Register for free to join our community of investors and share your ideas. You will also get access to streaming quotes, interactive charts, trades, portfolio, live options flow and more tools.

>>> A Week of Shock and Awe Ignites China’s Stock Markets

The Wall Street Journal

by Rebecca Feng, Jason Douglas

9-30-24

https://www.msn.com/en-us/money/markets/a-week-of-shock-and-awe-ignites-china-s-stock-markets/ar-AA1rr3gi?cvid=dfdee113fba5454bde0c227ee27e33a1&ei=72

It is too early to tell if China’s weeklong blizzard of stimulus will reignite flickering growth. But its impact is already unmistakable in one corner of the economy: Red-hot stock markets.

Some $143 billion worth of stocks changed hands in 35 minutes of fevered trading in Shanghai, Shenzhen and Beijing on Monday—the shortest-ever span of time in which stock trading hit the one-trillion yuan mark in the country’s history.

China’s benchmark CSI 300 index has soared 25% since the country’s central bank unleashed the first wave of easing measures on Tuesday last week, erasing the previous nearly 14 months’ losses in the span of five trading sessions. In the southern Chinese city of Shenzhen, the technology-focused ChiNext index rocketed up 15.4% on Monday, its largest single-day rise since the index came into existence in 2010.

The stock-market frenzy follows an extraordinary week for the Chinese economy. After months of drip-feeding tiny doses of policy support into an ailing economy crying out for major surgery, China’s top leadership relented. Volley after volley of growth-friendly pledges were announced in a daily staccato, with officials pledging more to come if needed. The blast of stimulus—and the epic rally it set off—came on the eve of a seven-day holiday marking the 75th anniversary of the founding of the People’s Republic.

Yet the big question is whether stock investors’ euphoria will be matched by a durable turnaround in China’s struggling economy. Official and private surveys of economic activity released Monday underscored the challenge: Manufacturers reported a fifth straight month of shrinking activity, adding to a run of downbeat data that economists say explains the government’s sudden jolt into action.

“Policy has moved into an emergency mode,” said Larry Hu, chief China economist at Macquarie.

Uncertainty over whether the stock-market rally will be followed by a similarly impressive economic revival springs from still-unanswered questions about just how much support Beijing is preparing to pump into the economy.

Though officials pledged more fiscal spending, they haven’t yet put a number on it, or offered much in the way of specifics. They promised to stabilize the property sector, but analysts say the details announced so far don’t come close to achieving that.

The larger worry, some economists say, is that authorities do enough to lift growth toward their official growth target of around 5% for this year—but not enough to drive a lasting recovery and see off the threat of persistent deflation.

“There is a danger that hope rather than facts are leading the market,” said Nick Borst, director of China research at Seafarer Capital Partners, a California asset manager focused on emerging markets.

In the blizzard of policy moves announced in China in the past week, the biggest slice of the action so far came from the People’s Bank of China. The central bank’s governor, Pan Gongsheng, on Tuesday last week announced plans to cut a bevy of interest rates and shove billions of yuan into the stock market—with pledges of billions more to come, if necessary.

On Thursday, the readout of a meeting of the Communist Party’s top decision-making body, chaired by leader Xi Jinping, showed that officials unexpectedly devoted their September meeting to scrutinizing the economy. Economics is typically discussed during its April, July and December meetings, providing a hint of the seriousness with which officials are now looking upon the economic malaise. The readout from the meeting was short on detail, but pledged more fiscal and monetary support for the economy and more action to stabilize the property sector, in crisis since 2021.

The measures kept coming. On Sunday evening, the government said it would lower down payments for second homes and allow existing homeowners to refinance their mortgages at lower interest rates, which although common in the U.S. is difficult in China.

Some big cities followed up with their own real-estate measures. The southern manufacturing hub of Guangzhou said Sunday that it would remove all remaining restrictions on home purchases, while Shanghai and Shenzhen, two of China’s biggest and wealthiest cities, said they would allow more people to buy homes and relax quotas on purchases in suburban areas.

The result of this policy blitz: Trading in stocks exploded, again, on Monday, while in Shenzhen, the local housing bureau pointed to apartments in a new affordable-housing project selling out in eight hours.

By the end of the day Monday, the value of stocks traded in China’s domestic stock market had reached $372 billion, the highest single-day total ever.

Of the five major stock-market rallies in China in the past quarter-century, three were powered by stimulus. Stocks during those episodes notched trough-to-peak gains of between 50% and 100%, suggesting this rally could have much further to run if policymakers follow through with meaningful stimulus and property-market support, Thomas Gatley, China strategist at Gavekal Dragonomics, wrote in a report Monday.

A surging stock market could help perk up consumers and stimulate growth, said Tommy Xie, OCBC Bank’s head of Greater China research and strategy. “What has excited markets even more is China’s recognition of the interconnectedness between capital markets and economic recovery,” he said.

Property stocks were some of the biggest gainers. Hong Kong-listed shares of Kaisa Group, Sunac China Holdings, and Fantasia Holdings, all of which have defaulted on their debts, surged 83%, 55% and 38%, respectively. More than a dozen other defaulted developers also saw their shares climb by 10% or more, according to data provider Wind.

The euphoria around bank stocks was much more restrained, as fresh policies such as lowering mortgage rates and cutting interest rates threaten to further erode profit margins. Shanghai-listed shares of the country’s largest four banks edged up by between 2% and 4%.

Then, there are the remaining concerns around China’s economic fundamentals. In addition to the fifth straight month of manufacturing-sector contraction, the official purchasing managers index also showed export orders weakening and surveyed firms signaling continued caution on hiring.

A parallel measure of activity in the services sector slid into contraction in September, offering another sign of faltering consumer sentiment. Recent data had shown slowing growth in retail sales.

Economists say Beijing needs to offer more details on its fiscal policy plans to assess whether stimulus plans will amount to much. Interest-rate cuts are welcome, they say, but data and surveys suggest many households and businesses are still reluctant to borrow, muffling the intended effects of central bank easing measures.

Robin Xing, chief China economist at Morgan Stanley, told clients in a note Sunday that he expects officials to announce a supplementary budget in October, in which he expects Beijing will pencil in another 1 trillion to 2 trillion yuan, equivalent to $143 billion to $285 billion, worth of spending focused on supporting consumption and local governments’ stretched finances.

But Xing added that officials face “a long drawn-out battle” to get inflation up and growth back on a sustainable path.

Beijing’s main response to the slowdown so far has been to funnel investment into factories. The resulting pickup in production has hammered prices and profits and fueled trade tensions overseas, where many countries are growing alarmed at a wave of cut-price Chinese imports squeezing homegrown industries.

And even after the latest announcements on real estate, the sector remains a severe drag on China’s economy. Economists say Beijing still needs to do more to clear a backlog of unfinished homes that have already been paid for if consumer confidence is to return.

“Amid all the euphoria, the structural issues are still there,” said Rory Green, chief China economist at GlobalData TS Lombard in London.

<<<

---

>>> US approves tariff hikes on Chinese goods, including a 100% duty on EVs

Semafor

by Marta Biino

September 13, 2024

https://www.yahoo.com/news/us-greenlights-tariff-hikes-chinese-142156503.html

The US ratified sharp increases in tariffs on Chinese products Friday including a 100% duty on electric vehicles, in ongoing efforts to protect domestic industries from a flood of cheap Chinese goods.

The tariffs, which include a 50% levy on solar cells and 25% on steel, aluminum, EV batteries and key minerals, will go into effect at the end of September, Reuters reported.

Top White House economic adviser Lael Brainard told the outlet that the decision was a way to “ensure that the US EV industry diversifies away from China’s dominant supply chain.”

Tariff stance on China is a key topic ahead of US election

The steep tariffs come as the US’ two presidential candidates — Kamala Harris and Donald Trump — have projected tough-on-China stances ahead of November’s election. Harris will likely adopt a similar policy position to that of the Biden administration, while Trump’s vowed to once again become a ”tariff man,” threatening even higher levies on Chinese goods if he is reelected, marks a “protectionist escalation” in rhetoric that is rattling Republicans, Semafor’s Burgess Everett reported. But overall, the difference in approach toward Beijing between the two candidates seem to have “less to do with direction and more to do with degree,” Time noted.

