has been a little over 6 years and Sharp has brought in two assets (Ligand and Maverick) both were obvious scams.

What happened to the S-1 Sharp filed for FORW? Sharp filed the S-1 on 12/19/2023 - so it has been 10 months since Sharp filed - and still nothing.

Typical Sharp move - he filed for a Reg A+ on 06/12/2020 and on 02/28/2022 the SEC declared it abandoned.

"Forwardly, Inc. filed with the Commission an offering statement to qualify an offering of securities under Section 3(b) of the Securities Act of 1933.

The offering statement has been on file for more than nine months and has not yet been qualified.

In view of the foregoing, it is ORDERED that the offering statement be declared abandoned on February 28, 2022.

For the Commission, by the Division of Corporation Finance, pursuant to delegated authority."

More Sharp big talk.

IG

FORW has been waiting for 6 years for the big news but Sharp has fail to deliver.

For today:

"Buy: 172K for Neutral: 15K Sell: 914K"

Much more Sells than Buys.

IG

You bet - people want $FORW before the NEWS hits!

up ....Do you see that?

Getting near the end of the year. George may need to make deposits on his stables, etc. for next year. His stocks will probably sink to 52 week lows.

Can't argue with logic. This is bound to go lower.

Low volume manipulation with 6 - 1 sells to buys is a great day?

George's stocks did well today!

Come on George, let's round that corner & head into the final stretch here 🐎

Kay sera sera but betting on all four of your ponies and my belief in you

💪👍

Two other scams being pumped and extracting money from novice investors.

"OTCs heating up! Huge winners noted-check-$CYBL-and-$ALYI the past 2 days.... Let's go George - the timing is right!"

Now that is desperation.

IG

Those .0075s didn't last long!

OTCs heating up! Huge winners noted-check-$CYBL-and-$ALYI the past 2 days.... Let's go George - the timing is right!

wondering…if Forwardly’s first…

Or does C get kicked to the curb, moving WNF!!! into the pole position…

Or could Sharp shock us all with an out of the blue announcement for Stratos to the stratosphere…

It’s been a few years watching this unwind…

Come on George, time to lay the hammer of the Gods down on these 3 plays ![]()

This scam will never be a SEC registrant security.

Going back down. But I read this was being accumulated.

Plus, this is an old Bill Schaefer shell - GRDO.

"The current president and secretary of the Company Bill Schaefer, was hired

on October 1, 2013. Mr. Schaefer is also the chairman and sole current

member of the Board of Directors of the Company."

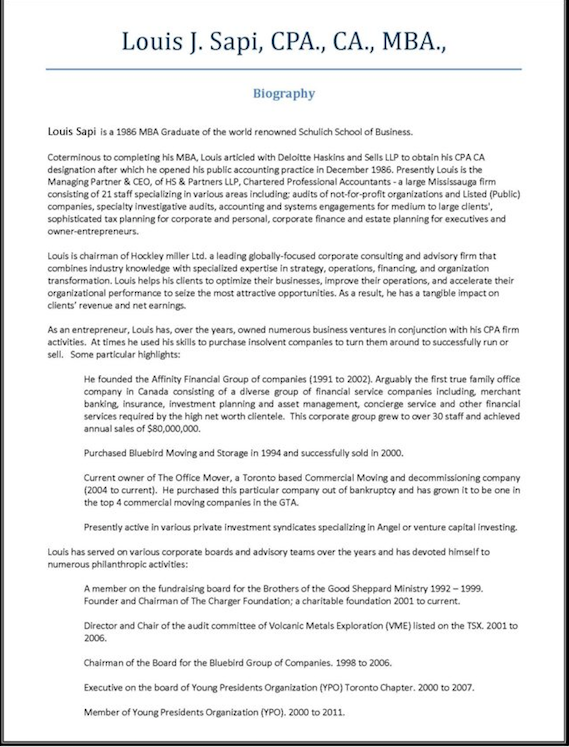

And Schaefer's Attorney and CPA

"Vic Devlaeminck"

I believe that the SEC will require Sharp to go back to 2015 with audited financials.

SEC registration would need audited financials. This shell is dirty. What fantasy merger? George has a track record of scam companies here.

Starsona, Breathe Medical and Maverick. George has no credibility.

At least any & all money to be made on this play (fingers crossed) will be long term cap gains…(for me)…

Must be close to SEC registration / merger news?

Here’s hoping if it’s a healthcare company like George stated, it’s a Hell of a Health Care company, w a potential BIG market cap…

Good luck to us who have/are sticking this one out (not to the paid shills) ![]() but to us, “real investors” 😉

but to us, “real investors” 😉

How many years have you been posting about accumulation?

