Register for free to join our community of investors and share your ideas. You will also get access to streaming quotes, interactive charts, trades, portfolio, live options flow and more tools.

Thanks for the wishes

I think you have been in this longer than I but I was init back in the 90's but took some profits and now

trying to regain all my old possitions which at these prices can't happen. No long can I get it at .25

One side of my family did fight in the war of 1812. Spent 38 yeara tracking down the family includeing my wife's

Had 11 cousins involved so ghot a lot. In 2020 I sent it to the printer I had covid and feared I'd die so what was done went

Now I have uncovered more But it would be costly to prfint a 2nd edition. Bill Sherman was the one who got us going in 1980

He had been WW 2 pilot, and had letters from the 1920's. He also had a partener and they form a company in OR. Sold out in 79 for 40 millionso 20 each. That is when he engaged the study. he died and never ahd anything printed. I got it into 7 libraies including the Library of Congress.. .

Sure looks like CMCL is about to bust out. I have severl checks sent to Schwab, but they take days to process.Not sure why. I sent one certified and it sat for 4 days

Jsc520333.......... Happy Fourth........ A great day to be in America...... No, I am NOT related to the Sherman Family of 1847, but thank you for asking. My heritage goes back to 1634 Rhode Island, so it is very sad to see how America is shaking in its foundation at the moment. With Cmcl, I am a stockholder from the days it was trading .03 to .06..... A long time, and maybe now we will start reaching for NEW Stock Heights. I would say the recent stock increase was the reaction of the Company announcing a dividend in July..... It looked bleak for a while but they came thru. I would say that Cmcl chart is bottomed, and hopefully ready to make some upward advances....... You stay well Jsc, and good success with Cmcl...... The pieces of the puzzle are coming together............ :>)

are you still in CMCL It has been tanking and I can't find any negative news

This was up almost 5% today and not a lot of VOL somehing may be up.

Are you still in this?

Are you a memeber of the Sherman family who came to USA in 1847?

Bob are you still in CMCL?

There was an anouncment about a major tresshold being reached I did not understand what hat was about

do you know what they are talking about.

someting is droping this one today

Bob any idea what has caused this to jumop. All my other Pm's are down today

This has been strong and in the past few weeks when trying to buy it was difficut to get fiiled by spliting the BA

there has been a good upside move but it left a gap at $13.62 which should fill. It has had a few trades get close when the POG droped but gap is open. IMO when it fills this will fly.

BTW are you related to the SHerman's of Portland?

Bob I pulled up a max chart back to 1984 it shows $391.25 high. Can that be right?

CMCL just anonced it will pay .14 on April 29 ex date the 14th

Bob where did you see they will increase the div?

its .14 what is it going to

Cmcl has NO DEBT, EXCELLENT REVS, and STEADY .14 PER QUARTER DIVIDEND.................. Good News report..... What a day!!!!!!!!!!!!!! :>)

https://seekingalpha.com/article/4497687-caledonia-mining-stock-central-shaft-makes-difference

04/10/2021 Declaration of increased quarterly dividend

23/09/2021

Caledonia acquires Maligreen project in Zimbabwe

https://www.caledoniamining.com/

Revisiting Caledonia Mining - No Developments On M&A And I Remain Bearish

Aug. 26, 2021 8:55 AM ETCaledonia Mining Corporation Plc (CMCL)1 Like

Gold Panda

Contributor Since 2015

- Disclosure: I am not a financial adviser. All articles are my opinion - they are not suggestions to buy or sell any securities. Perform your own due diligence and consult a financial professional before trading.

Summary

The company is on track to boost production at Blanket to 80koz per year by 2022.

The mine life stretches to 2034, but this is based on inferred resources.

Reserves at Blanket were just 527koz of gold as of the start of 2020 and Zimbabwe is a terrible mining jurisdiction.

Also, the Glen Hume property was impaired and there have been no updates on the potential purchase of the Isabella-McCays-Bubi mines.

I continue to be bearish and the short borrow fee rate stands at 1.69% as of the time of writing.

Bear icon

Maciej Koza/iStock via Getty Images

Investment thesis

In January, I wrote a bearish article on SA about Zimbabwe-focused gold miner Caledonia Mining (NYSE:CMCL). The company aimed to become a 500koz/year gold producer but the latest quarterly report looks unimpressive. Also, the Glen Hume property was impaired, and there have been no updates on the potential purchase of the Isabella-McCays-Bubi mines.

