Disclosure Statement Pursuant to the Pink Basic Disclosure Guidelines

FORTRAN CORPORATION A North Carolina corporation

3210 16th Avenue S.E. Conover, NC 28613

(828) 324-6412 www.fortrancorp.com info@fortrancorp.com SIC Code: 4813

Annual Report for the Twelve Months Ended June 30, 2019

As of June 30, 2019, the number of shares outstanding of our Common Stock was: 230,262,828

As of March 31, 2019, the number of shares outstanding of our Common Stock was: 280,914,351

Indicate whether the Company is a shell company (as defined in Rule 405 of the Securities Act of 1933 and Rule 12b-2 of the Exchange Act of 1934): NO

Indicate whether the Company’s shell status has changed since the previous reporting period: YES

Indicate whether a Change in Control of the Company has occurred over this reporting period: YES

Name of the Issuer and its Predecessors (if any)

Fortran Corporation, formerly known as Burkyarns, Inc. and Burke Mills, Inc., was incorporated in the state of North Carolina on March 17, 1948. Burkyarns, Inc. changed its name to Burke Mills, Inc. on May 7, 1979, and Burke Mills, Inc. changed its name to Fortran Corporation on February 12, 2013. Fortran Corporation’s current standing is “active” in the state of North Carolina.

Has the issuer or any of its predecessors ever been in bankruptcy, receivership, or any similar proceeding in the last five years? NO

Security Information

Trading Symbol: FRTN

Exact title and class of securities outstanding: Common Stock

CUSIP: 3460D 108

Par or Stated Value: None

Total shares authorized: 50,000, as of June 30, 2019

Total shares outstanding: 23,262,828 as of June 30, 2019 and 23,262,828 as of September 26, 2019

Number of shares in the Public Float: 18,703,049 as of September 26, 2019. Total number of shareholders of record: 1352 as of September 26, 2019.

Preferred share information:

Exact title and class of securities outstanding: Preferred Stock

CUSIP: N/A

Par or Stated Value: None

Total shares authorized: 10,00 as of June 30, 2019

Total shares outstanding: 123,500,000 as of June 30, 2019 and 112,500,000 as of September 26, 2019

Transfer Agent

Colonial Stock Transfer

91 Exchange Place, Suite 100

Salt Lake City, Utah 84111

(801) 344-7540 www.colonialstock.com

info@colonialstock.com

The Transfer Agent is registered under the Exchange Act.

List any restrictions on the transfer of security: See Item F under “Issuance History” below.

Describe any trading suspension orders issued by the SEC concerning the issuer or its predecessor: NONE

List any stock split, stock dividend, recapitalization, merger, acquisition, spin-off, or reorganization either currently anticipated or that occurred within the past 12 months: NONE

Issuance History

The goal of this section is to provide disclosure with respect to each event that resulted in any direct changes to the total shares outstanding of any class of the issuer’s securities in the past two completed fiscal years and any subsequent period.

Disclosure under this item shall include, in chronological order, all offerings and issuances of securities, including debt convertible into equity securities, whether private or public, and all shares or any other securities or options to acquire such securities issued for services. Using the tabular format below, please describe these events.

Changes to the Number of Outstanding Shares

Number of Shares outstanding as of July 1, 2017:

Opening Balance: Common: 27,637,351 Preferred: 1,700,000

Date of Transaction

Transaction type (e.g. new issuance, cancellation, shares returned to treasury)

Number of Shares Issued (or cancelled)

Class of Securities

Value of shares issued ($/per share) at Issuance

Were the shares issued at a discount to market price at the time of issuance? (Yes/No)

Individual/ Entity Shares were issued to (entities must have individual with voting / investment control disclosed).

Reason for share issuance (e.g. for cash or debt conversion) OR Nature of Services Provided (if applicable)

Restricted or Unrestricted as of this filing?

Exempti on or Registra tion Type?

December 3, 2018

January 16, 2019

January 16, 2019

January 16, 2019

January 16, 2019

January 16, 2019 May 10, 2019

May 20, 2019

May 10, 2019

May 10, 2019

December 3, 2018

New Issuance

New Issuance

New Issuance

New Issuance

New Issuance

New Issuance

New Issuance

Canceled

Canceled

375,000

52,000 150,000 100,000 250,000 350,000 800,000 270,715 247,975

Common

Common Common Common Common Common Common Common Common Common Preferred

75,000 No

3,712 No 10,707 No 7,138 No 17,845 No 24,983 No

200,000 Yes

N/A Yes

N/A Yes

N/A Yes No Par No

James M. Templeton

Frederick K. Greer

Brett Bertolami

Douglas L. Miller

Dayne L. Miller

Glenn Withers

Christopher L. Sharman

Tim Pearce

Todd Rankin

Douglas W. Rink

Brett Bertolami

Debt Conversion

Employee Compensation

Board Member Compensation

Board Member Compensation

Board Member Compensation

Board Member Compensation

In conjunction of bank debt settlement Prior Year Correction

Prior Year Correction

Legal Settlement

Board Member Voting Rights

Restricted

Restricted Restricted Restricted Restricted Restricted Restricted N/A

N/A

N/A

Restricted Control

Book Entry

Book Entry

Book Entry

Book Entry

Book Entry

Book Entry

Book Entry

Book Entry

Book Entry

Book Entry

Book Entry

Canceled 5,932,833

New

Issuance 150,000

December 3, 2018

December 3, 2018

May 10, 2019

Number of Shares Outstanding on June 30, 2019:

New Issuance

New Issuance

Canceled

500,000

500,000

1,350,000

Preferred Preferred Preferred

No Par No Par No Par

James M. No Templeton

Glenn No Withers

Douglas W. No Rink

Special Consultant Voting Rights

Board Member Voting Rights

Legal Settlement

Restricted Book Control Entry

Restricted Book Control Entry

N/A Book Entry

Ending Balance: Common: 23,262,828 Preferred: 1,500,000

Fortran Corporation has made the following issuances between June 30, 2019 and September 26, 2019

N/A

Debt Securities, Including Promissory and Convertible Notes

Date of Note Issuance

Outstanding Balance ($)

Principal Amount at Issuance ($)

Intere st Accru ed ($)

Maturity Date

Conversion Terms (e.g. pricing mechanism for determining conversion of instrument to shares)

Name of Noteholder

Reason for Issuance (e.g. Loan, Services, etc.)

May 16, 2018

714.77

784.77

$10

May 16, 2023

At any time before maturity, the outstanding balance may be converted for preferred shares at $.10 per share.

James M. Templeton

Legal Fees incurred

November 23, 2018

$542

January 8, 2024

At any time before maturity, the outstanding balance may be converted for common shares at $.25 per share.

James M. Templeton

Working Capital Needs

March 13, 2019

100,000.00

100,000.00

$279

March 13, 2024

At any time before maturity, the outstanding balance may be converted for common shares at $.25 per share.

James M. Templeton

Provide LOC to affiliate

March 28, 2019

150,000.00

150,000.00

$49

March 28, 2024

At any time before maturity, the outstanding balance may be converted for common shares at $.25 per share.

Charles D. Miller

Provide initial payment to TCA Global

March 29, 2019

100,000.00

100.00

$16

March 29, 2024

At any time before maturity, the outstanding balance may be converted for common shares at $.25 per share.

mes M. Templeton

Working Capital Needs

March 29, 2019

107,250.00

107,250.00

$18

March 29, 2024

At any time before maturity, the outstanding balance may be converted for common shares at $.25 per share.

Peter A. R. Sharman

Provide Debt Settlement Funding

February 21, 2019

220,000.00

400,000.00

N/A

September 3, 2020

$150,000 paid on April 3, 2019. $15,000 per month for 16 months. $10,000 due on 17th month.

TCA Global Fund

PSettlement

$1,000 per month for 24 April 11, $432 April 11, months. Balance due April

2019 138,345.90 138,957.85 2021 11, 2021. 6% per annum.

Peter A. R. and Donna T. Sharman

Deficiency Balance Settlement

May 22, 2019

7500.00

100,000.00

$99

May 22, 2024

At any time before maturity, the outstanding balance may be converted for common shares at $.25 per share.

James M. Templeton

Working Capital Needs

June 18, 2019

95,000.00

95,000.00

$187

June 18, 2024

At any time before maturity, the outstanding balance may be converted for common shares at $.25 per share.

Sherry T. Miller

Working Capital Needs

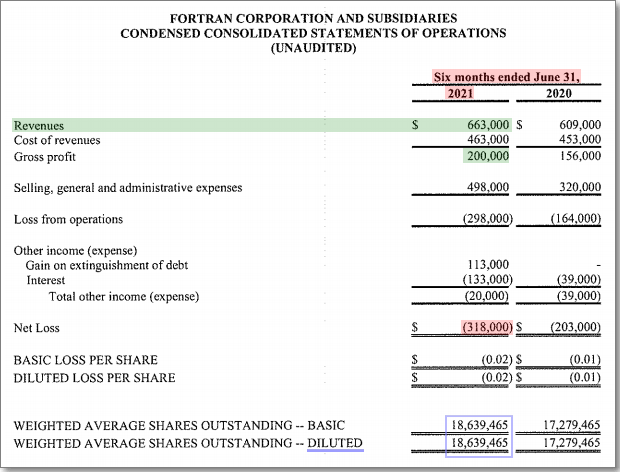

Financial Statements

A. The following financial statements were prepared in accordance with: U.S. GAAP

B. The financial statements for this reporting period were prepared by (name of

individual):

Dayne L. Miller

Chief Financial Officer of Fortran Corporation

Provide the financial statements described below for the most recent fiscal year or quarter. For the initial disclosure statement (qualifying for Pink Current Information for the first time) please provide reports for the two previous fiscal years and any subsequent interim periods.

A. Balance sheet;

B. Statement of income;

C. Statement of cash flows; D. Financial notes; and

E. Auditletter,ifaudited

You may either (i) attach/append the financial statements to this disclosure statement or (ii) post such financial statements through the OTC Disclosure & News Service as a separate report using the appropriate report name for the applicable period end. (“Annual Report,” “Quarterly Report” or “Interim Report”). See attached Balance Sheet, Statement of Operations, Statement of Cash Flows and Notes to the Financial Statements for the Twelve months ending June 30, 2019 attached to the end of this Company Information and Disclosure Statement Annual Report.

If you choose to publish the financial reports separately as described in part (ii) above, you must state in the accompanying disclosure statement that such financial statements are incorporated by reference. You may reference the document(s) containing the required financial statements by indicating thfor Current Information, a company must post its Annual Report within 90 days from its fiscal year-end date and Quarterly Reports within 45 days of its fiscal quarter-end date.

