Register for free to join our community of investors and share your ideas. You will also get access to streaming quotes, interactive charts, trades, portfolio, live options flow and more tools.

suppose to have ah growth earnings report,heavy http://www.ELIXINOL.com

For the first time ever,

a cannabis ad will appear on Times Square on New Year's Eve.

Celebrating new opportunities born from the passage of the 2018 Farm Bill,

Elixinol Global (OTC: ELLXF) subsidiary Elixinol will appear in

multiple locations throughout Times Square.

“A year ago, we were denied advertising in Times Square.

What a difference a year makes

— we join the entire hemp community in celebrating what’s to come in 2019,”

said Chris Husong, Director of Sales and Marketing for Elixinol.

“Times Square on New Year’s Eve is one of the most iconic advertising spaces in the United States,

with over a million in-person visitors and

over a billion around the globe watching the festivities on

TV. 2018 was a ground-breaking year for Elixinol in the U.S.

and internationally

— this placement reflects our optimism for 2019.”

Elixinol is joining other cannabis brands in Times Square

including Cannabis Network Media,

Curved Papers,

My Bud Vase,

MTracTech,

Restorative Botanicals.

The placements will run between 5 p.m. and 2 a.m. in 15 second increments.

Can't wait till we get some major US retailers to put us on the shelf! Management says each one will bring an average of $20 million annual revenue!

Agreed. And this volume ain't too shabby. Some healthy churning going on here.

Loaded more.

https://finance.yahoo.com/news/exclusive-canopy-growth-to-invest-up-to-500-million-in-hemp-production-in-rhode-island-other-states-101514451.html

Canopy looking to invest half a billion dollars in US Hemp to try and play catch up to the big 3. Looking good. We're the fastest growing of the big 3!

Nunyara meaning "to be made well again" is so confident in getting the land, they went ahead and bought the 60acre parcel of land!!

https://t.co/8Plu6F8tAy

— Focused Trades (@TradesFocused) February 6, 2019

Land purchase for Medical MJ @ElixinolCBD @elixinol

Wow. Very bullish indeed! Thank you Aries

Is Elixinol the Fastest Growing Hemp/CBD Producer?

https://www.streetwisereports.com/article/2019/02/05/is-elixinol-the-fastest-growing-hemp-cbd-producer.html

Contributed Opinion

Source: Fincom Investment Partners for Streetwise Reports (2/4/19)

Frederick Lacy

Fincom Investment Partners discusses Elixinol's Q4 earnings, previews Charlotte's Web and CV Sciences' earnings, and compares the three companies.

Q4 Q/Q growth rate at 14%—we suspect—Elixinol now fastest growing in hemp/CBD.

We initiate a target price of $5.76 USD, which is realistic, within current values.

Elixinol Global Ltd. (EXL:ASX; ELLXF:OTCQX) reported quarterly (Q4) revenue at US$8.57 million, up a very strong 14% over Q3. Full year revenue growth was up 121% from December 2017.

We will have further analyst when the full earnings become available the end of February. Some Australian stocks pre-release a short "cash flow" number, before full earnings, offering a glimpse at critically important top-line sales.

Our takeaway: Robust growth continues. Elixinol is heavily investing in materials and production capacity. We expect strong growth continues in 2019, and we project upcoming Q4 earnings will confirm: Elixinol is the fastest growing hemp/CBD company.

Scientific case for CBD continues to grow

We have long proposed the ultimate CBD market (cannabidiol, a non-intoxicant) is much larger, and better, than cannabis. We believe CBD will become a health standard, available in a variety of OTC forms, and routinely carried by mass retailers. The OTC market for pain relief, stress and sleeping issues alone is massive, and CBD is a near-ideal fit.

In addition, scientific evidence for CBD continues to grow. One recent study published in the April 2019 Cancer Letter concluded, "Taken together, the results obtained in this study re-demonstrated the effects of CBD treatment in vivo, thus confirming its role as a novel, reliable anti-cancer drug."

The growing weight of accumulated evidence supports our thesis whereby millions of consumers will add a daily regimen of CBD. The OTC option allows easy access. We believe there are more millions interested in improving their health, rather than getting "stoned", on a daily basis.

