Register for free to join our community of investors and share your ideas. You will also get access to streaming quotes, interactive charts, trades, portfolio, live options flow and more tools.

Interestingly its actually gone higher after Divy date this time

The Dip in July is where I should of added

Enbridge (NYSE:ENB) is one of the leading energy infrastructure companies in North America. It operates oil and gas pipelines, other midstream assets, and natural gas utilities. The company also has a sizable renewable energy business.

Enbridge has increased its dividend for more than 25 consecutive years. Despite the shift toward cleaner alternative energy sources, it’s still growing and estimates it can increase its annual cash flow per share by 5% to 7% through 2024. Because of that, the company is well-positioned to continue increasing its high-yielding dividend.

https://www.fool.com/investing/stock-market/market-sectors/industrials/construction-stocks/infrastructure-stocks/

Nearly 300 people attended a 10-hour-long virtual public hearing Wednesday about a draft environmental review for a $450 million plan to reroute an oil and gas pipeline across northern Wisconsin.

In December, the Wisconsin Department of Natural Resources released its draft environmental impact statement for a roughly 40-mile reroute of Enbridge’s Line 5 in Ashland and Iron counties. The pipeline carries up to 23 million gallons of oil and natural gas liquids per day and spans 645 miles from Superior to Sarnia, Ontario.

Enbridge wants to move the pipeline after the Bad River Band of Lake Superior Chippewa sued the company in 2019 to shut down and remove Line 5 from the tribe’s reservation.

The company’s new 30-inch line is expected to cross nearly 200 waterbodies and temporarily affect 135 acres of wetlands. Enbridge maintains the nearly 70-year-old pipeline serves as a vital link to fuel across the region.

Source: https://www.wpr.org/hundreds-participate-hearing-enbridges-proposed-oil-and-gas-pipeline-project

Yes…. Pays monthly 10% has been great

Only holds Enbridge

39.80 Pipeline operator Enbridge signs deals to produce RNG, hydrogen

https://www.reuters.com/business/sustainable-business/enbridge-inks-low-carbon-deals-with-shell-vanguard-renewables-2021-09-28/?taid=6153ee25c9cd470001335e06&utm_campaign=trueAnthem:+Trending+Content&utm_medium=trueAnthem&utm_source=twitter

"Enbridge Reports Strong First Quarter 2021 Financial Results; Reaffirms 2021 Financial Outlook"....

Didn't work.

line 5 weighs heavy on peoples minds.

Thanks for the info!!

Agree but be careful

April 30, 2021

Interesting quote of the day from energy expert Phil Flynn (emphasis added):

“…Michigan Governors Gretchen Whitmer’s plan to kill another Canadian Pipeline that has operated safely for 60 years. The governor gave an order demanding that Enbridge shut the pipeline down by May 12. Enbridge will ignore the order as they claim that the governor does not have the authority to tell them to shut it down. But why does the law matter when the climate is concerned?“

IMO Good buy considering the global economy situation and inflation going up. The commodity sector is a good bet. And the great thing is they over 7% dividend. Where can you get that these days.

So in at 37 Canadian eh and you're looking for 45 ?

Thanks fore the heads-up - Looks fairly-darned reasonable - Especially w the likely divy increase

Which I've YET to ever fully truly understand.....(whysay a .05% increase in say a 4% yield ?, is anything much to celebrate) ?

Regardless, an ultra great entry (for me - personally) would be The Tremendous Ruler-Line !

Still room to move looking for at least 35.00

Bought a Hugh position around 28.50

Look for a dividend increase to be announced at the share holders presentation on December 8.

Projecting a 5% increase in the dividend

Golferman

8 months later

The Great Covid Down-spike ;

8 months later https://www.fool.ca/2020/11/11/buy-high-yield-dividend-stocks-for-generous-passive-income/ Yield 8.7

Yes, Good Buy!!!

Good Buy??? Or NOT???

News: $ENB Where Will Kinder Morgan Be in 1 Year?

Kinder Morgan (NYSE: KMI) is one of the largest and most diversified midstream companies in North America. As a dividend-paying stock , it has a bit of a checkered past, notably including a 75% payout cut in 2016. It's working its way back from that , but the company's decisions over the...

In case you are interested ENB - Where Will Kinder Morgan Be in 1 Year?

