01-26-2024

RT77OOH 5K/10KW RACK SYSTEMS

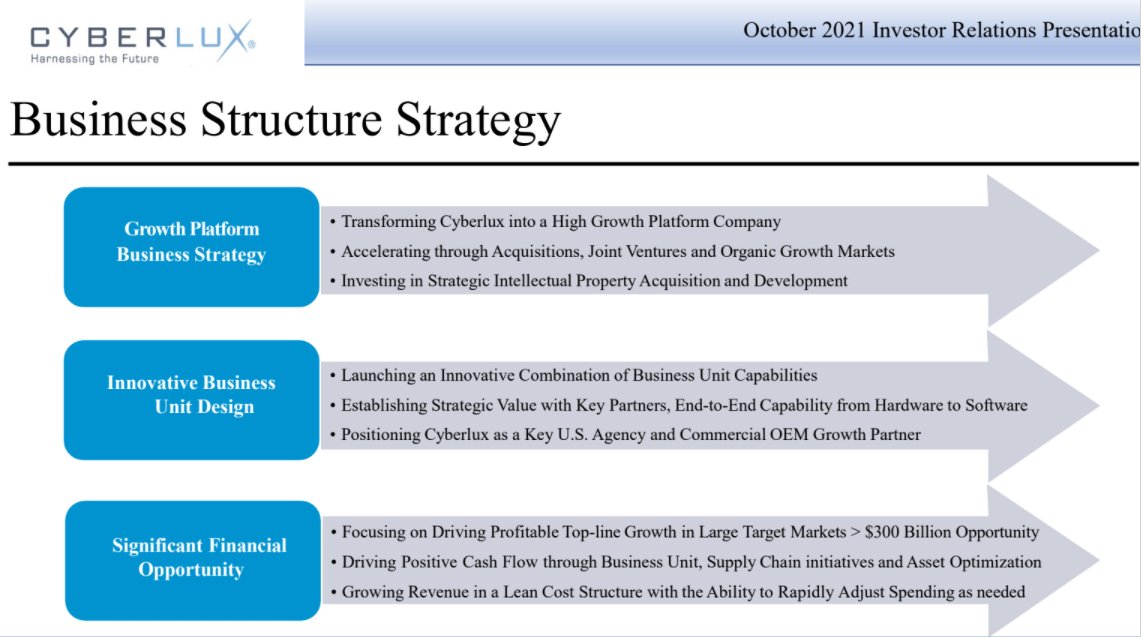

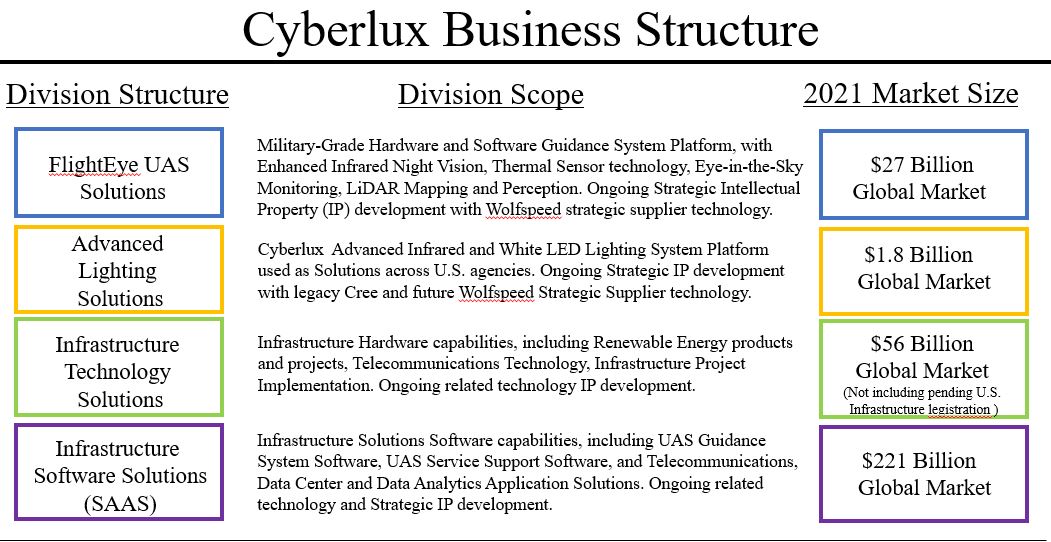

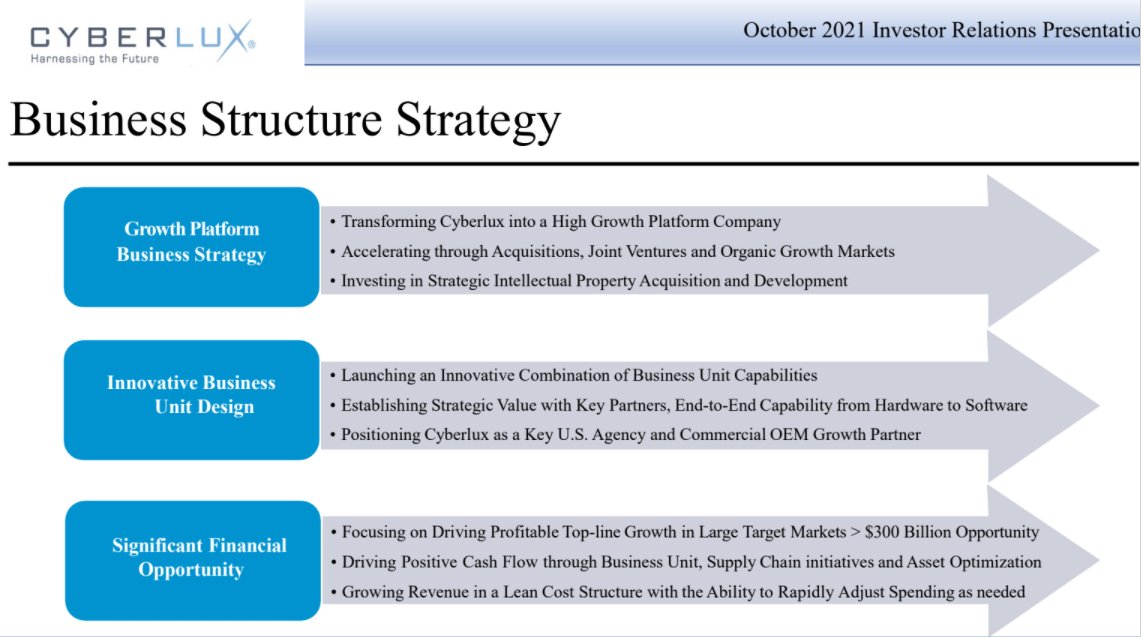

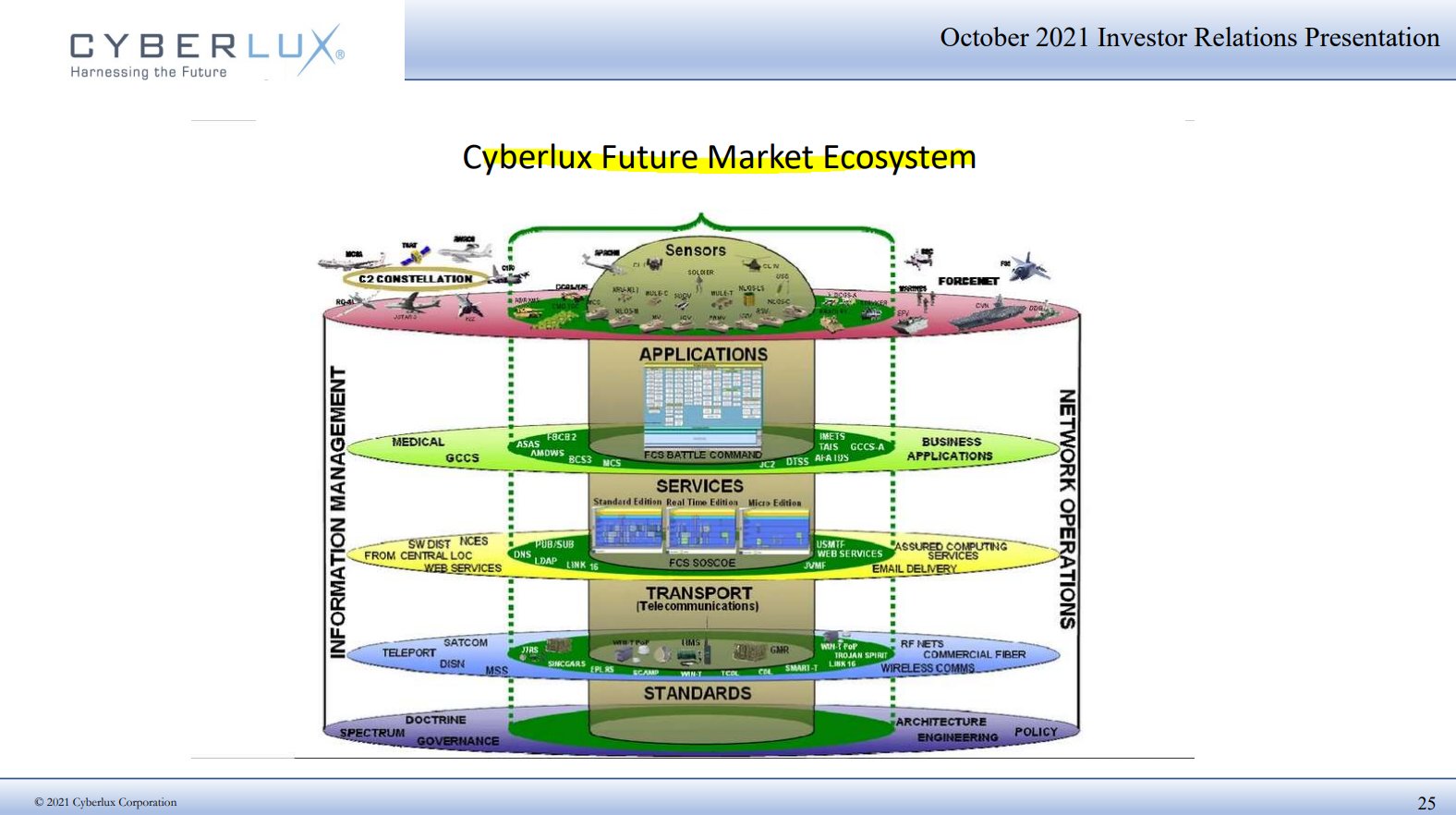

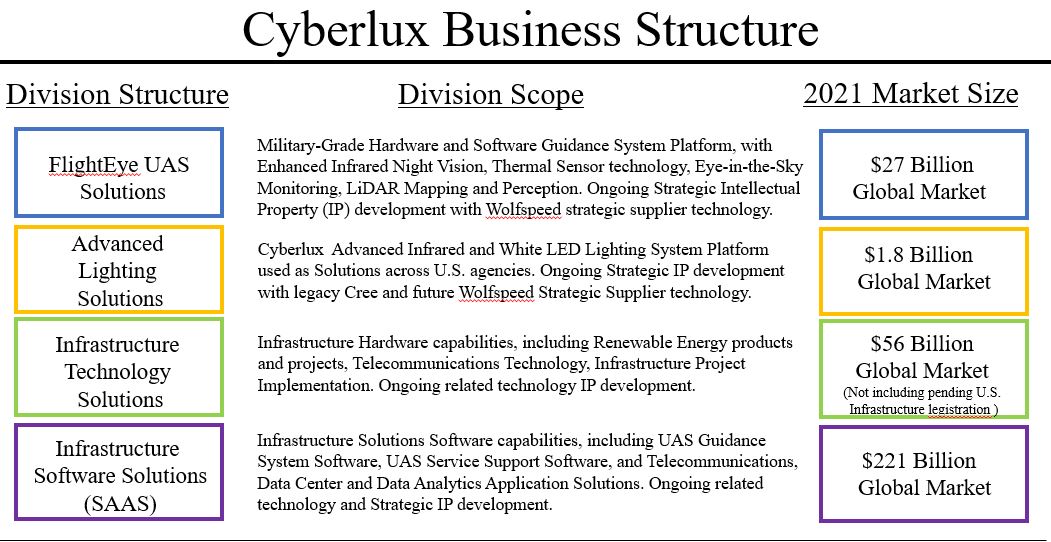

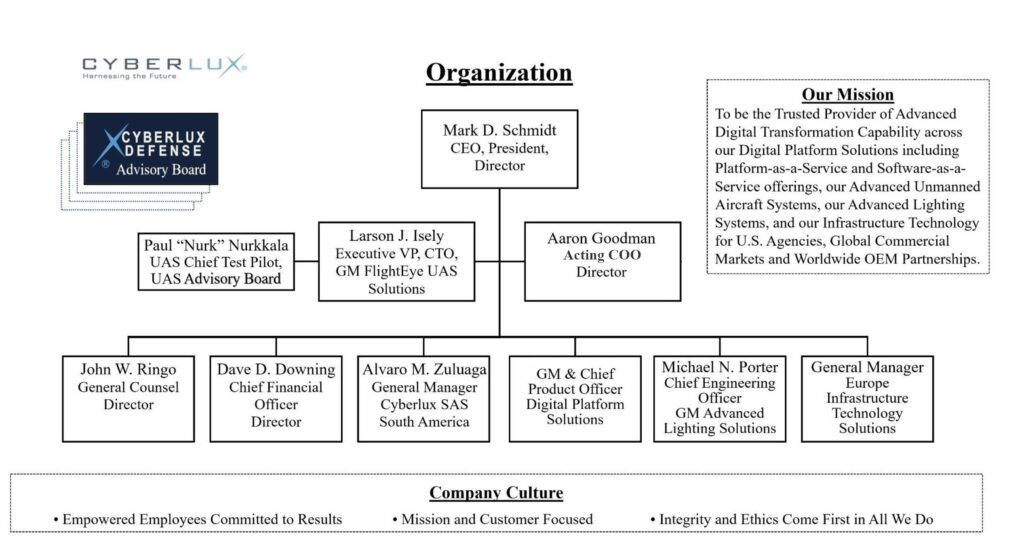

https://cyberlux.com/ Cyberlux Corporation ($CYBL) is a digital technology platform company comprised of

three vertical business units targeting global growth markets.

