Register for free to join our community of investors and share your ideas. You will also get access to streaming quotes, interactive charts, trades, portfolio, live options flow and more tools.

Cigna Says New York, California OK Express Scripts Deal (12/13/18)

On December 13, 2018, the State of New York determined that a previously noticed hearing in that State was not required and issued its approval of the transaction. Also on December 13, 2018, the State of California issued its approval of the transaction. We continue to work with regulators in New Jersey, the one outstanding state where approval is required, and continue to expect that the transaction will close by the end of 2018, subject to the satisfaction of all closing conditions.

ESRX MONTHLY 5 YEARS

http://schrts.co/T3a7Lv

This company has variable medical cost so they make money on each sale.

The Express Scripts/Cigna deal is in the final stages.

ESRX shareholders will receive $48.75 in cash and .2424 shares of CI per share.

Cigna and Express Scripts have extended the Termination Date from 12/06/18 to 6/08/19.

Both firms continue to anticipate that the transactions contemplated by the Merger Agreement will close in 2018, subject to the satisfaction of all closing conditions.

https://www.sec.gov/Archives/edgar/data/701221/000095015918000517/cigna8k.htm

Five Biggest PBMs

The five biggest PBMs operating in the United States are very large, covering more than 50 percent of patients with pharmacy benefits. The following are the five largest PBMs in the country, in terms of funding and growth:

ExpressScripts: ExpressScripts provides novel solutions for navigating pharmacy costs and improving patient care. Since ExpressScripts is not owned by or linked to any pharmaceutical company, their focus is entirely on its customers. Its focus on pharmacy benefits results in better patient care.

CVS Caremark: CVS Caremark is a growing PBM, providing comprehensive drug benefit services to over 2,000 healthcare plan sponsors and participants throughout the United States.

Argus: Argus is one of the last independent providers of healthcare information and services supporting Medicaid and Medicare Part D, serving some of the country's most vulnerable populations. They have a wide range of clients, from managed care organizations to pharmaceutical manufacturers.

Envision: Envision prides itself on its transparency to the public and its full disclosure on costs, agreements, and negotiations. Recently, Envision was acquired by Walgreens, so some change is expected moving forward.

ProCare RX: ProCare RX ( private company )is national pharmacy benefit manager with decades of experience in healthcare information technology.

Me too. Financials are solid and stocks don't trade at a value based on what might happen 3yrs from now. They have a growing client base and just beat earnings estimates. Wait for the opening dip IMO because as always more people will get freaked out at open.

This fun time for my own straddle form.

Along with a nice opportunity to cover the shorts. I hope it stays down for a few minutes after market open tomorrow.

Wow what a panic attack in AH could be mega bouncer tomorrow $56.61

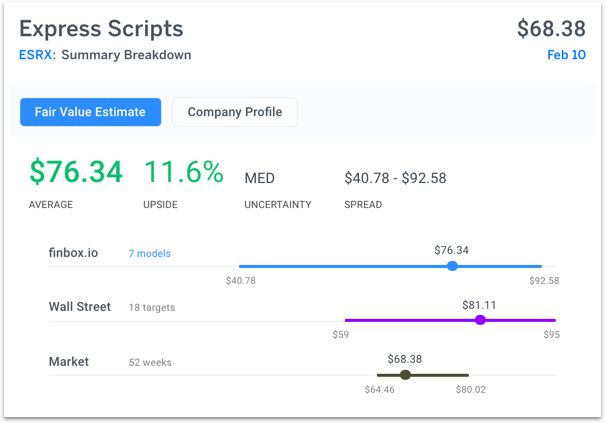

Seven Express Scripts cash flow analyses imply that the company is approximately 12% undervalued prior to reporting earnings (expected Tuesday). This compares to Wall Street's price target of $81.11 which implies over 20% upside:

Six Healthcare Stocks with Nice Upside Potential

Hey all, the largest Pharmacy Benefit Manager in the USA has dropped.. I think its looking good..

http://stockchimp.blogspot.sg/2014/05/express-scripts-holdings-looks-good-for.html

The end of the year is coming and more policy holders are loosing coverage and hence we may see a sales decline.

