Register for free to join our community of investors and share your ideas. You will also get access to streaming quotes, interactive charts, trades, portfolio, live options flow and more tools.

Fitch downgrades US debt rating from the highest AAA rating to AA+

on debt ceiling drama and governance worries

https://www.cnn.com/2023/08/01/business/fitch-downgrade-us-debt/index.html

US debt has long been considered the safest of safe havens, but Tuesday’s rating cut suggests it has lost some of its luster. The downgrade has potential reverberations on everything from the mortgage rates Americans pay on their homes to contracts carried out all across the world.

The move could cause investors to sell US Treasuries, leading to a spike in yields that serve as references for interest rates on a variety of loans.

Fitch said the decision wasn’t just prompted by the latest debt ceiling standoff but rather “a steady deterioration in standards of governance over the last 20 years” regarding “fiscal and debt matters.”

S&P has maintained its AA+ rating on the US after the 2011 downgrade while Moody’s has kept its AAA rating.

In fiscal year 2022, the US paid $475 billion in interest — or 1.9% of gross domestic product. That amount will nearly triple to $1.4 trillion by 2033, or well over 3% of GDP, according to the CRFB’s analysis of the Congressional Budget Office forecast.

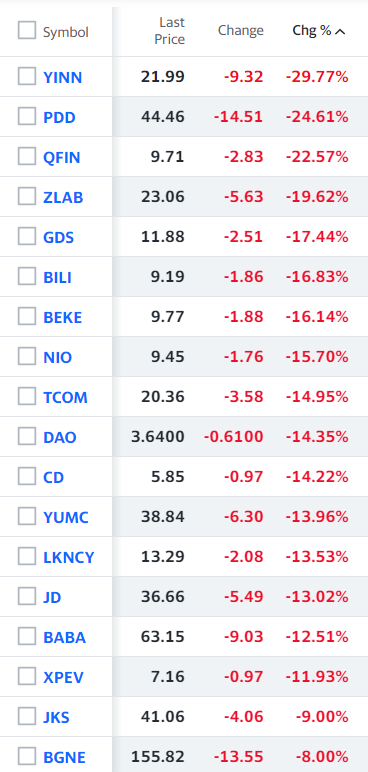

U.S.-listed Chinese tech stocks promptly fell off a cliff

after Chinese President Xi Jinping secured an unprecedented third term as leader of the People's Republic on Sunday -

https://finance.yahoo.com/m/96c1224d-c0d1-3a7d-9af7-53ce6d7732f5/why-baidu-dingdong-and.html

OPEC announces the biggest cut to oil production since the start of the pandemic

https://www.cnn.com/2022/10/05/energy/opec-production-cuts/index.html

OPEC+ said Wednesday that it will slash oil production by 2 million barrels per day, the biggest cut since the start of the pandemic, in a move that threatens to push gasoline prices higher just weeks before US midterm elections.

The group of major oil producers, which includes Saudi Arabia and Russia, announced the production cut following its first meeting in person since March 2020. The reduction is equivalent to about 2% of global oil demand.

“An announced cut of any volume is unlikely to be fully implemented by all countries, as the group already lags 3 million barrels per day behind its stated production ceiling,” Rystad Energy analyst Jorge Leon said in a note.

Rystad Energy estimates that the global oil market will be oversupplied between now and the end of the year, dampening the effect of production cuts on prices.

OPEC+ to consider oil cut of over than 1 million barrels per day

https://www.reuters.com/business/energy/opec-consider-oil-output-cut-over-1-mln-bpd-sources-2022-10-02/

OPEC+ will consider an oil output cut of more than a million barrels per day (bpd) next week, OPEC sources said on Sunday, in what would be the biggest move yet since the COVID-19 pandemic to address oil market weakness.

The meeting will take place on Oct. 5 against the backdrop of falling oil prices and months of severe market volatility which prompted top OPEC+ producer, Saudi Arabia, to say the group could cut production.

OPEC+, which combines OPEC countries and allies such as Russia, has refused to raise output to lower oil prices despite pressure from major consumers, including the United States, to help the global economy.

Prices have nevertheless fallen sharply in the last month due to fears about the global economy and a rally in the U.S. dollar after the Federal Reserves raised rates.

A significant production cut is poised to anger the United States, which has been putting pressure on Saudi Arabia to continue pumping more to help oil prices soften further and reduce revenues for Russia as the West seeks to punish Moscow for sending troops to Ukraine.

Saudi says OPEC+ can cut output to address oil slump

https://www.reuters.com/business/energy/saudi-says-opec-has-options-confront-market-challenges-including-cutting-output-2022-08-22/

..

..

..

Freeport LNG bounces

Looks to Restart in November

https://www.naturalgasintel.com/freeport-lng-looks-to-restart-in-november-halting-u-s-natural-gas-price-rally/

U.S. natural gas prices nosedived Tuesday afternoon after Freeport LNG Development LP outlined plans to restart partial operations at its export terminal on the Upper Texas Coast later than expected in November. The company had previously guided for a restart in early October.

_

..

_

..

..

London (CNN Business)The German government has stepped in to bail out one of its biggest energy companies — the latest casualty of Europe's natural gas crisis.

https://www.cnn.com/2022/07/22/energy/germany-uniper-bailout/index.html

Gas distributor Uniper will receive up to €15 billion ($15.3 billion) from the government after months of Russian supply cuts and soaring spot market prices have brought it to its knees.

Uniper is Germany's largest importer of gas, its Finnish parent company Fortum said in a Friday press release.

Under the rescue deal, the government has committed to provide €7.7 billion ($7.8 billion) to cover potential future losses, while state-run bank KfW will increase its current credit facility by €7 billion ($7.1 billion).

The government will also buy a 30% stake Uniper, while Fortum will reduce its stake from 80% to 56%.

"New geopolitical realities have shaken the European energy system to the core, and this determines a new framework for European energy companies," Fortum CEO Markus Rauramo said in the press release.

Rauramo said that further work was needed to make the gas industry sustainable.

Benchmark prices have risen 89% since the war began in late February, according to data from the Intercontinental Exchange.

Announcing the deal, German Chancellor Olaf Scholz said on Friday that Uniper was "in great trouble."

"[Uniper is] of paramount importance for the economic development of our country, for the energy supply of the individual citizen, but also of many companies," he added.

Supply crunch

Germany is particularly vulnerable to falling Russian gas exports. The European Union's biggest economy has long relied on Moscow's gas to power its homes and heavy industry. Russian gas accounts for more than half of Uniper's long-term supply contracts.