Caledonia's valuation has decreased significantly since my previous article but I remain bearish as the prospects for the company now look worse than before. Let's review.

Overview of the operations and the financials

In case you haven't read my previous articles on Caledonia, here is a quick overview of the operations. The company's main asset is a 64% interest in the Blanket gold mine, which is located on the northwest limb of the Gwanda Greenstone Belt in Zimbabwe. This is the largest gold mine in a belt which had 268 operating mines at its peak.

(Source: Caledonia Mining)

Blanket has so far produced over a million ounces of gold and its output stood at 16,710 ounces in Q2 2021. As you can see from the charts below, the grades have been decreasing over the past decade but the production has been improving as Caledonia keeps boosting the mined volume.

(Source: Caledonia Mining)

Caledonia's aim is to reach an annual production rate of 80,000 ounces of gold and is close to achieving this. Blanket is comprised of five significantly independent near vertical ore bodies and Caledonia the Central Shaft project last quarter. With this, July production reached almost 6,000 ounces. Overall, Caledonia has invested around $67 million into expanding its production rate since January 2015, which was fully funded from internal cash flows. This is impressive.

(Source: Caledonia Mining)

Blanket has a mine life stretching 13 years and is generating EBITDA of $14 million per quarter even before the expansion. Also, Caledonia has just around $0.2 million in debts and over $16 million in cash.

(Source: Caledonia Mining)

Why in the world would I be bearish on this one? Well, the main reasons are mining jurisdiction and reserves.

Zimbabwe is a terrible mining jurisdiction and this is why there are almost no mines left there today. The country has a history of nationalization plans for parts of its mining industry and is currently struggling with food and fuel shortages, electricity supply disruptions, soaring inflation, and an imploding currency.

Looking at the reserves, keep in mind that Blanket's 13-year mine life is based on resources. Sure, the mine has a very good track record of replacing reserves, but it's dangerous to base your mine life on inferred resources. As of January 2020, Blanket had proven and probable gold reserves of just 527koz.

(Source: Caledonia Mining, page 6 here)

If you take into account only measured and indicated resources, the mine life ends in 2026.

(Source: Caledonia Mining, page 131 here)

Oh and keep in mind that Caledonia owns less than two-thirds of Blanket, which means that the attributable reserves were just 337koz as of January 2020. With this in mind, Caledonia looks like a value trap.

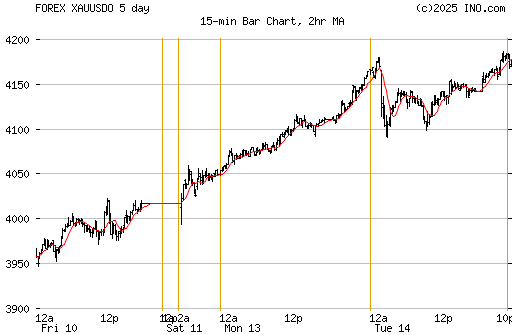

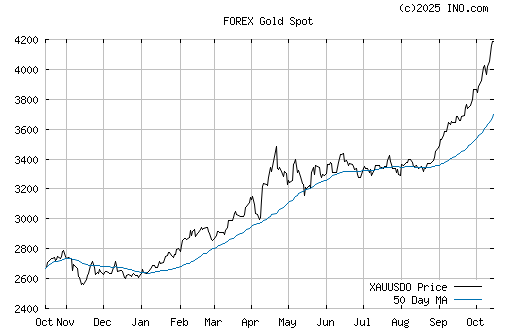

Let's move onto why I think the prospects for the company now look worse than before. There are two main reasons. First, gold prices are lower today compared to January:

(Source: Gold Price)

Second, I'm unimpressed by the recent exploration and M&A developments. Caledonia disclosed in its Q2 financials that it impaired the Glen Hume property near Gweru following disappointing exploration results. That's $3.5 million down the drain.

(Source: Caledonia Mining, page 18 here)

In addition, there has been no development in regards to a rumor that Caledonia was planning to buy the mothballed Isabella-McCays-Bubi mines in northwest Zimbabwe. The latter is said to have the potential to produce over 200koz of gold per year. It seems that Caledonia Mining is back to focusing on Blanket and I just don't see a way the company can achieve its ambition of growing output to 500koz per year.

Caledonia has a market capitalization of $147.1 million as of the time of writing. Blanket had a net present value (NPV) of $191 million according to the May 2021 technical report.