Global curbs on China EVs haven’t slowed sales

Along with the US, the EU and Canada have also introduced curbs on Chinese EVs — but they have had little effect on sales, Euronews reported. In August, delivery numbers for most major Chinese EV makers actually increased, signaling “a rebound in demand for the vehicles internationally and suggesting that Chinese EV makers may be able to withstand regulatory challenges posed by new tariffs,” the outlet noted. Beijing-backed electric vehicle makers are also looking for creative ways around the efforts to limit their sales, with BYD, the country’s biggest, investing in manufacturing facilities across the world to more easily sidestep the tariffs.

Tariffs an ‘irrational’ move in light of global green transition

From a climate perspective, tariffs on electric vehicles — such as those imposed by the EU — are “irrational,” the director of the Institute for European Policy-Making at Bocconi University in Milan argued in Project Syndicate. The race to develop electric cars should be seen as “desirable,” he wrote, given the bloc’s effort to position itself as leading the fight against climate change. And while an ongoing trade war between some Western countries and Beijing may justify some of the EU’s concerns, the tariffs will undoubtedly make reaching the bloc’s net-zero targets more expensive, if not jeopardize them altogether, an environment research associate wrote for Britain’s Chatham House think tank.

<<<

---

>>> China’s deflationary spiral is now entering dangerous new stage

Bloomberg News

Sep 9, 2024

https://finance.yahoo.com/news/china-deflationary-spiral-now-entering-103006274.html

(Bloomberg) — Deflation stalking China since last year is now showing signs of spiraling, threatening to worsen the outlook for the world’s second-largest economy and raising calls for immediate policy action.

Data released Monday confirmed that apart from food costs, consumer price growth barely registered in large swathes of the economy at a time when incomes are sagging.

A broader measure of economy-wide prices known as the gross domestic product deflator will likely extend its current five-quarter drop into 2025, according to Bloomberg Economics and analysts at banks including BNP Paribas SA. That would amount to China’s longest streak of deflation since data began in 1993.

“We are definitely in deflation and probably going through the second stage of deflation,” said Robin Xing, chief China economist at Morgan Stanley, citing evidence from wage decreases. “Experience from Japan suggests that the longer deflation drags on, the more stimulus China will eventually need to break the debt-deflation challenge.”

The danger for China is deflation could snowball by encouraging households reeling from falling paychecks to cut back on spending, or delay purchases because they expect prices to fall further. Corporate revenues will suffer, stifling investment and leading to further salary cuts and layoffs, bankrupting families and firms.

Private surveys show that’s already starting to happen. In sectors of the economy favored by the government — such as electric vehicle-manufacturing and renewables — entry-level salaries declined by almost 10% in August from a peak in 2022, according to findings by Caixin Insight Group and Business Big Data Co.

A survey of 300 company executives by the Cheung Kong Graduate School of Business showed growth in labor costs last month was the weakest since April 2020, when China’s initial Covid lockdowns began to ease.

Separate data from Zhaopin Ltd. shows average hiring salaries in 38 major cities barely changed in the second quarter, in contrast to the 5% growth seen in the two years before the pandemic.

It’s a cycle the world has seen before in Japan starting in the 1990s during a period that came to be known as its “lost decades” — when a grinding stagnation followed a burst bubble in real estate and financial markets.

While Chinese officials have sought to stifle discussion about deflation, warning analysts to avoid using the term, it’s beginning to enter public dialogue. Former central bank Governor Yi Gang last week said rooting out deflation has to take priority for policymakers, a rare admission by a prominent figure in China that falling prices are threatening the outlook.

Yi called for “proactive fiscal policy and accommodative monetary policy” and said officials “should focus on fighting deflationary pressure,” at a panel discussion at the Bund Summit in Shanghai on Friday. China’s immediate goal should be to turn its GDP deflator positive in the coming quarters, he said.

So far, officials have given no sign of any significant shift from their cure-all of encouraging production rather than addressing weak demand with steps such as greater government spending on public services and consumer subsidies.

In a sign price pressures are becoming even more subdued, China’s core inflation — which strips out volatile items such as food and energy — cooled in August to the weakest in more than three years. Expectations for deflation are spilling into markets, stoking a bond rally that’s sent yields to record lows and stoked official concerns that banks have become too exposed to interest-rate risks.

The weak price pressures are evident in the growth pace of China’s nominal GDP, which expanded just 4% in the second quarter — well under the nation’s real economic growth goal of around 5% this year.

At times of weak price gains, nominal expansion is a more useful indicator because it better reflects changes in wages, profits and government revenue, Luo Zhiheng, chief economist at Yuekai Securities Co., wrote in a note earlier this month.

For Jack Liu, a 37-year-old sales engineer of aluminum products in southern China, the impact hit home after realizing he no longer ordered extra eggs at breakfasts.

Plummeting market demand forced his company to cut prices and sell at a loss last year. That slashed his income to less than a 10th of what once exceeded 1 million yuan ($141,000), making mortgage payments a struggle.

“The country doesn’t admit there’s deflation,” said Liu, who lives in Foshan in Guangdong province. He has a modest following of 1,100 people on the Instagram-like Xiaohongshu, where he warns regularly about the danger of deflation.

The speed of the deterioration in China’s price outlook has taken the market by surprise.

Inflation was weaker than forecast in three of the past four months, growing just 0.6% in August — an increase due largely to a 2.8% pickup in food prices. Core inflation last month rose just 0.3% to remain below 1% for an 18th month.

Underscoring the drag on inflation, producer prices have been falling since late 2022. Manufacturers’ raw material and selling prices both contracted for the second month in August, official data shows, while charges by services and construction companies shrank at the fastest pace since April 2020.

The dilemma is that even monetary expansion in China could be deflationary by being mainly directed at the supply side of the economy, Michael Pettis, a senior fellow at the Carnegie Endowment for International Peace, wrote in an article last month.

Meanwhile, the deflationary mindset is starting to take hold. Consumer confidence is hovering at a record low, and households report a growing willingness to save instead of spending or buying homes.

For Liu, the aluminum industry worker, as the pain deepens, the solution lies with policymakers in Beijing. “The government needs to at least take some concrete measures,” he said, “to lift consumption and improve people’s expectations.”

<<<

---

>>> Sino-French satellite launched into orbit, China's CCTV says

by Reuters

6-22-24

https://www.msn.com/en-us/news/world/sino-french-satellite-launched-into-orbit-china-s-cctv-says/ar-BB1oHazN?OCID=ansmsnnews11

SHANGHAI/BEIJING (Reuters) - A satellite developed by China and France, the most powerful yet for studying the farthest explosion of stars, was launched into orbit on Saturday, Chinese state broadcaster CCTV reported.

The satellite to study phenomena including gamma-ray bursts was lifted into orbit by a Chinese carrier rocket launched from the Xichang Satellite Launch Center in the southwestern province of Sichuan, CCTV said.

The launch of the Space Variable Objects Monitor will play an important role in astronomical discoveries, the broadcaster said, citing the China National Space Administration.

It is the first astronomy satellite developed by China and France, although they developed the China-France Oceanography Satellite, launched in 2018, China Daily reported in April.

China's advances in space and lunar exploration are rapidly outpacing those of the United States, attracting partners from European and Asian countries as a result.

China's Chang'e-6 lunar probe this month carried to the far side of the moon payloads from the European Space Agency, as well as from Pakistani, French and Italian research institutes.

China is working with countries including Brazil, Egypt and Thailand to develop and launch satellites.

<<<

---

---

>>> Yuan Devaluation Debate Surfaces as Traders Weigh Next FX Shock

Bloomberg

4-28-24

https://www.bloomberg.com/news/articles/2024-04-29/yuan-devaluation-debate-surfaces-as-traders-mull-next-fx-shock

Supporters say sharp currency drop can help China’s economy

But such a move is controversial as it can trigger outflows..

<<<

---

NetEase - >>> ‘Warcraft’ Returns to China as Blizzard and NetEase Settle Spat

Bloomberg

by Sabrina Mao and Zheping Huang

April 9, 2024

https://finance.yahoo.com/news/warcraft-returns-china-blizzard-netease-010000423.html

(Bloomberg) -- NetEase Inc. reached a new agreement to distribute games in China for Microsoft Corp.’s Blizzard Entertainment, salvaging a 15-year relationship and reviving titles like World of Warcraft for the world’s biggest gaming market.