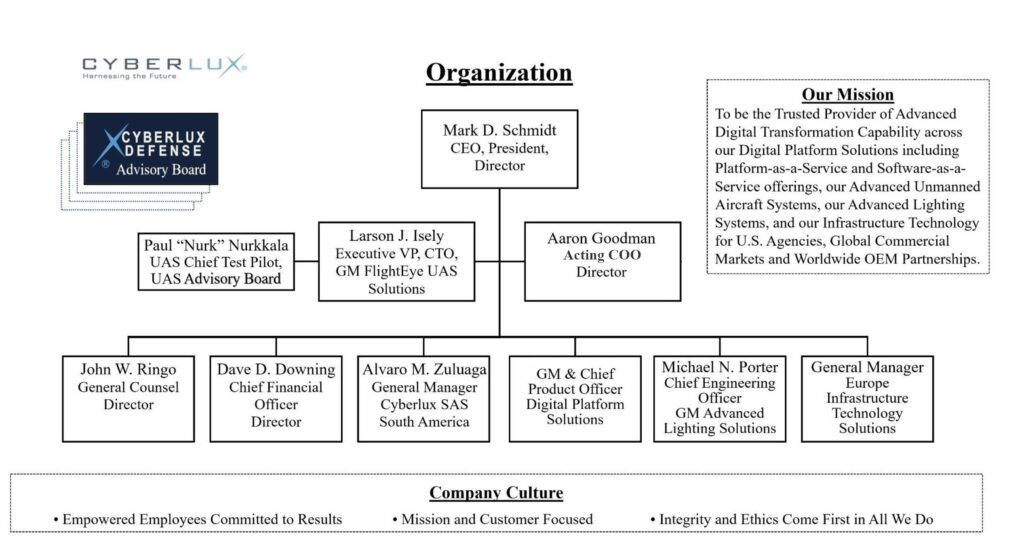

The Cyberlux company is organized around:

Military Communications Technology (MCT)

Unmanned Aircraft Solutions (UAS)

Advanced Lighting Solutions (ALS)

https://www.dtwc.com/strategic-hf-10kw-naval-rack?rq=dtx5K https://www.dtwc.com/strategic-hf-rt7700h?rq=RT7700h https://cyberlux.com/dps/ https://cyberlux.com/organization-chart/

[-chart]cyberlux.com/wp-content/uploads/2023/02/image-1024x557.jpeg[/chart]

https://cyberlux.com/wp-content/uploads/2023/02/image-1024x557.jpeg https://cyberlux.com/company-overview/ https://cyberlux.com/mct/ https://cyberlux.com/unmanned-aircraft-solutions-uas/ https://cyberlux.com/lighting/ https://cyberlux.com/news/ https://cyberlux.com/mct/ CHART SHOWING DIPS TO TRIPLE ZERO''S

HIT 4'S LOW FOR AUGUST , SO FAR

https://stockcharts.com/c-sc/sc?s=CYBL&p=D&b=5&g=0&i=t0157878737c&r=1691444648970 Updated 07-24-2023

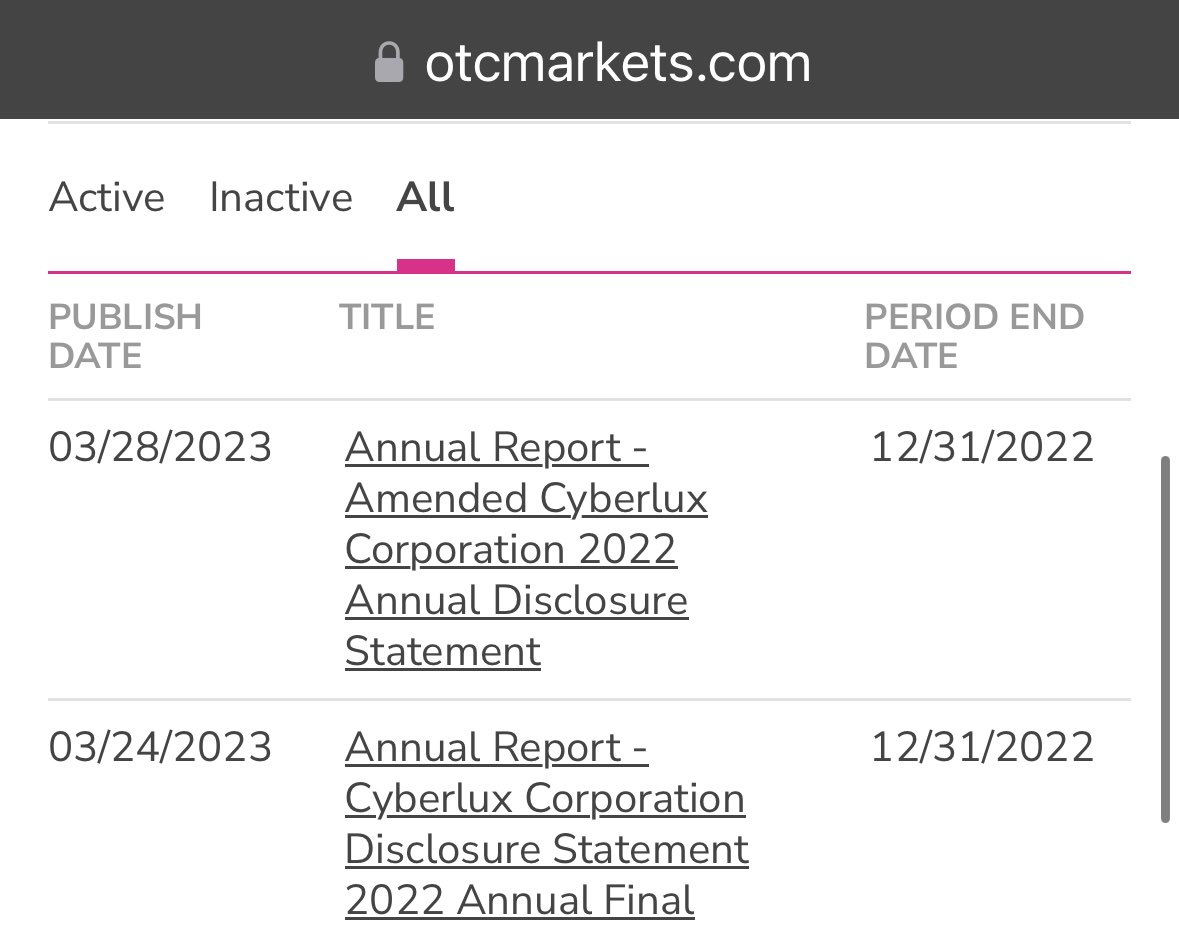

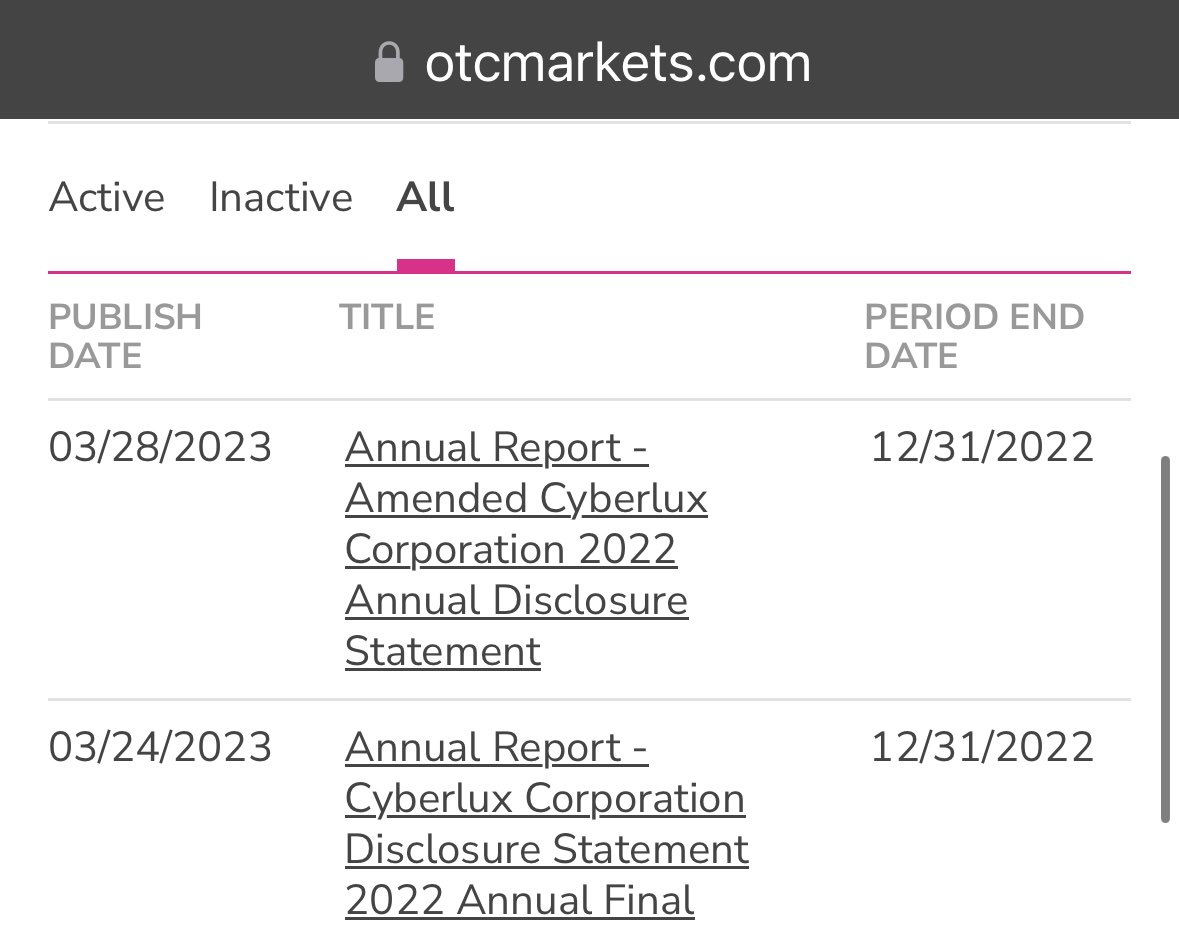

CORRECTION ON DATE 12-09-2022 WENT DARK

News by ceo, since since dec. 19th, 2022 , ceo let it go dark, Cyberlux Corporation Weekly Update 12.30.2022 -

FinalPress Release | 12/30/2022 Cyberlux Corporation Weekly Update 12/23/2022Press Release | 12/23/2022 https://www.otcmarkets.com/stock/CYBL/news and his videos. https://twitter.com/CyberluxC Official Account of Cyberlux Corporation - CYBL @CyberluxC Cyberlux Shareholder Update - 2/13/23: Our CEO Mark Schmidt addresses many aspects of the business to update everyone on all things going on with $CYBL. http://www.youtube.com Cyberlux Shareholder Update - 2/13/23 Our CEO Mark Schmidt addresses many aspects of the business to update everyone on all things going on with $CYBL.#ShareholderUpdate 8:50 PM · Feb 13, 2023 wit attachment , Official Account of Cyberlux Corporation - CYBL on Twitter: "Business ...

twitter.com

› CyberluxC › status › 1602308059145330688

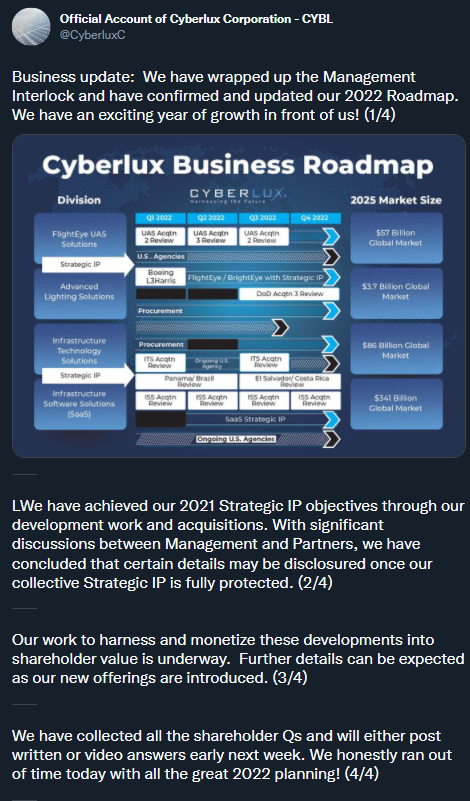

Business update: After a lengthy process spanning the last 5 months,

we have been cleared to share the first purchase request secured for 1,000

special FlightEye drones for $38.7M to support the Ukraine Ministry of Defense

and the Ukraine drone warfighters. 12 Dec 2022 14:23:05

UPDATE;

https://twitter.com/og_tigress/status/1640831842835132421 03-28-2023 ---

https://www.otcmarkets.com/stock/CYBL/disclosure $CYBL /

[-chart]pbs.twimg.com/media/FsVn3MwXgAcY8Wi?format=jpg&name=medium[/chart]

[-chart]pbs.twimg.com/media/FjyBaMZXEAA7zy3?format=jpg&name=4096x4096[/chart]

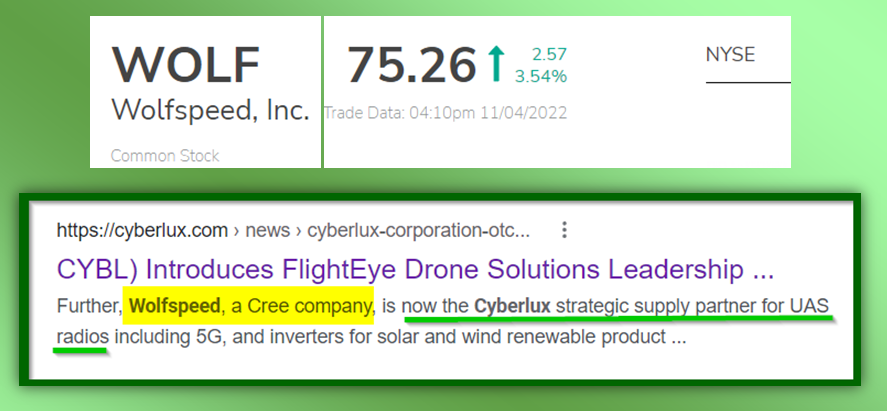

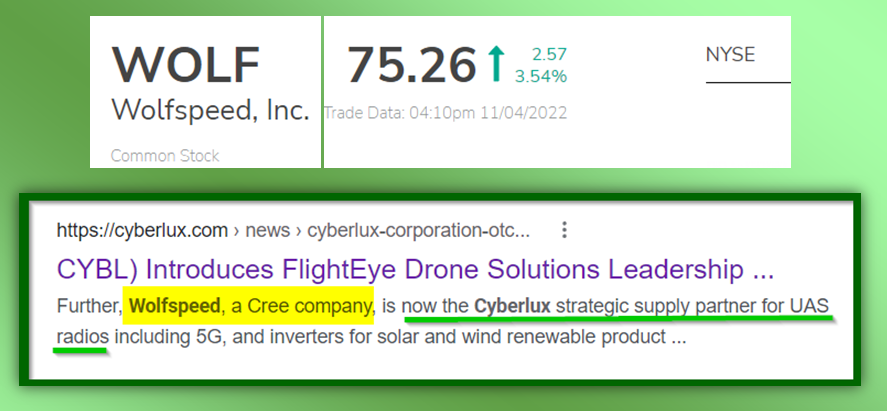

11-06-2022

courtesy of $WOLF , to $CYBL

[-chart]pbs.twimg.com/media/Fgw_wOAWYAA67Pi?format=png&name=900x900[/chart]

10-23-2022

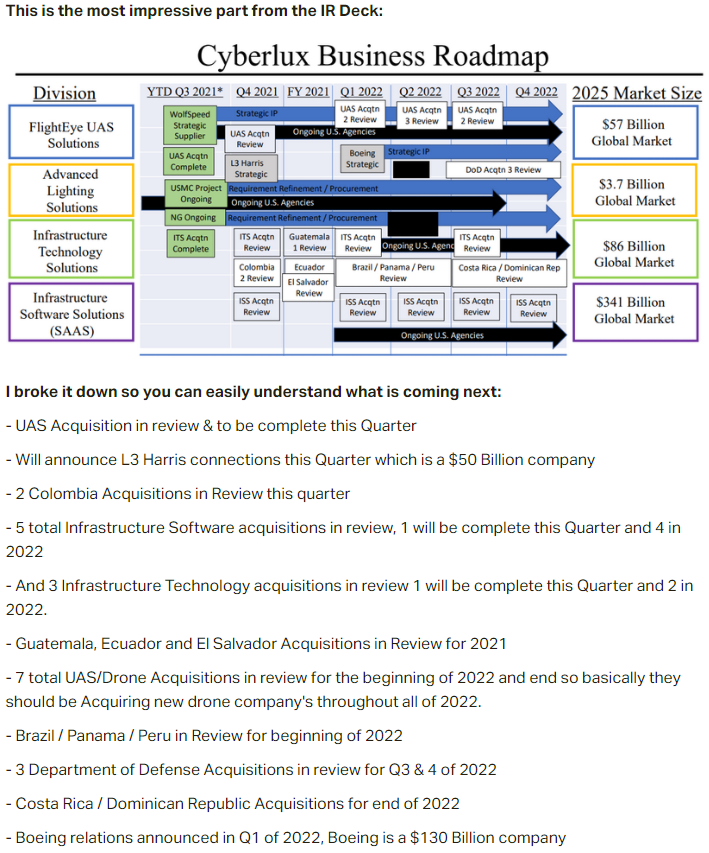

nice review my friend courtesy of DewmBoom

@dewmboom

https://twitter.com/dewmboom/status/1583212371405078528?s=46&t=8ZnmtykQDQja3vZBR8a4Jw This analysis is holding out very nicely. 1,364,899,705.00 traded since 7/1 in the range below. Huge accumulation going on before BREAKOUT!???? Get Ready for Some $CYBL Drones!