News: $ENB 1 More Reason to Love Enterprise Products Partners

North American midstream giant Enterprise Products Partners (NYSE: EPD) is a bellwether in its industry. Add in 22 years of annual distribution increases, a fat 6.1% yield, and 1.7 times distribution coverage through the first six months of 2019, and there's a lot for dividend-focused inv...

Find out more ENB - 1 More Reason to Love Enterprise Products Partners

$ENB Enbridge eases oil volume requirements for Mainline pipeline

Enbridge (NYSE:ENB) says it lowered oil shipping requirements on its Mainline pipeline by nearly two-thirds, a move that should soothe fears from smaller shippers that they would be pushed out by the company's initially higher volume minimums.

ENB now requires minimum volume commitments of 2,200 bbl/day, down from the 6K bbl/day commitment it previously sought, the company tells Reuters.

ENB plans to turn the Mainline oil shipping network from a common carrier system open to all shippers to one mostly contracted for up to two decades; it plans to launch an open season for space in July.

Update -

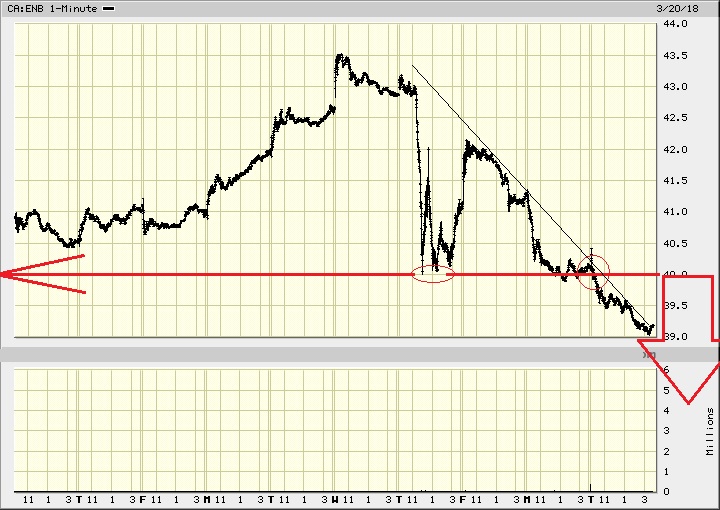

Old post from November 2017

https://investorshub.advfn.com/boards/read_msg.aspx?message_id=136533461

At that time it was briefly poking down thru the trend-line at around 45 then it suddenly zoomed up to 50 bucks before PLUNGING thru the TL)

Cagey downgap update :

I was interested in why you compared ENB to Enron?

If you saw, still see? systemic issues?

"What does pps have to do with BK risk?

How does this look anything like Enron to you?

Two very recent upgrades by analysts

I'm concerned about the divi

.. but you see BK risk?

How so, specifically?

"Almost looks to me like they're headed for bankruptcy !....

Are lookin' like another freakin' ENRON !.....but I've no idea WHAT the deal is with 'em

In that (old) post you replied to (dated March 20th ?),

I was writing about the need for the the $40 Level to hold....

This from 2 weeks ago - Why you no read it ?

https://investorshub.advfn.com/boards/read_msg.aspx?message_id=145911044

Doesn't it look like the 40 held well ?

What does pps have to do with BK risk?

How does this look anything like Enron to you?

Two very recent upgrades by analysts

I'm concerned about the divi

.. but you see BK risk?

How so, specifically?

"Almost looks to me like they're headed for bankruptcy !....

Are lookin' like another freakin' ENRON !.....but I've no idea WHAT the deal is with 'em.

Enbridge gas pipeline explosion causes fireball in Ohio

https://finance.yahoo.com/news/enbridge-gas-pipeline-explosion-causes-221709030.html

An explosion of an Enbridge Inc natural gas pipeline in Ohio on Monday created a fireball of flame and damaged homes, prompting the evacuation of nearby residents. The explosion occurred on Enbridge's Texas Eastern pipeline system and appeared to have destroyed two homes, said Chasity Schmelzenbach, emergency management director for Noble County, Ohio. "We got reports flames were shooting (up) 80 feet to 200 feet (25-60 meters)," Schmelzenbach said.

I don’t think it’s out of the woods yet but like this long term.

Well it's kind of come back into range again but.....Now what ?

Wonder how your Mackinac story turned out....and what're ya' thinkin' of The Sector right now ?