In June, Gazprom, Russia's state energy company, slashed gas shipments along the Nord Stream 1 pipeline — which links Moscow's gas directly to Germany — by 60% because of a dispute over the return of a turbine from Canada to Russia.

But Germany has made strides in recent months to reduce its dependency on the country, slashing Russia's share of its gas imports to 35% from 55% before the start of the war.

Further cuts are on the way. The European Union has pledged to reduce its Russian gas consumption by 66% before next year, and break its dependence completely by 2027.

On Wednesday, the bloc unveiled its emergency gas rationing plan which sets a target for member states to reduce their gas demand by 15% between August and March next year.

— Nadine Schmidt contributed reporting.

Interesting read. Seems they are blaming each other. Hopefully they can work it out soon.

Nord Stream turbine stuck in transit as Moscow drags feet on permits

https://www.euronews.com/next/2022/07/22/ukraine-crisis-gas-turbine-exclusive#:~:text=BERLIN%20%E2%80%93%20A%20missing%20turbine%20that,familiar%20with%20the%20matter%20said.

..

..

BERLIN – A missing turbine that Moscow says has caused the Nord Stream 1 pipeline to pump less gas to Europe is stuck in transit in Germany because Russia has so far not given the go-ahead to transport it back, two people familiar with the matter said.

The turbine, which usually operates at the Russian Portovaya compressor station, had been undergoing maintenance in Canada but was flown back to Cologne, Germany, on July 17 by logistics firm Challenge Group, one of the people said.

It is currently unclear when the turbine can be returned, the people said, adding this could still take days or even weeks.

The transport back to Germany happened after weeks of consultations between Berlin and the Canadian government over whether such a move would violate Western sanctions imposed on Russia in the wake of its invasion of Ukraine.

Last month, Moscow cut the capacity of Nord Stream 1 by 60%, citing the delayed return of the turbine being serviced by German power equipment company Siemens Energy.

Russia reopened the pipeline on Thursday after a ten-day scheduled maintenance shutdown, but it was still operating at reduced capacity.

Germany dismisses Russia’s argument that the missing turbine is the reason for lower supplies via Nord Stream 1, and has accused Moscow of using gas flows as a political weapon.

Russia has said that the return of the turbine had a direct impact on the pipeline’s safe operation, adding documentation from Siemens Energy needed to reinstall it was still missing.

One of the sources said Moscow had so far not provided the documents needed to import the turbine into Russia, including details on where exactly to deliver it and via which customs station.

“Under normal circumstances, the maintenance of turbines is a routine operation for us,” Siemens Energy said in a statement. “Naturally, we want to transport the turbine to its place of operation as quickly as possible. However, the time it takes is not exclusively within our control.”

The Kremlin said earlier on Thursday that all difficulties with the supply of Russian natural gas to Europe, including the turbine issue, were caused by Western restrictions, and that Russia remained an indispensable part of European energy security.

German Economy Minister Robert Habeck said of the turbine earlier on Thursday: “Sometimes one has the impression that Russia no longer wants to take it back.

“That means the pretext of technical problems actually has a political background, and that is the opposite of being a guarantor for energy security in Europe.”

Habeck said the government was in close contact with Siemens Energy and that it would communicate when the turbine arrives in Russia and has been handed over to Nord Stream’s majority-owner Gazprom.

A spokesperson for Germany’s Economy Ministry declined to comment further. Challenge Group, the logistics company, did not immediately respond to a request for comment. Gazprom, Russia’s natural gas export monopoly, did not reply to repeated requests for comment on Nord Stream 1 and turbines.

I like this one I may have to put another bid on it.

During periods of high temperatures, electricity demand increases as people turn up their air conditioners, dehumidifiers, fans, and other cooling equipment. Very high temperature events, like the one in July in the mid-East, tend to push electricity demand to very high levels.

Natural Gas Price Soars On Heat Waves!

..

..

EV competition: TSLA vs BYDDF

Tesla Stock (TSLA) Vs. BYD (BYDDF) Stock: Tesla Earnings Due; China EV Giant Launching Model 3 Rival

https://www.investors.com/news/tesla-stock-vs-byd-stock-comparing-ev-stocks-tsla-byddf/?src=A00220

..

Tesla (TSLA) and BYD Co. (BYDDF) are both fast-growing EV giants. While a lot of attention falls on startups such as Rivian Automotive (RIVN), Lucid (LCID), Nio (NIO), Xpeng (XPEV) and Li Auto (LI), as well as traditional automakers pushing into EVs, such as General Motors (GM) and Ford Motor (F), Tesla and BYD are setting the pace.

BYD easily seized the EV crown from Tesla in the second quarter as sales surged. Tesla deliveries fell significantly vs. Q1, reflecting Shanghai lockdowns that forced the factory there to shut down and then operate at limited capacity for much of the quarter. Tesla still leads in all-electric vehicles.

..

..

..

Novavax's (NVAX 2.26%) long wait is over. After multiple delays, the U.S. Food and Drug Administration (FDA) finally granted Emergency Use Authorization (EUA) to the company's COVID-19 vaccine on Wednesday.

https://www.fool.com/investing/2022/07/15/novavaxs-vaccine-won-us-authorization-5-reasons-wh

..

..

..

..

..

..

Novavax (NVAX) Down as EU Adds Side Effects to COVID Jab Label

https://finance.yahoo.com/news/novavax-nvax-down-eu-adds-122812455.html

Shares of Novavax NVAX fell 26.2% on Jul 14, after the European Medicines Agency’s (EMA) Pharmacovigilance Risk Assessment Committee (“PRAC”) updated the product label of Nuvaxovid, the company’s COVID-19 vaccine, to include some potential side effects like severe allergic reactions and skin problems.

Per the safety report, as of Jun 26, 2022, about 216,000 doses of Nuvaxovid have been administered in the European Union, ever since the company secured approval in the region, last December.

Shares of Novavax have plunged 63.9% so far this year compared with the industry’s 20.6% decline.