(Source: Caledonia Mining, page 12 here)

Keep in mind that 64% of this sum is $122.2 million. In view of this, I think Caledonia looks overvalued and investors can take advantage of this by short-selling the shares. According to data from Fintel, the short borrow fee rate stands at 1.69% as of the time of writing.

Investor takeaway

I view Blanket as a relatively small gold mine that has pretty low all-in sustaining costs (AISC). The problem is that the mine is located in Zimbabwe and reserves are low. Caledonia has done a good job at Blanket over the past several years, but I just don't see a clear path to a production profile of 500koz per year anymore. The company is already valued at above its NPV and I think it deserves to be trading at a discount due to the jurisdiction. In light of this, I view the company as overvalued.

I see two major risks for the bear case at the moment. First, gold prices might increase in the future. Central banks across the world are currently injecting record amounts of liquidity into the financial system due to the Covid-19 pandemic and gold is seen by many investors as a safe haven against inflation and currency depreciation (personally, I prefer real estate). Second, Caledonia could have success on the exploration front over the next few years, thus significantly boosting reserves. This, in turn, would increase Blanket's NPV.

As long as COVID is running loose in Africa, I cannot see how mining companies can avoid lower production.

I'm thinking that anything Africa is going to struggle for the next 30 years.

Now we have to contend with Covid and civil unrest in South Africa.

Caledonia Mining: Record Production in 2020 - Commissioning of Central Shaft almost Completed

1,874 views•Mar 23, 2021

NEWYORKBOB........... Looking forward to CMCL results at end of 2nd quarter now with the Central Shaft completed.......

Been following MMTMF for a few months now, and must say at this time I would wish the stock were more liquid...... Properties look good..........

I wish they’d hurry up and report 4Q2020 earnings and quarterly dividend info.

New Caledonia leaders agree terms for sale of Vale nickel mine

Mar 4, 2021 8:05AM EST

Political parties in New Caledonia on Thursday agreed new terms for the sale of Vale's nickel business, including a proposed majority stakeholding for local interests, seeking to resolve unrest over the planned sale.

All-new World Reimagined podcast

Listen Now

Adds Trafigura reaction, environment commitments

PARIS, March 4 (Reuters) - Political parties in New Caledonia on Thursday agreed new terms for the sale of Vale's VALE3.SA nickel business, including a proposed majority stakeholding for local interests, seeking to resolve unrest over the planned sale.

Brazilian miner Vale's VALE3.SA decision last year to sell its nickel mine and processing plant in the French Pacific territory to a consortium including Swiss commodity trader Trafigura TRAFGF.UL sparked fierce opposition from pro-independence groups.

Violent protests led Vale to shut down the site in December.

Under Thursday's agreement, pro-independence and loyalist leaders proposed that a 51% stake in the Vale operations be held by New Caledonia's provincial authorities and other local interests. Trafigura would have a 19% stake, less than the 25% planned in the initial sale deal with Vale.

The text released by the New Caledonian parties also mentioned a "technical and industrial partnership" with Tesla TSLA.O, under which the electric car company would source raw materials for batteries.

The parties also called for reinforced environmental standards and set a target for the mining complex to be carbon neutral by 2040.

Trafigura said it welcomed the political agreement.

"We're looking forward to operations resuming and for final completion of the transaction as soon as possible," a Trafigura spokesperson said.

Vale and Tesla did not immediately respond to requests for comment.

New Caledonia is the world's fourth-largest nickel producer behind Indonesia, the Philippines and Russia.

Demand for nickel, mainly used in making stainless steel, is expected to grow rapidly owing to increased demand for batteries for electric vehicle.

(Reporting by Gus Trompiz and Eric Onstad Editing by David Goodman )

https://www.nasdaq.com/articles/new-caledonia-leaders-agree-terms-for-sale-of-vale-nickel-mine-2021-03-04

Just reading some info into the news. With the vaccine not working in S. Africa, I am sure Zimbabwe is seeing the same thing. Think about the enclosed working spaces in a mine.

I didn't see i,t from what I get from your post is the miner are not in a groupto receive it?

Vaccine news out of South Africa cannot be helping CMCL.

COVID must be hitting the miners too. Sick miners means sick production.

