Register for free to join our community of investors and share your ideas. You will also get access to streaming quotes, interactive charts, trades, portfolio, live options flow and more tools.

>> Russell <<

Yes, it and the DJIA have lagged for some time, but looks like the Russell may be catching up fast. The Russell 2000 (IWM) was up 3.5% today, so a pretty spectacular move, which puts it right at the late March high. Once through that, then the all time highs from 2021 aren't too far off.

Fwiw, I've been mainly using the S+P 500 for the stock allocation, but recently added some small and mid cap individual stocks, and also the small / mid cap ETFs (VO, VB). The smaller stocks tend to be more sensitive to high % rates, so they should benefit from the upcoming Fed % cuts. With luck the bull market breadth should expand.

Lots of landmines out there though, so I'm keeping a fairly low stock allocation. Only 10% in the S+P 500 and another 3% in individual stocks and a few sector ETFs. So a fairly puny allocation, but am trying to avoid the Tagamet :o)

Btw, good luck with that gold related wager with your buddies. If your price prediction was on the high side, you could turn out to be the winner. Tough to predict, and the central banks also have a gold suppression mechanism, but the chart setup sure looks bullish. A month ago it looked like a pullback to lower levels might be in the offing, but now it's 'off to the races' again.

---

PFE golden cross.

---

ADM back above the 200 MA today.

---

Breakout for AVXL. It could use a little more volume, but it has cleared the May high, so next stop the 200 MA (?)

No news today that I can see, but the chart is looking good :o)

Also a nice day for LWLG, and it's back above the 50 MA. The chart setup is similar to AVXL. Next, it needs to break through resistance (June high), and then next stop could be the 200 MA (4.20).

---

>> Gold <<

With gold, you usually don't want it to be doing too well, since that means regular investments like stocks / bonds are still doing OK. I view gold as basically 'disaster insurance', an alternative to fiat paper money. If gold zooms to 3000, it likely means 'regular' investments are in trouble.

The US 'debt bomb' is ticking. 35 trillion now, but 40 tril in a few years, then 50 tril, yikes. Fwiw, I'm figuring 50 tril is the point where the world loses faith in the dollar system. So 2029 or thereabouts.

---

Weird about the Russel. While the NASDAQ 100 and S&P500 have been making daily new highs, the Russel and even the DOW have not been making new highs. I read years ago how a few highly weighed stocks can make the averages look deceptive. I have not followed the advance/decline line lately, but I can bet that has not looked as good as the S&P100 and 500, and that is usually a sign of bad things to come, as I recall.

https://finviz.com/futures_charts.ashx?p=d

OT, I am in a gold guessing contest with 2 buddies. We have been doing this since 1995. After the first of the year we eat a lunch, paid for by the previous year's loser. The guy in the middle gets the tip. I have lost 3 of the last 4 years, boo. I need 2406 to win at years end, happy today, anyway.

Yes, the metals are looking good. Gold over 2400 and silver near 32. The US dollar down big today.

Stocks have gotten near term overbought, but the Russell is up 2% today, so there could be a broadening out beyond the Mag 7 tech names, into the small / mid caps.

Lots of risks out there, but as the old saying goes - 'A bull market climbs a wall of worry'.

---

On the weekly chart, gold still looks like a bull flag. Mostly green bars since March.

Weekly>>>

https://finviz.com/futures_charts.ashx?p=w&t=GC

1Hour>>>>

https://finviz.com/futures_charts.ashx?p=h&t=GC

Chart setup - >>> Anavex Life Sciences Corp. (AVXL), a clinical stage biopharmaceutical company, engages in the development of therapeutics for the treatment of central nervous system diseases. Its lead product candidate is ANAVEX 2-73 for the treatment of Alzheimer's disease and Parkinson's disease, as well as other central nervous system diseases, including rare diseases, such as Rett syndrome, a rare severe neurological monogenic disorder; and infantile spasms, Fragile X syndrome, and Angelman syndrome. The company's drug candidate also comprises ANAVEX 3-71, which is in clinical trial for the treatment of schizophrenia, frontotemporal dementia, and Alzheimer's disease. Its preclinical drug candidates include ANAVEX 1-41 for the treatment of depression, stroke, and neurogenerative disease; ANAVEX 1066 for the potential treatment of neuropathic and visceral pain; and ANAVEX 1037 to treat prostate and pancreatic cancer. The company was incorporated in 2004 and is headquartered in New York, New York.