Elixinol versus Charlotte's Web

Both companies produce high-quality products, both were early innovators, both are primarily in Colorado. Charlotte's Web Holdings Inc. (CWEB:CSE: CWBHF:OTCQX) has a stronger presence with independent retailers, while Elixinol is strong with professionals (physical therapists and doctors) plus a large wholesale market. Indeed, many CBD "brands" are repackaging Elixinol's CBD oils, so that, while CWEB has about twice the headline sales, Elixinol's gross retail sales are significantly larger than shown.

The main difference: CWEB trades for over 5X the valuation. However, Elixinol has roughly about half the sales, half the cash. Elixinol has a vastly superior growth rate: Q3 Q/Q sales were up 27% while CWEB basically flat—less than 3%. Therefore, we propose a one-half weighting is justified.

Our target price for Elixinol is one-half of CWEB's current valuation—discounted 10%—or $5.76.

This represents a potential 130% increase, and assumes no further increase in overall CBD valuations. We—along with many others, including CNBC's Jim Cramer and Tim Seymour—remain strongly bullish on CBD for 2019.

Both companies are primary-listed in foreign markets, have strong daily volume in their respective U.S. OTC listings. CWEB however, was underwritten in Canada by a firm more famous for floating gold mining scams, while Elixinol was invited to Cowen's recent invitation-only cannabis conference.

https://c.stockcharts.com/c-sc/sc?s=CWEB.CA&p=D&b=5&g=0&i=t8765383747c&r=1549037622391

CWEB appears to have broken out of a triple top. Usually a bullish sign (charts source: Stockcharts)

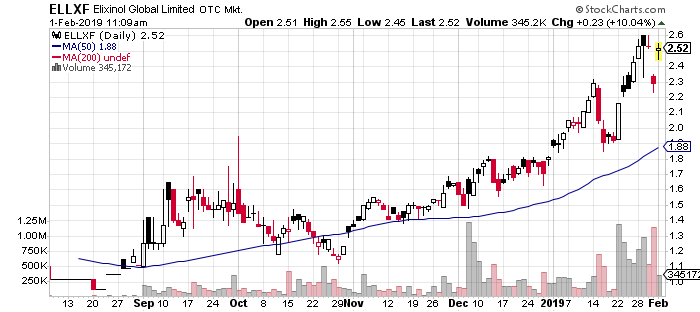

https://c.stockcharts.com/c-sc/sc?s=ELLXF&p=D&b=5&g=0&i=t7853970652c&r=1549037693152

Elixinol has appreciated nicely; still has catch-up opportunity. Dips being bought.

Elixinol was financed, and underwritten, in Australia, the U.S.'s most reliable, traditional ally. Its auditor is Deloitte. Over 80% of sales are in the U.S. Elixinol has begun a large-scale awareness campaign and is rapidly building up the U.S. team.

This offers Elixinol investors a "fresh" start—a new idea, one well-financed, and with established, growing sales. We believe dips can be bought—and that in 2019 Elixinol will become a better "known" hemp/CBD/cannabis participant.

Initial CBD stocking boom has matured

We believe most independent health retailers have pretty much already added CBD lines, and the great rush of stocking orders has subsided. We note CWEB's sales growth rate in Q3 slowed dramatically. Our industry contacts tell us CWEB began a month-long sale in January, discounting to retailers, for the first time. We doubt a company discounts if sales are "hot."

Therefore, we believe investors should have low expectations for CWEB's upcoming Q4 earnings. We will have further analysis after all earnings.

We believe, however, the CBD boom will continue, after any near-term lag—most likely toward the second half of 2019—as new, larger retailers, such as Whole Foods and the Vitamin Shoppe, and perhaps drugstore chains, etc., begin stocking product.

High quality, innovative products

In terms of growth, Elixinol has several cutting-edge products hitting the market, ahead of competitors. Elixinol has invested deeply, in time and effort, over several years, with product development, which we project will benefit sales in 2019.

Our contacts in health-related retailing are enthusiastic over Elixinol's new additions and believe they could have a "smash hit" product on their hands.

