| Followers | 686 |

| Posts | 142386 |

| Boards Moderated | 35 |

| Alias Born | 03/10/2004 |

Tuesday, May 14, 2024 3:54:55 PM

By: Tony Zhang | May 14, 2024

• Salesforce stock will likely trade within the $210 to $220 area.

• A bear put spread is a strategy to consider if you want to take advantage of the stock trading between $210 and $220.

• With CRM's earnings about three weeks away, a bear put spread could lower your cost of a bearish exposure.

Once a darling of the tech industry, Salesforce (CRM) had fallen out of favor until recently, when it hit a new all-time high earlier this year. Since then, though, investors have continued to shy away from this cloud computing stock as they focus on more pure AI-related companies, and Salesforce is at risk of turning lower again. As CRM matures and growth rates moderate, it simply cannot continue to command the industry-leading valuations it once did, and has to face the reality of its fundamentals.

Analyzing Salesforce

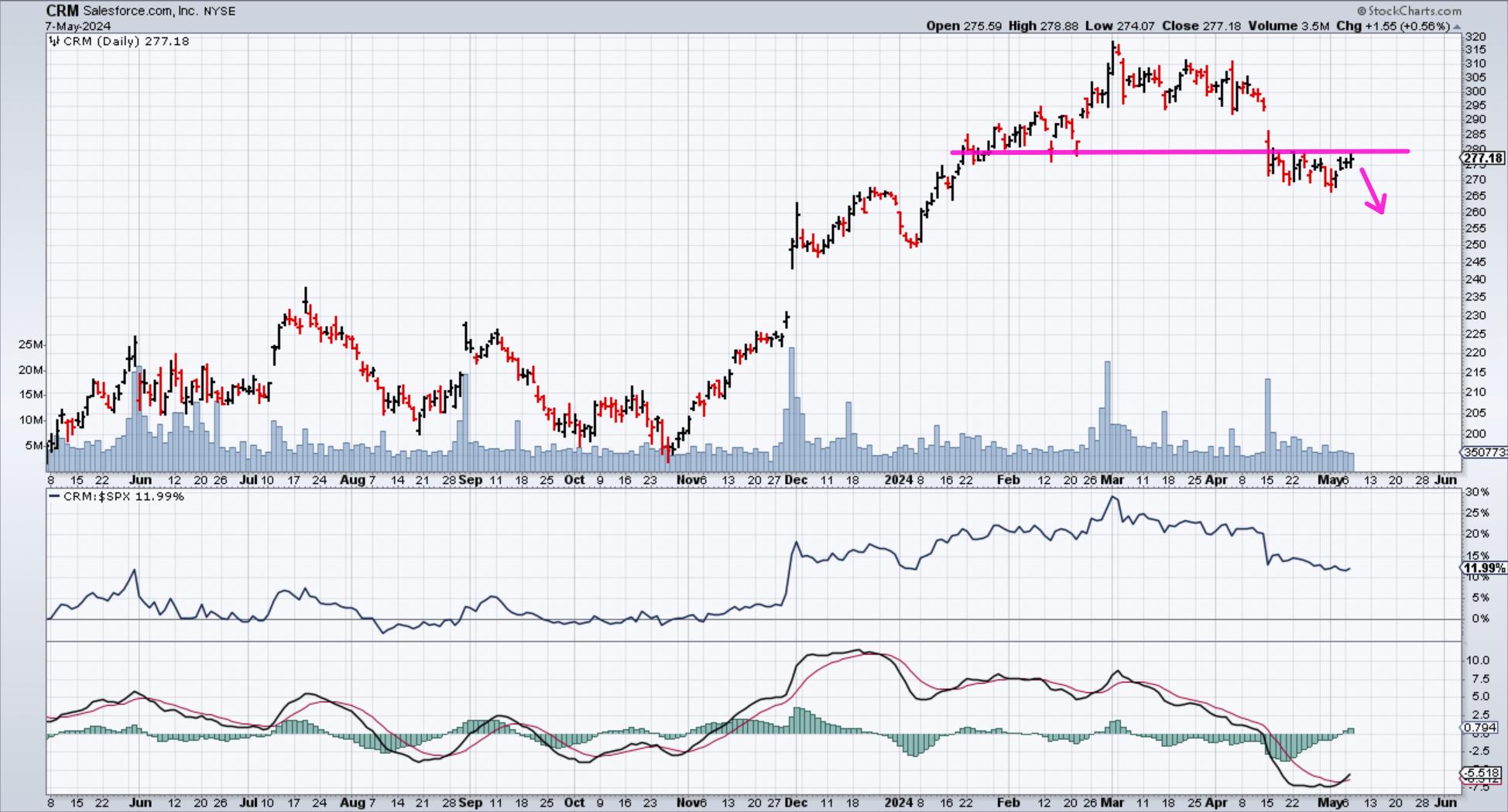

If you look at a five-year chart of CRM, you will see that the stock has traded within a significantly wide range of $130 to $310. Earlier this year, it revisited the upper bound of the range and attempted to break out higher to a new all-time high (see chart below). This quickly failed, and the stock reversed back into the range, with momentum recently turning negative. This suggests that CRM will likely continue to trade back towards the midpoint of the range, i.e., in the $210–220 area.