Stock Market Retreating since Last December

Semiconductor /Chip sector and the FAANG big tech group are not doing well. Recession continues til next year.

https://stockcharts.com/freecharts/candleglance.html?MU,AMD,NVDA,LRCX,TSM,AMAT,QCOM,KLAC,SOXS,SOXL|D|D20|0

https://stockcharts.com/freecharts/candleglance.html?META,AMZN,AAPL,NFLX,GOOG,TSLA,MSFT,BA,ROKU,ZM|D|D20|0

ZM and ROKU dropped from above 400 t below 100 during this period

Ohio Governor DeWine says Intel delay on $20 billion chip plant is about ‘leverage’

https://www.cnbc.com/2022/07/01/ohio-governor-intel-delay-on-20-billion-chip-plant-about-leverage.html

Ohio Gov. Mike DeWine still has high hopes for Intel, even after the company announced that its plan for a massive semiconductor plant east of Columbus could see its scope scaled back or construction delayed.

“I truly believe that this is the Midwest’s time. I believe it’s Ohio’s time,” DeWine, a Republican, said in an interview.

Intel said it was canceling a July 22 groundbreaking ceremony at the site while the company waits for Congress to pass the CHIPS Act, which includes $52 billion in assistance to the U.S. semiconductor industry to revitalize a key segment of the domestic supply chain.

5D15min_

1Y1d_

..

..

Qualcomm Spikes on Report It Will Remain iPhone 5G Modem Chip Supplier in 2023

Qualcomm shares soared Tuesday on a report that Apple’s push to develop modem chips for the iPhone “may have failed,” and that Qualcomm will remain the exclusive supplier of 5G chips for phones to be launched in the 2023 second half.

Writing on Twitter, the Taiwan-based hardware analyst Ming-Chi Kuo said that Qualcomm (ticker: QCOM) will hold on to 100% of the Apple (AAPL) modem supply for the 2023 iPhones vs the company’s own previous estimate of 20%.

Kuo wrote that he thinks Qualcomm’s revenue and profits for the 2023 second half and 2024 first half “will likely beat consensus” estimates as a result.

The analyst added that he thinks Apple will continue to develop 5G modem chips, “but by the time Apple succeeds and can replace Qualcomm, Qualcomm’s other new businesses should have grown enough to significantly offset the negative impacts caused by the order loss of iPhone 5G chips.”

https://finance.yahoo.com/m/1f1fd244-eec7-3af8-95d7-8ed5e6bfb9f0/qualcomm-spikes-on-report-it.html