Issuer’s Business, Products and Services

The Company

Fortran Corporation (“Fortran” or the “Company”), through its subsidiaries, is a leading telecommunications system integrator dedicated to designing, sourcing, implementing and maintaining complex telecommunications solutions and the installation, service and repair of cooling towers across the United States. The Company’s businesses are in two main segments:

Telecom Service Segment

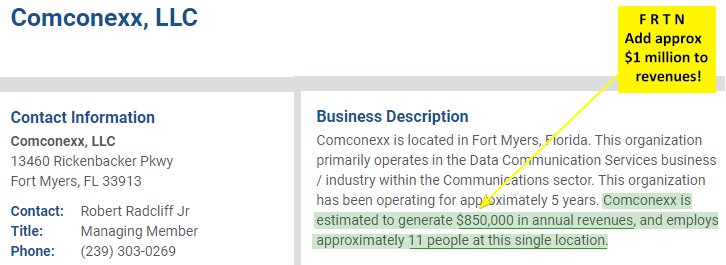

The telecom segment currently consists of two operating units. B and L Telephone Sales a that we

In addition to our NEC core products, we also offer our clients a wide array of complimentary products including cabling, fiber connectivity, SIP trunks, paging, access and control systems and security (including facial recognition technology).

New system sales (“Box Sales”) often generate a post-implementation maintenance agreement (“MSA”) to support the system, which generally ranges from 1-3 years for commercial clients and 3-5 years for government clients. Historically, such an agreement results in a fixed fee earned over the term of the contract. MSA and MAC revenues are the direct result of the Company’s relationship with its clients and its longstanding record of providing high-quality service.

Cooling Tower Service Segment

On November 16, 2015, we acquired an eighty percent (80%) interest in Tower Performance, Inc. (“TPI”) to provide cooling tower services. TPI is a national specialty contractor involved with the repair, maintenance, upgrade, inspection, construction and sale of parts for all types

of cooling towers, mechanical equipment parts and maintenance of air coolers. TPI has its own trained crews that perform work at its customers’ facilities.

Customer Markets

TPI’s clients are found in multiple industries including:

- Utilities, Chemical/petrochemical, Commercial real estate, Colleges and institutions, Phosphate/fertilizer, Steel, Hospitals, Air Separation, Paper/bottling, Export/wholesale

This diversification helps protect the Company from the impact of a downturn in any specific industry and results in consistent demand.

Organization

TPI is organized as a C-Corporation and was established in 1964. TPI is headquartered in Florham Park, New Jersey in a 3,000 square foot office approximately 10 miles northwest of Newark Liberty International Airport. Additionally, TPI leases a 2,000 square foot office and a 4,000 square foot warehouse/yard in Houston, Texas. TPI leases its facilities from third parties at a fair market rate of $109,000 per year.

Employee Base

TPI has 50-70 full-time employees, including 10 salespersons, a construction crew of up to 60 in Texas and 4 in New York/New Jersey and 3 administrative persons. TPI values its staff and their experience and that treatment is reflected in a low employee turnover.

TPI produced net revenues of $9,818,000 and $10,383,000 for the twelve months ended June 30, 2019 and 2018, respectively.

Issuer’s Facilities

The goal of this section is to provide a potential investor with a clear understanding of all assets, properties or facilities owned, used or leased by the issuer.

In responding to this item, please clearly describe the assets, properties or facilities of the issuer, give the location of the principal plants and other property of the issuer and describe the condition of the properties. If the issuer does not have complete ownership or control of the property (for example, if others also own property or if there is a mortgage on the property), describe the limitations of ownership.

If the issuer leases any assets, properties or facilities, clearly describe them as above and the terms of their leases.

See the “Issuer’s Business, Products and Services” section above.

Officers, Directors and Control Persons

The goal of this section is to provide an investor with a clear understanding of the identity of all the persons or entities that are involved in managing, controlling or advising the operations, business development and disclosure of the issuer, as well as the identity of any significant shareholders.

Using the tabular format below, please provide information regarding any person or entity owningny, regardless of the number of shares they own. If any listed are corporate shareholders or entities, provide the name and address of the person(s) beneficially owning or controlling such corporate shareholders, or the name and contact information of an individual representing the corporation or entity in the note section.

Name of Officer/Director and Control Person

Affiliation with Company (e.g. Officer/Director/Owner of more than 5%)

Resid

Richard C. Wilso

Officer (V. President), Director (V. Chairman) Owner of more than 5%

Owner of moe than 5%

Owner of more than 15% Owner of re than 5% Owner of more than 5%

Owner of more than 5% Owner of more than 5r of more than 5% Owner of more than 5%

Ocean Isle B, SC Elon, NC

Claremont, NC Mooresville, NCTaylorsville, NC Nashville, TN

Elon, NC lon, NC

Charleston, SC cottsburg, VA

Jersey ty, NJ

Conover, NC

Newton, N00,000

4113,29 1,263,125

51,7150

150,000

300,000 1,285,714

1,363,125

1,363,1125 1,363,125 1,346,250

350,000 5,6188,500 4,238,775

1,235,723

500,000 1,114,286

Preferred Common Common

Common

Preferred Common Common

Common

Common Common Common

Preferred Common Common

Common

Preferred Common

33.33% None 1.78%

5.43% None

2.29% None

10.00% None 1.29%

5.52% None

5.86% None

5.86% None 5.86% None 5.79% None

23.33% None 24.45%

1222% None

5.31% None

33.33% None 4.79%

Legal/Disciplinary History

A. Please identify whether any of the foregoing persons have, in the past ten years, been the subject of:

1. A conviction in a criminal proceeding or named as a defendant in a pending criminal proceeding (excluding traffic violations and other minor offenses); Fortran Corporation is not currently aware of anything relevant to this subsection with respect to any of the foregoing persons.