With the deal, famed franchises like StarCraft, Diablo, Hearthstone and Overwatch will once again be live for players in China. The Hangzhou-based publishing giant and Microsoft’s Activision Blizzard subsidiary halted a longtime partnership in January of last year after failing to agree on an extension, causing a 15% plunge in NetEase shares in Hong Kong.

Separately, Microsoft’s gaming division and NetEase have agreed to explore bringing new NetEase titles to Xbox consoles and other platforms, the companies said in a statement.

“We are thrilled to embark on the next chapter, built on trust and mutual respect, to serve our users in this unique community that we’ve built together,” NetEase Chief Executive Officer William Ding said in the statement. The expiration of the previous deal descended into acrimony when the two sides alleged bad-faith negotiations for a renewal of the terms.

Blizzard suspended most online game services and sales in mainland China when the prior pact expired more than a year ago, cutting off a lucrative collaboration for both parties. Its major release in June 2023 — Diablo IV, which got off to a hot start internationally — hasn’t been officially available in China. The companies now say Blizzard games “will return to the market sequentially” starting in the summer, with further details to be provided at a later date.

Activision Blizzard was acquired in October by Microsoft in a $69 billion deal that set a record for takeovers in the video-game industry. The combined entity ranks No. 3 among global games publishers, behind Tencent Holdings Ltd. and Sony Group Corp., and was expected to seek a rapprochement with NetEase.

First signed in 2008 and renewed in 2019, the NetEase-Blizzard distribution accord has benefited both companies, feeding NetEase with globally recognized hits and giving its US partner a gateway into the world’s biggest PC and mobile gaming arena.

Before NetEase, Blizzard distributed World of Warcraft in China through Shanghai venture The9 from its release in 2004 through 2008. But that partnership ended in a rift, with Chinese players unable to access the game for more than a month. China’s No. 2 gaming giant swooped in as Blizzard sought to find a new local publisher, first signing a deal to run StarCraft II and Warcraft III, then taking over World of Warcraft, which at the time was the most popular online game in China.

<<<

---

>>> Global X ETFs To Liquidate 19 ETFs

PR Newswire

January 19, 2024

https://finance.yahoo.com/news/global-x-etfs-liquidate-19-213000999.html

NEW YORK, Jan. 19, 2024 /PRNewswire/ -- Global X ETFs, the New York-based provider of exchange-traded funds, today announced the scheduled liquidation of the following ETFs (the "Funds"), based on an ongoing review process of its product lineup to ensure it meets the evolving needs of its clients. The Funds scheduled for liquidation include:

Global X Cannabis ETF

Global X Carbon Credits Strategy ETF

Global X China Biotech Innovation ETF

Global X Green Building ETF

Global X Health & Wellness ETF

Global X Metaverse ETF

Global X MSCI China Communication Services ETF

Global X MSCI China Consumer Staples ETF

Global X MSCI China Energy ETF

Global X MSCI China Financials ETF

Global X MSCI China Health Care ETF

Global X MSCI China Industrials ETF

Global X MSCI China Information Technology ETF

Global X MSCI China Materials ETF

Global X MSCI China Real Estate ETF

Global X MSCI China Utilities ETF

Global X MSCI Next Emerging & Frontier ETF

Global X MSCI Pakistan ETF

Global X MSCI Portugal ETF

Based upon the recommendation of Global X Management Company LLC, the Global X Funds' adviser, the Board of Trustees determined on January 19, 2024 that it was in the best interests of the Funds and their shareholders to liquidate each of the Funds. The Funds represent less than 1% of the assets of Global X ETFs.

Shareholders may sell their holdings in the Funds prior to the end of the trading day on Friday, February 16, 2024, and customary brokerage charges may apply to these transactions. The Funds will cease trading at the end of the trading day on Friday, February 16, 2024. The Funds are expected to liquidate on or around Friday, February 23, 2024. Any person holding shares in the Funds as of the liquidation date will receive a cash distribution equal to the net asset value of their shares as of that date. Global X Management Company LLC will bear all fees and expenses that may be incurred in connection with the liquidation of the Funds and the distribution of cash proceeds to investors, other than brokerage fees and other related expenses.

About Global X ETFs

Global X ETFs was founded in 2008. For more than a decade, our mission has been empowering investors with unexplored and intelligent solutions. Our product lineup features over $40 billion in assets under management.i While we are widely recognized for our Thematic Growth, Income, Commodity and International Access ETFs, we also offer Core, Risk Management, and other solutions to suit a range of investment objectives. Explore our ETFs, research and insights, and more at www.globalxetfs.com.

Global X is a member of Mirae Asset Financial Group, a global leader in financial services, with more than $550 billion in assets under management worldwide.ii Mirae Asset has an extensive global ETF platform ranging across the US, Australia, Brazil, Canada, Colombia, Europe, Hong Kong, India, Japan, Korea, and Vietnam with over $80bn in assets under management.iii

<<<

---

>>> Everything China is Doing to Rescue Its Battered Stock Market

Bloomberg News

Feb 7, 2024

https://finance.yahoo.com/news/everything-china-doing-rescue-battered-083645073.html

(Bloomberg) -- Chinese stocks have staged a nascent recovery from a $7 trillion rout, thanks to intensifying rescue efforts as authorities seek to prevent the market from slumping for a fourth straight year.

The benchmark CSI 300 Index has gained 5.2% so far this week. The rebound came after a quickening drumbeat of policy support, which included replacing the market regulator and wider trading curbs as well as state buying of major bank stocks. News that regulators planned to brief President Xi Jinping on markets also fueled optimism.

Chinese leaders are under mounting pressure to act more resolutely to end a stock-market meltdown that risks undermining financial and social stability, at a time when the economy is mired in worsening housing woes and persistent deflationary pressures. Authorities also appear keen to prevent a weak market from further dampening already anemic consumption as China enters the Lunar New Year holiday week.

Here’s a list of measures that have either been announced or reported on to start the year as China seeks to aid the economy and calm investors.

Feb. 7:

In a surprise move after markets had closed for the day, Beijing replaced the head of its securities regulator. Wu Qing, a banking and regulation veteran who earned the reputation as “the broker butcher” when he led a crackdown on traders in the mid-2000s, is replacing Yi Huiman as chairman and party chief of the China Securities Regulatory Commission, according to the official Xinhua News Agency.

Feb. 6:

Funding Support for Developers

China’s financial regulator calls for further, prompt implementation of a financing coordination mechanism to support developers at a meeting, according to a statement.

Regulators Plan to Brief Xi

Regulators plan to brief President Xi Jinping on the market as soon as Tuesday, Bloomberg News reported. While it’s unclear whether any new support measures will come out of the Xi meeting, traders are hoping this time will be different.

Sovereign Wealth Fund Pledges Support

Central Huijin Investment Ltd., the unit that holds Chinese government stakes in big financial institutions, said it will buy more exchange-traded funds. The securities regulator vowed in a follow-up comment to maintain stable market operations, adding that authorities will continue to guide various institutional investors and funds to enter the market with greater efforts.

M&A and Restructuring Support

China will strongly support listed companies to enhance their investment value through mergers, acquisitions and restructuring, the China Securities Regulatory Commission said in a statement.

‘National Team’ Buying Shares

The so-called national team has bought roughly 70 billion yuan ($9.7 billion) of onshore Chinese shares in the past month, according to estimates by Goldman Sachs, adding that 200 billion yuan or ~0.8% of free float market capitalization is needed to stabilize the market.

The national team refers to a group of Chinese state funds tasked to support markets. Meantime, overseas investors, which may include offshore proxies for such state funds, bought another 1.7 billion yuan of mainland stocks via trading links with Hong Kong Wednesday, marking the seventh consecutive session of inflows.

Read more: China’s Small-Cap Crash Shows What Happens Without Market Rescue

Restricting Sales

China is tightening trading restrictions on domestic institutional investors as well as some offshore units as authorities fight to stem a deepening stock rout, according to people familiar with the matter.

Officials this week imposed caps on some brokerages’ cross-border total return swaps with clients, limiting a channel that can be used by China-based investors to short Hong Kong stocks, said the people, asking not to be identified discussing a private matter. At the same time, some Chinese brokers that use the channel to buy mainland shares for their offshore units were told not to reduce their positions, the people said.

