Register for free to join our community of investors and share your ideas. You will also get access to streaming quotes, interactive charts, trades, portfolio, live options flow and more tools.

Auctus gets their shares 10/30, at 50% of the lowest trading price in the previous 25 days.... that’s a hard pill to swallow

Get over it bro and move on.

Hi Trow

Looking forward to contribute to this board. Thank you for setting it up. Great job.

Looking forward to the new name. DATA443 and new ticker atds "All Things Data Security! With more sales and cross selling we should see uplist to next OTCBB level. Stock split will help towards major goal Nasdaq

Glta

Nothing new. These info are out in the open for people to digest i.e SEC reporting company.

Next.

Thanks Trow for creating a new board. Bye Bye LDSR!

Next up - Q3 financials, uplist to QB maybe, possible resolution to court case, N8 finalize, CCPA coming Jan 2020.

Its looking positive in my opinion.

1 positive..not associated with the tire company anymore

Rs's usually stink

Up coming dilution dd package:

Convertible notes payable consists of the following

1) Non-interest bearing convertible note held by Blue Citi LLC (“Blue Citi”) for the original principal of $125,000, payable on demand and convertible at the option of the holder into common shares at the conversion price of $0.00005 per share. The outstanding principal for the convertible note was $0 as of June 30, 2019 and $75,000 as of December 31, 2018. During the six months ending June 30, 2019 Blue Citi converted $75,000 of this convertible note into 1,500,000,000 shares of common stock.

2) Convertible note held by Blue Citi for a total principal of $1,083,500 as of June 30, 2019. On June 19, 2019, the Company and Blue Citi entered into an Amendment and Forbearance Agreement. Under this agreement, Blue Citi agreed to forbear from enforcing its rights under the note with regard to certain possible events of default, and further agreed to amend the note as follows:

a) Blue Citi can convert the note into shares of the Company’s common stock only upon the earlier of (i) February 2020 or (ii) any event of default under the note.

b) The face amount of the note was increased to $1,083,500.

c) The interest rate was increased to 12% per annum.

d) The conversion price shall be equal to 85% of the lesser of the lowest trading price of the Company’s common stock for (i) the 20 days immediately preceding June 19, 2019 or (ii) the 20 days immediately preceding the date of conversion.

Because the terms of the conversion features have changed, the Company has determined the derivative liability features no longer exist and has reduced the derivative liability associated with this note to $0 as of June 30, 2019, from $3,276,331 as of December 31, 2018.

3) Convertible note held by SMEA2Z, LLC for a total principal of $242,000 as of June 30, 2019. On June 19, 2019, the Company and SMEA2Z entered into an Amendment and Forbearance Agreement. Under this agreement, SMEA2Z agreed to forbear from enforcing its rights under the note with regard to certain possible events of default, and further agreed to amend the note as follows:

a) SMEA2Z can convert the note into shares of the Company’s common stock only upon the earlier of (i) April 15, 2020 or (ii) any event of default under the note.

b) The face amount of the note was increased to $242,000.

c) The interest rate was increased to 12% per annum.

d) The conversion price shall be equal to 65% of the lesser of the lowest trading price of the Company’s common stock for (i) the 20 days immediately preceding June 19, 2019 or (ii) the 20 days immediately preceding the date of conversion. The note (i) accrues interest at the rate of 8% per annum and (ii) can be converted into shares of our common stock at a 30% discount to the lowest trading price during the twenty consecutive trading days immediately preceding the date of conversion.

Because the terms of the conversion features have changed, the Company has determined the derivative liability features no longer exist and has reduced the derivative liability associated with this note to $0 as of June 30, 2019, from $788,724 as of December 31, 2018.