Part of Express Scripts patient base is tied up with the PCIP program of Obamacare. This program terminates at the end of 2013 and some of those patients may end up elsewhere. Hence there is a shift which may occur. How this affects the gross sales or net income is unknown.

Annual-William-Blair Stock-Conference

Interesting comments

read here

ESRX must be careful that it does not become so big that it fails under its own weight and the erosion caused by Obamacare.

So the Liberty Medical financial collapse may still affect Tenant because of the merger of Medco.

ESRX was published today on the market watcher group as on of the best stocks to own in 2013.

With the price now slipping, perhaps reality is setting in. At current performance, the price should be more like 25.

The PPS during the last off market hours gives rise to the observation that the high point of stock value, for the time being, has been reached.

ESRX continues raising in price per share. While this is good for shareholders like me who own the stock during this time of price growth, the concerns remains that that growth is bigger than justified by the fundamental background data.

After deliberating on the previous posts and evaluating the company's PPS performance after the news and insider buys I believe it looks like this stock is due a market value correction downward. The next earnings report, based upon the company outlook, should reflect results of quarterly operations below the amount justifying current PPS.

PCIP may be only a few hundred thousand participants, but that is enough to affect the results of operations and thus affect the PPS.

By recollection, PCIP only covered around 350K people and was slated to be scrapped in 2014 as the ACA takes root. I fail to see how this blip would have any meaningful impact on ESRX numbers.

The insider trade data is interesting and rather condemning. Thanks for sharing it.

Stunning only when looking under the table. ESRX has been very quiet about their 100% lock on the USG PCIP market. This was acquired through the purchase of Medco. Letters went out last week to PCIP participants advising that they must use ESRX mail order or lose their discounts. Did not find any reference to this development on public news.

The low forcast of a red quarter ahead counters the PCIP business they don't talk about and their actual improved earnings. Why then the depressing new release?

12/5/12

Dir Benanav acquires 35,708 shares

12/3/12

Dir MacMahon acquires 18,740 shares

COO McNamee acquires 101,004 shares

It appears the insiders kept the PPS low for their acquisitions. I expect ESRX will now move back up to the mid 60s or above where they belong. IMO a good option or stock play to the upside. They disclosed everything publically far enough ahead to avert suspicion and got a very good price. The bad projections will just fade away and by next earnings they will be in the surprise category. Any by the way they are increasing costs for medications to the federal government, in some cases doubling the cost by forcing the use of the higher mail order cost than what the drugs can be purchased for at the local pharmacy. Your tax dollars at work employing bureaucrats and rewarding the drug companies!

Flatcat

Stunning impact of negative 2013 guidance. Very odd timing with election results still pending.

What a dumb move. Insty's will revolt with S/P down over $10.

This company needs some new IR blood. This debacle was unnecessary and will set S/P growth back for at least a year as big players remain gunshy from further self-inflicted wounds.

JMO.

Technical Analysis Express Scripts $ESRX Short target 50.92 (fib 38.2%) http://bit.ly/LJrRwr

Express Scripts Reports Fourth Quarter Results

http://ih.advfn.com/p.php?pid=nmona&article=51310576&symbol=ESRX

~ Wednesday! $ESRX ~ Earnings posted, pending or coming soon! In Charts and Links Below!

~ $ESRX ~ Earnings expected on Wednesday *

Want more like this? Search Keyword: MACMONEY >>> http://tinyurl.com/MACMONEY <<<

One or more of many earnings sites has alerted this security has or will be posting earnings on or around the day of this message.