Read more: China Widens Stock Trading Curbs on Quants, Offshore Units

Feb. 5:

Monetary Stimulus

Beijing added about 1 trillion yuan into markets Monday with the previously announced cut to banks’ reserve requirement ratio taking effect. That has helped keep cash ample, with money markets showing few signs of stress.

Regulators Check in With Listed Firms

China’s regulatory officials visited listed companies in 20 provinces and municipalities from Jan. 29-Feb. 4, according to a statement from China Securities Regulatory Commission. Regulators are accelerating their process to solve issues raised by listed companies on taxation policy, financing, land, imports and exports, as well as intellectual property right protection.

Help for Home Builders

Cash-strapped Chinese property developers said a range of their housing projects have been listed as eligible for funding under the latest program to support the ailing sector. The flurry of activity comes just three weeks after Beijing urged local authorities to draft a list of projects eligible for funding. Policymakers want risk-averse banks to step up lending to the real estate sector, which saw credit growth slow to the weakest in more than a year last quarter, undermining developers’ ability to complete homes.

Promise to Deal with Margin Call Risks

China stock traders are unwinding their margin debt rapidly, underscoring how a prolonged selloff may be leading to some forced share liquidation. In response, the securities regulator said it will guide brokerages to adjust their margin call levels and maintain “flexible” liquidation lines in an effort to reduce pressure from forced selling of pledged shares.

Feb. 4:

Regulator Vows to Prevent ‘Abnormal Fluctuations’

The China Securities Regulatory Commission vowed on Sunday to prevent abnormal fluctuations, saying it would guide more medium- and long-term funds into the market and crack down on illegal activities including malicious short selling and insider trading.

Feb. 1:

PBOC Supports Housing and Infrastructure

The People’s Bank of China provided 150 billion yuan worth of low-cost funds for lending to housing and infrastructure projects last month, stepping up support for the economy.

Share Buybacks

Firms listed in mainland China and Hong Kong spent 14 billion yuan and HK$21 billion ($2.6 billion) repurchasing shares last month, respectively, each marking a record since 2021 when Bloomberg began compiling the data.

Jan. 28: Securities Lending Restriction

Securities regulators said they will halt the lending of certain shares for short selling, the latest attempt to put a floor under the stock market rout. Strategic investors, which typically refers to holders with restricted shares, won’t be allowed to lend out the stock during agreed lock-up periods.

Read More: China Tightens Securities Lending Rule to Support Stock Market

Jan. 27: Real Estate Easing

Guangzhou, one of China’s biggest cities, further loosened home-buying curbs in a bid to stem falling prices. Beijing, Shanghai and Shenzhen have lowered down-payment requirements since November.

Read More: China’s Guangzhou Eases Property Curbs Further as Prices Fall

Jan. 26: Aid for Developers

The Ministry of Housing and Urban-Rural Development said it will provide a list of housing projects eligible for funding support by the end of the month, the latest attempt to boost lending for real estate to slow the sector’s slump.

Read More: China to List Property Projects Eligible for Funding

The same day, the National Financial Regulatory Administration urged banks to support requests by qualified developers including extending existing loans and adjusting repayment arrangements.

Read More: China Property Developers Rise After Guangzhou Easing, Supports

Jan. 24: RRR Cut, Property Loans, More

People’s Bank of China Governor Pan Gongsheng said the central bank will lower the reserve requirement ratio — the amount of cash lenders must keep in reserve — by 0.5 percentage points on Feb. 5 to release 1 trillion yuan ($139 billion) in long-term liquidity to the market. The announcement, coming after official data showed the nation’s economy was still grappling with major challenges, marked the biggest RRR cut since 2021.

Read More: China Ramps Up Stimulus, Market Rescue With Sudden RRR Cut

Hours later, regulators unveiled more measures, including broadening the use of commercial property loans for developers to help them repay other debt.

Read More: China Adds Support for Developer Funding By Easing Loan Uses

The same day, authorities in China and Hong Kong announced steps to deepen financial ties, including facilitating real estate purchases and expanding a program that allows for personal investments in the Greater Bay Area, a region of 70 million people that includes Hong Kong and megacities in the southern mainland such as Shenzhen and Guangzhou.

Read More: China and Hong Kong Broaden Investment and Financing Links

Jan. 23: Stock Rescue Package

Policymakers are considering using about 2 trillion yuan, mainly from the offshore accounts of Chinese state-owned enterprises, as part of a stabilization fund to buy shares onshore through the Hong Kong exchange link, Bloomberg reported. They have also earmarked at least 300 billion yuan of local funds to invest in onshore shares through China Securities Finance Corp. or Central Huijin Investment Ltd. A day earlier, Premier Li Qiang asked authorities to take more “forceful” measures to stabilize the stock market and investor confidence. His request came after the CSI 300 Index touched a five-year low.

Read More: China Eyes Stock Rescue Package Backed by $278 Billion

Jan. 19: Signs of State Buying

The aggregate turnover in some of the country’s top exchange-traded funds — commonly watched for signs of state-led buying — reached the third-largest weekly total ever. It was the most since July 2015, when the so-called “national team” tried to offset selling momentum amid an epic bubble bursting.

Read More: Record Turnover in China ETFs Fuels State Buying Speculation

Jan. 16: Special Bonds

China is considering 1 trillion yuan of new debt issuance under a so-called special sovereign bond plan, Bloomberg News reported. The proposal discussed by senior policymakers would involve the sale of ultra-long sovereign bonds to fund projects related to food, energy, supply chains and urbanization.

Read More: China Weighs More Stimulus With $139 Billion of Special Bonds

Jan. 5: Rental Housing

The PBOC and the NFRA published guidelines on financial support for the development of the market for rental housing. That included a policy to encourage banks to provide loans for developers, industrial zones, certain rural organizations and companies to build new homes for long-term renting or renovating existing facilities for that purpose.

<<<

---

>>> Leaders from emerging economies are visiting China for the 'Belt and Road' forum

Associated Press

10-15-23

https://www.msn.com/en-us/money/companies/leaders-from-emerging-economies-are-visiting-china-for-the-belt-and-road-forum/ar-AA1igDcm?OCID=ansmsnnews11

BEIJING (AP) — Leaders of emerging market countries are arriving in Beijing for a meeting organized by the Chinese government that will mark the 10th anniversary of its Belt and Road Initiative.

More than a dozen leaders from Africa, Asia and the Mideast were flying into Beijing on Monday, following the arrivals of Chilean President Gabriel Boric and Hungarian Prime Minister Viktor Orbán on Sunday. Others are coming on Tuesday.

Under the Belt and Road Initiative, a signature policy of President Xi Jinping, Chinese companies have built ports, roads, railways, power plants and other infrastructure around the world in a bid to boost trade and economic growth.

But the massive Chinese development loans that funded the projects have also burdened some poorer countries with heavy debts.

A flurry of diplomacy is expected on the sidelines of the third Belt and Road Forum, whose main events are on Wednesday. Orbán met with Xi and Premier Li Qiang, Hungary's state news agency MTI said. The forums also were held in 2017 and 2019.

Kenyan President William Ruto will be seeking additional loans for stalled road projects despite the country's already high public debt, and an easing of the repayment of a Chinese loan for a railway project that has not proven commercially viable.

Russian President Vladimir Putin is expected to attend the forum, as are representatives of the Taliban government in Afghanistan.

Putin downplayed the idea that China, through its Belt and Road projects in Central Asia, is competing for influence in a region that Russia has long considered its backyard.

"Our own ideas on the development of the Eurasian Economic Union, for example, on the construction of a Greater Eurasia, fully coincide with the Chinese ideas proposed within the framework of the Belt and Road Initiative,” he told Chinese state broadcaster CCTV, according to a transcript posted on the Kremlin website.

The leaders who arrived on Monday included Ethiopian Prime Minister Abiy Ahmed, Sri Lankan President Ranil Wickremesinghe, Republic of Congo President Denis Sassou Nguesso, Papua New Guinean Prime Minister James Marape and Cambodian Prime Minister Hun Manet.

