Register for free to join our community of investors and share your ideas. You will also get access to streaming quotes, interactive charts, trades, portfolio, live options flow and more tools.

I've been in this for a little while with a trailing stop loss order = .99 x the prior weeks low. While I'd like to wait until the close of friday to update my stop loss, today's schene in Egypt has inspired to up it early. Current Stop = $80.11.

I heard some discussion on Elliot waves of late, and here is a little expert from todays Stock Charts market message:

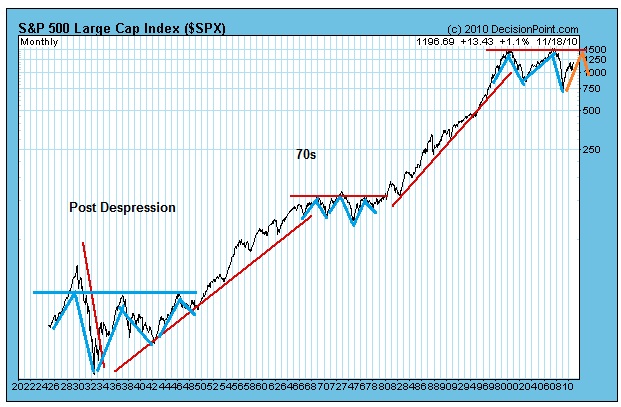

They are basically periods of consolidation and can take on different sizes. When you go to years you get bear "cyclical markets":

So the Despression period started in 1929 and really didn't end until 1950 for 21 years. The 70s started in 1966 and ended in 1978 for only 12 years. The current era started in 2000 and the argument is weather or not it ended in 1999 for only 9 years. Guess the answer is wheather or not we bust through 1500 on the SP 500 and thus only had two tops rather than the 3 of the past.

Many are saying we will languish for another 10 years. But This will break the wave pattern. Maybe well have 4 tops? What's clear is you have to respect to trend and body of theory as so many are pursuing now in auto pilot... Which tends to suggust no major breakdowns for another year followed by another downturn for 2 years of so. Looking at last two bear cyclical cycles, the last leg down was a mild one. That's not to say this time couldn't be different...

As for the article above, Stock Charts message is we may see some consolidation now and then probably break out higher. a mover higher to 1500 or so gives with the greater pattern, though there could be variation.

As for today, my bet for a little pullback should be short lived, but who knows, maybe it will turn into in a more substantial pullback to the 200 day. Or maybe I won't get any at all. Just don't see a strong follow through, not quite an abandemded baby, but not strong. A further pull back would in turn gives us a sweeter Elliot Wave to play through Christmas!

Been trying navigate DRV/DRN and TYH/TYP and just realized one could have done well enough here, perhaps with a slightly better chance gaging the overall markets...

The Fed manipulation: Americans are still fooled by the Fed and secretly colluded money swindling by indebting Americans with trillions.

The secret money swindling has gone for decades, but recently many are now aware of the facts. Given some evidences of statistical numbers such as US debt and financial market manipulation, we would think that some would wake up by now.

$COMPX 1998.72 28.99 1.47% 2,137,969

$INDU 9361.38 119.93 1.30% 1,215,424

$INX 1005.80 11.45 1.15%

Understanding this chart does not require a doctorate degree. Since 2000 after the Greenspan financial manipulation, Americans were slaughtered and still secretly and subtly being slaughtered with false hope propaganda just it was during the 1990-2007. Now, the greed has taken Americans to the next level of indebting the country by trillions. May GOD open the eyes of AMERICANS to understand what is happening -- getting robbed in bright daylight.

http://investorshub.advfn.com/boards/read_msg.aspx?message_id=40456144

Sickly low trading volumes

$COMPX 1799.73 6.52 0.36% 1,857,685

$INDU 8359.49 27.81 0.33% 971,510

$INX 905.84 4.79 0.53%

BGU 32.27 0.73 2.31% 10,993,066

Market Analysis and Forecasts as of 2/24/2009

http://trend-signals.blogspot.com/2009/02/market-analysis-and-forecasts_24.html

Making FORTUNE off of misfortune: It seems that not many know or admit the fact that more money is made by a few during bear market. Many are thinking that only markets which are going up someone is making money.

When markets are sold off, others are making a lot of money off of mass. In bear market, hedge funds are taking wealth off of many.

During bear market, a few are making big money off of misery of many. Novice and naive investors are brainwashed thinking that big money can be made during bull market, but the fact is bigger money is made during bear market as big short funds take money off of many naive investors.

Knowing the facts, the comments below are completely off-based and unethical because the author is misrepresenting the facts.