14

4)

Convertible note held by AFT Funding Group, LLC for a total principal of $210,000 as of June 30, 2019. On June 19, 2019, the Company and AFT Funding Group entered into an Amendment and Forbearance Agreement. Under this agreement, AFT Funding Group agreed to forbear from enforcing its rights under the note with regard to certain possible events of default, and further agreed to amend the note as follows:

a) AFT Funding can convert the note into shares of the Company’s common stock only upon the earlier of (i) April 15, 2020 or (ii) any event of default under the note.

b) The face amount of the note was increased to $242,000.

c) The interest rate was increased to 12% per annum.

d) The conversion price shall be equal to 65% of the lesser of the lowest trading price of the Company’s common stock for (i) the 20 days immediately preceding June 19, 2019 or (ii) the 20 days immediately preceding the date of conversion. The note (i) accrues interest at the rate of 8% per annum and (ii) can be converted into shares of our common stock at a 30% discount to the lowest trading price during the twenty consecutive trading days immediately preceding the date of conversion.

Because the terms of the conversion features have changed, the Company has determined the derivative liability features no longer exist and has reduced the derivative liability associated with this note to $0 as of June 30, 2019, from $394,958 as of December 31, 2018.

5)

Convertible note held by Auctus Fund, LLC for a total principal amount of $600,000 as of June 30, 2019. The note (i) accrues interest at the rate of 12% per annum, (ii) can be converted into shares of our common stock at the lesser of $0.0015, or a 50% discount to the lowest trading price during the twenty-five consecutive trading days immediately preceding the date of conversion, (iii) is convertible in whole or in part at any time after the four (4) month anniversary of the issuance of the Note, and (iv) has an original issue discount of $54,000.

6) Convertible note held by Redstart Holdings Corp., for a total principal amount of $63,000 as of June 30, 2019. The note (i) accrues interest at a rate of 22% per annum, (ii) can be converted 180 days from June 12, 2019 at a discount of 39% to the lowest trading price during the twenty consecutive trading days immediately preceding the date of conversion, (iii) is due and payable June 12, 2020, and (iv) has an original issue discount of $3,000.

NO

long pending name change - done

Today, the Company announced a change in its trading symbol. The new trading symbol will become OTCPK: ATDS which the Company feels more appropriately reflects the activities of the business – ‘All Things Data Security™’. For the next 20 business days (starting October 16, 2019) – the trading symbol will temporarily be "LDSRD," then will begin trading under the new ticker symbol, "ATDS."

Welcome to the new board! You might remember the ceo from previous scams like $a$p$h$d and landstar! Same scams different name glta

http://www.globenewswire.com/news-release/2019/10/15/1929862/0/en/LandStar-Inc-Announces-Corporate-Name-Change-Symbol-Change-Reverse-Stock-Split.html?fbclid=IwAR140eZ2K9ISWIdt0aDzKs5UIyhlVmsB-uygKDeNKXmSF3qQRsW3GAJsBcY

LandStar Inc. Announces Corporate Name Change, Symbol Change, Reverse Stock Split

Significant Corporate Changes Lay Foundation for Next Phase

RALEIGH, N.C., Oct. 15, 2019 (GLOBE NEWSWIRE) -- LandStar, Inc. (OTCPK: LDSR) (“LandStar” or the “Company”), the parent company of Data443 Risk Mitigation, Inc. (“Data443”), a leading data security and privacy software company, today announced that it has completed several significant corporate milestones.

“We are pleased to continue delivering on our commitments to shareholders and the marketplace. Our customer wins, product deliveries and continued progress in public markets demonstrates our teams’ commitment and capabilities,” stated Data443 Risk Mitigation, Inc. founder and LandStar, Inc. CEO Jason Remillard. “Completing these corporate developments enables us to strengthen the brand of our company for current and potential customers, while putting our stock in a better position to attract investment within the investment community. We look forward to announcing our third quarter financials in the near future and focusing on a strong finish for the year.”

Today, the Company announced a change in its trading symbol. The new trading symbol will become OTCPK: ATDS which the company feels more appropriately reflects the activities of the business – ‘All Things Data Security™’. For the next 20 business days (starting October 16, 2019) – the trading symbol will temporarily be LDSRD, then will begin trading under the new ticker symbol, ATDS.

