Register for free to join our community of investors and share your ideas. You will also get access to streaming quotes, interactive charts, trades, portfolio, live options flow and more tools.

$CRM You just don't understand how impressive 69 consecutive quarters of growth is

By: TrendSpider | July 1, 2024

• $CRM You just don't understand how impressive 69 consecutive quarters of growth is.

Read Full Story »»»

DiscoverGold

DiscoverGold

Today Salesforce.com Inc. (CRM) is the best performer in the DJIA

By: Thom Hartle | June 27, 2024

• Today (8:32 CST), the best performer in the DJIA is Salesforce.com Inc. CRM.

Read Full Story »»»

DiscoverGold

DiscoverGold

Salesforce $CRM Gap on watch.. right at the 21D as well.. Big spot for this one

By: Options Mike | June 23, 2024

• $CRM Gap on watch.. right at the 21D as well..

Big spot for this one

Read Full Story »»»

DiscoverGold

DiscoverGold

Salesforce $CRM Would be the ideal spot for a right shoulder to form

By: TrendSpider | June 22, 2024

• Would be the ideal spot for a right shoulder to form. $CRM

Read Full Story »»»

DiscoverGold

DiscoverGold

Today Salesforce.com Inc. (CRM) is the best performer in the DJIA

By: Thom Hartle | June 20, 2024

• Today (8:32 CST), the best performer in the DJIA is Salesforce.com Inc. CRM.

Read Full Story »»»

DiscoverGold

DiscoverGold

Where did they bounced $CRM after last month's carnage? The most traded price since the COVID lows.

By: TrendSpider | June 18, 2024

• Where did they bounced $CRM after last month's carnage?

The most traded price since the COVID lows.

Read Full Story »»»

DiscoverGold

DiscoverGold

Today Salesforce.com Inc. (CRM) is the best performer in the DJIA

By: Thom Hartle | June 14, 2024

• Today (8:32 CST), the best performer in the DJIA is Salesforce.com Inc. CRM.

Read Full Story »»»

DiscoverGold

DiscoverGold

Salesforce Director Mason Morfit bought nearly $100M in stock on Monday following the -20% drop on earnings

By: TrendSpider | June 6, 2024

• $CRM INSIDER BUYING STOCK

Salesforce Director Mason Morfit bought nearly $100M in stock on Monday following the -20% drop on earnings.

Read Full Story »»»

DiscoverGold

DiscoverGold

Today Salesforce.com Inc. (CRM) is the best performer in the DJIA

By: Thom Hartle | June 6, 2024

• Today (8:32 CST), the best performer in the DJIA is Salesforce.com Inc. CRM.

Read Full Story »»»

DiscoverGold

DiscoverGold

Salesforce posts first revenue miss since 2006

By: TrendSpider | June 2, 2024

• Salesforce posts first revenue miss since 2006.

Are you a buyer at 28x earnings? $CRM

Read Full Story »»»

DiscoverGold

DiscoverGold

I find this price will be giving us another really great buying opportunity in the sessions to come.

The amount of $CRM insider selling over the last 12 months is INSANE. Not a single buyer in sight.

By: TrendSpider | June 2, 2024

• The amount of $CRM insider selling over the last 12 months is INSANE.

Not a single buyer in sight.

Read Full Story »»»

DiscoverGold

DiscoverGold

Salesforce $CRM is the most oversold stock in the S&P 500

By: Barchart | June 1, 2024

• Salesforce $CRM is the most oversold stock in the S&P 500

Read Full Story »»»

DiscoverGold

DiscoverGold

Dang, could have squeezed out a few more % today.

May The Name of the Lord be praised forever.

$219.99 or better before I let go of the rest.

Happy Friday!!

Today Salesforce.com Inc. (CRM) is the best performer in the DJIA

By: Thom Hartle | May 31, 2024

• Today (8:32 CST), the best performer in the DJIA is http://Salesforce.com Inc. CRM.

Read Full Story »»»

DiscoverGold

DiscoverGold

The drop in Salesforce ($CRM) leaves behind a giant island top which is also a head and shoulders structure

By: Tom McClellan | May 30, 2024

• The drop in Salesforce ($CRM) leaves behind a giant island top which is also a head and shoulders structure. The down move almost got to the downside objective of that structure all at once. That does not mean the price has to stop, though.