<<<

---

Chart setup - >>> Archer-Daniels-Midland Company (ADM) engages in the procurement, transportation, storage, processing, and merchandising of agricultural commodities, ingredients, flavors, and solutions in the United States, Switzerland, the Cayman Islands, Brazil, Mexico, Canada, the United Kingdom, and internationally. It operates in three segments: Ag Services and Oilseeds, Carbohydrate Solutions, and Nutrition. The company originates, merchandises, stores, and transports agricultural raw materials, such as oilseeds and soft seeds. It also engages in the agricultural commodity and feed product import, export, and distribution; and various structured trade finance activities. In addition, the company offers soybean meal and oil; vegetable and salad oils and protein meals; ingredients for the food, feed, energy, and industrial customers; margarine, shortening, and other food products; and partially refined oils to produce biodiesel and glycols for use in chemicals, paints, and other industrial products. Further, it provides peanuts, peanut-derived ingredients, and cotton cellulose pulp; sweeteners, corn and wheat starches, syrup, glucose, wheat flour, and dextrose; alcohol, and other food and animal feed ingredients; ethyl alcohol and ethanol; corn gluten feed and meal; distillers' grains; corn germ; and citric acids. Additionally, the company provides proteins, natural flavors, flavor systems, natural colors, emulsifiers, soluble fiber, polyols, hydrocolloids, probiotics, prebiotics, postbiotics, enzymes, and botanical extracts; and other specialty food and feed ingredients; edible beans; formula feeds, and animal health and nutrition products; and contract and private label pet treats and food products. It also offers futures commission merchant; commodity brokerage services; cash margins and securities pledged to commodity exchange clearinghouse; and cash pledged as security under certain insurance arrangements. The company was founded in 1902 and is headquartered in Chicago, Illinois.

<<<

---

I think the number of long entities holding for years is more relevant.

Using rough numbers for an example...

If 60-70% of the shares are held by long term longs that simply aren't selling...

... and ...

Institutions hold just under 10% per fintel...

https://fintel.io/so/us/lwlg

... and ...

20,236,887 shares are short which is 16.9% per fintel..

https://fintel.io/ss/us/lwlg

Covering on news is going to be next to impossible.

Institutions add when they can..

Xena, It would be interesting to find out if there is a relatively small number of entities holding most of the short positions? If so they will have a difficult time covering. Sometimes short outfits will issue a hit piece on the target company to get longs to panic.

Up almost 50% from the low on Monday, and so far this week ~ 4 mil shares have traded. We'll see if the June and July data shows the short position shrinking. It's also possible that some key upcoming news is in the offing, like a new deal or partnership announcement, and the shorts are scrambling to cover.

---

There are an awful lot of shorts for the number of available shares, so the smart ones are starting to cover. It will get crazy when the ones that didn't do their DD and were unaware of how many long term holders were still holding. I think my first buy was at $1.66 and many of the EU stockholders were invested years before I did.

Xena, LWLG shorts starting to cover?

Nice recovery this week. No apparent news that I can find, so it might be short covering (?) The short data for June should be interesting.

---

Yes, things look bullish for gold, but it's had a big recent move, up 20%, so some consolidation is likely. I figure at minimum a consolidation to 2200, but 2000 should be a solid floor. There's also a long history of central bank suppression of gold, so that's another aspect. But the eventual upside for gold could be huge as things unravel for the US dollar system.

Jim Rickards recommends10% of one's investable assets in gold (but no more than 20%). With T-Bills and money markets paying 5%, it's tougher to sit with a lot of gold, but still good to own some imo.

The global de-dollarization of trade and central bank reserves is increasingly ominous for the US dollar, as is BRICS expansion and their plans for a gold-linked currency. Then there is the US 'debt bomb'. Here's my approx timeline (below). I figure something hits the fan once the US debt gets in the 40 and 50 trillion range. So by 2029 at the latest, assuming 3 tril in new debt per year. As investors, this means we have ~ 5 years to reposition out of financial assets (stocks, bonds) and more into hard asset areas (real estate, land, gold, silver, etc). The assumption is that by 50 tril there will be a global loss of confidence in the US dollar's future, and a dollar crisis ensues. So not a very cheery future for the US, but let's hope the 'timeline to disaster' can be extended out past our own life expectancies, and we won't be around for the unravelling.

2024 - 35 tril

2025 - 38 tril

2026 - 41 tril

2027 - 44 tril

2028 - 47 tril

2029 - 50 tril

---

The uncertainty of the world situation, threats of war, election turmoil, etc. looming? On my chart, starting in March, the volume bars spell accumulation, mostly green. But yes, it is struggling a bit here, volume could get more red.

https://finviz.com/futures_charts.ashx?p=d&t=GC

>> gold chart <<

Over the last several months it's also starting to look like a bearish head + shoulders top has formed, with the neckline around 2300. Next support would be down around the 2200 level from March, and below that the key support at 2000.

