Register for free to join our community of investors and share your ideas. You will also get access to streaming quotes, interactive charts, trades, portfolio, live options flow and more tools.

Yawn. I’ll pass. Think I’ll watch instead reruns of The Waltons. More exciting.

Govt-

“Let’s skip

The appeals process and just ask our old paid off buddy to throw out the case.

The media won’t do anything

No one knows

We can act like we never lost”

Unreal

Has this ever been done before?

Tia

Donotunderstand - I'm just making reference to the bazillion times KThomp refers to quotes in Calabria's book.

A recollection of a conversation from years prior, where someone said something and it gets positioned as Treasury said or did something official, when in fact it is nothing more than hearsay.

Senate Banking & Housing Hearing Begins @ 10:10 am EST ...

Link :

https://www.banking.senate.gov/hearings/oversight-of-federal-housing-regulators

No idea. I posted for those who know about litigation, laws, courts, etc and share the meaning to us

THANK YOU

What is this litigation or is it a repeat of some old stuff?

THANK YOU FOR THE LINK

yup

he has his finger on the pulse of the problem

not enough physical land ??

WTF ??

who is paying him to say such silly stuff

?

just because something is written -- article ? book ?

Tons of stuff - lies - opinions stated as facts - have been written in articles and books

this is where the court system could completely break down, if any judge ignores the judicial process and gives in to Government pressure because they lost. we are truly in a banana republic or worse, communism, where Government does whatever they want for whatever greedy reason they want, and tells judges to ignore the truth and the people

Good Morning - for me

I have suggested a temporary suspension of the FEES to reduce rates on mortgages to the end user

Your post noted ---

......on how the gse's would help more houses being built, better loan rates,

can you elaborate with specifics ? Whether we like it or not - best I can see - the GSEs have a GOV risk back up and are doing well for profit - consumers - banks who use them.

what would being free do to lower rates ?

again - I have suggested my approach that I know would work and fast

??

Govt goons have filed for Lamberth to THROW OUT the

UNANIMOUS 8-0 JURY JUDGEMENT and the DAMAGES

that "THEY" HAVE AGREED TO .. ! 67 pages worth :

https://www.glenbradford.com/wp-content/uploads/2024/04/13-mc-01288-423.pdf

It seems there’s not much anyone gse related can ask that outdated dinosaur simili judge- he’s above the law- biased comments in court and doesn’t follow any timeline.

How is he still a judge is beyond any logic.

Fnma

Are asking Judge Lamberth to ignore the jury verdict and Court grant judgment as a

matter of law for Defendants.

Freddie Mac Tightens Lending Rules In Bid To Detect Fraud

Need Subscription to read full article, sorry

snippet:

Freddie Mac is rolling out new policies to help detect fraud and mitigate risks, the latest policy adjustments following two high-profile instances of alleged malfeasance in New York.

https://www.bisnow.com/national/news/multifamily/freddie-mac-tightens-lending-rules-in-bid-to-detect-fraud-123826

What does the latest here mean exactly? Did FHFA file to keep these documents sealed? Just want to know if I'm understanding this right.

The FHFA Director lies in her written testimony for today's hearing.

1st. She refers to the FHFA-R's duty "ensure that FnF operate in a safe and sound manner", but she omits once again (like all other FHFA directors) what comes up next: "...including maintenance of adequate capital".

And "capital", in this world, means regulatory capital if everything is set forth in the FHEFSSA that establishes the capital ratios, definitions, etc. She can't make up "Capital Reserve" and badly assessed (Adjusted Capital Reserve = $0) with the Net Worth.