Read Full Story »»»

DiscoverGold

DiscoverGold

$CRM $1.5 Million Call LEAP that was bought to open (Above the Ask)

By: Cheddar Flow | May 30, 2024

• $CRM is a call LEAP that was bought to open (Above the Ask)

Read Full Story »»»

DiscoverGold

DiscoverGold

Salesforce (CRM) Stock in Freefall After Earnings

By: Schaeffer's Investment Research | May 30, 2024

• Salesforce posted its first revenue miss since 2006, and the stock is suffering

• CRM options volume is running at 35 times the intraday average amount

Salesforce Inc (NYSE:CRM) stock is plunging this morning, last seen 18.5% lower to trade at $221.80, after the cloud software vendor disclosed a disappointing first-quarter earnings report. Salesforce reported its first quarterly revenue miss since 2006, issued weaker-than-expected guidance, and saw budget scrutiny and longer deal cycles for the quarter.

Options traders are flooding CRM in response. So far, 54,000 calls and 59,000 puts have been exchanged, which is 35 times the average daily volume. New positions are being bought to open at 16 of the top 20 contracts, led by the weekly 5/31 220-strike put.

No less than 25 analysts cut their price targets on Salesforce stock, the steepest coming from UBS to $250 from $310. These look long overdue, too, considering the 12-month consensus price target of $306.84 is a 37.7% premium to the equity's current perch.

Now at its lowest level since November 2023, CRM is pacing for its worst single-session percentage drop since 2020. The shares are also trading below their 320-day moving average for the first time since March 2023. Year to date, Salesforce stock is now down nearly 16%.

Read Full Story »»»

DiscoverGold

DiscoverGold

Salesforce falls as Q2 revenue forecast lower than estimates

By: Reuters | May 29, 2024

** Shares of cloud service provider Salesforce CRM fall 14% to $232.45 in extended trading

** Co forecast Q2 revenue between $9.20 bln and $9.25 bln compared with estimates of $9.37 bln- LSEG

** CRM reports Q1 revenue of $9.13 bln, missing estimate of $9.18 bln- LSEG

** Co returned $2.2 bln by way of share repurchases and $0.4 bln in dividend payments to stockholders

** Up to last close, stock had risen 3.4% YTD

Read Full Story »»»

DiscoverGold

DiscoverGold

Salesforce $CRM Just Reported Earngs:

By: Evan | May 29, 2024

• SALESFORCE $CRM JUST REPORTED EARNINGS

EPS of $2.44 beating expectations of $2.37

Revenue of $9.13B missing expectations of $9.15B

Read Full Story »»»