http://stockcharts.com/h-sc/ui?s=ESRX&p=D&b=3&g=0&id=p88783918276&a=237480049

http://stockcharts.com/h-sc/ui?s=ESRX&p=W&b=3&g=0&id=p54550695994

~ Google Finance: http://www.google.com/finance?q=ESRX

~ Google Finance: http://www.google.com/finance?q=ESRX

~ Google Fin Options: hhttp://www.google.com/finance/option_chain?q=ESRX#

~ Google Fin Options: hhttp://www.google.com/finance/option_chain?q=ESRX#

~ Yahoo! Finance ~ Stats: http://finance.yahoo.com/q/ks?s=ESRX+Key+Statistics

~ Yahoo! Finance ~ Stats: http://finance.yahoo.com/q/ks?s=ESRX+Key+Statistics

~ Yahoo! Finance ~ Profile: http://finance.yahoo.com/q/pr?s=ESRX

~ Yahoo! Finance ~ Profile: http://finance.yahoo.com/q/pr?s=ESRX

Finviz: http://finviz.com/quote.ashx?t=ESRX

Finviz: http://finviz.com/quote.ashx?t=ESRX

~ BusyStock: http://busystock.com/i.php?s=ESRX&v=2

~ BusyStock: http://busystock.com/i.php?s=ESRX&v=2

<<<<<< http://www.earningswhispers.com/stocks.asp?symbol=ESRX >>>>>>

http://investorshub.advfn.com/boards/post_prvt.aspx?user=251916

*If the earnings date is in error please ignore error. I do my best.

~ Monday! $ESRX ~ Earnings posted, pending or coming soon! In Charts and Links Below!

~ $ESRX ~ Earnings expected on Monday *

Want more like this? Search Keyword: MACMONEY >>> http://tinyurl.com/MACMONEY <<<

One or more of many earnings sites has alerted this security has or will be posting earnings on or around the day of this message.

http://stockcharts.com/h-sc/ui?s=ESRX&p=D&b=3&g=0&id=p88783918276&a=237480049

http://stockcharts.com/h-sc/ui?s=ESRX&p=W&b=3&g=0&id=p54550695994

~ Google Finance: http://www.google.com/finance?q=ESRX

~ Google Finance: http://www.google.com/finance?q=ESRX

~ Google Fin Options: hhttp://www.google.com/finance/option_chain?q=ESRX#

~ Google Fin Options: hhttp://www.google.com/finance/option_chain?q=ESRX#

~ Yahoo! Finance ~ Stats: http://finance.yahoo.com/q/ks?s=ESRX+Key+Statistics

~ Yahoo! Finance ~ Stats: http://finance.yahoo.com/q/ks?s=ESRX+Key+Statistics

~ Yahoo! Finance ~ Profile: http://finance.yahoo.com/q/pr?s=ESRX

~ Yahoo! Finance ~ Profile: http://finance.yahoo.com/q/pr?s=ESRX

Finviz: http://finviz.com/quote.ashx?t=ESRX

Finviz: http://finviz.com/quote.ashx?t=ESRX

~ BusyStock: http://busystock.com/i.php?s=ESRX&v=2

~ BusyStock: http://busystock.com/i.php?s=ESRX&v=2

<<<<<< http://www.earningswhispers.com/stocks.asp?symbol=ESRX >>>>>>

http://investorshub.advfn.com/boards/post_prvt.aspx?user=251916

*If the earnings date is in error please ignore error. I do my best.

ESRX gained 1.31% on 03/23/11 and a total percentage of 2.79% in the past 2 days

ESRX is trading in the range of $50.91 - $58.68 in the past 30 days.

Commodity Channel Index (CCI) is bullish for ESRX.

Money Flow Index (MFI) is bullish and moving up for ESRX.

ESRX formed a bullish 5-day simple moving average and 10-day simple moving average crossover.

The 10-day simple moving average is bearish and moving down for ESRX.

Average volume decrease over 5% for ESRX.

Stock performance base on day of week in the past 90 days.

Monday: 2.79%

Tuesday: -1.58%

Wednesday: -1.99%

Thursday: 3.06%

Friday: -3.14%

Express $ESRX Zacks Analyst Blog Highlights: @Zacks did you say $ESRX is on your @Demandmedia Rx @Legitscripts List?

http://bit.ly/EQUITIESRxVIPPSINDEX

http://bit.ly/EQUITIESDAMAN

http://bit.ly/EQUITIES

Date : 01/27/2011 @ 10:08AM

Source : PR Newswire

Stock : Express Scripts (MM) (ESRX)

Quote : 57.83 0.2 (0.35%) @ 7:22AM

Zacks Analyst Blog Highlights: WellPoint, Express Scripts, Unitedhealth Group, CIGNA Corporation and Aetna

Express Scripts (MM) (NASDAQ:ESRX)

Intraday Stock Chart

Today : Thursday 27 January 2011

Zacks.com Analyst Blog features: WellPoint Inc. (NYSE: WLP), Express Scripts (Nasdaq: ESRX), Unitedhealth Group, Inc. (NYSE: UNH), CIGNA Corporation (NYSE: CI) and Aetna Inc. (NYSE: AET).

