Register for free to join our community of investors and share your ideas. You will also get access to streaming quotes, interactive charts, trades, portfolio, live options flow and more tools.

Looks like the turmoil in the ME stopped we out of here this morning. Well enough. Was a nice little ride...

I've been in this for a little while with a trailing stop loss order = .99 x the prior weeks low. While I'd like to wait until the close of friday to update my stop loss, today's schene in Egypt has inspired to up it early. Current Stop = $53.56.

Put my money were my mount is and took some Nov29 QQQQ 52 Puts today.

I see the 10 day crossing over the 20 day here in the major markets and pushing the indicies lower. The NAS should test the 50 day in the process and we might see some better oversold indicaters in the markets. This will be a nice setup for a holiday bounce (at least a nice preception of a holiday bounce setup!)

Whatyaknow, got one right... Lets see if she can break through the 20 and 10 day MAs...

This is turning into a pretty bad day for the market. Looking at the NAS Composite chart, the 50 day has only offered a minor bounce point the past 6 months when tested. This pullback could go all they way down to the 200 day. Stayed tuned...

Definately got yanked around here... Went short this morning again. Only betting for a move down to the 50 day MA on the NAS.

My biggest problem is I get get up in daily BS and got side track with the white hammer last week. Today went short a again. Will cover though when the market stalls at the 50 day MA as that should provide a bounce as we are still in a bull market overall since last spring of 2009.

These cycles tend to last for 3-4 years. Does this one end prematurely? That one if for the gods...

Hammer yesterday made me close my short position and go for some QQQQ 54 Calls. Ugh.... Doubled down. Hopefully the G20 will come up with some more money for a short term bounce.

Enguling candle today for the NAS. Could see a sharp move lower tomorrow for TYH. Still hold my short positions (TYP and some QQQQ 53 puts).

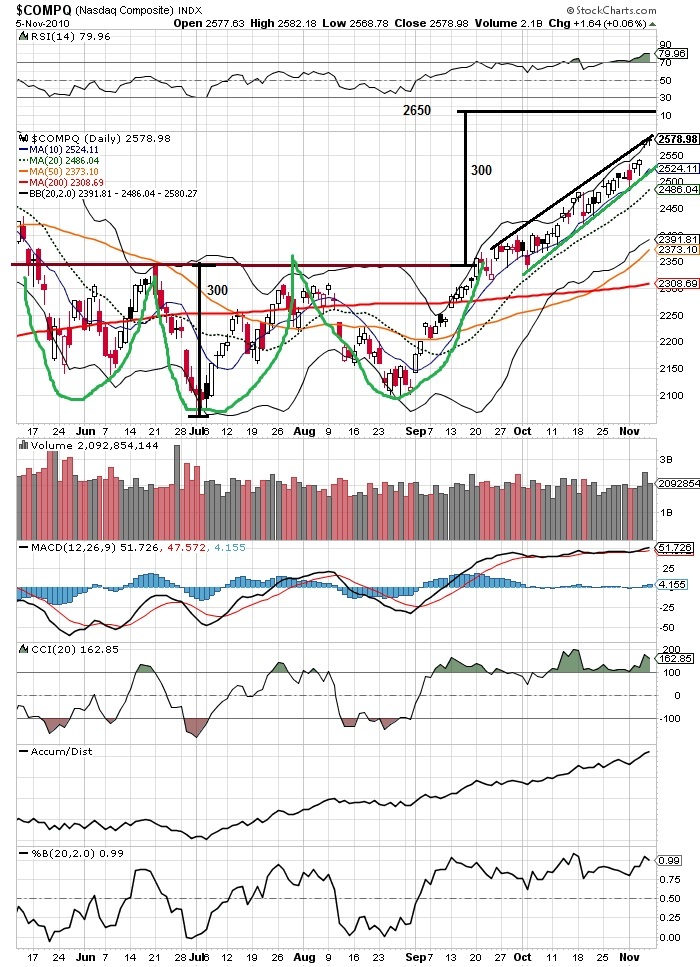

Tried to put together some various stuff I've been looking at in my own charts and here is a weekly chart of the NAS

We closed above the last major tops of the past 4 years and it looks 2700 is a possibility.

Looking at the daily chart

We're at the top of our current channel. All the indicators are off the charts. Maybe we'll see a short term pull back. There was an inverse head and shoulders that John Murphy pointed out as a bullish indicator, which I didn't respect... He says the ultimate move up above the old resistance could be the hieght of the inverse head. This is 300 points and takes us up to 2650.

What all this tells me there is a possible move higher from here. But I also see strong pontential for a pullback of some kind right now based on the current channel. It may take a little longer before the next real leg down...

If I don't see red Monday afternoon may close my current short positions.

Well I've certainly been taking a beating on my TYP position. Since today was a little weak with no follow through on yesterdays big day, and we haven't been this overbought in over 2 years, decided to gamble on some QQQQ 54 Puts here.

Regarding the TYP position taken on 10/21, clearly I rode that out to long. If the trade doesn't go your way with a week, probably best to get the hell out. Be careful switching immediately as you don't want to be oscilating on the wrong side of the trade. Today I booked the profits on the options (obsorbed 1/2 of the loss and will hope for a pullback on the TYP position.)

I think the signals for sell off are mounting and I actually went short with TYP on 10/21. My posts on the DRV board track my market reads... Though TYP is down 7% since this move, with the Nov 52 QQQQ calls 5% of investment hedge I'm only down 4% which has helped me have the staying power to keep my TYP position through today.

Pretty amazing how this market just shrugs off everything... Nice bounce off the 5 day means hold? Feel like I'm play with fire here, but do what the market tells you...

Nice little pre-market action here. Beginning of another big leg up.

Gap up today in QQQQ could lead to another significant run here. Only going for a quick ride since were getting above pre financial meltdown levels. I'm using 401(k) money here, but otherwise would protect myself with 5% of investment in QQQQ near the money puts.

Using earning reports and other news, markets are going absolutely deceptive -- obviously stealing money to upside fooling left-over scavenging those who are still uninformed.

* Intel Profit Falls but Easily Tops Expectations

The world's biggest maker of microrocessors reported a profit, excluding one-time items, of 18 cents a share in the second quarter, against 28 cents a share in the same period last year.

* Democrats Offer Healthcare Bill With Tax Hikes—And Mandates

House Democrats unveiled ambitious legislation Tuesday to remake the nation's health care system and called on medical providers, businesses and the wealthiest Americans to pick up the tab for President Barack Obama's top domestic priority.

* Intel Profit Easily Tops Earnings Expectations

Intel reported a profit excluding one-time items that blew out expectations, and a revenue figure that also beat forecasts.

* Madoff Begins Life Sentence at Prison in Butner, NC

O Editor's Desk: Playing 'Where's Bernie?' Via the Internet

* Obama: Many Lost Auto Jobs Won't Be Back

* Dollar Stores: Are You Getting What You Bargained For?

* Investors Cautious Despite Gains in Economy, Earnings

* Goldman Beats Forecasts, Led by Strong Trading

*

Porn Consumption: The Leading US States

* Cap-And-Trade: Bridge to Economic Disaster?

|

Followers

|

1

|

Posters

|

|

|

Posts (Today)

|

0

|

Posts (Total)

|

23

|

|

Created

|

04/26/09

|

Type

|

Free

|

| Moderators | |||

| Volume | |

| Day Range: | |

| Bid Price | |

| Ask Price | |

| Last Trade Time: |