Register for free to join our community of investors and share your ideas. You will also get access to streaming quotes, interactive charts, trades, portfolio, live options flow and more tools.

CANADIAN ZINC REPORTS FINANCIAL RESULTS FOR SECOND QUARTER

AND PROVIDES PROJECT UPDATES

Vancouver, British Columbia, August 10, 2017 -

http://www.canadianzinc.com/images/Docs/News_Releases/CZNNR20170810.pdf

Canadian Zinc Corporation (TSX: CZN;

OTCQB: CZICF) (“the Company” or “Canadian Zinc”) reports its interim financial results and

development activities for the three and six month periods ended June 30, 2017.

This news release should be read in conjunction with the Company’s unaudited interim consolidated financial

statements for the three and six month periods ended June 30, 2017 and the related management’s discussion and

analysis (MD&A) which are available on the Company’s website at www.canadianzinc.com, under the “Financials”

section, or on SEDAR (www.sedar.com).

Financial Results for the Second Quarter of 2017

For the three and six month periods ended June 30, 2017, the Company reported a net loss and

comprehensive loss of $3,238,000 and $5,800,000, respectively, compared to a net loss and

comprehensive loss of $866,000 and $1,643,000 for the same periods ended June 30, 2016.

For the three and six month periods ended June 30, 2017, the Company expensed $2,438,000

and $3,804,000, respectively on its exploration and evaluation programs at the Prairie Creek

Mine, compared to $385,000 and $693,000 for the three and six month periods ended June 30,

2016. The higher expenditure in 2017 results from extensive work on the feasibility study for the

Prairie Creek Mine and the ongoing environmental assessment and permitting for the all season

road, which were not as high in the comparable periods.

For the three and six month periods ended June 30, 2017, the Company also expensed $28,000

and $402,000, respectively on its exploration and evaluation properties in central Newfoundland

compared to $51,000 and $111,000 for the comparative periods.

Prairie Creek Project

The Prairie Creek mine site was re-opened in late April and operates on a care and maintenance

basis throughout the season. A week-long site engineering assessment was carried out at the

mine in early May by a team of Ausenco engineers and contractors.

Three separate programs relating to the all season Road were completed. The programs were

part of the Company’s further commitments to the road/route assessment during the regulatory

processes and involved centre-line survey location for the all season Road route and additional

baseline environmental studies including, bird, wildlife and vegetation studies. The helicopter

supported programs were carried out from bases at both the mine site and at the community of

Nahanni Butte.

Feasibility Study to be Completed in Third Quarter

The Definitive Feasibility Study (“DFS”), which is being carried out by AMC Mining Consultants

(Canada) Ltd. (“AMC”) and Ausenco Engineering Canada Inc. (“Ausenco”) to facilitate the

raising of project debt financing for the Prairie Creek Project is in the advanced stages. It is

expected that the DFS will be completed in the third quarter.

Ausenco is also developing a contracting and procurement strategy for further stages of work,

which will align with the project execution schedule and will serve to support the capital cost

estimate and make provision for the identified execution risks and opportunities.

Concurrently, the Company is working with HCF International Advisers (“HCF”) as financial

advisers with the goal of arranging debt financing of up to 70% of the capital expenditures

required once the DFS is completed.

Mineral Processing Optimization

In tandem with the development of the DFS, the Company also initiated a mineral processing

optimization program in January 2017, which included testing of new composite bulk samples

collected from underground drill holes completed at the Prairie Creek Mine in 2015. The principal

objectives of the program are to optimize the proposed mineral processing flow sheet and simplify

the flotation circuit design, thereby improving projected metal recoveries and lowering milling

costs.

Prairie Creek Permitting Update

The environmental assessment for the Company’s permit application for use of the access road

on an all season basis is nearing completion and it is expected that a Report of Environmental

Assessment by the Mackenzie Valley Review Board will be submitted to the Minister of

Indigenous and Northern Affairs by the end of August 2017.

The Review Board held Community Hearings in Nahanni Butte on April 24, 2017 and in Fort

Simpson on April 25, 2017. The Community Hearings provided an opportunity for local

communities to hear and to participate in a discussion of the issues related to the proposed road

development and to raise any concerns directly with the Review Board. There was strong support

shown for the Prairie Creek project from both communities.

The Environmental Assessment process has now been completed and the public record has been

closed.

The Review Board is required to decide if the project is likely to cause significant adverse impacts

or cause significant public concern. The Review Board Report of Environmental Assessment will

describe the Board’s decision and its reasons for the decision and may include recommended

mitigation measures. The report of the Review Board is then sent to the Minister of Indigenous

and Northern Affairs.

Newfoundland Exploration Work

Canadian Zinc owns and is exploring an extensive mineral land package in central Newfoundland

that includes three large VMS projects, each containing defined mineral deposits.

In June 2017, the diamond drilling exploration program at the South Tally Pond project resumed.

The 2017 summer drill program consists of up to 5,000 metres in 24 diamond drillholes and is

designed to continue to test for mineralized extensions to the Lemarchant massive sulphide

deposit. The drilling will initially focus on further testing the up-dip mineralization discovered during

the 2017 winter drill program and will be followed by further drill testing at the Lemarchant

Northwest Zone.

The summer drill program will also include initial drill testing of previously defined electromagnetic

(“EM”) geophysical anomalies at the North and South Lemarchant target areas, located

approximately 500 metres along strike from the Lemarchant deposit.

A ground EM geophysical program is also underway at the South Tally Pond project with the aim

of defining new drill targets. The geophysical program is focused on three priority target areas

located immediately south and east of the Lemarchant deposit. Each area is associated with

airborne EM conductors that remain untested by drilling.

At the Spencers Pond prospect, located approximately 2 km southwest of the Lemarchant

deposit, initial drill testing of newly defined EM targets is also being planned. In this area, a single,

historic drillhole intersected massive sulphide (pyrite) over 0.5 metres associated with

geochemically similar mudstones to that which overly the Lemarchant deposit.

In February 2017, the Company completed a winter drill program on the South Tally Pond property

based on the magnetic and electromagnetic geophysical surveys completed in late 2016 which

outlined new drill targets in three priority areas. The 2017 winter drill program was designed to

test for mineralized extensions to the Lemarchant massive sulphide deposit immediately along

the strike and up-dip of the currently defined Lemarchant resource.

Ten drillholes and three drillhole extensions, totaling 3,070 metres were completed at the

Lemarchant massive sulphide deposit. For full results refer to Canadian Zinc News Release April

18, 2017, with a drill hole location map and key sections provided on the Canadian Zinc website

(www.canadianzinc.com).

The drilling successfully extended the Lemarchant mineralization up to 65 metres up-dip on two

sections located 125 metres apart and 25 metres along strike to the south. The vertical depths of

the mineralized drill intercepts range from 130 -170 metres. The mineralized zone remains open

for further expansion both up-dip and along strike.

About Canadian Zinc

Canadian Zinc is a TSX-listed exploration and development company trading under the symbol

“CZN”. The Company’s key project is the 100%-owned Prairie Creek Project, a fully permitted,

advanced-staged zinc-lead-silver property, located in the Northwest Territories.

For further information contact:

John F. Kearney Alan B. Taylor Steve Dawson

Chairman & Chief

Executive

Vice President Exploration

& Chief Operating Officer

Vice President

Corporate Development

(416) 362-6686 (604) 688-2001 (416) 203-1418

Suite 1805,

55 University Avenue

Toronto, ON M5J 2H7

Fax: (416) 368-5344

Suite 1710 – 650 West Georgia Street,

Vancouver, BC V6B 4N9

Fax: (604) 688-2043

Tollfree:1-866-688-2001

Suite 1805,

55 University Avenue

Toronto, ON M5J 2H7

Fax: (416) 368-5344

E-mail: invest@canadianzinc.com

Website: http://www.canadianzinc.com

http://www.canadianzinc.com/images/Docs/News_Releases/CZNNR20170810.pdf

- God Bless -

Zinc market is tight and selling +$1/lb.

Hunt Brothers Old Silver Dream Mine -

one of the richest in the world @ bargain price -

Cdn Zinc Corp J (CZN)

0.295 ? 0.035 (+13.46% ![]() ))

))

Volume: 686,116 @ 2:41:03 PM ET

Bid Ask Day's Range

0.29 0.295 0.265 - 0.3

TSX:CZN Detailed Quote

http://www.canadianzinc.com/

http://www.canadianzinc.com/images/media_articles/2014/CZN_NorthernMiner_Nov2014.pdf

https://pbs.twimg.com/media/B8fajUwCYAAgpGE.jpg">https://pbs.twimg.com/media/B8fajUwCYAAgpGE.jpg";; />

- God Bless -

Goldman, JPMorgan, Glencore defeat U.S. lawsuit over zinc prices

Thu Jan 7, 2016 12:12pm EST BY JONATHAN

Mofos got away near scot free again!!!

http://www.reuters.com/article/us-zinc-antitrust-decision-idUSKBN0UL1VT20160107

A U.S. judge on Thursday dismissed a private antitrust lawsuit in which zinc purchasers accused affiliates of Goldman Sachs Group Inc (GS.N), JPMorgan Chase & Co (JPM.N) and Glencore Plc (GLEN.L) of conspiring to drive up the metal's price.