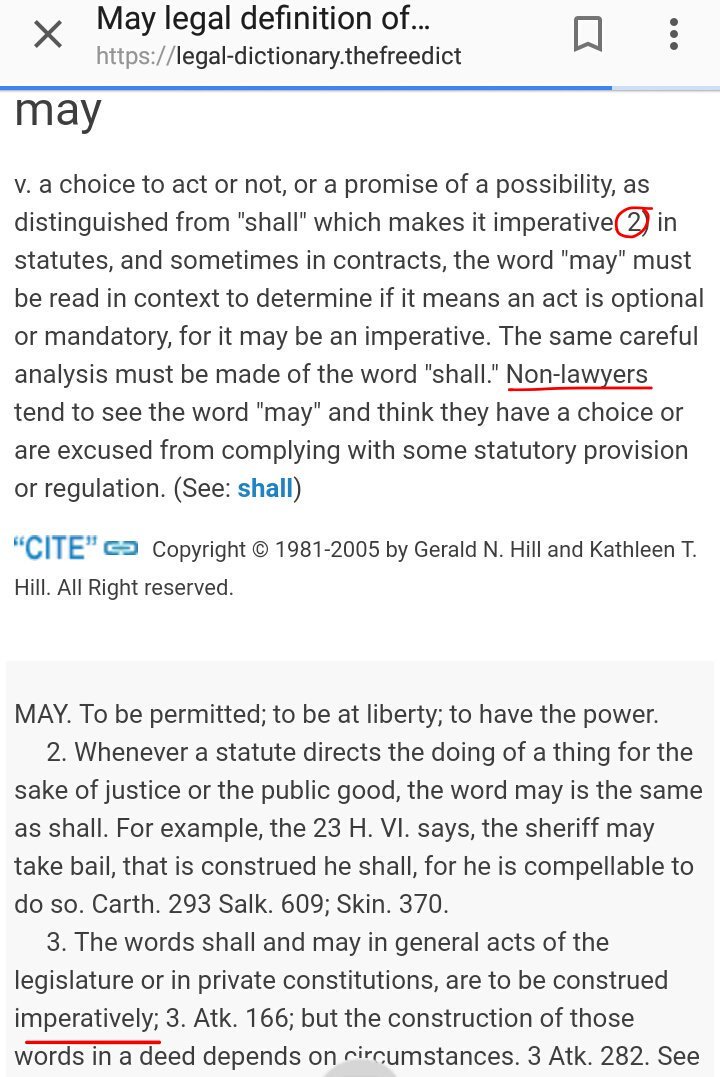

Also, she omits her role as director of the FHFA acting as conservator, with a Power of recapitalization, commonly known as "Rehab power": "May put FnF in a sound and solvent condition", when soundness is related to capital levels. And "may" is related to some leeway in activities that carry more risk or incur losses, taking into account that supposedly the American economy is still bleeding (Huh?). In no event "may" means that it's excused from complying once the capital has been generated, authorizing to syphon it off to the Treasury.

Legal dictionary:

2nd. She has omitted this time, the prior slogan: "FnF remain undercapitalized". She must have read my comments pointing out that that was a quote taken from the Restriction on Capital Distributions in the law, as a reason for the restriction. Now she says that their capital available is "well below the minimum capital requirement".

3rd. The same lie: "FnF retain earnings", like Bill Ackman and his clerk, Bradford, and recently the FNMA CEO, based on the Financial Statement fraud of FnF, when they are reluctant to post on the balance sheet the SPS LP increased for free since December 2017, because they carry an offset (reduction of Retained Earnings account) that wipes out the Retained Earnings just built.

It would show that their current $125B Net Worth has been built solely with $125B SPS LP increased for free, currently missing.

She has omitted this time the: "FnF continue to build capital" before "through retained earnings", a slogan repeated by the others mentioned, and now she just says: "FnF built $125B Net Worth", when that's not a metric for the soundness in a financial company.

It's time to appoint someone with the knowledge in capital adequacy matters, who doesn't play with the words all the time: "Dividend obligation", in order to pass it off as the security "obligation" in the RefCorp obligation (FHLBanks' 1989 bailout).

This way, she wants to turn the dividend payments on SPS into the interest payments on RefCorp obligations, and skip the Restriction on Capital Distributions (Dividends, today's SPS LP increased for free and the Lamberth rebate).