__________________________________________________

http://tinyurl.com/bmyqj5

10 dirty tricks to jump-start a new bull, fast!

How Wall Street lobbyists, PR hot shots will limit reform, brainwash America

By Paul B. Farrell, MarketWatch

Last update: 6:40 p.m. EST Feb. 9, 2009

ARROYO GRANDE, Calif. (MarketWatch) -- Yes, America wants an economic recovery. A brand new bull. And nobody wants it more than Wall Street. It gets rich off bull markets. Yes, Warren Buffett may be buying, but the odds are against Wall Street now.

The financial sector's in the tank: Stocks are huge losers. Earnings stink. Bonuses are down. And if they ask for TARP money, CEO salaries get capped, there are no lavish conferences and you fly commercial -- very humbling for a big boss used to making a million bucks a week.

Thomas Kee, editor of Stock Traders Daily, says he's expecting a market recovery this year. In an interview with MarketWatch's Stacey Delo, Kee explains his analysis and his strategy for picking stocks. (Feb. 9)

Still, Wall Street wants a new bull more than you do. Why? Bulls breed megapayoffs.

Yes, Wall Street's running a handicap race on a bad playing field, a rotten economy. Yes, the pressure's enormous. But if Wall Street wants to get its hands back in the magic cookie jar soon, it has no choice. It must get super-clever super-fast and jump-start a roaring new bull for the rest of America's 95 million investors, quickly.

Get it? Wall Street must deliver a new bull market, fast and soon.

How? By hook or by crook. Whatever pragmatic or Machiavellian power plays work. Why? Wall Street's got huge incentives at the end of this rainbow: Citing Watson Wyatt, the Economist says money management is a golden goose, with $64 trillion managed by professionals at the peak of the last bull. Assuming Wall Street controlled a third for an average 2% fee, there's roughly $400 billion at stake.

So Wall Street's army of lobbyists will have to pull off some fancy tricks, many at odds with today's demands for "change" by the president and political reformers. But now's the time to act, with the new TARP rules and an $800 billion stimulus bonanza on the way.

Look beyond the bad news. Remember, Washington's run by 40,000 lobbyists not 537 elected politicians. I'm betting lobbyists will use the following tactics to neutralize activists and limit reforms. That way, behind the scenes Wall Street keeps control with its business-as-usual tactics, schemes, scams, hustles and wheeling and dealing.

Here are the 10 "dirty tricks" Wall Street lobbyists likely will use to help jump-start a new bull market:

1. Gridlock helps the rich get richer

Sure, Wall Street bet on Obama and he won a big majority and mandate. But remember, Forbes 400 richest, CEOs and K-Street lobbyists as well as Wall Street insiders, all get richer when Washington's in gridlock. The GOP's stonewalling is already leading the way, so lobbyists start hedging bets, contributing to a partisan war and more gridlock.

2. No Glass-Steagall revival

From 1933 until 1999 the Glass-Steagall Act separated banking to avoid conflicts of interest: Investment banks are high-risk gamblers playing with other people's money, raising capital, trading, crafting merger deals and earning commissions. Commercial bankers have a fiduciary responsibility to conserve capital and minimize depositors' risk; they earn salaries. In 1999 Congress tore down that wall.

Citigroup merged the two, became a financial supermarket, and has since lost 90% of its stock value, contributing to the meltdown. Still, last year Morgan Stanley and Goldman Sachs became bank holding companies to engage in both businesses and get free TARP money. Reviving Glass-Steagall would hurt them, and delay a new bull.

3. Keep rating agencies 'official'

We know credit-rating agencies are Street puppets. They shield Wall Street from liability, and create an illusion of security for investors in a bull market. But they're paid by Wall Street to protect issuers, and totally failed to protect the investor. Writing in the Wall Street Journal, Michael Lewis and David Einhorn said: "The world is worse off for the existence of companies like Moody's and Standard & Poor's."

Ending the "official" role of rating agencies will prevent future meltdowns. Solution: Let investors or the public pay the bill. But Wall Street wants ratings as a shield in a bull, so they'll keep the agencies official.

4. Limit new derivative regulations, keep 'shadow banking' alive

Congress is holding hearings on regulating credit default swaps. That will impact the entire $683 trillion global "shadow banking system" for derivatives, enforcing transparency.

True, CDS added to the meltdown by offering an illusion of insurance protection. But derivatives also generate hefty commissions in bull markets. So Wall Street lobbyists must minimize reforms and keep shadow banking alive and as much outside the jurisdiction of the Fed and Treasury as possible.