Amazing that we are off almost 50 percent from its highs

Caledonia lifts 2021 gold production guidance after record 2020 output

Caledonia's Blanket gold mine, in Zimbabwe

18TH JANUARY 2021

BY: MARLENY ARNOLDI

CREAMER MEDIA ONLINE WRITER

ARTICLE ENQUIRY SAVE THIS ARTICLE EMAIL THIS ARTICLE

FONT SIZE: -+

Aim- and NYSE-listed Caledonia Mining Corporation produced a record

57 899 oz of gold in 2020, meeting the top end of its revised increased

guidance for the year.

The company had its guidance set at between 55 000 oz and 58 000 oz last year.

About 15 012 oz of total output was produced in the fourth quarter

alone.

The company has set its gold production guidance for this year at

between 61 000 oz and 67 000 oz.

The company’s Central shaft at the 64%-owned Blanket mine, in Zimbabwe,

is due to be commissioned before the end of the first quarter,

extending the life of the mine to 2034, as well as increasing output.

Caledonia in December entered into option agreements on two properties

in Zimbabwe, delivering on its strategy of organic growth, while it

increased its dividend at the start of January to $0.11 apiece, marking

a 10% increase on the prior quarterly dividend of $0.10 apiece.

The company has increased its dividend four times in the last 15 months.

Caledonia is aiming to produce 80 000 oz/y from 2022.

EDITED BY: CHANEL DE BRUYN

CREAMER MEDIA SENIOR DEPUTY EDITOR ONLINE

EMAIL THIS ARTICLE SAVE THIS ARTICLEARTICLE ENQUIRY

To subscribe email subscriptions@creamermedia.co.za or click here

To advertise email advertising@creamermedia.co.za or click here

any idea how to buy mmy at Schwab I can't find a symbol for them except MMY.V which won't work at Schwab

A close above $30 would get us going again, imo

Wish I had taken more profits during that run.

Caledonia targets Gweru gold operations

21 DEC, 2020 - 00:12 0 COMMENTS 1 IMAGES

https://www.chronicle.co.zw/caledonia-targets-gweru-gold-operations/

God Bless

Caledonia Mining Corporation Q&A: Enormous potential in the gold space in Zimbabwe

2 hours ago Gilbert Nyambabvu 0 Comments

https://www.zbcnews.co.zw/caledonia-mining-corporation-qa-enormous-potential-in-the-gold-space-in-zimbabwe/

MMY a low cost gold producer great bargain with many gold mines worth

about 10 x the market cap > CMCL should pick up MMY -

Imo!

https://investorshub.advfn.com/Monument-Mining-TSXV-MMY-13403/

https://www.monumentmining.com

In GOD We Trust - Real Money -

https://www.kitco.com/images/live/silver.gif?0.8344882022363285

http://www.kitconet.com/images/live/au0001wb.gif

Gold & Silver is the only REAL Legal Tender -

by The Founding Fathers for your -

Rights, Liberty and Freedom -

http://www.biblebelievers.org.au/monie.htm

God Bless America

Ps.

opinion appreciated

TIA

Previous | Next

Good idea. Thanks for the links.

Spicknspan thanks, a good way is to tell them....

https://www.caledoniamining.com/investors/reports-presentations/

https://www.caledoniamining.com/contact/

https://investorshub.advfn.com/boards/read_msg.aspx?message_id=159624707

https://www.caledoniamining.com/

Time for a dividend increase.

Caledonia eyeing one of Zimbabwe’s largest gold mines

October 21, 2020 Staff Reporter Business 0

Photographer: Waldo Swiegers/Bloomberg

HARARE (Bloomberg) — Caledonia Mining Corp., is interested in buying one of Zimbabwe’s largest gold operations as it embarks on an aggressive plan to acquire more assets in the country, according to a person familiar with the details.

The Jersey-based gold producer is weighing an acquisition of Bilboes Gold Ltd.’s Isabella-McCays-Bubi mines, in northwest Zimbabwe, said the person, who asked not to be identified as the details aren’t public.

A Caledonia spokeswoman declined to comment.

Bilboes Chief Executive Officer Victor Gapare said the company is looking for investors but is not holding talks with Caledonia. “Every gold mine in Zimbabwe, without exception, is looking for money and it’s not a secret,” Gapare said. “Yes, we were on the market, but there is absolutely nothing in us talking to Caledonia.”

The mines can potentially produce more than 200,000 ounces of gold, making it the largest project by output in the country, said the person. Most of the Isabella-McCays-Bubi operations are currently mothballed as the owners search for investors, the person said.

