Register for free to join our community of investors and share your ideas. You will also get access to streaming quotes, interactive charts, trades, portfolio, live options flow and more tools.

Why don't you ask the Mods for clarification on the number of posts per day

I still don't understand why I'm limited to one post per day

I am feeling a surge today of 1 penny.

LOL

Go FNF

BOOM

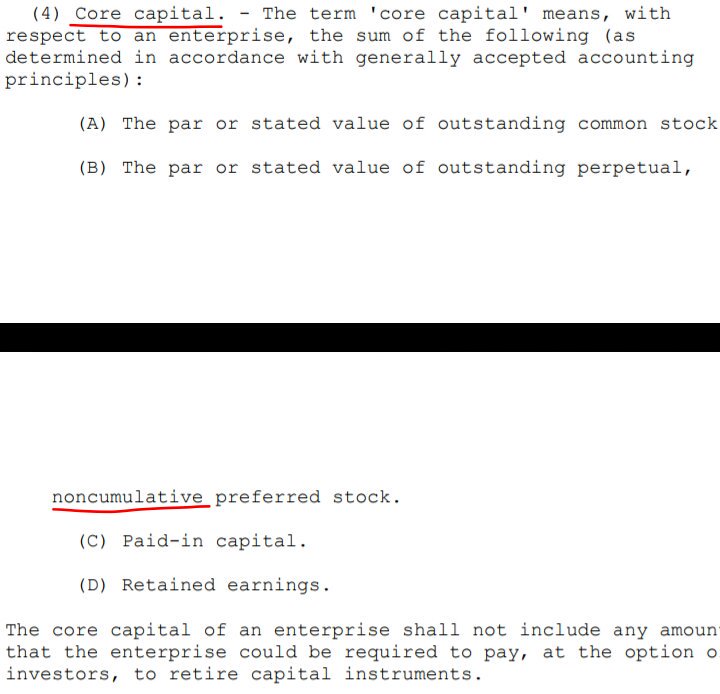

FnF calculate the capital metrics 'upside down', that is, they take a different concept (Net Worth or Equity) and subtract different items unrelated to the capital metric that you are calculating (SPS).

I already called the plaintiff Mr.Pro Se out, when he did the same 3 days ago, posting:

Net Worth

-SPS

-some portion of the DTA

= unaware that he was calculating Tier 1 Capital in his reply, and not the Core Capital that I was talking about with its statutory definition. He simply copy-pasted the script he had received beforehand.

This is Freddie Mac. Fannie Mae does the same:

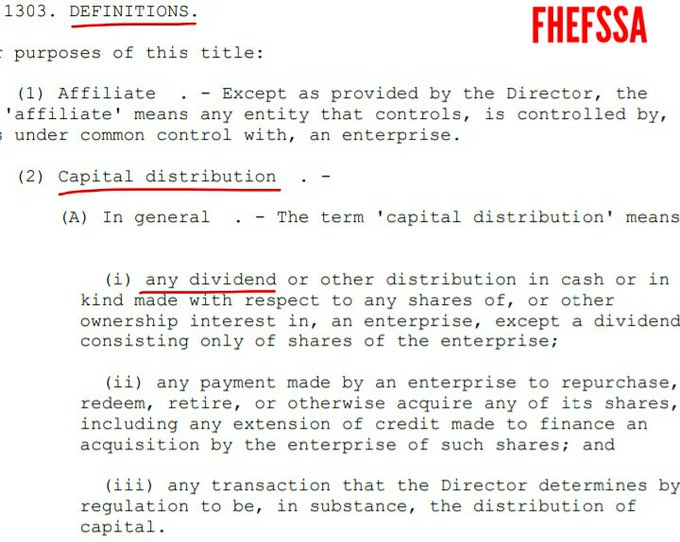

Their objective was to conceal the components of each capital metric, so people don't see that FnF have $-84B Accumulated Deficit Retained Earnings account combined, shown on the Balance Sheets , but it's important to see it here as a component of the capital amount that later is required a minimum through regulation and statute ($-216B RE with the offset -Reduction of Retained Earnings- attached to the $132B SPS LP increased for free), an account tasked with absorbing future (unexpected) losses and a gauge of the rehabilitation in a financial company (RE is Core Capital for the capital ratios). Justice Alito's prerequisite to allow the Separate Account plan through restricted capital distributions: "Rehabilitate FnF in a way...".