And don't worry about another meltdown. Once again, in good times, Wall Street wins. And in bad times, Main Street picks up the tab.

5. Offload toxic debt into a government-owned 'bad bank'

Yes, BusinessWeek is right, Bush's $350 billion "bailout is a bust," for the taxpayers, homeowners and local banks. But at least Wall Street got tons of cash and credit to stockpile for reserves, mergers, dividends, bonuses and other perks. Plus no transparency. What a deal.

Now it's crucial Wall Street keeps what it got, while cleaning up its balance sheets by dumping all the toxic trash into a government-owned "bad bank." Let the Treasury, Fed and taxpayers worry about recovering value, while Wall Street focuses on creating a new bull market that generates big salaries and bonuses again.

6. Support executive pay limits -- in public, anyway

Wall Street banks are cash cows for insiders. They get rich off huge client fees and commissions from Main Street investors. Goldman's boss got $54 million in 2006. The average compensation even in a c***** 2008 was better than a half million for insiders.

But the president shames insiders from the bully pulpit. Sen. Claire McCaskill calls insiders "idiots" and introduce a bill to limit executive pay. So Wall Street's lobbyists have their work cut out for them: Limit amounts, disclosures and enforcement, while launching a feel-good PR campaign showing a contrite face to Main Street -- at least till the smoke clears.

The masses will forget once the new bull begins and the golden goose returns.

7. Create accounting standards loopholes

Forget all the campaign promises of ethical reform, transparency and sundry new executive orders attempting to erase Bush's footprint. America's new president has been creating loopholes that suggest a willingness to compromise, especially regarding lobbyists.

Equally important, accounting rules must be kept flexible, subject to interpretations favorable to business. The Washington Post reports that the International Accounting Standards Board recently bowed to political pressure, allowing Deutsche Bank to shift $32 billion in toxic assets so that a quarterly loss of $970 million magically became a $129 million profit.

Wall Street should continue making campaign donations to politicians and keep alive this kind of "flexibility" enforcement behind the scenes.

8. No limitations on SEC hiring

One of Lewis and Einhorn's recommendations: "Close the revolving door between the SEC and Wall Street," or at least forbid staff from going to work on Wall Street for some period. Lobbyists will make sure this reform is DOA.

Lawyers take low paying SEC jobs knowing it's a combination graduate school, boot camp and executive search firm. Graduates get big bucks representing Wall Street before their old buddies at the SEC. And yes, staffers tend not to get too aggressive for fear of irritating possible future bosses.

But this is a Catch 22: Not only would Wall Street lose a steady supply of well-trained securities lawyers, but who'd want to work for the SEC?

9. Invest heavily in lobbying

A couple years ago the Washington Post called lobbying "Washington's biggest business." And those 40,000 lobbyists are still manipulating the new administration. They "can't hire people fast enough ... starting salaries have risen to about $300,000 a year for the best-connected aides" who squeeze megabucks out of the federal budget.

One lobbyist was paid an $11 million fee for delivering a $1.2 billion benefit to clients. Another: "There's unlimited business out there for us." They manipulate from the shadows, while PR firms manipulate publicly. They're in Wall Street's army to launch a new bull.

10. Major PR brainwashing: Yes, yes, a new bull is coming!

Yes, Wall Street, Corporate America and Washington have many huge issues: Costly wars, Social Security reform, health care for all, oil independence, alternative energies, global warming, to name a few. But the bottom line, the No. 1 priority is very simple: America needs a new bull market, and that means brainwashing the public with "good news" to renew confidence and trust.

Main Street investors must feel safe to follow Buffett's lead back into the market. In short, more PR hype and propaganda (so long as there's substance actually coming down the road). We know bull markets typically start a couple quarters before economic recovery, so there will be a dark period of skepticism, doubt and fear.

But if Wall Street's confident about a new bull, it's time for their lobbyists and PR geniuses to tool up the brainwashing machine, and start "wagging the dog!"

Add your comments! Look beyond the skepticism and satire: Will Wall Street's lobbyists and the stimulus plan jump-start a new bull? What will? How about a PR campaign during the dark days? What do you recommend? End of Story

Stimulus Plan Faces Tough Road Through Congress

OBAMA, BAD BANK, ECONOMY, TARP, STIMULUS, CONGRESS, WALL STREET,

The Associated Press

| 09 Feb 2009 | 10:15 AM ET

A showdown is brewing in Congress over a massive economic stimulus plan, with the House and Senate at odds over some key features of the package.

The $827 billion Senate version of the plan was expected to pass a procedural vote around 5:30 pm EST Monday and the full Senate on Tuesday.

