Register for free to join our community of investors and share your ideas. You will also get access to streaming quotes, interactive charts, trades, portfolio, live options flow and more tools.

you have told us before that you sold it all. zero credibility. good luck, we see a lot like you.

Hi Clarence,

It is quite a confusing situation to wrap one’s head around. There are 3 laws, and 3 potential roles for a Director of FHFA to play. First the Charter act privatized the former gov agencies and created FNMA. The safety and soundness act of 1992 established the framework for regulating the GSEs. Finally HERA came along and modified both the charter act and the safety and soundness act. HERA replaced the original regulator with the new “independent agency” FHFA. The Director of FHFA priority role is to regulate the GSEs based on the requirements enumerated in the statutes. This role of the Director establishes regulations required of him such as the Capitol rule, and new products rule. The Director in this role also issues reports and is supposed to provide in writing, permission for the GSEs to make a capitol distribution from the retained earnings account if the retained earnings account is below the statutory minimum. Thus all of these requirements of the director must follow the Administrative Procedures Act. In other words, the Directors role as regulator is Administrative and subject to potential APA claims. HERA also allows the Director in the regulator role to appoint himself as either a receiver or a conservator of the GSEs. The role of receiver is subject to the enumerated actions in the statutes to achieve the end result of liquefying the GSE. Therefore there is no guesswork to achieve the result. The law states exactly what a receiver is allowed to do. Finally, HERA allows the Director as Conservator to take any action necessary to put the GSE in a sound and solvent position and benefit the FHFA itself. Unlike a receivership, the final result of Conservatorship can’t be guaranteed by statute. It is necessary therefore to provide the Conservator the assumption of correctness in the actions that he takes to achieve the goals of rehabilitation of the GSEs and benefit the FHFA. Congress includes the anti-injunction clause only for the actions taken by the Director acting as Conservator. All of the courts have ruled that only when the Director acting as Conservator acts ultra-vires will a court step in. They have ruled that the Conservator has not acted ultra-vires. To date there have been no legal claims against the Director as regulator for violations of other laws.

Make it 10.

Royce is not who you think he is.

ok

I agree - i post too fast and sloppy

will add discipline -- at least for a while

Been saying it for years the lawyers have their ideal client, rich clients. Lawyers are smart enough to extract as much as possible.

Post judgment interest will have almost no effect.

The gubmint has done a number on you as you are thinking about this well into the night.

Can you write in English and use decent grammar????? No one can understand you. ??????

Well, we are completing another and larger Bull Pennant also!

Yes every price change has nothing to do with who's buying or selling. It's all based on the polls.

No you are not buying you have no money.

thank you

can you relink - if each case is listed

otherwise - bluntly - I will think and believe ALITO made a mistake as I hate him anyway

question in April 2024

if things are as black and white as you note --- APA not followed

why no lawsuit - (maybe due to focus on NWS)

can this still be SUED - civil or criminal or - ?????? or is it too late

and if yes - can you contact our lawyers - pick any that are winning and would take it on contingency - maybe by now as class action

What is going on with pps?

Wiseman, Will DJT have access to the “Secret Plan”? Or is this ONLY for the current President?

(Asking for a friend).

Hello? $1.55

Very much appreciated !

You’re confusing the law with its case-specific application to facts. I was only discussing the former because the original poster made the assertion that actions of the conservator could not be questioned, which is a false statement.

Again, and as I said twice before, read page 12 of Collins and you’ll see every circuit ***to review*** 4617f agreed with the statement of law I posted.

If your selling, I'm buying. Good Karma for F&F

The Administrative Procedure Act (APA) is a federal act that governs the procedures of administrative law.

Director Regulator / Conservator two different positions. Strangely enough Director Lockhart Regulator, and Director Lockhart Conservator held both positions as Regulator and Conservator at the same time.

The Senior Preferred Stock, with a variable liquidation preference outlined in the SPSPA and its amendments and share certificates is a new product for the purposes of the Safety and Soundness Act of 1992 as amended by HERA.

