Register for free to join our community of investors and share your ideas. You will also get access to streaming quotes, interactive charts, trades, portfolio, live options flow and more tools.

Anyone know if there is a short, inverse ETF to USO? In other words FXP is to FXI what _____ is to USO. SAT analogies there for you! lol

Anybody know of any good INDIA stocks???

Something that doesn't suck balls?

Wondering which fund would be the best few to hold for long term. I don't want any that can potential suck balls... lol

Would like to get back in china once that big correction comes.

List of ETFs

JUST WATCHING right now for a good entry.

I think some of these may have bottomed out already so we just need confirmation.

KF korea fund

EWJ japan

EZA south africa

IFN india

EWM malaysia

EWZ brazil

ILF latin america

EWW mexico

FXI china xinhua (or the ultrashort FXP)

EWH hong kong

Biotech

FBT best performing biotech etf so far.

PHI undervalued? I'd love to see it's chart if it ever corrected that situation! Yowzer!

Here's a seven year chart comparison of the three.

Btw, I could kick myself for not staying in PHI years ago. MANY years ago. In fact, I think it was on the Nasdaq back when I was in it! Damn!

http://quotes.nasdaq.com/quote.dll?page=charting&mode=basics&intraday=off&timeframe=7y&charttype=ohlc&splits=off&earnings=off&movingaverage=None&lowerstudy=volume&comparison=on&index=&drilldown=off&symbol=PHI&symbol=FTE&symbol=MBT&selected=PHI

is it just me? Telecom industry look like it is going very strong.

PHI FTE MBT etc... anybody know anything about these stocks?

PHI is deeply undervalued btw

Japan not an EM, but Lehman agrees with your "ready to rock" outlook -- says you should be overweight Japan in their recommended global portfolio -- they say 15% of the portfolio vs the typical 9%...they are underweight the UK and Latin America and neutral the rest of the world.

They also suggest overweight equities and underweight cash and bonds right now (75% equities vs their typical 60%)

In terms of sectors Lehman is overweight: Financials (42% of portfolio - twice their normal allocation) Healthcare, Tech, Telecoms, and Media

Report came out yesterday via my Fidelity Account.

anybody have an ETF that's shown strong resistance to this credit-mess?

Your welcome. here's a news story for you.

I couldn't find a chart showing the Turkish index.

ISTANBUL, Nov 19 - Turkish stocks are expected to make gains on Monday as selling pressure eases in world markets and the lira is seen firming due to tax payments by companies.

ADVERTISEMENT

Global credit worries have sparked selling in Turkish markets alongside other emerging markets in recent weeks.

"We are seeing that selling pressure is losing momentum in the Istanbul stock exchange and world markets. We think bargain hunting is likely," said Gedik Investment analyst Yunus Kaya.

The first target level for the stock market could be 55,350 points, he said.

A recovery on Wall Street and a cautious advance in Asian stocks are also seen supporting Turkish stocks.

The main stock index fell 0.8 percent to 54,304.47 points, following losses the previous day of 1.7 percent.

The lira <IYIX=> opened firmer on Monday at 1.1830 against the dollar versus 1.1870 on Friday.

"The Turkish financial markets may follow a cautious positive trend...We predict the lira will firm to 1.1730 due to tax payments," HSBC bank said in a report.

Companies sell foreign exchange to buy lira to make tax payments.

Bonds were weak on Friday, with the yield on the Aug. 5, 2009 benchmark bond <0#TRTSYSUM=IS> at 16.4 percent against Thursday's 16.29 percent.

The sentiment in Turkish markets was hurt in recent weeks by uncertainty over the security situation in the southeast of the country, where up to 100,000 troops have been assembled in preparation for a possible military assault on Kurdish militants hiding in northern Iraq.

Late on Thursday Turkey's second most senior general said Ankara was "in the process of implementing" a cross-border operation against Kurdish guerrillas in northern Iraq, but there have been no signs of increased military activity there.