However, it must be reconciled with the House version, which totaled $820 billion in spending and tax cuts, which could mean more inaction and partisan recriminations in the days ahead.

# How House-Senate Versions Compare

President Barack Obama, who has not explicitly backed either proposal but wants a stimulus plan passed quickly, is likely to face a barrage of questions on the stimulus at a town hall meeting in Indiana, where he is speaking.

# CNBC.com is now streaming the event live

# Obama In Indiana: Crisis As Dire As Any Since Great Depression

The House and Senate bills overlap in many ways, but the Senate bill has a greater emphasis on tax cuts, while the House bill devotes more money to states, local governments and schools.

The differences are likely to mean difficult negotiations when House and Senate conferees meet later in the week to try to reconcile the two measures.

The Senate stripped $108 billion in spending, including $40 billion in aid to state governments for education and other programs. The bill retained items that also probably won't do much for the economy, such as spending $1 billion to fix problems with the 2010 Census.

Still, the bill retained the core of Obama's plan to combine hundreds of billions of dollars in spending to boost consumption by the public sector with tax cuts designed to increase consumer spending.

Much of the new spending would be for victims of the recession, in the form of extending unemployment insurance through the end of the year and increasing benefits by $25 a week, free or subsidized health care, and increased food stamp payments.

Senator Ben Nelson, Democrat of Nebraska, said on NPR Monday that the Senate's version is the one that needs to be passed, instead of the House version.

Two key players in crafting the version now before the Senate, Maine Republican Susan Collins and Nebraska's Nelson, said Monday morning they believe this is the best that can be achieved in the current circumstances.

"This bill is not perfect," Collins acknowledged in a nationally broadcast interview. "We're not claiming that. But in fact I think this bill will help to create 3.5 million jobs...We're facing a crisis and it makes no sense to have a partisan divide." She said the measure on balance is "a good bill. It is needed and I think it will make a difference."

Appearing with Collins on NBC's "Today" show, Nelson said, "I think the things we have focused on will help turn this economy around."

With Senate and House negotiators trying to prepare a deal, Obama is likely to push for a bill on his desk for his signature by mid-month. To focus on the stimulus bill, the Obama administration postponed to Tuesday the unveiling of the second part of the $700 billion bailout of the financial industry.

Instead, Obama focused on campaigning for the stimulus bill with his trips to areas hit hard by the economic crisis.

Obama Road Show

Trips Monday and Tuesday to cities hurting under the economic meltdown and a prime-time news conference Monday night show that Obama and his advisers are worried about a looming Senate vote on the stimulus bill, which failed to gather meaningful Republican support during rare weekend debate.

The question-and-answer sessions with citizens and later with news reporters will allow Obama to appeal directly for grass-roots backing of his plans. Both trips were added to Obama's schedule as difficulties with the legislation on Capitol Hill increased.

# Click Here for CNBC.com Slideshows

# Mortgage Rescue Plan Involving Freddie, Fannie?

Originally, aides had insisted his time would be better spent in Washington to shepherd the bill rather than traveling the more traditional presidential route around the country, pressuring lawmakers from his bully pulpit.

"The president's top man on the economy is the president," Larry Summers, the chairman of the White House National Economic Council, said on "Fox News Sunday." Summers added: "He listens to advice from all of us, and he sets his direction." For his first direct pitch to citizens, Obama scheduled a town hall meeting in Elkhart, Ind.

He was to return to Washington for the news conference Monday night. On Tuesday he plans to visit Fort Myers, Fla., an area hit hard by foreclosures. And he'll visit Peoria, Illinois on Thursday, the White House announced Monday.

"Americans across this country are struggling, and they are watching to see if we're equal to the task before us. Let's show them that we are. And let's do whatever it takes to keep the promise of America alive in our time," Obama said in his weekly radio and Internet address.

The Elkhart-Goshen region in northern Indiana saw its unemployment rate soar to 15.3 percent in December, up a whopping 10.6 percentage points from December 2007.

The region has been bruised by layoffs in the recreational vehicle industry. Hundreds of workers have lost their jobs at RV makers such as Monaco Coach Corp., Keystone RV Co. and Pilgrim International.

White House spokesman Robert Gibbs said the meeting would give the president a chance to hear Americans' concerns about the bill, which was set to have a key vote in the Senate on Monday afternoon.

"I think this is another chance for the president to talk directly to the American people about what he thinks is at stake," Gibbs said.

"Watching millions lose their jobs, and having in front of Congress—and hopefully in front of him soon—a plan to save or create millions more jobs and get people back to work, putting money in people's pockets, getting help for state and local governments so they don't have to lay off firefighters or teachers or police officers."