Elixinol vs. CV Sciences

Both Elixinol and CV Sciences Inc. (CVSI:OTCQB) have strong controls and solid relationships over their supply chain. Elixinol, led by founder Paul Benhaim, has carefully sourced hemp for over 20 years, with key relationships and quality farmers. Elixinol products are mostly organically grown, while CV Sciences (OTCBB:CVSI) buys its hemp supply as a non-organic commodity.

Like CWEB, CV Sciences' majority revenue source is independent retailers. Since we believe the initial stocking rush has completed, we suspect CVSI declining growth rate continues. Investor's with high quarterly expectations should be cautious.

We have several growing concerns:

Retailers we have spoken with have complained about CVSI sales department having challenges. It took weeks, and several requests, just to get brochures or product sent.

CV management continues to insist on promoting its bizarre "pet project"—a CBD-laced smoking cessation drug. That would be fine, only without a patent, which hasn't been forthcoming, the idea is essentially worthless. Management gave away a tremendous amount of shares, for the drug, so perhaps feel obligated to justify the gift.

CVSI management stubbornly continues to split the company into two parts, confusing investors, none of whom (that we know) has any interest beyond CBD sales, especially with no patent. Yet, CVSI still devotes nearly half its precious presentation time and space to it.

In addition, management has pretty much decided to ignore its large base of retail shareholders, those responsible for building up share price in the first place. We dislike companies who treat people and shareholders with contempt. Many new "rookie" CEO's make mistakes—when their shares go up 10X, the head swells. Trouble usually follows.

https://c.stockcharts.com/c-sc/sc?s=CVSI&p=D&b=5&g=0&i=t8478773840c&r=1549038316902

CVSI shares have been consolidating; volume declining.

In summary, our investigation found Elixinol to be more open, aggressive, with a far better balanced team, and a strong commitment to enhancing shareholder value.

We do agree CVSI is most likely to become first to "uplist" to a senior U.S. exchange (having already applied to NASDAQ) and expectations of a subsequent bounce appear valid. We continue to hold shares in anticipation.

We further argue there are strong odds all of these larger CBD companies doing well in 2019—we believe there will be numerous announcements—and growing excitement, as deals with mainstream partners, and retailers such as Whole Foods, pop. Other, mostly Canadian cannabis competitors, rushing into the bonanza, will take at least two years to develop any serious supply.

Important Disclosure: Fincom Investment Partners and related accounts have purchased, and continue to purchase, Elixinol shares in the open market. In addition, a Director of Fincom Investment Partners has been an executive and business owner in the nutrition industry for over 35 years, and developed numerous close working relationships in the industry. Fincom Investment Partners has started helping Elixinol, as a consultant. We have introduced distribution relationships, key management personnel and made other suggestions, based on our long and direct experience in the retail and wholesale nutrition industry. For this we are receiving a modest monthly consulting fee. We are not insiders and our investment opinion continues to remain our own.

Frederick Lacy, President of Fincom Investment Partners, began as a Chicago commodity broker in 1984. In 1987 he joined Bateman Eichler, Hill Richards in Los Angeles, focusing on small to mid-cap equities, ultimately "retiring" in 2000 as a Managing Director of Investment Banking. Mr. Lacy has been involved in numerous investments, from arranging start-up capital for what became Petrohawk, which sold for $15 Billion, to mobile payments in India. Several long-time clients were founding investors of Cheniere Energy. Mr Lacy's decades in California technology includes arranging an early $13 million VC financing for "permanent ledger" software (now commonly known as "blockchain") led by top-tier fund Upfront Ventures. Other investments include 3D holographic display technology, early mobile applications, power conversion, along with multiple consumer health-related products: Canadian Glacier bottled water, Kinetin skin cream, a proprietary oxidative-stress formula, and UV purification systems. In 1989 Mr. Lacy hosted "the Venture Capitalist" which aired on (now) CNBC, and has followed the natural foods industry for 35 years.