2. The entry of an order, judgment, or decree, not subsequently reversed, suspended or vacated, by a court of competent jurisdiction that permanently or temporarily enjoined, barred, suspended or otherwise limited such person’s involvement in any type of business, securities, commodities, or banking activities; Fortran Corporation is not currently aware of anything relevant to this subsection with respect to any of the foregoing persons.

3. A finding or judgment by a court of competent jurisdiction (in a civil action), the Securities and Exchange Commission, the Commodity Futures Trading Commission, or a state securities regulator of a violation of federal or state securities or commodities law, which finding or judgment has not been reversed, suspended,l parties thereto, a description of the factual basis alleged to underlie the proceeding and the relief sought. Include similar information as to any such proceedings known to be contemplated by governmental authorities.

See “Commitments and Contingencies” footnote to Fortran Corporation’s Annual Financial Statements as of the twelve months ended June 30, 2019.

Third Party Providers

Please provide the name, address, telephone number, and email address of each of the following outside providers:

Accounting Advory Firm

GreerWalker CPAs and Business Advisors Carillon Building

227 W, Ste. 1100

Charlotte, NC 28202

(704) 377 Tax Advisory Firm

Keener Cassavaugh Farmer & Connor PA 426 Harper Avenue NW

Lenoir, NC 28645

(828) 758-3779 Investor Relations Consultant Fortran Corporation

3210 16th Avenue S.E. Conover, North Carolina 28613

(828) 624-4611 info@fortrancorp.com www.fortrancorp.com

Issuer Certification

Principal Executive Officer:

/s/ GLENNITHERS

Glenn E. rs, CEO and President

Principal Financial Officer:

I, Dayne L. Miller certify that:

1. I have reviewed this annual disclosure statement of Fortran Corporation;

2. Based on my knowledge, this disclosure statement does not contain any untrue statement of a material fact or omit to state a material fact necessary to make the statements made, in light of the circumstances under which such statements were made, not misleading wiect to the period covered by this disclosure statement; and

3. Based on my knowledge, the financial statements, and other financial information included or incorporated by reference in this disclosure statement, fairly present in all material respects the financial condition, results of operations and cash flows of the issuer as of, and for, the periods presented in this disclosure statement.

September 26, 2019 /s/ DAE L. MILLER Dayne L. Miller, C

ANNUAL FINANCIAL STATEMENTS

June 30, 2019 and June 30, 2018

As of the Twelve Months Ended June 30, 2019

FORTRAN CORPORATION

(A

Cash and cash equivalen

Receivables, less allowances

Invento

Prepaid expenses and other current assets

Total current assets

Due from affiliate

Equity method investment Property, plant and equipment (net) Other assets

$ $

$ $

$

$ $ $

$

$

$

$

$

$ $

$

$

$

$

$ $ $ $ $

FORTRAN CORPORATION CONSOLIDATED BALANCE SHEETS

(unaudited)

ASSETS

As of June 30, 2019

61,629 50,316

76,411 -

188,356

1,511,000 2,178,211 35,596 162,067

4,075,230

244,682 1,100,000 31,041 41,505 183,803

2,2908

1,603,939

1,189,908

2,793,847

5053,000

461,6 -

314,749

1,281,383 4,075,230

$ 120,000

$ 461,36 $ -

$ 608,312 $ 1,189,946

$ 4,9318,844

Total assets

LIABILITIES AND STOCKHOLDERS’ EQUITY

Current liabilities:

Accounts payable

Due to affiliate shareholders Deferred revenue

Accrued expenses

Current portion debt

Other current liabilities

Total current liabilities

Long-term debt

Total liabities

Commitments and contingencies Stockholders' equity:

Stockholders' equity:

Common stock, no par value, 50,00 shares authorized, 1,700,000 shares issued, respectively

Additional paid-in capital

Treasury stock

Retained earnings

Total stockholders' equity

Total liabilities and sckholders' equity

23,262,828 and 1,500,000

and

See accompanying notes to consolidated financial statements

1

Revenue:

Net revenues

Total revenue Costs and expenses (a):

$

$

$ $ $

$

$ $ $ $

$

$

$ $

Fiscal Year June 30,2 2019

1,387,805

1,387,805

1,709,104 36,6245 1,745,749

(357,944)

(375,7250) 475,144 (35,013)

(293,2563)

-

(293,563)

(0.013) (0.013)

23,262,828 23,262,828

Fiscal Year June 30, 2018

$ 1,124,341

$ 1,124,341

$ 1,633,218 $ 110,060 $ 1,743,278

$ (618,937)

$ (109,851) $ 315,619 $ (101,072) $ (514,241)

$ -

$ (514,241)

$ (0.019) $ (0.019)

27,487,351 27,487,351

FORTRAN CORPORATION CONSOLIDATED STATEMENTS OF OPERATIONS

(unaudited)

Net costs and expenses (exclusive of depreciation, amortization and accretion shown separately below) Depreciation, amortization and accretion

Total costs and expenses Operating income

Income (loss) in equity method investment Other income (expense)

Interest expense

Income before income taxes

Income tax expense

Net income Earnings per share:

Basic

Diluted

Weighted average shares outstanding:

Basic Diluted

See accompanying notes to consolidated

financial statements.