In an 87-page decision, U.S. District Judge Katherine Forrest in Manhattan said purchasers failed to show that the defendants artificially inflated zinc prices by violating the Sherman Act, a federal antitrust law.

"It remains possible that shenanigans drove up the price of physical zinc," Forrest wrote. "But, at long last, plaintiffs have not adequately alleged that such price movement was due to a plausible antitrust violation, as opposed to parallel, unilateral conduct beyond the reach of that statutory scheme."

Christopher Lovell, a lawyer for the purchasers, did not immediately respond to requests for comment. Goldman spokesman Michael DuVally, JPMorgan spokesman Brian Marchiony and Glencore spokesman Charles Watenphul declined to comment.

The lawsuit echoes a similar case alleging aluminum price manipulation. It is among several in Manhattan in which investors and businesses accused banks and other defendants of conspiring to rig prices in financial and commodities markets. U.S. and European regulators also have examined such activity.

Zinc purchasers accused the defendants in a proposed class-action lawsuit of conspiring since May 2010 to ensure lengthy queues for the metal at their warehouses, which were licensed by the London Metal Exchange.

The purchasers said the alleged conspiracy included hoarding, moving zinc from one warehouse to another, falsifying shipping records and manipulating LME rules. They said the moves caused artificial supply shortages that boosted prices.

Forrest, however, said other factors independent of any alleged conspiracy may have influenced prices.

"Plaintiffs cannot adequately plead their broad, five-year conspiracy simply by noting developments in the zinc market, particularly when many of those developments occurred at vastly different times over the class period such that the possibility of causation is hard to assess," she wrote.

Forrest said the plaintiffs may replead some claims against Glencore, the Anglo-Swiss mining company, or its Pacorini Metals USA unit, which operates several warehouses. A lawyer for Pacorini did not immediately respond to requests for comment.

Zinc is used to coat steel to protect against corrosion and also is used in batteries, castings and alloys such as brass. It is, according to court papers, the world's fourth most widely produced metal by weight, trailing iron, aluminum and copper.

Cdn Zinc Corp J (CZN)

0.07 ? 0.0 (0.00%)

Volume: 1,100 @ 9:51:21 AM ET

Bid Ask Day's Range

0.07 0.075 0.07 - 0.07

TSX:CZN Detailed Quote Wiki

http://politicalvelcraft.org/2015/10/29/every-icelander-to-get-paid-in-bank-sale-26-bankers-behind-bars/

http://politicalvelcraft.org

Cdn Zinc Corp J (CZN)

0.07 ? 0.0 (0.00%)

Volume: 1,100 @ 9:51:21 AM ET

Bid Ask Day's Range

0.07 0.075 0.07 - 0.07

TSX:CZN Detailed Quote Wiki

Cdn Zinc Corp J (CZN)

0.095 ? 0.02 (26.67%)

Volume: 1,606,201 @ 2:40:46 PM ET

Bid Ask Day's Range

0.095 0.105 0.085 - 0.105

TSX:CZN Detailed Quote

Canadian Zinc Corpor (CZN)

0.08 ? 0.0 (0.00%)

Volume: 283,000 @ 3:38:53 PM ET

Bid Ask Day's Range

0.08 0.08 0.075 - 0.09

TSX:CZN Detailed Quote Wiki

Cdn Zinc Corp J (CZN)

0.11 ? -0.01 (-8.33%)

Volume: 65,500 @ 1:24:22 PM ET

Bid Ask Day's Range

0.11 0.115 0.11 - 0.13

Cdn Zinc Corp J (CZN)

0.11 ? -0.01 (-8.33%)

Volume: 65,500 @ 1:24:22 PM ET

Bid Ask Day's Range

0.11 0.115 0.11 - 0.13

TSX:CZN Detailed Quote Wiki

http://www.canadianzinc.com/

Cdn Zinc Corp J (CZN)

0.145 ? -0.005 (-3.33%)

Volume: 32,000 @ 10:16:40 AM ET

Bid Ask Day's Range

0.135 0.15 0.135 - 0.155

TSX:CZN Detailed Quote Wiki

http://www.canadianzinc.com/

http://www.canadianzinc.com/images/media_articles/2014/CZN_NorthernMiner_Nov2014.pdf

https://pbs.twimg.com/media/B8fajUwCYAAgpGE.jpg">https://pbs.twimg.com/media/B8fajUwCYAAgpGE.jpg";; />

God Bless

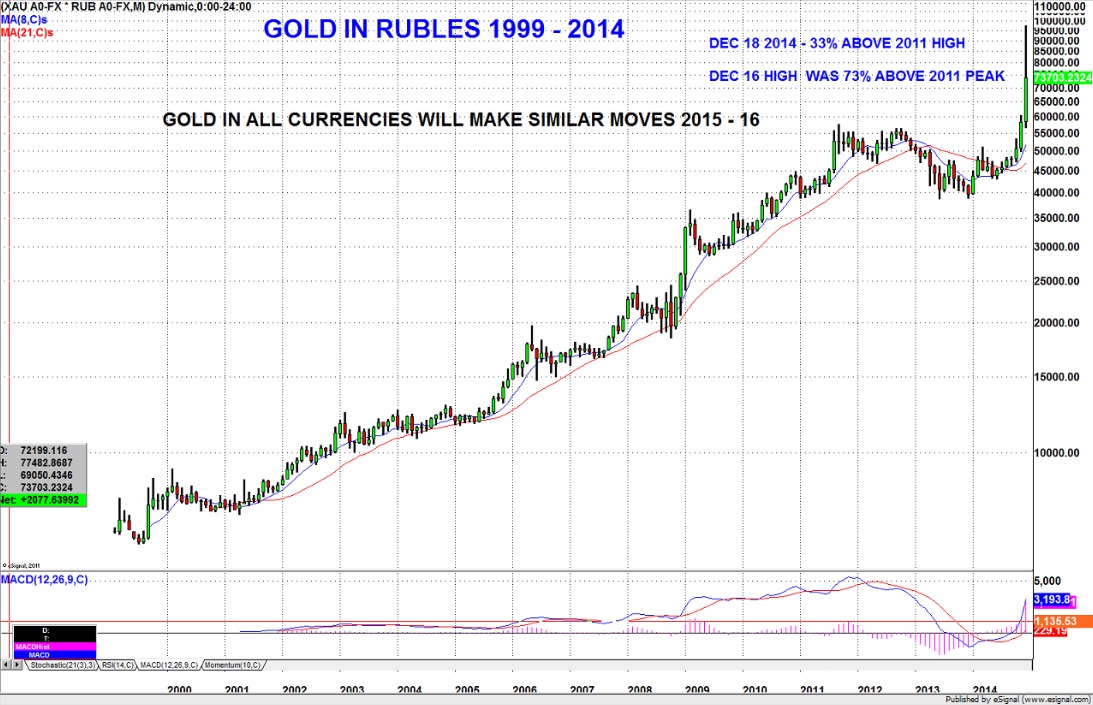

From my #2 author, compelling:

Those Crazy Gold Bugs!

-- Posted Monday, 1 June 2015

By Bill Holter

http://news.goldseek.com/GoldSeek/1433170054.php

Rather than write about the economy, the markets or geopolitics, today let's look at something a little different. It's important every once in a while to step back and take in the big picture because we are all guilty of getting too close or "finite" if you will. We fight the daily battles while losing sight of what the war is really about. Gold advocates otherwise known as "gold bugs" have been worn down by the daily battles, some have even forgotten what the real war is. Gold bugs, these are the "crazies" out there who are described as nuts or "conspiracy theorists". We know now they were not "theorists" at all. JP Morgan's $32 billion paid in fines along with many other fined and censured firms is proof of conspiracy FACT!