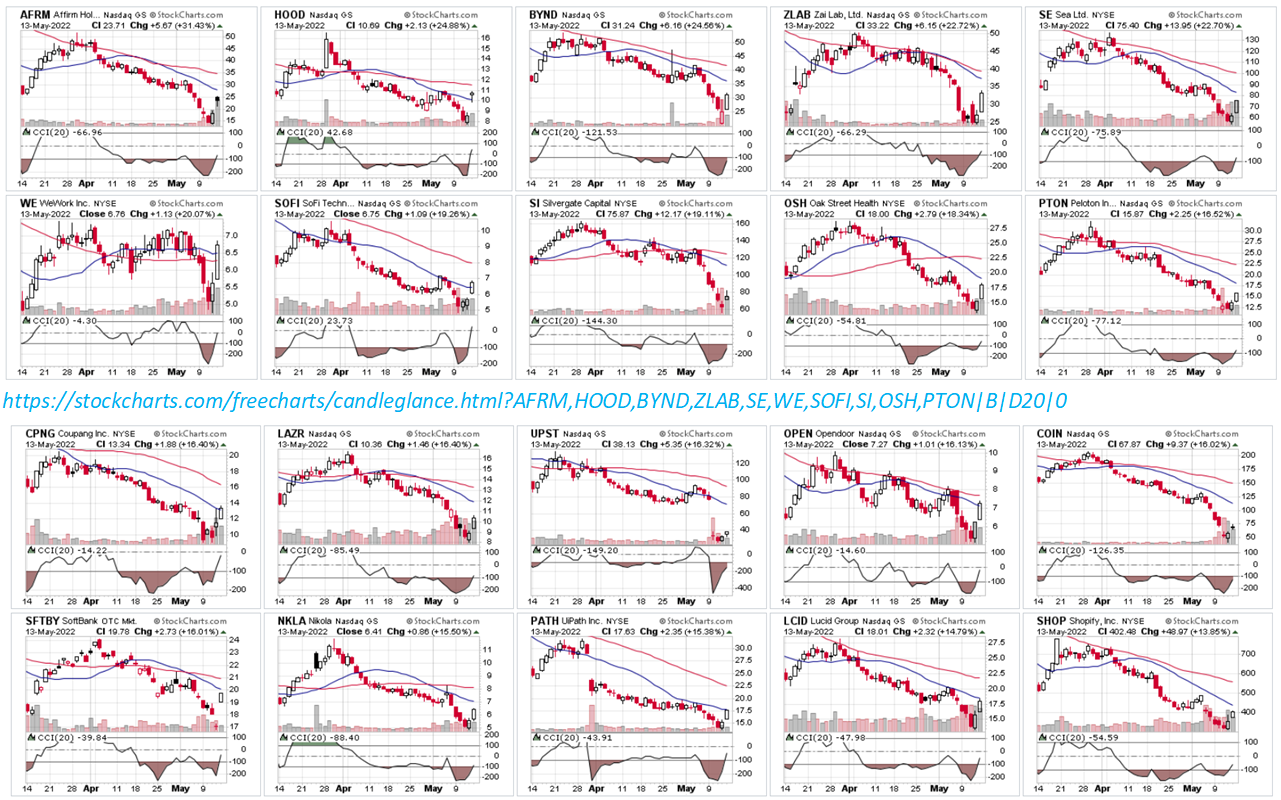

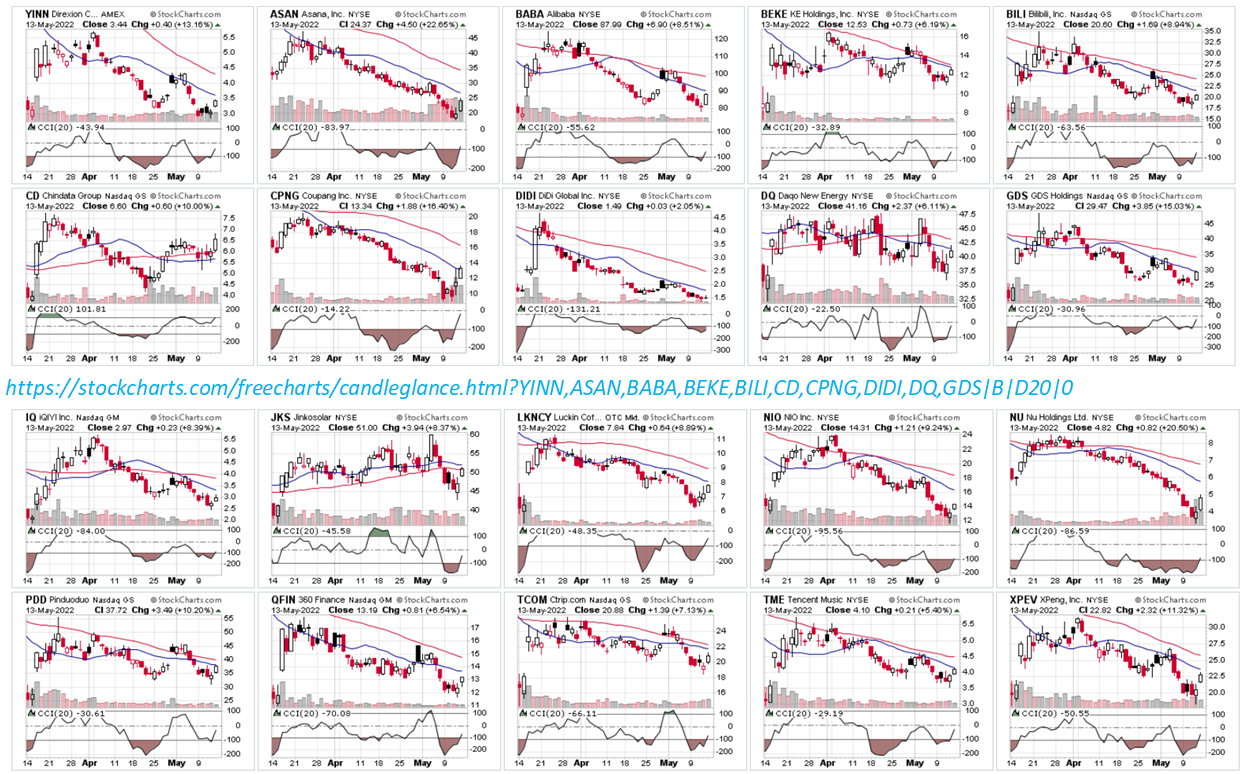

Market bounce after selling off for 5 days since Fed rate hike announcement on May 4

As-of-220513

https://stockcharts.com/freecharts/candleglance.html?AFRM,HOOD,BYND,ZLAB,SE,WE,SOFI,SI,OSH,PTON|B|D20|0

https://stockcharts.com/freecharts/candleglance.html?CPNG,LAZR,UPST,OPEN,COIN,SFTBY,NKLA,PATH,LCID,SHOP|B|D20|0

------------------------------------------------------------------------

https://stockcharts.com/freecharts/candleglance.html?YINN,ASAN,BABA,BEKE,BILI,CD,CPNG,DIDI,DQ,GDS|B|D20|0

https://stockcharts.com/freecharts/candleglance.html?IQ,JKS,LKNCY,NIO,NU,PDD,QFIN,TCOM,TME,XPEV|B|D20|0

Fed raises key rate by a half-point in bid to tame inflation

https://apnews.com/article/federal-reserve-interest-rate-inflation-8d5e20882cdfd7975ebb3bb48a437f11

https://stockcharts.com/freecharts/candleglance.html?VMVAX,VVIAX,VFTAX,TNA,SOXL,QQQ,SPY,IWM,LABU,YINN|B|D20|0

The Federal Reserve intensified its fight against the worst inflation in 40 years by raising its benchmark interest rate by a half-percentage point Wednesday — its most aggressive move since 2000 — and signaling further large rate hikes to come.

The increase in the Fed’s key short-term rate raised it to a range of 0.75% to 1%, the highest point since the pandemic struck two years ago.

The Fed also announced that it will start reducing its huge $9 trillion balance sheet, made up mainly of Treasury and mortgage bonds. Reducing those holdings will have the effect of further raising borrowing costs throughout the economy.

Fed hikes key interest rate

The Federal Reserve, which has kept its benchmark federal funds rate near zero since the coronavirus pandemic disrupted the economy in 2020, has raised the rate for the second time this year to tame inflation.

Key for market key indices bounds for 3%

“A (three-quarters of a point) hike is not something that the committee is actively considering,” he said — a remark that caused stock indexes to jump. Before he spoke, the Dow Jones Industrial Average was up only modestly. By the close of trading, the Dow had soared 930 points, or 2.8% — its best single-day gain since May 2020.