2

Cash flows from operating activities:

Net income

2019

$ (293,563) $

$ 36,645 $ $ (350,722) $ $ 375,750 $

$ 117,526 $ $ (200,000) $ $ 38,589 $ $ (298,111) $ $ (280,323) $

$ 21,906 $

2018 (514,242)

110,060 -

109,851

24,269 -

290,9931 31,542

566,713

FORTRAN CORPORATION CONSOLIDATED STATEMENTS OF CASH FLOWS

(Unaudited)

Purchases of investments $

Twune 30,

Adjustments to reconcile net income to net cash provided by operating activities: Depreciation, amortization and accretion

Cancellation of debt income

Loss (gain) in equity method investment

Changes in operating assets and liabilities:

Receivables, prepaid expenses and other assets

Due from affiliate

nventories

Accounts payable, deferred revenueand other liabilities Net cash provided by operating activities

Cash flows from inties: Capital expenditures, net

(75,354) -$-

Net cash used in investing activities

Cash flows from financing activities: Debt repayments

Proceeds from debt

Net cash used in financing activities

(Decrease) increase in cash and cash equivalents Cash and cash equivalents at beginning of period Cash and cash equivalents at end of period

$ 21,906 $

$ (494,570) $ $ 1,020,852 $ $ 526,282 $

$ (25,698) $ $ 87,327 $ $ 61,629 $

(75,354)

-

78,115

78,115

55,232

32,095 87,327

See accompanying notes to consolidated financial statements

3

FORTRAN CORPORATION AND CONSOLIDATED SUBSIDIARIES NOTES TO FINANCIAL STATEMENTS

FOR THE TWELVE MONTHS ENDED JUNE 30, 2019 AND 2018

Basis of Pre Description of Business

Basis of Presentation

The accompanying unaudited financial statements have been prepared in accordance with accounting principles generally accepted in the United States of America for financial information.

In the opinion of management, the unaudited condensed financial statements contain all adjustments considered necessary to present fairly the Company’s financial position for all periods presented.

Description of Business

Fortran Corporation (the “Company”) is primarily engaged in the sales, installation and service of telecommunication systems in North Carolina and South Carolina. The Company purchased an eight percent (80%) interest in Tower Performance, Inc. (“TPI”) in November 2015. TPI is engaged in the engineering, sales, installation and servicing of cooling towers for large businesses in New Jersey, New York and Texas.

ITEM 1: Summary of Significant Accounting Policies

The accompanying financial statements and notes are prepared in accordance with accounting principles generally accepted in the United States of America.

Cash and Cash Equivalents

The Company considers cash equivalents to be those investments which are highly liquid and readily convertible to cash with a maturity date within three months of the date of purchase.

Earnings (Loss) Per Share

The Company reports earnings (loss) per share in accordance with FASB Accounting Standards Codification (“ASC”) 260. This statement requires dual presentation of basic and diluted earnings per share amounts and are based on the weighted average share of common stock outstanding. If applicable, diluted earnings per share assume the conversion, exercise or issuance of all common stock instruments such as options, warrants and convertible securities, unless the

4

When fixed assets are sold or retired, their costs and accumulated depreciation or amortization are eliminated from the accounts and any gain or loss resulting from their disposal is included in the statement of operations.

The Company incurs repair and maintenance expenses on its vehicles and equipment. These expenses are recognized when incurred, unless such repairs significantly extend the life of the asset, in which case the cost of the repairs is amortized over the remaining useful life of the asset utilizing the straight-line method.

Due From Affiliate

The amount due from affiliate represents management fees earned for services provided to an equity method investment in prior periods.

Basis of Consolidation

We present the financial statements of the Company and consolidate those financial statements with the financial statements of all subsidiaries that the Company controls. All significant intercompany transactions and balances have been eliminancial statements.

Equity Method Investment

Investments in affiliated companies that the Company does not control, but over which the Company exerts significant operating and financial influence, are accounted for using the equity method. Due to the nature of the operating agreement in place with TPI’s minority shareholders, the Company has determined that it does not control TPI and has accordingly recorded it as an equity method investment.

Revenue Recognition

The Company recognizes revenue when it is realized or realizable and earned. The Company considers revenue realized or realizable and earned when all of the following criteria are met: (i) persuasive evidence of an arrangement exists, (ii) the product has been shipped or the services have been rendered to the customer, (iii) the sales price is fixed or determinable, and (iv) collectability is reasonably assured.

5

Allowance for Doubtful Accounts

Trade accounts receivable are stated net of an allowance for doubtful accounts. The Company estimates the allowance based on an analysis of specific customers, taking into consideration the age of past due accounts and an assessment of the customer’s ability to pay. As of June 30, 2019 and 2018, all remaining accounts receivable were considered collectible. Accordingly, no allowance has been provided in the accompanying financial statements.

Inventory

Inventory consists of parts and materials valued at the lower of cost (first-in, first-out method) or net realizable value.

Subsequent Events

In preparing the consolidated financial statements, the Company has evaluated subsequent events through September 26, 2019, which is the date the financial statements were available to be issued.