(Logo: http://photos.prnewswire.com/prnh/20101027/ZIRLOGO)

Get the most recent insight from Zacks Equity Research with the free Profit from the Pros newsletter: http://at.zacks.com/?id=4579

Here are highlights from Wednesday's Analyst Blog:

WellPoint Exceeds Expectations

WellPoint Inc. (NYSE: WLP) reported its fourth-quarter income from continuing operations of $524.7 million or $1.33 per share, surpassing the Zacks Consensus Estimate of $1.21. This also compares favorably with the income of $536.0 million or earnings of $1.16 in the year-ago quarter.

WellPoint also posted its income from continuing operations of $2.8 billion or $6.74 per share for fiscal year 2010, surpassing the Zacks Consensus Estimate of $6.60 and the income of $2.9 billion or $6.09 in the fiscal year 2009. The company's earnings were in-line with the management's guidance of above $6.60 earnings per share for the fiscal year 2010.

The improved showing was attributable to higher operating cash flows and the implementation of organizational changes in the health care. The sale of NextRx pharmacy benefit management subsidiaries to Express Scripts (Nasdaq: ESRX) in the fourth quarter of 2009 also contributed a significant return of capital.

WellPoint's income from continuing operations excludes net investment gains of $24.1 million after-tax, or approximately 7 cents per share in the fourth quarter of 2010, and $100.2 million after-tax, or approximately 23 cents per share in fiscal 2010, which was partially offset by an intangible asset impairment charge of $13.7 million after-tax, or 3 cents per share.

The earnings of the fourth quarter of 2009 excluded the after-tax net income of $2.2 billion, or $4.79 per share, resulting from a gain on the sale of the NextRx, partially offset by costs for restructuring activities and intangible asset impairments.

Fiscal year 2009 excluded after-tax net income of approximately $1.8 billion, or $3.79 per share, resulting from the gain on the sale of NextRx, partially offset by net investment losses, intangible asset impairments and costs for restructuring activities.

Including these one-time items, WellPoint reported a net income of $548.8 million or $1.40 per share in the fourth quarter 2010 as opposed to $2.7 billion or $5.95 per share in the prior-year quarter. Net income in 2010 was $2.9 billion or $6.94 per share as against $4.7 billion or $9.88 per share.

Segment Results

Commercial Business: Operating gains in the segment increased 89.6% year over year to $600.7 million in the fourth quarter of 2010 and 27.0% year over year to $3.1 billion in fiscal 2010.

Consumer Business: Operating gains in the segment plummeted 29.5% year over year to $112.0 million in the reported quarter and declined 21.8% year over year to $1.0 billion in fiscal 2010.

Other: Operating gains in this segment experienced an operating loss of $19.6 million in the fourth quarter of 2010, compared with an operating gain of $100.8 million in the fourth quarter of 2009. This was due primarily to the fact that fourth quarter 2009 results included two months of NextRx operations prior to its sale on December 1, 2009.

WellPoint's Others segment also faced an operating loss of $8.8 million in full year 2010 as compared with an operating gain of $469.4 million in full year 2009.

Evaluation of Capital Structure

WellPoint generated operating cash flow of $587.0 million in the fourth quarter of 2010 and $1.4 billion in the fiscal year 2010, which included $1.2 billion of tax payments related to the 2009 sale of NextRx. At the end of December 31, 2010, cash and investments at the parent company totaled approximately $3.3 billion.

As of December 31, 2010, WellPoint had $148.5 million remaining under its share repurchase authorization. During the reported quarter, WellPoint repurchased 17.8 million shares for $1.0 billion and repurchased 76.7 million shares of its stock for approximately $4.4 billion in fiscal 2010, following the sale of NextRx.

