Register for free to join our community of investors and share your ideas. You will also get access to streaming quotes, interactive charts, trades, portfolio, live options flow and more tools.

In any event HERA did not amend the Charter to allow this type of agreement.

I don’t believe there will be any cram down, I don’t believe that warrants will be exercised. I believe the conservatorship will continue until it is no longer politically advantageous to continue. At that time I believe the GSEs will be released with the terms of the SPSPA cancelled by an agreement and announced as saying look how great we are for solving the home financing system and protecting the taxpayers while doing it.

It's a bitch when your ignore list on this godforsaken site grows faster than share price appreciation.

clayton

“Treasury cannot be accused of transferring any economic value to the “investors,” i.e. the owners of the pre-conservatorship common and preferred shares. Since those investors are now dominated by institutions, such as private equity or hedge funds, that purchased their shares at steep discounts after the two companies were placed in conservatorship, anything that looks like a windfall to them will be subject to substantial criticism by virtually every Democrat in Congress, and also probably many Republicans as well.”

replace pre-conservatorship with pre-nws and is a good compromise. i am personally good with pre-conservatorship too. but the investors who were part of rescue and invested in post conservatorship i.e. pre –nws should be rewarded as well. 19.9% of company should go them, only to them. imo. also need to include those who had to sell but bought pre nws on record.

It doesn't matter who wins in November, the GSE's won't even be a topic of conversation until 2026.

ron, when do you think this happens? and what impact on bottomline of each?

serious about it. the lamberth jury trial judgment money , all of it should be divided only among those who owned shares pre nws. think about it. as the ex ceo of fannie wrote that govt does not want these hedge fund rats to make a ton of money. they all got it post nws and now flooded fhfa with lawsuits that went nowhere. the sane solution is 19.9% of the company should be owned by those who bought pre nws and should be rewarded even if they sold. i do understand the theory that rights travel with shares but what right? this is unusual situation.

fraud?

the green light is great for us ?

Gov would argue

Consideration was given by and to both sides ----- e.g. GOV was backing all paper "and built a clear path to infuse up to 100B" --- that to me is worth more than 1B cash

agree

and - with my "type of mind" (that sees the GRAY in many - most situations and contract wording ) I may never fully understand with certainty

I still do not understand why you used the word borrow which then directly leads to interest etc.

Keep in mind - I own a fair amount (in shares) of common and JPS - FNMA and FMCC - and from where I sit the main problem to a higher PPS (a big jump) is the 200B overhang (not 4B more shares or such).

That 200B (fair or not) seems to be a serious and massive threat to the value of any future PPS of current FNMA common AND JPS shares. IMO, once that is removed - even with some Warrants dilution - we jumped say 5X that day even if we do not know the exact nature of the future F and F or FF. At that point - at say 10 a share we can decide (individually) if we want to stay for the 100% new company we own (and maybe $20 or $30 or ?) --- given at that point we should have a clear knowledge we own 20% or 40% or whatever of FNMA not to be further diluted beyond beating us up from 100% to 20% or 40% or ?)

Very directly

What is the difference if money -cash - moved?

I hear you

Would the GOV argue that the language of the amendment --- that created this argued over "instrument - equity - obligation" call the variable LP Senior Preferred Stock - mutes or "combats" the

"the Law “Charter Act” forbids or prohibits the USA including Treasury from imposing any “charge” or “fee” on the purchase of any obligation, mbs, or security issued by FNMA."

From a non lawyer and not fully informed view - seems that one can argue that the HERA created paper - obligation - is the amendment to that prohibition ?

interesting

I am not a lawyer - and also have not read every sentence of all documents OR other situations that may have some precedent value

I can see why the LP can be called a charge

At same time ---- without direct knowledge of the "wording" - I have viewed the LP as the "counter"

Regardless of amount invested by the GOV in dollars - or gained in dividends - the # of shares and the value per share of the SP stock does not change (there is no market and it was not designed to change up or down). Thus there has to be a way to count up - to count - the amount invested - thus the LP takes on that role . The below is cut and paste and followed by a serious question

If FNMA takes treasuries money, then in consideration of that money, FNMA must give treasury warrants for common stock, and must attach the money borrowed plus 10% (later NWS) to each share of the Senior Preferred.