ITEM 2: Going Concern Statement

These financial statements have been prepared in accordance with generally accepted accounting principles applicable to a going concern, which contemplates the realization of assets and the satisfaction of liabilities and commitments in the normal course of business. The Company’s ability to continue as a going concern is contingent upon its ability to achieve and maintain profitable operations, and the Company’s ability to raise additional capital as required. These conditions raise substantial doubt about the Company’s ability to continue as a going concern. The liquidity situation is improving rapidly, but ultimate success depends upon signed contracts with commensurate financing. (See subsequent events)

ITEM 3: Tower Performance, Inc.’s Liabilities

In conjunction with the purchase of eighty percent (80%) of TPI’s stock on October 31, 2015, the Company entered into three subordinated promissory notes of $266,667 each, payable to the three individual sellers (the “Sellers”) of TPI upon maturity in November 2018. Interest is payable monthly at a five percent (5%) annual rate and is current through the period ended June 30, 2019 and 2018. Although the maturity date was November 2018, the Company feels strongly that a favorable restructuring of this debt obligation will occur by December 31, 2019.

The TPI purchase agreement also provides Sellers with a put option requiring the Company to purchase the remaining twenty percent (20%) of TPI stock. The put option became exercisable at August 31, 2018; and, subsequent to that date, was exercised by the Sellers prior to its expiration. The put price is to be calculated by multiplying TPI’s average gross profit for the 12 month periods ending March 31, 2016, 2017 and 2018 by .829, minus the initial purchase price of $2,200,000. The Sellers have calculated a put price of $335,000, but the Company has yet to finalize the put option transaction. No amounts have been recorded related to the put option as 0, 2019 or 2018.

In addition, the Company owes Sellers $300,000 held in a deposit account for three years after the traThis amount does not bear interest and is expected to be paid by December 31, 2019. The liability was recorded as debt at Jue 30, 2019 and 2018.

ITEM 4: Debt Information

On February 10, 2016, The New Telephone Co. and B & L Telephone, LLC, subsidiaries of the pany, borrowed $115,625.00 plus interest at a rate of thirty two percent (32%) payable at $433.59 per day from CAN Capital. As of March 31, 2018, the outstanding principal balance was $26,450.31. The Company negotiated afavorable settlement of this obligation during the nine months ending March 31, 2019 and paid $10,000.00 to CAN Capital. The remaining $16,450.31 balance was record as “Other Income” in the Statement of Operations.

On March 26, 2007, New Telephne, Inc. borrowed $750,000 from Banco Poplar at a rate

of Prime + 2.75 percent per annum. Said loan was secured by New Telephone, Inc.’s assets, real estate owned by Rink Media and a personal guarantee of Douglas Rink. On August 17, 2017 Banco Poplar filed suit against New Telephone, Inc., Rink Media and Douglas Rink personally for non-payment of tis loan. As of Mat a rate of $.35 per common share. These common shares were issued on March 13, 2019.

On October 20, 2015, James M. Templeton loaned the Company $300,000 payable at $25,000 pr month at an interest rate of ten percent (10%) per annum, with principal and interest paid monthly and with all payments due in full by October 15, 2016. On October 5, 2016, Mr. Templeton filed suit against the Company i the amount of $300,000 plus interest and attorneys’ fees for non- payment. On August 28, 2017 the court awarded Mr. Templeton a judgment in the amount of $300,000 plus interest and attorneys’ fees, which were reorded as liabilities at March 31, 2019. On December 3, 2018, the remaining principal balance, including accrued interest, was $75,000. On that date, Mr. Templeton exercised his option to convert thce to 375,000 shares of common stock at the rate of $.25 per common share.

On May 20th, 2016 Peoples Bank, Inc. in Newton, NC loaned the Company $650,000 on two dferent tracks of land, including buildings. At the same time Peoples Bank loaned the Company $500,000 as a revolving account for the Company. In December 2016 the Company sold its property located at 725 11th Ave. SE, ickory NC and reduced the $650,000 loan by $380,000. On July 25, 2018 Peoples Bank filed suit against the Company for non-payment on each of the above (See “Commitments and Contingencies”). Peoples Bank folloed this action with a foreclosure suit against the Company on the office building of the Company. Sale of said foreclosure property was held during the month of November 2018. At the time legal action

began, the approximate balance was $680,355.89 which was reflected as an outstanding obligation at March 31, 2018 in the accompanying Balance Sheet. It was anticipated that a deficiency balance would remain after the oreclosure sale. This balance was dealt with in the courts in accordance with the suit initially filed by Peoples Bank. After the foreclosure sale, the Company negotiated a fair rental agreement with the new owner. The roperty as sold by the bank for $400,000.00, which ultimately left a deficiency balance of $338,957.85 (including all attorneys’ fees, property taxes and closing costs). During the nine months ending March 31, 2019, this deficiency alance was settled by executing a Promissory Note to Peter A. R. Sharman for $138,957.85 and the issuance of 800,000 shares of common stock to Christopher L. Sharman with a conversion price of $.25 per common hare. This Promissory Note is payable at $1,000.00 per month (payment includes principal and interest at 6% per annum) for 23 months with a final balloon payment on April 11, 2021 (final payment includes all outstanding rincipal and interest).

n May 16, 2018 the Company issued to James M. Templeton a promissory note in the amount of $78,114.77 with an interest rate of five percent (5%) per annum payable upon demand with an option to convert to Company referred stock at $.10 cents per share at any time prior to maturity. The maturity date of this Convertible Debenture is May 16, 2023. Said note was issued in connection with a settlement and mutual release agreement with r. Templeton and certain shareholders.