Thanks,

looks like its earnings are down 63%... I'll bite some if they post some higher earnings. looks like it's one hell of a volatile etf though. current sitting at the 200day moving average.

TURKISH INVESTMENT FUND (TKF) is a closed-end fund that invests in Turkish companies. The latest reported earnings were down 62.9%, and the stock sells for 1.18 times net asset value.

I don't know if it's "good" or not, but check this out.

http://seekingalpha.com/symbol/tkf

For all I know, it could really suck balls! ( :

Anybody know of a good Turkey fund?

From what I remember hearing more than a few times, SS, is Japan's been told their overall money policy is poorly thought out. They may be trying NOT to let what happened the last time their market got out of control. Was it hyper-inflation that eventually killed their market? I can't remember. Anyways, that may be something to consider as to what's been holding the Japanese market back.

Wow. ETFs Shorting the EMs, you say? THAT takes balls! ( :

JAPAN ready to rock... Anybody know what the ticker for the japanese indexes are?

I looked at EWJ ishares japan and it looks like japan's market since 2003 has been rising like everybody else... but rather slowly. Near term target looks like it has been reached and may see a breather, imo.

Maybe it's gonna pick up soon? I might bite some at the Fitty-day moovin average.

http://online.barrons.com/public/article/SB119526244805596512.html

Ultrashort Emerging Markets Fund (EEV) looks interesting, same with the new FXP, which is short version of the FXI

Also ran into a closed end Emerging Markets Telecom Fund (ETF) today which looks interesting

just a few more ideas for those looking for something a little different but still related to emerging markets

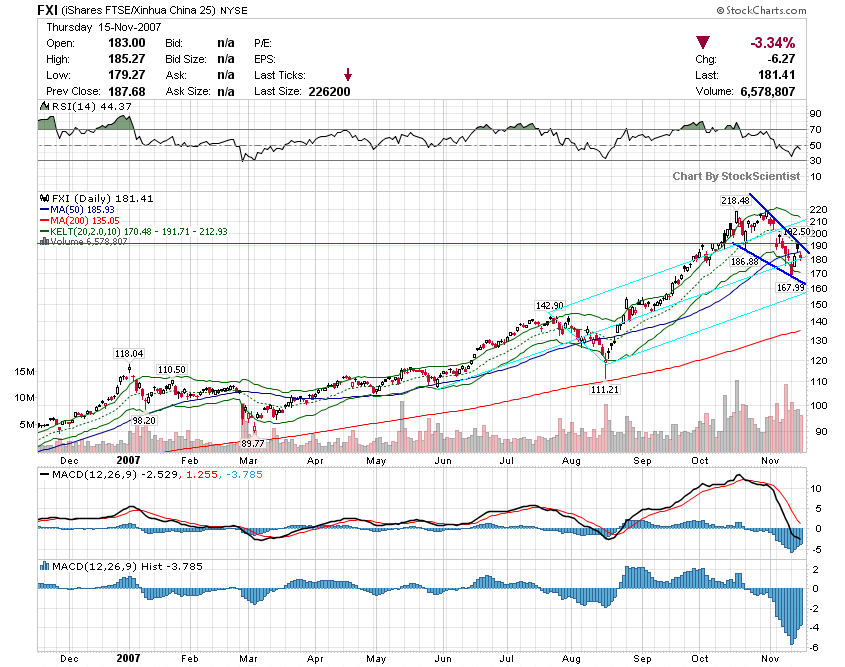

FXI daily chart... let me know what ya'll think.

Pattern is a Downsloping Pennant

Break at $185 Some Resistance at $192.5

Apparently it's holding at the mid fork line so far. I'll pull a weekly chart later.

Dow dropped down quite a bit so I thought it's considered a corRECTion. Lets hope that in a few days we all get a huge candlestick eRECTion. LMAOO!!

"I'm not sure if I care what the manager's doing as long as he's makin me money, lol." And NOT suckin' balls, right!?