Is it going to come back down to 40 ?

Bit of a crumby? low-down on Enbridge right here https://seekingalpha.com/article/4231342-top-buys-2019?lift_email_rec=false

.

Enbridge getting exposed for scam by a consumer thats using their service and posted a LIVE video on youtube.

ENB smoking hot! These 2 High-Yield Stocks Team Up on a Win-Win Deal

Motley Fool

Matthew DiLallo, The Motley Fool

,Motley Fool•July 5, 2018

This year has been a disappointing one for investors in Enbridge (NYSE: ENB) and Brookfield Infrastructure Partners (NYSE: BIP) as both stocks are down double-digits. Two different factors have weighed on their valuations. In Enbridge's case, investors worried that the Canadian pipeline giant's debt level had grown too high. Meanwhile, Brookfield Infrastructure has been under pressure due to concerns about growth in the near-term after a recent asset sale.

Those issues, however, should fade away after the companies teamed up on a deal where Enbridge will sell a business unit to Brookfield for 4.31 billion Canadian dollars ($3.3 billion) in cash. That's because it should solve Enbridge's balance sheet problems while also addressing concerns about Brookfield's ability to grow. By correcting those issues, the deal makes it increasingly likely that the two companies can increase their high-yielding dividends at a healthy rate in the coming years.

Two people shaking hands with an energy facility in the background.

Two people shaking hands with an energy facility in the background.

More

Image source: Getty Images.

Details on the deal

Enbridge is selling its natural gas gathering and processing assets in Western Canada to Brookfield Infrastructure and its institutional partners in a two-stage deal. This business includes more than 2,200 miles of gathering pipelines and 19 natural gas processing and liquids handling facilities. These assets gather natural gas from wells and transport it to the processing plants, which extract natural gas liquids (NGLs) from the gas. Brookfield will acquire the assets regulated by provincial governments later this year and the federally regulated ones by the middle of 2019.

How this transaction helps Enbridge

For Enbridge, the cash payments will give the company the financial flexibility to address its balance sheet concerns as it funds a CA$22 billion ($16.8 billion) expansion program. It's the third non-core asset sale by the company this year as part of its efforts to accelerate the deleveraging of its balance sheet. With this latest transaction, Enbridge has announced CA$7.5 billion ($5.7 billion) of asset sales, more than double its CA$3 billion ($2.3 billion) target.

Even with those divestitures, Enbridge still expects to achieve its forecast to grow cash flow per share at a 10% annual rate through 2020. That keeps the company on pace to increase its 6%-yielding dividend at the same double-digit pace over that timeframe.

How the deal helps Brookfield Infrastructure

Brookfield, meanwhile, intends on investing $500 million into this transaction to acquire a 30% stake in the business, with its partners acquiring the other 70% interest in the assets. The company will fund its portion of the deal using some of the cash proceeds from the sale of its Chilean electricity transmission business.

These assets are an ideal fit for Brookfield, which has been eyeing energy midstream businesses in North America. "This investment represents an exciting opportunity to invest in scale in one of North America's leading gas gathering and processing businesses based in Western Canada. The business is strategically positioned for the continued development of the prolific Montney Basin," according to CEO Sam Pollock. Not only does it offer growth potential, but it generates stable cash flows underpinned by long-term contracts that have an average remaining life of 10 years.

Continue Reading

ENB added at the close friday for the long haul & Divy

$ENB Enbridge's Line 5 pipelines beneath the Straits of Mackinac linking two of the Great Lakes appear to have been damaged by the same vessel believed to have caused a recent leak of 550 gallons of coolant fluid from submerged electric cables.

Michigan Gov. Snyder says ENB notified the state about the damage to its Line 5 pipelines, saying it was minor and consisted of three small dents; ENB says the structural integrity of the pipelines was not compromised, and it is "taking immediate action to assess appropriate, reinforcing repairs."

The 65-year-old pipelines carry 23M gallons/day of crude oil across the Straits of Mackinac, which connect Lake Huron and Lake Michigan.

You can say that again. I’ve been adding but haven’t figured out where it’s going just yet.

Wow it's putting on quite the show alright - AT the $30 Level

Man.

Toronto's equivalent to 30 hasn't held - so it's chart appears a bit scarier.

Poss Cdn dollar related ?