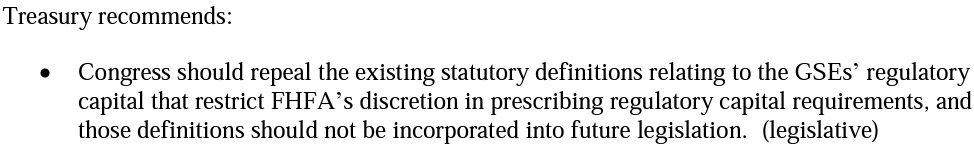

Congress directed the Director of FHFA to apply the Administrative Procedures Act to the new products sold to Treasury. The FHFA did not follow the administrative procedures congress required in the plain language of the safety and soundness act.

The Director of FHFA as regulator violated the safety and soundness act and the administrative procedures act by not following the statutory duty to approve new products issued by the GSEs to Treasury for the purpose of stabilizing the secondary mortgage market.

The law required the publication in the federal register of the SPS with their variable rate liquidation preference tied to the commitment. It requires a public comment period, and a rule making process to make the SPS legal. It is the same law that required the capital rule. And the same law that required FHFA a year ago issue the new products law for MBS products. They have ignored this requirement for 15 years.

Director Lockhart Regulator, and Director Lockhart Conservator. Holding both positions as Regulator and Conservator; Conservator Lockhart is required by law to file notice to himself as Regulator.

The Safety and Soundness Act required Director Lockhart as regulator not conservator to approve a new product issued by Director Lockhart acting as conservator FHFA-C (SPS with variable liquidation Preference) to Treasury under the terms of the SPSPA for the purpose of carrying out the secondary mortgage market. He was required as regulator to file notice in the federal register, seek public comment and issue federal regulations for the new product we call the Senior Preferred shares sold to Treasury.

HOUSING AND ECONOMIC RECOVERY ACT OF 2008

Page 2689

SEC. 1321. PRIOR APPROVAL AUTHORITY FOR PRODUCTS.

Link: https://www.congress.gov/110/plaws/publ289/PLAW-110publ289.pdf

I'll still have 75% left, don't I still qualify?

hhmm

boy does that sound right

the return to Lamberth - to quantify and finalize damages - was sent to Lamberth by SCOTUS - upholding that small part of the EN BANC ruling

not sure every circuit - appeals court - agreed

now if you add - EVENTUALLY -- that might be a different story

we - plaintiffs for equity would never have asked for or needed and then received an EN BANC hearing and ruling if the first three judge panel of that circuit - appeals court had ruled for plaintiffs. So that circuit first dais nope to us - then the total court said yup - if FHFA exceeds the law then courts can come in - despite the courts not allowed sign on the fence (written into HERA)

Seems odd?? It’s been explained, not odd at all… The fact of the matter the lawyers got it wrong.

Barron4664

09/20/23 9:36 AM

Post #768746 on Fannie Mae (FNMA)

The problem is not with the rulings of the courts. The problem is and always has been that the plaintiffs attorneys have only challenged the “Actions of the Conservator” such as the NWS or other provisions of SPSPA which is a contract. 4617f bars courts from questioning the actions of a conservator. As it should. None of the 15 + years worth of court cases have challenged the action of the FHFA as regulator or Treasury with respect to the statutes that actually matter. The charter act, safety and soundness act, chief financial officer act, etc. To get a takings or an illegal exaction verdict, you have to show that the gov broke the laws. The actions of the conservator cant break a law. But if you go before a judge and say the SPSPA is bad and the gov stole our companies and limiting the argument to the specifics of the SPSPA agreement and the amendments you get 15 years of no results.“ End of Quote

Good bye. Thanks for coming. Close the door on your way out. I will cross you off the Vegas party list at the Wynn.

To your first question, no, Lamberth said FHFA acted within its powers and functions, but in doing so it breached the implied covenant of good faith and fair dealing anyway. This seems odd, but Lamberth explains that the alleged APA violation and contractual violation are very different claims and have different legal elements. FHFA violated only the latter.

But to your second question, yes.

This “Separate Account plan” kindly, explain to us how this will unfold. And when will this take place?

You calculate “An adjusted $402B core capital shortfall as of end of 2023.” What I understand from your perspective is the shortfall is by reason of the outstanding Senior Preferred Stock with the Liquidation Preference. Are you saying the SPS LP will be cancelled?