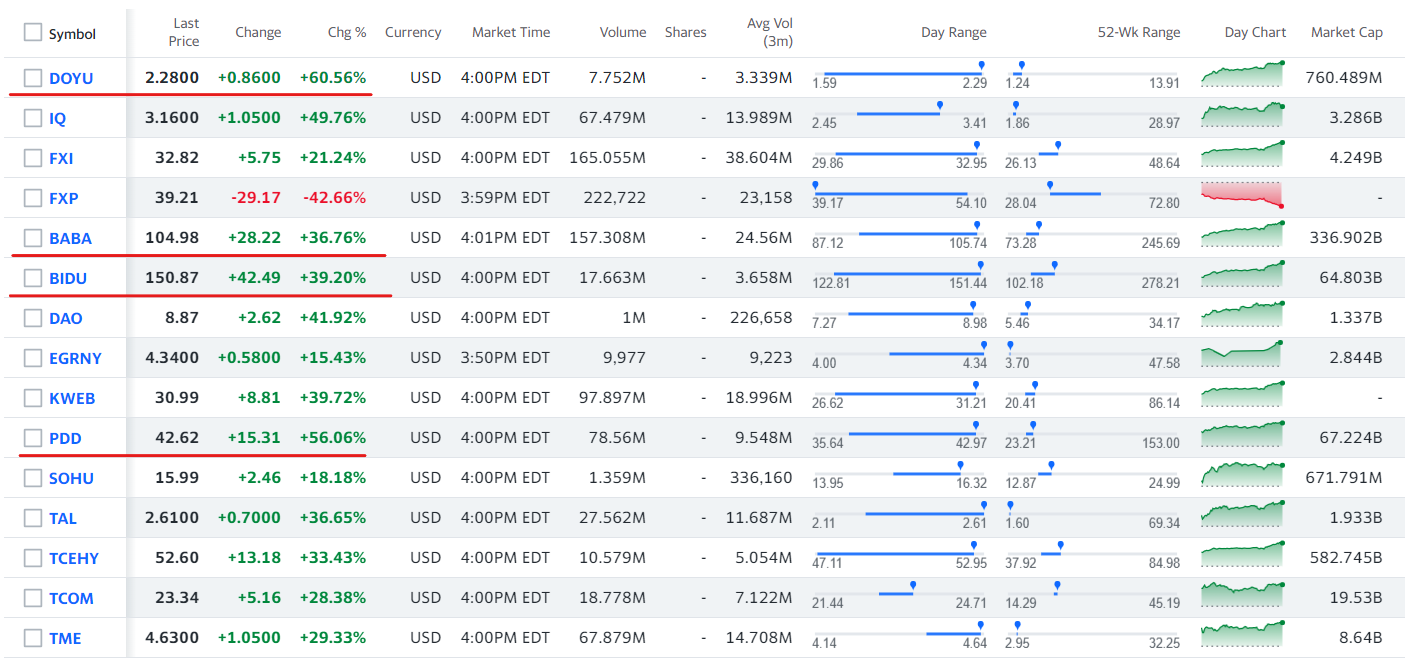

YINN/YANG and FXI/FXP

On March 16, YINN and YANG reversed course after The China Securities Regulatory Commission said it would work with U.S. regulators to find a solution over audit supervision, which has put some China-based stocks in risk of being delisted from U.S. stock exchanges.

YINN, a triple leveraged fund that is designed to outperform the China 50 Index by three times, plummeted more than 63% between Feb. 23 and March 15 before beginning to rebound. YANG, which is inversely correlated to the FTSE China 50 and delivers three times its decline, soared 144% higher over that same time period before suffering a massive sell-off.

..

_

..

..

_

..

China Shares Soar After Beijing Signals Support; Alibaba Up More Than 20%

https://www.wsj.com/articles/china-markets-rebound-on-supportive-government-comments-11647416023

#msg-168163849

Energy Utility

AEP, AES,D, EXC,ETR,FE,PEG,SO

https://stockcharts.com/freecharts/candleglance.html?AEP,AES,D,EXC,ETR,FE,PEG,SO|B|D20|0

..

_

..

..

..

_

..

..

_

..

..

_

..

Exelon Executive: EV Charging Rollout Requires State, Utility Cooperation

https://ih.advfn.com/stock-market/NASDAQ/exelon-EXC/stock-news/87523243/exelon-executive-ev-charging-rollout-requires-sta

Building a national U.S. highway network of electric vehicle charging stations will take utilities working closely with states when federal funding becomes available, said Calvin G. Butler Jr., chief operating officer of Exelon Corp.

The roughly $1 trillion federal infrastructure bill approved by Congress last year included around $5 billion for high-use corridors that connect the entire U.S. and ease driver anxiety about recharging on road trips.

"Some states are very effective and have already set up an infrastructure to receive those block grants. And they're ready to roll," said Mr. Butler at the CERAWeek by S&P Global energy conference.

If utilities do not "lean in" to the process, "the build out may not be as quick and therefore not as efficient," he said.

More than 50 utilities have joined the National Electric Highway Coalition to try to provide charging along major highways by the end of 2023.

Write to Jennifer Hiller at jennifer.hiller@wsj.com

Alibaba and Other Chinese Stocks Got Crushed Today (3-10-22)

https://www.barrons.com/articles/alibaba-stock-china-delisting-51646949382?siteid=yhoof2

https://stockcharts.com/freecharts/candleglance.html?ASAN,BABA,BEKE,BGNE,BILI,CD,CPNG,DIDI,DQ,FUTU,GDS,GRUB,IQ,JD,JKS,LKNCY,NIO,NU,PDD,QFIN,TCOM,TME,XPEV,YUMC,ZLAB|B|D20|0

Alibaba (BABA), Yum China Holdings (YUMC), ACM Research (ACMR), Baidu (BIDU), and Pinduoduo (PDD) were among the Chinese stocks that got hammered in U.S. trading Thursday after the U.S. Securities and Exchange Commission put forward a list of five companies that could be delisted if they don’t measure up to U.S. accounting standards.

The list was a first step in applying the Holding Foreign Companies Accountable Act, which became law on Dec. 18, 2020. The act requires foreign companies to make documents available for accounting purposes and delist them if they can’t meet the requirements. The preliminary list of five companies includes BeiGene (BGNE), Zai Lab (ZLAB), Hutchmed (China) (HCM), Yum China, and ACM.

Not surprisingly, BeiGene declined 5.9%, Hutchmed fell 6.5%, Zai Lab dropped 9%, Yum China slumped 11%, and ACM tumbled 22%.

But Chinese ADRs that weren’t named also fell, including Alibaba, which dropped 7.9%, Baidu, which declined 6.3%, Nio (NIO), which slumped 12%, and Pinduoduo, which tumbled 17%.

ASAN,BABA,BEKE,BGNE,BILI,CD,CPNG,DIDI,DQ,FUTU,GDS,GRUB

..

_

..

..

..

_

..

..

_

..

..

_

..

..

_

..

..

_

..

Are Chips falling Again?

SOXS INTC MU AMD NVDA LRCX TSM AMAT QCOM KLAC

https://stockcharts.com/freecharts/candleglance.html?SOXS,INTC,MU,AMD,NVDA,LRCX,TSM,AMAT,QCOM,KLAC|B|D20|0

..

.

..

_

..

_

..

_

..

_

..

Powell says Fed is poised to hike interest rates to fight inflation despite Ukraine war, market sell-off

https://www.usatoday.com/story/money/2022/03/02/interest-rates-jfed-2022/9332358002/

Despite Russia’s invasion of Ukraine and a sliding stock market, Federal Reserve Chair Jerome Powell told Congress on Wednesday the central bank plans to raise its key interest rate from near zero this month to fight a historic surge in inflation.

Powell said he'll propose a quarter-point hike, rather than a half-point, suggesting that's likely what the Fed's policymaking committee will approve.

“With inflation well above 2% and a strong labor market, we expect it will be appropriate to raise the target range for the federal funds rate at our meeting later this month,” Powell said at a House financial services committee hearing. "I would say we will proceed cautiously along the lines of that plan."

"I'm inclined to propose and support a 25 basis point rate increase," he added.

He noted, however, the Fed is prepared to possibly lift rates more sharply, depending on the effects of the Ukraine war and other developments.

"Inflation is too high – we understand that," Powell said. "It'll take some time but we're going to get it under control."