During the fourth quarter of 2010, WellPoint witnessed net investment gains of $37.2 million pre-tax, consisting of net realized gains from the sale of securities totaling $47.6 million, partially offset by other-than-temporary impairments totaling $10.4 million.

In the prior year quarter, WellPoint experienced net investment losses of $4.5 million pre-tax, consisting of other-than-temporary impairments of $40.5 million, primarily offset by net realized gains from the sale of securities totaling $36.0 million.

Comparison with Competitors

Rival company Unitedhealth Group, Inc. (NYSE: UNH) reported its fourth quarter results on January 20, 2011 with income from continuing operations of 94 cents per share, better than the Zacks Consensus Estimate of 90 cents. Full year EPS was $4.10, which also surpassed the Zacks Consensus Estimate of $3.99. WellPoint's peers like CIGNA Corporation (NYSE: CI) is scheduled to report its fourth quarter and fiscal year 2010 results on February 3, followed by Aetna Inc. (NYSE: AET) on February 4.

Outlook for Fiscal 2011

WellPoint anticipates a net income of at least $6.30 per share.

Our Recommendation

Though we are pleased with the strong results of WellPoint along with solid capital management, we remain wary of the impact of the health insurance reforms and expect these reforms to increase unemployment and stretch profit margins of WellPoint and its competitors. The resulting downward pressure is likely to overshadow the stock.

WellPoint has a strong cash flow generation, leading market share positions, diversified product portfolio, proven track record of execution, attractive valuation, and consistency that would provide long-term value to its investors. Meanwhile, WellPoint has been increasing its premiums and controlling costs.

Further, WellPoint is well positioned among its peer group and has been strengthening its portfolio through its acquisition strategy, the synergies of which are expected to lead to margin expansion and top-line growth. Moreover, the sale of its in-house pharmacy benefits business to Express Script has strengthened its balance sheet and fueled a major stock repurchase.

Currently, WellPoint carries a Zacks #3 Rank, which translates into a short-term Hold recommendation, indicating no clear directional pressure on the stock over the near term.

Want more from Zacks Equity Research? Subscribe to the free Profit from the Pros newsletter: http://at.zacks.com/?id=5514.

About Zacks Equity Research

Zacks Equity Research provides the best of quantitative and qualitative analysis to help investors know what stocks to buy and which to sell for the long-term.

Continuous coverage is provided for a universe of 1,150 publicly traded stocks. Our analysts are organized by industry which gives them keen insights to developments that affect company profits and stock performance. Recommendations and target prices are six-month time horizons.

Zacks "Profit from the Pros" e-mail newsletter provides highlights of the latest analysis from Zacks Equity Research. Subscribe to this free newsletter today: http://at.zacks.com/?id=5516

About Zacks

Zacks.com is a property of Zacks Investment Research, Inc., which was formed in 1978 by Leonard Zacks. As a PhD in mathematics Len knew he could find patterns in stock market data that would lead to superior investment results. Amongst his many accomplishments was the formation of his proprietary stock picking system; the Zacks Rank, which continues to outperform the market by nearly a 3 to 1 margin. The best way to unlock the profitable stock recommendations and market insights of Zacks Investment Research is through our free daily email newsletter; Profit from the Pros. In short, it's your steady flow of Profitable ideas GUARANTEED to be worth your time! Register for your free subscription to Profit from the Pros at http://at.zacks.com/?id=4580.

Visit http://www.zacks.com/performance for information about the performance numbers displayed in this press release.

Follow us on Twitter: http://twitter.com/ZacksResearch

Join us on Facebook: http://www.facebook.com/home.php#/pages/Zacks-Investment-Research/57553657748?ref=ts

Disclaimer: Past performance does not guarantee future results. Investors should always research companies and securities before making any investments. Nothing herein should be construed as an offer or solicitation to buy or sell any security.

Contact:

Mark Vickery

Web Content Editor

312-265-9380

Visit: www.zacks.com

SOURCE Zacks Investment Research, Inc.