Correction? You call this a correction? ( :

No, Stock...I'm talking about a corRECTion!!! LOL.

I consider this a minor pullback. It's the sudden large day to day swings that worry me. Seems like opposing forces are at work. If evil wins.....we're all doomed!

Sorry...I tend to get carried away. ( :

I'll probably end up sitting tight. I've been known to stand on a railroad track and hope the train goes around me.

I'm not sure if I care what the manager's doing as long as he's makin me money, lol.

If you've been holding until now, it's probably better to just stay in at this time cuz u might miss out on a huge recovery rally... all your worries are most likely behind you at this point in the 'correction'.

Considering that the EM funds can move in and out of the different countries, it'd be great to know what the manager's thoughts are. Maybe like, if they're raising cash presently?

Which countries are they shifting into and out of?

How much downside and for how long they expect to have to weather what may be ahead? IF there's anything ahead to weather.

Man, am I a worry-wart, or what? ( :

yeah my etfs are very volatile too... sucking elephant balls at the moment but hopefully in a few days we start ballin

Well....yeah. I know that. lol.

ETFs, aside from say EEM, are more concentrated than most of the EM Funds out there -- thus would make sense they they are more volatile imo.

The ETFs look like they're "sucking balls" (lol) worse than the EM funds are. I first posted here because I was skittish about the overall market, especially in light of what effects the credit crunch COULD have on not just our economy, but the world's economy.

I've heard commentary on how foreign markets will feel the effects as well as from industry leader types.

Today I was on Socotherm's website and they discussed in their third Q report how they'll see an impact. They're an international pipe supplier to the oil and gas industry. Not exactly one you'd expect to hear that kind of talk from.

Just musing aloud.

The problem is in moving in and out too often. They allow three changes a year to discourage flipping.

Besides, I like to stay in something I like and not worry about when to get back in.

Take for example CBI, which I see you have a new board on.

I bought that in '05 and haven't even followed it much lately! Same with ARD, AUY, ALTI and MSTR.

Some come and go. But these I've liked for awhile.

I won't mention my stinkers. (like HW!)

that's cool. I'd like to see that. Especially on FXI and EWZ. Thanks!

China's due for a "correction" in a matter of months, This will present a very good buying opportunity for all of us.

HOWEVER, those of us who are already in China and other EM stocks don't wanna get caught on the wrong side, lol

Gonna try to do a trend analysis on EWH, EWZ, EEM, FXI, FNI this evening to see where the near term target is.

might want to base your buys and sells on the RSI(14)...sell when the RSI is 80 or so, and buy when it dips below 30 -- not sure what your restrictions are though -- most 401ks have a limit on transactions in addition to any restrictions (30 days, etc) that certain funds might have on buying after selling some shares...

check the chart - if you did use this method, assuming you could -- you'd have sold at 29.50, bought back at 27, sold again at 32, bought back at 29, and sold again at 42/43 and you'd be waiting for the next buy signal.

Could do the same using the Wm%R -- but its a little more volatile.

Some EM markets, there aren't enough data that stretches back to pre 1998, but most show that when the US market went bear and tanked, EM market have both tanked in a general downward trend

but were not as severe and the recovery was quicker (for EM).

Trying to find a reliable source for that kind of guidance is tough. There always seems to be an opposite point of view.

Bill Fleckenstein (the infamous bear) I see has come out with his dire forecast for our economy. I just wonder if the EMs can disconnect from any possible downturn in the US market and be a good place to be still.

If I come across anything on the subject you're looking at, I'll post it for sure.

The obvious bunch are "ChIndia" Malaysia, latin america, africa... lol but I want to get into a safer play not something bubbly or too volatile... maybe Hongkong / Malaysia?

I'm hearing that economy in France might be picking up rapidlly too but that information was from only one source.

I haven't looked at it from the standpoint of an individual country, Stock. Haven't had to, of course, being in a fund.