[-chart]pbs.twimg.com/media/FfizQAfXEAI-t4e?format=jpg&name=360x360[/chart]

2:43 PM · Oct 20, 2022

no change in share structure sine i owed $CYBl

CYBL SECURITY DETAILS market cap 64,332,423

Share Structure

Market Cap Market Cap

64,332,423

10/21/2022

Authorized Shares 7,000,000,000

10/11/2022

Outstanding Shares 5,383,466,363

10/11/2022

Restricted 615,063,060

10/11/2022

Unrestricted 4,768,403,303

10/11/2022

Held at DTC 4,333,047,857

10/11/2022

Float 3,779,932,470

06/30/2021

Par Value

0.001

10-12-2022

Courtesy of $CYBL

Official Account of Cyberlux Corporation - CYBL

@CyberluxC

ICYMI: CEO Mark Schmidt talks about the current status of the business, recent activities and future work that #Cyberlux is apart of!

Courtesy of cashmagnet

$CYBL Wednesday, October 12, 2022 1:55:28 AM

https://www.youtube.com/watch?v=chafH1EQouA Fox News anchor Martha MacCallum interviews former US Army intelligence

special ops and drone warfare expert Brett Velicovic who called urgently for

drone tech from US based companies like Cyberlux to assist with the war

effort in the Ukraine ASAP at the 37 second mark of the video below:

https://www.youtube.com/watch?v=chafH1EQouA

UPDATE: CEO 08-18-2022

https://youtu.be/lg1ayJPFGMU ;

#BusinessUpdate $CYBL

youtube.com

Business Update 8/18/22

CEO Mark Schmidt talks about the current status of the business, recent activities and future work that #Cyberlux is apart of!?? Subscribe for more: https://...

6:50 AM · Aug 19, 2022

$CYBL courtesy of $cybl macd bullish , acumm. bullish

????MoneyMaker ????

@MoneyisFoReal

$CYBL ???? Long view of last 1.5years looks good. Uptrends are no biggie if you dont like money ????

Looks like continuation with a high probability of a “BREAKOUT” soon imo. Creating wealth doesnt happen overnight!! GLTA!

[-chart]pbs.twimg.com/media/FVoottZXoAAgYeJ?format=jpg&name=small[/chart]

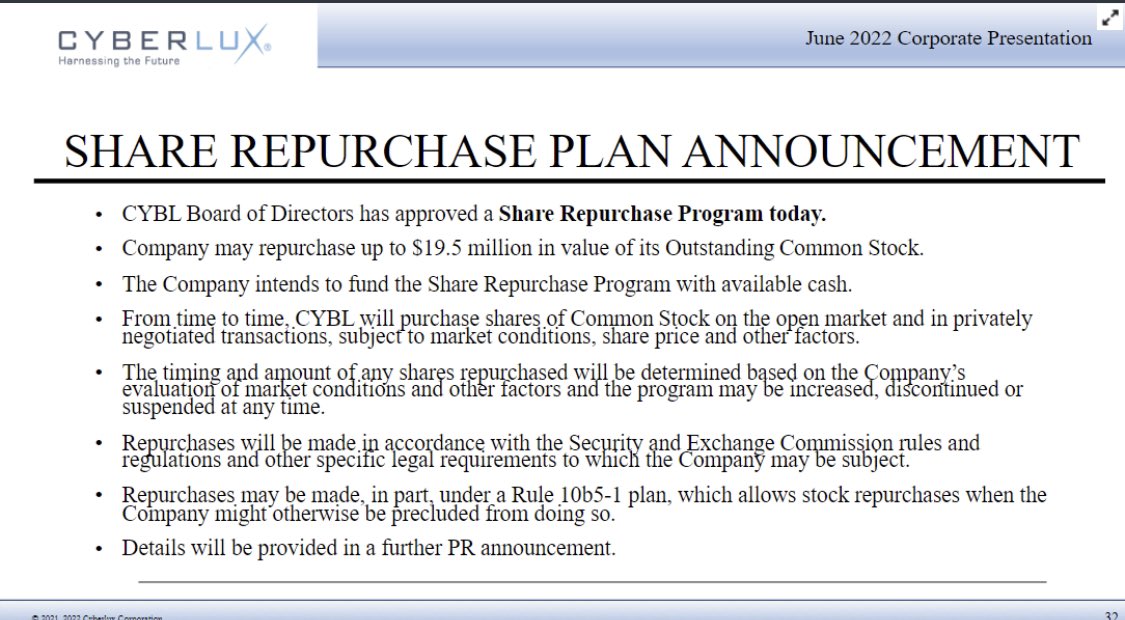

UPDATE: 06-8-2022

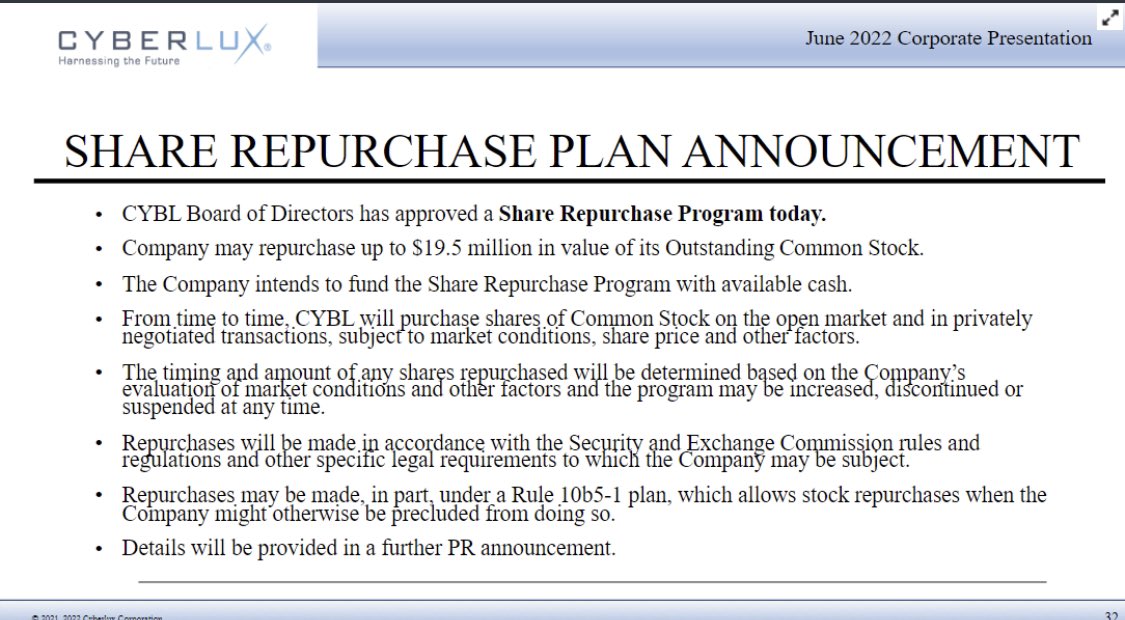

courtesy of $CYBL program /\ close to $20 mil. /\ time to time

[-chart]pbs.twimg.com/media/FUvzxiyX0AMdXZy?format=jpg&name=medium[/chart]

https://twitter.com/CyberluxC

UPDATE:6-8-22

courtesy of $CYBL

????MoneyMaker ????

@MoneyisFoReal

$CYBL Takeaways from the Q &A: ?12% Share reduction not yet reflected in PPS.

?Audit=SEC Report

?Possible Dividends

?Uplist/Organic Growth

?Company in Best Financial Position ever

?Substantial Cash Flow for future

?.10/.25 Cent PPS mgmt Incentive target (25x multiplier)

UPDARE; 5-6-2022

da moon courtesy of $cybl

[-chart]pbs.twimg.com/media/FSGIOLHXwAExfaw?format=png&name=900x900[/chart]

Moon Market

@MoonMarket_

$CYBL 700M Outstanding Shares Officially canceled!

11:49 AM · May 6, 2022·Twitter Web App

19

Retweets

2

Quote Tweets

108

Likes

courtesy of $CYBL 4-19-22

[-chart]pbs.twimg.com/media/FQr22yeXEAAnhRU?format=jpg&name=large[/chart]

$CYBL Broke out of the bull pennant I mentioned yesterday , needs to hold 0.0224 today before our next leg up. This is just getting started imo ???

UPDATE; 4-15-2022

/[]\ 4-15-22 /\ yes /\ #QandA #ShareholderValue #OperationAlpha Cyberlux Corporation Q&A April 2022 373 viewsApr 15, 2022 https://www.youtube.com/watch?v=kqV3eZq2APk https://cyberlux.com/ https://cyberlux.com/dps/ https://cyberlux.com/unmanned-aircraft-solutions-uas/ https://cyberlux.com/infrastructure-technology-solutions-its/ https://cyberlux.com/lighting/ https://cyberlux.com/organization-chart/ $CMW - software will profits start showing marker of $45 million projection /\ $0.10 pps catalyst machine works /\ great group buyback plan /\ to balance pps is KODK related to ????? /\ 3-d printing UAS - drones 700 millions share reduction /\ pps for 2022 about $0.10 per share no reverse split /\ partner to go nasdaq /\ in da making uplisting /\ working on banking partner /\ growth /\ digital solutions /\ trying to help people shorting $CYBl broadband deal / canada ????? digital platform /\ boeing blackboxes ????? web-3 /\ blockchain /\ digital platform /\ opportunity /\ digital currency /\ solar farm /\ we have debt /\ metaverse /\ exploring platform /\ customer information security /\ solar ????? do not manufacture unit but parts we do /\ 25,000 gov't contracts /\ to sell shares @ 0.10 pps /\ IMHO anything under $0.02 cents is ah steal. $45,000,000 project /\ europe ????? mentioned shareholder value many X's UKRAINE /\ support plan /\ supply chain is stable /\ no spinout for now /\ time is our factor for pps /\ uplisting depends on bank partners /\ performance over shorts /\ UPDATE; 4-8-22 courtesy of $CYBL 4-8-22

