Register for free to join our community of investors and share your ideas. You will also get access to streaming quotes, interactive charts, trades, portfolio, live options flow and more tools.

The share of outstanding mortgages guaranteed by Fannie Mae, Freddie Mac, and Ginnie Mae has also increased. Together, these shifts mean that exposures to the nonbank mortgage sector have grown significantly.

But nonbank mortgage companies also present unique risks. The report finds that their specialized business model means they are especially susceptible to macroeconomic fluctuations in the housing market, such as changes in housing prices, interest rates, and delinquency rates. They are more reliant than depository institutions on the value of mortgage servicing rights, which may lose value in the event of a downturn in the housing market. And they are also vulnerable because they can have high leverage, short-term funding, and operational risks.

These vulnerabilities matter. If a nonbank mortgage company fails, it may be difficult for it to find funding to continue critical servicing operations, such as making required servicing advances or providing adequate loss mitigation for distressed borrowers. Suspending services can in turn harm borrowers and other stakeholders. Even transferring the portfolio of a distressed servicer is a resource-intensive and time-consuming process, and disorderly servicing transfers can cause additional harm to borrowers. And if a new servicer cannot be found, the federal government may be left to assume the servicing obligations itself. All of these outcomes could disrupt economic activity and the provision of financial services.

DID that article - which I could not reach ----- say anything real?

???

see my post --- if my EXCEL based math is correct

150B - at a land/build cost of $150K a house would be enough for 1MM homes ---- how does anyone get 14 million ?

14 million would be GREAT ---- ROI --- is high

but would that not require a 10K per unit cost to build which is 1924 price to build not 2024

imagine F and F working with $8,000 mortgages v the typical over $100K mortgage?

How does she propose to invest such a large amount of money

1. ? Only for buildings where the developer matches GOV money ?

2. Multi unit housing - say 2-4 flat for condo type ownership

3. Multi-unit housing as in say 40-60 units for renting or condo

I did some VERY global math - and to build 1,000,000 stand alone houses --- one would need a build cost of 150,000 or lower ?

Would that be worth it ?

Price is going up

MM's and Sherwin must have went home early for happy hour and the weekend

break $1.50

IDK

Go FnF

i am sure he would love to compaign for sandra to advocate receivership, hiding stress test results. he is probably comfortable with his consulting money from special interests than taking fhfa job, just like the fellow traveler parrott, buddy, buddy . by the way, the low iq, pence, put him there, lot of bootlicking he must have done to get it and then got kicked out

I had been hearing lots of BUZZ about this.

Shareholders have been stung.

https://necn.app.link/rt0t2SopuJb

That is correct. He would love to get his old job back. If he wants to play his cards correctly he should join the Trump campaign and help him get elected. That would virtually guarantee his job back. Hope Calabria is not reading my post.

Catman is working hard to see if he can be nominated again by DJT as next FHFA Director. He is a complete hypocrite.

In Singapore, Stamp Duty is 30% for locals buying their second property. Foreign investors pays $60% stamp duty. Property Tax Rates (i.e. annual increase in property value) for Non-Owner-Occupied Residential Properties is 12%, 20%, 28% and 36% for first $15,000, next $15,000, next $15,000 and above $60,000.

I don't know WTF he's talking about. Catman is all over the place at times.

$2.50 FMCC Nearterm Target!

FMCC BUY - 91.6% Upside - price Target $2.50 💰💰 pic.twitter.com/D75qkVRI4x

— Cmdr Ron Luhmann (@usnavycmdr) May 10, 2024

is the catman advocating bankruptcy again? can you believe the previous admin put him in place to fok the gse's and who knows if they win , a bigger idiot may be put in place.

i guess he forgot to take them today.

"With CET1 >2.5% of ATA, the time has come."

Oh wow. There seems to be some difficulty breaking through $1.42 right about now. Raise the ASK as per Captain TightCoil. They will gladly pay. I will now enter The Sphere and sound the whale horn. Hope I can get out. Last time I got stuck.

Pass me the secret sauce, please.

;)

Warriors! “The Secret Plan” The myth that keeps on going for years & years. Last time, the Secret Plan was on his desk. The voices in one’s head! They do make meds for that.