Fincom Investment Partners Disclaimer

This report is for informational purposes only and is not a solicitation of any security purchase or sale. We use a .72 conversion rate for Australia to USD and .75 for Canada. Opinions expressed herein by the author are not an investment recommendation and are not meant to be relied upon in investment decisions. The information upon which this material is based was obtained from sources believed to be reliable, but has not been independently verified. Therefore, Fincom Investment Partners cannot guarantee its accuracy. Do your own due diligence. Any opinions or estimates constitute our best judgment as of the date of publication, and are subject to change without notice. We recommend investors conduct thorough investment research of their own, including detailed review of the related Companies' filings, and consult a qualified investment adviser. Fincom Investment Partners and its officers and directors own shares in the securities mentioned in this report and may buy or sell shares at any time without prior notice. Fincom Investment Partners has a consulting relationship with Elixinol.

Want to read more about Cannabis? Sign up to receive the FREE Streetwise Reports' newsletter.

Elixinol Global Ltd. (ELLXF)

2.54 ? 0.0 (0.00%)

Volume: 0 @- ET

Bid Ask Day's Range

2.5 2.53 - - -

ELLXF Detailed Quote

Great article. I'm in all 3. This one is a sleeping giant tho. Very undervalued

This is a winner. Could be the second favorite to cweb.

Really nice read comparing essentially the big 3 CBD companies emerging at this point. Very happy with my position here

https://seekingalpha.com/amp/article/4237540-charlottes-web-vs-cv-sciences-vs-elixinol-saucy-intruder

Woooow 1 mill in volume

Someone asked for list of countries we sell to.

Here you go!!

American Samoa

Brazil

China

Colombia

France

Germany

Hong Kong, SAR China

India

Israel

Japan

Korea (South)

Lebanon

Nigeria

Puerto Rico

Romania

Russian Federation

Senegal

Slovenia

South Africa

Switzerland

Taiwan, Republic of China

United Kingdom

United States of America

Korea

Spain

Poland

Thailand

italy

Greece

Austria

Belize

Bahamas

Chad

Congo

Fiji

FInland

Great Britain

Iceland

Luxembourg

Norway

New Zealand

Lots of loading again today

Yes I do. The times are a changing. Global growth. Cweb rockin it. I believe we are and will be the favorite alternative to them for many reasons.

100K ELLXF traded already. Remember when 200k was average daily volume? Just a few weeks ago.

For the record, I don't know why TDA shows prices in advance of open on some stocks, even on ones that are only traded on the OTC.

TDA showing 2.45 before open. Discounts didn't last. Might pick up a few more.

Recommends rescheduling. Sorry getting ahead of myself.

World Health Organization Recommends Rescheduling Marijuana Under International Treaties via @forbes https://t.co/T0oZpogatm

— Focused Trades (@TradesFocused) February 1, 2019

Nice find. Gonna be a stellar 2019. Thinking we uplist in the US!

ELLXF at Asian Hemp Summit

Global industry leaders and key stakeholders will converge on Kathmandu this Friday and Saturday for the Asian Hemp Summit, including our very own Paul Benhaim! Check out the event program here https://t.co/OGMxSqQV20

— Elixinol Wellness Limited (@EXLWellness) January 29, 2019

ELLXF: ABC News reveals Elixinol Global was one of the best performing stocks to debut on the ASX Exchange in 2018.

2018 was a 'poor' year for newly-listed companies on the ASX

By business reporter David Chau

Updated Tue at 11:03pm

Investors watch the boards at the Australian Securities Exchange in Sydney.

Photo: The market volatility in 2018 led to a sharp fall in value for newly listed companies. (Tracey Nearmy, file photo: AAP)

Most companies which listed on the Australian share market in 2018 "performed poorly", and the outlook for this year is looking rather downbeat.

Half of the 93 businesses which floated last year lost, on average, 18 per cent of their value — with a quarter suffering losses of 50 per cent or more.

Those were the key findings of an "IPO Watch Australia" report, released today by accounting and advisory firm HLB Mann Judd.

2018 was a year of extreme volatility, particularly in the final quarter, as Asian markets, Wall Street (briefly) and oil prices fell into a bear market, plummeting 20 per cent from their peak prices.

This coincided with the United States and China escalating their trade war, the Federal Reserve raising US interest rates, and a surge in value for the US greenback.

Only 20 out of the 93 companies which listed on the ASX in 2018 ended the year on a stronger note.