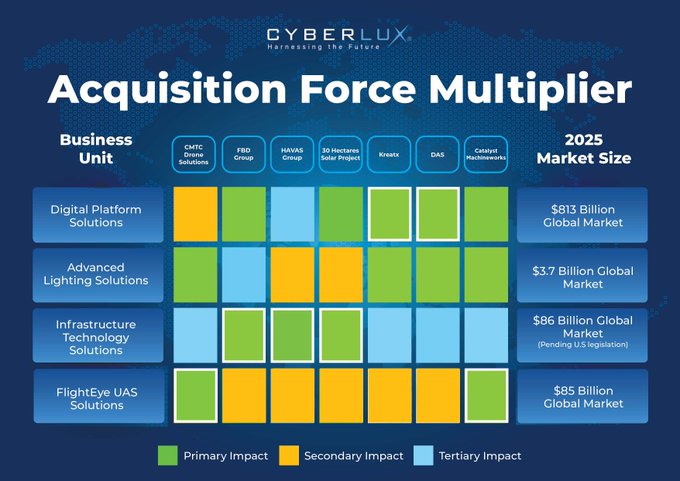

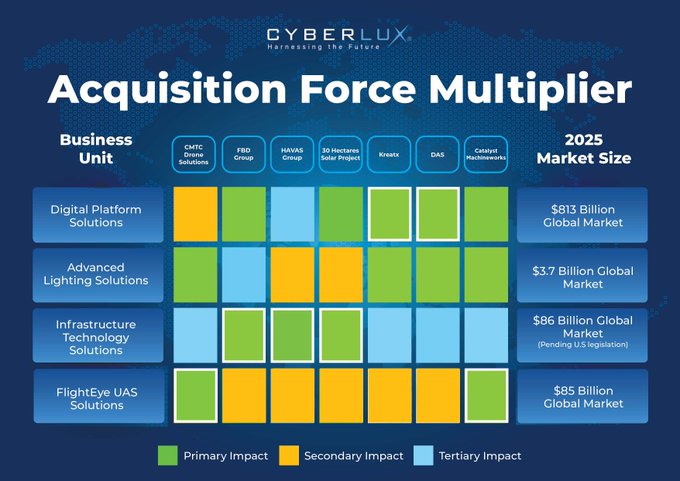

Official Account of Cyberlux Corporation - CYBL

@CyberluxC

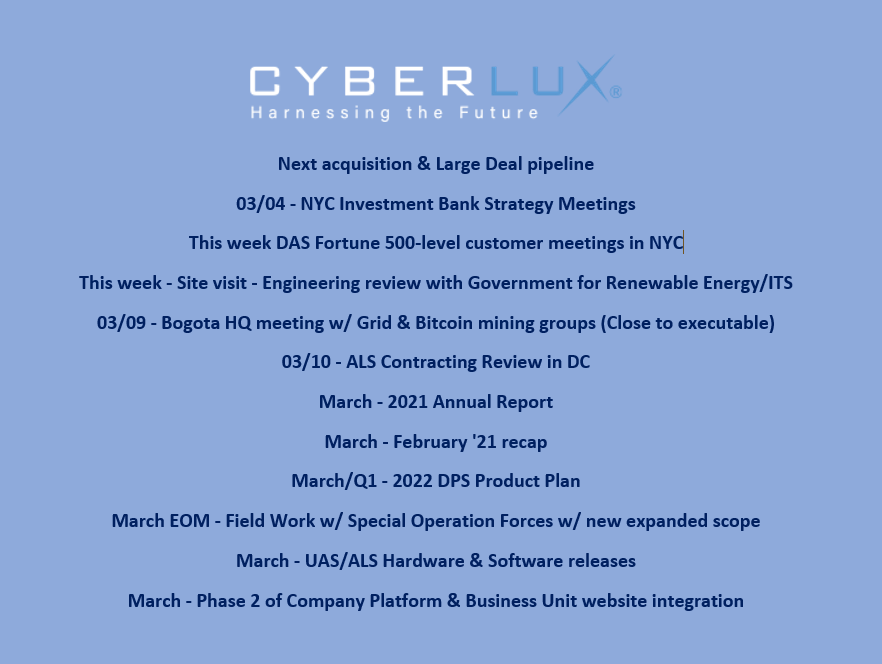

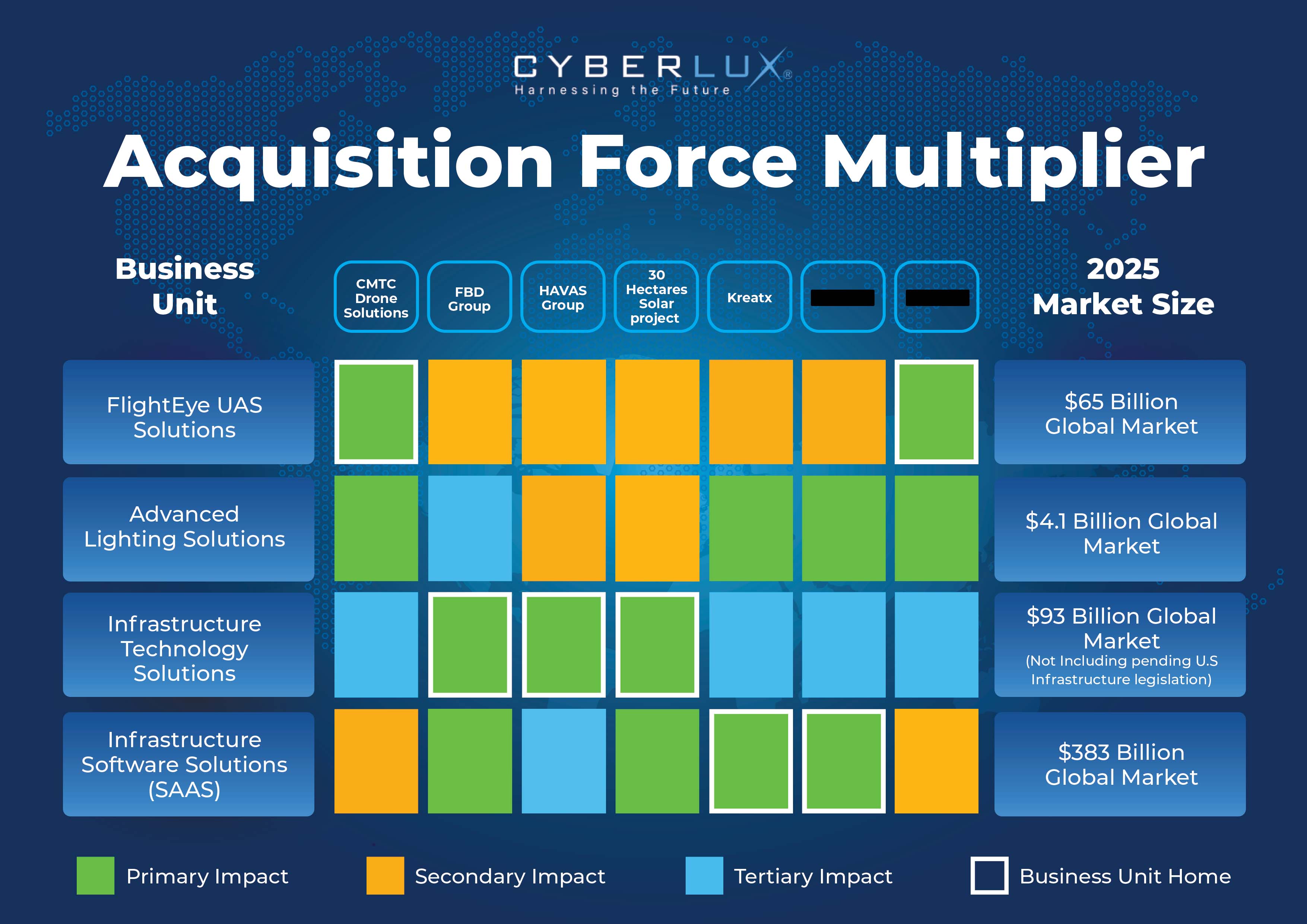

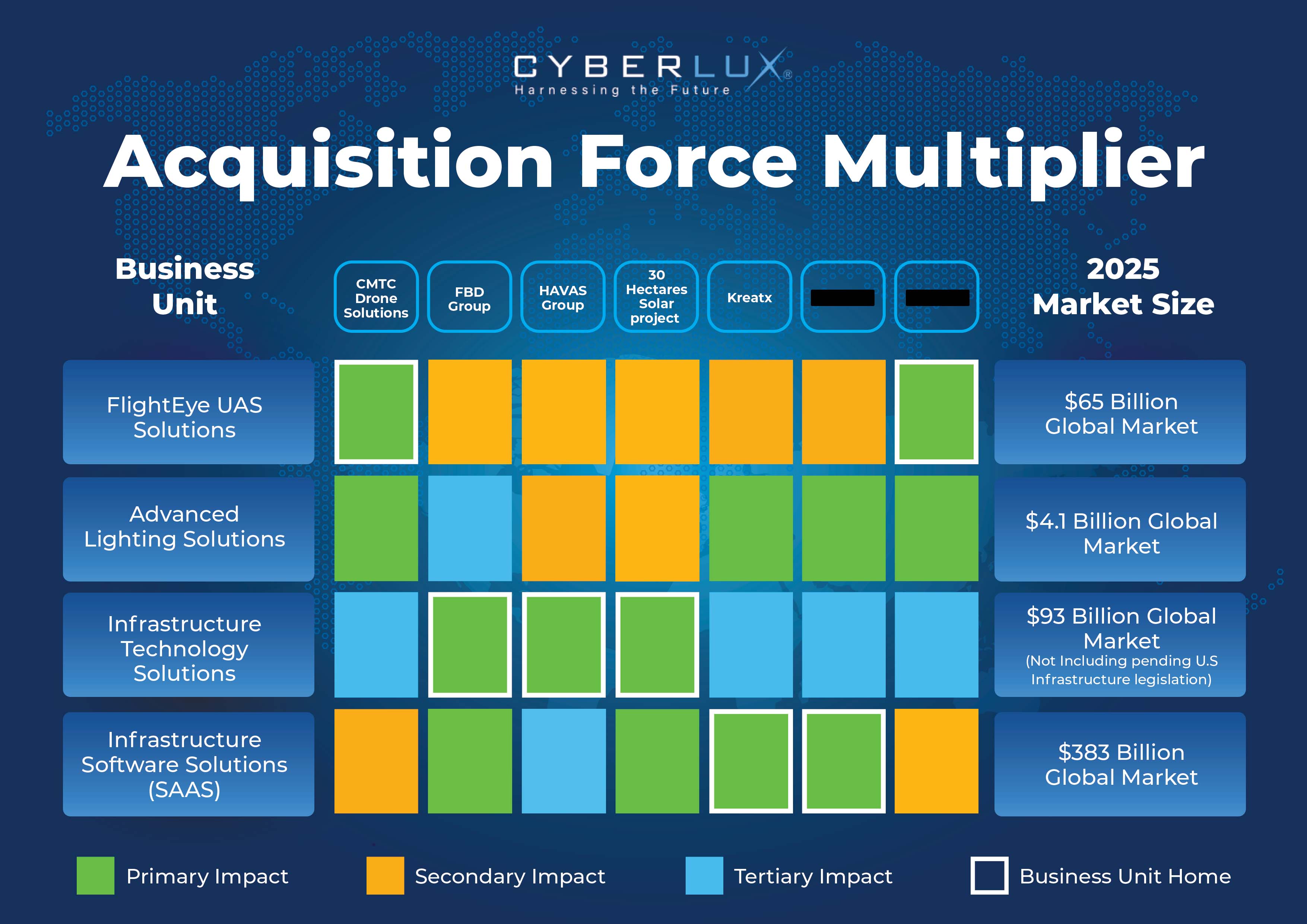

Business update: As we close out Q1, we have updated our Acquisition Force Multiplier chart with our recent acquisition of Catalyst Machineworks. Here’s how the business units fit together as an enterprise!

#2022FastStart #OperationAlpha $CYBL

[-chart]pbs.twimg.com/media/FP1x_gxVQAg8Qje?format=jpg&name=small[/chart]

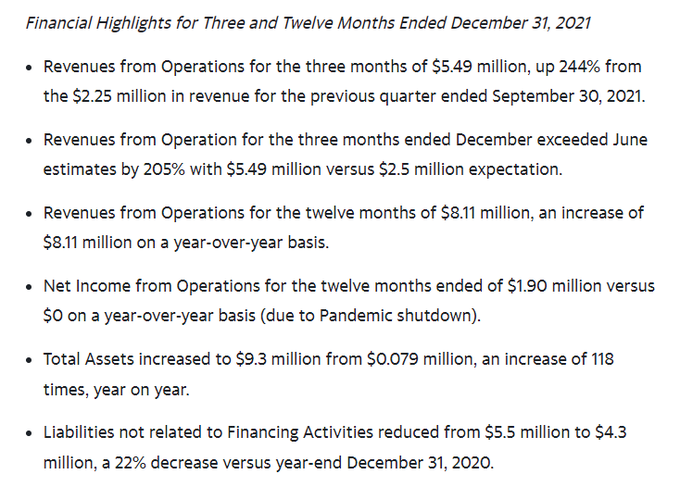

UPDATE; courtesy of $cybl 4-1-22

Moon Market

@MoonMarket_courtesy of

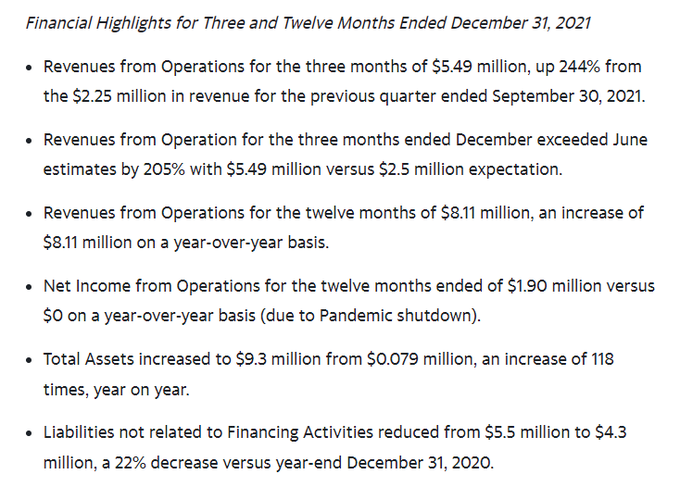

- Q4 Revenue $5.49M up 244%

- 2021 Revenue $8.11M

- Net income $1.9M

- Total Assets $9.3M an increase of 118x

[-chart]pbs.twimg.com/media/FPR83WLXIAYzgIO?format=png&name=small[/chart]

UPDATE; 3-28-22

$cybl Cyberlux Corp. Has Billion-Dollar Contracts In Its Crosshairs; Current Prices Warrant Investment Consideration (OTC: CYBL) ByGetNewsPublishedMarch 28, 2022 Read more: https://www.digitaljournal.com/pr/cyberlux-corp-has-billion-dollar-contracts-in-its-crosshairs-current-prices-warrant-investment-consideration-otc-cybl#ixzz7OqJyDu6u

Cyberlux Is Already A Vendor In Government Systems

In fact, CYBL announced completing initial consumer product trials, making them better positioned than ever to provide the DoD with specialized lighting technology and serving the military, first responder, and specific commercial markets with its innovative BrightEye Tactical Lighting System products. Results were so encouraging in its product trials that CYBL believes it can become a go-to provider of advanced lighting solutions worldwide to government and military organizations. Listening to the CEO at the Emerging Growth Conference, they intend to make that happen.

By the way, there’s still more to like. And again, revenue-generating firepower is included.

Accretive Acquisitions Generate Additional Rev-Gen Firepower UPDATE; 3-23-22

courtesy of $CYBL---3-23-22

[-chart]pbs.twimg.com/media/FOjo0T-XoAEJFck?format=png&name=900x900[/chart]

Tigress ???????

@og_tigress

$CYBL ????

??700M Phantom Share removal EXECUTION IN PROCESS

??Kreatx Software deal = GOVT PRESS RELEASE APPROVAL PENDING =NEW #DPS MARKET segment ??

??Europe = Situational #Ukraine??

??Next acquisition target EOM

??NEW #IP and filings EOM

??Q1 EXCEEDING ??

??BEST Q IN HISTORY!

UPDATE; 3-22-22

$CYBL - MARK SCHMIDT

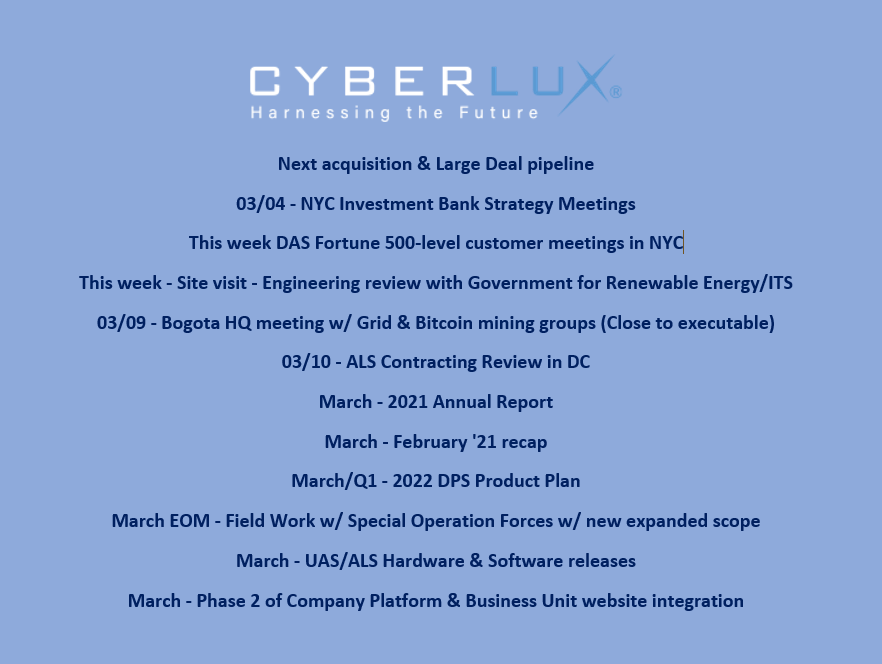

3-16-22 Cyberlux Corporation (OTC PINK: CYBL) Emerging Growth Conference 27 March 16, 2022 436 viewsMar 17, 2022 https://www.youtube.com/watch?v=KzfXqomldzM WHERE WE WERE & NOW STARTED LED LIGTHING 2021- BEGAN LEVERING TECHS- FOUR DIVISIONS RECENT 5 DIFFERENT ACQUISITIONS HISTORY RICH INNOVATIONS PRODUCT & SOLUTIONS PARTNER CO'S WOFF LAST SIX MOS-IDEAS-TEAM-SOUTH AMERICA-EUROPE-ADVANCED LIGHTING- DRONES-ENGINEERING-PORTFOLIOS-ACQUISTIONS-DATA SCIENCE-CASHFLOW- FINANCING- WORKING TO GO NASDAQ-NEW BUSINESS DESIGN-VALUE- SOFTWARE-HARDWARE-GROWTH-GROWING REVENUE- FOUR BUSINESS UNITS- DIGITAL PLATFORM SOLUTIONS BRIGHTEYE GUIDING LIGHT TECHNOLOGY SOLUTIONS-DRONES ADVANCED LIGHTING PLATFORM https://www.youtube.com/watch?v=KzfXqomldzM COURTESY OF $CYBL 3-4-22

[-chart]pbs.twimg.com/media/FNArFVZWUAMe1Is?format=png&name=900x900[/chart]