The Company also announced a corporate name change in the State of Nevada. Effective October 15, 2019, LandStar, Inc. amended its corporate name registration to become Data443 Risk Mitigation, Inc.

Additionally, the Company announced a 1:750 reverse split of its outstanding common stock. The reverse stock split will become effective October 16, 2019 (the “Effective Date”). The company’s common stock is expected to begin trading on a split-adjusted basis when the markets open on October 16, 2019 under the trading symbol “LDSRD”. The new CUSIP number following the reverse split will be 23804G104.

Every 750 shares of the Company’s issued and outstanding common stock were automatically converted into one issued and outstanding share of common stock, with no change in par value per share. As a result, each stockholder's percentage ownership interest and proportional voting power remains unchanged and the rights and privileges of the holders of the Company's common stock are unaffected. Stockholders are not required to take any action. (Example: in a 1-for-750 reverse split, a shareholder that held 75,000 shares at $0.01 per share, for a total value of $750, will now own 100 shares, or 1/750 the number of shares as previously, at a value of $7.50 per share, or 750 times the pre-split price, for the same total value of $750.)

No fractional shares will be issued following the reverse split. Stockholders holding fractional shares as a result of the reverse stock split will be rounded up to the next whole share.

Please contact your broker or Matthew Abenante, Investor Relations for the Company, with any questions.

|

Followers

|

8

|

Posters

|

|

|

Posts (Today)

|

0

|

Posts (Total)

|

17

|

|

Created

|

10/15/19

|

Type

|

Free

|

| Moderators | |||

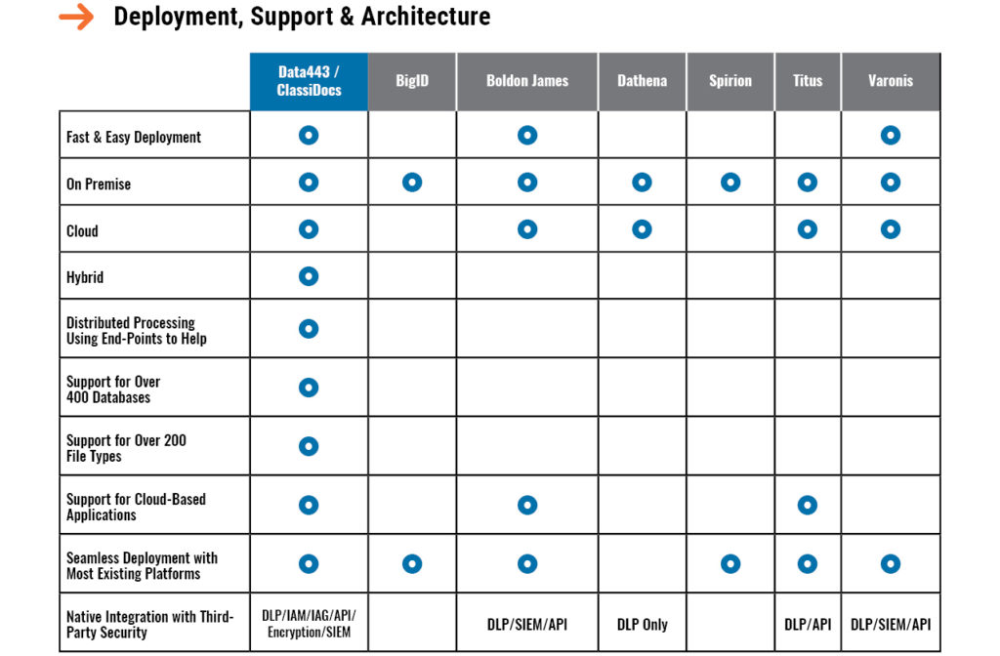

Rapidly combining some of the best DRM, eDiscovery, Classification, Identity Governance and DLP technologies into a solution positioned for Privacy and Compliance activities – across virtually any data source and device. The only provider to offer a full GDPR/CCPA request management platform, and an open sourced platform that has over 10,000 active installations.