Anyhoo....Onwards....with Broader markets turning up ?

I don’t see any systemic issues I think the market is not giving them proper valuation but I’m still digging. I did add at $30 though.

Almost looks to me like they're headed for bankruptcy !....

Are lookin' like another freakin' ENRON !.....but I've no idea WHAT the deal is with 'em.....

What I do not get, is this BMO buy recco ! : Done at $ 46 bucks in November !....ha

Glad I never bought.......Is currently down 26 % from there (the red dot)

Shares are down 10 % from 43.50 :

Down 2.5 % just today (because the 40 failed)

The yields are becoming HUGE !......( 6.9 % right now )

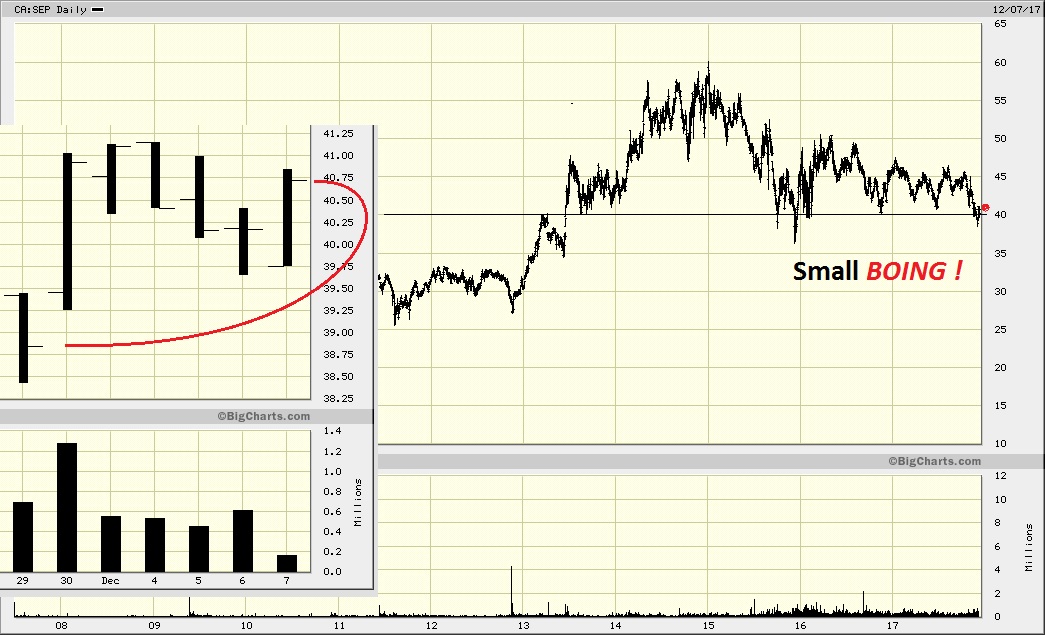

See also their ticker symbol EEB where the yield now = 15 % ! . . . .

See also Spectra ; Symbol ca:SEP Yield = 8.7

$ENB buying opp if you ask me. Very surprised to see it drop.

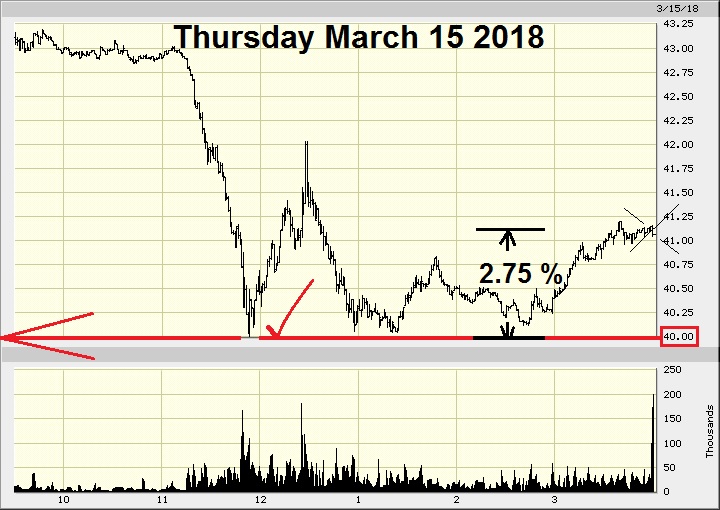

Great bounce off of $ 40 though (naturally, of course).....Up 2.75 %

So why didn't I have a bid parked down there ?.....