n November 23, 2018, Douglas L. Miller purchased a Convertible Debenture from the Company in the amount of $60,000.00 plus interest payable monthly at a rate of six percent (6%) per annum. The maturity date of this vertible Debenture, Mr. Miller is entitled, at his option, to convert all or any lesser portion of the outstanding principal amount into shares of common stock of the Company at a conversion price of $.25 per common share at any time prior to maturity.

n December 21, 2018, James M. Templeton purchased a Convertible Debenture from the Company in the amount of $100,000.00 plus interest payable monthly at a rate of six percent (6%) per annum. The maturity date of his Convertible Debenture is December 21, 2023. Under the terms of this Convertible Debenture, Mr. Templeton is entitled, at his option, to convert all or any lesser portion of the outstanding principal amount into shares of ommon stock of the Company at a conversion price of $.25 per common share at any time prior to maturity.

n January 8, 2019, James M. Templeton purchased a Convertible Debenture from the Company in the amount of $150,000.00 plus interest payable monthly at a rate of six percent (6%) per annum. The maturity date of this onvertible Debenture is January 8, 2024. Under the terms of this Convertible Debenture, Mr. Templeton is entitled, at his option, to convert all or any lesser portion of the outstanding principal amount into shares of common tock of the Company at a conversion price of $.25 per common share at any time prior to maturity.

On March 13, 2019, James M. Templeton purchased a Convertible Debenture from the Company in the amount of $100,000.00 plus interest payable monthly at a rate of six percent (6%) per annum. The maturity date of this onvertible Debenture is March 13, 2024. Under the terms of this Convertible Debenture, Mr. Templeton is entitled, at his option, to convert all or any lesser portion of the outstanding principal amount into shares of common tock of the Company at a conversion price of $.25 per common share at any time prior to maturity.

n March 28, 2019, Charles D. Miller purchased a Convertible Debenture from the Company in the amount of $150,000.00 plus interest payable monthly at a rate of six percent (6%) per annum.

The maturity date of this Convertible Debenture is March 28, 2024. Under the terms of this Convertible Debenture, Mr. Miller is entitled, at his option, to convert all or any lesser portion of the outstanding principal amount nto shares of common stock of the Company at a conversion price of $.25 per common share at any time prior to maturity.

On March 29, 2019, James M. Templeton purchased a Convertible Debenture from the Company in the amount of $100,000.00 plus interest payable monthly at a rate of six percent (6%) per annum. The maturity date of this Convertible Debenture is March 29, 2024. Under the terms of this Convertible Debenture, Mr. Templeton is entitled, at his option, to convert all or any lesser portion of the outstanding principal amount into shares of common stock of the Company at a conversion price of $.25 per common share at any time prior to maturity.

On March 29, 2019, Peter A. R. Sharman purchased a Convertible Debenture from the Company in the amount of $107,250.00 plus interest payable monthly at a rate of six percent (6%) per annum. The maturity date of this Convertible Debenture is March 29, 2024. Under the terms of this Convertible Debenture, Mr. Sharman is entitled, at his option, to convert all or any lesser portion of the outstanding principal amount into shares of common stock of the Company at a conversion price of $.25 per common share at any time prior to maturity.

On May 22, 2019, James M. Templeton purchased a Convertible Debenture from the Company in the amount of $100,000.00 plus interest payable monthly at a rate of six percent (6%) per annum. The maturity date of this Convertible Debenture is May 22, 2024. Under the terms of this Convertible Debenture, Mr. Templeton is entitled, at his option, to convert all or any lesser portion of the outstanding principal amount into shares of common stock of the Company at a conversion price of $.25 per common share at any time prior to maturity.

On June 18, 2019, Sherry T. Miller purchased a Convertible Debenture from the Company in the amount of $95,000.00 plus interest payable monthly at a rate of six percent (6%) per annum. The maturity date of this Convertible Debenture is June 18, 2024. Under the terms of this Convertible Debenture, Ms. Miller is entitled, at her option, to convert all or any lesser portion of the outstanding principal amount into shares of common stock of the Company at a conversion price of $.25 per common share at any time prior to maturity.

On February 21, 2019, the Company settled its legal matters with TCA Global by executing a Promissory Note in the amount of $400,000.00 plus giving title to a small tract of land in Lexington, NC with a transfer value of $100,000.00. This tract of land was not carried on the accounting records by the prior management; therefore, there is no Balance Sheet or Income Statement effect with its release to TCA Global. The Company recognized $300,000.00 as “Other Income” in the Statement of Operations as a result of the TCA Global settlement (See “Commitments and Contingencies”). The Promissory Note required the Company pay $150,000.00 to TCA Global on April 3, 2019 and $15,000.00 per month for 16 months and a final payment of $10,000.00 in the 17th month. This Promissory Note bears no interest rate. This Promissory Note had a balance at March 31, 2018 of $700,000.00.

9

Future scheduled long-term debt maturities are as follows for the years ending June 30:

2020 $ 18303

2021 $ 174,5

2022 $-

2023 $ 78,115

2024 $ 872,250

Thereafter $ 95,000

Please see the Commitments and Contingencies Footnote below for additional legal matters related to certain Debt Instruments.