The term itself "gold bugs" is disparaging as if gold advocates are like some sort of cockroaches running around and dirtying up the place. It is true that some "advocates" go off half cocked and see everything as a conspiracy, I have even come across some who are so fervent they believe in gold as some sort of "religion". It is not. "Gold" as JP Morgan once said "is money, nothing else". Gold is in fact money, it is real money that has value on its own and not "legislated" or as it is in today's world, "mandated upon" the public. Most Americans who are reading this may have a difficult time understanding it even though true, many foreigners are nodding their heads with a slight smile! It should be pointed out, everything these crazy gold bugs have been saying about the world from a "fiscal" standpoint has and is in fact coming to fruition. It has not happened "when" nor as soon as they believed it would (me included), because the current insanity of balance sheets could never have been imagined even 10 years ago ...however, "timing" does not change "the ending"!

Stepping back and looking at the forest rather than the trees, collectively a very large part of the world is in a state of bankruptcy even though not declared, recognized or admitted. No matter how you look at it or on what level (state, corporate or individual), the standard of living is broadly in decline globally. (Yes I know, that top 1% or even .1% is living well and improving with each drop of sucked blood they receive from the system.) While choosing this topic to write about, I had no idea how fortuitous the timing was. Within 15 minutes of beginning this piece, a link to an interview of none other than Alan Greenspan, Richard Fisher, and Lawrence Lindsey hit my inbox!

I could only chuckle after watching the interview because my entire writing can now consist of "yeah, what they said!". Rather than write an entire article on this, I believe it might be better to let you watch what I was going to write, and we can move on to the "motives" of these three telling "mostly" the truth. If you watch this interview, please keep in mind this one question "...and the alternative is"?

Why exactly would these former Federal Reservists hint that, mathematically, logically, intuitively and in real life, IT'S OVER! They did back peddle a little bit as the interview went on but "why" or better yet why now? I believe they know what the crazy gold bugs have been saying all along is true and the day of reckoning is very close at hand. They must be trying to get "out in front" of what is coming so they're on the record for historical and "legacy" purposes. Nothing else makes any sense. Are they "trying" to torpedo the system or to break confidence? I highly doubt it but after watching the interview, would any kid with a paper route invest their money into the current system? Are they trying to bad mouth the Fed now they are no longer employed there? No, in fact, they each one pointed the blame at Congress. It's Congress' fault we are in this mess! "They" (Congress) spent the money and made the promises which cannot be honored and will ultimately be broken.

There is a punch line of course, one these three men don't want you to hear! Actually, the joke AND the punch line are both one in the same, "the money itself is bad and is the core to ALL economic and financial problems!". You see, Congress could never had authorized all of the spending if the Treasury did not have the "money" in its coffers. Yes Treasury could have borrowed money but would have been restrained if "money" was gold or something "real". The only way that Congress has been able to get away with bankrupting the country was with the aid of ... yes, the FEDERAL RESERVE these guys used to work for! The Fed has in fact underwritten the scheme, if there was no Fed ...the leverage could never have been built into the system. Greenspan, Fisher and Lindsey of course know this but they can never admit it. Were they to admit it, it would be an admission that they knew all along they were driving the bus over a cliff ...with a roadmap wide open!

All three spoke about the current state of interest rates and the unsustainability of the situation. They ask "why", for what good reason are interest rates at levels only justified by a crisis? The answer of course is; we are still in a crisis, we never exited and if rates HAD been increased ...their greatest fears would have already been realized! Mathematically, rates cannot go higher because of the inability to service interest payments (not to mention blowing up the leveraged interest rate derivatives) would come front and center. They are trying to say the inability to pay is guaranteed to come ...but is a future event. If rates were to rise now, it becomes a current event. It's really this simple!

Lawrence Lindsey even said at the 45 minute mark, "this is how they all end ...including Zimbabwe"! All "what" Larry? Fiat currencies? Or central banks who issue them? This brings me to another article which has come out and ties in perfectly. Actually, it ties in so well we can bring this entire article full circle and back to one of the gold bugs most central theses. Zerohedge posted an article regarding a systemic bet being made by billionaire hedge fund manager Paul Singer. Mr. Singer's strategy is simple, he calls it the "bigger short". He believes interest rates have only one way to go, up. He also believes we will see far more staggering defaults than we did in 2008-09. He believes shorting the debt of the world is a no brainer trade and one where you can win ALL the marbles.

Zerohedge of course picked up on the "minor flaw" in this strategy. The very same flaw I might add that Harry Dent, Martin Armstrong and others are missing. You see, when you "win", you must be "paid", but paid in "what" is the question. Assuming Mr. Singer is correct and the system does collapse on itself and he "wins". His win of course will be HUGE ...but, he will be paid in dollars or euros or whatever fiat currency his trade is done in. What will his winnings be worth if the currency itself is worth nothing? It reminds me of Mikhail Barishnikoff in the movie "White Nights", he had a stack full of worthless rubles and threw them handful after handful up in the air while saying "rubles, rubles, lots and lots of rubles". He had money ...but it wasn't worth anything.

You see, the currencies themselves are supported by the very debt Mr. Singer is selling short and expects to collapse! Which now brings us back full circle to the crazy gold bugs. This is exactly what they have been saying all along, a debt default will also mean a collapse in confidence of the currencies themselves and direct "fear capital" back into real money. This will create huge demand, force supply into hiding and additionally revalue gold higher because the currencies themselves are losing value and confidence. Gold bugs are not so different from those who see the dangers in the system from overheated markets and overleveraged debtors. The only difference is that these nut jobs want what hasn't been for nearly 50 years, they want TRUE and REAL "SETTLEMENT"! They actually want to get paid in something real! How crazy is that?

Regards, Bill Holter for;

Holter/Sinclair collaboration.

Oh, #ell, YES!!! Love my $SILVER!!!

Pro-Life my friend - will silver go with the gold -

GOLD FORUM 2015 -$60,000 Gold May Be Laughably Low -Bill Holter & Greg Hunter Video -

Tuesday, May 26, 2015 22:06 -

Cdn Zinc Corp J (CZN)

0.2 ? 0.005 (2.56%)

Volume: 199,425 @ 3:54:38 PM ET

Bid Ask Day's Range

0.195 0.2 0.19 - 0.2

TSX:CZN Detailed Quote Wiki

http://www.canadianzinc.com/

http://www.canadianzinc.com/images/media_articles/2014/CZN_NorthernMiner_Nov2014.pdf

https://pbs.twimg.com/media/B8fajUwCYAAgpGE.jpg">https://pbs.twimg.com/media/B8fajUwCYAAgpGE.jpg"; />

God Bless

CZN CA$0.22 -0.005 (-2.22%) what a Ag bargain -

http://www.canadianzinc.com/

http://www.canadianzinc.com/images/media_articles/2014/CZN_NorthernMiner_Nov2014.pdf

God Bless

Canadian Zinc Corporation (TSX:CZN) - 20th Anniversary Vancouver Resource Investment Conference 2015 -

212-1661 Portage Avenue Winnipeg, MB, R3J 3T7 Canada

Canadian Zinc Corp.

1710-650 W Georgia Street Vancouver, BC, V6B 4N9 Canada

http://www.canadianzinc.com

ABOUT

Canadian Zinc Corporation is a development stage company listed on the Toronto Stock Exchange under the symbol "CZN", in the United States on the OTCQB under the symbol "CZICF" and in Germany on the Frankfurt under the symbol "SRS" and is engaged in the business of exploration and development of natural resource properties. The Company has an experienced Executive and Board based in Vancouver BC.

Canadian Zinc aims to bring its 100%-owned Prairie Creek Mine into production at the earliest possible date. The Mine, situated in the Mackenzie Mountains of the Northwest Territories, has a fascinating history which includes the famous Hunt Brothers' plan to corner the world silver market. The Mine hosts substantial resources of high-grade silver, zinc, and lead.

Prairie Creek contains 5.22 million tonnes of Proven and Probable Mineral Reserves averaging 9.4% Zn, 9.5% Pb, 0.3% Cu and 151 g/t Ag. In addition, there are 5.43 million tonnes of Measured and Indicated Mineral Resources with an average grade 10.8% Zn, 10.2% Pb, 0.31% Cu and 160 g/t Ag as well as 6.24 million tonnes of Inferred Mineral Resources with an average grade of 14.5% Zn, 11.5% Pb, 0.57% Cu and 229 g/t Ag.

Prairie Creek has received a positive decision on the Environmental Assessment completed by the Mackenzie Valley Environmental Impact Review Board and is in the final stages of permitting the operation. Canadian Zinc is also completing a Feasibility Study on the project before operations commence.