DiscoverGold

DiscoverGold

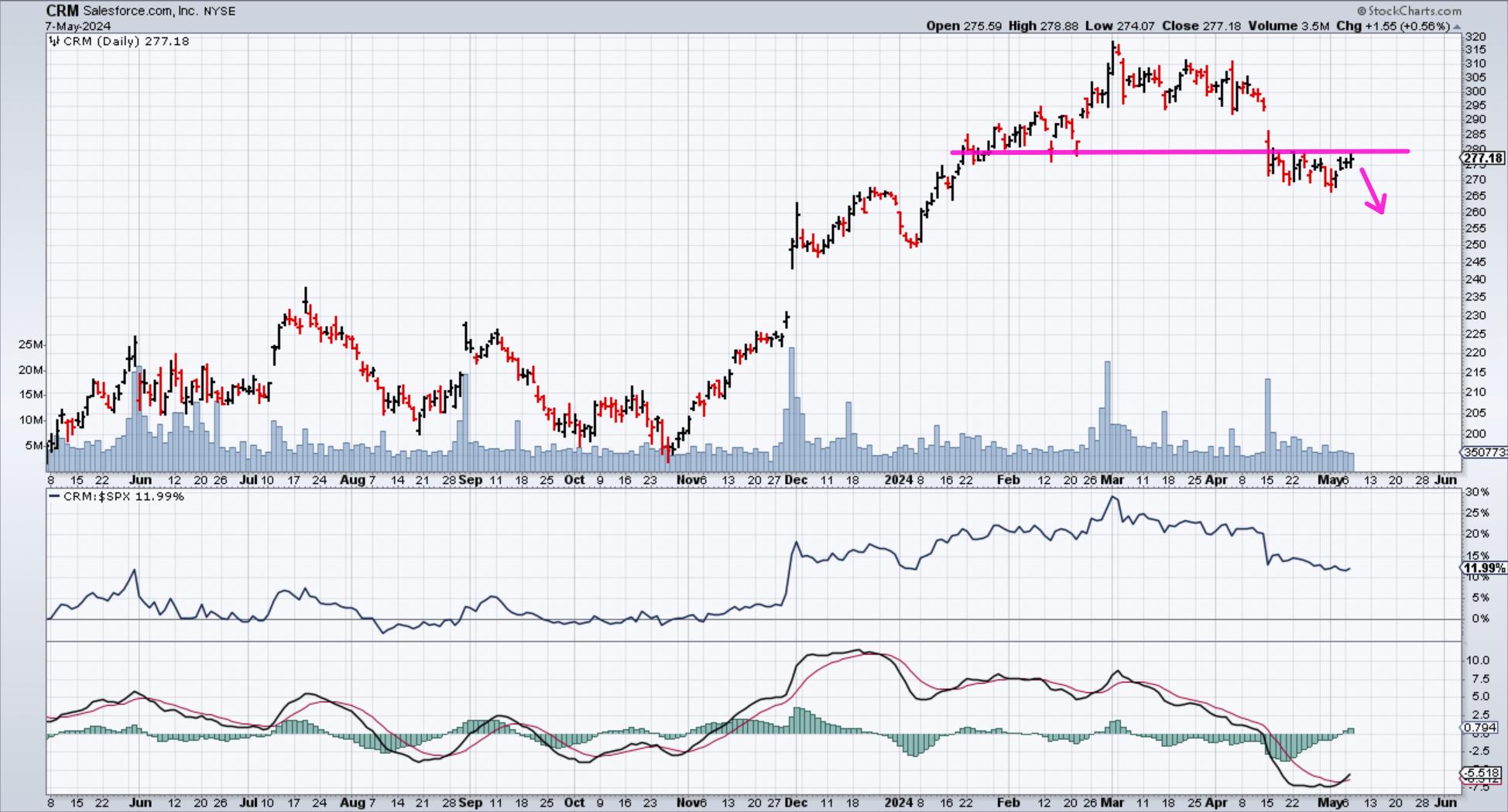

Salesforce Falls Out of Favor: Trade the Bear Put Spread Options Strategy

By: Tony Zhang | May 14, 2024

• Salesforce stock will likely trade within the $210 to $220 area.

• A bear put spread is a strategy to consider if you want to take advantage of the stock trading between $210 and $220.

• With CRM's earnings about three weeks away, a bear put spread could lower your cost of a bearish exposure.

Once a darling of the tech industry, Salesforce (CRM) had fallen out of favor until recently, when it hit a new all-time high earlier this year. Since then, though, investors have continued to shy away from this cloud computing stock as they focus on more pure AI-related companies, and Salesforce is at risk of turning lower again. As CRM matures and growth rates moderate, it simply cannot continue to command the industry-leading valuations it once did, and has to face the reality of its fundamentals.

Analyzing Salesforce

If you look at a five-year chart of CRM, you will see that the stock has traded within a significantly wide range of $130 to $310. Earlier this year, it revisited the upper bound of the range and attempted to break out higher to a new all-time high (see chart below). This quickly failed, and the stock reversed back into the range, with momentum recently turning negative. This suggests that CRM will likely continue to trade back towards the midpoint of the range, i.e., in the $210–220 area.

CHART 1. DAILY CHART OF SALESFORCE (CRM) STOCK. CRM's stock price tested a resistance level and turned lower. Momentum is also negative, which means the stock is likely to move lower.

Chart source: StockCharts.com. For educational purposes.

CRM currently trades at over 28x forward earnings, which flies in the face of growth rates that have moderated significantly over the past 12 months. After averaging EPS growth of over 45% over the past three years, future EPS growth is expected to slow to just a third of that at 16%. Revenue growth is expected to drop to under 10%. This makes a valuation that is 40% higher than the S&P 500 harder to justify when growth rates are slowing down significantly...