My understanding is Fannie Mae had a GAAP positive net worth of $78 billion at YE23, the Enterprise Regulatory Capital Framework excludes the stated value of the senior preferred stock ($120.8 billion), as well as a portion of deferred tax assets, resulting in the Company being significantly undercapitalized. Indeed, at YE23, the shortfall to adjusted capital requirements totaled $243 billion, with the Company reporting negative regulatory capital ratios given deficit for each tier of capital. Given covenants under the PA, Fannie Mae also does not have access to equity funding except through draws from the U.S. Treasury (and only when total liabilities exceed total assets).

Sorry boys, I'll be putting on some selling pressure today. Liquidating 25% of my FnF position today.

Invest in a coloring book!

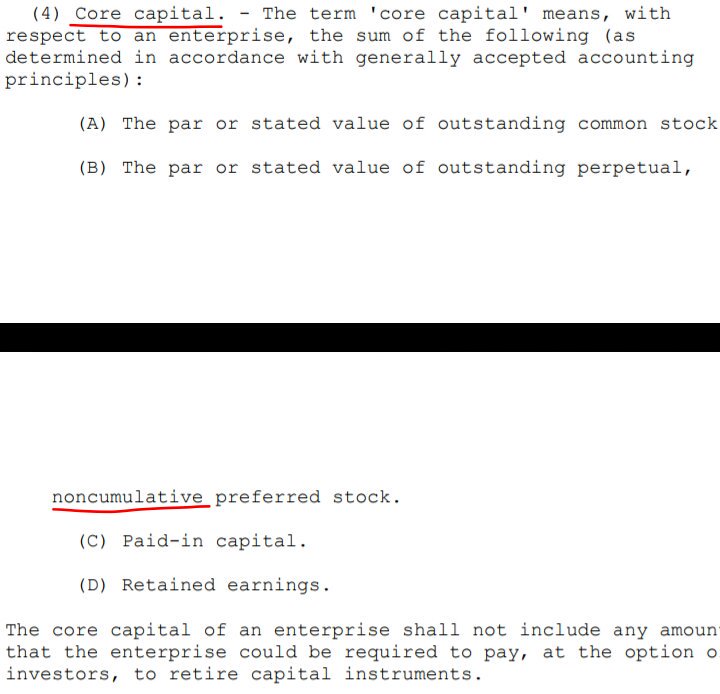

Now, hit this wall: Definition of Core Capital 12U.S.Code§4502(7)

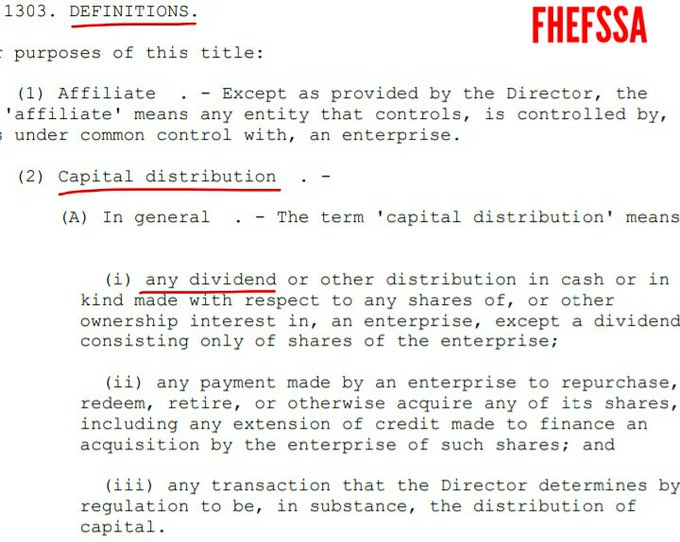

This is the FHEFSSA, not the U.S. Code:

Retained Earnings account is core capital. The only account that absorbs the future (unexpected) losses (the other Loan Loss Reserve -ALLL- is for expected losses -CECL accounting standard-. ALLL shows up as Asset writedown, that is, it assumes that the loss already occurred. Though it isn't true and that's why it's recorded as Tier 2 Capital for the Total Capital that has to meet the Risk-Based Capital requirement)