My question ---- in the context that what I did read over the years uses the words stock - dividends - investment ---- and not loan ------ Why do you say the "money is borrowed "? And if you believe it is borrowed is the 10% then interest? Summary point :: As you have all the language - does the paperwork - agreements - covenants - whatever -- as written by GOV --- every use the words loan or borrowed or interest ? My impression has always been the words would be investment - equity - and dividends ---- which makes a huge difference. The GOV did not call this senior debt paper but LP associated equity (and yes there is clear absolute discussion of FEES - but those IMO are neither interest nor dividends but fees) Second question --- Even if it requires a stretch --- do you think the paperwork would flat out allow FNMA and or Freddie to call in the SR Preferred Paper via issuing warrants (the original or some more ?) I am always looking for more ways the GOV can wipe out the full LP counted SP obligation (and believe GOV (Treasury) can do so now already)

you and your other hedge fund traders are responsible for the delay. you bought in 2014 knowing of nws. what the hell you are crying about? folks like me who bought pre 2008 as well as added pre nws should be compensated first even though i had to sell my shares due to financial need. do you get the fact that you should have no right to shout about nws? and the lamberth trial is frivolous for those who bought after nws as they did not even suffer a loss, the trial awards for one day drop in price as nws was announced and you did not even own it then as you bought in 2014. talk about greed and sham.

As long as the company man has it on his to do list, it's gonna be a long wait. There are no rules any longer.

Only in Manhattan!

Check back mid July.🤞

Will the 8-0 jury trial ever get certified?

It’s like today’s generation that just ghosts you until you go away and give up because they just ignore a reply or an answer.

Does anyone know of there is a deadline for this and has the judge already ignored it and is just not going to do anything?

Are the lawyers that won this jury trial doing anything to get this certified or just playing golf and billing more hours?

Unreal how nothing ever gets done here

A possible attack with "Chevron" has been defused before it happens, over on the Fanniegate hashtag.

Pagliara's clerk has already began to spread this theory in this message board.

In yesterday's post, it's clear that the statutory provisions aren't up for interpretation, as all roads lead to Rome. Therefore, the Chevron doctrine doesn't apply in our case.

It was also defused the rhetoric "unaccountable Agency" and "abusive conservator".

The Supreme Court is expected to either overturn or limit Chevron deference.

It was also defused the aftermath of a first attack with Chevron, already pointed out by the GOP.

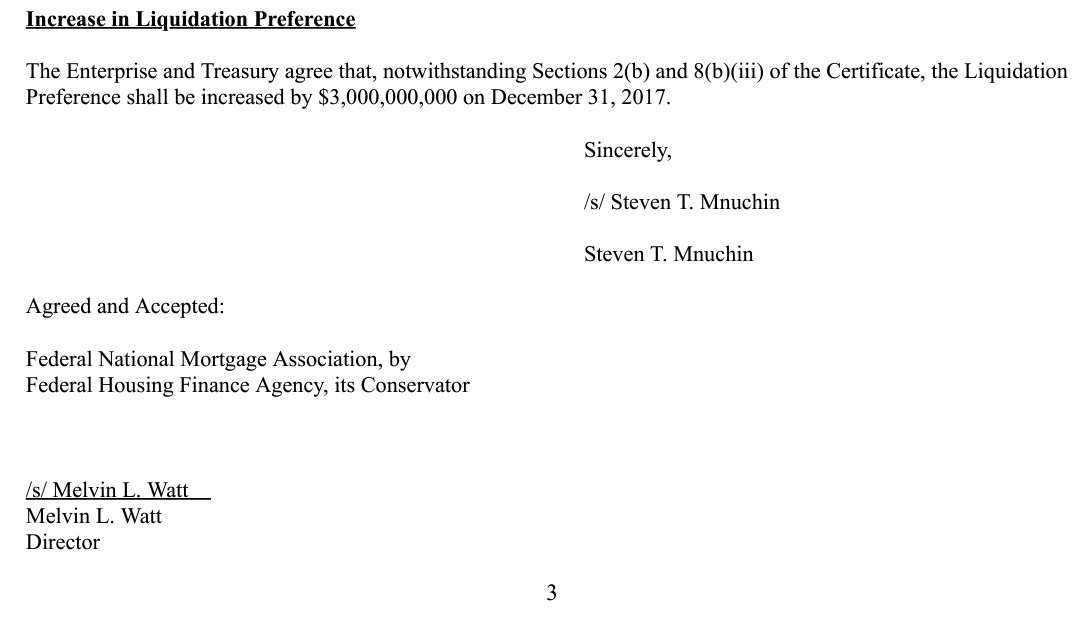

We've got it covered. Trump is the mastermind of the NWS 2.0 (same Common Equity Sweep as before), that began with the Mnuchin-Watt combo on December 2017 ($3B SPS LP increased for free), when they were warned by a shareholder that the SPSPA is void as of 2018, because the 3rd PA amendment had a target of $0 Net Worth in 2018, a breach of the Charter Act that requires the management to have a minimum Net Worth.