Fwiw, I'm thinking it breaks down through 2300 and then a test of 2200. But tough to say, and may depend upon the direction the dollar.

---

Looks like gold is making an old fashion pennant or ragged bull flag.

https://finviz.com/futures_charts.ashx?t=GC&p=w

Xena, Imo, too many hunches and an over-reliance on info from I-Hub posters. I would stick to companies with earnings, especially for larger positions. But people have to learn the hard way. Face it, most I-Hubbers would qualify as having a gambling problem.

Historically, women tend to be better investors than men (article below), in part because for them it's not primarily about ego and gambling. With men it's all tied up in their egos. I-Hub is full of these clowns, ignorant gunslingers on a mission to get rich fast. This almost never works, and they end up broke. Betting it all on a risky small cap is the purview of these losers, so don't emulate them. Just my 2 cents..

>>> Why Women Are Better (Investors) Than Men

Forbes

https://www.forbes.com/sites/timmaurer/2023/04/30/why-women-are-better-investors-than-men/

<<<

---

If this is the way it "looks" to you you haven't a clue as to what's really going on...

The people who have that ability are LWLG's potential customers, but so far they haven't been biting (much). Looks like a paradigm shift type of technology, ahead of its time, but this needs confirmation by more industry acceptance and actual orders. Looks like investors have grown tired of waiting and are in 'show me' mode, but if more orders / deals appear, the shorts panic and up she goes.

The fact of the matter is that if LWLG product is not superior this country is in deep doo doo...

The Chinese are aware of the product, and furiously trying to develop a substitute seems to be what is actually going on. Lebby is also developing advanced products while getting the first one on the market.

I don't understand everything in the paper linked in this post, but the folks on the LWLG board that do don't seem worried about China:

https://investorshub.advfn.com/boards/read_msg.aspx?message_id=172486298&txt2find=lithium%20chinese

This poster states that Lightwave Polymer has a cost advantage:

https://investorshub.advfn.com/boards/read_msg.aspx?message_id=174569108&txt2find=lithium%20chinese

A very detailed post on LWLG advantage in this area:

https://investorshub.advfn.com/boards/read_msg.aspx?message_id=174497410&txt2find=lithium%20chinese

More on the subject:

https://investorshub.advfn.com/boards/read_msg.aspx?message_id=173037277&txt2find=lithium%20chinese

https://investorshub.advfn.com/boards/read_msg.aspx?message_id=173037242&txt2find=lithium%20chinese

So it seems that this issue is not heavily discussed on the board because it is of little concern.

Xena, >> Lithium niobate, Lithium tantalate <<

That's the problem with this type of tech stock --> a cool / seductive sounding technology, but so advanced and specialized that it takes a PhD in the field to understand it, the competitive landscape, etc. The people who have that ability are LWLG's potential customers, but so far they haven't been biting (much). Looks like a paradigm shift type of technology, ahead of its time, but this needs confirmation by more industry acceptance and actual orders. Looks like investors have grown tired of waiting and are in 'show me' mode, but if more orders / deals appear, the shorts panic and up she goes.

I used to go for these moonshot type stocks (in biotech), but then switched to regular stocks, and now just use the S+P 500 as the main vehicle. The results have been much better, and with these exciting stocks, I'll follow them for fun but only take very small positions. SMCI was a nice double earlier in the year, but only a small position. Like the old saying goes - 'little pigs get fed, but big pigs get slaughtered'. These days I go by the maxim - 'Moderation / nothing to excess', and the results have been much better.

---

It would be interesting to see these materials compared to Lightwave's.. It also explains the urgency of developing new materials which LWLG is also working on:

Chinese high speed uses lithium tantalate offers cheap, more efficient photonic chips

Lithium tantalate offers cheap, more efficient photonic chips

Recently, the lithium niobate-on-insulator wafer platform has emerged as a superior material for photonic integrated electro-optical modulators due to its strong Pockels coefficient, which is essential for high-speed optical modulation. Nonetheless, high costs and complex production requirements, have kept lithium niobate from being adopted more widely, limiting its commercial integration.

Lithium tantalate (LiTaO3), a close relative of lithium niobate, promises to overcome these barriers. It features similar excellent electro-optic qualities but has an advantage over lithium niobate in scalability and cost, as it is already being widely used in 5G radiofrequency filters by telecom industries.

Now scientists led by Professor Tobias J. Kippenberg at EPFL and Professor Xin Ou at the Shanghai Institute of Microsystem and Information Technology (SIMIT) have created a new PIC platform based on lithium tantalate. The PIC leverages the material's inherent advantages and can transform the field by making high-quality PICs more economically viable. The breakthrough is published in Nature.