"Drugdoctor

Friday, 12/29/2023 4:10:04 PM

What a beautiful $FORW trading day/week! It's all coming together now, HUGE ACCUMULATION happening!"

"Drugdoctor

Thursday, 03/02/2023 1:00:55 PM

$WNFT and TRIFECTA shares are under heavy accumulation now, as SMART MONEY is moving in on these low prices"

"Drugdoctor

Thursday, 02/09/2023 11:01:05 AM

Capitulation has turned into accumulation on the 1 minute chart - nice"

"Drugdoctor

Tuesday, 08/23/2022 11:02:04 PM

Yes, huge accumulation seen here now. Every dip below .06 is bought hard"

Anyone accumulating the Sharp garbage - is underwater.

IG

Now that is a good one with 80,000 traded 50/50 buys to sells.

Looks like the quiet accumulation is starting here $FORW

Who knows what's going on here? Many do, George is a failure! Just look at his history of bringing in more scams into his scam.

Who knows what's going on here, maybe the bashers here on board pushed it down to .0065 and it's cheap to collect (no idea who - what - why is pushing it down) and it's too quiet with the bashers and maybe they pushed and got in cheaply and want to take 100% quicker, only to then write bad posts and repeat the whole process (and that's how some people make their money)

No idea, but I suspect that as soon as there's an update or a rumor or a tweet, it's all going to take off - steeply upwards

Everyone is assuming, of course, that GS won't be dealing with its shares again until mid-2025

and there's a saying that "the unexpected often happens"

and if GS delivers or writes or shares its plan "before" summer 2025, then it will go up faster than most people think, as many people are certainly investing their money elsewhere because they think they still have time until spring/summer 2025,

all only imho

The ask size is hidden by the market takers, but that is a nice bid they are showing. Go George $FORW

..... and very thin on .0065 🥳

on .0063 - very great BID now , wow

Yep, looks like someone is liquidating a position down here. Guess old George made him wait too long, lol.

We also remember when George told you to STFU! LOL

Fair value is ZERO.

Ah, remember when, George used to give updates on Friday, and we would spend the weekend speculating on how much higher the stock would go next week? Those were the days...

I am not wrong about securities law - once again you are posting false and misleading information for pumping purposes only.

Hey your Hero Sharp was eviserated by Hindenburg Research and - https://hindenburgresearch.com/humbl/

"The strategy was orchestrated in part by the company’s financial advisor and a major warrant holder, George Sharp, who gaslit investors following revelations of the issuance, later saying details on corporate action were withheld so as not to create “mass panic” and to save investors from themselves."

"But HUMBL Shareholders Weren’t Told That Insiders Were To Be Issued Preferred Shares Convertible Into ~5.54 Billion Common Shares Until Over 4 Months Later The HUMBL deal was shepherded by OTC investor George Sharp"

"I’m not easily impressed, but I was blown apart,” Sharp said about his introduction to HUMBL…This deal is going to bring credibility finally to the OTC."

Sharp is a bottom feeding pumper and serial scammer.

And I told everyone that HUMBL was a OTC share selling scheme before the Hindenburg Research report was released.

I posted that HUMBL was frontloaded and pumped on 11/10/2020. The Hindenburg report was published on May 20, 2021.

Huggy was there from the beginning.

So you keep being Sharp's little pumper boy.

IG

|

Followers

|

1054

|

Posters

|

|

|

Posts (Today)

|

0

|

Posts (Total)

|

344065

|

|

Created

|

05/17/06

|

Type

|

Free

|

| Moderators Drugdoctor surfkast Huggy Bear al19 SmellMyFinger | |||

George A. Sharp

George Sharp is an experienced businessman with a diverse background in information technology and growth companies.After studying at Canada’s University of Waterloo, George joined the Engineering Department of the City of Calgary’s Electric System. There, George engineered a software application to more accurately examine the physical stresses on electrical wood poles. That effort garnered him recognition at the 1983 Stanford University Congress of Electrical Engineers. George was then recruited to join Northern Telecom in Bramalea, Ontario as a software engineering consultant. In the early 1990s, George founded Progressive Microsystem Designs to develop a series of business software applications for the emerging microcomputer market. The centerpiece of PMD was one of the first Human Resources Administration software products designed for microcomputers. Eventually, George relocated PMD to Southern California in order to better service the bulk of its clients. Since 2002, after being a victim himself, George has dedicated himself to eradicating stock market fraud, specifically in the micro-cap genre. He has become a well-known and outspoken activist against penny stock fraud and has appeared on television and as an expert witness in litigation. His work has launched or contributed to investigations by the United States Securities and Exchange Commission (SEC), the Financial Industry Regulatory Industry (FINRA), the United States Department of Justice/FBI and the Alberta Securities Commission, many of which have resulted in criminal and civil charges. A former consultant to OTC Markets Group, George now provides services to publicly traded small companies seeking management advice; routes, including financing, towards progress; and, looking to stay onside of regulations.