* * *

Read Full Story »»»

DiscoverGold

DiscoverGold

Bull Signal Flashing for Salesforce.com, inc. (CRM) Stock

By: Schaeffer's Investment Research | April 22, 2024

• The equity's 126-day moving average acted as a springboard in the past

• CRM is overdue for a near-term bounce

Salesforce.com, inc. (NYSE:CRM) stock is 0.2% higher at $270.90 at last glance. Shares of the blue-chip cloud technology stock recently suffered a bear gap on the charts that pulled it away form its March 1, record high of $318.72. The equity has shed 11.6% over the last month and is now closing in on its year-to-date breakeven mark, though a historically bullish trendline could help turn things around.

Specifically, Salesforce.com stock just came within one standard deviation of its 126-day moving average, after months spent above this trendline. According to data from Schaeffer's Senior Quantitative Analyst Rocky White, one similar signal was seen over the last three years. CRM enjoyed a positive return one month later after that instance, snagging a 5.5% gain. From its current perch, a comparable move would place the security at nearly $286.

The stock's 50-day put/call volume ratio of 0.91 at the International Securities Exchange (ISE), Cboe Options Exchange (CBOE), and NASDAQ OMX PHLX (PHLX) is in the elevated 85th percentile of its annual range. This suggests a very healthy appetite for long puts of late, and an unwinding of this pessimism could help the stock move higher.

The stock's "oversold" 14-day relative strength index (RSI) of 23.9 points to near-term tailwinds. Options are affordable at the moment too, per Salesforce.com stock's Schaeffer's Volatility Index (SVI) of 29% that ranks in the 20th percentile.

Read Full Story »»»

DiscoverGold

DiscoverGold

Today Salesforce.com Inc. (CRM) is the best performer in the DJIA

By: Thom Hartle | April 22, 2024

• Today (8:32 CST), the best performer in the DJIA is Salesforce.com Inc. CRM.

Read Full Story »»»

DiscoverGold

DiscoverGold

What CRM do you usually use for trading? I'm also curious about integrating a data enrichment platformto gain deeper insights into potential clients. Have you had any experience with that combination?

Today Salesforce.com Inc. (CRM) is the best performer in the DJIA

By: Thom Hartle | March 6, 2024

• Today (8:32 CST), the best performer in the DJIA is Salesforce.com Inc. CRM.

Read Full Story »»»

DiscoverGold

DiscoverGold

Salesforce $CRM decent Call roll

By: Flowrensics | March 5, 2024

• $CRM decent roll.

Read Full Story »»»

DiscoverGold

DiscoverGold

2 Cloud Stocks In Focus After Earnings

By: Schaeffer's Investment Research | February 29, 2024

• Snowflake and Salesforce.com both reported fourth-quarter results

• Analysts are targeting both stocks

Snowflake Inc (NYSE:SNOW) and Salesforce Inc (NYSE:CRM) are moving in vastly different directions today, after the cloud computing companies both reported quarterly results.

SNOW FALLS AFTER ICE-COLD FORECAST, C-SUITE CHANGE

Shares of cloud data storage name Snowflake are 19.4% lower at last glance, last seen trading at $185.44. Not only did the company's first-quarter outlook disappoint, CEO Frank Slootman, who took the company public in 2020, is also retiring.

In response, SNOW drew a slew of bear notes, including at least 20 price-target cuts. Most notable was Morgan Stanley's note, which included a downgrade to "equal weight" from "overweight" and a price-target cut to $175 from $230. The 12-month target price of $230.15 is a 24.8% premium to current levels, while 26 of 39 covering brokerages still rate SNOW a "buy" or better. This means more bear notes could be on the way.

Today's fall dragged Snowflake stock below its year-to-date breakeven level, now down 7.1% in 2024. The equity also just crossed back below its 80-day moving average for the first time since early November.

ANALYSTS LIFT BLUE CHIP'S PRICE TARGET

The brokerage bunch is chiming in on Dow component Salesforce stock as well, after the company's downbeat annual revenue growth forecast. This was lighter than what analysts expected, but sentiment got a boost from better-than-expected fourth-quarter earnings and revenue.

No fewer than 20 analysts lifted their price targets on the tech stock. Raymond James looks to be the most optimistic, moving all the way up to $380 from $300. There's room for upgrades, too, considering 13 of 40 covering firms rate CRM a "hold" or "strong sell."