Growth Plans

Caledonia, which has Cape Town-based fund manager Allan Gray as its biggest shareholder, would be able to return the mines to full production within a short period, said the person. They could be operated for more than a decade and would align with the company’s plans to grow its Zimbabwean presence. Raising financing for the deal depends on the nature of the final agreement, the person said.

The gold miner is ramping up production at its Blanket mine in the southwest of the country, and needs larger assets to expand. It sees potential in some mines which were shut down in the 1980s due to a lack of capital, Maurice Mason, the company’s vice president for corporate development said earlier this month.

Caledonia could increase its output more than eightfold through deals, to half a million ounces a year as the company considers investing $400 million in Zimbabwe over the next decade, the person said. This month, Caledonia CEO Steve Curtis signed a memorandum of understanding with the government to evaluate some of the gold assets of state-owned Zimbabwe Mining Development Corp., pending possible purchases.

I wish the company would come out with an update are that mine improvement project.

Caledonia eyeing one of Zimbabwe’s largest gold mines

October 21, 2020 Staff Reporter Business 0

Photographer: Waldo Swiegers/Bloomberg

HARARE (Bloomberg) — Caledonia Mining Corp., is interested in buying one of Zimbabwe’s largest gold operations as it embarks on an aggressive plan to acquire more assets in the country, according to a person familiar with the details.

The Jersey-based gold producer is weighing an acquisition of Bilboes Gold Ltd.’s Isabella-McCays-Bubi mines, in northwest Zimbabwe, said the person, who asked not to be identified as the details aren’t public.

A Caledonia spokeswoman declined to comment.

Bilboes Chief Executive Officer Victor Gapare said the company is looking for investors but is not holding talks with Caledonia. “Every gold mine in Zimbabwe, without exception, is looking for money and it’s not a secret,” Gapare said. “Yes, we were on the market, but there is absolutely nothing in us talking to Caledonia.”

The mines can potentially produce more than 200,000 ounces of gold, making it the largest project by output in the country, said the person. Most of the Isabella-McCays-Bubi operations are currently mothballed as the owners search for investors, the person said.

Growth Plans

Caledonia, which has Cape Town-based fund manager Allan Gray as its biggest shareholder, would be able to return the mines to full production within a short period, said the person. They could be operated for more than a decade and would align with the company’s plans to grow its Zimbabwean presence. Raising financing for the deal depends on the nature of the final agreement, the person said.

The gold miner is ramping up production at its Blanket mine in the southwest of the country, and needs larger assets to expand. It sees potential in some mines which were shut down in the 1980s due to a lack of capital, Maurice Mason, the company’s vice president for corporate development said earlier this month.

Caledonia could increase its output more than eightfold through deals, to half a million ounces a year as the company considers investing $400 million in Zimbabwe over the next decade, the person said. This month, Caledonia CEO Steve Curtis signed a memorandum of understanding with the government to evaluate some of the gold assets of state-owned Zimbabwe Mining Development Corp., pending possible purchases.

CMCL is pretty connected in Zimbabwe. The company stayed in the country as others left. That counts for something.

If they can finish the mine shafts, we are back above 25

"INCREASE GOLD PRODUCTION IN EXCESS OF 500,000 oz., around 15,5 tonnes by 2030"..............

https://www.herald.co.zw/blanket-mine-ramps-up-third-quarter-output/

conix thank you, Caledonia to evaluate Zim govt's minerals portfolio for development potential

Aim-listed Caledonia Mining will evaluate mining rights, properties and projects in the gold sector that are controlled by the Zimbabwe government with a view to assessing the potential to advance the development of these properties or projects.

Caledonia believes Zimbabwe is a highly prospective region for gold discoveries.

“Caledonia has assessed and continues to assess investment opportunities in the Zimbabwe gold sector that are privately owned.

"However, the government of Zimbabwe has a considerable portfolio of assets in the gold sector that are potentially very attractive and Caledonia and the government have, therefore, entered into an agreement whereby Caledonia is provided an opportunity to review this portfolio to determine whether they may be commercially developed for mutual benefit,” Caledonia notes.

"I am delighted we have reached this agreement, which will give Caledonia access to a new and much increased number of potential investment opportunities in the Zimbabwe gold sector.