<<<

---

Rickards on China - >>> Paper Tiger

BY JAMES RICKARDS

SEPTEMBER 11, 2023

https://dailyreckoning.com/paper-tiger/

Paper Tiger

The story of China’s explosive growth from 1978 to 2008 is well-known.

China’s GDP surged from less than $150 billion in 1978 to over $3 trillion by 2008. China’s average annual growth rate exceeded 10% from 1978 to 2005. During this period, over 600 million people escaped poverty to obtain at least a stable if low-income standard of living.

Between 2000 and 2008, China became the factory to the world providing everything from simple assembly to textiles to world-class automobiles and laptop computers.

In the 1960s and 1970s, development economists believed that moving an economy from low-income to middle income was a huge challenge, but once middle-income status was reached the path to high-income was just a matter of time.

This was called the “takeoff ” theory based on the view that it was hard to get a plane off the ground, but once airborne it could soar to almost any feasible altitude in time.

It turns out that theory was completely wrong.

In fact, it’s relatively easy to move an economy from low-income to middle-income. All that is required is cheap and plentiful labor, urban infrastructure, basic education, and foreign capital. With those ingredients, an economy can turn itself into a manufacturing powerhouse.

The catch is that this manufacturing is mostly assembly-based. Investors may know that China is the source for about 90% of all iPhones. They may not know that Chinese value-added to the iPhone is only 6% of the sale price.

The other 94% of value added comes from the U.S. (invention and patents), Japan (gorilla glass), South Korea (semiconductors), and 26 other countries that supply critical parts.

China assembles the phones, but they did not invent them, and they did not create the high-tech inputs.

A low-income country is considered to have about $5,000 annual income per capita. The middle-income countries begin at about $10,000. The high-income countries begin around $20,000 annual per capita income but have no ceiling.

China is often touted as the “second largest economy in the world,” which it is on an aggregate basis. But when calculated on a per capita basis, it drops from number 2 to number 77 in global rankings, between Equatorial Guinea and Botswana. On a per capita basis, U.S. income is six times greater than China.

So much for China taking over the world.

Therefore, the challenge for China is how to break out of the middle-income trap and reach high-income status. This is extremely difficult to do. The only countries that have made the leap are Japan, South Korea, Hong Kong, Taiwan and Singapore.

The list of countries stuck in the middle-income trap along with China is a long one — Malaysia, India, Turkey, Thailand, Brazil, Mexico, Argentina, Russia, Chile and others.

China Is Trapped

By Jim Rickards

The way out of the middle-income trap is to develop your own high-technology intellectual property that you can then apply yourself and license to others. The middle-income countries basically pay others licensing fees for the technology they need to grow.

It’s only when you develop your own technology that you can move to higher value-added in your manufacturing and earn fees from others. The key to forecasting Chinese growth in the years ahead is therefore technology.

Can China develop its own technology ahead of advanced economy competitors and create the high-value-added industries that come with it? The outlook here is not good for China. They have shown little or no capacity to invent or produce in areas such as advanced semiconductors, high-capacity aircraft, medical diagnostics, nuclear reactors, 3D printing, AI, water purification, and virtual reality.

The projects that China does have on display that are advanced (such as their bullet trains that run quietly at 310 kph) are done with technology licensed from Germany or France or with stolen technology. China has produced major technological advances, but it has done so in non-sustainable ways including excessive debt and theft of intellectual property.

China has done little innovation on its own. The stolen technology channel is being shut down by bans on advanced semiconductor exports to China, and sanctions on the use of 5G systems from Huawei. Even China’s ability to import high-tech semiconductor manufacturing equipment as a path to developing their own semiconductors has been cut off through export bans from the U.S. and Netherlands.

The second hurdle to growth in China is its overreliance on investment to drive GDP. A country’s GDP account consists of consumption + investment + government spending + (exports–imports).

Investment can be a good way to drive an economy forward assuming the investment is carefully chosen and the returns on investment exceed any financing costs. That has not been the case in China.

Most developed economies (Germany is an exception) have consumption at about 50% to 70% of total growth with investment around 25%. In China, consumption is only 25% of GDP while investment is 45%. (Net exports are a large percentage).

China’s problem is that much of its investment is wasted. It consists of large white elephant infrastructure projects (such as the Nanjing South train station which I have visited; it has high marble walls and 128 escalators mostly empty). I’ve also visited the construction sites of the “ghost cities” one after the other almost to the horizon, also mostly empty.

This infrastructure binge is financed with debt that is now both unpayable and acts as a drag on real growth in other sectors of the economy. China has consistently failed to pivot its economy from investment to consumption with the result that the waste continues and the debt pile grows larger. China is trapped in an infrastructure and debt dead-end with no way out.

There are many other headwinds to Chinese growth in addition to the middle-income trap and the debt trap. These include declining demographics, geopolitics, corruption, extreme income inequality, and the rise of Xi Jinping as the new Mao Zedong.

But I want to widen the aperture and look at new challenges to China beyond those I’ve covered in the past. These new challenges include the risk of financial panic and new corporate failures that make the notorious Evergrande collapse look like small beer.

China is not only slowing but it may be on the brink of a financial and economic collapse that will reverberate around the world. That’s because what happens in China doesn’t stay in China. It’s critical to understand that what’s happening in China today is more than a slowdown and more than a credit crunch. It’s much closer to a full scale financial collapse.

It is possible that the Chinese government can intervene with massive fiscal stimulus. Of course, that simply increases the already colossal debt burden and kicks the problem into the tall grass for the time being.

That said, it’s not clear that the Chinese government wants to intervene in this manner. Chairman Xi may just let the chips fall where they will, knowing that most of the losses will actually fall on U.S. investors and Japanese banks.

If Xi takes that approach, the damage will not be confined to China. In fact, the financial contagion could resemble the virus contagion that began in China. It starts in China, but spreads quickly to Europe, Japan, and the United States. The damage here may be greater than the damage there; a strange kind of net benefit to China.

This comes at a time when the U.S., Europe, and Japan are facing their own headwinds (in terms of reduced commercial lending, declining manufacturing, and contracting world trade despite consumers remaining somewhat strong for the moment).

So, a Chinese collapse would be a force multiplier that might throw the world into a global financial panic.

In fact, China is facing a new financial crisis that may leave the rest in the shade. This involves the collapse of a shadow bank called Zhongrong International Trust. Zhongrong is not a pure play property developer like Evergrande nor is it a bank. Instead, it is a shadow bank (offering notes and investing the proceeds) with some property development activities, but many other investment schemes as well.

For years, Zhongrong relied on its reputation as one of the top financial groups in China. Yet, it’s now been revealed that assets taken in as wealth management products were transferred to corporate headquarters and used for various speculations not connected to any specific wealth management goal.

In this respect, Zhongrong resembles the notorious FTX crypto fraud in which billions of dollars of customer funds were diverted to proprietary speculation and spending sprees by the principals. Above all, Zhongrong is non-transparent and lightly regulated, which has resulted in a complete lack of accountability. As the firm fails it has become impossible for regulators to respond appropriately since they really have no idea what is going on inside the company.

Chinese authorities have established a task force to study possible contagion. Of course, the contagion has already started, which shows how behind the curve regulators are. I can’t say with certainty how large the losses from the Zhongrong will be although a total loss of $500 billion taking into account shareholder equity, wealth management products, and direct accounts seems likely.

Of course, that will just be the tip of the iceberg as contagion takes hold and the panic spreads.

My expectation is that Chairman Xi and the CCP will not resort to fiscal stimulus this time, but will let the rotten edifice of bad debt and fraud collapse of its own weight. Chinese stock markets will fall 50% or more as a result. This will give China a chance to clean out the deadwood (with lots of fraud trials and jail terms) and reset the system.

Of course, a collapse of that size will not be confined to China. In fact, the CCP may be betting that much of the economic fallout will land in the United States. Investors in the U.S. should expect a U.S. stock market collapse along with bank failures and a wave of bad debts beginning late this year.

It’s not too late to prepare accordingly. Yet, this may be the last warning.

<<<

---

>>> Chip Leaders Head to Washington to Lobby for China Rules Relief

Bloomberg

by Jenny Leonard and Ian King

July 14, 2023

https://finance.yahoo.com/news/chip-leaders-head-washington-lobby-001528633.html

(Bloomberg) -- America’s largest semiconductor companies are embarking on a last-ditch effort to head off new curbs on their sales to China, with senior executives traveling to Washington next week for talks with administration officials and lawmakers.