The researchers developed a wafer-bonding method for lithium tantalate, which is compatible with silicon-on-insulator production lines. They then masked the thin-film lithium tantalate wafer with diamond-like carbon and proceeded to etch optical waveguides, modulators, and ultra-high quality factor microresonators

Interesting Engineering

https://interestingengineering.com › Innovation

May 8, 2024 — This material has excellent electro-optic properties similar to lithium niobate, but it offers advantages in terms of scalability and cost. This ...

I asked AI:

"How long does it take to develop a new semiconductor chip?"

Search Labs | AI Overview

Learn more

…

The process of designing and manufacturing a semiconductor chip can take 18 months to two years or more:

Design

The chip design process can take 18 months to two years, and can become more expensive and time-consuming as compute requirements increase.

Manufacturing

The manufacturing process can take more than three months from design to production and involves thousands of steps. These steps include:

Wafer preparation: Slicing a silicon wafer from a bar of 99.99% pure silicon

Building layers: Building up layers of interconnected patterns on the wafer

Lithography: Using different types of lithography systems for different layers

Cleanrooms: Keeping air quality and temperature tightly controlled in cleanrooms that are about 10,000 times cleaner than the outside air

Other steps: Polishing the wafer, covering it with a light-sensitive coating, exposing it to light, and baking and developing it

The cost of building and maintaining semiconductor fabs can also be enormous, with Intel estimating that a single fab can take more than $10 billion and three years to complete. Chip manufacturers also need to find locations with lots of space, good water and electricity sources, and a low risk of natural disasters.

Xena, >> fundamentals here are strong enough <<

I'm still learning about the company, and it sounds like they have a great technology, but the target industry (internet backbone) just hasn't been ready for the big transition yet. That would explain - 1) the large short position, 2) the lack of sales / orders, and 3) why a larger tech company hasn't snapped them up.

Another key question --> are there other new technologies coming up that do what LWLG does? That's the problem with these tech hardware stocks, it takes a specialized PhD to understand them, and there are always new gizmos coming along. That's why Buffett sticks to simple businesses he can understand, like Coca Cola, etc. They lack tech's excitement, but are great performers, and a lot fewer ulcers a long the way :o)

---

Xena, Using the 'EU 40% of Retail' figure, here is the approx breakdown of share ownership (below). So of the 120 mil shares outstanding, ~ 33 mil shares are held by owners in the EU, and ~ 53 mil shares are held by owners in the US / other, and ~ 31 mil by institutions (approx figures). If we assume both the EU shares and the institutionally owned shares are not readily available for closing out short positions, that would only leave the US / other shares available. So ~ 53 mil shares available to close out 20 mil shares short. And based on an average daily trading volume of 1/2 mil shares / day, it would take ~ 40 days. So not an easy task, especially if the short positions are held by just a few big players. So it does sound like the shorts are in a pickle.

Shares Outstanding -- 120 mil shares

*******************************************

Institutional (26%) -- 31 mil shares

Insiders (0.5%) - under 1 mil shares

Retail -- US / other - 53 mil shares (60% of Retail)

Retail -- EU - 33 mil shares (40% of Retail)

---

Thanks for the info - sitting on a bunch of physical silver...

It has been verified to my satisfaction...

Contacts with real people through linked-in and PM.

It is 40% of all shares, people not institutions.

IMO - the fundamentals here are strong enough to beat the algos.

Xena, Just curious if that 40% EU figure can be verified? Thanks.

It does seem apparent that 'something' is preventing the shorts from covering. With the stock down so much, the shorts are sitting with massive gains, so one would expect at least some covering soon. But since the stock has been in freefall, they might be waiting for the 2.00 or 1.50 level before the short covering really kicks in. It could also be that some shorts are in fact being covering, but the rapidly declining stock price is bringing in new shorters to replace them, so the total short figures remain steady at 20 mil. It will be interesting to see the upcoming short figures for June and July.

TIA for any additional verification of the 40% figure :o)

---

jeunke22

Re: None

Saturday, June 08, 2024 2:05:45 AM

Post# 193803 of 193850

Just to put the task for Lightwave shorts in perspective and to underline their desperate and very risky position.

LWLG short position : 21 mio, 17% of float, 40 days to cover.

NVIDIA short position: 27 mio, 1.18% of float, 1,5 day to cover.

Lightwave has a very solid retailbase.

Take out the European contingent of retail shareholders around 40% ( who can’t and or are not willing to short) and you understand the uphill battle Lightwave shorts face.