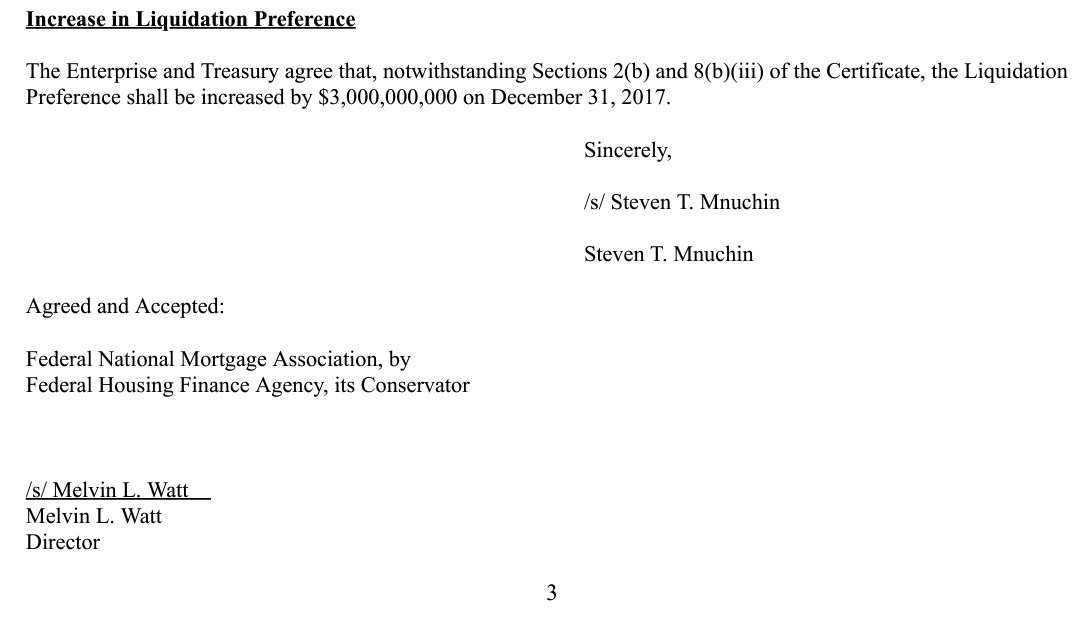

Today, the Retained Earnings accounts stand at an adjusted $-216B ($-91B officially on their Balance Sheets), adjusted for the offset (reduction of Retained Earnings) for the $125B worth of SPS LP increased for free (without getting the corresponding cash) since December 2017, with the masterminds of this 3rd phase of the Separate Account, Mnuchin/Trump, when they agreed with the FHFA director at the time, Mel Watt, on $3B gifted SPS on December 2017, when the Applicable Capital Reserve was raised to $3B.

Then it continued with Calabria on the September 2019 PA amendment and the latest, on the January 2021 amendment with the fraudulent concept "Capital Reserve End Date": when the capital requirements are met with Capital Reserve, and badly assessed, because of the offset mentioned (adjusted CR = $0)

It's the Core Capital the one that meets the Minimum Leverage Capital requirement, as per the definition of Capital Classification of Undercapitalized.

An adjusted $402B core capital shortfall as of end of 2023.

So much for "rehabilitation".

Mnuchin/Trump and Watt simply looked up the definition of capital distributions posted before, which are restricted, and when judge Willett called them out, unware that there is a Separate Account plan behind and in a half-baked ruling commented before, stating, about the NWS dividend, "that kind of liquidation exceeded the powers of the conservator", 3 weeks later they picked a different compensation to UST, notwithstanding that it's the same Common Equity Sweep as before, as we can see in:

- The Income Statement: Net Income less dividends or other compensation to UST, equals $0 Net Income Attributable to Common Shareholders. That is, $0 EPS.

- The Balance Sheet: here we can't see it here, because this SPS LP increased for free and its offset, are missing (Financial Statement fraud). But have a look to this adjusted Net Worth activity table, to see how it plays out. The Common Equity is always held in escrow, in order to uphold the Rehab power.

In the best interests of the Agency: mess around, in a conspiracy with the crooked litigants and Co.