The ARALOC Boardroom by Data443™ Content Distribution and Board Management System provides custom configured and branded native apps to streamline your corporate board governance and security guidelines. The only product on the market that features an array of user-friendly board content publishing and distribution automation controls, Boardroom requires minimal training and support. Using THE ARALOC Content Library, board members can use dedicated apps to view board materials from their mobile or desktop devices online or offline. With industry-leading fully enabled Rich Media Support, members are able to upload and encrypt all file formats for distribution. System notifications and automatic synchronization ensure board members always have the most recent board content materials. Multi-level views allow multiple boards to be houses and controlled from one central location.

GDPR Compliance

The GDPR Framework WordPress Plugin by Data443 allows for an easy, fast and cost-effective compliance solution for the GDPR. Achieve a fast time-to-value with 12 GDPR articles being met straight out-of-the-box. In a few clicks you can handle DSARs, consent, report and many other GDPR requirements. We are developer-friendly. Everything can be extended; every feature and template can be overridden. We are excited to announce we just hit 100k downloads and 10k active installations.

CCPA Compliance

Data443 ClassiDocs™ allows for an easy, fast and cost-effective compliance solution for the new CCPA. Achieve a fast time-to-value with the five key requirements of CCPA being met straight out-of-the-box. Data443 ClassiDocs™ supports over 200 file types and 400 databases while integrating with your existing DLP/CASB/SIEM/Cloud Solutions. Data443 ClassiDocs™ is the solution for classification, governance, and discovery across all data sources.

ClassiDocs™ takes the effort out of classifying your data by applying the same rules, technology, machine learning, and ongoing classification stewardship throughout the organization. This ensures always-accurate, continually relevant data security for your whole IT estate. ClassiDocs™ is purposefully user-centric to increase adoption and adherence with no training. Ease-of-use control with minimal interruptions and your-company-specific branding allows users to engage quickly and make fewer mistakes. Administration is simple via an easy-to-understand, centralized control panel that delivers both preset and customizable analytics.

LandStar, Inc. (OTCPK: LDSR) (“LandStar” or the “Company”), the parent company of Data443™ Risk Mitigation, Inc. (“Data443”), a leading data security and privacy company, today announced the completion of joint efforts with finance partners resulting in the favorable new terms on existing debt. Additionally, the Company has received notice of final conversion of the $125,000 legacy convertible note issued by the Company in 2014 and subsequently acquired by Blue Citi LLC (“Blue Citi”).

Effective June 19, 2019 the Company and three existing note holders have agreed as follows:

LandStar, Inc. (OTCPK: LDSR) (“LandStar” or the “Company”), the parent company of Data443™ Risk Mitigation, Inc. (“Data443”), a leading data security and privacy software company, today filed its Form 10-Q with the U.S. Securities and Exchange Commission (the “SEC”) to disclose its financial results for the first quarter ended March 31, 2019.

Key Takeaways:

Management Commentary:

Jason Remillard, Founder of Data443 and CEO of LandStar, commented, “I consider the first quarter 2019 to be the start of our three-phase program to reach the critical scale and revenue volumes that support our aggressive business plan. As per the results, these capabilities – both product and corporate – are delivering. Our performance in the first quarter was predicated on the growing demand for our suite of products and services, particularly as data security continues to dominate the news today.

“On the acquisition front, we expect to announce an updated pipeline of new strategic acquisition opportunities during Q2. These acquisitions reflect our efforts to providing additional products and services to our existing and expanding customer base.

“Great customer wins, renewals, product and strategic partnerships all helped to round out a great Q1. I believe we are on the cusp of a major operational inflection point in our business and look forward to the anticipated creation of long-term value for our shareholders and customers,” concluded Mr. Remillard.