A Goldman Sachs alumni will always do Goldman Sachs things.

Judge Lamberth, accomplice. FHFA files a motion for JMOL.

Under Rule 50 (b) and filed under seal, without the reply to the FHFA's Wall Street law firm of a question submitted last Friday, asking whether it can skip the page limitation to 55 pages.

Without the judge's required reply, the judge skips having to forfeit the motion at the same time, for the reasons outlined yesterday.

It was imprudent to file an oral motion for JMOL Rule 50(a) previously, during the trial, because the Rule requires that both have to have the same sufficiency-of-the-evidence arguments.

It isn't satisfied with an oral motion by any stretch of the imagination.

Therefore, judge Lamberth is accomplice of this delay tactic.

The judge has waived what his job requires, pointed out in my follow-up:

(*) Pending to know what the judge has to say in a reply.

You continue to skip the FHEFSSA's Critical Capital level.

You only talk about HERA, despite that HERA only inserted amendments in the FHEFSSA (and the Charter Act).

Thus, without amendments, the Critical Capital level remains as is. And therefore:

An enterprise shall be classified as critically undercapitalized if—

(ii)does not maintain an amount of core capital that is equal to or exceeds the critical capital level for the enterprise;

Hopefully, some smart Senators grill her on that.

The Government is coming out with a new homeless program . Citing the in expensive cost of building igloos, the Government has decided on a trial program in Phoenix, Arizona. There will be multiple units in ten acre lots to save on the cost of cooling.

only thing wrong with this letter is she states the GSE's are still "well below the minimum capital needed".

she is not helping with lowering the capital requirement and ignoring the stress tests.

many should bulldoze her and her bosses the stress test info to correct her, because she is using this Batman bogus cap rule to insulate herself.

Go FnF

$FMCC $FNMA Exiting conservatorship is inevitable, not a matter of uncertainty There's clarity on this matter.

— Patrick (@InvestIt3) April 17, 2024

Testimony of Sandra L. Thompson

"FHFA will build upon this work to promote sustainability and durability of these reforms after the Enterprises exit conservatorship” pic.twitter.com/yQCuPJVg3r

Honestly totally forgot about Libor and Yes that certainly allows the process to definitely be fast tracked especially with November only 5-6 months away, not to mention, pre November……if you catch my drift.

Nothing bad happening with Fannie and/or Freddie...we've come

a long way in just a few months (when FNMA was comfortable

in the 35-40 cent range...we're good for continued gains

in the near future

Did The Pregnancy Test Start Last Summer?

When F&F lifted above $.45?

I track the LIBOR Litigation also.

https://www.docketbird.com/court-cases/In-re-Libor-Based-Financial-Instruments-Antitrust-Litigation/nysd-1:2011-md-02262

Something positive happened last summer with LIBOR/FHFA settlements.

Ron

What more do we need to know?

(((((((((((( after we exit Conservatorship)))))))))

I know it’s been a horrible investment with many of us having bought shares at $60 + and missed out on fixed income dividends, BUT fir the first time in 17 years we now know for sure we will be exiting Conservatorship at some point in the future.

And we know markets trade six months in advance of large developments so I give this a pregnancy term and no longer than nine months for release.

We Are Due Updates on GSA Litigation.

Please see calendar in sticky post;

https://investorshub.advfn.com/boards/read_msg.aspx?message_id=173560014

Ron

Do you ever post anything meaningful?

Did anyone ask glen where she says that or how is she going to do that?

CEO is powerless against the government in a conservatorship. That’s why we are in one.

Govt loves full power and control over the gse’s

Will I be alive to see this end?

It’s been 16 years. I was young and skinny that long ago. lol

"The Seeking Alpha article says "Recall too that John Paulson, whose fund holds Fannie common is a part of Trump's transition team" but that is not anything even approaching proof."

So.... Just because something is written in an article or a book doesn't mean it's a fact? Got it.

Thanks for clarifying Hypocrite! 😄

LOL!!!!