With CET1 >2.5% of ATA, the time has come.

mr. wise man, you never answer the questions. We are 16 years into this prison sentence and somehow your separate account plan makes it all legal and then you turn around and say the FHFA / Companies have committed Acounting Fraud. As Boat would say, "Asking for a Friend."

“Separate Account plan” kindly, explain to us how this will unfold. And when will this take place? Hello!

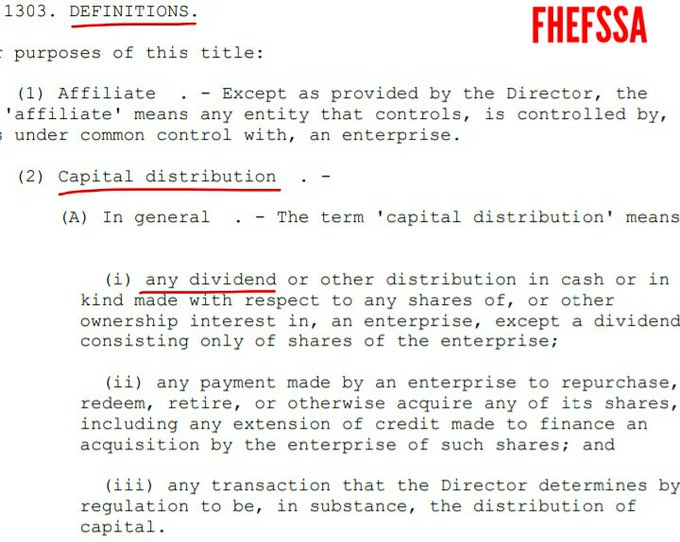

CAN'T YOU SEE IT'S A CAPITAL DISTRIBUTION RESTRICTED?

(SPS LP increased for free as compensation to the UST in the absence of dividends).

Just like the dividend payments. Both number 1.

Then, we use the Incidental Power ("any action", like lying) to legalize this action applying it towards the EXCEPTIONS:

-Pay down the SPS. U.S. Code §4614(e),

-The exception added in "the supplemental" on July 20, 2011 CFR 1237.12 (Recapitalization in a separate account, either in the exception 1, 2, 3 and 4, because it (c) supplements and it shall not replace or affect the Restriction on Capital Distribution by the statue posted in the prior point.

A restriction on Capital distribution is meant for the recapitalization (the Capital is built internally). FnF can redeem the SPS and, at the same time, build capital. Double-entry accounting (cash - Retained Earnings acct: you pay down the SPS with simple cash. The Retained Earnings acct stays. Watch my signature image below)

This is why a recapitalization in a Separate Account (outside their balance sheets) CFR 1237.12 supplements the Restriction on Capital Distributions by statue that is meant for the recapitalization too. A follow-on plan.

In the end, they've been assessments sent to the UST in the form of capital distributions, no actual dividend was ever paid (Besides unavailable Earnings for distribution as dividend, out of Accumulated Deficit Retained Earnings accounts) and no SPS LP was ever intended to stay (instead of lying, like the dividends, a joke "in the best interests of the Agency"), as the evidence seen because they are absent from the Balance Sheets.

If you continue to play the fool, you will end up wearing diapers.

Jesus!

Here’s an interesting back and forth. Follow the Joshua Rosner path:

Congress needs to merge FHFA into OCC, I’ve reluctantly concluded standalone safety/soundness regulation of GSEs just isn’t politically sustainable or feasible over long periods of time

— Mark Calabria (@MarkCalabria) May 9, 2024

It is absolutely amazing astounding how many shareholders dislike Calabria. Virtually all of them including myself.

— Rick Nagra (@RickNagra) May 10, 2024

He doesn't respond on X. Only posts.. so ...

NeoSunTzu or anyone that has access to X...

Point Calabria to the facts and ask him to explain it to us. He signed the document to increase the LP dollar for dollar for every dollar the company retains.

Calabria Quote: "he thought as a regulator he shouldn’t buck what he thought was the will of Congress (HERA)." End of Quote

https://investorshub.advfn.com/boards/read_msg.aspx?message_id=174362245

A Conservatorship for the rehabilitation of financial companies can't end up with people pleading the 5th amendment of the constitution, like this corrupt litigant that just seeks to be in the limelight, turning himself into a savior:

We are trying to save the companies

Thanks Guido - it would be good to get a clarification on remaining paths forward.