LWLG - >>> Common Stock, Options and Warrants

In January 2019, the Company signed a purchase agreement with the institutional investor to sell up to $25,000,000 of common stock. The Company registered 9,500,000 shares pursuant to a registration statement filed on January 30, 2019 which became effective February 13, 2019. The Company issued 350,000 shares of common stock to the institutional investor as an initial commitment fee valued at $258,125, fair value, and 812,500 shares of common stock are reserved for additional commitment fees to the institutional investor in accordance with the terms of the purchase agreement. The Company registered an additional 6,000,000 shares pursuant to a registration statement filed on January 24, 2020 which became effective February 4, 2020. The Company registered an additional 8,000,000 shares pursuant to a registration statement filed on November 20, 2020 which became effective November 20, 2020. During the period January 2019 through June 30, 2021, the institutional investor purchased 22,337,500 shares of common stock for proceeds of $23,773,924 and the Company issued 772,666 shares of common stock as additional commitment fee, valued at $1,575,509, fair value, leaving 39,834 in reserve for additional commitment fees. All of the registered shares under the purchase agreement have been issued as of December 31, 2023.

On July 2, 2021, the Company filed a $100,000,000 universal shelf registration statement with the U.S. Securities and Exchange Commission which became effective on July 9, 2021.

On October 4, 2021, the Company entered into a purchase agreement with the institutional investor to sell up to $33,000,000 of common stock over a 36-month period. Concurrently with entering into the purchase agreement, the Company also entered into a registration rights agreement which provides the institutional investor with certain registration rights related to the shares issued under the purchase agreement. Pursuant to the purchase agreement, the Company issued 30,312 shares of common stock to the institutional investor as an initial commitment fee valued at $279,174 fair value, and 60,623 shares of common stock are reserved for additional commitment fees to the institutional investor in accordance with the terms of the purchase agreement. During the period October 4, 2021 through June 30, 2023, the institutional investor purchased 3,632,456 shares of common stock for proceeds of $33,000,000 and the Company issued 60,623 shares of common stock as additional commitment fee, valued at $694,531 fair value. All of the registered shares under the purchase agreement have been issued as of December 31, 2023.

On February 28, 2023, the Company entered into a purchase agreement with an institutional investor to sell up to $30,000,000 of common stock over a 36-month period. Concurrently with entering into the purchase agreement, the Company also entered into a registration rights agreement which provides the institutional investor with certain registration rights related to the shares issued under the purchase agreement. Pursuant to the purchase agreement, the Company issued 50,891 shares of common stock to the institutional investor as an initial commitment fee valued at $279,391 fair value, and 101,781 shares of common stock are reserved for additional commitment fees to the institutional investor in accordance with the terms of the purchase agreement. During the period February 28, 2023 through March 31, 2024, the institutional investor purchased 4,120,455 shares of common stock for proceeds of $21,298,402 and the Company issued 72,261 shares of common stock as additional commitment fee, valued at $433,003, fair value, leaving 29,520 in reserve for additional commitment fees. During the three-month period ending March 31, 2024, pursuant to the purchase agreement, the institutional investor purchased 1,250,000 shares of common stock for proceeds of $5,152,350 and the Company issued 17,482 shares of common stock as additional commitment fee, valued at $76,977 fair value. During April and May 2024, pursuant to the purchase agreement, the institutional investor purchased 250,000 shares of common stock for proceeds of $973,950 and the Company issued 3,304 shares of common stock as additional commitment fee, valued at $13,658 fair value, leaving 26,216 in reserve for additional for additional commitment fees.

On December 9, 2022, the Company entered into a sales agreement with an investment banking company. In accordance with the terms of this sales agreement, the Company may offer and sell shares of its common stock having an aggregate offering price of up to $35,000,000 from time to time through or to the investment banking company, as sales agent or principal. Sales of shares of the Company’s common stock, if any, may be made by any method deemed to be an “at the market offering”. The sales agent will be entitled to compensation under the terms of the sales agreement at a commission rate equal to 3% of the gross proceeds of the sales price of common stock that they sell. During the three months period ending March 31, 2024, pursuant to the sales agreement, the investment banking company sold 77,150 shares of the Company’s common stock for proceeds of $330,453 after a payment of the commission in the amount of $10,221 to the investment banking company. During April and May 2024, pursuant to the sales agreement, the investment banking company did not sell any shares of the Company’s common stock.

<<<

https://www.sec.gov/ix?doc=/Archives/edgar/data/1325964/000155335024000021/lwlg_10q-033124.htm

---

LWLG - >>> The Company's first commercial agreement occurred in May 2023, in the form of a four-year material supply and license agreement (the “License Agreement”) that incorporates the Company's patented electro-optic polymer materials for use in manufacturing of photonic devices (the “Licensed Product”). The licensee shall pay the Company a running royalty with a minimum royalty paid on an annual basis over the term of the License Agreement. Additional future revenue will be generated from royalties from the licensee’s sale of Licensed Product that exceed the minimum royalty payments and milestone license fees. The License Agreement is a non-exclusive material supply and license agreement.