LandStar, Inc. (OTCPK: LDSR) (“LandStar” or the “Company”), the parent company of Data443™ Risk Mitigation, Inc. (“Data443”), a leading data security and privacy company, announced today that it has received notice from the Securities and Exchange Commission (the “SEC”) that the SEC has completed its review of the Form 10 Registration Statement as filed with the SEC on January 11, 2019; and, amended on April 24, 2019. The Form 10 was effective as of March 12, 2019. The completion of review by the SEC further confirms the Company’s commitment to being subject to the reporting requirements of the SEC, and specifically of the Exchange Act of 1934, as amended. While the Company has already filed an Annual Report on Form 10-K and five (5) periodic reports on Form 8-K since the filing of the Form 10, the Company will not be required to file any further amendments to the Form 10.

Jason Remillard, Chief Executive Officer of the Company and founder of Data443, said, “The completion of the review of our Form 10 by the SEC is yet another milestone achieved in our continued growth. We view it as a validation of our reporting process and financial management, which continues to evolve. Similar to when the Form 10 went effective back in March, this also underscores our commitment to provide our investors with transparency and accountability.”

“We are excited to bring Mr. Dawson onto the Data443 team to help us achieve our growth goals and support both our investor and client communities,” said Jason Remillard, founder and CEO of Data443. “His expertise will make an immediate and long-term impact on our business and we are especially enthusiastic about his ability to build and manage finance and accounting practices within complex, highly-regulated industries.”

LandStar, Inc. (OTCPK: LDSR) (“LandStar” or the “Company”), the parent company of Data443™ Risk Mitigation, Inc. (“Data443”), a leading data security and privacy software company, today filed its Form 10-K with the U.S. Securities and Exchange Commission (the “SEC”) to disclose its financial results for the fourth quarter and fiscal year ended December 31, 2018.

Key Takeaways:

Management Commentary:

Jason Remillard, Founder of Data443 and CEO of LandStar, commented, “2018 was much more than a transitional year for LandStar; it was a major foundational year in which we established the platform that the Company is being built upon. I’m excited to say that we are now at the point where we can accelerate the pace of our planned corporate actions, as well as continue on our product development and acquisition roadmap.”

“These results only validate what has been our growth strategy all along; to acquire highly successful companies with complementary technologies and skill-sets that can easily fit and rapidly enhance our market positioning, provide a healthy customer base, and that are accretive to our bottom-line. I’m happy to report our initial revenues, and look forward to subsequent quarterly reports, when the full-quarter’s contribution of revenues from our acquired businesses will be reflected in our financial statements.”

LandStar, Inc. (OTCPK: LDSR) (“LandStar” or the “Company”), the parent company of Data443™ Risk Mitigation, Inc. (“Data443”), a leading data security and privacy company, announced that it is has launched its online ordering platform for the ARALOC™ Board Management product.

Jason Remillard, Chief Executive Officer of LandStar and founder of Data443™, commented, “As we continue our marketing campaigns, the ability to order and provision online is an important step in the customer buying journey. Our trial and buy portal has been long planned and we are pleased to offer several different editions of the leading ARALOC Board Management Software platform. We will introduce more purchase options for the ARALOC platform and the rest of our product catalogue over the near term.”

"Data443 has joined forces with Business Partner Solutions, Inc. (BPS), a U.S.-based security focused value-added reseller (VAR). Founded in 2005, BPS is a certified CPUC and Woman Owned and Operated enterprise, a proven go-to for security VAR focused on providing emerging but proven security and compliance solutions to its customers. These clients include many Fortune 500 companies, public utilities, healthcare and retail. The partnership expands U.S. market coverage for Data443’s growing portfolio of products and aligns the company with a leading reseller that has specific expertise in data security, privacy compliance, and risk mitigation."

