Register for free to join our community of investors and share your ideas. You will also get access to streaming quotes, interactive charts, trades, portfolio, live options flow and more tools.

I agree, unless the dividend and compensation to shareholders is enough to keep me around

I firmly believe that a Stockade level (Public Shaming) in the courthouse square would do wonders for "convicted" criminals.

Especially those who fall into the Nonviliant/White collar crime category, To Hell with house arrest & community lockup during

the week just to be let out on Fridays @ noon for the weekend.

i have stuck in this for 10 years, i'm with ackman - take the 50 and run now dammit no more waiting

this stock is still worth 50 with the warrants

The GSE's are like the rock climber who caught his arm in the rocks and cannot get free.

Do I cut off my arm (aka warrants) to get free or do I stay here and die?

warrants are not legal at this point but how else do we get free except court or Trump.

Courts will take years, so Trump in the next hope. then do we cut off our arm to get free (warrants)?

"Potttersville"-from It's a wonderful Life

unreal govt rats have sold out future generations from home ownership to fatten their wallets.

they should all be prosecuted and be publicly disgraced

> Given the exponential rise in unethical law-fare perpetuated by the industry over the last decades I see no other explanation.

Not to be cynical but appeals/delays also mean more billable hours for certain parties (which also means a new Mercedes, a second vacation home, etc.) It's in your best interest to advise your client that appeals/delays are in their best interest.

Ace

pet projects - votes ---- that is politics and political corruption. I have no idea why democracy and politics is socialism

We had a Republican WH - Treasury and Justice Dept and we did not exit

cash account - no borrowing

IRA or similar - no borrowing

Margin Account --- unless some companies have "strayed" --- the margin agreement always includes the account owner agreeing stock held in that account/margin can be borrowed by parent brokerage firm

Physical possession - no borrowing

And those other type "places" --- I suggest (have not read the agreements) that unless the agreement (account agreement or similar) says THEY can borrow - then no borrowing

very informative

and if he was over ruled - that IMO should end it --- at his level and at the level above him

i.e. it is COURT decided in our favor

Do I read your post correcttly?

lol thanks for comparing it in 2024.

I had been saying all along they nominated dumb idiot sandra for a reason.

He has consistently ruled against the Shareholders. Nothing could surprise us, now. Disappoint us, Yes—Surprise us, No.

Saying something is false or partly false without stating why you believe that with either an opinion or some facts is a waste of time. I have established over many posts why I believe part 1 and 2 to be creditable assumptions. You have not. So your post serves no actual purpose. I have no problem and would prefer you educate me so that I don’t perpetuate any falsehoods. Thanks. Dumb is one way to think of the attorneys. I prefer to think of their strategy as malicious and extremely effective if the goal is obfuscation and run out the clock. Given the exponential rise in unethical law-fare perpetuated by the industry over the last decades I see no other explanation.

i had read in the past that anyone who knowingly purchased shares after 3rd amend may not be part of any settlement as they knew going in. would ackman, berkowitz fall in that category?

but then i believe lamberth ruled ? that rights travel with shares and that logic does not apply.

what do you think? where is defense going with it?

Judge Lambert was very straight about it had to be 8-0 verdict ! Why? did he already know that the FHFA would appeal asking for this very thing and for him to deny the FHFA this motion and for it to hold up on appeal !!! The 8-0 makes it very clear to him which way he can decide this case.

Part 1 is false.

Part 2 is partly false but you are correct in your insinuation that then plaintiff ATTORNEYS ARE DUMB AS SHIT.

“how to block your stock being loaned to short sellers”

based on this cnbc story (link at the end)

-holding shares in a cash account at a brokerage firm as opposed to a margin account: believe this would be a permanent change and if you want margin, you will have to apply again and those who do day trade cannot do so if not margin? Is that correct? also, can you specifically list specific stock to be on non-margin or the brokerage firm decides?

-opting out of any securities lending program: is this an account feature or do you have to call? how does one look it up?

-moving to the company’s designated transfer agent - ??