© 2009 The Associated Press. All rights reserved. This material may not be published, broadcast, rewritten or redistributed.

URL: http://www.cnbc.com/id/29098612/

We will see 8/8.6 cycle bottom in 2010 with long term consolidation of the "K" cycle.

Obama: Economic Crisis Is As Dire As Any Since 1930s

Reuters

| 09 Feb 2009 | 12:38 PM ET

President Barack Obama says the nation cannot afford to "posture and bicker" while people are losing their jobs by the millions in a failing economy.

Obama went to Elkhart, Ind., to talk to voters in a state where the rate of unemployment has soared to over 15 percent of the workforce. He was introduced by a man who lost his job in the recreational vehicle industry.

The president, in a town hall meeting, said he wanted to come to the Midwest to assure people that he's working hard to turn the economy around.

# Watch Obama Town Hall Live

Obama said the nation is facing "an economic crisis as deep and as dire as any since the Great Depression."

Obama said that the economic stimulus bill being considered by Congress is the right size and scope and warned that the country's troubles will worsen if it is not passed promptly.

"It is the right size, it is the right scope. Broadly speaking it has the right priorities to create jobs that will jump-start our economy and transform it for the 21st century," Obama said of the more than $800 billion bill. "I can say with complete confidence that endless delay or paralysis in Washington in the face of this crisis will only bring deepening disaster," Obama said.

Obama also said that an independent, bipartisan board will oversee spending in the massive economic stimulus package to ensure that the money is not wasted.

"We're going to set up an independent board made up of Democrats and Republicans to review how the money is being spent, because we've got to make sure that it's not being wasted on somebody's special project that may not actually create help for people," Obama said.

Getting Momentum

The president, in office just three weeks, flew to Elkhart for a campaign-style town hall meeting with some 1,700 residents of a city whose recreational vehicle manufacturing industry has been hit hard by the recession.

The president was trying to regain momentum after a week in which a key cabinet nominee withdrew in a flap over unpaid taxes and his push for a stimulus plan hit unexpected snags in the Democratic-controlled Congress. And on Monday, at 8 pm EST, he is due to hold his first White House news conference in the East Room after returning from Elkhart. On Tuesday, he plans to visit Fort Myers, Fla., an area hit hard by home foreclosures.

But the White House added yet another stop this week: in Peoria, Ill., on Thursday. Gibbs said that Obama will visit a Caterpillar Inc. plant. The heavy equipment maker has announced 22,000 job cuts in recent weeks, including at its East Peoria facility.

The Indiana visit gave Obama a chance to make his case for the economic rescue package in a familiar setting.

The White House said the manufacturing city has seen its unemployment rate soar to 15.3 percent from 4.7 percent over the past year. Hundreds of workers have lost their jobs at RV makers such as Monaco Coach, Keystone RV and Pilgrim International.

The later prime-time news conference in the White House East Room would let him make his economic case to a national audience and allow him to try to clear the air after admitting he "screwed up" his handling of the nomination of Tom Daschle, a former prominent senator, to lead his healthcare reforms.

Focus on the stimulus package, which has been approved by the House of Representatives and is expected to clear the U.S. Senate on Tuesday, led the administration to postpone Treasury Secretary Timothy Geithner's much-awaited announcement of a bank rescue plan until Tuesday.

The House of Representatives has approved an $819 billion economic recovery plan, while the U.S. Senate is expected to pass an $827 billion measure, but fashioning a compromise could be difficult because the two versions differ on tax cuts and spending.

Stimulus Needed Now

"We've got to work through the differences, find the best bill we possibly can, and get it in place as quickly as possible," Lawrence Summers, a top Obama economic adviser, told "Fox News Sunday," noting some 600,000 jobs were lost last month.

"If there was ever a moment to transcend politics, this is that moment," said Summers, director of the White House National Economic Council.

A procedural vote on the Senate bill was set for 5:30 p.m. EST, and if the bill survived that vote it was likely to receive final approval on Tuesday.

"It's a good package and one that our country really needs," Republican Senator Susan Collins of Maine, a chief author of the compromise bill, said on Monday on NBC's "Today Show."

Concerned that accusations of wasteful spending were bogging down the stimulus bill in Congress, Obama has adopted a sharper tone toward his Republican critics, warning them "the time for talk is over" and charging that tax cuts alone are a "losing formula" to stimulate the economy.

Obama has repeatedly reminded Republicans they lost the November election and that Americans voted for his agenda of change.