20th Anniversary Vancouver Resource Investment Conference 2015 -

http://cambridgehouse.com/event/33/20th-anniversary-vancouver-resource-investment-conference-2015

Cdn Zinc Corp J (CZN)

0.23 ? 0.02 (9.52%)

Volume: 208,500 @ 12:31:54 PM ET

Bid Ask Day's Range

0.23 0.24 0.21 - 0.24

TSX:CZN Detailed Quote Wiki

Cdn Zinc Corp J (CZN)

0.19 ? -0.01 (-5.00%)

Volume: 165,500 @ 3:49:33 PM ET

Bid Ask Day's Range

0.185 0.195 0.185 - 0.2

TSX:CZN Detailed Quote Wiki

Nelson Bunker Hunt, Alleged Silver Manipulator, Has Died –

TDV Week in Review: October, 26 2014

Sunday, October 26, 2014 9:45

http://beforeitsnews.com/economy/2014/10/nelson-bunker-hunt-alleged-silver-manipulator-has-died-tdv-week-in-review-october-26-2014-2671304.html

God Bless

Nelson Bunker Hunt, Alleged Silver Manipulator, Has Died –

TDV Week in Review: October, 26 2014

Sunday, October 26, 2014 9:45

http://beforeitsnews.com/economy/2014/10/nelson-bunker-hunt-alleged-silver-manipulator-has-died-tdv-week-in-review-october-26-2014-2671304.html

God Bless

Cdn Zinc Corp J (CZN)

0.23 ? 0.0 (0.00%)

Volume: 138,000 @ 3:59:55 PM ET

Bid Ask Day's Range

0.225 0.235 0.22 - 0.23

TSX:CZN Detailed Quote Wiki

http://investorshub.advfn.com/boards/read_msg.aspx?message_id=98967896

http://www.canadianzinc.com

God Bless

Cdn Zinc Corp J (CZN)

0.29 ? -0.015 (-4.92%)

Volume: 173,500 @ 3:59:58 PM ET

Bid Ask Day's Range

0.29 0.295 0.29 - 0.305

TSX:CZN Detailed Quote Wiki

http://investorshub.advfn.com/boards/read_msg.aspx?message_id=98967896

http://www.canadianzinc.com

God Bless

Cdn Zinc Corp J (CZN)

0.33 ? 0.005 (1.54%)

Volume: 78,000 @ 3:58:17 PM ET

Bid Ask Day's Range

0.325 0.335 0.325 - 0.335

TSX:CZN Detailed Quote Wiki

http://investorshub.advfn.com/boards/read_msg.aspx?message_id=98967896

http://www.canadianzinc.com

God Bless

Cdn Zinc Corp J (CZN)

0.3075 ? -0.0125 (-3.91%)

Volume: 160,000 @ 3:53:52 PM ET

Bid Ask Day's Range

0.305 0.32 0.3 - 0.32

TSX:CZN Detailed Quote Wiki

http://investorshub.advfn.com/boards/read_msg.aspx?message_id=98967896

http://www.canadianzinc.com

God Bless

Cdn Zinc Corp J (CZN)

0.4 ? -0.01 (-2.44%)

Volume: 125,500 @ 12:28:28 PM ET

Bid Ask Day's Range

0.395 0.41 0.4 - 0.41

TSX:CZN Detailed Quote Wiki

2014 Winter Drill Program Commences at South Tally Pond, Newfoundland

- Drill testing of the newly discovered Northwest zone

http://web.tmxmoney.com/article.php?newsid=65376699&qm_symbol=CZN

VANCOUVER, BRITISH COLUMBIA--(Marketwired - Jan. 29, 2014) - Canadian Zinc Corporation (TSX:CZN)(OTCQB:CZICF) ("the Company" or "Canadian Zinc") is pleased to announce the commencement of a winter diamond drill program at the Company's wholly-owned South Tally Pond zinc-lead-copper-silver-gold project in central Newfoundland. The planned drill program will consist of eight to ten drillholes, totaling 3,000 metres.

The 2014 winter drill program will follow up on favourable results from the 2013 drill programs, which totaled 8,300 metres in 26 drillholes at the Lemarchant deposit. Highlights of the 2013 drilling programs include the discovery of Northwest zone located 250 metres to the northwest of the Lemarchant deposit and further extensions to the Lemarchant deposit (see Company news release dated December 11, 2013 and April 17, 2013).

Priority drill targets for 2014 include testing for additional massive sulphide mineralization to expand the newly discovered Northwest zone and expanding the known Indicated and Inferred resources of the Lemarchant deposit. The 2014 program is fully supported by funds from the $4 million flow-through financing, which closed on August 20th, 2013.

South Tally Pond Project

The South Tally Pond Project, which includes the Lemarchant deposit, is located in a proven mining district in central Newfoundland. The project is located immediately southwest of Teck Resources Limited's Duck Pond Cu-Zn Mine and south of the world-class, historic Buchans deposits. The Lemarchant deposit is a significant precious metal-rich, copper-lead-zinc volcanogenic massive sulphide ("VMS") discovery with the potential to develop into a viable economic resource.

A National Instrument ("NI") 43-101 mineral resource estimate on the Lemarchant deposit completed in 2012 includes an indicated resource of 1.24 million tonnes at an average grade of 5.38% Zn, 1.19% Pb, 0.58% Cu, 59.17 g/t Ag and 1.01 g/t Au; and an inferred resource of 1.34 million tonnes at an average grade of 3.70% Zn, 0.86% Pb, 0.41% Cu, 50.41 g/t Ag and 1.00 g/t Au.

Canadian Zinc also owns an extensive land package, in excess of 500 square kilometres in central Newfoundland, which includes three polymetallic (copper-lead-zinc-silver-gold) deposits with NI 43-101 compliant resources, numerous exploration targets and a detailed exploration database spanning several decades of previous work. The South Tally Pond project hosts the Lemarchant deposit and Northwest zone; the Tulks South project hosts the Boomerang-Domino deposits and Hurricane zone; and the Long Lake project which host the Main Zone deposit. Exploration programs are now being planned for key central Newfoundland properties during 2014.

About Canadian Zinc

Canadian Zinc is a TSX-listed exploration and development company trading under the symbol "CZN". The Company's key project is the 100%-owned Prairie Creek Project, a fully permitted, advanced-staged zinc-lead-silver property, located in the Northwest Territories.

With a Mineral Reserve of 5.2 million tonnes averaging 9.4% zinc, 9.5% lead and 151 g/t silver and an additional Inferred Resource of 6.2 million tonnes averaging 14.5% zinc, 11.5% lead, 0.57% copper and 229 g/t silver, (AMC Mining Consultants (Canada) Ltd. J M Shannon and D Nussipakynova, Qualified Persons, June 2012), Canadian Zinc's objectives are to complete engineering and securing financing for the development of Canada's next zinc mine. Prairie Creek has the majority of infrastructure in place including a 1,000 tonne per day mill, five kilometres of underground workings and related equipment, a heavy duty and light duty surface fleet, three exploration diamond drills and a 1,000 m airstrip.

Cautionary Statement - Forward-Looking Information

This press release contains certain forward-looking information, including, among other things, the expected completion of acquisitions and the advancement of mineral properties. This forward looking information includes, or may be based upon, estimates, forecasts, and statements as to management's expectations with respect to, among other things, the completion of transactions, the issue of permits, the size and quality of mineral resources, future trends for the company, progress in development of mineral properties, future production and sales volumes, capital costs, mine production costs, demand and market outlook for metals, future metal prices and treatment and refining charges, the outcome of legal proceedings, the timing of exploration, development and mining activities, acquisition of shares in other companies and the financial results of the company. There can be no assurances that such statements will prove to be accurate and actual results and future events could differ materially from those anticipated in such statements. Mineral resources that are not mineral reserves do not have demonstrated economic viability. Inferred mineral resources are considered too speculative geologically to have economic considerations applied to them that would enable them to be categorized as mineral reserves. There is no certainty that mineral resources will be converted into mineral reserves.

Cautionary Note to United States Investors

The United States Securities and Exchange Commission ("SEC") permits U.S. mining companies, in their filings with the SEC, to disclose only those mineral deposits that a company can economically and legally extract or produce. We use certain terms in this press release, such as "measured," "indicated," and "inferred" "resources," which the SEC guidelines prohibit U.S. registered companies from including in their filings with the SEC.