-transferring shares to a bank – so you can’t trade anymore

-holding them in your retirement account – depends if you are eligible without paying additional taxes

any thoughts? wondering why they did not list putting a sell order at an absurd high price so it is not available anymore. some brokerages would not allow you to put an absurd price as far as i know.

https://www.cnbc.com/2024/04/18/trump-media-tells-djt-shareholders-how-to-block-short-sellers.html

None of this at all matters if the latter half is sealed. Motion for a longer reply was itself a waste of paper.

I was comparing scorecards between Calabria and Thompson this morning (no, seriously) and differences were very stark - Calabria: prepare the GSEs for exit - Thompson: affordable housing, climate, appraisal bias, and no mention of exit from conservatorship.

— Tim Rood (@tim_rood_) April 18, 2024

I believe the defendants are going back to 2013 when they argued that in conservatorship only the conservator can file suits. Judge Lamberth agreed that shareholders' rights were transferred to FHFA and dismissed the suits. He was later overruled.

Yes I heard Senator Hagerty in its entirety. He is our friend. Basically told Thompson to continue Calabria’s work raise private capital quickly which gets the GSEs out of conservatorship. However I think he wants to exercise the warrants because he mentioned $100B for the government.

JNOV. Hmmmmm.....where have I heard this before?

Did you people hear Haggerty? Him is da Man..

He was ready to tear ST a new one

"Seems like old times."

"More like old habits "

Is Freddie about to adopt a home insurance policy for a fee in conjunction with all new mortgages bypassing insurance companies?

$$

I changed my mind and decided to watch this hearing. Thompson now talking. If she actually were to say something positive we could print $5 today. Can it happen ? Can elephants fly ? Oh wait Dumbo can fly I just remembered so there is hope.

The gov motion for dismissal as a mater of law I believe establishes 2 things. First, if the 8-0 verdict survives, then the SPSPA as currently written will have to end. Second, the gov motion is highly likely to succeed because this verdict is all that is left of a failed flimsy attempt from 15 years ago that never alleged any violations of the actual laws that mattered. No one in all of these years from state and federal district courts to the supreme court ever mentioned the charter act or the safety and soundness act of 1992. The only laws that actually matter. Therefore, with the absence of those claims, the Gov is correct based on the historical adjudication of the NWS as if it existed in a bubble that the jury verdict should be overturned. Sad but true in my opinion.

Yawn. I’ll pass. Think I’ll watch instead reruns of The Waltons. More exciting.

Govt-

“Let’s skip

The appeals process and just ask our old paid off buddy to throw out the case.

The media won’t do anything

No one knows

We can act like we never lost”

Unreal

Has this ever been done before?

Tia

Donotunderstand - I'm just making reference to the bazillion times KThomp refers to quotes in Calabria's book.

A recollection of a conversation from years prior, where someone said something and it gets positioned as Treasury said or did something official, when in fact it is nothing more than hearsay.

Senate Banking & Housing Hearing Begins @ 10:10 am EST ...

Link :

https://www.banking.senate.gov/hearings/oversight-of-federal-housing-regulators

No idea. I posted for those who know about litigation, laws, courts, etc and share the meaning to us

THANK YOU

What is this litigation or is it a repeat of some old stuff?

THANK YOU FOR THE LINK

yup

he has his finger on the pulse of the problem

not enough physical land ??

WTF ??

who is paying him to say such silly stuff

?

just because something is written -- article ? book ?

Tons of stuff - lies - opinions stated as facts - have been written in articles and books

this is where the court system could completely break down, if any judge ignores the judicial process and gives in to Government pressure because they lost. we are truly in a banana republic or worse, communism, where Government does whatever they want for whatever greedy reason they want, and tells judges to ignore the truth and the people

Good Morning - for me

I have suggested a temporary suspension of the FEES to reduce rates on mortgages to the end user

Your post noted ---

......on how the gse's would help more houses being built, better loan rates,

can you elaborate with specifics ? Whether we like it or not - best I can see - the GSEs have a GOV risk back up and are doing well for profit - consumers - banks who use them.

what would being free do to lower rates ?

again - I have suggested my approach that I know would work and fast

??