Return To Elkhart

Obama returned to Concord High School, having campaigned there in August in his successful push to become the first Democratic presidential candidate to win Indiana since 1964.

The industrial city of about 50,000 just east of South Bend also has long been home to musical instrument makers. "We've done some diversification over the years, but not enough to offset what has happened in the RV industry," Elkhart County Commissioner Terry Rodino said last week.

Keystone RV Co. in Goshen informed 350 workers on Feb. 2 that they will be laid off in April. Jayco Inc. in Middlebury told more than 250 workers that they will be out of work in two weeks. Elkhart County Commissioner Mike Yoder estimated that the county's unemployment rate is now likely closer to 20 percent.

Copyright 2009 Reuters. Click for restrictions.

URL: http://www.cnbc.com/id/29100482/

BGU, markets are showing -D with intraday OB -- trading near to BGU 33R.

Market Insider: The Week Ahead

cnbc.com

| 06 Feb 2009 | 09:10 PM ET

Stocks got a lift from optimism that the government's bank bailout and stimulus plans will help mend the economy, but the question for investors in the coming week is whether the market is getting ahead of itself.

Details of the latest version of the much-anticipated bank bailout will be unveiled by Treasury Secretary Tim Geithner in a noon address Monday. That plan is expected to tackle the toxic assets on bank books with the creation of a so-called "aggregator bank" or "bad bank" as well as other steps. CNBC's Steve Liesman reports the size of the bad bank to be $500 billion. The Geithner plan will also include more capital injections and tougher scrutiny of institutions.

Congress in the coming week will also be working towards tying up the $800 billion stimulus package. The Senate reached a compromise on a bill late Friday. The fate of that package should play a big role in driving markets early in the week.

Stocks had their first up week in a month and their best week since early January. The Dow rose 3.5 percent to 8280, while the S&P 500 was up 5.2 percent at 868. The Nasdaq, driven by a rally in tech, jumped 7.8 percent to 1591, giving it a nearly 1 percent gain for the year-to-date.

"We're telling people this is a decent time to invest in the markets," said Tobias Levkovich, chief U.S. equities strategist at Citigroup. He said earnings estimates have gotten more realistic and volatility has come down, and he is feeling relatively constructive about the stock market despite the challenging economy.

"Challenged economic times doesn't mean you can't make money in stocks. We think it's a little late to play defense. You have to take a little bit more of an offensive edge to your portfolio," he said. Levkovich said some sectors he likes to dip into now are retailing, semiconductors and insurance.

Traders had been expecting a retest of the market's November lows, but were surprised instead by a willingness by investors to put money back to work in some of the less defensive, down trodden sectors in the past week. Technology finished the week up 9.7 percent, and the commodities-driven materials sector, rose 7.4 percent. Financials were up nearly 6 percent. Defensive consumer staples were the worst performers, up just 1.7 percent.

What's Ahead

In the week ahead, in addition to the Treasury announcement, markets will be focused on testimony by Geithner and Fed Chairman Ben Bernanke before separate Congressional committees Tuesday. On Wednesday, eight bank CEOs appear before the House Finance Committee to discuss accountability for the TARP, Troubled Asset Relief Program. There is also a massive $67 billion Treasury refunding in the coming week, and some key economic data, including retail sales for January.

By the end of the week, the G-7 meets in Rome where finance ministers will discuss the global economic crisis.

"When the G-7 meets, they're going to talk about currencies, but they always do," said Marc Chandler, chief currency strategist at Brown Brothers Harriman. "It seems quite clear they're not going to intervene...It will be Geithner's first time there as Treasury Secretary so it's more of a 'get to know you' than a look over of international proposals."

The dollar fell 0.9 percent against the euro in the past week, snapping a five-week winning streak. The dollar rose 2.4 percent against the yen. The 10-year Treasury fell on the week to 106-16/32, raising its yield to 2.980 percent. The two-year yield rose to 0.987 percent.

The Treasury's auctions for three-year, 10-year and 30-year notes fall Tuesday through Thursday. "The question is how are the auctions going to go?" said Deutsche Bank chief economist Joseph Lavorgna. "I'm not saying we're going to have a failed auction but supply is becoming an issue for the market. You're getting all this supply coming. We're going to get like $2 trillion supply between now and the end of the year...I think the market is going to test the Fed."

Econorama

The big economic news comes from the Treasury this week, but there are also some key numbers to watch. Retail sales for January, reported Thursday, is one of the most important. The NFIB survey on small business activity is released on Tuesday morning. Wholesale trade is also released that day. On Wednesday, look for news on international trade and the Federal budget. Weekly jobless claims are reported Thursday, as usual. Retail sales for January are also issued that day, as are business inventories. Consumer sentiment is reported Friday.