******

******

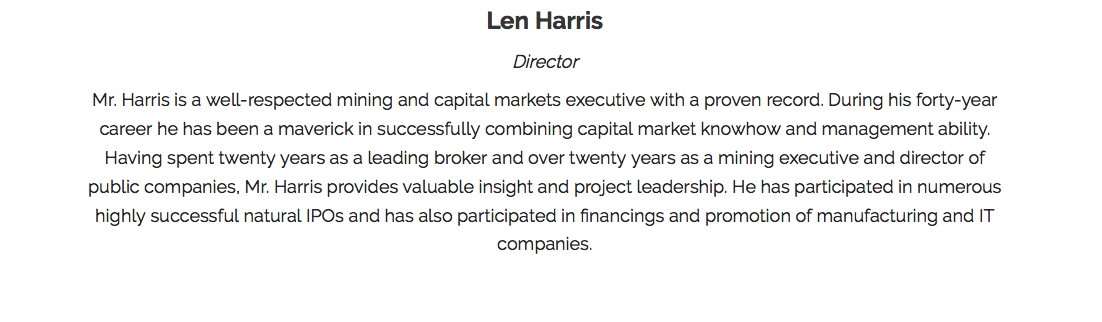

The following info is for the WRONG Leonard Harris:

Leonard Harris - Director:

Leonard Harris Mr. Harris is a professional engineer with Metallurgy diploma and 50 years’ experience in all aspects of mineral processing and mining operations worldwide, a significant part of which has been in South America. Mr. Harris spent 16 years with Cerro de Pasco Corporation before joining Newmont Mining Corporation, where he served as President and General Manager of Newmont Peru Limited and Vice-President and General Manager of Newmont Latin America. Mr. Harris was General Manager (involved in construction and operation) of the Minera Yanacocha gold mine in Peru. Since 1995, Mr. Harris has been a consultant and director of several small capitalized mining companies including Glamis Gold Ltd., Solitario Resources Inc., Alamos Gold Inc., Corriente Resources Inc., Endeavour Silver Corp. and Cardero Resource Corp. In such roles, he has had extensive experience with the review and understanding of the accounting principles relevant to the financial statements of public natural resource companies, including companies comparable to the Company.

******

******

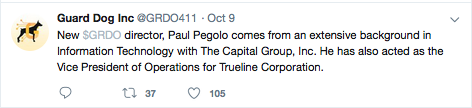

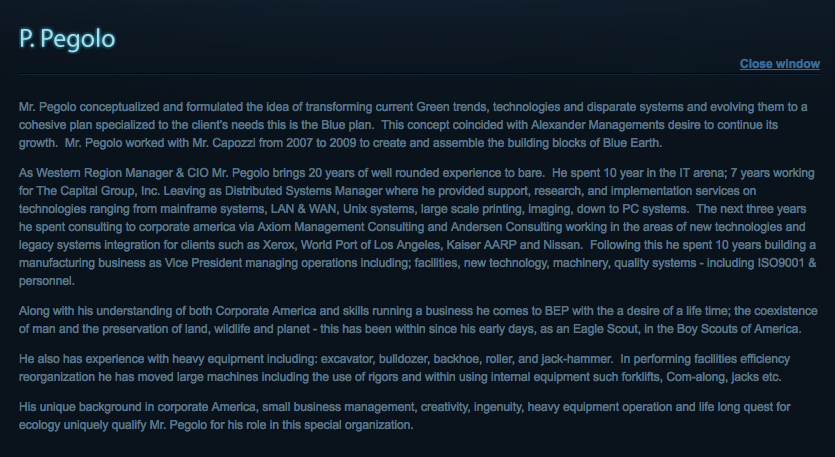

Paul Pegolo - Director:

“As Western Region Manager & CIO Mr. Pegolo brings 20 years of well rounded experience to bare. He spent 10 year in the IT arena; 7 years working for The Capital Group, Inc. Leaving as Distributed Systems Manager where he provided support, research, and implementation services on technologies ranging from mainframe systems, LAN & WAN, Unix systems, large scale printing, imaging, down to PC systems. The next three years he spent consulting to corporate america via Axiom Management Consulting and Andersen Consulting working in the areas of new technologies and legacy systems integration for clients such as Xerox, World Port of Los Angeles, Kaiser AARP and Nissan. Following this he spent 10 years building a manufacturing business as Vice President managing operations including; facilities, new technology, machinery, quality systems - including ISO9001 & personnel.”