Critical Alerts for ConocoPhillips, ARM Holdings, Express Scripts, Chipotle, and Goldcorp Released by Seven Summits Research

Date : 01/14/2011 @ 9:31AM

Source : PR Newswire

Stock : Express Scripts (MM) (ESRX)

Quote : 57.59 -0.04 (-0.07%) @ 6:06PM

Critical Alerts for ConocoPhillips, ARM Holdings, Express Scripts, Chipotle, and Goldcorp Released by Seven Summits Research

Express Scripts (MM) (NASDAQ:ESRX)

Historical Stock Chart

1 Month : December 2010 to January 2011

Click Here for more Express Scripts (MM) Charts.

Seven Summits Research issues critical PriceWatch Alerts for COP, ARMH, ESRX, CMG, and GG.

To see what our analysts have discovered about these stocks read the Seven Summits Strategic Investments' PriceWatch Alerts at http://www.iotogo.com/s/011411B (Note: You may have to copy this link into your browser then press the [ENTER] key.)

Today's PriceWatch Alerts cover the following stocks: ConocoPhillips (NYSE: COP), ARM Holdings plc (Nasdaq: ARMH), Express Scripts Inc. (Nasdaq: ESRX), Chipotle Mexican Grill, Inc. (NYSE: CMG), and Goldcorp Inc. (NYSE: GG).

In today's unsure markets these brief PriceWatch Alerts contain concise detailed strategies for each covered stock and include position protection tactics designed to potentially defend investors from unexpected market shifts. While other market reports only provide stock news and opinion, we offer strategies that position investments against uncertainty and increase chances of making a profit, even if a stock goes down.

"Our PriceWatch Alerts go beyond other market reports. Along with a brief concise overview, each PriceWatch Alert provides useful strategies, which ensure potential investments are protected with basic hedging techniques," says Reid Stratton, Seven Summits Senior Analyst. "These brief company reports contain information that can benefit expert and novice investors who want to stay ahead of the market."

For essential information on stocks poised to move go to: http://www.iotogo.com/s/011411B for Seven Summits Strategic Investments' PriceWatch Alerts.

Seven Summits Investment Research is an independent investment research group, which focuses on the U.S. equities and options markets. Our analytical tools, screening techniques, rigorous research methods and committed staff provide solid information to help our clients make the best possible investment decisions. For more information go to www.SevenSummitsInvestmentResearch.com . CRD# 137114

All stocks and options shown are examples only -- not recommendations to buy or sell. Our picks do not represent a positive or negative outlook on any security. Potential returns do not take into account your trade size, brokerage commissions or taxes -- expenses that will affect actual investment returns. Stocks and options involve risk, thus they are not suitable for all investors. Prior to buying or selling options, a person should request a copy of Characteristics and Risks of Standardized Options available from Catherine at 800-698-9101 or at http://www.cboe.com/Resources/Intro.aspx . Privacy policy available upon request.

SOURCE Seven Summits Investment Research

ESRX Express Scripts to Present at the J.P. Morgan Healthcare Conference

Express Scripts (MM) (NASDAQ:ESRX)

Historical Stock Chart

1 Month : December 2010 to January 2011

Click Here for more Express Scripts (MM) Charts.

Express Scripts, Inc. (Nasdaq: ESRX) announced that it will present at the 29th Annual J.P. Morgan Healthcare Conference on January 10, 2011 at 8:30 a.m. PST (11:30 a.m. EST) at the Westin St. Francis in San Francisco, CA.

The presentation will also be broadcast via the Internet and can be accessed on the investor relations section of Express Scripts web site at http://www.express-scripts.com. RealPlayer or Windows Media Player is needed to listen to the Webcasts and free downloads of these players are available at the Webcast site. The Webcasts will be archived and available for replay for 14 days.