Canadian Zinc Corporation

John F. Kearney

Chairman

(416) 368-5344

(416) 362-6686

Canadian Zinc Corporation

Alan B. Taylor

VP Exploration & Chief Operating Officer

(604) 688-2043

(604) 688-2001 or Tollfree: 1-866-688-2001

Canadian Zinc Corporation

Steve Dawson

VP Corporate Development

(416) 368-5344

(416) 203-1418

invest@canadianzinc.com

http://www.canadianzinc.com

God Bless

Cdn Zinc Corp J (CZN)

0.475 ? 0.005 (1.06%)

Volume: 244,500 @ 3:46:44 PM ET

Bid Ask Day's Range

0.475 0.48 0.465 - 0.49

TSX:CZN Detailed Quote Wiki

Cdn Zinc Corp J (CZN)

0.45 ? -0.01 (-2.17%)

Volume: 141,500 @ 3:59:04 PM ET

Bid Ask Day's Range

0.455 0.465 0.45 - 0.47

TSX:CZN Detailed Quote Wiki

Cdn Zinc Corp J (CZN)

0.45 ? 0.005 (1.12%)

Volume: 129,500 @ 3:37:18 PM ET

Bid Ask Day's Range

0.45 0.46 0.44 - 0.47

TSX:CZN Detailed Quote Wiki

Cdn Zinc Corp J (CZN)

0.445 ? 0.005 (1.14%)

Volume: 91,500 @ 3:24:09 PM ET

Bid Ask Day's Range

0.445 0.45 0.44 - 0.47

TSX:CZN Detailed Quote Wiki

http://investorshub.advfn.com/boards/read_msg.aspx?message_id=93425526

Canadian Zinc Corp. (CZICF)wkly

CANADIAN ZINC ANNOUNCES C$4 MILLION

BOUGHT DEAL FLOW-THROUGH PRIVATE PLACEMENT -

http://www.canadianzinc.com/images/Docs/News_Releases/CZNNR20130801.pdf

http://www.canadianzinc.com/

http://www.canadianzinc.com/investor/slideshows

http://investorshub.advfn.com/Canadian-Zinc-Corporation-TSX-CZN-14899/

$CZICF - Canadian Zinc Corporation: Drill Program Underway for South Tally Pond, Newfoundland

- Drill testing of a new massive sulphide zone near Lemarchant deposit - Phase two Step-out drilling from known resources at Lemarchant deposit - Drill testing of a strong geophysical anomaly

http://finance.yahoo.com/news/canadian-zinc-corporation-drill-program-100000644.html

Note;

fiat currency created by khazarian gypsy king pin Rothschild

banksters 666 cult -

as a slave 666 currency with only air and paper backing it -

beware soon NO ONE want the paper fiat -

Cdn Zinc Corp J (CZN)

0.455 ? 0.01 (2.25%)

Volume: 161,500 @ 3:57:07 PM ET

Bid Ask Day's Range

0.455 0.46 0.45 - 0.465

TSX:CZN Detailed Quote Wiki

Canadian Zinc Corporation (TSX:CZN)

http://www.bloomberg.com/news/2013-09-01/gold-bulls-increase-wagers-to-highest-since-january-commodities.html

$CZICF - CANADIAN ZINC ANNOUNCES C$4 MILLION BOUGHT DEAL FLOW-THROUGH PRIVATE PLACEMENT

http://www.canadianzinc.com/images/Docs/News_Releases/CZNNR20130801.pdf

$CZICF - Canadian Zinc Corporation: Drill Program Underway for South Tally Pond, Newfoundland

- Drill testing of a new massive sulphide zone near Lemarchant deposit - Phase two Step-out drilling from known resources at Lemarchant deposit - Drill testing of a strong geophysical anomaly

http://finance.yahoo.com/news/canadian-zinc-corporation-drill-program-100000644.html

Note;

fiat currency created by khazarian gypsy king pin Rothschild

banksters 666 cult - u

as a slave 666 currency with only air and paper backing it -

beware soon NO ONE want the paper fiat -

Canadian Zinc Corporation (TSX:CZN)

http://www.bloomberg.com/news/2013-09-01/gold-bulls-increase-wagers-to-highest-since-january-commodities.html

$CZICF - CANADIAN ZINC ANNOUNCES C$4 MILLION BOUGHT DEAL FLOW-THROUGH PRIVATE PLACEMENT

http://www.canadianzinc.com/images/Docs/News_Releases/CZNNR20130801.pdf

$CZICF - Canadian Zinc Corporation: Drill Program Underway for South Tally Pond, Newfoundland

- Drill testing of a new massive sulphide zone near Lemarchant deposit - Phase two Step-out drilling from known resources at Lemarchant deposit - Drill testing of a strong geophysical anomaly

http://finance.yahoo.com/news/canadian-zinc-corporation-drill-program-100000644.html

Note;

fiat currency created by khazarian gypsy king pin Rothschild

banksters 666 cult -

as a slave 666 currency with only air and paper backing it -

beware soon NO ONE want the paper fiat -

MV2008L2-0002 - CZN - Minister Approval letter for type A WL - Sept17-13.pdf

http://www.mvlwb.ca/Boards/mv/SitePages/search.aspx?Company=Canadian+Zinc+Corporation&startdate=2013-9-17&enddate=2013-9-17

Cdn Zinc Corp J (CZN)

0.67 ? -0.01 (-1.47%)

Volume: 88,500 @ 12:33:39 PM ET

Bid Ask Day's Range

0.66 0.67 0.65 - 0.68

TSX:CZN Detailed Quote Wiki

The declines in commodities were overdone on

the concerns over China’s economy,”

said Adrian Day,

who manages about $135 million as the president of

Adrian Day Asset Management in Annapolis, Maryland.

“We’re seeing a more realistic view of the Chinese economy.

http://www.bloomberg.com/news/2013-09-01/gold-bulls-increase-wagers-to-highest-since-january-commodities.html

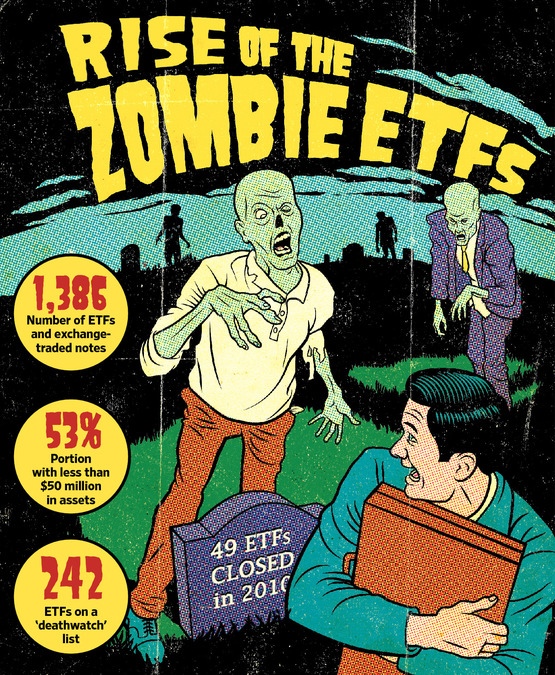

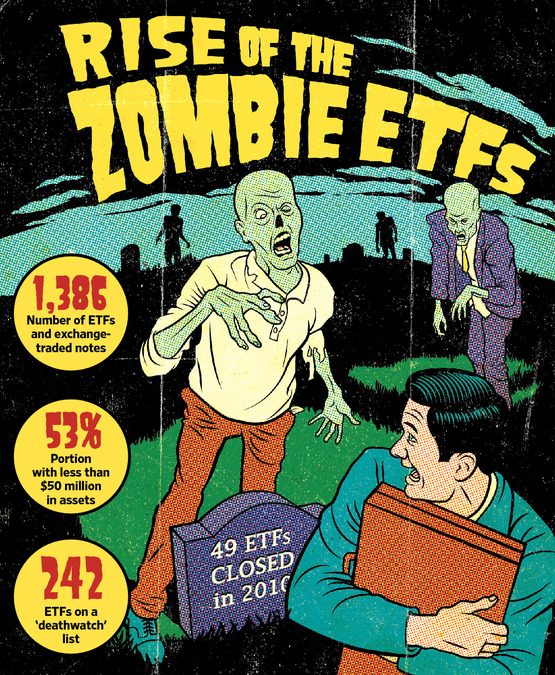

Massive Debt Levels Will Push Silver To $150 And Beyond

Hubert Moolman | Monday, September 2nd

The massive debt bubble created by our monetary system is about to burst.

The demonetization of gold and silver, has over the years

diverted value from these metals, to all paper assets (such as

bonds) linked to the debt-based monetary system.

The process of the devaluation of gold and silver, started by the

demonetization of gold and silver, is about to reverse at a

greater speed than ever before.

This is similar to what happened during the late 70s, when the

gold and silver price increased significantly.

However, what happened in the 70’s was just a prelude to this

coming rally.

The 70’s was the end of a cycle, this is likely the end of a major

cycle;

an end of an era of the debt-based monetary system

(dishonest money).

This era of dishonest money, has filled the economic world with

many promises that will never be fulfilled.

There will be a massive flight out of paper promises, into the

ideal safe haven assets that would offer protection.

In my opinion, silver will be the leading asset when this flight

out of paper promises happens.

This fraud started with the demonetization of silver and it will

end with silver taking its place as money -

the most marketable commodity.