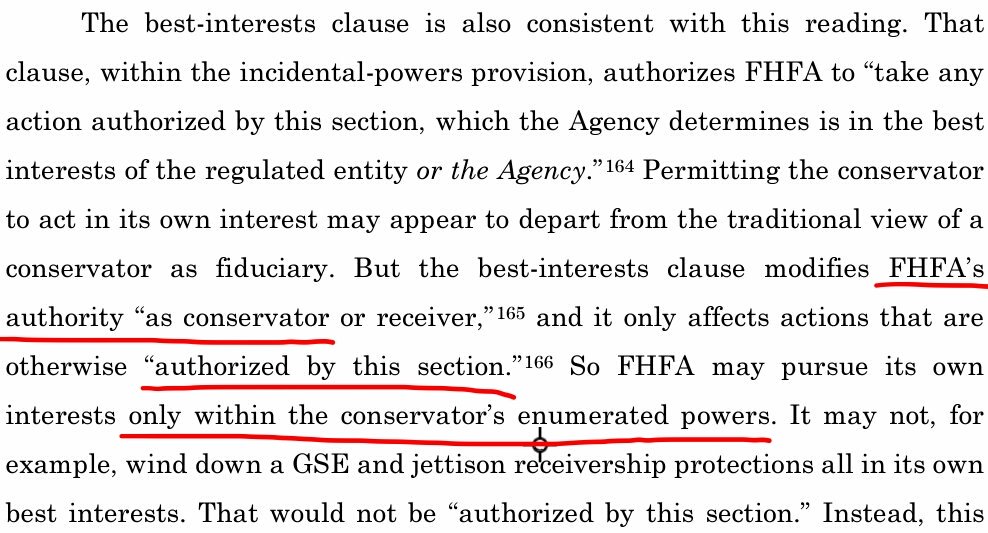

You shamelessly conceal that the UPMOST judge, justice Alito, began his interpretation of the FHFA-C's Incidental Power: "Rehabilitate FnF in a way....".

By the way, this comes after judge Sweeney's interpretation of this provision, deleted the words "authorized by this section", so she could read "take any action in the best interests of the FHFA", ending up with "the FHFA is the government". She was called out and renamed "The Tipp-Ex Queen", and it's when the big boys stepped in to give a proper interpretation of the written text. Primarily because take their capital away is NOT authorized by this section (a breach of the FHFA-C's Rehab power, knowning that "may" is imperative in legislation, once the capital has been generated, and not a choice. Already commented.)

Justice Alito was just making clear what judge Willett stated in a prior ruling (5th Cir.) over the same Collins case and regarding the same provision: "Any action within the enumerated powers".

Therefore, the savy Justice Alito simply looked for the FHFA-C's Powers, something that judge Willett missed, and determined that it's about the rehabilitation of FnF, when he read: "Put FnF in a sound and solvent condition", because he knows that the soundness in a financial company is measured with the Capital levels, where the Retained Earnings are recorded as Core Capital. And solvency (ability to meet the obligations) is suitable for the reduction of the SPS (obligations in respect of Capital Stock) and restore their capital levels as well.

Both are, precisely, the exceptions to the Restriction on Capital Distributions.

Then, we can come to the conclusion that the Restriction on Capital Distributions is a tool to achieve the FHFA-C's Rehab power.

This is why the FHFA's Power is also called "the Rehab power" or the "Recap power".

You have just posted justice Alito's add-on "and the public it serves" in your piecemeal approach (The Tipp-Ex gang), that stretches the interpretation of the FHFA-C's Incidental Power, useful to use FnF for government policies and to put an example, it would allow the Congress to keep the estimated $15B it owes to FnF for managing Obama's Making Home Affordable program (HAMP and HARP), that even made FnF advance the payments to borrowers and servicers (banks), with the promise that they would be reimbursed for this cost with TARP funds, but it didn't happen.

Also, the utilization of the hedge funds as a tool for government policies, after Trump approved the debt forgiveness plan (the short-sales that DeMarco prohibited), forcing FnF to sell their NPL and RPL to the hedge funds at a deep discount, because it contains a clause that includes debt forgiveness, and with the collateral (properties) valued sky high given away. This is an incentive to prompt manufactured crisis.