UPDATE; 3-3-22

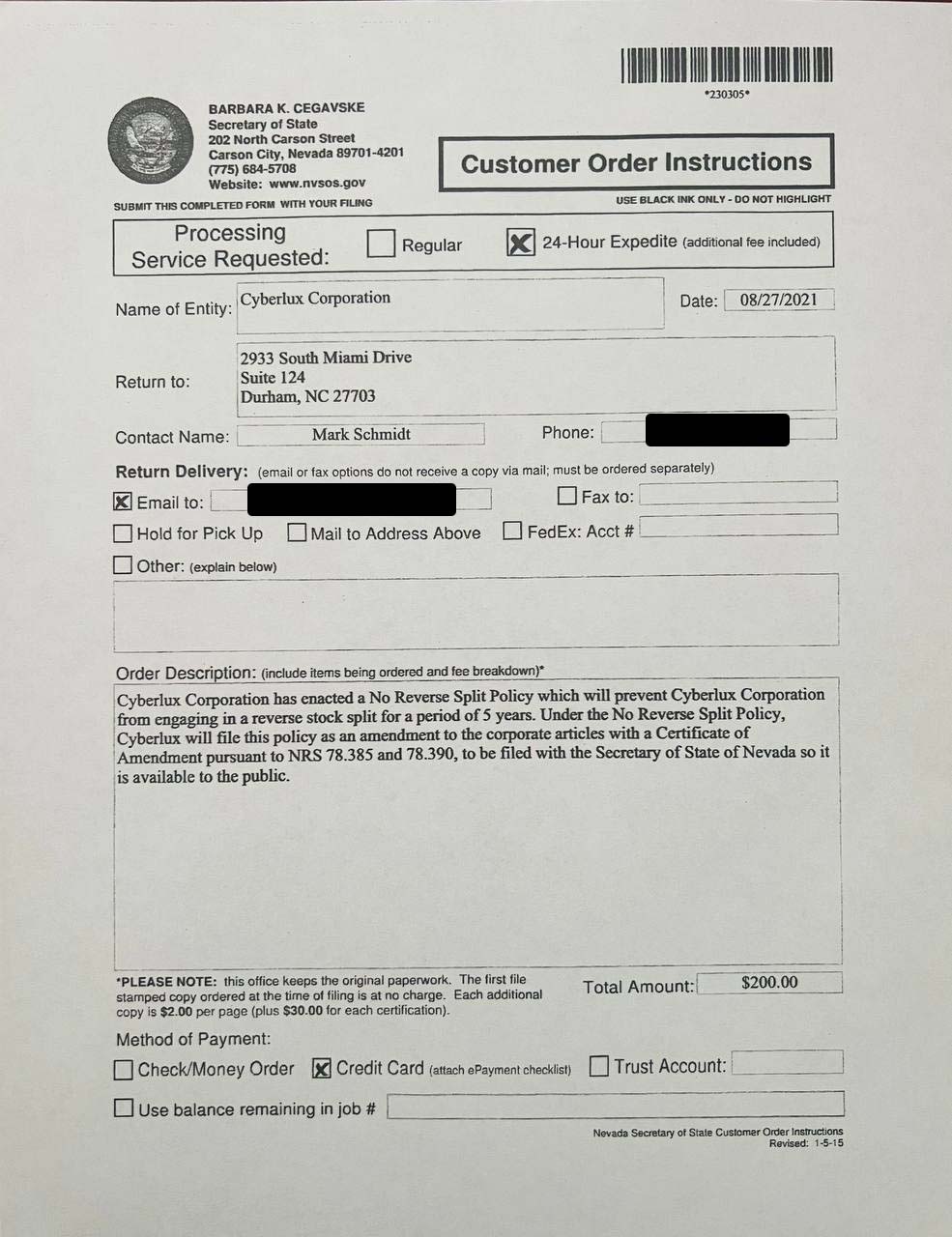

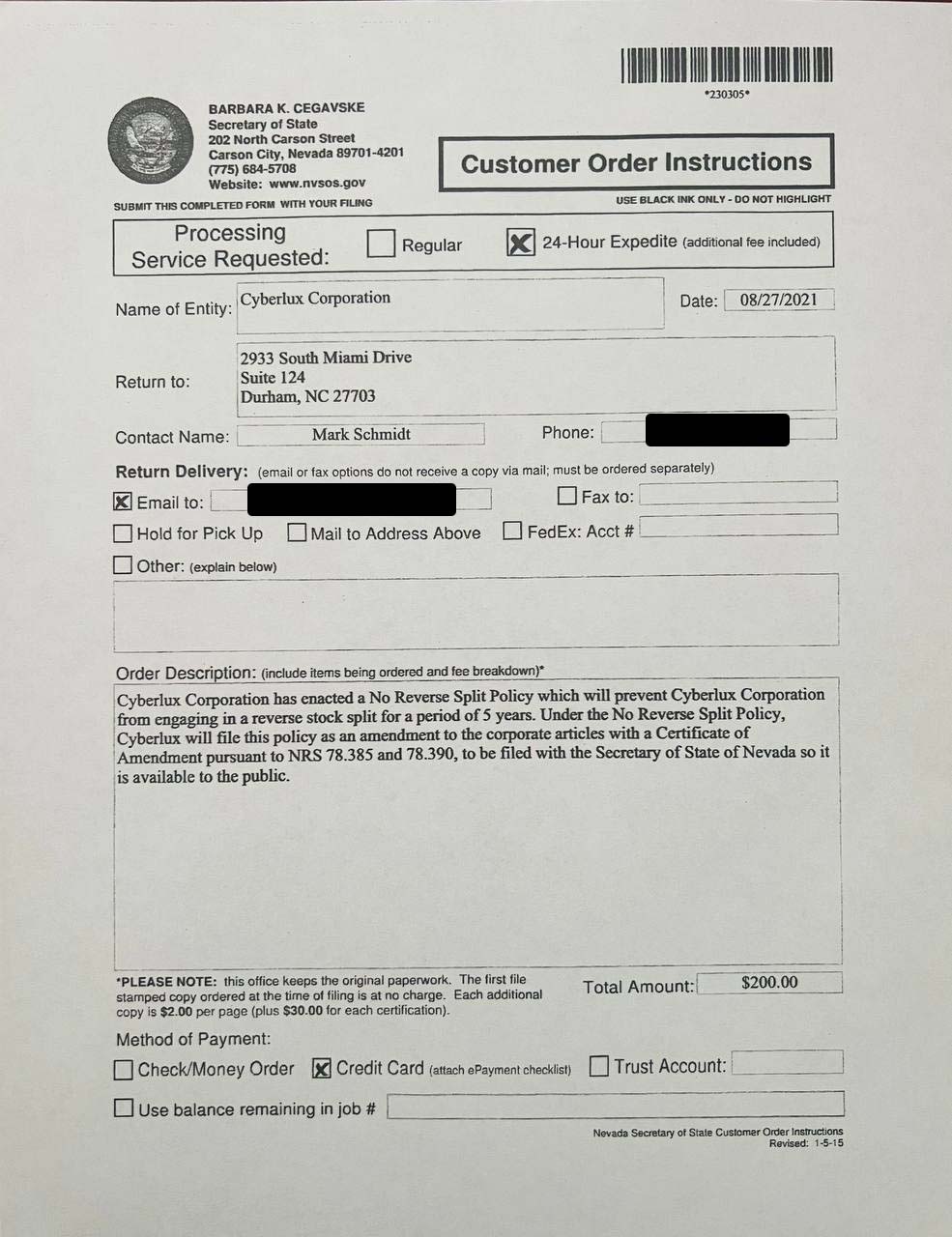

courtesy of $CYBL Quick update: One our our shareholders suggested after the last Q&A that we share the full “No Reverse Split Amendment” we filed last year. See attached!

#ShareholderValue #NoReverseSplit #Transparency $CYBL

[-chart]pbs.twimg.com/media/FM7z0FqUcA8qGy2?format=jpg&name=large[/chart]

https://www.bloomberg.com/press-releases/2022-03-10/cyberlux-corporation-otc-pink-cybl-exceeds-its-february-revenue-plan-by-41-and-records-11-month-to-month-growth-to-drive-th

https://www.bloomberg.com/press-releases/2022-03-10/cyberlux-corporation-otc-pink-cybl-exceeds-its-february-revenue-plan-by-41-and-records-11-month-to-month-growth-to-drive-th wow read

Cyberlux Corporation (OTC PINK:CYBL) Exceeds its February Revenue Plan by 41% and Records 11% Month to Month Growth to Drive th

March 10, 2022, 2:21 PM MST

Share this article

The Company Exceeded Its February Plan by 41 Percent and Increased Revenue by

11 Percent Month-to-Month as One of Many Key Milestones Achieved During

February 2022

RESEARCH TRIANGLE PARK, NC / ACCESSWIRE / March 10, 2022 / Today, Cyberlux

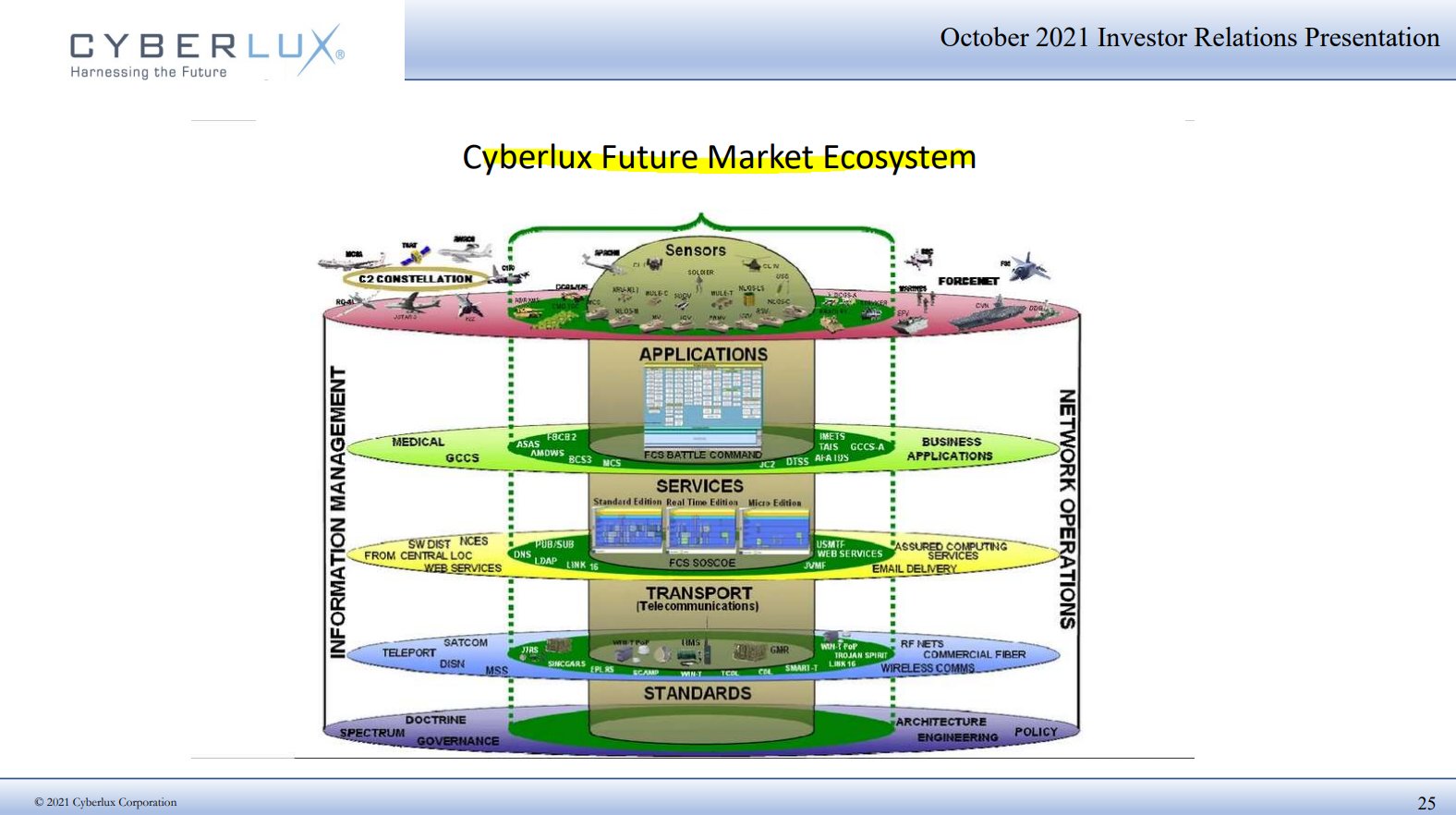

Corporation, (OTC PINK:CYBL), an advanced digital technology platform company

leading the digital transformation evolution across industries with

breakthrough Platform-as-a-Service (PaaS) and Software-as-a-Service (SaaS)

solutions, advanced unmanned aircraft systems (UAS), cutting-edge lighting

solutions, and renewable energy and infrastructure technology solutions,

announced that the Company exceeded its February Revenue Plan of $1.5 million

by 41 percent, delivering $2.12 million in revenue for the month. The Company

also drove an 11 percent increase in February revenue over January's record

revenue. For the first time in the history of the Company's financial

performance, the February revenue results exceeded $2 million and marked the

seventh consecutive month of sustained revenue growth. Further, Cyberlux

Management expects the quarterly revenue growth to continue during 2022 and

beyond, as the Company achieves its 2022 revenue outlook of $44.8 million and

generates a substantial positive net income from Operations for the year.

Cyberlux Corporation CEO Mark Schmidt commented:

"Dear CYBL Community, we are witnessing our advanced technology platform

strategy yield the results we imagined when we put the Operation Alpha plan in

action during Q3 2021. With the four business units we now have and the

markets we now serve, including our Digital Platform Solutions team and our

FlightEye Unmanned Aircraft Systems team, I am truly excited with our February

revenue performance. For the month, we exceeded our 2022 February revenue plan

of $1.5 million by 41% and posted our best month ever with our $2.12 million

revenue results. This also puts us well over $1 million ahead of our internal

year-to-date goals for achieving our $45 million revenue outlook for the 2022

full year.

As I've said before, we generally see Cyberlux business and revenue building

through the year from Q2 to Q4, with Q1 being a fraction of the full year

results. The Operation Alpha acquisition strategy and the 2022 Fast Start

program we're executing are driving the Company to grow at an amazing rate

month-to-month, across all our business units. Over the last six months, the

addition of the FlightEye drone team with GM Larson Isely, the infrastructure

business with the FBD Group and the HAVAS team, the Digital Platform Solutions

team under GM Igor Stanisavljev with both the Kreatx and the DAS teams, and

the stellar Chris Damvakaris as our Chief Revenue Officer, our team is driving

the Cyberlux company forward as a global enterprise like we've never seen

before. Each month we now see the results of Cyberlux participating in the $1

trillion global markets we serve and building growth in revenue and profit

month after month.

For the seventh consecutive month, we have exceeded our expected revenue

performance and the continued growth we've seen from January to February is

exceptional. During the last seven months, we have ramped revenue growth to

almost $12 million cumulatively and set the course to achieve our 2022 outlook

and grow to the $2 billion company we expect Cyberlux to become. While we have

been in difficult OTC market ‘risk off' conditions over the last few months,

we are truly just getting started and just beginning to see the results of the

first phase of our growth plans. Each Cyberlux manager, across the four

business units, is incented by growth in shareholder value and we are aligned

with the CYBL shareholder community in everything we do. As we move forward

this year, quarter by quarter, we believe the market will recognize the

shareholder value we are delivering, see the enormous opportunity in markets

like the digital transformation market and the UAS market, and understand why

our exponential company growth is just beginning. Let's go!

In addition to the best-ever February revenue results for the Company, we had

many other significant accomplishments during the month. Here's a brief recap

of the milestones we achieved:

* We reported revenue for February of $2.12 million, which is the first time

revenue has exceeded $2 million in month in the history of Cyberlux.

February revenue exceeded both our February Plan of $1.5 million by 41%

and our internal operational milestones for our full year growth outlook.

Each business unit overachieved the February Plan with ALS +10%, UAS +12%,

ITS +31% and DPS +46% to Plan levels. We also saw month-to-month revenue

growth of 11% over January's revenue results.

* We formed a new Channel Business Partnership with The ARG Group, LLC

(www.thearggroup.com) to drive and accelerate the revenue growth of the

FlightEye Unmanned Aircraft (UAS) Solutions products, the Advanced

Lighting Solutions (ALS) products and certain tactical solar power

generation solutions. The ARG Group (ARG) is a Service-Disabled

Veteran-Owned Small Business and a HUBZone certified small business, and a

leading provider of advanced technology equipment to the Department of

Defense, Federal Law Enforcement Agencies and US Allies. ARG has a global

reach across North and South America and Europe and delivers tactical

solutions to the warfighter, including drone capabilities and advanced

technology products for special operators, through the Special Operations

Command, the U.S. Air Force, the National Guard Bureau, Homeland

Security/Customs and Border Protection.

* We launched the Digital Platform Solutions (DPS) business development and

sales efforts with the first wave of target companies and industries, with

the mission to drive both end-to-end PaaS and SaaS offerings to global

government, military, and commercial customers. The Digital Automation

Solution team (DAS) (https://www.digitalautomationsolution.com) has expert

knowledge and customer experience in building Platform-as-a-Service

(PaaS), Software-as-a-Service (SaaS) and Mobile applications across a

variety of industries, and we began the software engineering and solution

development coordination between the DAS team and the Kreatx team to

force-multiply the innovative software solutions development and continue

the groundbreaking PaaS and SaaS intellectual property development

underway.

* We began to implement of our strategic investment plan with our digital

technology platform development and ongoing incremental investments in our

four business units - Digital Platform Solutions, FlightEye UAS Solutions,

Advanced Lighting Solutions, and Infrastructure Technology Solutions - to

continue our drive to make Cyberlux a leading digital technology growth

company.

* During February, we had multiple significant U.S., South American and

European ALS and UAS meetings on opportunities across the regional

military and law enforcement agency we have been pursuing, expanding on

our earlier DC meetings. We expect contracting in Q2 2022 fiscal quarter.

We will have more to report once there is no further competitive threat.

* Following our Q1 Roadmap plan, we are continuing to evaluate our strategic

financial partners. We have eliminated 4 of the 7 financial partners we

have in consideration, to ensure that shareholder value creation is the

fundamental objective. With ongoing strategic guidance from our

institutional partners, we are continuing to drive the Company's

transformation and institutionalize as rapidly as possible, with ongoing

changes in our corporate development and positioning. We will continue to

communicate updates as possible.