ITEM 5: Impairment of Long-lived Assets

In accordance with FASB Accounting Standards Codification (“ASC”) 360, “Accounting for the Impairment or Disposal of Long-lived Assets”, the Company reviews long-lived assets, such as rental equipment and fixed assets, for impairment whenever events or changes in circumstances indicate that the carrying amount of an asset group may not be fully recoverable. Recoverability of asset groups to be held and used is measured by a comparison of the carrying amount of an asset group to estimated undiscounted future cash flows expected to be generated by the asset group. If the carrying amount exceeds its estimate future cash flows, an impairment charge is recognized as the amount by which the carrying amount of an asset group exceeds the fair value of the asset group. The Company evaluated its long-lived assets, including its equity method investment, and the Company does not consider these assets to be impaired.

ITEM 6: Income Taxes

Income taxes are accounted for in accordance with FASB Accounting Standards Codification (“ASC”) 740, “Accounting for Income Taxes.” A deferred tax asset or liability is recorded for all temporary differences between financial and tax reporting and for net operating loss carry forwards.

Deferred tax assets are reduced by a valuation allowance when, in the opinion of management, it is more likely than not that some portion or the entire deferred tax asset will not be fully realizable. Deferred tax assets and liabilities are adjusted for the effect onciples in the United States of America requires management to make estimates and assumptions that affect the reported amounts of the assets and liabilities, disclosure of

contingent assets and liabilities at the date of the financial statements, and the reported amounts of revenue and expense during the reporting periods. Actual results may differ from those estimates and assumptions.

ITEM 9: Commitments and Contingencies

On May 9, 2018, Peoples Bank filed a complaint against the Company, MMMG Transport, LLC, New TPI, LLC and Douglas Rink in the North Carolina General Court of Justice, Superior Court Division for Catawba County (Case No. 18-CVS-1256). Plaintiff Peoples Bank alleged in its complaint that the Company defaulted on two promissory notes in the original principal amounts of $650,000.00 and $500,000.00 (collectively, the “Promissory Notes”). Peoples Bank alleged that the principal sum of $680,355.89 plus interest remain unpaid on the Promissory Notes. Plaintiff further alleged that defendant Douglas Rink executed and delivered an unlimited personal guaranty of the Promissory Notes,

On August 23, 2018, the Company filed a complaint against Douglas Rink in the North Carolina General Court of Justice, Superior Court Division for Catawba County (Case No. 18-CVS-2382). In the Company’s action against Doug Rink, the Company sought to invalidate 5 million shares of Common Stock and 350,000 shares of Series A Preferred Stock. The Company also sought to invalidate 247,975 additional shares of Common Stock that Doug Rink improperly transferred to himself in connection with the settlement of a lawsuit with another party (Todd Rankin). Defendant Rink served as the President, CEO and Chairman of the board of directors of the Company from 2013 until his resignation on April 19, 2018. The complaint alleged that defendant

11

Rink breached his fiduciary duties while serving as an officer and director of the Company and engaged in self-interested transactions to benefit himself at the expense of the Company. The complaint alleged that defendant Rink improperly issued shares of the Company’s common stockisappropriated certain of the Company’s assets for his personal use and benefit. The complaint asserted claims against defendant Rink for declaratory relief, breach of fiduciary duty, constructive fraud, unfair and deceptive trade practices, negligence, conversion and civil theft. Defendant Rink responded to the complaint on December 27, 2018, denying the allegations of the Company’s complaint and asserting various counterclaims against the Company, including a request for a judicial dissolution and appointment of a receiver. On March 1, 2019, the Company and Douglas Rink entered into a Settlement and Release Agreement whereby Douglas Rink would, among other things, on or before April 1, 2019 deliver to the Company all Company stock certificates in his possession or control, sign a stipulation of dismissal with prejudice of his counterclaims in Case No. 18-CVS-2382 and resign as an officer, director and/or manager of all of the Company’s subsidiaries. Pursuant to the same Settlement and Release Agreement, the Company agreed to, among other things, on or before April 1, 2019 file a stipulation of dismissal with prejudice of the claims in Case No. 18-CVS-2382 and pay Douglas Rink the amount of $175,000. On May 10, 2019, Douglas Rink’s shares of common stock and preferred stock of the Company were canceled. To the Company’s knowledge, the obligations of the Company and Douglas Rink under the Settlement and Release Agreement have been satisfied and the case has been dismissed.

On August 16, 2018, TCA Global Credit Master Fund (“TCA”) filed, as the sole petitioning creditor, an involuntary bankruptcy petition under title 11 of the U.S. Bankruptcy Code against the Company (the “Involuntary Petition”). The Involuntary Petition was filed in the United States Bankruptcy Court for the Western District of North Carolina (Case No.

18-50532). The Company disputes that the Involuntary Petition was properly filed. The Company reached a favorable settlement with TCA Global on February 21, 2019. The Company executed a Promissohis Promissory Note bears no interest rate. This settlement resulted in a $300,000.00 reduction in the total amount due and this reduction is accounted for in “Other Income” on the Statement of Operations.

Banco Poplar North America v. The New Telephone Company

Banco Popular obtained a default judgment in the total amount of approximately $131,000 (including principal, interest and fees). The Company settled this obligation with Banco Poplar with a payment of $81,478.02. This settlement resulted in a $34,271.98 reduction in the total amount due and this reduction is accounted for in “Other Income” on the Statement of Operations.

Where a probable contingent liability exists and the amount of the loss can be easily estimated, the Company records the estimated liability. Considerable judgment is required in analyzing and recording such liabilities and actual results may vary from the estimates. Management is not aware of any unrecorded liabilities for which payment is probable and the amount can be reasonably estimated.

12

_-_frtn_market_cap_share_structure_7.5_mill_only.png)