US-China trade war explained

It is upping the ante in a high stakes game, but what are the implications of President Trump targeting hi-tech Chinese imports?

"This is a worse performance than other market indicators, with the ASX 200 recording a decrease of 7 per cent for the calendar year," said HLM partner Marcus Ohm.

He also said there is likely to be a fall in the number of initial public offerings (IPOs) in the next half-year.

"Unsurprisingly only 17 companies had applied to list on the ASX at the end of 2018, well down on the 37 that had applied at the same time in the previous year," he said.

"The companies that have applied are hoping to raise $179 million, which is a 70 per cent reduction on the $603 million sought at the end of 2017."

Mr Ohm also said that more than a quarter of companies attempting to list publicly last year failed in their attempts because they were unable to raise enough capital.

"Only 72 per cent of all new listings were able to meet their target," he said.

He explained this was "down on both the 2017 and 2016 years, which saw 79 per cent and 83 per cent of targets met respectively."

Embed: ASX200 vs other key markets in 2018

Best and worst performers

Of the "large cap" stocks which debuted on the local share market, hemp oil producer Elixinol Global was the best performer, according to HLM.

Elixinol's stock jumped 150 per cent to finish the year at $2.50 per share, since it debuted on the ASX in early-2018.

Mr Ohm said only three large cap stocks ended the year higher, with the other two only posting gains of 7 per cent or lower.

HLM's report said the three largest IPOs last year were Viva Energy (an oil company), Coronado Global Resources (a coal producer) and L1 Long Short Fund (an investment firm).

Collectively, they raised $4.75 billion between them, and accounted for 64 per cent of the total funds raised from IPOs last year.

The best-performing newly-listed companies were in the consumer durables and apparel segment, as their share prices soared 96 per cent since their debuts.

2018's $120b ASX wipeout

Investors ended last year with the distinct feeling they should have left the party earlier, after seeing the ASX 200 share index lose 7 per cent of its value.

The next-best-performing segments were household and personal products (+87pc) and pharmaceuticals, biotechnology and life sciences (+54pc).

On the flipside, the worst performers among the stocks which floated last year were telecommunications (-60pc), consumer services (-42pc), technology, hardware and equipment (-35pc) and diversified financials (-32pc).

Materials was the sector which had the most listings (35), and represented 38 per cent of all IPOs.

However, newly listed materials companies underperformed as they finished the year, on average, 26 per cent lower than the price at which they were initially listed.

More than half the listings in that sector were gold projects (60pc). There were also a significant number of copper (23pc) and cobalt (14pc) listings.

The number of large-cap company listings (over $100 million market cap) continued to fall in 2018, and was down from 39 in 2014 to 21 in 2018.

Wow your right. We might not be able to get as much of a discount as I thought we would. Oh well.. Let's go higher!

Looking good in the asx! Let's rebound!

Cool. Ty

LOL, had me scratching me head

Not sure clean life. I don't follow that.

He's using Clean Life to dummmmmmpa dumppppa dump shares.....

BeachBum ? Wednesday, 01/23/19 04:36:06 PMRe: JamesP2 post# 9397?0Post # of 9645

No personal shares? That’s a non answer. This guy needs a lesson in being straight with shareholders. He owns the company FTEG signed a letter of intent with. Did he forget to mention HE IS Clean Life? Negotiating with himself on our behalf? Unreal

https://www.otcmarkets.com/stock/FTEG/news/story?e&id=1244281 ; ;

https://gust.com/companies/clean-life-corporation ; ;

Advertise Here

440 more at 2.245

Looks like MMs desperately are trying to close that gap.

NO new shares issued I might add

$37m for the year, forecast over $50 next year - $40m in cash to continue growing.

All looks good here. Safe place for my $$ to grow especially in this economy.

I think people are looking for a walkoff homerun in the world series final every quarter.....4 base hits will also win the game.