* Our South American team completed the engineering plan for the 31-hectare

renewable energy generation project and submitted to the Colombian

government agencies for approval. The team is also in early stage

development of our next potential solar farm in the Manizales, Colombia

area. Also, there was additional implementation progress on two municipal

streetlight projects and our Infrastructure Technology Solutions (ITS)

services are being presented across South America now. As previously

disclosed, our ITS team is also in the final phase of the $47 million U.S.

infrastructure opportunity selection, which is progressing slowly but we

expect results this month. Further, our ITS business unit reported on a

European project being executed by our FBD team. This $3+ million project

covers 40 miles of electrical grid and fiber optics communications

infrastructure construction.

https://twitter.com/CyberluxC/status/149440243 5816689689

* Our Cyberlux Chief Test Pilot Paul "Nurk" Nurkkala recently conducting a

Cinematography Class Drone Assessments at the National Museum of the

United States Air Force and we published the results here:

https://youtu.be/gWLz8zyX01s

* We received great media coverage of our business growth, including

Marketwatch:

https://www.marketwatch.com/press-release/cybe

rlux-corp-has-a-550-billion-govt-backed-revenue-generating-opportunity-in-its-cr

osshairs-and-thats-not-all-otc-cybl-2022-02-24

* We published a 30+ question Q&A to provide our shareholders with

information and answers:

https://youtu.be/F2s23TIQ7Eo

* We completed execution of Phase 1 and began Phase 2 of the Company

Platform and Business Unit Website Integration Plan. We expect the new

website to evolve incrementally this month and transform to fully

represent the Cyberlux advanced technology platform business.

* Our 2021 Annual Report is in review for publishing in March as planned

well before the March 31st requirement

As I've noted, February was a great month for the Cyberlux company and our

shareholders as we posted the best revenue results ever for a single month and

grew the business significantly across all four of our business units. The

transformation of the Cyberlux company is fully underway with amazing monthly

accomplishments across the organization, along with a markable pipeline of

growth catalysts derived from our new platform companies. Our Cyberlux team is

a 24/7 organization, as exemplified yesterday and last night as we worked

across business units to support the efforts to aid Ukraine. I've mentioned

before the ‘do whatever it takes' character of our team, but it is really

true. Our team is full speed, every hour of every day when necessary and I am

grateful for these awesome people I have the honor to work with. This team

will deliver amazing shareholder value growth, only limited by the macro

environment, and is fully committed to the success of the Cyberlux enterprise.

And the Cyberlux team is continuously grateful for the constant support of our

shareholders as we harness the future!"

About Cyberlux Corporation

Cyberlux Corporation (OTC PINK:CYBL) is a digital technology platform company

providing breakthrough Digital Platform Solutions, including

Platform-as-a-Service and Software-as-a-Service solutions, advanced Unmanned

Aircraft Systems (UAS) Solutions, Advanced Lighting Solutions, Infrastructure

and Renewable Energy Technology Solutions to U.S. government agencies,

commercial customers, and international growth markets. Cyberlux is

"Harnessing the Future" by leading digital transformation across global

industries, driving operational growth through an accelerated acquisitions and

joint ventures strategy, and continuously fueling growth with current and

future technology developments. For more information, please visit

www.cyberlux.com. For investor information, please contact:

ir_cybl@cyberlux.com

SAFE HARBOR STATEMENT

This press release contains forward-looking statements that can be identified

by terminology such as "believes," "expects," "potential," "plans,"

"suggests," "may," "should," "could," "intends," or similar expressions. Many

forward-looking statements involve known and unknown risks, uncertainties and

other factors that may cause actual results to be materially different from

any future results implied by such statements. These factors include, but are

not limited to, our ability to continue to enhance our products and systems to

address industry changes, our ability to expand our customer base and retain

existing customers, our ability to effectively compete in our market segment,

the lack of public information on our company, our ability to raise sufficient

capital to fund our business operations, our ability to continue as a going

concern, and a limited public market for our common stock, among other risks.

Many factors are difficult to predict accurately and are generally beyond the

company's control. Forward-looking statements speak only as to the date they

are made, and we do not undertake to update forward-looking statements to

reflect circumstances or events that occur after the date the forward-looking

statements are made.

SOURCE: Cyberlux Corporation

View source version on accesswire.com:

https://www.acc

esswire.com/692610/Cyberlux-Corporation-OTC-PINKCYBL-Exceeds-its-February-Revenu

e-Plan-by-41-and-Records-11-Month-to-Month-Growth-to-Drive-the-Companys-Key-Acco

mplishments-for-the-Month-of-February-2022 UPDATE; 01-21-2022 HUGE [GOING TO BE BILLION DOLLAR CORP.

$CYBL

courtesy of $CYBL lot of credits to Chris Damvakaris

Cyberlux Corporation Announces Mr. Chris Damvakaris as Chief Revenue Officer to Lead the Revenue Growth Plans and Strategic Partnerships for the Advanced Digital Technology Company

Friday, January 21, 2022 11:30 AM

Share this article now

Topic: Company Update

Cyberlux Corporation

Cyberlux Corporation

The Company announces Mr. Damvakaris as Chief Revenue Officer to Drive the Revenue Growth Plans

and Strategic Partnerships across the FlightEye UAS, Advanced Lighting, Infrastructure Technology

and Infrastructure Software-as-a-Service Solutions Business Units.

RESEARCH TRIANGLE PARK, NC / ACCESSWIRE / January 21, 2022 / Today, Cyberlux Corporation, (OTC PINK:CYBL),

an advanced technology platform company leading the digital transformation evolution across industries with advanced unmanned aircraft systems (UAS),

advanced lighting, renewable energy and infrastructure technology,

and Software-as-a-Service (SaaS) solutions, announced the appointment

of Mr. Chris Damvakaris as Chief Revenue Officer for Cyberlux Corporation.

In his role as Chief Revenue Officer, Mr. Damvakaris will be

responsible for overseeing Cyberlux business development,

strategic partnerships and sales execution across each of the Company's four business units -

FlightEye UAS Solutions,

Advanced Lighting Solutions,

Infrastructure Technology Solutions

and Infrastructure Software Solutions

- to target the highest impact and most scalable opportunities,

as well as accelerate the collaboration with the Cyberlux alliance channel partnerships.

Mr. Damvakaris brings to the role more than 20 years of global sales experience in both SaaS and enterprise software solutions.

During his career, Mr. Damvakaris has managed various go-to-market sales,

marketing and business development teams ranging from start-ups to multi-million-dollar dynamic growth IT firms.

Prior to joining Cyberlux, Mr. Damvakaris led commercial

and strategic sales and managed channel partnerships with global

systems integrators such as HPE, IBM, and Infosys for numerous technology companies across government and commercial markets.

"As we expand our innovative pipeline of platform-based information technology solutions

and position Cyberlux for our next phase of growth, the appointment

of a Chief Revenue Officer reinforces our strong focus on operational execution across our organization

and our commitment to sales performance across our four business units for all our stakeholders," said Mark Schmidt, Chief Executive Officer at Cyberlux.

"We have been searching for the best person to lead our dynamic revenue growth

and help our CYBL executive team further accelerate the Company's strategic initiatives. I am so excited to welcome Chris to our

Executive Management Team and look forward to his leadership

in driving our Cyberlux mission to be a leader in the

digital technology evolution and bridge the gap between software

and business performance to deliver results for our customers."

Chris Damvakaris, Chief Revenue Officer

Mr. Damvakaris has consistently demonstrated the ability to drive revenue growth through a solution-oriented approach in positioning technology as an enabler of innovation and change.

With deep knowledge of customer requirements and an understanding of

the broader digital ecosystem,

Mr. Damvakaris has built long-term business relationships across numerous industries.

These key capabilities and achievements drive forward the Cyberlux strategy to serve our Department of Defense and Commercial customers with innovative digital platform solutions.

"Clients expect a higher level of domain knowledge from digital technology solution providers as well as the capability to support,

extend and transform their business model in order to stay competitive", Mr. Damvakaris stated.

"With the Cyberlux digital transformation platform capabilities

and the product and intellectual property developments underway,

I am excited to join the remarkable Cyberlux team.

The entire company is truly on a mission to transform industries

and become a global enterprise.

I am ready to help make this happen through ongoing sales growth,

new business opportunities and further strategic partnerships."

Mr. Damvakaris has held senior executive positions within the Information Technology, Healthcare, and Telecommunications sectors.

He has been a thought-leader in technology innovation and digital transformation through a three-pronged approach of engagement, collaboration,

and critical thinking to guide customers through the transformation process.

Mr. Damvakaris earned a Bachelor of Science in Economics from Old Dominion University and a Master of Business Administration from American University Kogod School of Business.

Cyberlux Corporation CEO Mark Schmidt stated:

"As our Cyberlux community knows,

we are on a mission and we need someone with significant executive management experience and strategic sales knowledge who understands digital technology transformation

and how to create a sustainable strategic advantage through deep customer relationships and the leveraging of the Cyberlux technology platform capabilities.

Chris is an amazing professional with vast business development

and strategic sales experience that covers all four of our business units,

from our Unmanned Aircraft Systems to our emerging powerhouse Infrastructure Software Solutions Software-as-a-Service (SAAS)

business unit.

With Chris on the team, I know Cyberlux will reach our transformative growth targets

and achieve our aggressive company objectives to be a billion-dollar company in the coming years."

Mr. Damvakaris commented:

"The Cyberlux team has had remarkable success in 2021,

and I look forward to leading the continued revenue, partnership

and business development efforts for the Company in 2022 and forward.

I am confident that my experience and deep understanding of the industries we serve,

and the sales performance required to achieve our growth targets will create ongoing shareholder and customer value.

The synergies between my background and the Company's vision are

a good complement to drive success.

I am excited to get started and kick off plans to address the large markets the Company

is targeting and the aggressive growth plans the team has,

and begin building the future with our SaaS digital transformation global expansion plans.

I am super excited to be part of the Cyberlux team."

To learn more about Mr. Damvakaris, please refer to his career profile on LinkedIn as follows:

https://www.linkedin.com/in/chris-damvakaris-8675474/

Going forward, Cyberlux Corporation is

"Harnessing the Future" by leading digital transformation across

global industries, by driving operational growth through

an accelerated acquisitions and joint ventures strategy, with growth from current and future technology developments,

including fundamental organic growth from the Company's four ?business units

-

?FlightEye UAS Solutions, Advanced Lighting Solutions, Infrastructure Technology Solutions and Infrastructure Software Solutions -

About Cyberlux Corporation

Cyberlux Corporation (OTC PINK:CYBL), a digital technology platform company providing advanced unmanned aircraft systems (UAS), advanced lighting solutions,

renewable energy and infrastructure technology, and Software-as-a-Service solutions to U.S. government agencies, commercial markets and international customers.

For more information, please visit http://www.cyberlux.com. For investor information, please contact: ir_cybl@cyberlux.com

SAFE HARBOR STATEMENT

This press release contains forward-looking statements that can be identified by terminology such as "believes," "expects," "potential," "plans," "suggests," "may," "should," "could," "intends,"

or similar expressions. Many forward-looking statements involve known and unknown risks, uncertainties and other factors that may cause actual results to be materially different from any

future results implied by such statements.

These factors include, but are not limited to, our ability to continue to enhance our products and systems to address industry changes, our ability to expand our customer base and retain existing customers,

our ability to effectively compete in our market segment, the lack of public information on our company, our ability to raise sufficient capital to fund our business operations, our ability to continue as a going concern,

and a limited public market for our common stock, among other risks. Many factors are difficult to predict accurately and are generally beyond the company's control.

Forward-looking statements speak only as to the date they are made,

and we do not undertake to update forward-looking statements to reflect circumstances or events that occur after the date the forward-looking statements are made.