During 2024, the Company performed device poling work for a customer.

Timing of Revenue Recognition and Contract Balances

Revenues related to the initial license fee and a minimum annual royalty are recognized over time commencing with the License Agreement in May 2023. An up-front license fee in the amount of $50,000 was paid during the period ending December 31, 2023. $35,708 of this amount is recorded in short term liability deferred revenue in the Company’s balance sheet as of March 31, 2024. For the three months ended March 31, 2024, the Company recognized $16,667 in revenue related to this agreement.

In March 2024, the Company completed coating and poling work on the devices supplied by a customer. Revenue for this contract was recognized at the time of shipment of the devices back to the customer and amounted to $13,750 for the three months ended March 31, 2024.

<<<

https://www.sec.gov/ix?doc=/Archives/edgar/data/1325964/000155335024000021/lwlg_10q-033124.htm

---

LWLG - from Q1-24 (Form 10 Q)

>>> Our future expenditures and capital requirements will depend on numerous factors, including: the progress of our research and development efforts; the rate at which we can, directly or through arrangements with original equipment manufacturers, introduce and sell products incorporating our polymer materials technology; the costs of filing, prosecuting, defending and enforcing any patent claims and other intellectual property rights; market acceptance of our products and competing technological developments; and our ability to establish cooperative development, joint venture and licensing arrangements. We expect that we will incur approximately $1,840,000 of expenditures per month over the next 12 months. Our current cash position enables us to finance our operations through August 2025.

On February 28, 2023, the Company entered into a purchase agreement with an institutional investor to sell up to $30,000,000 of common stock over a 36-month period (described in Note 10). Pursuant to the purchase agreement, the Company received $973,950 in April and May 2024 and the remaining available amount of $7,727,648 is available to the Company per the agreement.

On December 9, 2022, the Company entered into a sales agreement with an investment banking company whereby the Company may offer and sell shares of its common stock having an aggregate offering price of up to $35,000,000 from time to time through or to the investment banking company, as sales agent or principal (described in Note 10). There were no sales of shares of the Company’s common stock pursuant to the sales agreement in April and May 2024. The remaining available amount of $33,096,514 is available to the Company per the agreement.

The Company's first commercial agreement occurred in May 2023 from a material supply and license agreement that incorporates the Company's patented electro-optic polymer materials for use in manufacturing photonic devices (described in Note 3). For the three months ended March 31, 2024, we recognized $16,667 in revenue related to this agreement.

Our cash requirements are expected to increase at a rate consistent with the Company’s path to revenue as we expand our activities and operations with the objective of increasing our revenue stream from the commercialization of our electro-optic polymer technology. We currently have no debt to service.

<<<

https://www.sec.gov/ix?doc=/Archives/edgar/data/1325964/000155335024000021/lwlg_10q-033124.htm

---

Xena, You said - >> private parties in the EU own more stock than the institutions <<

Just curious if you know the approx number of shares held by these EU entities? Also, any idea if these EU shares are held by a single entity, small group, etc? Thanks.

I see LWLG's float and total shares outstanding is ~ 120 mil shares, and the ongoing short position is ~ 20 mil shares. So for the shorts to be seriously impeded in covering, the shares held in Europe would have to be a substantial percentage of the total shares outstanding.

Considering that most of the short positions were likely taken at much higher levels than the current 2.50, they have huge profits built up, and many 'should' be trying to cover right now or in the near future. We'll see what the June short numbers are, but if it remains around the current 20 mil shares, there must be a reason why they aren't covering and grabbing those big profits. The EU position, if big enough, would be a logical explanation.

With the short hyenas, sometimes they will continue to hold until the bitter end, until the company goes broke. But in LWLG's case the company still has approx $30 mil in cash and almost no debt, so enough to go another year or more without a money raise. And over that period LWLG might announce some additional business deals, plus it isn't like LWLG's technology is a dead end, on the contrary. So it's unlikely the strategy of the shorts is to stay short until LWLG goes under. So why aren't they covering? Your main premise (the big EU block of shares as the impediment) would make sense.

Thanks for any insights :o)

---

I would not be surprised to see $50 by years end?

Yes, looks like a major breakout for silver :o)

With the momentum building, I'm thinking it could blast up to 33 or even 35 in the near term (?), and then a consolidation that establishes 30 as the new 'floor'. Just a guess, but the metals are finally coming to life. It's great for gold investors, but with central banks around the world loading up on gold, it could be ominous for the future of the US dollar reserve system.