Govt goons have filed for Lamberth to THROW OUT the

UNANIMOUS 8-0 JURY JUDGEMENT and the DAMAGES

that "THEY" HAVE AGREED TO .. ! 67 pages worth :

https://www.glenbradford.com/wp-content/uploads/2024/04/13-mc-01288-423.pdf

It seems there’s not much anyone gse related can ask that outdated dinosaur simili judge- he’s above the law- biased comments in court and doesn’t follow any timeline.

How is he still a judge is beyond any logic.

Fnma

Are asking Judge Lamberth to ignore the jury verdict and Court grant judgment as a

matter of law for Defendants.

Freddie Mac Tightens Lending Rules In Bid To Detect Fraud

Need Subscription to read full article, sorry

snippet:

Freddie Mac is rolling out new policies to help detect fraud and mitigate risks, the latest policy adjustments following two high-profile instances of alleged malfeasance in New York.

https://www.bisnow.com/national/news/multifamily/freddie-mac-tightens-lending-rules-in-bid-to-detect-fraud-123826

What does the latest here mean exactly? Did FHFA file to keep these documents sealed? Just want to know if I'm understanding this right.

The FHFA Director lies in her written testimony for today's hearing.

1st. She refers to the FHFA-R's duty "ensure that FnF operate in a safe and sound manner", but she omits once again (like all other FHFA directors) what comes up next: "...including maintenance of adequate capital".

And "capital", in this world, means regulatory capital if everything is set forth in the FHEFSSA that establishes the capital ratios, definitions, etc. She can't make up "Capital Reserve" and badly assessed (Adjusted Capital Reserve = $0) with the Net Worth.

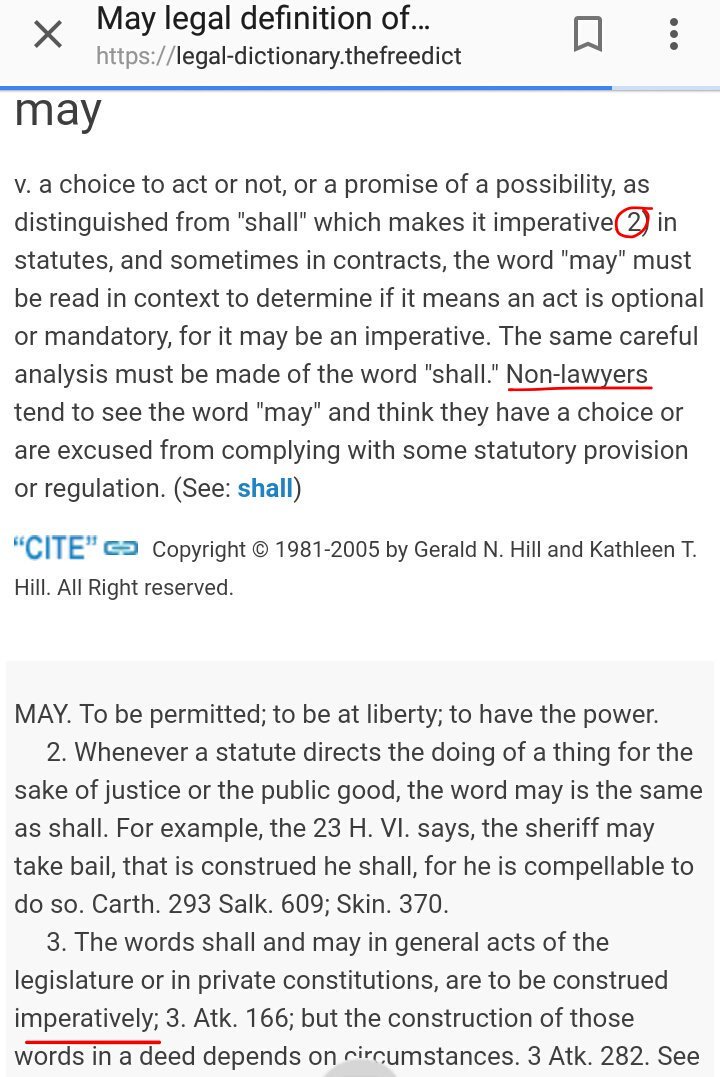

Also, she omits her role as director of the FHFA acting as conservator, with a Power of recapitalization, commonly known as "Rehab power": "May put FnF in a sound and solvent condition", when soundness is related to capital levels. And "may" is related to some leeway in activities that carry more risk or incur losses, taking into account that supposedly the American economy is still bleeding (Huh?). In no event "may" means that it's excused from complying once the capital has been generated, authorizing to syphon it off to the Treasury.