SOURCE: Cyberlux Corporation UPDATE; 01-14-2022

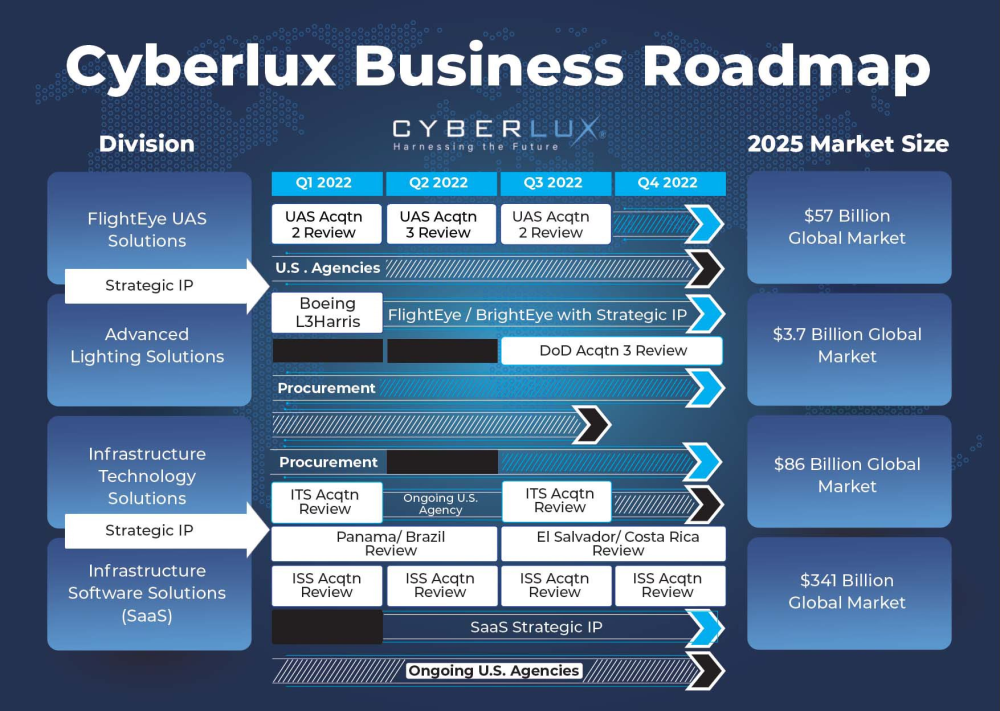

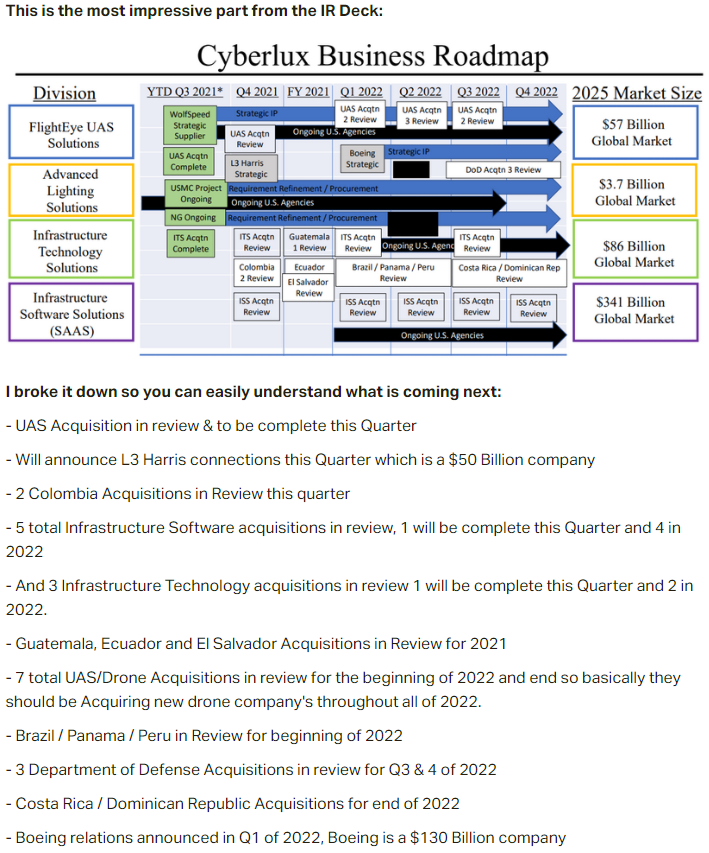

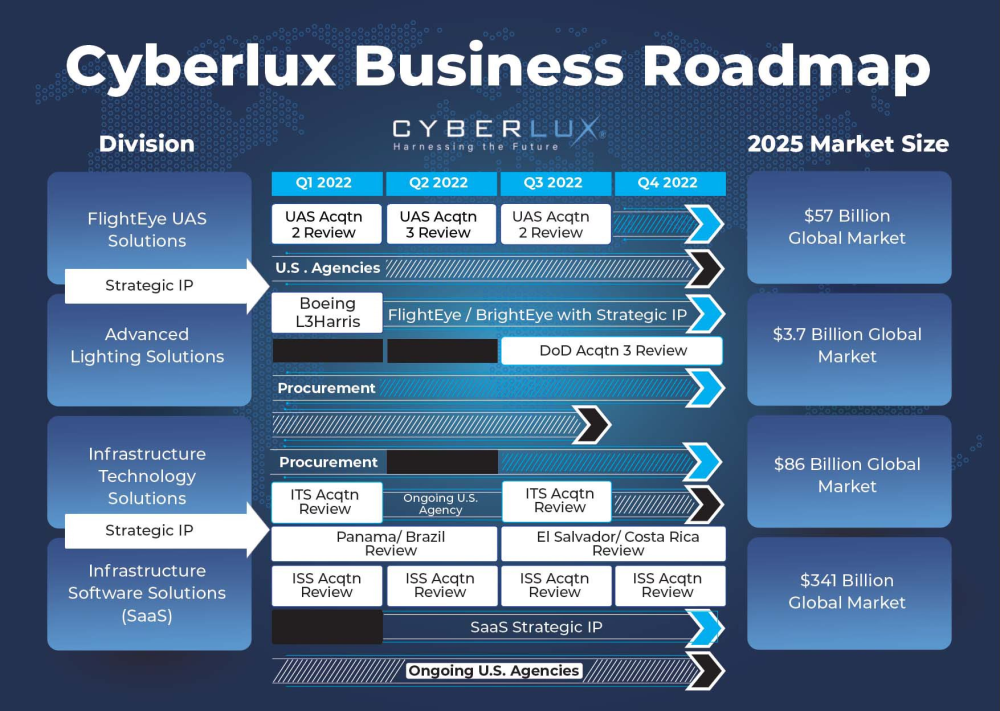

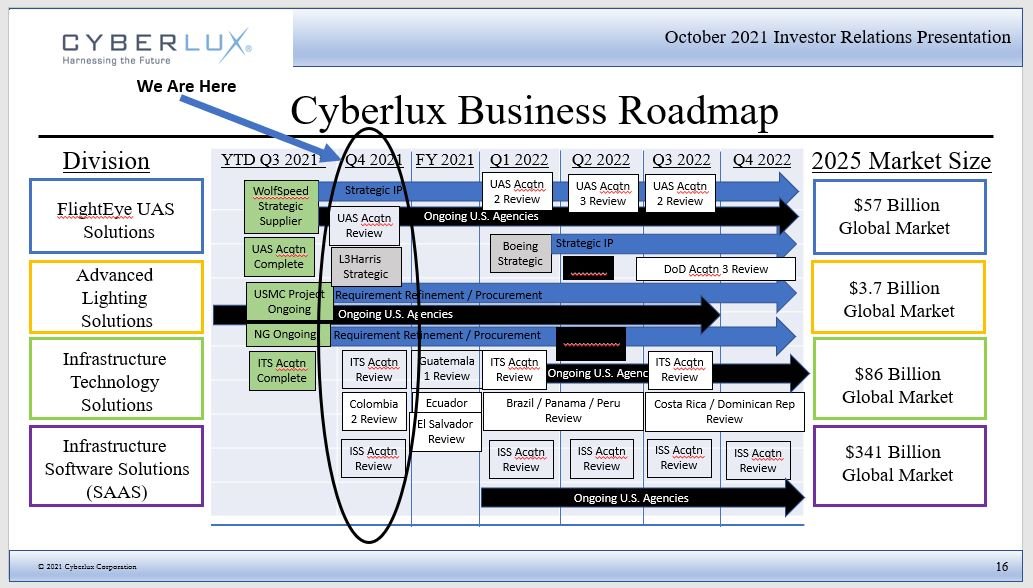

courtesy of $cybl road map plan courtesy of $cybl 01-20-2022

[-chart]pbs.twimg.com/media/FJAdRqxUYAY8hFa?format=jpg&name=4096x4096[/chart]

11-15-2021

$CYBL's stock price by Christmas will a  Catalysts: - 2-4 Acq. this Quarter, 20+ in review -

Catalysts: - 2-4 Acq. this Quarter, 20+ in review -

Filings this week - biggest revenue ever - Infrastructure deals - $45M+ Opportunity -

Hire COO/New directors - $LHX/ $BA partnership info - Solar/UAS Acq. - $10.5M funding RB Cap 11-01-2021

$CYBL Number Of Employees Changed:  9

9  23 Address Changed:

23 Address Changed:  2933 South Miami Blvd Suite 124 Durham NC 27707

2933 South Miami Blvd Suite 124 Durham NC 27707  800 Park Offices Drive Suite 3209 Research Triangle Pa NC 27709

800 Park Offices Drive Suite 3209 Research Triangle Pa NC 27709  Linkedin Added

Linkedin Added UPDATE; 01-02-2022

COURTESY OF $CYBL

Moon Market

@MoonMarket_

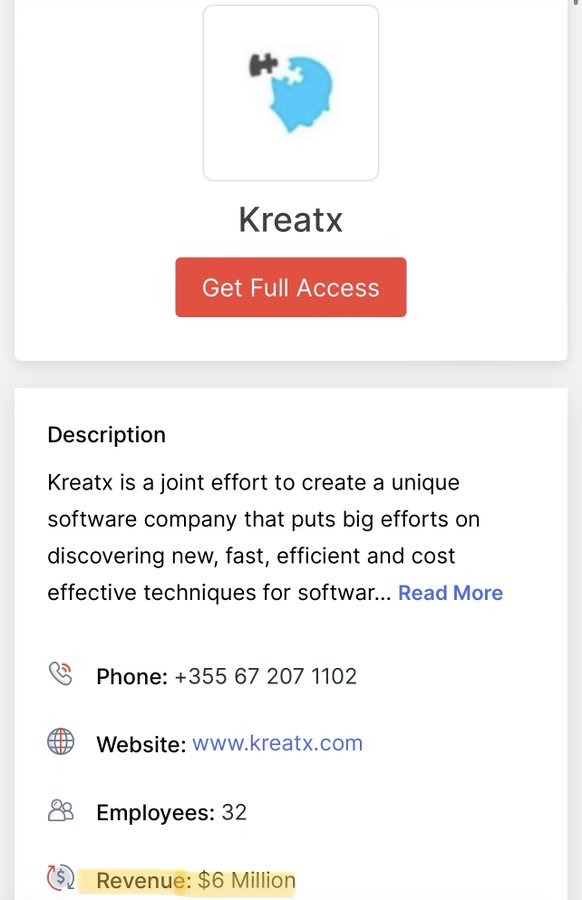

$CYBL Cyberlux Announces the Acquisition of Kreatx

- $6M+ revenue

- staff of 38, including 30 software development and customer support engineers. Importantly

- existing customers, revenues, and technical capabilities

- $500 Billion Market size

- Government and Commercial

[-chart]pbs.twimg.com/media/FIEB0YiX0AA_m-3?format=jpg&name=900x900[/chart]

UPDATE; 12-31-2021

$CYBL road map 2021/2022 courtesy of

Moon Market New moon symbol Retweeted

Tigress

@og_tigress

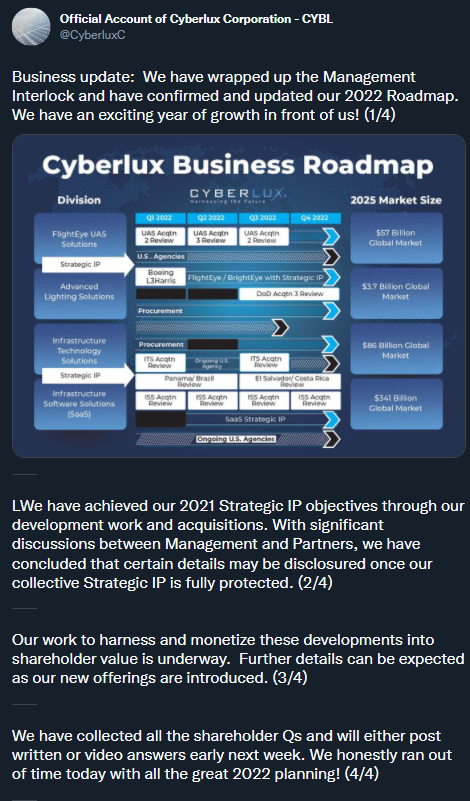

$CYBL "We have achieved our 2021 Strategic IP objectives through our development work and acquisitions.

With significant discussions between Management and Partners,

we have concluded that certain details may be disclosured once our collective Strategic IP is fully protected." Fire

[-chart]pbs.twimg.com/media/FH9VWQbXoAQFhSB?format=png&name=900x900[/chart]

[-chart]investorshub.advfn.com/uimage/uploads/2021/12/31/TPQGGVAUVTAMWVK.jpg[/chart]

$UPDATE; VIDEO WITH CEO CYBL 12-08-2021

THANK YOU, LISTENING RIGHT NOW $CYBL TALKED ABOUT NASDAQ TOO

$CYBL ALL PROJECT DIVISIONS CYBL Stock New DoD Contracts, NASDAQ, 10 Acquisitions, Share Reductions, Boeing ??

3,838 viewsDec 8, 2021

https://www.youtube.com/watch?v=ffDdqgk14TQ UPDATE; 10-25-2021

courtesy of $cybl

[-chart]pbs.twimg.com/media/FCkkmQxXIAUisP-?format=png&name=900x900[/chart]

UPDATE; 10-22-2021

$cybl OTC DISCLOSURE & NEWS SERVICE

https://www.otcmarkets.com/stock/CYBL/news/Letter-to-Shareholders-10222021?id=326878

Letter to Shareholders 10.22.2021

Press Release | 10/22/2021

October 22, 2021

OTC Disclosure & News Service

Durham, NC —

This release includes additional documents. Select the link(s) below to view.

CYBL Shareholder Letter 10.22.2021.pdf

October 22, 2021

Dear CYBL Community,

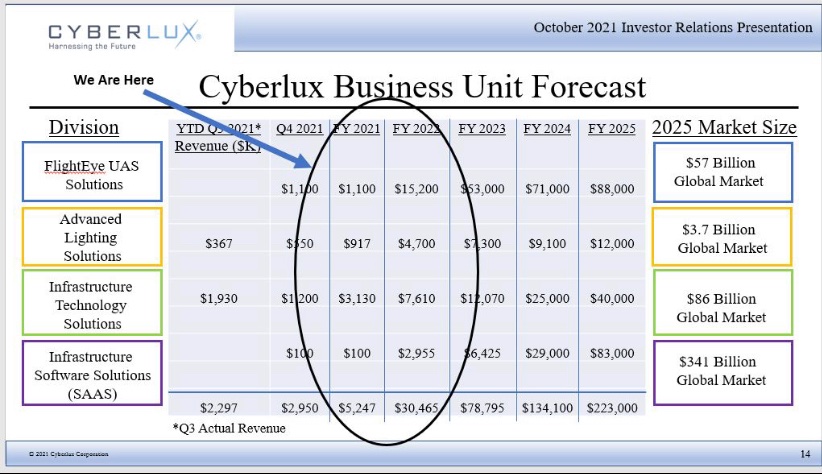

Yesterday, the Cyberlux Corporation Board of Directors met and

approved a plan for me and our CFO, David Downing,

to contribute our 420 million shares of common stock back to the Companys Treasury. These shares of common stock were previously

issued to Management as Incentive Award shares, and both Dave and

I will each contribute 210 million shares of restricted common stock back to the Company.

These shares will then be deducted from the Companys Outstanding

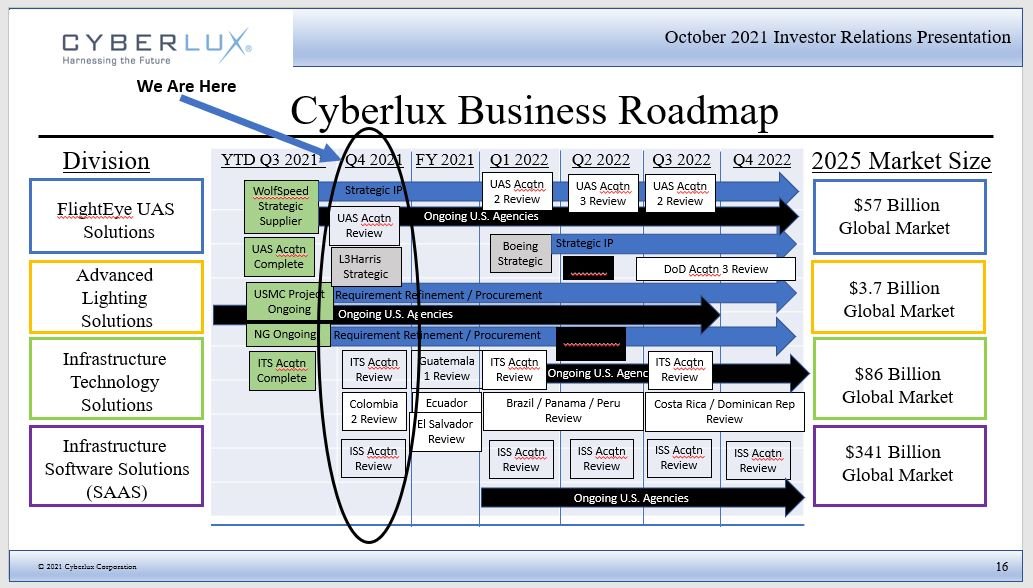

Share count in order to help offset and balance the Company's

aggressive Business Roadmap, as was detailed in the recent Investor Relations presentation.

Given the significant number of potential acquisitions in the Cyberlux pipeline,

with well over 20 companies and projects under review,

it is important to recognize that each acquisition requires some

related common stock issuance and certain related financing activities to drive the business forward,

to close the acquisition and to further incent the incoming management team to grow exponentially. This is one of the key underlying

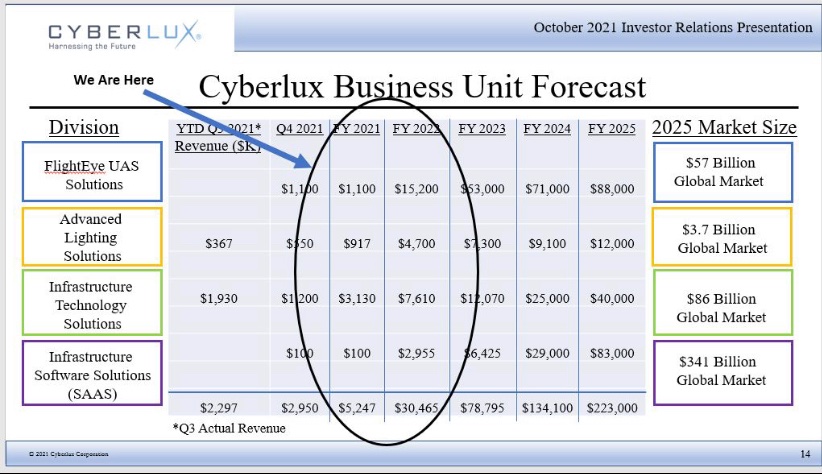

requirements to deliver the revenue growth in our Business Unit Forecast and how Cyberlux grows

from $5 million in revenue in 2021 to well over $100 million in revenue by 2024.

With a current market value of close to $16 million, we believe our

420 million share contribution is an important re-investment in the Cyberlux company and a demonstration of our belief in the Companys mission,

as defined by the Operation Alpha execution plan.

Going forward, we will be issued new Management Incentive Award

shares to replace this $16 million in share value,

at the incentive price levels of $0.10 and $0.25 as share price milestones.