"I do think the economic data are going to take a back seat just now to company earnings and to what's happening with the banks. People know things are bad and it's going to take a lot to shock them," LaVorgna said.

"It's safe to say the data does not show the rate of economic deceleration is accelerating. Maybe we're even starting to level off," he said.

Earnings Central

The pace of earnings news is slowing a bit in the next week but two big cola companies duke it out with reports Thursday, from Coca-Cola , and Friday, from Pepsi .

Barclay's is a key report to watch ahead of the bell Monday. Also reporting Monday are Beazer Homes, Hasbro, Loews, Nissan, NYSE Euronext, and Whirlpool. After the bell Monday, Lincoln National reports. See below the chart for more companies reporting next week.

On Tuesday, DirecTV, Molson, Qwest and Coventry Health Care report ahead of the open. Applied Materials, Computer Sciences, Nvidia and VF Corp report after the bell that day. Allegheny Energy, Arcelor Mittal, Genzyme, Ingersoll-Rand, Marsh McLennan, and Sanofi-Aventis report Wednesday. See more below the chart.

Thursday's reports include Aetna, BT Group, Marriott, Masco, Viacom, Cephalon, and Waste Management.

Questions? Comments? marketinsider@cnbc.com

© 2009 CNBC, Inc. All Rights Reserved

URL: http://www.cnbc.com/id/29061745/

Greedy markets are duping many -- selling in light volume manipulation for days. Markets are trading at supports.

------------------------------------------------------------------

Big lie & manipulation: re President Obama: We Can Defeat Crisis In Economy

He would know that economic/financial bubble/crash is big lies and manipulation to legally steal wealth from many around the world.

re President Obama: We Can Defeat Crisis In Economy

http://www.cnbc.com/id/28749674/

Depressing OE markets going into the Obama Inauguration

With RBS excuse, markets are selling off as if there is no tomorrow breaking supports. The recent "bear fund fortune making trillions" is already forgotten, as markets are selling off again. Futures are trading near at the recent low which is not a good sign for markets. Market hype going up, and now market hype going down with blood squeeze cleaning out small fund holders.

Supports: DOW 8000, SPX 817, Nasdaq 1455, and Qs 28.

http://investorshub.advfn.com/boards/read_msg.aspx?message_id=34925942

BGZ should move a lil this week

BGU from 60 to 23, 60% MOVE. It's volatility hell markets with manipulated high volatility. It's evil greed monster markets.

Extreme greed and manipulation: Volatility hell manipulated markets

Markets are trading in extreme volatility, targeted specific stocks.

In 2 weeks, markets moved 50-120% using high volatility manipulation. Markets were burning - hell markets.

The greed monsters and children will burn in hell for being so greedy.

Hell high volatility greed monster market.

Russell Indexes Bolster New ETFs Based on Sectors, Commodities

Direxion's Launch of Leveraged Bull and Bear Funds Marks a First for Russell Global Sectors

Last update: 5:12 p.m. EST Nov. 7, 2008

TACOMA, Wash., Nov 07, 2008 (BUSINESS WIRE) -- Direxion Funds' launch of eight exchange-traded funds (ETFs) based on Russell Indexes this week introduced for the first time funds specifically tracking Russell's sector methodology. Direxion's announcement parallels a similar launch by ETF Securities on the London Stock Exchange and Irish Stock Exchange that for the first time employ Russell's commodity industry indexes for long exposure to world commodity markets.

"Both launches showcase the growing demand for a widening array of products based on our benchmarks," said Ron Bundy, managing director for Russell Indexes. "For similar reasons, these new ETF products rely on the same objective index methodology used for more than $4 trillion in benchmarked funds."

Direxion Funds, a pioneer in providing alternative investment strategies to sophisticated investors, now offers several Direxion Shares 3x ETFs -- leveraged Bull and Bear index funds that seek 300% of the daily performance, or 300% of the inverse of the daily performance (before fees and expenses) of four separate Russell Indexes. The list includes the large-cap Russell 1000(R) Energy Index as the benchmark for the Direxion Energy Bull 3x Shares fund and the Direxion Energy Bear 3x Shares fund. Similar funds were launched based on the Russell 1000 Index, Russell 2000(R) Index, and the Russell 1000 Financial Services Index.

Earlier this fall, ETF Securities, the global pioneer and market leader in Exchange Traded Commodities, launched its first platform of ETFs tracking equity indexes, including the Russell 1000 and Russell 2000 as well as the newly unveiled Russell Global Coal, Russell Global Gold, Russell Global Steel Large Cap, and Russell Global Shipping Large Cap indexes. The initial launch on the Irish Stock Exchange was followed this week with a complementary launch on the London Stock Exchange.

