Friday, May 10, 2024 9:13:57 AM

(SPS LP increased for free as compensation to the UST in the absence of dividends).

Just like the dividend payments. Both number 1.

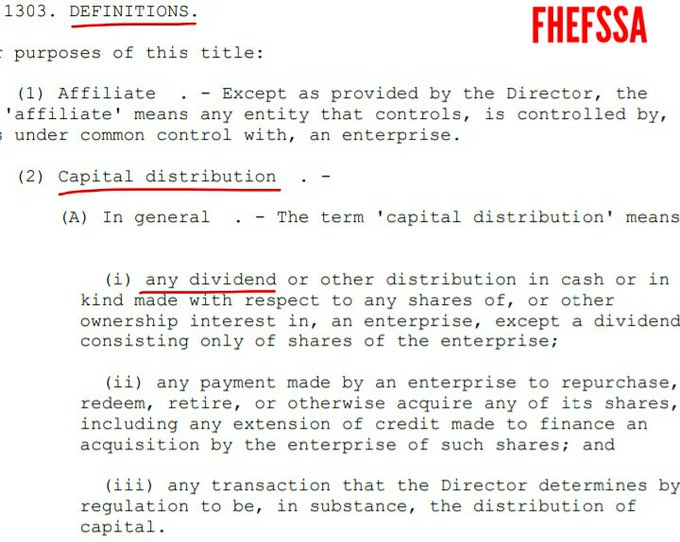

Then, we use the Incidental Power ("any action", like lying) to legalize this action applying it towards the EXCEPTIONS:

-Pay down the SPS. U.S. Code §4614(e),

-The exception added in "the supplemental" on July 20, 2011 CFR 1237.12 (Recapitalization in a separate account, either in the exception 1, 2, 3 and 4, because it (c) supplements and it shall not replace or affect the Restriction on Capital Distribution by the statue posted in the prior point.

A restriction on Capital distribution is meant for the recapitalization (the Capital is built internally). FnF can redeem the SPS and, at the same time, build capital. Double-entry accounting (cash - Retained Earnings acct: you pay down the SPS with simple cash. The Retained Earnings acct stays. Watch my signature image below)

This is why a recapitalization in a Separate Account (outside their balance sheets) CFR 1237.12 supplements the Restriction on Capital Distributions by statue that is meant for the recapitalization too. A follow-on plan.

In the end, they've been assessments sent to the UST in the form of capital distributions, no actual dividend was ever paid (Besides unavailable Earnings for distribution as dividend, out of Accumulated Deficit Retained Earnings accounts) and no SPS LP was ever intended to stay (instead of lying, like the dividends, a joke "in the best interests of the Agency"), as the evidence seen because they are absent from the Balance Sheets.

If you continue to play the fool, you will end up wearing diapers.

Jesus!

Avant Technologies Engages Wired4Tech to Evaluate the Performance of Next Generation AI Server Technology • AVAI • May 23, 2024 8:00 AM

Branded Legacy, Inc. Unveils Collaboration with Celebrity Tattoo Artist Kat Tat for New Tattoo Aftercare Product • BLEG • May 22, 2024 8:30 AM

"Defo's Morning Briefing" Set to Debut for "GreenliteTV" • GRNL • May 21, 2024 2:28 PM

North Bay Resources Announces 50/50 JV at Fran Gold Project, British Columbia; Initiates NI 43-101 Resources Estimate and Bulk Sample • NBRI • May 21, 2024 9:07 AM

Greenlite Ventures Inks Deal to Acquire No Limit Technology • GRNL • May 17, 2024 3:00 PM

Music Licensing, Inc. (OTC: SONG) Subsidiary Pro Music Rights Secures Final Judgment of $114,081.30 USD, Demonstrating Strength of Licensing Agreements • SONGD • May 17, 2024 11:00 AM