BOULDER CITY, Nev., Sept. 23, 2019

BOULDER CITY, Nev., Oct. 25, 2019 (GLOBE NEWSWIRE) -- via OTC PR WIRE – George Sharp, President of Guard Dog, Inc. (PINKSHEETS: GRDO) announced today that the company’s securities counsel is continuing to work with Nevada’s office of the Secretary of State to unwind and correct past corporate actions, which if left as is would have made it impossible for the corporation to move forward with its plans. As a result of these past corporate actions, some going back as far as when the corporation was formed, the more recent actions initiated by current management also had to be unwound. Shareholders may notice a series of temporary changes to the number of authorized and outstanding shares, but once the required and proper corporate actions have been completed, these numbers will return to their expected state and the company will resume its application to FINRA for a name change and one for eight reverse split. Management expects all of this to be completed at some time during November.

The company’s Starsona investment remains in the company’s plans and a Definitive Agreement is expected to be executed once the company’s corporate structure and capitalization has been finalized.

NOTE 5 – CONVERTIBLE PROMISSORY NOTES The Company entered into promissory notes as follows as of June 30, 2020 and December 31, 2019: Principal Accrued Interest Principal Accrued Interest August through September 2019 $300,000 Notes convertible into common stock at $0.0032 per share, 15% interest, due one year from issuance (August through September 2020) with issuance of 46,875,000 warrants with a term of three-years and an exercise price of $0.0064 per share $ 300,000 $ 37,336 $ 300,000 14,959 Total Convertible Notes Payable, Net $ 300,000 $ 37,336 $ 300,000 $ 14,959 Less: Debt Discount (22,321) - (85,396) - $ 277,679 $ 37,336 $ 214,604 $ 14,959 Interest expense for the six months ended June 30, 2020 amounted to $22,377 and accrued at June 30, 2020 was $37,356. Amortization of the debt discount for the six months ended June 30, 2020 was $63,075.

Dubbed the LifeAir G1, Sapi said the emergency ventilator was initially designed to be sold for about $1,000 U.S., making it more affordable for poor and remote hospitals and clinics in the developing world.

The business group recently received $150,000 in funding from an American seed money startup accelerator called Y Combinator, which Sapi said has helped finalize the prototype and get the emergency ventilator closer to Health Canada for possible certification.

Sapi said the group is about three to four weeks away from having its prototype tested to World Health Organization (WHO) parameters. He said the finalized design is now with Health Canada for certification.

https://www.ligandglobal.com/our-team

FORW recently secured exclusive US distribution rights to LifeAir, a patent pending, non-invasive ventilator currently under development by Ligand Innovation Global, a Canadian corporation. A newer iteration of the LifeAir ventilator is currently being engineered for a summer 2020 submission to the US Food and Drug Administration (“FDA”) and Canada Health in the hopes of obtaining fast track approval. In June the Company filed its application to raise up to $15 million under Regulation A+. More recently FORW received funding commitments of $500,000 of an anticipated total of $1.3 million in financing and will itself fund Ligand Global Innovation’s development of its latest prototype of the LifeAir G1 Portable Ventilator.

| PUBLISH DATE | TITLE | PERIOD END DATE | STATUS |

|---|---|---|---|

| 11/18/2020 | Quarterly Report - Amended Report for Period Ending 9-30-2020 | 09/30/2020 | A |

| 09/29/2020 | Attorney Letter with Respect to Current Information - Attorney Opinion Letter Re: Annual Report Ending December 31, 2019 | 12/31/2019 | A |

| 09/27/2020 | Quarterly Report - Second Amended Report for Period Ending 3-31-2020 | 03/31/2020 | A |

| 09/27/2020 | Annual Report - Amended Annual Report for Year Ending 12-31-2019 | 12/31/2019 | A |

| 07/31/2020 | Quarterly Report - Quarterly Report - Amended Report for Period Ending 6-30-2020 | 06/30/2020 | A |

| 11/11/2019 | Quarterly Report - Amended Report for Period Ending 9-30-2019 | 09/30/2019 | A |

| 08/12/2019 | Attorney Letter with Respect to Current Information - Attorney Letter with Respect to Current Information | 12/31/2018 | A |

| 08/02/2019 | Quarterly Report - Quarterly Report | 06/30/2019 | A |

| 04/30/2019 | Quarterly Report - Quarterly Report for Period Ending March 31, 2019 | 03/31/2019 | A |

| Volume | |

| Day Range: | |

| Bid Price | |

| Ask Price | |

| Last Trade Time: |