The chief executive officers of Intel Corp., Qualcomm Inc. and Nvidia Corp. are planning to lobby against extending restrictions on the sale to China of certain chips and the equipment to manufacture the semiconductors that the Biden administration is set to roll out in the coming weeks, people familiar with the matter said.

While they don’t expect to stave off all the actions, the companies are sensing a window of opportunity to convince the Biden team that an escalation would hurt the current diplomatic efforts by the White House to engage Chinese officials and establish a more productive relationship, according to the people, who asked not to be identified because the trip isn’t yet public.

Chip companies are at the center of what has been an escalating row between Beijing and Washington. The US, where the majority of the technology originates, believes that restricting China’s access to it will bolster national security and hold back the Asian nation’s efforts to advance its military capabilities.

The companies have argued that being cut off from their largest market will harm their ability to spend on advancing their technology and ultimately undermine US leadership.

Representatives for the three companies declined to comment.

Qualcomm CEO Cristiano Amon gets more than 60% of his company’s revenue from the China region by supplying components to smartphone makers such as Xiaomi Corp. Intel’s Pat Gelsinger, who visited Beijing earlier this month to show off his company’s latest artificial intelligence chips, counts the nation as his biggest sales region. The country provides about a quarter of Intel’s sales. And for Nvidia, run by co-founder and CEO Jensen Huang, China provides about a fifth of revenue.

The Commerce Department in October issued rules that bar semiconductor equipment makers from selling certain tools to China, as well as prohibit the export of some chips used in artificial intelligence applications — an announcement that roiled the industry last October.

So far, chip equipment makers such as Applied Materials Inc. have taken the biggest hits to revenue, being forced to knock billions of dollars off their projections. But the restrictions, which companies fear will be extended to other classes of chips, are also affecting some makers of devices. Nvidia’s ability to ship its industry-leading artificial intelligence accelerators to China has been curbed by an approval process, costing it sales.

“I’m alarmed that some American CEOs continue to advocate for weaker export controls on sensitive technology,” Representative Mike Gallagher, a Wisconsin Republican and chairman of a House committee on competition with China, said in a statement on Friday. “The Biden administration needs to tighten our export controls on advanced chips”

The administration is planning to update and finalize the measures by strengthening what’s already been announced. Earlier this week, Bloomberg reported that the US is using some of its powers to influence overseas companies to further cut off China’s access. ASML Holding NV, one of the biggest providers of chipmaking equipment, is facing tighter restrictions from its home government in the Netherlands and new restrictions from the US, because some of its components are made in America.

In general, the US new rules will also reflect the outcome of negotiations with Japan and the Netherlands, people briefed on the plans said.

Reuters previously reported on the plan for some of the CEOs to meet with US officials.

<<<

---

Re-post - >>> More on multinational companies seeking to ringfence China:

https://investorshub.advfn.com/boards/read_msg.aspx?message_id=172208444

https://www.wsj.com/articles/companies-try-new-strategy-to-stay-in-china-siloing-61c88721

Russia’s war in Ukraine has pushed many boardrooms to discuss contingency plans for a potential China-Taiwan war, business advisers say. In a worst-case scenario, some executives fear they may have to write down or hive off their China business, as was the case with Russia.

Russia was relatively easy to relinquish in that it comprised a minuscule portion of sales and profits of most multinational companies (excluding the oil and gas industry). China is a different story, however; there are many multinational companies in various sectors of the economy who derive more than 10% of sales in China.

<<<

---

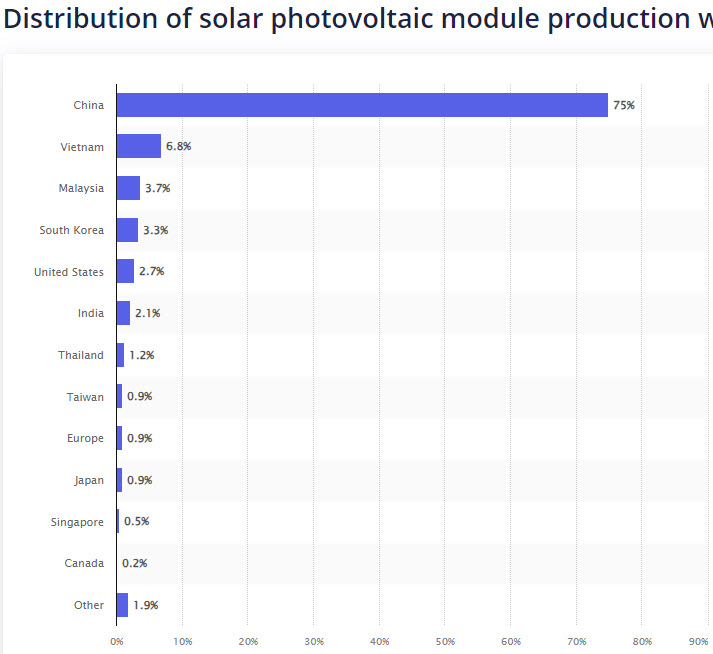

Re-post w/chart - >>> This is the model China uses for every industry they want to enter. In the early 2000s we bought solar panels primarily from Japan and South Korea. We never sold a Chinese solar panel. By the time I left the industry in the mid-2010s it was difficult to compete without selling Chinese panels. Today they own the market and most of the non-Chinese brand panels are manufactured in China.

Customers would ask about Canadian Solar as a non-Chinese brand. Their sales office is in Ontario. Everything else is owned and operated in China.

https://investorshub.advfn.com/boards/read_msg.aspx?message_id=172189022

<<<

---

Re-post - >>> TSLA—The “KFC Call” redux:

https://investorshub.advfn.com/boards/read_msg.aspx?message_id=172184649

https://www.wsj.com/articles/its-getting-riskier-to-do-business-in-china-taiwan-capital-control-yuan-tesla-d3dc88f6

By sharing its technology with China, Tesla jump-started an entire domestic industry. Now, as that industry is beginning to show signs of maturity, Tesla faces increasingly tough domestic competition from Chinese companies.

…China’s population is shrinking and getting older. The official count is in dispute, but demographer Yi Fuxian predicts China’s population will decline to one billion by 2050.

…As China’s economy contracts, the Communist Party will protect the profits of state-owned enterprises, further limiting opportunities for foreign companies.

Soon Beijing won’t need Tesla, and Mr. Musk will face regulatory hurdles and other difficulties....

<<<

---

>>> AZN considering separating China business, according to sources:

https://investorshub.advfn.com/boards/read_msg.aspx?message_id=172174660

https://www.fiercepharma.com/pharma/misinformation-astrazenecas-china-head-refutes-spinoff-report

AstraZeneca, the largest multinational pharma company in China, has reportedly made plans to separate its local business there in case geopolitical tensions worsen.

With the help of bankers, the British drugmaker has worked out a plan to potentially spin its China business into a separate entity listed in Hong Kong while retaining control, the Financial Times reports, citing people familiar with the discussions.

…“Every multinational with a strong China business” seems to have considered a similar move, one senior Asia-based banker told the FT. “Even if it’s just the option to give you flexibility in the future, it’s worth thinking about.”

…AZ is the largest Western pharma in China by sales and has the most business exposure to the country. Despite mounting pricing pressure, the China outfit generated $1.6 billion in sales for AZ in the first quarter, representing 15% of the company’s total revenue during the period....

<<<

---

>>> Billionaire investor Mark Mobius says he cannot take money out of China - FOX Business

Reuters

March 5, 2023

https://www.reuters.com/markets/billionaire-investor-mark-mobius-says-he-cannot-take-money-out-china-fox-2023-03-05/

SHANGHAI, March 5 (Reuters) - Billionaire investor Mark Mobius told FOX Business he cannot take his money out of China due to the country's capital controls, cautioning investors to be "very, very careful" about investing in an economy under a tight government grip.

"I have an account with HSBC in Shanghai. I can't take my money out. The government is restricting flow of money out of the country," Mobius, founder of Mobius Capital Partners, told FOX Business in an interview published on March 2.

"I can't get an explanation of why they're doing this ... They're putting all kinds of barriers. They don't say: No, you can't get your money out. But they say: give us all the records from 20 years of how you made this money ... This is crazy."