Your "three year growth" reference, though, goes to what I'm interested in. Do you see from what you've read, the Emerging Market Countries continuing to do well?

which country do you feel will see tremendous growth in the next 3 years?

LOL! Now cut that out!

Are you Cartman, from South Park, by any chance? ( :

how about MMKBX, morgan stanley institutional emerging market porfilio fund... or does this one suck balls too? lol

That's where I'm putting my money, frog...my 401k and it's all in MGEMX. So, you can see why I want to protect my gains. I'm limited as to how many times I can go in and out of the funds they offer, so I'm leery of trying to pick a top.

But, if I was comfortable thinking the EMs could continue to do well through 2008, I'd just let it ride and weather the ups and downs.

And what doesn't go into my 401k, goes into paying extra principal on my mortgage.

I'm going to retire in less than ten years debt free and hopefully a ton of money in MGEMX. ( :

Those are my favorite ETFs. What's amazing is that the daily performance / gains are very competitive to the daily gains of most bigboard stocks.

ewm gonna really rock and roll very soon, imo

Emerging Markets are best played in by ETF imo -- alows for more flexibility. Unless you are buying in your 401k go with one of the ETFs (EEM, EEB, BIK, ADRE, ILF etc) or even the EWZ, EWH, EWM, FXI...nice to be able to buy the intraday dips on these...unless you want to buy and forget about it then go with a mutual fund

I use stops and trade triggers,

watching the general market trends for potential tops / bottoms is also a good way to steer clear of risks and to get in at optimal times.

Hey. You're paraphrasing! Quit it! lol.

It seems like we have a nice selection of mutual funds and "country funds" to choose from. But, since I'm already fully loaded, I'm more interested in figuring out a long term strategy. That may not be possible, and I know one normally holds onto a mutual fund and rides the ups and downs, but this is a little outside the norm, what with the great gains we've seen.

You could see sizable gains wiped out on a short term correction and/or slowly erode on a long term correction.

I just wonder how everyone feels generally on the topic and whether they think there's a smart way to protect their gains.

I am doing DD on DGS as we speak and will get back to the board on it in the near future. I see some potential in the thought process at least, but I have no idea with whom they are invested.

i think somebody here said that DGS sucks balls... lol

if u know if any good fundz post em here. thanks

Nice board you all! I just marked it! Personally, I like EWZ long, but you never know these days. DGS is an interesting new one as stockscientist pointed out. I will be watching closely, but am a little skiddish on that right now as well.

EWH EWZ EEM SKF SRS DUG ADRE ILF EZA

I'm sure when you look into it, you'll come across this, Stock....

http://www.seekingalpha.com/article/12344-concerns-with-the-new-wisdom-tree-etfs

There's no track record for any of their funds. In addition to trusting their "extrapolated" performance history back to '97, investors are also trusting his investment philosophy. Being a former hedge fund manager, he may be a little less risk adverse than one would like to see. He got killed in '95, one article stated.

The performance graph in that article you posted was one of those "too good to believe" kinda things, you know? Now we know why. It was all hypothetical! ( ;

Anybody know anything about DGS? Looks like a nice ETF emerging market fund... but I haven't looked closely into it.

http://www.thestreet.com/_htmltscu/funds/etf/10389085.html

I was surprised to see that the MGEMX chart looked so much more similar to the NASDAQ index than did my SSMVX (US small caps).

I'd hoped to be able to see what our market has done as compared to other markets. In other words, can the EMF index (if there was one) disconnect from ours and do well, if the US were to perform poorly in the coming years?

Steven Leeb is bullish on Chindia. Anyone follow him?

http://quotes.nasdaq.com/quote.dll?page=charting&mode=funds&timeframe=9y&index=nasdaqcomp&symbol=SSMVX&symbol=MGEMX

Seems like latin america, China, south korea are going to continue to be hot markets for the next few years.

JT, maybe you should include a black skull and crossbones with the chart for PYEMX ( :

I couldn't believe they could perform so poorly in the emerging markets area.