Billionaire investor Stanley Druckenmiller dumped Facebook parent Meta before its one-day $230 billion wipeout — and took stakes in Snap and Chevron

https://markets.businessinsider.com/news/stocks/stanley-druckenmiller-facebook-meta-snap-chevron-13f-duquesne-office-holdings-2022-2

Billionaire investor Stanley Druckenmiller dumped his holdings in Meta before the company's shocking 26% plunge in share price earlier this month. Meta lost more than $230 billion in value on February 3, the largest one-day loss in US corporate history, after posting a $10 billion operating loss from its metaverse business. It warned of further hefty losses this year due to the impact of Apple's privacy changes.

..

..

..

..

--Stanley Druckenmiller's Duquesne Family Office sold its entire position in Facebook parent Meta last quarter.

--The New York-based firm unveiled new sizeable stakes in Snap and Chevron.

--Druckenmiller also dumped holdings in Penn National Gaming, Moderna, and Zoom Video.

His family office ditched its $35.9 million stake in Facebook parent Meta last quarter, suggesting the social media company's shift in focus to the metaverse may not have reflected an immediately bullish opportunity to him.

Druckenmiller's Duquesne Family Office revealed a new stake worth $67 million in Snap, a Securities and Exchange Commission filing from Monday showed.

The New York-based firm, which manages Druckenmiller's personal wealth, disclosed his biggest acquisition in the last quarter was a near-$100 million position in oil major Chevron.

The former hedge fund boss has been managing his own money through the family office since closing his fund, Duquesne Capital, in 2010. He has a net worth of $10.4 billion, according to the Bloomberg Billionaires Index.

Druckenmiller's firm also dumped stakes in casino operator Penn National Gaming, COVID-19 vaccine developer Moderna, and pandemic-era winner Zoom Video Communications.

Its largest position is a $51 million stake in Coupang, also known as the "Amazon of South Korea."

Recent securities filings from other billionaire investors suggest Big Tech has been fading from preferences even before January's brutal tech sell-off. Quarterly 13F filings, required by the SEC for portfolios holding at least $100 million in US equities, provide a look at positions held by Wall Street's largest stock pickers.

George Soros, the founder of Soros Fund Management, trimmed his positions in Amazon and Alphabet last quarter. His firm also slashed its position in the largest ETF that tracks the Nasdaq by 97% from the previous quarter to a stake now worth just $9.4 million.

In another example of well-timed investments, Warren Buffet's Berkshire Hathaway revealed a billion-dollar stake in Activision Blizzard last quarter, before Microsoft agreed to acquire the video-games company in January.

Read more: 'We've seen the lows' Fidelity's global macro director says. He lays out the 'key ingredient' the Fed uses to keep the stock market stable — and shares the 1 under-the-radar risk that could upset it

Read the original article on Business Insider

https://markets.businessinsider.com/news/stocks/stanley-druckenmiller-facebook-meta-snap-chevron-13f-duquesne-office-holdings-2022-2

White House record boxes recovered at Trump's Mar-a-Lago: report

https://thehill.com/homenews/administration/593065-boxes-improperly-removed-from-white-house-recovered-at-trumps-mar-a?rl=1

The National Archives and Records Administration (NARA) retrieved multiple White House record boxes last month that were improperly kept at former President Trump's Mar-a-Lago property, The Washington Post reported.

The boxes reportedly contained important records of communication, gifts and letters from world leaders, which, according to the Post, is a violation of the Presidential Records Act.

The newspaper added that the boxes retrieved from the Florida estate included correspondence with North Korean leader Kim Jong Un as well as a letter from former President Obama to Trump.

The Post noted that recent administrations have all had some Presidential Records Act violations, including the use of unofficial email and telephone accounts as well as the destruction of emails.

But a source told the newspaper that the transfer to Mar-a-Lago was "out of the ordinary ... NARA has never had that kind of volume transfer after the fact like this."

The Hill has reached out to the National Archives and Trump's office for comment.

The Presidential Records Act, which was put in place following the Watergate scandal, requires administrations to document and maintain records of the White House decisionmaking process.

The new development comes just a week after NARA handed over some Trump White House documents to the House select committee investigating the Jan. 6, 2021, insurrection that were reportedly torn up and taped back together.

The Hill's 12:30 Report: Congress nears yet another funding deadline

Trump 2020 campaign chief to advise Gibbons in Ohio Senate race

The National Archives said last week that the documents "included paper records that had been torn up by former President Trump."

The former president had sued to stop the committee from being given certain documents, with his attorney claiming it was illegal and that Trump wanted to preserve privileges over certain documents.

Peter Thiel to Leave Meta Board to Pursue Trump Agenda

https://finance.yahoo.com/news/peter-thiel-leave-meta-board-210751414.html

1Y1d_

..

Peter Thiel, the tech investor and conservative provocateur who has advised Mark Zuckerberg for nearly two decades at Facebook parent Meta Platforms Inc., will step down from the company’s board after Meta’s annual shareholder meeting in May.

Thiel, 54, who became a director in 2005 after an early investment in Facebook, plans to increase his political support of former President Donald Trump’s agenda during the 2022 election and doesn’t want his political activities to be a distraction for Facebook, according to a person close to Thiel.

His focus will be on backing Blake Masters, JD Vance and others who advance the Trump agenda, the person added, referring to Republican candidates for U.S. Senate.

“Peter is truly an original thinker who you can bring your hardest problems and get unique suggestions,” Zuckerberg said in a statement. “He has served on our board for almost two decades, and we’ve always known that at some point he would devote his time to other interests.”

Thiel helped elect Trump president in 2016 by donating money and speaking on his behalf at the Republican National Convention. When Trump became president, Thiel worked on his transition team while nominating colleagues to fill government positions, including former Thiel Capital Chief of Staff Michael Kratsios, who served as the chief technology officer of the White House until last year. Thiel has continued to support Trump while meeting with members of the Republican Party and members of the far-right in recent years.

Thiel’s departure will mark the end of one of the most productive -- and harshly criticized -- partnerships between a chief executive officer and an investor in all of business. Thiel has been a close adviser to Zuckerberg ever since the duo met through Napster co-founder Sean Parker, when Facebook was still just a social network for college campuses. Thiel was instrumental in shaping Zuckerberg’s ethos during the early days of Facebook and its relentless pursuit of growth.

That relationship continued even as Thiel became more and more controversial in the technology industry, and became a frequent target for Facebook critics and unhappy employees.