This isn't a coincide. FnF calculated it correctly in early Conservatorship, and, for instance, this is how I learned that the Treasury Stock (stock buybacks) reduces the common stock par value when calculating the Core Capital.

FnF and this unsophisticated plaintiff, received instructions to change how to report the formulaic of the capital metrics.

Remember that Sandra Thompson arrived to FHFA in 2013 as Deputy Director, in charge of "overseeing regulatory policy, capital policy and financial analysis". Everything that is being put into question since long time ago (The Capital Reserve is what has to meet the capital requirements; SPS LP increased for free and its offset, are missing in the Balance Sheets; formulaic of the capital metrics, etc)

They all receive instructions from the same big players.

And who doesn't.

First, it wasn't Mnuchin. Secondly, the SCOTUS wasn't informed that the NWS had ended.

Mnuchin sent SCOTUS a letter stating that he and Calabria had ended the NWS. One of the justices even referenced that letter.

the enterprise will compensate Treasury through increases in the (SPS) liquidation preference rather than through variable cash dividends.

The conservator has limited powers. You are repeating the take by Bill Ackman, who implied that the SCOTUS said FHFA has absolute discretion (Source).

O Ackman’s clerk, Bradford:

With your quote:

4617f bars courts from questioning the actions of a conservator. As it should.

Don’t need to read TH’s BS. FnF owe nothing to anyone anymore.

Read the latest comments from Tim Howard on the senior preferred stock and SPS line of credit: https://howardonmortgagefinance.com/2024/01/16/the-crt-charade/#comments

Thanks Neo, I just subscribed to TH blog. Good info.

I never trusted him since day 1

Fannie to the Moon, Tomorrow

With leaders like Tim Howard, who needs enemies. Instead of rallying his followers, he's given up. PATHETIC!

Here government is and has always been the problem.

Hey government too bad you have immunity for your stupidity...

Now drop your weapons and get out of the way. Let the private sector back in. The private sector that made fannie and freddie capable of withstanding your onslaught and treasonous takeover....

Government... go home.

Serious question here. The Conservator is supposed to have a duty to "Conserve and Preserve." Let's forget the history we all know here and assume this to be true. How is it they can give away billion$ to low income housing when their stated duty is to conserve and preserve. I would expect they should not be allowed, legally, to give ANY of that money away. Other than being the government that nationalized the GSEs, how do they get away with this?

thought so. fhfa has amassed close to thousand useless overheads with job security and billions to dole out in various programs , they can't even do stress test properly. tsy getting free money 100%, lawyers getting fee and may get 300 million from class action, so why bother responding? right? shareholders lost everything, 16 years $1500 down to $0.40, lost retirement and 529. i have my doubts that this will resolve anytime soon as there isn't any urgency. only hope is libor and maybe cfpb case soon decided by scotus. we may get another calabria like who would move the goal post to 5% and hide stress test.

I know the feeling. I have contacted my congressman and senators, but no real response.

John Cornyn responded saying that the government cannot worry about people making bad investment decisions.

After I rebutted that statement he never answered again.

I am not following the Lamberth filings so I cannot say what the exact status is. But I think Navy previously posted a copy of an email from the plaintiff counsel saying they expected the USG to file an appeal, despite the verdict. I would agree with that thinking. I would estimate the whole Shebang could take another 12-24 months.

Unfortunately no response.

Translation: we are f*cked until TSY decides to play fair.