We anticipate an approximate $8 million in share issuance at the $0.10 share price level and $8 million at the $0.25 share price level,

but this will also reduce the number of Management shares issued by almost 75% for the same dollar value.

Both Dave and I are committed in word and deed to the exponential

growth of the Cyberlux business platform. We believe our contribution

of these previously issued Management Incentive Award shares will

result in a 30X to 50X return in Company growth over the coming years.

This is the best investment we can make now to grow the bottom-line earnings and keep the share denominator as low as possible.

Our goal is to maintain our Outstanding Share level between the

current 5.64 billion to 6 billion shares over the next 12 months, including our growth and acquisition plans.

Thank you for your ongoing support, CYBL community!

Lets Go!

Best

Mark Schmidt

President & CEO

Cyberlux Corporation UPDATE; 10-20-2021

$CYBL road map [-chart]pbs.twimg.com/media/FCKnrDeUUAEs4gG?format=jpg&name=900x900[/chart]

UPDATE; 10-19-2021

$CYBL road map [-chart]pbs.twimg.com/media/FCEpv2kWYAAjwYV?format=jpg&name=medium[/chart]

UPDATE; 10-15-2021

$cybl courtesy of mgmt

[-chart]pbs.twimg.com/media/FBwIBryWUAEwt9Z?format=jpg&name=medium[/chart]

CONTINUATION FOR $CYBL 10-12-2021

https://www.aheadsup.com/twitter/newsentiment.html?user=otc CYBL

otc

10/12/2021 07:48 PM COURTESY OF $CYBL [-chart]pbs.twimg.com/media/FBcIrYFWUAM5Sxm?format=jpg&name=large[/chart]

courtesy of $cybl

[-chart]pbs.twimg.com/media/FBhkJ0IXoAEeR2I?format=jpg&name=large[/chart]

[-chart]pbs.twimg.com/media/FBcSB0ZX0AgakvC?format=jpg&name=medium[/chart]

UPDARE; 10-11-2021

$cybl courtesy of [-chart]pbs.twimg.com/media/FBalxb3WEAQmK_7?format=jpg&name=large[/chart]

UPDATE; 10-06-2021

courtesy of 'Cyberlux Corp (CYBL)'

https://twitter.com/i/web/status/1445828975222132736 Official Account of Cyberlux Corporation - CYBL

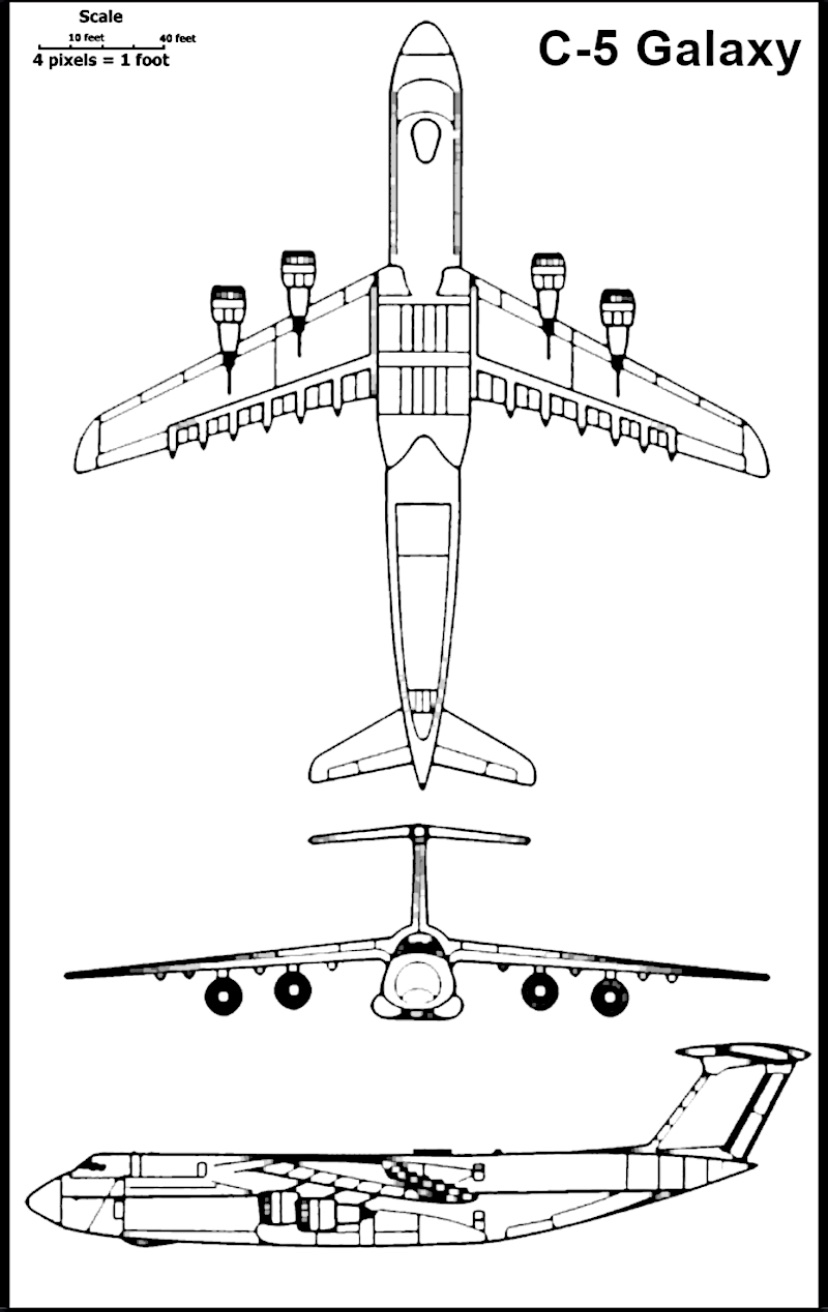

@CyberluxC

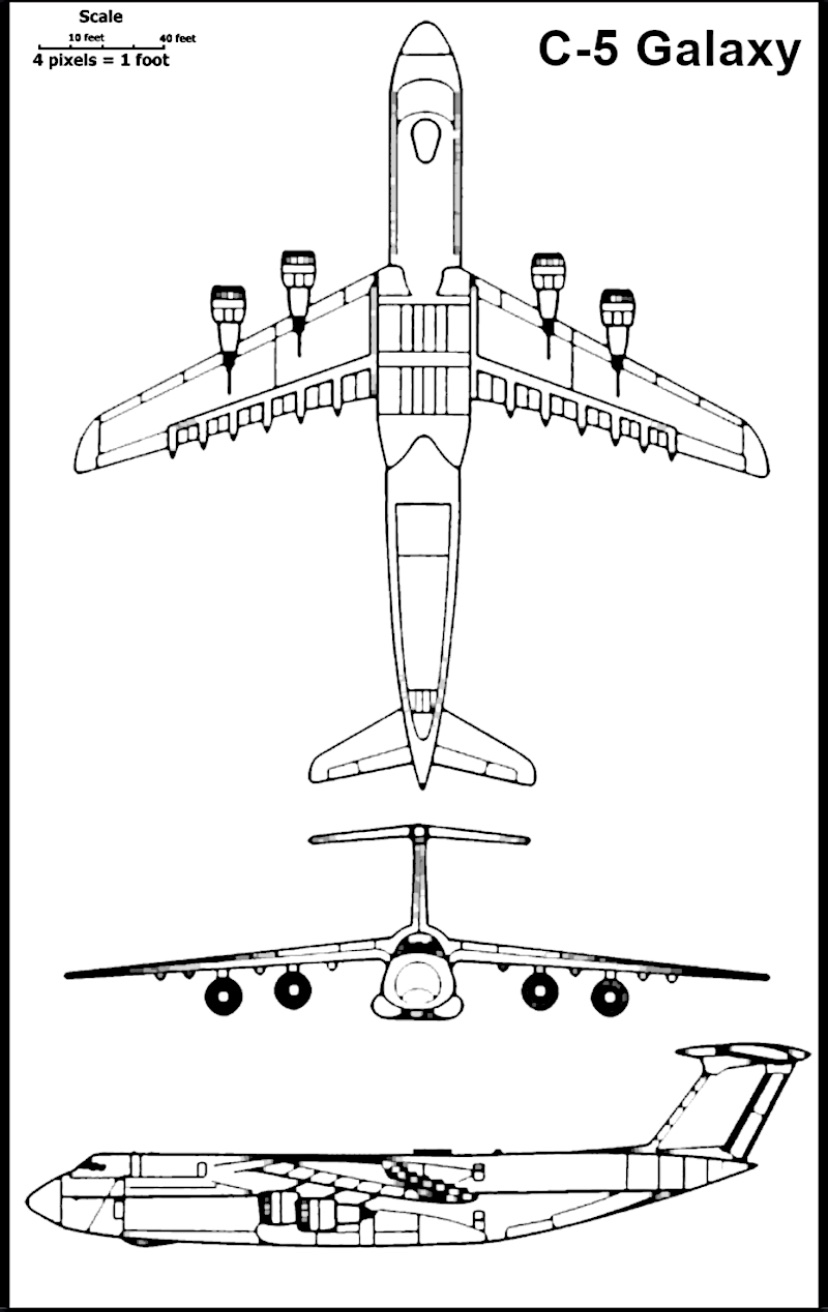

Quick update: The dots do connect.

Cyberlux WatchDog was designed to meet the USAF covert & white illumination requirements specified by

the dimensions of the larger Lockheed C-5 Galaxy with a 223-ft wingspan.

[-chart]pbs.twimg.com/media/FBCco8rVkA0GtDd?format=jpg&name=large[/chart]

https://cyberlux.com/lighting/the-watchdog/

https://cyberlux.com/lighting/the-watchdog/ #OperationAlpha #FlightEyeDNA #StrategicIP

UPDATE; 10-01-2021

$CYBL $CYBL … and #drones are just a small portion of #OperationAlpha. Flushed face

Gem stone Advanced Lighting Technology

Gem stone Solar & Energy

Gem stone Unmanned Aircraft Systems (UAS)

Gem stone Software Development $IBM Winking face

Gem stone Infrastructure & Telecom

Gem stone Product Engineering $WOLF Winking face

$CYBL PHOTOS

[-chart]pbs.twimg.com/media/FBA65ShXMAET743?format=jpg&name=medium[/chart]

[-chart]pbs.twimg.com/media/FBA65SeWEAAwBoI?format=jpg&name=medium[/chart]

[-chart]pbs.twimg.com/media/FBA65ShXMAAKP-W?format=jpg&name=medium[/chart]

[-chart]pbs.twimg.com/media/FBA65SgWYAEQWO0?format=jpg&name=medium[/chart]

UPDATE 09-10-2021

$CYBL & DIS FILINGS AND DISCLOSURE 08-10-2021

OTC Disclosure & News

https://www.otcmarkets.com/stock/CYBL/security https://www.otcmarkets.com/stock/CYBL/profile https://www.otcmarkets.com/stock/CYBL/overview https://www.otcmarkets.com/stock/CYBL/quote $CYBL SECURITY DETAILS MKT CAP 93,042,675 Share Structure Market Cap Market Cap.93,042,675 08/16/2021 Authorized Shares..20,000,000,000 08/16/2021 Outstanding Shares..5,316,724,292 08/16/2021 Restricted..................1,536,791,822 08/16/2021 Unrestricted...............3,779,932,470 08/16/2021 Held at DTC...............Not Available Float.........................3,779,932,470 06/30/2021 Par Value................................0.001 [-chart]nebula.wsimg.com/2a484eb241e46d88693893be45618c6f?AccessKeyId=7933C78C270198A00912&disposition=0&alloworigin=1[/chart]

http://www.cyberlux.com/ Contact Information Cyberlux Mailing address Cyberlux Corporation 2933 South Miami Blvd Suite 122 Durham, NC 27703 Tel (919) 474 9700 Fax (919) 400-4401 http://www.cyberlux.com/company-overview.html Founded in 2000, Cyberlux Corporation (CYBL) is a trusted provider of advance lighting solutions to Commercial, Government and Military organizations.

As a Department of Defense (DoD) supplier, we provide light-weight, portable battery-powered advanced LED lighting systems for special operators,

forward-base operations, security and equipment maintenance.

Since 2006, Cyberlux has produced leading-edge, battle-tested, portable LED lighting systems for the U.S. Air Force, National Guard,

Special Operations Command (SOCOM), the U.S. Army and the Defense Logistics Agency (DLA).

The BrightEye and WhiteEye, patented products, are advanced light-weight, portable, battery powered LED lighting systems for special operation actions,

tactical deployments, remote operations and maintenance, emergency and disaster recovery programs.

BrightEye and WhiteEye solutions are powered with milspec rechargeable power systems, with AC and solar powered options.

BrightEye solutions deliver both White and Night Vision (NVG) Security Lighting.

http://www.cyberlux.com/products.html

Click on "View" Button below to view details

http://www.cyberlux.com/services.html http://www.cyberlux.com/gsa-advantage.html [-chart]nebula.wsimg.com/810e2221381d3b40fac03cc3709a19ce?AccessKeyId=7933C78C270198A00912&disposition=0&alloworigin=1[/chart]

General Services Administration Schedule 56 Contract Holder

For more than 10 years, Cyberlux has produced leading-edge, battle-tested, portable LED lighting

systems for various DoD customers, including the U.S. Air Force, National Guard, Special Operations

Command (SOCOM), U.S. Army and the Defense Logistics Agency (DLA).

Since 2006, the Company has operated under its GSA Contract Award GS-07F-9409, and during this time

Cyberlux has supplied mission-critical portable lighting systems to its DoD customers.

GSA Advantage Contract: GS-07F-9409S

CAGE CODE: 38HR0

Primary NAICS: 336411

https://www.stockscores.com/chart.asp?TickerSymbol=CYBL&TimeRange=275&Interval=d&Volume=1&ChartType=CandleStick&Stockscores=1&ChartWidth=830&ChartHeight=500&LogScale=None&Band=None&avgType1=SMA&movAvg1=50&avgType2=SMA&movAvg2=100&Indicator1=RSI&Indicator2=BBW&Indicator3=AccDist&Indicator4=MACD&endDate=&CompareWith=&entryPrice=&stopLossPrice=&candles=redgreen

02-07-2021

DISCLAIMER: ONLY FOR MICK

https://investorshub.advfn.com/boards/profilea.aspx?user=1012

*The Board Monitor and herewithin , are not licensed brokers and assume NO responsibility for actions,

investments,decisions, or messages posted on this forum.

CONTENT ON THIS FORUM SHOULD NOT BE CONSIDERED ADVISORY NOR SOLICITATION

AUTHORS MAY HAVE BUYS OR SELLS WITH THE COMPANIES MENTIONED IN TRADING POSTERS SHOULD DUE DILIGENT BUYING OR SELLING.

ALL POSTING SHOULD BE CONSIDERED FOR INFORMATION ONLY. WE DO NOT RECOMMEND ANYONE BUY OR SELL ANY SECURITIES POSTED HEREWITHIN.

ANY trade entered into risks the possibility of losing the funds invested.

• There are no guarantees when buying or selling any security.Any

DISCLAIMER;

JUST TO MAKE SOME THINGS CLEAR

I AM NOT AH FINANCIAL ADVISIOR

& NOT AH BROKER.

I AM JUST AH REGULAR GENT DAT LIKES TO

CHAT CHATTER ON MANY COMPANIES.

SOME I OWN AH LOT I DON'T.

SO NOT RESPONSIBLE ANYTHING I DESCRIBE.

DA MICK.

Catalysts: - 2-4 Acq. this Quarter, 20+ in review -

Catalysts: - 2-4 Acq. this Quarter, 20+ in review - 9

9  23 Address Changed:

23 Address Changed:  2933 South Miami Blvd Suite 124 Durham NC 27707

2933 South Miami Blvd Suite 124 Durham NC 27707  800 Park Offices Drive Suite 3209 Research Triangle Pa NC 27709

800 Park Offices Drive Suite 3209 Research Triangle Pa NC 27709  Linkedin Added

Linkedin Added