The NWS 2.0 continued with Calabria.

A #SCOTUS decision re #Chevron that establishes deference for administrative action, can't be used in #Fanniegate for the "Blame DeMarco doctrine".

— Conservatives against Trump (@CarlosVignote) June 26, 2024

He deliberately enacted the supplemental CFR1237.12,enabling a follow-on Separate Acct plan.#Trump built on it: Gifted SPS(NWS 2.0) https://t.co/9N0M7imwTP

The same you replied with your alias "HappyAlways", contending that you wanted to continue to call the dividend payments "interests".

I will not stop using the word contract.

“SEPARATE ACCOUNT FOR THE REPAYMENT OF PRINCIPAL”. This statement is confusing the reader

.jpeg)

"He is a lawyer that represents himself" and 50+ aliases on Ihub.

Overheard at Kelly's Pool Parlor

Eight-Ball Louie said he's loadin' up tomorrow on Fannie Mae

That is of zero worth to us

Up 4.38%. Nice. A hedge fund trader i know bought recently on the decline. Fwiw

The Derivative Market Needs to Pay Up.

I find it interesting that I posted two related posts on COOP, and on LEHNQ, FNMA regarding the value of investments in ABS/RMBS.

I received no relevant response!

The point is that the performing ABS/RMBS make all four corporations solvent.

All four are awaiting the Derivative insurance contracts to pay up.

Resolution releases the accumulation of funds with interest for the ABS/RMBS.

Ron

FNF Closing prices today - Last minutes SHOPPING !!

FNMA - 1.3100+0.0600 (+4.80%) At close: 03:59PM EDT

FMCC - 1.2500+0.0900 (+7.76%) At close: 03:59PM EDT

Hahahahasnork. Polls shifting to Kamala Word Salad.

He was reportedly instrumental in getting a young Joe Biden's political career off the ground. Unfortunately, the older Joe Biden appears to have forgotten who Gary Hindes is. Hindes probably doesn't want to embarrass the President. If I recall correctly, he only published one article during the current administration. I am confident he'll be more vocal in the next.

Market makers will bleed buyers on ANY sizeable buy - especially "larger" orders at the end of the day, but overall volume on both Fannie & Freddier were pretty anemic today. Both yesterday and today were below average volume. We'll see tomorrow.

Yes, the finish suggests that some big announcement is coming. Maybe Lamberth's ruling?

The way the polls are shifting, we better be ready for what Kamala Harris thinks as well on GSE reform strategy

I know, its not a popular opinion or option on this board, but that could be the truth as well

I think he’s still in. He gave me a “Like” on Twitter about Five - Six months ago.

FNMA closed at $1.31–5 cent last minute rally-That 126 is a late post to the tape from an earlier transaction

And the closing prices of Fannie vs. Freddie

is ONE CENT

Fannie close - $1.26

Freddie close - $1.25

Somethins'coming,

I don't know

what it is, but it is

gonna be BIG

Nice end of day rally

Is Gary Hindes out? Has he exited? I haven't heard or seen much of him lately ...

Trust the voices in your head telling to

to LOAD UP on Fannie and Freddie

Load up and Fight to Right the Wrongs

done to shareholders

Here we FKing GO! Let the fraud games begin!

https://www.foxbusiness.com/media/mortgage-giant-gets-green-light-from-biden-administration-risky-pilot-program

I like Tim Scott, but I don't think he's getting the nod. And the GSE's will not get so much as a mention despite the fact that housing will be discussed. Whether it will be discussed fairly and honestly remains to be seen.

Wise Man is a smart aleck but it’s worth noting what he said…. “ these SPS issued for free” …

The question I had was the SPSPA consummated when no cash changing hands?

Wise Man

Re: Rodney5 post# 753028

Tuesday, 04/18/2023 2:08:20 AM

15 years later, you wonder what $1B SPS was about, on day one of conservatorship.

Also, these SPS issued for free (all others, increased) are an essential evidence of the accounting fraud with today's SPS increased for free, because FnF, in 2008, posted a charge on the Additional Paid-In Capital account (shareholders' pocket) to reflect that they were securities issued for free.

Today, with the APIC exhausted, it's debited from the Retained Earnings account (Core Capital and Common Equity too).

But FnF now don't post the gifted SPS on the Balance Sheets, in order to don't post this offset and peddle the big lie of "FnF build capital".