Answer = Just not organized enuf.

Plus it's only by fluke that I even managed to click on 'em today.

It's not like a maintain a watch-list or nuthin'.

Their 1-day chart :

Their 1-month chart :

Their All-Data chart :

2 days ago (on March 13th) : (also just happened to click on 'em then) : and at that time drew up this chart :

Came out their earnings on Feb 15th

https://boereport.com/2018/02/15/enbridge-energy-partners-l-p-reports-fourth-quarter-2017-results/

Haven't checked into their ex-div dates

TODAY they got downgraded by XXXXXX some smallish outfit - so that's seemingly cause of the down-spike

Next report - May 10th : Useful info / helps explain today, etc. - https://friscofastball.com/enbridge-inc-enb-shareholder-pcj-investment-counsel-ltd-has-cut-stake-by-3-45-million/

Submit

.

Man what a clobbering (and just 2 days after posting this) : https://investorshub.advfn.com/boards/read_msg.aspx?message_id=139268838

I dunno why tho - Is it dividend-related ?

$ENB Canada’s biggest pipeline export system is full and will remain full even if owner Enbridge (NYSE:ENB) succeeds in completing its Line 3 project, CEO Al Monaco said during today's earnings conference call.

ENB’s Mainline system delivered record deliveries of 2.73M bbl/day of crude from Alberta to refineries in the U.S. Midwest in December and the system will be full for at least the next three years, Monaco said.

“January and February volumes look pretty strong as well and we expect the system will essentially be full for the rest of the year. In fact, we expect that to be the case through 2020, including our Line 3 given growing supply and lack of other pipeline capacity before them,” the CEO said.

The news that ENB’s pipelines would remain full until 2020 were aimed at long-term concerns for the mainline system and whether utilization would slip if competing pipeline projects are built.

ENB expects regulators in Minnesota to make a decision on Line 3, which has been approved by Prime Minister Trudeau, during Q2 and to begin shipping oil between Alberta and Wisconsin in 2019.

7 days later : Charts Update :

https://www.bnn.ca/video/ways-to-use-options-to-boost-returns~1279164

I dunno ENB....What're you up to NOW ?

https://www.theglobeandmail.com/report-on-business/industry-news/energy-and-resources/enbridge-to-issue-shares-sell-assets-following-spectra-deal/article37132541/

BMO sees ‘once in a multi-year buying opportunity’ for Enbridge

Enbridge to cut 1,000 jobs in wake of Spectra Energy acquisition

Enbridge (ENB +1.3%) says it will cut ~1K positions, or 6% of its work force, in its first layoffs after buying Spectra Energy.

ENB says duplications exist in the combined company's "organizational structure," and the workforce reductions are a component of the synergies expected over the coming months as it fully integrates the companies.

ENB has said it has no plans for consolidation at its three MLP businesses: Enbridge Energy Partners (EEP -0.9%), Midcoast Energy Partners (MEP) and Spectra Energy Partners (SEP -0.1%).

U.S. may become world's biggest LNG supplier by 2035, CEOs say

The U.S. may surpass Australia and Qatar as the world’s biggest supplier of liquefied natural gas by 2035, according to the CEO of Canada's Enbridge (ENB -0.1%) and LNG exporter Tellurian (TELL -11.5%).

"North America’s energy advantage extends from a unique combination of resources, the most advanced technologies being applied to those resources and the availability of capital,” ENB CEO Albert Monaco tells attendees at the CERAWeek energy conference.

Enbridge (ENB -1.1%) says it's acquired 100% interest in the New Creek Wind Project, an under-development 103-megawatt wind farm, from EverPower Wind Holdings.

Enbridge is in for about $200M on the West Virginia project, which is backed by renewable energy credit sales and off-take agreements with fixed pricing. It gives Enbridge an interest in a total near 2,000 megawatts of net renewable generating capacity.

The project comprises 49 turbines and is expected to be in service in December 2016.

|

Followers

|

18

|

Posters

|

|

|

Posts (Today)

|

0

|

Posts (Total)

|

65

|

|

Created

|

07/30/11

|

Type

|

Free

|

| Moderators | |||

| Volume | |

| Day Range: | |

| Bid Price | |

| Ask Price | |

| Last Trade Time: |