---

Wow, silver hit 29.99, so it could be the fun is just beginning. A lot of momentum building, and I'm thinking a blast up to 33 - 35 might be in the cards for the nearer term (?) Then a consolidation that establishes 30 as the new 'floor'. Just a guess, but that would replicate what gold has already done.

With silver, there is an incentive for the globalist ghouls to keep the price down, since silver represents a significant input cost for solar panels. But for now it looks like the market forces are in the driver's seat :o)

The surge in the old meme stocks this week suggests a return to 'risk on' investing could be underway, at least for a while. The main 3 stock indices all put in new highs today. RSIs for the S+P 500, DJIA, and Nasdaq are currently - 69, 69, 67, so closing in on the 70 overbought level. But I figure with luck the current momentum continues into next week, barring any news flow that derails the party.

---

Shiller P/E ratio - >>> The Oracle of Omaha's $56 billion silent warning foreshadows potential trouble for Wall Street

https://finance.yahoo.com/news/warren-buffetts-56-billion-silent-092100169.html

Although Warren Buffett has consistently shied away from offering negative takes on the U.S. economy and/or stock market during his nearly six-decade tenure as CEO of Berkshire Hathaway, $56 billion of net-equity security sales over an 18-month stretch speaks volumes without the Oracle of Omaha having to say a word.

The culprit for this consistent net-selling activity looks to be a historically pricey stock market and the irrational behavior of some of its participants.

In Buffett's annual letter to shareholders that was released in February, he had this to say about the "casino-like behavior" he wants no part of:

Though the stock market is massively larger than it was in our early years, today's active participants are neither more emotionally stable nor better taught than I was in school. For whatever reasons, markets now exhibit far more casino-like behaviors than they did when I was young. The casino now resides in many homes and daily tempts the occupants.

At the end of the day, Warren Buffett and his team want a fair deal on a great business, and they aren't willing to waiver from this ideal. As the S&P 500's Shiller price-to-earnings (P/E) ratio shows, there simply aren't many good deals at the moment.

The Shiller P/E ratio, which is also known as the cyclical adjusted price-to-earnings ratio (CAPE ratio), is based on average inflation-adjusted earnings from the last 10 years. This differs from the traditional P/E ratio which only examines trailing-12-month earnings. The beauty of the Shiller P/E averaging earnings over a 10-year period is that it minimizes the impact of one-off events (e.g., the COVID-19 lockdowns).

As of the closing bell on May 3, the S&P 500's Shiller P/E stood at 34.05. This is nearly double its average reading of 17.11 when back-tested to 1871, and it's the third-highest reading during a bull market in over 150 years.

Perhaps the bigger concern is what's historically followed the five previous instances where the Shiller P/E ratio surpassed 30 during a bull market rally. Following all five prior instances, the S&P 500 or Dow Jones Industrial Average went on to lose between 20% and 89% of their respective value. Though the Shiller P/E ratio isn't a timing tool -- i.e., stocks can stay pricey for multiple quarters, if not years -- readings above 30 tend to be a precursor to big moves lower in the stock market.

The lack of desire by Buffett and his team to buy stocks during an 18-month stretch suggests they expect valuations to contract.

<<<

---

QIPT --> key support broken over past several weeks, and is now bouncing to re-test that level (now resistance)

---

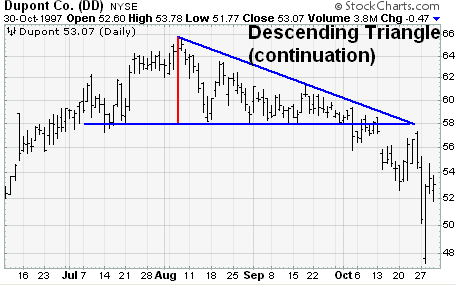

LWLG breaks key support

Had formed descending triangle over past year.

---

In addition to RSI for the main stock indices, another indicator I'm using is the $VIX, since when its RSI approaches or reaches overbought (RSI of 70), this has consistently identified stock market bottoms (see below). The $VIX had an RSI reading over 70 yesterday, and is currently ~ 68, so this suggests that a near term bottom could be near.

I figure a lot will depend upon Israel's response to the Iranian bombing. Since the US has told Netanyahu pretty bluntly that the US will not support his retaliatory efforts, it seems doubtful that he'll do anything really big. Who knows, but I figure that after a few more days the financial markets will go back to concentrating more on corporate earnings. Anyway, I re-upped my stock allocation to 20%, so will go with that for now. I figure a conservative approach might be 12.5% as Core (LT buy/hold), and 7.5% as Flex, but still a 'work in progress'.