Last seen up 1.1% to trade at $303.29, the stock earlier secured a fresh two-year high of $308.50. On a closing basis, the $280 level stepped up to save two recent pullbacks, and more recently the $295 area has acted as a floor. Salesforce stock is up more than 81% in the last 12 months, and now boasts a nearly 15% year-to-date lead.

Read Full Story »»»

DiscoverGold

DiscoverGold

THESE CROOKS ALWAYS COOKS THEIR BOOKS!!!!!!!!!

Today (8:32 CST), the best performer in the DJIA is Salesforce.com Inc. CRM

By: Thom Hartle | February 23, 2024

• Today (8:32 CST), the best performer in the DJIA is http://Salesforce.com Inc. CRM.

Read Full Story »»»

DiscoverGold

DiscoverGold

Today Salesforce.com Inc. (CRM) is the best performer in the DJIA

By: Thom Hartle | February 22, 2024

• Today (8:32 CST), the best performer in the DJIA is http://Salesforce.com Inc. CRM.

Read Full Story »»»

DiscoverGold

DiscoverGold

Today (8:34 CST), the best performer in the DJIA is Salesforce.com Inc. CRM

By: Thom Hartle | February 14, 2024

• Today (8:34 CST), the best performer in the DJIA is Salesforce.com Inc. CRM.

Read Full Story »»»

DiscoverGold

DiscoverGold

Salesforce is cutting 700 jobs - WSJ

By: Investing | January 26, 2024

Salesforce (NYSE:CRM) is set to lay off approximately 700 employees, constituting around 1% of its workforce, according to the Wall Street Journal.

The cloud-based customer-relationship management software company had undertaken a more significant reduction of 10% (about 8,000 employees) one year ago in response to investor pressure to cut costs.

The current layoffs are part of Salesforce's ongoing efforts to focus spending on growth, with the company still having around 1,000 open positions across various departments. This move is seen as a routine adjustment of the workforce rather than a significant shift in strategy.

Salesforce's decision comes after facing challenges in the previous year, dealing with a post-pandemic sales slowdown that impacted its growth. Activist investors, including Elliott Management, sought to increase the company's profit margins more rapidly than originally planned.

Read Full Story »»»

DiscoverGold

DiscoverGold

$CRM Not a single insider buy in sight

By: TrendSpider | January 24, 2024

• $CRM Not a single insider buy in sight.

Read Full Story »»»

DiscoverGold

DiscoverGold

Salesforce $CRM nice move last week, 275 big reistance. Watch for dips to the 8D

By: Options Mike | January 15, 2024

• $CRM nice move last week, 275 big reistance.

Watch for dips to the 8D.

Read Full Story »»»