Playing the fool is not an option, Mr. Pro Se, after 10 years messing around in the U.S. courts. It's called abuse of court process.

Can't wait to see the penalties.

As will housing prices.

Thanks Barron,

I found the discussion.

https://investorshub.advfn.com/boards/read_msg.aspx?message_id=171709055

Rodney5

Re: None

Monday, 04/17/2023 9:10:47 PM

I have a question, when the SPSPA took place did any money change hands from the Treasury Department on to the balance sheet of the companies? Recorded in the amount of $1 billion?

Bryndon

04/17/23 9:34 PM

#753030 RE: Rodney5 #753028

I'm pretty sure it was a non-cash activity.

Fannie Mae's December 31, 2008 10-K:

https://www.sec.gov/Archives/edgar/data/310522/000095013309000487/w72716e10vk.htm#304;

It doesn’t matter, I am explaining what the contract in fact says. What actually happened is a different topic. Donotunderstand doesn’t understand, which means many others don’t understand what has happened as well. Knowledge is power.

“Treasury Department bought 1million shares of Senior Preferred Shares for $1,000 per share or $1 billion dollars.”

I’m pretty sure no money ever changed hands from the Treasury to the companies. We had this discussion several months back.

The only section of the Charter Act that was amended by HERA was Section 304(G). That section gave Treasury temporary authority to purchase GSE obligations and securities to help the secondary mortgage market. That section expired long ago. It is the section that Treasury used to enter into the SPSPA with FHFA gaining 100 percent of ownership of GSEs net worth and non-regulatory control of FNMA including whether and if the Conservatorship can ever end.

sure,

i haven't seen any of these potential legal filings/briefs yet so haven't posted any, shrug.

i usually get them in my email from someone who checks pacer.

josh angel just had his case dismissed --- his angle has always been a bit different.. he has had interesting arguments and i think he is a lawyer that represents himself which is pretty neat.

GSE release & Tim Scott-as VP will be launched in the debate by Biden & Trump respectively

Close but no cigar. If you read the SPSPA, you will see the Treasury Department bought 1million shares of Senior Preferred Shares for $1,000 per share or $1 billion dollars. However, the “variable Liquidation Preference” is a charge that is tacked on to the 1million shares of SPS that reflects dollar for dollar, how much “commitment” FNMA uses from Treasury. Initially $100 billion available to draw from. Second amendment increased that to $200 billion of commitment. The Treasury did not purchase 100 billion worth of SPS and then purchased another 100 billion worth of SPS in the second amendment to the SPSPA. No. They only ever bought 1 million shares of SPS at $1000 per share. So what is the Variable Liquidation Preference? And what are the warrants? Well, if you read the SPSPA they are defined as a “commitment fee”. If FNMA takes treasuries money, then in consideration of that money, FNMA must give treasury warrants for common stock, and must attach the money borrowed plus 10% (later NWS) to each share of the Senior Preferred. The problem with a “commitment fee” is that the Law “Charter Act” forbids or prohibits the USA including Treasury from imposing any “charge” or “fee” on the purchase of any obligation, mbs, or security issued by FNMA.

yes

I agree

but as to a court case --- even understanding that right now the amendments "are not as permanent" - if a key section of the Charter Act is directly amended ------- as I understand it - the AMENDED law would be the law in a court case ------- not what the charter act said in the first place

?

So - where HERA does not talk to charter act directly (or maybe in some cases indirectly but clearly) the Charter Act rules

But in the other cases - the direct amendment or such - the amendment rules the day

That is where my head is at ----- I wonder if key parts of the violated Charter Act were violated due to sections of HERA designed for that purpose ?

|

Followers

|

2331

|

Posters

|

|

|

Posts (Today)

|

21

|

Posts (Total)

|

802507

|

|

Created

|

07/14/08

|

Type

|

Free

|

| Moderators not one red cent ~NORC~ stockprofitter Ace Trader EternalPatience jeddiemack FOFreddie | |||

Fannie Mae (the Federal National Mortgage Association, or FNMA) is a government-sponsored enterprise (GSE) in the U.S. that was established in 1938. Its main purpose is to provide liquidity, stability, and affordability to the U.S. housing market. It does this by purchasing mortgages from lenders (like banks), packaging them into mortgage-backed securities (MBS), and selling those securities to investors. This process ensures that lenders have more capital to issue new home loans, helping more Americans get access to homeownership.

| Volume | |

| Day Range: | |

| Bid Price | |

| Ask Price | |

| Last Trade Time: |