Thiel, who is also a co-founder and chairman of Palantir Technologies Inc., was known to advise Zuckerberg on political issues. He was among those reportedly encouraging the CEO not to fact-check political advertisements in the run-up to the 2020 presidential election, a move that many believe benefited Trump. He also joined a dinner with Zuckerberg and Trump at the White House in 2019.

Many Facebook employees were upset with Thiel’s role in backing Trump in 2016 given the former president’s stance on immigration, and allegations of sexism and racism against then-candidate Trump. But Zuckerberg defended Thiel and his role on Facebook’s board in an internal post to employees in October 2016. “We can’t create a culture that says it cares about diversity and then excludes almost half the country because they back a political candidate,” he wrote at the time.

Thiel was one of the first venture capitalists to see the potential in Zuckerberg’s vision. He became the first outside investor in Facebook when he loaned the then-Harvard undergrad $500,000 in 2004.

The bet validated Thiel’s instincts and acclaim as an investor but it had the potential to be far more lucrative. He sold most of his stake in 2012 through a prearranged stock-trading plan at an average price of less than $20 a share.

Those share sales generated more than $1.1 billion in proceeds for the billionaire, before taxes. Had he maintained his stake at its pre-IPO level however, his holding in Meta would now be worth ten times as much.

Masters, a former student of Thiel’s who co-wrote “Zero to One” with him, is running for Senate as a Republican from Arizona. Masters still oversees Thiel’s personal investment vehicle, Thiel Capital.

Vance, who previously invested on behalf of Thiel, is running for the Senate as a Republican from Ohio who is a “conservative outsider.” Vance is best known for his 2016 memoir “Hillbilly Elegy” and is campaigning on promises to abolish the Bureau of Alcohol, Tobacco, Firearms and Explosives and push back against gun laws.

U.S. Crude-Oil Stockpiles Likely Increased in DOE Data, Analysts Say

https://www.marketwatch.com/story/u-s-crude-oil-stockpiles-likely-increased-in-doe-data-analysts-say-update-271643752006

U.S. crude-oil stockpiles are expected to increase from the previous week in data due Wednesday from the Energy Department, according to a survey of analysts and traders by The Wall Street Journal.

Estimates from 11 analysts and traders showed U.S. oil inventories are projected to have risen by 1.1 million barrels for the week ended Jan. 28. Eight of the analysts forecast an increase, while three predicted a decline. Forecasts range from a decrease of 2.2 million barrels to an increase of 2.9 million barrels.

The closely watched survey from the DOE's Energy Information Administration is scheduled for release at 10:30 a.m. ET Wednesday.

Gasoline stockpiles are expected to rise by 1.7 million barrels from the previous week, according to analysts. Estimates range from a decrease of 200,000 barrels to an increase of 3.1 million barrels.

Stocks of distillates, which include heating oil and diesel, are expected to decrease by 1.6 million barrels from the previous week. Forecasts range from a decrease of 3.6 million barrels to an increase of 500,000 barrels.

Refinery use likely fell by 0.1 percentage point from the previous week, to 87.6% of capacity. Forecasts range from a decrease of 0.7 percentage point to an increase of 0.6 percentage point. Two analysts didn't make a forecast.

The American Petroleum Institute, an industry group, said late Tuesday that its own data for the week showed a 1.6-million-barrel decrease in crude supplies, a 5.8-million-barrel rise in gasoline stocks and a 2.5-million-barrel decline in distillate inventories, according to a source.

Netflix Stock Gets Pummeled, Closing At Lowest Level Since April 2020 After Disappointing Earnings & Wall Street Downgrades

https://finance.yahoo.com/news/netflix-stock-gets-pummeled-falling-171254217.html

The rout followed a fourth-quarter earnings report that disappointed many Wall Street analysts and investors and triggered a larger debate about the outlook for streaming in general. While the company missed its fourth-quarter target for subscribers by just 200,000 (8.3 million additions vs. the expected 8.5 million), its weak guidance for the current quarter set off alarms. During their quarterly earnings interview, top executives could not identify any one cause for the slowdown in subscriber growth, instead reiterating confidence in their overall trajectory. “For now, we are just staying calm,” co-CEO Reed Hastings said.

Why Coinbase and Other Crypto Stocks Took a Nosedive Today

https://www.fool.com/investing/2022/01/21/why-coinbase-and-other-crypto-stocks-took-a-nosedi/?source=eptyholnk0000202

The reason for the sell-off is Bitcoin itself. The top cryptocurrency took a more than 10% spill over the last 24 hours. For companies and funds like MicroStrategy that hold sizable Bitcoin positions on their balance sheet, the reason for their stock dropping is pretty straightforward: Lower Bitcoin value means the company is worth less.

Coinbase and Silvergate are a slightly different story, though. Coinbase doesn't own much Bitcoin directly, and Silvergate is merely a bank that operates a crypto exchange from which institutional investors can send U.S. dollars to clients 24/7 (a key function since crypto exchanges never close).

The worry for Coinbase is thus more about the volume of trading in Bitcoin and related cryptos, since the firm earns a fee every time someone places a trade. And for Silvergate, lower crypto prices could mean lower client funds on deposit for it to earn interest on. Nevertheless, a fall in Bitcoin doesn't automatically equate to lower revenue or income for either company.

1Y1d_

..

..

Peloton stock plummets after the company halts production of bikes, treadmills

https://finance.yahoo.com/video/peloton-stock-plummets-company-halts-182039527.html

Production of Peloton’s main stationary bikes will be paused for two months, CNBC reported, citing internal documents. And the company will stop making its treadmill machine for six weeks, starting in February, the news outlet said.

..

Self-driving sensor maker Luminar shares rally on Mercedes-Benz tie-up

https://finance.yahoo.com/news/1-self-driving-sensor-maker-200521322.html

Luxury carmaker Mercedes-Benz will partner with self-driving sensor maker Luminar Technologies Inc to enable fully automated driving on highways for its next-generation vehicles, Luminar's founder said.

Luminar shares surged 24% at $16.75 on Thursday. Luminar said Mercedes-Benz will have 1.5 million shares in Luminar, which will vest over time when certain milestones are met.

..

China's home-grown C919 aircraft expected to be delivered in 2022 - official

https://news.yahoo.com/chinas-home-grown-c919-aircraft-145926411.html

China's home-grown narrowbody C919 aircraft, which is yet to be certified by the country's aviation regulator, is expected to be delivered in 2022, local media cited an official with the state planemaker COMAC as saying on Wednesday.