Express Scripts, Inc., one of the largest pharmacy benefit management companies in North America, is leading the way toward creating better health and value for patients through Consumerology®, the advanced application of the behavioral sciences to healthcare. This approach is helping millions of members realize greater healthcare outcomes and lowering cost by assisting in influencing their behavior. Headquartered in St. Louis, Express Scripts provides integrated PBM services including network-pharmacy claims processing, home delivery services, specialty benefit management, benefit-design consultation, drug-utilization review, formulary management, and medical and drug data analysis services. The company also distributes a full range of biopharmaceutical products and provides extensive cost-management and patient-care services. More information can be found at http://www.express-scripts.com/ and http://www.consumerology.com/

SOURCE Express Scripts, Inc.

Verified Internet Pharmacy Practice Site (VIPPS) WellPoint NextRx Acquired by ESRX Express-Scripts, Inc

A Program of the National Association of Boards of Pharmacy

WellPoint NextRx

www.wellpointnextrx.com

Corporation

Express-Scripts, Inc

Phone

314-996-0900

Address

One Express Way

St. Louis, MO 63121

Jeffrey Hall President

State of Incorporation OH

Experience Operating a Pharmacy Since 1991

Dispensing Pharmacies

Pharmacy Name Address

NextRx, Inc 5450 N Riverside Drive

Ft Worth, TX 76137 Click for Details

NextRx, Inc 8990 Duke Boulevard

Mason, OH 45040 Click for Details

To report medication / device problems:

Click www.wellpointnextrx.com or call 866-629-1614

To report business compliance problems:

Click www.wellpointnextrx.com or call 866-629-1614

Original VIPPS Accreditation Date Expiration Date

September 10, 2002 September 10, 2011

|

Followers

|

4

|

Posters

|

|

|

Posts (Today)

|

0

|

Posts (Total)

|

51

|

|

Created

|

01/16/11

|

Type

|

Free

|

| Moderators | |||

Express Scripts is one of the three largest pharmacy benefit managers in the United States. Through its mail-order pharmacy and network of retail pharmacies, we expect Express Scripts to administer around 750 million adjusted prescriptions in 2010.

Address One Express Way,Saint Louis,MO,63121

Telephone +1 314 996-0900

Facsimile +1 314 770-2378

Email investor.relations@express-scripts.com

Site http://www.express-scripts.com

Market Cap 30.3Bil

Net Income 1.1Bil

Sales: 41.9Bil

Sector: Healthcare Services

Industry: Health Care Plans

George Paz

Chairman of the Board

President and Chief Executive Officer,

Express Scripts

Calendar of Events

Learn about upcoming investor-related events.

E-Mail Alerts

Get notified by e-mail whenever new investor information is posted.

Financial Information

Read annual reports, view SEC filings and learn how to request more information.

Governance

Meet the Express Scripts Board of Directors and review corporate governance documents.

Investor Overview

Learn more about Express Scripts and find corporate and shareholder information.

Presentations

Access print and audio versions of recent presentations.

Press Releases

View new and archived press and earnings releases.

Stock Information

Review stock charts, earnings estimates, fundamentals and more.

Express Scripts, one of the nation's largest pharmacy benefit managers, recently acquired NextRx.

https://www.wellpointnextrx.com/wps/portal/wpo/home

Verified Internet Pharmacy Practice Site (VIPPS)

A Program of the National Association of Boards of Pharmacy

WellPoint NextRx

www.wellpointnextrx.com

| Corporation Express-Scripts, Inc | Phone 314-996-0900 |

| Address One Express Way St. Louis, MO 63121 | Jeffrey Hall President |

| State of Incorporation OH | Experience Operating a Pharmacy Since 1991 |

| Dispensing Pharmacies | ||

| Pharmacy Name | Address | |

| NextRx, Inc | 5450 N Riverside Drive Ft Worth, TX 76137 | |

| NextRx, Inc | 8990 Duke Boulevard Mason, OH 45040 | |

| To report medication / device problems: |

| Click www.wellpointnextrx.com or call 866-629-1614 |

| To report business compliance problems: |

| Click www.wellpointnextrx.com or call 866-629-1614 |

| Original VIPPS Accreditation Date | Expiration Date |

| September 10, 2002 | September 10, 2011 |

Source: The EQUITIES Group

| Volume | |

| Day Range: | |

| Bid Price | |

| Ask Price | |

| Last Trade Time: |