Data443, a leading data security and privacy company, announced today the completion of the audit of its Consolidated Annual Financial Statements for the fiscal years ending December 31, 2016 & 2017. An independent auditor (which is a PCAOB registered accounting firm) completed two consecutive years of the audits of the Company’s financial statements within the guidelines of Generally Accepted Accounting Principles (GAAP). The results will be filed without delay with OTC Markets as an amendment to the Company’s previously filed financials for its year ending December 31, 2017.

https://www.data443.com/pr-n8-letter-of-intent/

November 8, 2018

LANDSTAR, INC. ANNOUNCES THAT DATA443 HAS SIGNED LETTER OF INTENT TO ACQUIRE N8 IDENTITY IN ACCRETIVE DEAL VALUED AT $3.2 MIL IN CASH AND STOCK

Data443, a leading data security and privacy company, announced today that the company has signed a letter of intent to acquire all technology, sales assets, and customers of N8 Identity (“N8”),a leader in agile, cloud-based identity governance solutions. N8 Identity had revenues of 2.6 mil in last 12 months and had EBIT of 700k+. Landstar subsidiary Data 443 acquired N8 for $3.2 Million in cash and restricted stock.

https://www.data443.com/pr-data443-completes-araloc-acquisition/

October 25, 2018

LandStar, Inc. Closes Recurring Revenue, High Margin Generating Acquisition In $8 Billion Data Security Market Segment

Data443, a leading data security and privacy company, announced the closing of the ARALOC™ acquisition.

Jason Remillard, Chief Executive Officer of LandStar and founder of Data443, commented, “We have closed the ARALOC deal and continue to extend our lead as the top Privacy Compliance product suite in the market. The acquisition of ARALOC adds an unmatchable capability to our growing portfolio of cloud, data and security services to meet the rapidly expanding consumer privacy market. Demand for consumer privacy solutions was ignited when congressional testimony brought to light the personal privacy violations inherent within the internet customer relationship practices of Fortune 500 companies like Facebook. LandStar is in a position to dominate that demand.”

Recorded audio of the session can be accessed here:

https://www.data443.com/investor-faq/

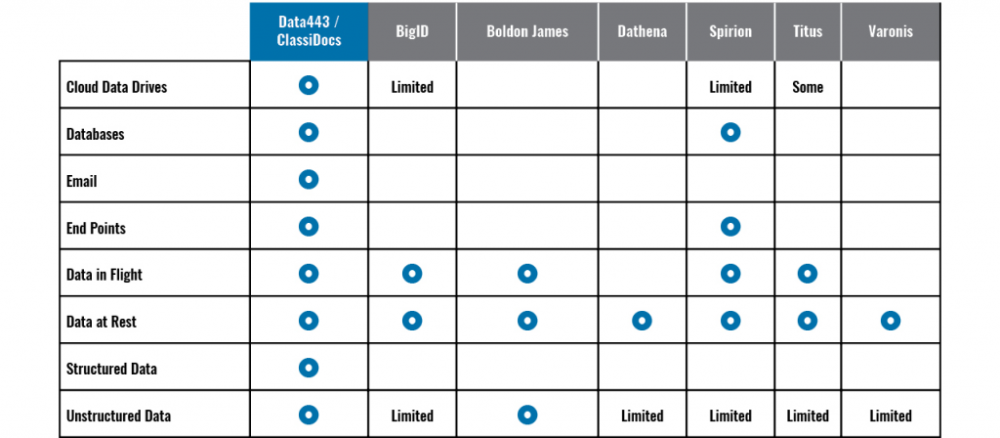

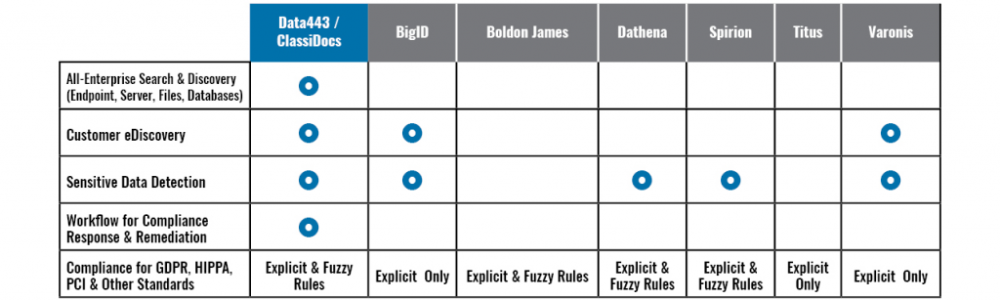

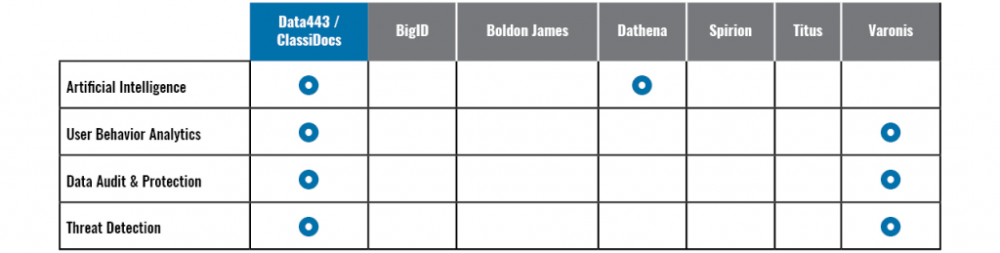

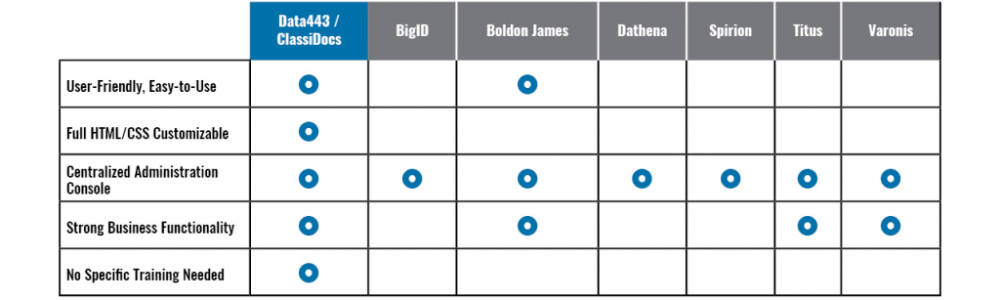

Data443/ClassicDocs Competitive Review

\

\

\

\

\

\

\

Classidocs Pricing

ARALOC Pricing

WORD PRESS PLUGIN INFO

Data443 Secures Global Rights to Leading WordPress GDPR Solution

https://wordpress.org/plugins/gdpr-framework/advanced/

| Today | 188 |

|---|---|

| Yesterday | 156 |

| Last 7 Days | 2,877 |

| All Time | 232,028 |

"A Serious Effort at GDPR Compliance. GDPR compliance is a complicated matter. Definitely not something you want to wing by yourself. And definitely not something you want to ignore. The obvious solution is a plugin that guides you through the process of making your site compliant. This plugin is the easiest and most comprehensive attempt that I have found so far. It has a wizard that walks you through the setup and lots of options you can configure afterward. It even builds a page where users can download and delete their personal data. It’s written by developers for developers, so you can customize just about everything. In today’s world, you’d expect to pay a hefty annual subscription for something like this. But the developers are providing it for free. All they’re asking is a five-star review, and I’m happy to give it to them. Thanks guys!"

"My colleagues and I are amazed at the functionality of this plugin. We researched many solutions to adding GDRP compliance to our client’s sites and your FREE plugin was the best. The documentation you include was essential to our understanding of GDRP.

We were also impressed at how fast the support team responded with fix a recent glitch with a new feature."

"This plugin cuts the time it takes to understand the new guidelines in half! So easy to use, everyone should be using it."

"Very happy with this plugin. There is attention to detail and it works well for visitors wanting to download the data we have. Very much hope they add the cookie policy part soon so we can have everything just under this one plugin. Big thanks and appreciation to the developers "

| Volume | |

| Day Range: | |

| Bid Price | |

| Ask Price | |

| Last Trade Time: |