"Both of these innovative investment strategies clearly demonstrate Russell's ability to segment our comprehensive index design to great depth and with consistent precision," said Bundy.

Bundy noted that both ETF products show the industry's growing acceptance of Russell's index methodology. This growth includes the launch last year of global indexes which already have attracted nearly 200 subscribing clients including more than 100 investment managers.

These new funds are based on the sectors and industry groupings available with Russell Global Sectors (RGS), which features nine sectors and spans more than 10,000 stocks, 163 industries and 70 countries.

About Russell

Russell Investments is a global investment company with $180billion in assets under management as of September 30, 2008. Russell serves individual, institutional and advisor clients in more than 40 countries and provides investment solutions including mutual funds, retirement investments, institutional asset management, implementation services and global stock market indexes. Russell is world-renowned for its depth of manager research, quality of manager selection and access to some of the world's leading investment managers. It helps investors of all sizes put this access to work in corporate defined benefit and defined contribution plans, and in the life savings of individual investors.

With approximately 2,200 associates in more than 20 offices around the world, Russell provides financial services in major financial centers. Founded in 1936, Russell is a subsidiary of Northwestern Mutual Life Insurance Company and is headquartered in Tacoma. Russell operates principal offices in Amsterdam, Auckland, Johannesburg, London, Melbourne, New York, Paris, San Francisco, Seoul, Singapore, Sydney, Tokyo and Toronto.

About Direxion

Direxion Shares and Direxion Funds, managed by Rafferty Asset Management, LLC, offer leveraged index funds, ETFs and alternative-class fund products for investment advisors and sophisticated investors who seek to effectively manage risk and return in both bull and bear markets. Founded in 1997, the company has approximately $1.6 billion in assets under management. The company's business model is built on continuous product innovation, exceptional customer service and a commitment to building strategic relationships with distribution partners. For more information, please visit www.direxionfunds.com or www.direxionshares.com. To request more information on Direxion Shares 3x ETFs or to speak to a member of the Direxion team, contact Carol Graumann at 973-732-3521 or carol@jcpublicrelations.com.

About ETF Securities

ETF Securities Ltd is an issuer of Exchange Traded Commodities (ETCs) and Exchange Traded Funds (ETFs). ETF Securities is independently owned and is the European market leader in ETCs. The management of ETF Securities pioneered the development ETCs, with the world's first listing of an ETC, Gold Bullion Securities in Australia and London in 2003 and then the world's first entire ETC platform which was listed on the London Stock Exchange in 2006. Since then, ETF Securities has listed its ETCs on Europe's major exchanges (Frankfurt, Paris, Amsterdam and Italy) with each exchange creating a separate ETC segment. ETF Securities has most recently launched the largest platform of commodity sector ETFs in Europe providing exposure to European firsts such as Coal, Steel, Shipping and Nuclear Power. For more information visit www.etfseurities.com.

Russell Investments, a Washington, USA corporation, operates through subsidiaries worldwide.

Russell Investments is the owner of the trademarks, service marks and copyrights related to its indexes.

SOURCE: Russell Investments

Russell Investments

Steve Claiborne, 253-439-1858

newsroom@russell.com

www.russell.com

Copyright Business Wire 2008 End of Story

3x etf ~ with 2x etfs, we have seen high VIX. Even though the volatility is seen as a result of the recent financial melt, I think that the entire market bubble and crisis is planned.

I noted this before that as many are now becoming like traders rather than long term investors and now learned how to trade markets with technical analysis, markets create new ways to control market participants whether they are small, big, or institutions.

Certainly, Cramer college tour and globalism changed the financial markets and trading world. We are seeing radical changes with information explosion recently.

With new 3X etfs and with economic condition, we will see continued volatility.

BGU volatility in 2day is 27%.

Yesterday volatility:

BGU 7.16% Large Cap Bull 3x Shares

BGZ 8.90% Large Cap Bear 3x Shares

TNA 9.03% Small Cap Bull 3x Shares

TZA 10.56% Small Cap Bear 3x Shares

I think that 3x volatility will be about 5% + per day.

|

Followers

|

5

|

Posters

|

|

|

Posts (Today)

|

0

|

Posts (Total)

|

29

|

|

Created

|

11/07/08

|

Type

|

Free

|

| Moderators | |||

| Volume | |

| Day Range: | |

| Bid Price | |

| Ask Price | |

| Last Trade Time: |