DiscoverGold

DiscoverGold

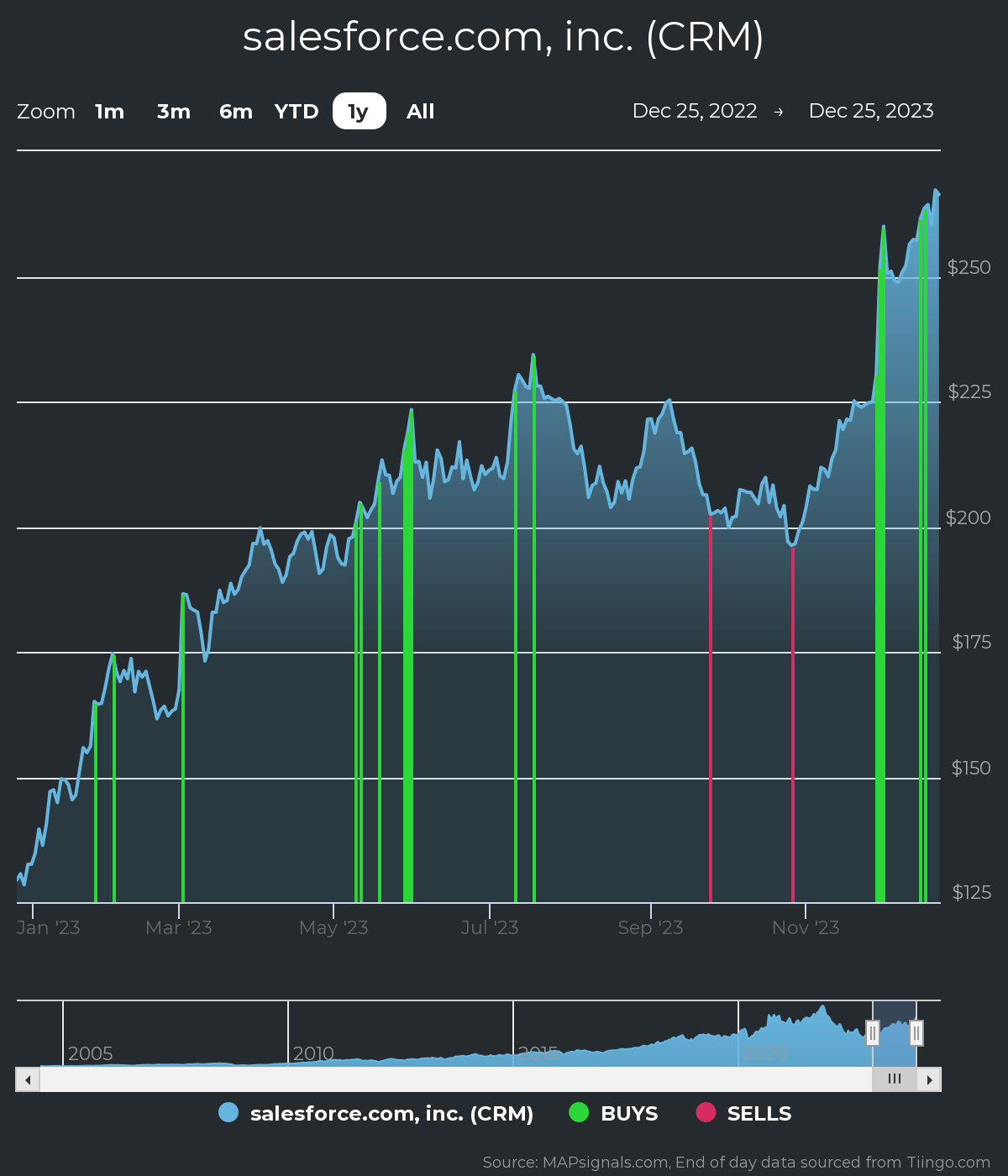

Salesforce (CRM) Stock is Heavily in Demand

By: Lucas Downey | December 26, 2023

• Salesforce.com, Inc. (CRM) shares have more than doubled, up 101% this year. What’s incredible is how the shares have traded recently.

Salesforce Shares are Surge with Inflows

Over the past year, CRM’s stock has climbed alongside increasing volumes. That’s indicative of healthy institutional support.

Each green bar signals unusual increasing volumes in CRM shares, pushing the stock higher:

Source: www.mapsignals.com

Few stocks have charts this strong. Recent green bars suggest healthy demand. Now, let’s check the fundamental story.

Salesforce Fundamental Analysis

Institutional support coupled with a healthy fundamental backdrop makes this company interesting. As you can see, CRM has had positive sales & earnings growth in recent years:

• 3-year sales growth rate (+13.8%)

• 3-year EPS growth rate (+65%)

Source: FactSet

Now it makes sense why the stock has been powering higher. CRM is an earnings powerhouse.

Marrying great fundamentals with our proprietary software has found some big winning stocks over the long-term.

Check this out. Salesforce has been a top-rated stock at MAPsignals. That means the stock has had unusual buy pressure and growing fundamentals. We have a ranking process that showcases stocks like this on a weekly basis.

It’s made the rare Top 20 report many times. The blue bars below shows when CRM was a top pick:

Source: www.mapsignals.com

Tracking unusual volumes reveals the power of money flows.

This is a trend that’s hard to fight.

Salesforce Price Prediction

The CRM rally began months ago. Big Money buying in the shares is signaling to take notice. Given the historical gains in share price and strong fundamentals, this stock could be worth a spot in a diversified portfolio.

Read Full Story »»»

DiscoverGold

DiscoverGold

|

Followers

|

47

|

Posters

|

|

|

Posts (Today)

|

0

|

Posts (Total)

|

864

|

|

Created

|

12/10/07

|

Type

|

Free

|

| Moderators DiscoverGold | |||

| Volume | |

| Day Range: | |

| Bid Price | |

| Ask Price | |

| Last Trade Time: |