Benson is out in his official capacity tomorrow - he exited the last of his shares at 1.45-1.46, and yet we just closed at 1.48

https://www.sec.gov/Archives/edgar/data/1444618/000112760213017852/xslF345X03/form4.xml

Great find and thanks for sharing. I read what Tim wrote. All good stuff but somewhat confusing and hard to understand. Maybe someone can explain what he is saying in plain English.

Read the latest comments from Tim Howard on the senior preferred stock and SPS line of credit: https://howardonmortgagefinance.com/2024/01/16/the-crt-charade/#comments

clarencebeaks: WTF is the legal standing / situation with Lamberth's jury case. I have nothing coming since I'm only in FNMA but some clarity would be nice. Is he following protocol, are the two sides still haggling over something arcane, or .... ??!!

99.99 % of all insiders never spent a dime to buy shares.

How do/did they get shares ?

They got shares through granting.

Now most of insiders are filing form 3 to open for future granting of free shares upon releasing from conservatorship

Any insider information would/should have been

acted on when F & F were trading in the .50-.70

range. Quick increases of share price is the FOMO.

These two will not make any lasting gains until they

have been released from Conservatorship. Once these

are released, share prices will be in the double digits,

and volume will increase dramatically. Joe B doesn't

care and neither does his opponent. They have more

pressing problems. I hope to see them released in my

lifetime, but it has gone on too long.

stockanalyze, yes I have contacted several of the lawyers involved, in addition I contacted the FINANCIAL SERVICES Committee Members 118th CONGRESS. Also, contacted my local House of Representative. Hope you are doing something to help our cause. Best Regards

Crappy Alias (RickNagra)

Read the latest comments from Tim Howard on the senior preferred stock and SPS line of credit: https://howardonmortgagefinance.com/2024/01/16/the-crt-charade/#comments

rodney, you have written this many times over here. the thing is to reach out to all the plaintiff lawyers involved to date. have you?

Rkt - that's how a stock shd react for fascinating results in this housing market

FNMA and FMCC - go figure

3R or pay $1.5B fine with upcoming FNMA common lawsuit

For both JPS & FMCC common, total fine plus interest is $900M. If you add FNMA common in future lawsuit, GSEs have to pay $1.5B.

Why would they pay $1.5B? They can just do 3R. That makes everbody happy.

Please pass the joint friend…

Well said. I prefer just to keep it more simple. The NWS is alive n well and to be employed at the discretion of the conservator.

Thanks.

Suit Up with High-Altitude Gear

and take a 3D Printed Fish Filet

for the Flight to the upper realms

of FNMA and FMCC stratosphere

"whack a mole" day today. MM's have strict orders to keep under 1.50

it's all fixed

FNMA volume so far: 1.8 million shares

FMCC volume so far: 645,000

WEIRD

What it does mean is that if they are to do so (convert senior preferred shares to any other class) they will need another amendment. After the jury decision, presided over by Lamberth, I want to see how they pull off yet another self-enriching act knee-capping current shareholders. Any new amendment will be the perfect opportunity to reassess the full picture and, in light of all that has transpired, the new assessment should be quite positive for the company and current shareholders.

And think about who has positons... John Paulson, Carl Icahn, Bill Ackman, etc....Think of the Legal Power those 3 guys have on our side and their ability to litigate with the top lawyers in the game!

Let's give the ba$tard$ what they so desperately desire: free reign to enrich their selected winners. Time to false flag post you have had it with the corruption and are exiting your positions. I'll start: over the next week I will liquidate in 25% chunks. They obviously will not make a move until they face no risk of enriching the plebians.

DoNotUnderstand,

Yes, it states this in the SPSA:

6. No Conversion or Exchange Rights

The holders of shares of the Senior Preferred Stock shall not have any right to convert such shares into or exchange such shares for any other class or series of stock or obligations of the Company.