Thanks for the correction.

Thanks for the correction.

The biggest scam in history is @FHFA putting 2 financially healthy corporations in a “temporary” conservatorship in 2008 and then siphoning $301 billion of their equity for projects not funded by Congress.

— Guido da Costa Pereira (@GuidoPerei) May 10, 2024

FREE FANNIE!

FREE FREDDIE! https://t.co/Quy94sg2Q7

Calabria: if you want an idea what’s in Calabria’s head give a listen to this podcast episode from April. All the topics he was posting on X today are mentioned in this podcast.

WARNING: you all do know he’s a policy wonk and he’s an advisor at the Cato Institute, right? It’s 36 minutes long and you WILL be bored. He has strong opinions about agency independence, banking regulation, housing policy, he does want a combined financial regulator (at a minimum merging FHFA into the OCC), etc.

He ADMITS pushing back on the Trump Admin when they wanted him to move on the GSEs because he thought as a regulator he shouldn’t buck what he thought was the will of Congress (HERA).

https://www.cato.org/multimedia/media-highlights-radio/mark-calabria-discusses-how-solve-housing-crisis-intrafis-banking

Catman is posting like crazy on X today about GSE's and the FHFA (non-mission). Wonder what's up all that?

fisher case gone? again? oh well

Take a trip down south from wherever you are. Coz unfortunately that's where this is going... Misery will love company

No Costco

You deserve finer cuisine,

And that's why I've ordered

for you and Gabby, 2-3D Printed Fish Filets

Go Fannie, Run Freddie, Go, Run

Only? And what do you think is left?

Oh wow. What is the plan for tomorrow Captain TightCoil ? Should I wake up early and suit up for a trip to the moon ? Or should I just go to Costco and load up on the dogs ? Please advise.

Re: FNMA & FMCC

Don't Sell - Don't Fold

Hold for the Gold

Our cases have been sustained because of Tooley, and other things. Our focus now is on First Hartford, and the Fifth Amendment to the Constitution. We’re trying to save those companies, and thus save our investments in such.

— Bryndon Fisher (@bryndonfisher) May 9, 2024

Only the amended complaint was denied.

Bradfordamus and his predictions. -- you are probably the only one who believes and hopes on them coming true

Mike Kelly Suit Dismissed.

https://www.glenbradford.com/2024/05/kelly-v-u-s-5/

Fisher was denied En Banc.

In Kelly the case was moved from a DJT Appointee to JB Appointee

This would be a terrific idea and I’d love to see it happen. It would save the GSEs $700m a year too.

Supposed to say such a bafoon

Auto spell correct really made it funny

Lmao

It’s very relevant. A board of directors structure that the GSE’s should have been placed in from the beginning of conservatorship. Maybe they wouldn’t be in the position that they’re in now with a board instead of a single director.

If they ever do get out of this mess I believe they will be placed under a board of directors management structure.

what is OCC?

tia

suck a baboon cat man do nothing is

trying to stay relevant

LOL

Ya know there’s some good solid footing when this hits .40 no need to worry about going to zero .. that would be somewhat unlikely 🤣

Notice gold lately

it's the only rational hedge for a position in these things

|

Followers

|

2445

|

Posters

|

|

|

Posts (Today)

|

12

|

Posts (Total)

|

825417

|

|

Created

|

07/14/08

|

Type

|

Free

|

| Moderators not one red cent ~NORC~ Ace Trader EternalPatience jeddiemack FOFreddie | |||

Fannie Mae (the Federal National Mortgage Association, or FNMA) is a government-sponsored enterprise (GSE) in the U.S. that was established in 1938. Its main purpose is to provide liquidity, stability, and affordability to the U.S. housing market. It does this by purchasing mortgages from lenders (like banks), packaging them into mortgage-backed securities (MBS), and selling those securities to investors. This process ensures that lenders have more capital to issue new home loans, helping more Americans get access to homeownership.

https://www.cbo.gov/publication/60190

| Volume | |

| Day Range: | |

| Bid Price | |

| Ask Price | |

| Last Trade Time: |