If silver only equals the performance of the 70s, it will reach

$150.

However, this cycle will only be over when silver and gold are not

quoted in the current fiat currencies or any other fiat currency.

Instead, most goods would be quoted in terms of silver and gold.

Below, is a self-explanatory comparison of the current silver bull

market and the 70s bull market:

For more of this kind of analysis on silver and gold, you are

welcome to subscribe to my premium service.

by Hubert

“And it shall come to pass, that whosoever shall call on the name

of the Lord shall be saved”

The Truth is our primary weapon against satan -

http://www.jesus-is-savior.com/End%20of%20the%20World/lying_wonders.htm

$CZICF - CANADIAN ZINC ANNOUNCES C$4 MILLION BOUGHT DEAL FLOW-THROUGH PRIVATE PLACEMENT

http://www.canadianzinc.com/images/Docs/News_Releases/CZNNR20130801.pdf

$CZICF - Canadian Zinc Corporation: Drill Program Underway for South Tally Pond, Newfoundland

- Drill testing of a new massive sulphide zone near Lemarchant deposit - Phase two Step-out drilling from known resources at Lemarchant deposit - Drill testing of a strong geophysical anomaly

http://finance.yahoo.com/news/canadian-zinc-corporation-drill-program-100000644.html

God Bless

$CZICF - Canadian Zinc Corporation: Drill Program Underway for South Tally Pond, Newfoundland

- Drill testing of a new massive sulphide zone near Lemarchant deposit - Phase two Step-out drilling from known resources at Lemarchant deposit - Drill testing of a strong geophysical anomaly

http://finance.yahoo.com/news/canadian-zinc-corporation-drill-program-100000644.html

CZN.TO 0.65 -0.0300

VANCOUVER, BRITISH COLUMBIA--(Marketwired - Sept. 16, 2013) - Canadian Zinc Corporation (CZN.TO)(CZICF) ("the Company" or "Canadian Zinc") is pleased to announce the commencement of a follow-up exploration diamond drill program at the Company's wholly-owned South Tally Pond copper-lead-zinc-silver-gold project in central Newfoundland.

The planned program consists of 20 drillholes, totaling 6,300 metres. This program will involve two diamond drill rigs, one of which is already on the property. The program is fully supported by a recently completed $4 million flow-through financing which closed on August 20, 2013 (refer to Company news release of same date).

The drill program is designed to follow up on favourable results from the drill program completed earlier this year at the Lemarchant deposit (refer to news release dated February 27, 2013 and April 17, 2013). Priority targets include:

testing for additional massive sulphide mineralization at the newly discovered Northwest Target (3,200 metres over 9 drillholes);

lateral and depth extensions to the known indicated and inferred resources of the Lemarchant deposit (2,500 metres over 9 drillholes); and

initial testing of a strong Titan 24 geophysical anomaly (West Target) located 1.2 kilometres west of the Lemarchant deposit (600 metres over 2 drillholes).

The Lemarchant deposit is a significant precious metal-rich, copper-lead-zinc volcanogenic massive sulphide ("VMS") discovery with expansion potential. An initial NI 43-101 mineral resource estimate completed on the Lemarchant deposit reported an indicated resource of 1.24 million tonnes at an average grade of 5.38% Zn, 0.58% Cu, 1.19% Pb, 1.01 g/t Au and 59.17 g/t Ag; and an inferred resource of 1.34 million tonnes at an average grade of 3.70% Zn, 0.41% Cu, 0.86% Pb, 1.00 g/t Au and 50.41 g/t Ag.

Highlights of the winter 2013 drill program included:

new massive sulphide mineralization was discovered 250 metres to the northwest of the Lemarchant deposit in drillholes LM13-73 and LM13-74 (the Northwest Target);

significant massive sulphide mineralization intersected in drillhole LM13-79 (the Main Zone) extended the Lemarchant deposit mineralization 35 metres up-dip; and

three drillholes testing the south extension to the Lemarchant deposit intersected favourable felsic volcanic stratigraphy with locally anomalous base metal mineralization.

South Tally Pond Background

The South Tally Pond property, which includes the Lemarchant deposit, is located in a proven mining district near Buchans, Newfoundland. The property is located immediately adjacent to Teck Resources Limited's Duck Pond Cu-Zn mine and mill complex. (See Paragon' Technical Report and Mineral Resource Estimate on Lemarchant Deposit, South Tally Pond VMS Project, central Newfoundland, dated March 2, 2012 filed on SEDAR).

The exploration potential outside of the Lemarchant area of the South Tally Pond Property is still relatively untapped with numerous priority targets that have seen limited or no drilling. Additional exploration programs will be proposed in 2014 to further test for mineral potential in some of these areas.

About Canadian Zinc

Canadian Zinc is a TSX-listed exploration and development company trading under the symbol "CZN". The Company's key projects are the 100%-owned Prairie Creek property, an advanced-staged zinc-lead-silver property, located in the Northwest Territories in Canada and the 100% owned South Tally Pond project, which includes the Lemarchant deposit, along with other property interests in central Newfoundland.

Canadian Zinc also recently announced the proposed acquisition of Messina Minerals, a mineral exploration company focused on base metals and gold properties in central Newfoundland. Messina holds the South Tulks Hill project with its Boomerang and Domino deposits situated near the South Tally Pond project. Boomerang and Domino are located approximately 50 kilometres from the Lemarchant deposit (see CZN press release dated September 12, 2013).

The declines in commodities were overdone on

the concerns over China’s economy,”

said Adrian Day,

who manages about $135 million as the president of

Adrian Day Asset Management in Annapolis, Maryland.

“We’re seeing a more realistic view of the Chinese economy.

http://www.bloomberg.com/news/2013-09-01/gold-bulls-increase-wagers-to-highest-since-january-commodities.html

Massive Debt Levels Will Push Silver To $150 And Beyond

Hubert Moolman | Monday, September 2nd

The massive debt bubble created by our monetary system is about to burst.

The demonetization of gold and silver, has over the years

diverted value from these metals, to all paper assets (such as

bonds) linked to the debt-based monetary system.

The process of the devaluation of gold and silver, started by the

demonetization of gold and silver, is about to reverse at a

greater speed than ever before.

This is similar to what happened during the late 70s, when the

gold and silver price increased significantly.

However, what happened in the 70’s was just a prelude to this

coming rally.

The 70’s was the end of a cycle, this is likely the end of a major

cycle;

an end of an era of the debt-based monetary system

(dishonest money).

This era of dishonest money, has filled the economic world with

many promises that will never be fulfilled.

There will be a massive flight out of paper promises, into the

ideal safe haven assets that would offer protection.

In my opinion, silver will be the leading asset when this flight

out of paper promises happens.

This fraud started with the demonetization of silver and it will

end with silver taking its place as money -

the most marketable commodity.

If silver only equals the performance of the 70s, it will reach

$150.

However, this cycle will only be over when silver and gold are not

quoted in the current fiat currencies or any other fiat currency.

Instead, most goods would be quoted in terms of silver and gold.

Below, is a self-explanatory comparison of the current silver bull

market and the 70s bull market:

For more of this kind of analysis on silver and gold, you are

welcome to subscribe to my premium service.

by Hubert

“And it shall come to pass, that whosoever shall call on the name

of the Lord shall be saved”

The Truth is our primary weapon against satan -

http://www.jesus-is-savior.com/End%20of%20the%20World/lying_wonders.htm

$CZICF - CANADIAN ZINC ANNOUNCES C$4 MILLION BOUGHT DEAL FLOW-THROUGH PRIVATE PLACEMENT

http://www.canadianzinc.com/images/Docs/News_Releases/CZNNR20130801.pdf

Note;

fiat currency created by gypsy king pin Rothschild

banksters cult -

as a slave 666 currency with only air and paper backing it -

beware soon NO ONE want the paper fiat -

Cdn Zinc Corp J (CZN) gypsyfiat$0.68 UP 0.02 $3.03% ![]()

Volume: 84,500 @ 3:37:35 PM ET

Bid Ask Day's Range

0.67 0.68 0.67 - 0.69

TSX:CZN Detailed Quote Wiki

http://ih.advfn.com/p.php?pid=nmona&article=58885995

CANADIAN ZINC ANNOUNCES C$4 MILLION

BOUGHT DEAL FLOW-THROUGH PRIVATE PLACEMENT -

http://www.canadianzinc.com/images/Docs/News_Releases/CZNNR20130801.pdf

http://www.canadianzinc.com/

http://www.canadianzinc.com/investor/slideshows

http://investorshub.advfn.com/Canadian-Zinc-Corporation-TSX-CZN-14899/

God Bless

CANADIAN ZINC ANNOUNCES C$4 MILLION

BOUGHT DEAL FLOW-THROUGH PRIVATE PLACEMENT -

http://www.canadianzinc.com/images/Docs/News_Releases/CZNNR20130801.pdf

http://www.canadianzinc.com/

http://www.canadianzinc.com/investor/slideshows

http://investorshub.advfn.com/Canadian-Zinc-Corporation-TSX-CZN-14899/

God Bless

$CZICF - CANADIAN ZINC ANNOUNCES C$4 MILLION BOUGHT DEAL FLOW-THROUGH PRIVATE PLACEMENT

http://www.canadianzinc.com/images/Docs/News_Releases/CZNNR20130801.pdf

Vancouver, British Columbia, August 1, 2013 – Canadian Zinc Corporation (TSX: CZN; OTCQB: CZICF) (the “Company” or “Canadian Zinc”) is pleased to announce that it has entered into an agreement with Canaccord Genuity Corp. (“Canaccord”), pursuant to which Canaccord has agreed to purchase as underwriter for resale 6,460,000 flow-through common shares (the “FT Shares”) of the Company at a price of C$0.62 per FT Share (the “FT Share Price”) through a private placement for aggregate gross proceeds of C$4,005,200 (the “Offering”).