Legal dictionary:

2nd. She has omitted this time, the prior slogan: "FnF remain undercapitalized". She must have read my comments pointing out that that was a quote taken from the Restriction on Capital Distributions in the law, as a reason for the restriction. Now she says that their capital available is "well below the minimum capital requirement".

3rd. The same lie: "FnF retain earnings", like Bill Ackman and his clerk, Bradford, and recently the FNMA CEO, based on the Financial Statement fraud of FnF, when they are reluctant to post on the balance sheet the SPS LP increased for free since December 2017, because they carry an offset (reduction of Retained Earnings account) that wipes out the Retained Earnings just built.

It would show that their current $125B Net Worth has been built solely with $125B SPS LP increased for free, currently missing.

She has omitted this time the: "FnF continue to build capital" before "through retained earnings", a slogan repeated by the others mentioned, and now she just says: "FnF built $125B Net Worth", when that's not a metric for the soundness in a financial company.

It's time to appoint someone with the knowledge in capital adequacy matters, who doesn't play with the words all the time: "Dividend obligation", in order to pass it off as the security "obligation" in the RefCorp obligation (FHLBanks' 1989 bailout).

This way, she wants to turn the dividend payments on SPS into the interest payments on RefCorp obligations, and skip the Restriction on Capital Distributions (Dividends, today's SPS LP increased for free and the Lamberth rebate).

A Goldman Sachs alumni will always do Goldman Sachs things.

Judge Lamberth, accomplice. FHFA files a motion for JMOL.

Under Rule 50 (b) and filed under seal, without the reply to the FHFA's Wall Street law firm of a question submitted last Friday, asking whether it can skip the page limitation to 55 pages.

Without the judge's required reply, the judge skips having to forfeit the motion at the same time, for the reasons outlined yesterday.

It was imprudent to file an oral motion for JMOL Rule 50(a) previously, during the trial, because the Rule requires that both have to have the same sufficiency-of-the-evidence arguments.

It isn't satisfied with an oral motion by any stretch of the imagination.

Therefore, judge Lamberth is accomplice of this delay tactic.

The judge has waived what his job requires, pointed out in my follow-up:

(*) Pending to know what the judge has to say in a reply.

You continue to skip the FHEFSSA's Critical Capital level.

You only talk about HERA, despite that HERA only inserted amendments in the FHEFSSA (and the Charter Act).

Thus, without amendments, the Critical Capital level remains as is. And therefore:

An enterprise shall be classified as critically undercapitalized if—

(ii)does not maintain an amount of core capital that is equal to or exceeds the critical capital level for the enterprise;

|

Followers

|

2331

|

Posters

|

|

|

Posts (Today)

|

19

|

Posts (Total)

|

802417

|

|

Created

|

07/14/08

|

Type

|

Free

|

| Moderators not one red cent ~NORC~ stockprofitter Ace Trader EternalPatience jeddiemack FOFreddie | |||

Fannie Mae (the Federal National Mortgage Association, or FNMA) is a government-sponsored enterprise (GSE) in the U.S. that was established in 1938. Its main purpose is to provide liquidity, stability, and affordability to the U.S. housing market. It does this by purchasing mortgages from lenders (like banks), packaging them into mortgage-backed securities (MBS), and selling those securities to investors. This process ensures that lenders have more capital to issue new home loans, helping more Americans get access to homeownership.

| Volume | |

| Day Range: | |

| Bid Price | |

| Ask Price | |

| Last Trade Time: |