Mobius' comments were circulated on Chinese social media site WeChat at the weekend.

Mobius led emerging market investment at Franklin Templeton Investments for three decades and is known for his bullish view on China. Now, though, he said, he "would be very, very careful" investing in the country.

"The bottom line is that China is moving in a completely different direction than what Deng Xiaoping instituted when they started the big reform program," he said, referring to the former Chinese leader.

"Now you have a government which is taking golden shares in companies all over China. That means they're going to try to control all of these companies ... So I don't think it's a very good picture when you see the government becoming more and more control-oriented in the economy."

Mobius, who calls himself "the Indiana Jones of Emerging Market investing", told FOX Business he's increasing exposure to alternative markets such as India and Brazil.

Mobius and HSBC could not be reached at the weekend.

<<<

---

>>> US unprepared in electric car fight against China, says Ford boss

The Telegraph

Howard Mustoe

June 19, 2023

https://finance.yahoo.com/news/us-unprepared-electric-car-fight-105515836.html

The US is unprepared in the battle to compete with China on electric cars, the boss of Ford has warned.

Bill Ford, chairman, said the Chinese electric car market had developed at a rapid pace and that the company was now taking “an all hands on deck” approach to prepare for a flood of foreign imports.

Mr Ford, who is the great grandson of the company’s founder Henry Ford, said: “They’re [China] not here but they’ll come here, we think, at some point, we need to be ready, and we’re getting ready.

“They developed very quickly, and they developed them in large scale. And now they’re exporting them.”

China is poised to overtake Germany as the biggest car exporter in the world with overseas shipments of cars made in China tripling since 2020 to reach more than 2.5 million last year.

Ford is investing $3.5bn (£2.7bn) in building a gigafactory battery plant in Michigan in a deal with Chinese firm CATL.

However, the deal is under scrutiny from Senator Marco Rubio, the top Republican on the Senate Intelligence Committee, who says it risks making the US more reliant on China.

In common with the UK and European nations, the US is braced for an influx of Chinese-made cars.

Chinese-made electric cars are already available in the UK, made under the MG brand owned by SAIC. Another major Chinese manufacturer with an interest in exports is Geely, which owns Volvo, Lotus and has a stake in Aston Martin.

MGs have gained in popularity in part because they are cheaper than other EVs made by the likes of Tesla, and the firm has said it plans an expansion in sales in the UK. For instance, the MG ZS starts at £30,500, while the Tesla Model 3 starts at £38,800.

Chinese brands including BYD; Funky Cat, which is owned by the giant Great Wall Motor; and Chery; are all planning to bring their vehicles to the UK.

China has cheap labour, cheap raw materials such as steel and a vast headstart when it comes to building battery plants, with more than 100 built and 200 on the way, while Europe and the US each have fewer than a dozen.

As the biggest car market in the world, it is looking to export and capitalise on this advantage.

Their plans in the UK may be foiled if public charging is not expanded quickly and cheaply enough to tempt car buyers who don’t have access to home charging, however. Cars which cost more than their petrol equivalents combined with expensive electricity offer a poor deal.

<<<

---

>>> Chip wars with China risk ‘enormous damage’ to US tech, says Nvidia chief

Jensen Huang tells lawmakers to be ‘thoughtful’ about imposing more export controls on Beijing

Financial Times

5-24-23

https://www.ft.com/content/ffbb39a8-2eb5-4239-a70e-2e73b9d15f3e?ftcamp=traffic/partner/feed_headline/us_yahoo/auddev

The chief executive of Nvidia, the world’s most valuable semiconductor company, has warned that the US tech industry is at risk of “enormous damage” from the escalating battle over chips between Washington and Beijing.

Speaking to the Financial Times, Jensen Huang said US export controls introduced by the Biden administration to slow Chinese semiconductor manufacturing had left the Silicon Valley group with “our hands tied behind our back” and unable to sell advanced chips in one of the company’s biggest markets.

At the same time, he added, Chinese companies were starting to build their own chips to rival Nvidia’s market-leading processors for gaming, graphics and artificial intelligence.

“If [China] can’t buy from?.?.?.?the United States, they’ll just build it themselves,” he said. “So the US has to be careful. China is a very important market for the technology industry.”

The US’s efforts to prevent China buying or developing advanced chips has become the most aggressive front in a new cold war between the two powers.

Huang’s comments came just days before Chinese authorities announced a ban on US memory chipmaker Micron’s products from critical infrastructure, a move seen as the first significant retaliation against Washington’s export controls.

The Taiwanese-American executive warned US lawmakers to be “thoughtful” about imposing further rules restricting trade with China.

“If we are deprived of the Chinese market, we don’t have a contingency for that. There is no other China, there is only one China,” Huang said, adding that there would be “??enormous damage to American companies” if they were unable to trade with Beijing.

Huang added that blocking the US tech industry’s access to China would “cut the Chips Act off at the knee”, referring to the Biden administration’s $52bn funding package to encourage construction of more semiconductor manufacturing facilities — known as “fabs” — in the US.

“If the American tech industry requires one-third less capacity [due to the loss of the Chinese market], no one is going to need American fabs, we will be swimming in fabs,” he said. “If they’re not thoughtful on regulations, they will hurt the tech industry.”

Nvidia has embedded itself at the centre of a global race to develop a new generation of AI tools, becoming the primary source of chips that are used to train the “large language models” that power chatbots such as OpenAI’s ChatGPT.

As excitement has grown around AI, Nvidia’s market capitalisation has more than doubled so far this year to about $770bn, ahead of its latest earnings report on Wednesday. Its valuation now dwarfs US rivals such as Intel and Qualcomm, each worth close to $120bn. Despite a rally among some chip stocks, Nvidia is still far larger than its next nearest rival, Taiwanese chipmaker TSMC, which is worth about $450bn.

However, the California-based company has been blocked from selling its most advanced chips — the H100 and A100 series — to Chinese customers since August when the US imposed export controls on technology used for AI. Nvidia has been forced to reconfigure some of its chips to comply with US rules limiting the performance of products sold in China.

Huang said China made up roughly one-third of the US tech industry’s market, and would be impossible to replace as both a source of components and an end market for its products.

Most of the world’s advanced chips — including Nvidia’s — are made in Taiwan, which Beijing claims as part of its territory. President Joe Biden has said the US would intervene if China took unprovoked military action against Taiwan. Analysts fear such a conflict would lead to severe global disruption in production of everything from cars to computers.

“We can theoretically build chips outside of Taiwan, it’s possible [but] the China market cannot be replaced. That’s impossible,” Huang said. “So you’ve got to ask yourself which way do you want to push it.”

China, including Hong Kong, accounted for more than a fifth of Nvidia’s sales in its latest financial year ending January 2023, according to its annual report, while Taiwan represented more than a quarter.

The figures reflect the “billing location” of its customers, which could include contract manufacturers who then sell on to “end customers” in other markets. Based on last year’s figures, more than $12bn in Nvidia’s annual revenues — almost half its total — might be exposed to any potential conflict in the region.

Huang also reflected on his failed takeover of UK-based chip business Arm due to regulatory hurdles, saying he had been “deeply hurt” and it was no longer “easy for us to invest” in the UK. “I built the first implementation of the AI supercomputer in England, the Cambridge-1. I’m not going to build another,” he said. “I’m done.”

<<<

---

>>> Business dangers loom as the U.S. and EU converge on ‘de-risking’ from China

Fortune

by Peter Vanham, Chloe Taylor

May 26, 2023

https://finance.yahoo.com/news/business-dangers-loom-u-eu-101911864.html

Good morning, Peter Vanham here in Geneva, filling in for Alan.

It’s the chronicle of a death foretold: Germany, Europe’s largest economy, entered a recession yesterday. The recession was widely expected, but beneath its surface lies a major dilemma for the German economy: to “de-risk” or depend on China, that’s the question.

The question became acute because Germany’s engine sputtered partially due to faltering exports to China. German companies saw an 11.3% drop in their exports to the world’s second-largest economy so far, whereas most other European economies exported more. What happened?

Part of it can be brought back to conventional factors. Cars typically represent a large share of German exports, but Chinese consumers are increasingly buying Chinese brands, and government subsidies which pushed German car sales higher last year, ended.