The net proceeds of the Offering will be used to incur eligible Canadian Exploration Expenses and flow-through mining expenditures, as defined under the Income Tax Act (Canada), that will be renounced in favour of the purchasers with an effective date of no later than December 31, 2013. The funds are intended to be used to explore and advance the Company’s projects, which include the Prairie Creek Mine in the Northwest Territories as well as the South Tally Pond property in Newfoundland.

The FT Shares will be offered by way of the “accredited investor” and “minimum amount” exemptions under National Instrument 45-106 in British Columbia, Alberta and Ontario (the “Canadian Selling Jurisdictions”).

The Offering is subject to the receipt of all necessary regulatory approvals, including the approval of the Toronto Stock Exchange (the “TSX”). The FT Shares will be subject to resale restrictions for a period of four months and one day from the closing date of the Offering under applicable securities legislation.

The Offering is scheduled to close on or about August 20, 2013, or such other date as may be agreed with Canaccord.

The FT Shares will not be registered under the U.S. Securities Act of 1933 (the “1933 Act”), as amended, or any applicable state securities laws, and may not be offered or sold to, or for the account or benefit of, persons in the United States or “U.S. persons,” as such term is defined in Regulation S regulated under the 1933 Act, absent registration or an applicable exemption from the registration requirements. This press release does not constitute an offer of securities for sale in the United States or to U.S. persons.

About Canadian Zinc

Canadian Zinc is a Toronto-listed exploration and development company. The Company’s key project is the 100%-owned Prairie Creek Mine, an advanced-staged zinc-lead-silver property, located in the Northwest Territories in Canada. Prairie Creek is an underground operation that will utilize multiple mining methods to access readily available ore. Canadian Zinc has the majority of the required infrastructure in place including a 1,000 tonne per day mill, five kilometres of underground workings and related equipment, a heavy duty and light duty surface fleet, three exploration diamond drills and a 1,000 metre airstrip.

Canadian Zinc also holds a 100% interest in the South Tally Pond VMS project, along with other property interests in central Newfoundland, where a successful drilling program was carried out in winter 2013.

Cdn Zinc Corp J (CZN) fiat$0.6

-0.03 (-4.76%)

Volume: 73,000 @ 3:59:36 PM ET

Bid Ask Day's Range

0.6 0.61 0.6 - 0.65

TSX:CZN Detailed Quote Wiki

http://investorshub.advfn.com/boards/read_msg.aspx?message_id=89713409

http://investorshub.advfn.com/boards/read_msg.aspx?message_id=89629521

$CZICF - CZN.TO - Canadian Zinc Corporation: Water Board Completes Regulatory Process; Water Licence Recommended for Approval

http://finance.yahoo.com/news/canadian-zinc-corporation-water-board-100000812.html

VANCOUVER, BRITISH COLUMBIA--(Marketwired - July 8, 2013) - Canadian Zinc Corporation (CZN.TO)(CZICF) ("the Company" or "Canadian Zinc") is very pleased to announce that the Mackenzie Valley Land and Water Board ("MVLWB") has completed its regulatory process for the issue to Canadian Zinc of a Type "A" Water Licence for the Company's wholly owned Prairie Creek Mine in the Northwest Territories, Canada and has forwarded the Licence to the Federal Minister of Aboriginal Affairs and Northern Development Canada with the recommendation that the Minister approve and sign the Licence.

"This Type 'A' Water Licence is the key regulatory permit needed for the construction, development and operation of the Prairie Creek Mine," stated Alan B. Taylor, COO and VP of Exploration for Canadian Zinc.

"The successful completion of the regulatory process is the culmination of many years of effort by the Canadian Zinc team, the Mackenzie Valley Land and Water Board, the various government agencies and all the stakeholders in the region. The positive recommendation of the Water Board demonstrates that a broad consensus has been achieved through the process and we look forward to receiving the approval of the Minister and the issue of the Water Licence in due course," added Mr. Taylor.

In its recommendation to the Minister, the Water Board provided some comments on the issues faced and the decisions made in respect of this Licence. The Board accepted the site-specific water quality objectives (SSWQO) derived by Canadian Zinc. These are almost all more stringent than the country-wide guideline values adopted by the Canadian Council of Ministers of the Environment (CCME). The Board also determined, after many months of review and study, that effluent quality criteria (EQC) using a variable load-based discharge approach, as proposed by Canadian Zinc, will be a more protective and practical way of controlling effluent discharge from the mine to Prairie Creek. The Board recognizes that this is a new approach compared to the standard fixed EQC, but believes that practical and effective mechanisms can be put in place to ensure compliance.

Upon receipt of Ministerial approval, the new Type "A" Water Licence MV2008L2-0002 will permit Canadian Zinc to conduct mining, milling and processing activities at the Prairie Creek Mine Site, use local water, dewater the underground mine, and dispose of waste from mining and milling.

In January 2013, the MVLWB issued Land Use Permit ("LUP") MV2012F007 which permits the construction, maintenance, operation and use of the winter access road connecting the Prairie Creek Mine to the Liard Highway. This permit allows the outbound transportation of the zinc and lead concentrates produced at the mine, and the inbound transportation of fuel and other supplies during the actual operation of the Prairie Creek Mine.

In June 2013, the MVLWB issued LUP MV2008D0014 which permits Canadian Zinc to extract ore and waste rock from the Prairie Creek Mine, operate a flotation mill concentrator to produce zinc and lead concentrates, create a waste rock facility, and refurbish and develop site facilities in support of the mining operation, along with the eventual closure and reclamation of the mine site.

Also in June 2013, the MVLWB issued LUP MV2008T0012 which permits Canadian Zinc to construct and operate the Liard Transfer Facility to be situated near the junction of the existing Prairie Creek Mine access road and the Liard Highway. The Liard Transfer Facility is a staging area at the south end of the winter access road designed to temporarily store outbound concentrate and inbound supplies.

Following the approval of the Type "A" Water Licence from the Minister, and receipt of a final LUP and a Type "B" Water Licence from Parks Canada for the portion of the realigned access road within the Nahanni National Park Reserve ("NNPR"), Canadian Zinc will have secured all of the water licenses and land use permits required to operate the Prairie Creek Mine. Canadian Zinc currently holds a LUP issued by Parks Canada for the use of the original road route through NNPR to resupply the mine site during exploration activities.

Permitting Background

The permit applications for the Prairie Creek Mine operations have undergone an extensive regulatory, environmental assessment and permitting process which began in June 2008 when Canadian Zinc applied to the MVLWB for a Water Licence and associated LUPs to support a mining operation at Prairie Creek.

Environmental Assessment:

The 2008 applications were referred to an Environmental Assessment ("EA") by the Mackenzie Valley Environmental Impact Review Board ("Review Board"), the primary authority responsible for all environmental assessment and review throughout the Mackenzie Valley in the Northwest Territories, and underwent various stages within the EA that included a written hearing, submittal of a Developers Assessment Report, Information Requests, Technical Sessions, a Community Hearing, a two-day Public Hearing, and Final Submissions.

On December 8, 2011, the Review Board issued its Report of Environmental Assessment and Reasons for Decision and concluded that the proposed development of the Prairie Creek Mine, including commitments made by Canadian Zinc during the proceedings, is not likely to have any significant adverse impacts on the environment or to be a cause for significant public concern.

The Review Board found that there was broad support among aboriginal organizations and communities in the Dehcho Region for the benefits that the Prairie Creek Mine could bring to the Dehcho Region of the Northwest Territories.