Here's a two year comparison chart I did for what looked like the best of them and included the DOW average, as well.

While the range for the six "best" was from 185% - 245%, that stinker PYEMX, at a pitiful 8%, couldn't even beat the DOW at 30%!

http://quotes.nasdaq.com/quote.dll?page=charting&mode=funds&timeframe=2y&index=djia&symbol=MGEMX&symbol=VEIEX&symbol=MMKBX&symbol=JAOSX&symbol=DFEMX&symbol=PRLAX&symbol=FEMKX&symbol=PYEMX

|

Followers

|

3

|

Posters

|

|

|

Posts (Today)

|

0

|

Posts (Total)

|

126

|

|

Created

|

07/23/07

|

Type

|

Free

|

| Moderators | |||

Offering

Offering  FOR A

FOR A  Also a nice place to finds stocks / funds / ETFs / EMFs that will upgrade that old dusty 401k...FORGET 7 to 14% Returns....granted it is better than a saving/checking account(1-4%) or even a Money Market (MM) (3-5, maybe 6 %)...

EMFs perhaps should be at least 20% of your tax deferred retirement account/annuity/401k. We believe this as most EMFs outperform most mutual funds with returns between 10 and 45% with an average closer to 24%...

ALL,... SO YOU CAN (see photo below)

Also a nice place to finds stocks / funds / ETFs / EMFs that will upgrade that old dusty 401k...FORGET 7 to 14% Returns....granted it is better than a saving/checking account(1-4%) or even a Money Market (MM) (3-5, maybe 6 %)...

EMFs perhaps should be at least 20% of your tax deferred retirement account/annuity/401k. We believe this as most EMFs outperform most mutual funds with returns between 10 and 45% with an average closer to 24%...

ALL,... SO YOU CAN (see photo below)

interesting.... http://en.wikipedia.org/wiki/Emerging_markets

http://www.emergingmarkets.org/

http://www.riedelresearch.com/

A few in eastern Europe: http://www.gemius.com/

http://www.etfexpert.com/etf_expert/global/index.html

http://etfguide.com/

http://www.emergingmarketsmonitor.com/

http://seekingalpha.com/tag/emerging-market?source=sector

http://ftalphaville.ft.com/blog/2007/01/08/1678/emerging-market-returns/

http://globaledge.msu.edu/ResourceDesk/mpi/

http://www.inchcape.com/ourbusiness/regions/emergingmarkets/

http://www.fundadvice.com/

The Nordic Link: http://sandberghans.blogspot.com/2008/01/carl-freer-starts-over-with-gizmondo.html

http://finance.yahoo.com/etf/browser/tv?c=0&k=5&f=0&o=d&cs=1&ce=693

interesting.... http://en.wikipedia.org/wiki/Emerging_markets

http://www.emergingmarkets.org/

http://www.riedelresearch.com/

A few in eastern Europe: http://www.gemius.com/

http://www.etfexpert.com/etf_expert/global/index.html

http://etfguide.com/

http://www.emergingmarketsmonitor.com/

http://seekingalpha.com/tag/emerging-market?source=sector

http://ftalphaville.ft.com/blog/2007/01/08/1678/emerging-market-returns/

http://globaledge.msu.edu/ResourceDesk/mpi/

http://www.inchcape.com/ourbusiness/regions/emergingmarkets/

http://www.fundadvice.com/

The Nordic Link: http://sandberghans.blogspot.com/2008/01/carl-freer-starts-over-with-gizmondo.html

http://finance.yahoo.com/etf/browser/tv?c=0&k=5&f=0&o=d&cs=1&ce=693

________________________________________________________________________________________________________________________________

A FEW GLOBAL ETFs also

________________________________________________________________________________________________________________________________

A FEW GLOBAL ETFs also

| Volume | |

| Day Range: | |

| Bid Price | |

| Ask Price | |

| Last Trade Time: |