CHART 1. DAILY CHART OF SALESFORCE (CRM) STOCK. CRM's stock price tested a resistance level and turned lower. Momentum is also negative, which means the stock is likely to move lower.

Chart source: StockCharts.com. For educational purposes.

CRM currently trades at over 28x forward earnings, which flies in the face of growth rates that have moderated significantly over the past 12 months. After averaging EPS growth of over 45% over the past three years, future EPS growth is expected to slow to just a third of that at 16%. Revenue growth is expected to drop to under 10%. This makes a valuation that is 40% higher than the S&P 500 harder to justify when growth rates are slowing down significantly...

* * *

Read Full Story »»»

DiscoverGold

DiscoverGold

Information posted to this board is not meant to suggest any specific action, but to point out the technical signs that can help our readers make their own specific decisions. Caveat emptor!

• DiscoverGold

Recent CRM News

- Salesforce Announces Quarterly Dividend • Business Wire • 06/28/2024 12:35:00 AM

- U.S. Futures Decline Ahead of Triple Witching, Oil Prices Edge Lower • IH Market News • 06/21/2024 12:00:27 PM

- Dow Closes Firmly Positive But Nasdaq, S&P 500 Give Back Ground • IH Market News • 06/20/2024 08:30:11 PM

- Yale Chief Executive Leadership Institute Honors Marc Benioff with Legend in Leadership Award • Business Wire • 06/20/2024 08:05:00 PM

- Form DEFA14A - Additional definitive proxy soliciting materials and Rule 14(a)(12) material • Edgar (US Regulatory) • 06/14/2024 09:23:20 PM

- Salesforce Announces Annual Stockholders Meeting to be Held Virtually on Thursday, June 27, 2024 • Business Wire • 06/13/2024 08:05:00 PM

- Form 4 - Statement of changes in beneficial ownership of securities • Edgar (US Regulatory) • 06/12/2024 09:31:09 PM

- Form 4 - Statement of changes in beneficial ownership of securities • Edgar (US Regulatory) • 06/12/2024 09:14:42 PM

- Form 4 - Statement of changes in beneficial ownership of securities • Edgar (US Regulatory) • 06/11/2024 10:15:12 PM

- Form 144 - Report of proposed sale of securities • Edgar (US Regulatory) • 06/11/2024 09:06:13 PM

- Form 4 - Statement of changes in beneficial ownership of securities • Edgar (US Regulatory) • 06/11/2024 01:42:25 AM

- Form 4 - Statement of changes in beneficial ownership of securities • Edgar (US Regulatory) • 06/07/2024 08:29:19 PM

- Form 4 - Statement of changes in beneficial ownership of securities • Edgar (US Regulatory) • 06/06/2024 08:15:51 PM

- Nvidia Becomes 2nd Most Valuable Company in the USA, ASML Takes 2nd Spot in Europe, and More News • IH Market News • 06/06/2024 11:34:59 AM

- Form 4 - Statement of changes in beneficial ownership of securities • Edgar (US Regulatory) • 06/05/2024 09:35:42 PM

- Form 4 - Statement of changes in beneficial ownership of securities • Edgar (US Regulatory) • 06/05/2024 09:27:43 PM

- Form 4 - Statement of changes in beneficial ownership of securities • Edgar (US Regulatory) • 06/05/2024 08:01:15 PM

- Form 4 - Statement of changes in beneficial ownership of securities • Edgar (US Regulatory) • 06/04/2024 08:19:00 PM

- Economic Worries May Lead To Weakness On Wall Street • IH Market News • 06/04/2024 01:10:54 PM

- U.S. Stocks Close On Mixed Note • IH Market News • 06/03/2024 08:44:00 PM

- Form 4 - Statement of changes in beneficial ownership of securities • Edgar (US Regulatory) • 06/03/2024 08:34:30 PM

- Form PX14A6G - Notice of exempt solicitation submitted by non-management • Edgar (US Regulatory) • 06/03/2024 05:23:24 PM

- Form 4 - Statement of changes in beneficial ownership of securities • Edgar (US Regulatory) • 05/31/2024 09:07:08 PM

- Futures Turn Positive Following Closely Watched Inflation Data • IH Market News • 05/31/2024 01:20:44 PM

- U.S. Index Futures Dip in Pre-Market Amid Earnings Assessments and Upcoming Inflation Report • IH Market News • 05/31/2024 11:51:14 AM

FEATURED BNCM and DELEX Healthcare Group Announce Strategic Merger to Drive Expansion and Growth • Jul 2, 2024 7:19 AM

EWRC's 21 Moves Gaming Studios Moves to SONY Pictures Studios and Green Lights Development of a Third Upcoming Game • EWRC • Jul 2, 2024 8:00 AM

NUBURU Announces Upcoming TV Interview Featuring CEO Brian Knaley on Fox Business, Bloomberg TV, and Newsmax TV as Sponsored Programming • BURU • Jul 1, 2024 1:57 PM

Mass Megawatts Announces $220,500 Debt Cancellation Agreement to Improve Financing and Sales of a New Product to be Announced on July 11 • MMMW • Jun 28, 2024 7:30 AM

VAYK Exited Caribbean Investments for $320,000 Profit • VAYK • Jun 27, 2024 9:00 AM

North Bay Resources Announces Successful Flotation Cell Test at Bishop Gold Mill, Inyo County, California • NBRI • Jun 27, 2024 9:00 AM