The Socio-economic Agreement signed between Canadian Zinc and the Government of the Northwest Territories was a key document in the Review Board's findings on impacts of the project on the human environment. In the Review Board's view, the Prairie Creek Mine is not likely to have significant adverse impacts on the human environment of the Dehcho Region or the Northwest Territories provided the developer's commitments are followed and enforced and the Socio-economic Agreement is implemented.

In a Decision dated June 8, 2012, the Minister of Aboriginal Affairs and Northern Development, on behalf of the responsible Ministers with jurisdiction, including the Minister of the Environment, the Minister of Fisheries and Oceans, the Minister of Environment and Natural Resources, the Minister of Transport Canada and the Minister of Environment and Natural Resources of Government of the Northwest Territories, advised the Review Board of the decision that the Ministers would not order an environmental impact review of the proposed development of the Prairie Creek Mine, nor would they refer the proposal to the Minister of the Environment for a Canadian Environmental Assessment Act joint panel review.

Permitting Phase:

In January 2012, following the completion of the EA in December 2011, the Water Board commenced the regulatory process for the issue of a Type "A" Water Licence and associated Land Use Permits.

After the original applications for the operating permits had been submitted to the Water Board in 2008, the adjacent NNPR was expanded in 2009 and now encircles, but does not include, the Prairie Creek Property, but the expanded Park area includes a significant portion of the Prairie Creek Access Road route. However, when NNPR was expanded the Canada National Parks Act was amended to enable the Minister of the Environment to enter into leases or licences of occupation of, and easements over, public lands situated in the expansion area for the purposes of a mining access road leading the Prairie Creek area, including the sites of storage and other facilities connected with that road.

The applications for land use permits, and water licences relating to the road access became multi-jurisdictional and the Company applied to both to the Water Board and Parks Canada for road related permits and licences.

The permit applications underwent various stages within the regulatory process and included submittal of a Consolidated Project Description Report, Information Requests, a Technical Session, Written Interventions, additional water quality/treatment studies, Public Hearings in Fort Simpson and Nahanni Butte and Closing Statements.

On March 15, 2013 the Water Board circulated a Draft Type "A" Water Licence and two Draft Type "A" Land Use Permits for the operation of the Prairie Creek Mine to the government agencies and departments and to interested parties with a request for comments by April 12, 2013. Canadian Zinc had an additional week to review any comments and responded to the Water Board with its own comments.

About Canadian Zinc

Canadian Zinc is a Toronto-listed exploration and development company. The Company's key project is the 100%-owned Prairie Creek Mine, an advanced-staged zinc-lead-silver property, located in the Northwest Territories in Canada. Prairie Creek is an underground operation that will utilize multiple mining methods to access readily available ore. Canadian Zinc has the majority of the required infrastructure in place including a 1,000 tonne per day mill, five kilometres of underground workings and related equipment, a heavy duty and light duty surface fleet, three exploration diamond drills and a 1,000 metre airstrip.

Canadian Zinc also holds a 100% interest in the South Tally Pond VMS project, along with other property interests in central Newfoundland, where a successful drilling program was carried out in winter 2013.

Canadian Zinc Corpor (CZN)

0.465 ? 0.01 (2.20%)

Volume: 12,500 @ 3:16:24 PM ET

http://investorshub.advfn.com/boards/read_msg.aspx?message_id=89629521

World Resource Investment Conference 2013 - May 26 - 27, 2013

Sunday, May 26 at 8:30am - May 27 at 6:00pm

Vancouver Convention Centre West

1055 Canada Place Vancouver BC V6C 0C3 Canada

http://cambridgehouse.com/event/world-resource-investment-conference-2013

Today's Hearings?

Anyone have any insights on how the hearings going today?

Read thru much of 300+ pages of yesterday's transcript. The tone seemed good with a few annoying questions about the 2nd pond, etc.

Ready for the run up!

Canadian Zinc receives first operating permit for Prairie Creek mine -

By: Idéle Esterhuizen

28th January 2013

TEXT SIZE

JOHANNESURG (miningweekly.com) – The Mackenzie Valley Land and Water board has issued Canadian Zinc Corporation a land-use permit for the establishment and operation of the winter road that would service the Prairie Creek zinc/lead/silver mine.

The land-use permit was issued for a period of five years, starting January 10, and permitted the construction, maintenance, operation and use of the winter road connecting the Prairie Creek mine to the Liard highway. The permit allowed the outbound transportation of the zinc and lead concentrates to be produced at the mine and the inbound transportation of fuel and other supplies.

The permit also incorporated realignment of the original route, which would improve access and further reduce the potential environmental impact.

The board further issued Canadian Zinc a Type B water licence that was also valid for a period of seven years starting January 10 and which permitted the limited use of water and the disposal of waste for road construction, maintenance and operational activities.

Canadian Zinc indicated that the new permits upgraded the use and permitted activities in support of the operation of the Prairie Creek mine, which would enable the start of initial construction work on the road prior to the finalisation and issue of the main mine operating permits and Class A water licence in the final permitting stages.

Edited by: Chanel de Bruyn

http://www.miningweekly.com/article/canadian-zinc-receives-first-operating-permit-for-prairie-creek-mine-2013-01-28

http://www.canadianzinc.com

God Bless

Cdn Zinc Corp J (CZN)

0.425 ? 0.015 (3.66%)

Volume: 108,000 @ 4:18:26 PM ET

Bid Ask Day's Range

0.415 0.425 0.41 - 0.43

TSX:CZN Detailed Quote Wiki

http://investorshub.advfn.com/boards/read_msg.aspx?message_id=79997616

Cdn Zinc Corp J (CZN)

0.395 ? 0.005 (1.28%)

Volume: 113,500 @ 2:54:26 PM ET

Bid Ask Day's Range

0.385 0.4 0.385 - 0.4

TSE:CZN Detailed Quote Wiki

|

Followers

|

12

|

Posters

|

|

|

Posts (Today)

|

0

|

Posts (Total)

|

344

|

|

Created

|

01/26/09

|

Type

|

Free

|

| Moderators | |||

Canadian Zinc Corporation -

The Hunt brothers dream - Silver Mine -

http://www.canadianzinc.com/content/investor/press/western-standard.php

Video Gallery

http://www.canadianzinc.com/content/gallery/video/

http://www.canadianzinc.com

Canadian Zinc Corporation is a development stage company listed on the Toronto Stock Exchange under the symbol "CZN"

and in the United States on the OTCBB under the symbol "CZICF" and is engaged in the business of exploration and

development of natural resource properties.

The Company's principle focus is its efforts to advance the Prairie Creek Mine, a zinc/lead/silver property located in the Northwest Territories of Canada, towards production. The Prairie Creek Mine is partially developed with an existing 1,000 tonne per day mill and related infrastructure. In 2006 and 2007, the Company carried out major programs at Prairie Creek including driving a new internal decline approximately 600 metres long which enabled a significant underground exploration and infill drilling program to occur. A total of $18.7 million was invested in Prairie Creek in 2006 and 2007.

www.canadianzinc.com/content/mine/

www.canadianzinc.com/content/gallery/video/

www.vatukoulagoldmines.com/index.asp

CZN now holds approximately 548,000,000 shares, or 20% of the issued shares of VGM. (See Canadian Zinc Press Release dated June 10, 2009)

http://www.vatukoulagoldmines.com/Investor_Shareprice.html

www.ivarkreuger.com/metalcharts.htm

www.ivarkreuger.com/metalcharts.htm

Ps.ice to Readers: The CZN website and the information on it are owned by Canadian Zinc Corporation and may be changed or updated from time to time without notice. By accessing the website and the information provided, you agree to hold Canadian Zinc Corporation, and their respective officers, employees and agents harmless against any claims for damages or cost or any loss of any kind arising out of the access to or use of this website or any information contained in or obtained through this website.

Cautionary Note to U.S. Investors - The United States Securities and Exchange Commission permits U.S. mining companies, in their filings with the SEC, to disclose only those mineral deposits that a company can economically and legally extract or produce. We use certain terms on this website, such as "measured," "indicated," and "inferred" "resources," which the SEC guidelines strictly prohibit U.S. registered companies from including in their filings with the SEC. U.S. Investors are urged to consider closely the disclosure in our Form 20-F which may be secured from us, or from the SEC's website at http://www.sec.gov/edgar.shtml

What if you invest in Can Zinc Corporation and it become a LION -

ex. in 1975?..

take a look at the past gains in a few juniors:

$GOLD INDX Chart TA TI P&F Alert Bullish Price Objective $2,040.0 / oz

| Volume | |

| Day Range: | |

| Bid Price | |

| Ask Price | |

| Last Trade Time: |