2022 - late Sept / early Oct

2023 - March

2023 - August

2023 - late Sept thru Oct

2024 - mid Feb

2024 - April

---

Chart-wise, the main stock indices are nearing oversold, based on the RSI (under 30 is oversold) -

DJIA ------ 31

S+P 500 - 39

Nasdaq -- 42

Russell --- 37

Wall Street is waiting to see Israel's response to the Iranian bombing, but if nothing happens soon then the near term bottom in stocks might be in (?)

---

High Tide (HITI) - nice break out on high volume :o)

>>> High Tide Inc. (HITI) engages in the cannabis retail business in Canada, the United States, and internationally. The company operates through Retail and Wholesale segments. It operates licensed retail cannabis stores; and provides data analytics services. In addition, the company manufactures and distributes consumption accessories. Further, it sells its products through online sales via e-commerce platform. The company offers its products under the Daily High Club, DankStop, FABCBD, GC, Nuleaf, Smoke Cartel, and Blessed CBD brands. The company was formerly known as High Tide Ventures Inc. and changed its name to High Tide Inc. in October 2018. High Tide Inc. was founded in 2009 and is headquartered in Calgary, Canada. <<<

---

>> silver <<

Silver also coming to life :o) Looking at the SLV chart, as with gold there is a quasi 12 year cup + handle (bullish), with the 3 year 'cup' having a quasi inverted head + shoulders (also bullish). It's much less classic than on the gold chart, but is easier to see now that silver is climbing. Also the 'neckline' on the silver chart is sloped, where gold's is flat and thus more 'classic'.

Anyway, looks like silver is playing catch up to gold. There is also a potential motivation for price suppression with silver, since it represents a key input cost for solar panels. Therefore keeping silver prices lower helps keep solar cost competitive with traditional types of energy. Not sure how much price suppression of silver has been going on in recent years, but like gold. it does seem to have peculiar 'smack downs' at times.

---

HITI -- quasi Inverted Head + Shoulders bottom -

>>> High Tide Inc. (HITI) engages in the cannabis retail business in Canada, the United States, and internationally. The company operates through Retail and Wholesale segments. It operates licensed retail cannabis stores; and provides data analytics services. In addition, the company manufactures and distributes consumption accessories. Further, it sells its products through online sales via e-commerce platform. The company offers its products under the Daily High Club, DankStop, FABCBD, GC, Nuleaf, Smoke Cartel, and Blessed CBD brands. The company was formerly known as High Tide Ventures Inc. and changed its name to High Tide Inc. in October 2018. High Tide Inc. was founded in 2009 and is headquartered in Calgary, Canada. <<<

---

IIPR --> Inverted Head + Shoulders -

>>> Innovative Industrial Properties, Inc. (IIPR) is a self-advised Maryland corporation focused on the acquisition, ownership and management of specialized properties leased to experienced, state-licensed operators for their regulated cannabis facilities. Innovative Industrial Properties, Inc. has elected to be taxed as a real estate investment trust, commencing with the year ended December 31, 2017. <<<

---

Xena, While the current LWLG chart pattern clearly looks bearish, if the company is actually turning the corner in their business, that could override the bearish chart. The fact that support at 4 has held so tenaciously for over a year is good, but the subsequent bounces have been petering out at lower and lower levels, thus forming the descending triangle, similar to those shown below.

I was aware of LWLG back in 2020-22, but haven't followed them closely. It sounds like their business model is to be the supplier of their proprietary EO polymer material to companies that will use it in their own products, and LWLG will collect royalties on the sale of the products containing the polymer. It's great they signed their first licensing deal, with more potential deals in the works (per the CEO's recent shareholder letter). Key questions include - the terms of the licensing deal, how much revenue can be expected from the deal, and the timing of the revenue flow. But I assume the terms haven't been disclosed by LWLG, but has the CEO given any guidance on expected revenue flows? In the shareholder letter he says they have numerous other deals in the works, so those could be the big wildcard. Another deal announcement could help the stock a lot, and make moot the current bearish chart. Thanks for any insights :o)

---

Actually it's a quadruple bottom for LWLG. Institutions entered at the highs and loaned their shares to the shorts and it's been monkey business ever since.

What they haven't accounted for in their algos is that private parties in the EU own more stock than the institutions and they aren't selling.

Commercialization and revenues are imminent... shorts are screwed because the can't cover.

Cup + Handle breakout for Gold, GLD (formed over the last 12 years)

Also an Inverse Head + Shoulders breakout for Gold / GLD (formed over last 4 years)

---

| Volume | |

| Day Range: | |

| Bid Price | |

| Ask Price | |

| Last Trade Time: |