Monday, April 29, 2024 3:36:21 AM

This is the FHEFSSA, not the U.S. Code:

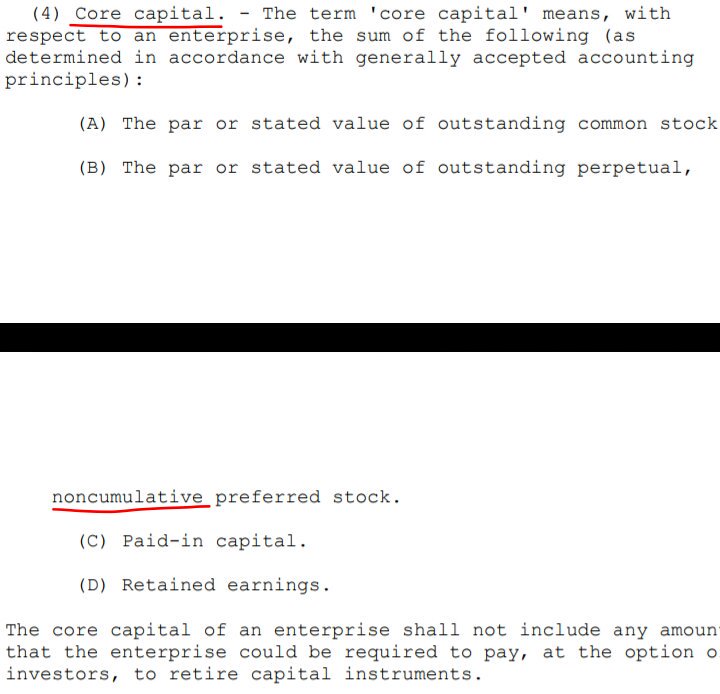

Retained Earnings account is core capital. The only account that absorbs the future (unexpected) losses (the other Loan Loss Reserve -ALLL- is for expected losses -CECL accounting standard-. ALLL shows up as Asset writedown, that is, it assumes that the loss already occurred. Though it isn't true and that's why it's recorded as Tier 2 Capital for the Total Capital that has to meet the Risk-Based Capital requirement)

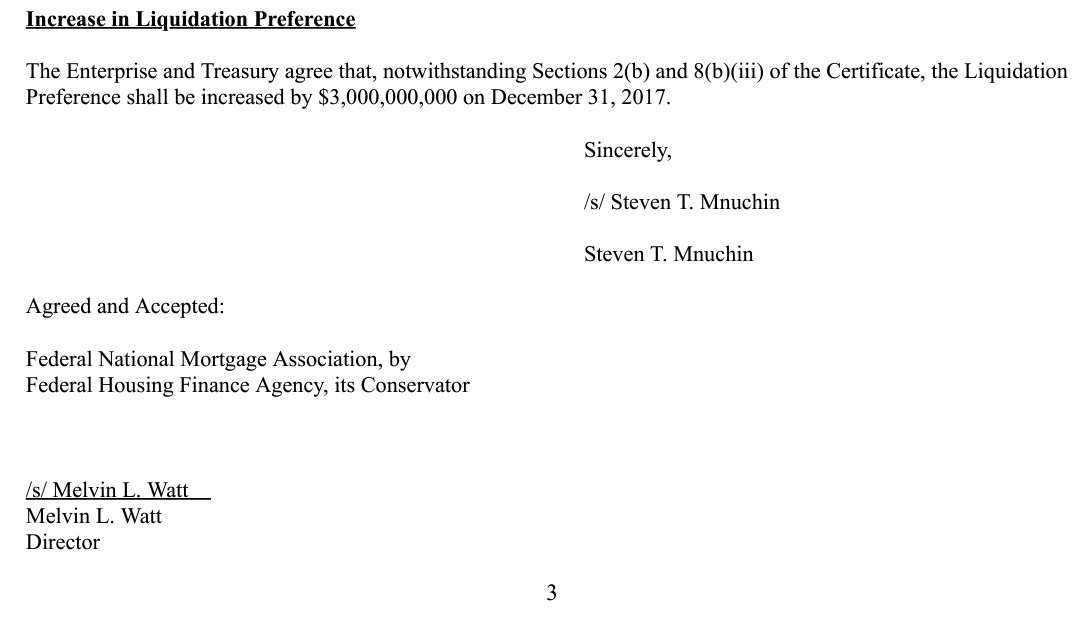

Today, the Retained Earnings accounts stand at an adjusted $-216B ($-91B officially on their Balance Sheets), adjusted for the offset (reduction of Retained Earnings) for the $125B worth of SPS LP increased for free (without getting the corresponding cash) since December 2017, with the masterminds of this 3rd phase of the Separate Account, Mnuchin/Trump, when they agreed with the FHFA director at the time, Mel Watt, on $3B gifted SPS on December 2017, when the Applicable Capital Reserve was raised to $3B.

Then it continued with Calabria on the September 2019 PA amendment and the latest, on the January 2021 amendment with the fraudulent concept "Capital Reserve End Date": when the capital requirements are met with Capital Reserve, and badly assessed, because of the offset mentioned (adjusted CR = $0)

It's the Core Capital the one that meets the Minimum Leverage Capital requirement, as per the definition of Capital Classification of Undercapitalized.

An adjusted $402B core capital shortfall as of end of 2023.

So much for "rehabilitation".

Mnuchin/Trump and Watt simply looked up the definition of capital distributions posted before, which are restricted, and when judge Willett called them out, unware that there is a Separate Account plan behind and in a half-baked ruling commented before, stating, about the NWS dividend, "that kind of liquidation exceeded the powers of the conservator", 3 weeks later they picked a different compensation to UST, notwithstanding that it's the same Common Equity Sweep as before, as we can see in:

- The Income Statement: Net Income less dividends or other compensation to UST, equals $0 Net Income Attributable to Common Shareholders. That is, $0 EPS.

- The Balance Sheet: here we can't see it here, because this SPS LP increased for free and its offset, are missing (Financial Statement fraud). But have a look to this adjusted Net Worth activity table, to see how it plays out. The Common Equity is always held in escrow, in order to uphold the Rehab power.

In the best interests of the Agency: mess around, in a conspiracy with the crooked litigants and Co.

Avant Technologies Engages Wired4Tech to Evaluate the Performance of Next Generation AI Server Technology • AVAI • May 23, 2024 8:00 AM

Branded Legacy, Inc. Unveils Collaboration with Celebrity Tattoo Artist Kat Tat for New Tattoo Aftercare Product • BLEG • May 22, 2024 8:30 AM

"Defo's Morning Briefing" Set to Debut for "GreenliteTV" • GRNL • May 21, 2024 2:28 PM

North Bay Resources Announces 50/50 JV at Fran Gold Project, British Columbia; Initiates NI 43-101 Resources Estimate and Bulk Sample • NBRI • May 21, 2024 9:07 AM

Greenlite Ventures Inks Deal to Acquire No Limit Technology • GRNL • May 17, 2024 3:00 PM

Music Licensing, Inc. (OTC: SONG) Subsidiary Pro Music Rights Secures Final Judgment of $114,081.30 USD, Demonstrating Strength of Licensing Agreements • SONGD • May 17, 2024 11:00 AM