However, this doesn't mean it's not possible to happen. FHFA and Treasury simply have to agree to another amendment to change these terms. Treasury doesn't have the *right* to convert, but FHFA can *offer* them to convert, if that makes sense.

Whether FHFA does or doesn't offer conversion, or what they may offer may depend on directions given to the FHFA Director by our Executive leader. IMO, Sandra Thompson isn't going to offer anything to Treasury, as she is awaiting instructions that may or may not be coming.

i think we can be pretty certain that some serious

insider trading is now going on, and, assuming

plans will be in place for release, some double

serious insider trading will be going on big time

treasury secretaries, heads of large government administrative bureaucracies, heads of government sponsored entities, voters that can't or won't pay their own bills...

probably missed some as well.

there is so much corruption behind all of this. makes you wonder if the lawyers have been on the take from the TBTF banksters as well.

the list is amazing, something the mob would tip their hats too

paid off list-

judges

media

BOD

social media

lawyers

who am I missing?

why don't the TBTF banksters pay us off to go away? LOL

Lawyers failed and never applied the Law! The argument in the courts “pay me my dividends.” The SCOTUS basically said we will not be an arbitrator in such matters of contract. SPSPA is an illegal contract that requires the application of Law to prove it’s an illegal contract which non of the lawyers brought the Law before the Judges. The courts dismissed the lawsuits…

Charter act prohibits the commitment fees (Seniors, warrants, variable liquidation preference). More importantly the actions of Treasury to appropriate 200 billion in taxpayer debt, take non regulatory control of the companies through the SPSPA (require Treasury permission at least 10 separate times) and ownership of more than 50% of the companies requires them under the GAO act and the CFO act to consolidate the GSEs onto the nations balance sheet. The fact that that hasn't happened means the Treasury has violated the 14th amendment to the Constitution by repudiating the 5 trillion plus in debt the Treasury has acquired through their actions since 2008. Their actions have resulted in a takings of the entire enterprise value of the formerly private companies. These actions have necessarily turned the GSEs back into agencies of the executive branch as they were originally created. This is the definition of a major question and also a separation of powers problem since Congress did not authorize the actions Treasury took and continues to take. Non of the lawyers mentioned any of this.

“I do not think SCOTUS ruled on this specifically.”

The reason that specific part of Alito’s rationale is precedential is because it is necessary to the court’s explanation that supports its opinion. That is a basic concept of law.

?

I thought some one cleared this up with the distinction

Conservator acting as conservator - and in norms - has a ton and then more capacity/authority to do what they want (and all is kosher and 4617 or whatever is a stop sign)

Conservator acting as conservator - but ULTRA VIRES - can be reviewed by a court and 4617 is not a stop sign

I do not think SCOTUS ruled on this specifically - but said GOV followed rules in setting up the NWS and FHFA is within the norm

(although a breach of an equity contract is pursuable)

??

Assuming that case in the link was never heard en banc, and that it remained a two-person panel majority, their opinion was simply superseded by Collins.

Future lower court decisions are duty-bound to follow Collins, not a conflicting decision in any federal circuit at any level.

|

Followers

|

2331

|

Posters

|

|

|

Posts (Today)

|

5

|

Posts (Total)

|

802359

|

|

Created

|

07/14/08

|

Type

|

Free

|

| Moderators not one red cent ~NORC~ stockprofitter Ace Trader EternalPatience jeddiemack FOFreddie | |||

Fannie Mae (the Federal National Mortgage Association, or FNMA) is a government-sponsored enterprise (GSE) in the U.S. that was established in 1938. Its main purpose is to provide liquidity, stability, and affordability to the U.S. housing market. It does this by purchasing mortgages from lenders (like banks), packaging them into mortgage-backed securities (MBS), and selling those securities to investors. This process ensures that lenders have more capital to issue new home loans, helping more Americans get access to homeownership.

| Volume | |

| Day Range: | |

| Bid Price | |

| Ask Price | |

| Last Trade Time: |