Fannie Mae. Sale of RPL:

purchasers must offer delinquent borrowers a waterfall of loss mitigation options, including loan modifications, which may include principal forgiveness, prior to initiating foreclosure on any loan. Source.

You continue to hit the wall of the Restriction on Capital Distributions and its exception (pay down the SPS) U.S.Code §4614(e), along with the exception added in "the supplemental" on July 20, 2011 CFR 1237.12 (Recapitalization in a separate account, either in the exception 1, 2, 3 and 4, because it (c) supplements and it shall not replace or affect the Restriction on Capital Distribution by the statue I began this comment with, which is meant for the recapitalization as well, because when you pay down the SPS, you are recapitalizing FnF at the same time, as the SPS are pay down with normal cash and they aren't core capital, whereas the posting on Retained Earnings stays, Core Capital)

At the same time, the FHFA is complying with its Power of Recapitalization and also improving their Solvency with the reduction of SPS.

"(May) put FnF in a sound and solvent condition".

When "may" is imperative once the capital has been generated, and it's only to give the conservator some leeway to carry out activities or actions (upholding the law, obviously. It wasn't turned into an outlaw Agency).

The Restriction on Capital Distributions is written in stone.

The same as the penalty on all those individuals that have covered it up in formal documents: court briefs including Amicus briefs, GSE slides, "letters to my partners", articles, books, etc., as long as these documents are publicly available

The obsession to conceal the FHEFSSA, so that the definitions regarding capital go unnoticed, is of epic proportions.

Like the very Mnuchin's Treasury Department:

Something that people should have learned beforehand, in order to make decisions about FnF, that's why to become FHFA director is required a deep understanding in financial matters.

The judges are providing the alibi to not unveil the Separate Account plan. That is, playing the fool with the pomp of a black robe.

Now, hit this wall too. CAPITAL DISTRIBUTION: Dividends, today's SPS increased for free and the Lamberth rebated added later in #3 through regulation CFR 1229.13.

So, dosen't the Lambreth case do exactly that? We just need it finialized, right?

Every appeals court to review the anti-injunction clause held that relief was allowed if FHFA exceeded its authority. Again, refer for this to Collins on page 12. Something to read, indeed.

And because your rhyme, I'd be exited about a dime.

“ granted motion to dismiss based on 4617”

I think you have it right Donotunderstand. That’s my understanding of what took place at the SCOTUS.

Count on Double Barrel middle fingers this time.....

LOL

Go FNF

something to read

I did not know Alito said that in the ruling (that courts can "enter" when conservator exceeds)

BEST I recall - all judges at circuit said ouch - too hot to touch when cases came to them

the first panel of the circuit said too hot to touch !! 4617 chases us away

but then then the EN BANC --- at the circuit level ---- said --- YUP if the Conservator GOES TO FAR that creates the green light for trial - fact district courts to enter

So that idea - that courts are not 100% "injunctioned" was an EN BANC circuit court (appeals court) decision --- that then is repeated by SCOTUS as an appeals court too

(no real re examination of fact pattern)

But --- until the EN BANC so declared partial freedom every judge in every case - granted motion to dismiss based on 4617 as I recall - not just Lamberth

Is that right or wrong ?

$125B as long as the GOV does not claim 300B of LP or do a conversion

Q1 earnings will be stellar. Higher profits, higher margin, higher everything

But we investors, as usual get the finger

We can take it to the bank

Let’s see what the Fnma quarterly looks like. Can only look forward to more profits.

Fnma

I want to thank our friend Barron for bringing his knowledge to this board.

“ Notice I do not touch the conservatorship. That is a failed legal strategy of 15 years.”