HIGHLIGHTS:

-Revenue of $11.9m1 for Q4 FY2018, representing 116% growth on prior corresponding period (PCP) and 14% growth vs Q3 FY2018

-Full year FY2018 revenue growth of 121% vs FY2017 (December year end) 2018 Farm Bill signed by US President with US CBD market size forecast to grow from US$174m (2016) to reach US$22bn by 20222

-International growth strategy commenced in Europe and New Zealand

-Continued focus on US growth initiatives with broader community awareness and increased marketing investment for FY2019 to drive top line revenue growth

ELLXF: Profitable pot stock Elixinol is getting excited about US growth opportunities

https://stockhead.com.au/health/profitable-pot-stock-elixinol-is-getting-excited-about-us-growth-opportunities/

Sam Jacobs

Elixinol Global continues to make money at a rate of knots but today investors finally said nope, that isn’t enough for us anymore.

Quarterly revenue rose 14 per cent to $11.9 million while full-year revenue rose to $37.2m — an annual growth rate of 121 per cent.

They are still burning cash though — $2.6m in the December quarter — and shareholders sold off, sending the share price down almost 8 per cent to $3.13.

At that price the company’s stock is still up more than 100 per cent since August.

Elixinol’s international arms sell a range of products derived from hemp, including skin care products and hemp-based food items.

It’s also chasing the relevant licences in Australia to gain entry to the nascent market for medicinal cannabis.

The American dream

Australia legalised hemp in November 2017 but bugs in the industry, such as farmers needing to learn how to best grow the plant, means most of Elixinol’s sales come from the established US business still.

The company is particularly excited about the US Farm Bill, which was signed into law by the Trump administration in December.

One effect of the Farm Bill is that hemp-derived cannabidiol (CBD) is no longer considered a controlled substance, which frees up sellers of hemp products to engage in more traditional commercial activities such as advertising.

“As an example, Elixinol secured advertising space in New York City’s iconic Times Square for the recent New Year’s Eve celebrations,” the company said.

It cited industry research which forecasts the size of the US hemp industry to increase to $22 billion by 2022, up from a forecast of $2 billion pre-Farm Bill.

And as evidence of its US focus, Elixinol announced earlier this month that chief financial officer Ron Duffey will be relocating to the company’s US headquarters in Colorado.

Armed with $40 million in cash following its September 2018 capital raising, Elixinol now wants to beef up its US distribution channels and expand its product range.

Elixinol was the first Aussie pot stock to turn a profit, thanks to that hemp focus.

It has renamed its Australian medicinal cannabis company to Nunyara Pharma Pty Ltd, to differentiate it from the more profitable hemp division.

Medicinal cannabis still growing at a snails pace

Business is moving a little slower for fellow listed pot stock Auscann (ASX:AC8), as it pivots towards the manufacture of pharmaceutical cannabis products.

The company has just spent $5m on a new R&D facility in Perth, and has partnered with US-based PCI Pharma to produce Auscann’s proprietary hard-shell cannabis capsules. (PCI Pharma’s Australian subsidiary is licensed by the Therapeutic Goods Administration).

Auscann’s plan is to produce the capsules “for treatment of chronic pain” and submit them for clinical trials later this year.

The company has plenty of cash — around $40 million — but no income, and its quarterly report this morning showed operating outflows of $1.102m.

A short time ago, Auscann shares were up by almost 1 per cent at 65 cents — well off their 12-month high of $1.77.

Down 41 cents. Great I’ll buy more. Thanks

Yes it should be.

Nice buying opportunity for Thursday and Friday. All those who missed out on the run up will get a nice (possibly last) chance to get in. I'll be adding

Also, they stated that Colorado first harvest yields were below expectations.

I think the market was expecting a bit higher revenue. The language about the Australian medical cannabis division taking longer might be seen as not so good. The company is spending to accelerate exposure and increase supply. All in all, I believe we get back to business as usual (climbing higher) by next week.

Yes, I see that. Financials don't warrant a fall,IMO, but we'll see.

Down on asx. Hopefully we consolidate for next level

|

Followers

|

26

|

Posters

|

|

|

Posts (Today)

|

0

|

Posts (Total)

|

1174

|

|

Created

|

09/18/18

|

Type

|

Free

|

| Moderators | |||

50 Pitt Street,

Level 6

Sydney, NSW 2000

Australia

| Volume | |

| Day Range: | |

| Bid Price | |

| Ask Price | |

| Last Trade Time: |