Thanks Patswil, did Bradford text this info from his Shell phone?

Bidenomics is pushing the dream of homeownership out of reach for so many Americans.

Americans want the ability to control their own future—not a far-left economic agenda that destroys opportunity.

https://twitter.com/SenatorTimScott

She's taking us out of conservatorship $FNMA #FANNIEGATE https://hispanicexecutive.com/priscilla-almodovar-the-latina-at-the-center-of-americas-housing-finance-system/

She's taking us out of conservatorship $FNMA #FANNIEGATE https://t.co/atiQTqcqwP pic.twitter.com/EIMRRtf6zo

— Fanniegate Hero (@DoNotLose) April 17, 2024

Fanniegate Hero

@DoNotLose

·

7m

"FHFA will build upon this work to promote the sustainability and durability of these reforms after the Enterprises exit conservatorship." - FHFA's Sandra Thompson $FNMA #FANNIEGATE

Quote

Fanniegate Hero

@DoNotLose

·

12m

"I have heard about the need for more workforce housing" - from more rural areas like Tennessee. h/t @garrettashton-24.pdf $FNMA #FANNIEGATE

"Personally I don’t care about the current share I care about the success of the company"

What bull shit!

Not me, I would have been Perfectly happy with my annuity account and the 1/4ly return from 1980 where GSE's both Commons & SPS were at +30% of the portfolio.

After 2007 then 2013 the overall value was diminished by 50%. Thanks to Donot-Holes Good buddy "O" Buttboy.

$FNMFO UP $96,000

$FNMFO is being quoted by @jpmorgan over par value of $105k. @SECGov is this a scam?

— Swamps & Shitholes 🇯🇵🇱🇷🇺🇦🇮🇱 (@AZbroker) April 17, 2024

I have a limit sell order for much less that was never triggered? $FNMA pic.twitter.com/KHXUVZLNOI

Well it won’t be today

We almost got to the $2 above range

then the tbtf banksters played

"whack a mole" with us again like they have been doing for over a decade

Trump and Paulson seem like our only hope

sure would be nice to get some news not he 8-0 jury verdict being used in other cases or added to them for appeal.

anyone have any info on this?

TIA

When we get a 5 dollar instant spike in share price then we know something is going on🛹🌵🇺🇸

What it did say was - To see the company in action, how we came together, how we communicated with our stakeholders, how we assessed our risk, I was able to see firsthand the impact and scale of our organization during a potential time of crisis across the financial sector,” Almodovar says. “It really accelerates one’s learning when you’re in it. [We have an] amazing team of people. They’re smart, very committed to what we do, and it’s that mission—what Fannie Mae does—that brings the entire company together.”

Personally I don’t care about the current share I care about the success of the company ![]()

Ask that P dude Bradford about that. He seems to always have the inside scoop.

I red the whole article no were in there does it talk about releasing the gses 🌵🛹🇺🇸🤔

Hahaha you think 1.45 is expensive? You can’t even get a Costco hot dog for that price!

Don’t be so cheap lol

Well it's going to end at some point they need to tank it one more time so I can buy @ 50 cents 🌵🛹🇺🇸

|

Followers

|

2331

|

Posters

|

|

|

Posts (Today)

|

13

|

Posts (Total)

|

802411

|

|

Created

|

07/14/08

|

Type

|

Free

|

| Moderators not one red cent ~NORC~ stockprofitter Ace Trader EternalPatience jeddiemack FOFreddie | |||

Fannie Mae (the Federal National Mortgage Association, or FNMA) is a government-sponsored enterprise (GSE) in the U.S. that was established in 1938. Its main purpose is to provide liquidity, stability, and affordability to the U.S. housing market. It does this by purchasing mortgages from lenders (like banks), packaging them into mortgage-backed securities (MBS), and selling those securities to investors. This process ensures that lenders have more capital to issue new home loans, helping more Americans get access to homeownership.

| Volume | |

| Day Range: | |

| Bid Price | |

| Ask Price | |

| Last Trade Time: |