Wu Yongliang, deputy general manager of COMAC, made the comments on the sidelines of an annual meeting of the political advisory body for Shanghai city, where COMAC is based, according to the government-backed media outlet The Paper.

The C919 aircraft, China's ambition to rival Aibus SE and Boeing Co, earlier missed a previously stated target of achieving certification by the end of 2021, with the Civil Aviation Administration of China (CAAC) saying the programme only completed 34 certification tests out of 276 planned.

When asked about the impact of the COVID-19 pandemic on the C919 programme, Wu said the impact was manageable and relevant work was being carried out in an orderly manner, according to The Paper.

Reuters in September reported COMAC has found it harder to meet certification and production targets for the C919 amid tough U.S. export rules, according to people with knowledge of the programme.

Leeham News analyst Scott Hamilton said in a note on Monday he expects the entry into service of the jet to be in 2023 or 2024. (Reporting by Stella Qiu, Ella Cao and Ryan Woo; Editing by Bernadette Baum)

Microsoft to Acquire Activision Blizzard for Nearly $70 Billion

AVTI jumps 30%

Nucor Stock Dives From Near Buy Point On Profit Warning

https://finance.yahoo.com/m/60782e68-04dd-37e2-8281-756e6bac0467/nucor-stock-dives-from-near.html

Steel mills earnings will be comparable to Q3, Nucor said, downshifting from an earlier view. Nucor stock fell after a breakout attempt Tuesday.

..

1Y1d_

..

..

Dow tumbles 900 points for worst day of year on fears of new Covid variant, S&P 500 drops 2%

https://www.cnbc.com/2021/11/26/stock-futures-open-to-close-market-news.html

Airlines __

.

.

Cruise __

.

.

CASINO/HOTEL __

.

.

Entertainment __

.

.

Retails __

.

.

.

Chinese Stock __

.

Gainers/Work from Home __

.

Drugs/Health Care __

.

.

|

Followers

|

17

|

Posters

|

|

|

Posts (Today)

|

0

|

Posts (Total)

|

489

|

|

Created

|

11/07/08

|

Type

|

Free

|

| Moderators | |||

Direxion 3X Russell Funds

|| http://www.direxionshares.com/etfs || 3X Bull: BGU TNA ERX FAS || 3X Bear: BGZ TZA ERY FAZ || ETF Summary || 2X Commodity/Yen ETF || ETF Options ||

| ETF | Large Cap | Small Cap | Energy | Financial | ||||

|  |  |  |  |  |  |  | |

| 3x | BGU | BGZ | TNA | TZA | ERX | ERY | FAS | FAZ |

| Top Holding | Top Holding | Top Holding | Top Holding | |||||

| 2x | DDM | DXD | UWM | TWM | DIG / DXO | DUG / DTO | UYG | SKF |

| 1x | IWB | DOG | IWM | RWM | XLE | DDG | XLF | SEF |

| Options | Mar 35.0 call | Mar 30.0 call | Mar 40.0 call | Mar 10.0 call | ||||

| ETF | ||||||||

|  |  |  |  |  |  |  | |

| 3x | SPXL | SPXS | TNA | TZA | ERX | ERY | FAS | FAZ |

| Top Holding | Top Holding | Top Holding | Top Holding | |||||

| 2x | DDM | DXD | UWM | TWM | DIG / DXO | DUG / DTO | UYG | SKF |

| 1x | IWB | DOG | IWM | RWM | XLE | DDG | XLF | SEF |

| Options | Mar 35.0 call | Mar 30.0 call | Mar 40.0 call | Mar 10.0 call | ||||

|| Large/Small Cap Comparison || Russell 1000 Index || ETF - Bios || 36 New Fund || 36 New Fund ||

. . . . . . . . . . . . . . . . . . . DOW 30. . .

..

. . . . . . . . . . . . . . . . . . . S&P 500. . .

..

. . . . . . . . . . . . . . . . . . . QQQ. . .

..

. . . . . . . . . . . . . . . . . . . Russell 2000. . .

..

. . . . . . . . . . . . . . . . . . . Semi. . .

..

. . . . . . . . . . . . . . . . . . . Bio. . .

..

. . . . . . . . . . . . . . . . . . . Financial. . .

..

. . . . . . . . . . . . . . . . . . . Oil./Gas . .

..

..

..

. . . . . . . . . . . . . . . . . . . Gold. . .

..

..

. . . . . . . . . . . . . . . . . . . Real Estate. . .

..

. . . . . . . . . . . . . . . . . . . . . US Dollar. . .

..

. . . . . VIX. . .inverse VIX ETF (SVXY, ZIV) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . VIX ETF (UVXY, TVIX)

..

ETF. . .EWH (HK), EWT(TW), EWY(KR), EWJ(JP), EWM(Malaysia)

ishares msci etf => https://www.ishares.com/us/products/etf-investments#!type=ishares&fr=43526&fc=43537%7C43769%7C43544%7C43568%7C43570%7C43571%7C43579%7C43582%7C43593%7C43606%7C43614%7C43617%7C43624%7C43628&usS=136&usS3=144%7C159%7C162%7C165%7C168%7C171%7C174&view=keyFacts

..

..

.

.

.

.

.

.

. . . . . . . . . . . . . . . . . . . Casino. . .

..

ProShares UltraProshares: https://www.proshares.com/funds/umdd.html

Leveraged 3X Long/Bull ETF List: https://etfdb.com/themes/leveraged-3x-long-bull-etfs/

Leveraged 3X Inverse/Short ETF List: https://etfdb.com/themes/leveraged-3x-inverse-short-etfs/

. . . . . . . . . . . . . . . . . . . . SPY. . . . . . . . . . . . . . . . . . . . . . . .. . . . . . . . . .. . . . . . . . . Tech . . . . . . . . . . . .. . .. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . Emerging Market . . . . . . . . . . . . . . . . . . . . . .. . . . . . . . . . . . . . . . . . . . . . Developed Market . . .

http://www.velocitysharesetns.com/tvix

http://etfdb.com/index/nasdaq-biotechnology-index/

http://stockcharts.com/h-sc/ui?s=%24INDU&p=D&yr=1&mn=9&dy=0&id=p14393644199

| Volume | |

| Day Range: | |

| Bid Price | |

| Ask Price | |

| Last Trade Time: |