Barron4664

08/16/23 2:32 PM

Post #763179 on Fannie Mae (FNMA)

The idea behind my proposal is for the little share holders to use their local federal district courts to put foreword direct claims for illegal exaction based on actions of Treasury and FHFA as regulator that I believe violate the Charter Act, Safety and Soundness Act, Administrative Procedures Act, and possibly the Chief Financial Officers Act. Notice I do not touch the conservatorship. That is a failed legal strategy of 15 years now and counting. A legal rabbit hole. The Treasury violates the Charter Act by attaching a variable liquidation Preference based on the amount of public debt used to the purchase of a set number of senior preferred shares and calls this a commitment fee. The same with the warrants. Defined as “in consideration for access to the commitment (public debt)”. The Director of FHFA as regulator violated the safety and soundness act and the administrative procedures act by not following the statutory duty to approve new products issued by the GSEs to Treasury for the purpose of stabilizing the secondary mortgage market. The law required the publication in the federal register of the SPS with their variable rate liquidation preference tied to the commitment. It requires a public comment period, and a rule making process to make the SPS legal. It is the same law that required the capital rule. And the same law that required FHFA a year ago issue the new products law for MBS products. They have ignored this requirement for 15 years and not one plaintiff attorney has bothered to ask why Dir Lockhart didnt do his job. My idea is that if multiple shareholders file in different districts using the little tucker act, we might get some results. Even better if different districts get different results as it would then be a controversy. These are plain language laws. If we win then everything in the SPSPA would be null. What does that mean? I don’t know. Someone smarter than me would have to figure out the unwinding of this. I do know that Mr. Kelly would be the biggest benefactor of a positive ruling of this sort. I would imagine all money returned to the GSEs. SPS and warrants cancelled.

Clarence, again I appreciate you wanting to understand our situation. I’m saying it one more time.

Conservator AND Regulator are entirely two different positions. The attorney’s DID NOT CHALLENGE the Authority of the Regulator. The plaintiffs are focused on the contract SPSPA lost dividends and never challenged the FHFA Director Regulator as breaking the Law.

Bradturd, you have not been right about ANYTHING!

Why do you even post?

Aren't you embarrassed?

For tomorrow?

Launch before Lunch

Moon by Noon

Fight, Fight, Fight for what is Right

Fight to Right the Wrongs done to Shareholders

Fight with All your Might

Shareholders have been Wronged -

Cheated out of their Investments in Fannie and Freddie

Thousands upon Thousands of Shareholders ROBBED

The assertion that “4617f bars courts from questioning the actions of a conservator” is a false statement.

As background, 4617f is the so-called anti-injunction clause.

I suggest reading Collins v Yellen, particularly published pages 12-15 in Justice Alito’s opinion. Alito expressly states that “where the FHFA does not exercise but instead exceeds those powers or functions, the anti-injunction clause imposes no restrictions. With that understanding in mind, ***we must decide whether the FHFA was exercising its powers or functions as a conservator***” (emphasis added).

After analyzing statutory construction and reviewing the Agency’s actions, Alito concludes in the last sentence of page 14 that “the FHFA could have reasonably concluded that (the Third Amendment) was in the best interests of the … public. The Recovery Act therefore authorized the Agency to choose this option.” So, not only is your assertion false, its converse is true:

Courts first are duty-bound to decide whether the FHFA exceeded its authorized powers or functions as conservator. Only if this review (i.e., in your words—questioning the conservator) shows that FHFA did not exceed its powers or functions, is 4617f then triggered.

Whether or not some lower courts had the correct understanding before Collins, the approach in Collins is the law. We would all be wise to understand it.

Link: https://www.supremecourt.gov/opinions/20pdf/19-422_k537.pdf

LOL

The government would have given the $$$ and the companies back?

Can I have a puff too? Whatever it is, it must be a powerful one

|

Followers

|

2331

|

Posters

|

|

|

Posts (Today)

|

33

|

Posts (Total)

|

802387

|

|

Created

|

07/14/08

|

Type

|

Free

|

| Moderators not one red cent ~NORC~ stockprofitter Ace Trader EternalPatience jeddiemack FOFreddie | |||

Fannie Mae (the Federal National Mortgage Association, or FNMA) is a government-sponsored enterprise (GSE) in the U.S. that was established in 1938. Its main purpose is to provide liquidity, stability, and affordability to the U.S. housing market. It does this by purchasing mortgages from lenders (like banks), packaging them into mortgage-backed securities (MBS), and selling those securities to investors. This process ensures that lenders have more capital to issue new home loans, helping more Americans get access to homeownership.

| Volume | |

| Day Range: | |

| Bid Price | |

| Ask Price | |

| Last Trade Time: |