Since a few months, though, there is another major factor, and it is one that represents a seismic shift: German politicians are steering their companies away from China.

The country’s political leaders won’t go as far as some in the U.S. have, pursuing a policy of “decoupling”. But Europe’s largest economy is increasingly aligning with the U.S., anyway.

“The U.S. and the European Union have converged on using the term 'de-risking' [from China], and Germany’s chancellor Olaf Scholz emphasized the term in his [G7] speech as well,” Costanze Stelzenmueller, director of the Center on the United States and Europe at Brookings told me.

A few months ago, leaked documents also indicated “Germany’s foreign ministry wants to take a tougher line on China and push companies to reduce their dependency on Beijing”, Politico reported.

It means German executives still depending on China, and wanting to expand their market share there, such as Siemens, are facing an uphill battle. “I will defend my market share, and if I can, I will expand it,” Siemens CEO Roland Busch told the Financial Times this week.

Back in the U.S., Nvidia chief Jensen Huang also warned about the consequences of the G7’s desire to de-risk from China. “There is no other China, there is only one China,” he said this week, warning of “enormous damage to American companies” if the trade in chips stopped.

But if exports falter, and the notion of “economic dependency” becomes a political problem on both sides of the Atlantic, it’s hard to see how this wouldn’t have any long-term effects.

CEO Daily is off on Monday for Memorial Day. We'll see you back here Tuesday. More news below.

Peter Vanham

Executive Editor

peter.vanham@fortune.com

@petervanham

This story was originally featured on Fortune.com

<<<

---

>>> Iran's embassy in Riyadh opens gates for first time in years

Reuters

4-12-23

By Aziz El Yaakoubi

https://www.reuters.com/world/middle-east/iranian-delegation-arrives-saudi-arabia-prepare-embassy-reopening-statement-2023-04-12/

RIYADH, April 12 (Reuters) - Iran's embassy in Saudi Arabia reopened its gates on Wednesday for the first time in seven years, a Reuters witness said, under a deal to re-establish ties that could ease a long-standing rivalry that has helped fuel conflicts around the Middle East.

The heavy gates of the Iranian embassy's compound were open in Riyadh with a team inspecting its premises, a Reuters reporter said. A white truck was seen arriving at the gate.

The diplomatic mission opened hours after the Iranian foreign ministry said a technical delegation arrived in the kingdom.

"The Iranian delegation will take the necessary measures in Riyadh and Jeddah to set up the embassy and consulate general," Iranian foreign ministry spokesman, Nasser Kanaani, said in a statement.

The mission had been closed since Saudi Arabia cut ties with Iran in 2016, after its embassy in Tehran was stormed during a dispute between the two countries over Riyadh's execution of a Shi'ite cleric. The kingdom subsequently asked Iranian diplomats to leave within 48 hours while it evacuated its embassy staff from Tehran.

The relationship had begun worsening a year earlier, after Saudi Arabia and the United Arab Emirates intervened in Yemen's war, where the Iran-aligned Houthi movement had ousted a Saudi-backed government and taken over the capital Sanaa.

Riyadh accused Iran of arming the Houthis, who went on to attack Saudi cities with armed drones and ballistic missiles. In 2019, the kingdom blamed an attack on Aramco oil facilities, which knocked out half of its oil output, directly on the Islamic Republic.

Iran denied those accusations.

The hostility between the two regional arch-rivals and major oil producers helped to fuel strife around the region. Last month, they agreed to end their diplomatic rift and reopen their diplomatic missions in a deal brokered by China.

Both countries' foreign ministers met in Beijing earlier this month for the first formal gathering of their top diplomats.

Saudi officials also arrived in Iran to discuss procedures for reopening Riyadh's embassy in Tehran and consulate in Mashhad, the Saudi foreign ministry said on Saturday.

<<<

---

>>> U.S. and China wage war beneath the waves – over internet cables

Subsea cables, which carry the world's data, are now central to the U.S.-China tech war. Washington, fearful of Beijing's spies, has thwarted Chinese projects abroad and choked Big Tech's cable routes to Hong Kong, Reuters has learned.

Reuters

By JOE BROCK

March 24, 2023

https://www.reuters.com/investigates/special-report/us-china-tech-cables/

It started out as strictly business: a huge private contract for one of the world’s most advanced undersea fiber-optic cables. It became a trophy in a growing proxy war between the United States and China over technologies that could determine who achieves economic and military dominance for decades to come.

In February, American subsea cable company SubCom LLC began laying a $600-million cable to transport data from Asia to Europe, via Africa and the Middle East, at super-fast speeds over 12,000 miles of fiber running along the seafloor.

That cable is known as South East Asia–Middle East–Western Europe 6, or SeaMeWe-6 for short. It will connect a dozen countries as it snakes its way from Singapore to France, crossing three seas and the Indian Ocean on the way. It is slated to be finished in 2025.

It was a project that slipped through China’s fingers.

A Chinese company that has quickly emerged as a force in the subsea cable-building industry – HMN Technologies Co Ltd – was on the brink of snagging that contract three years ago. The client for the cable was a consortium of more than a dozen global firms. Three of China’s state-owned carriers – China Telecommunications Corporation (China Telecom), China Mobile Limited and China United Network Communications Group Co Ltd (China Unicom) – had committed funding as members of the consortium, which also included U.S.-based Microsoft Corp and French telecom firm Orange SA, according to six people involved in the deal.

HMN Tech, whose predecessor company was majority-owned by Chinese telecom giant Huawei Technologies Co Ltd, was selected in early 2020 to manufacture and lay the cable, the people said, due in part to hefty subsidies from Beijing that lowered the cost. HMN Tech’s bid of $500 million was roughly a third cheaper than the initial proposal submitted to the cable consortium by New Jersey-based SubCom, the people said.

The Singapore-to-France cable would have been HMN Tech’s biggest such project to date, cementing it as the world’s fastest-rising subsea cable builder, and extending the global reach of the three Chinese telecom firms that had intended to invest in it.

But the U.S. government, concerned about the potential for Chinese spying on these sensitive communications cables, ran a successful campaign to flip the contract to SubCom through incentives and pressure on consortium members.

Reuters has detailed that effort here for the first time. It’s one of at least six private undersea cable deals in the Asia-Pacific region over the past four years where the U.S. government either intervened to keep HMN Tech from winning that business, or forced the rerouting or abandonment of cables that would have directly linked U.S. and Chinese territories. The story of those interventions by Washington hasn’t been previously reported.

SubCom had no comment on the SeaMeWe-6 battle, and HMN Tech did not respond to requests for comment. In a statement last year about infrastructure projects, the White House briefly noted that the U.S. government helped SubCom to win the Singapore-to-France cable contract, without giving details. China’s foreign ministry did not respond to requests for comment. China Telecom, China Mobile, China Unicom and Orange did not respond to requests for comment. Microsoft declined to comment.

Undersea cables are central to U.S.-China technology competition.

Across the globe, there are more than 400 cables running along the seafloor, carrying over 95% of all international internet traffic, according to TeleGeography, a Washington-based telecommunications research firm. These data conduits, which transmit everything from emails and banking transactions to military secrets, are vulnerable to sabotage attacks and espionage, a U.S. government official and two security analysts told Reuters.

The potential for undersea cables to be drawn into a conflict between China and self-ruled Taiwan was thrown into sharp relief last month. Two communications cables were cut that connected Taiwan with its Matsu islands, which sit close to the Chinese coast. The islands’ 14,000 residents were disconnected from the internet.

Taiwanese authorities said they suspected a Chinese fishing vessel and a Chinese freighter caused the disruption. However, they stopped short of calling it a deliberate act and said there was no direct evidence showing the Chinese ships were to blame. China, which considers Taiwan a breakaway province, has ratcheted up military and political efforts to force the island to accept its dominion.

Eavesdropping is a worry too. Spy agencies can readily tap into cables landing on their territory. Justin Sherman, a fellow at the Cyber Statecraft Initiative of the Atlantic Council, a Washington-based think tank, told Reuters that undersea cables were “a surveillance gold mine” for the world’s intelligence agencies.

“When we talk about U.S.-China tech competition, when we talk about espionage and the capture of data, submarine cables are involved in every aspect of those rising geopolitical tensions,” Sherman said.