"Over the years of operating in Zimbabwe, we have established a professional relationship with the appropriate bodies and have a strong performance, social and ethical record. We look forward to applying the same approach to any future opportunities in the country, developing the assets in the same responsible way we have done at Blanket, with any new developments including a local ownership structure and community engagement,” CEO Steve Curtis says.

He adds that the signing of this agreement is very timely, as the Blanket mine, Caledonia's current investment in Zimbabwe, is approaching the end of a multiyear investment of more than $60-million in a new shaft - the Central shaft.

When this project is completed later this year, Blanket's gold production is expected to increase from about 55 000 oz/y to about 80 000 oz/y from 2022 onwards.

“The increased level of production, in conjunction with the higher gold price, means that we should have the financial capacity to consider further meaningful investments in the Zimbabwe gold sector,” Curtis enthuses.

“Blanket mine has more than doubled its employment from less than 800 in 2006 to [about] 1 650; Blanket is also a major taxpayer in Zimbabwe and we expect this to increase substantially in the next few years. Caledonia is also an outstanding corporate citizen in Zimbabwe, having facilitated local ownership partnerships of Blanket mine since 2012.

"I am therefore pleased that Caledonia will apply its experience, technical expertise and its financial capacity to evaluate the portfolio of gold assets that are held by the government. I am confident that Caledonia will make an even larger contribution to the economy of Zimbabwe as a result of further investments in our gold industry,” says Zimbabwe Mines and Mine Development Minister Winston Chitando.

https://m.miningweekly.com/article/caledonia-to-evaluate-zim-govts-minerals-portfolio-for-development-potential-2020-10-06

Caledonia to evaluate Zim govt's minerals portfolio for development potential

Aim-listed Caledonia Mining will evaluate mining rights, properties and projects in the gold sector that are controlled by the Zimbabwe government with a view to assessing the potential to advance the development of these properties or projects.

Caledonia believes Zimbabwe is a highly prospective region for gold discoveries.

“Caledonia has assessed and continues to assess investment opportunities in the Zimbabwe gold sector that are privately owned.

"However, the government of Zimbabwe has a considerable portfolio of assets in the gold sector that are potentially very attractive and Caledonia and the government have, therefore, entered into an agreement whereby Caledonia is provided an opportunity to review this portfolio to determine whether they may be commercially developed for mutual benefit,” Caledonia notes.

"I am delighted we have reached this agreement, which will give Caledonia access to a new and much increased number of potential investment opportunities in the Zimbabwe gold sector.

"Over the years of operating in Zimbabwe, we have established a professional relationship with the appropriate bodies and have a strong performance, social and ethical record. We look forward to applying the same approach to any future opportunities in the country, developing the assets in the same responsible way we have done at Blanket, with any new developments including a local ownership structure and community engagement,” CEO Steve Curtis says.

He adds that the signing of this agreement is very timely, as the Blanket mine, Caledonia's current investment in Zimbabwe, is approaching the end of a multiyear investment of more than $60-million in a new shaft - the Central shaft.

When this project is completed later this year, Blanket's gold production is expected to increase from about 55 000 oz/y to about 80 000 oz/y from 2022 onwards.

“The increased level of production, in conjunction with the higher gold price, means that we should have the financial capacity to consider further meaningful investments in the Zimbabwe gold sector,” Curtis enthuses.

“Blanket mine has more than doubled its employment from less than 800 in 2006 to [about] 1 650; Blanket is also a major taxpayer in Zimbabwe and we expect this to increase substantially in the next few years. Caledonia is also an outstanding corporate citizen in Zimbabwe, having facilitated local ownership partnerships of Blanket mine since 2012.

"I am therefore pleased that Caledonia will apply its experience, technical expertise and its financial capacity to evaluate the portfolio of gold assets that are held by the government. I am confident that Caledonia will make an even larger contribution to the economy of Zimbabwe as a result of further investments in our gold industry,” says Zimbabwe Mines and Mine Development Minister Winston Chitando.

https://m.miningweekly.com/article/caledonia-to-evaluate-zim-govts-minerals-portfolio-for-development-potential-2020-10-06

Caledonia Mining Corporation Plc Completion of ATM Fund-Raising for

Solar Project, Block Admission Cancellation and Block Admission Return

(NYSE AMERICAN: CMCL; AIM: CMCL)

St Helier, September 4, 2020 -

Caledonia Mining Corporation Plc ("Caledonia" or the "Company") today announces that, further to its announcement on July 24, 2020 relating to a block admission application and an "At the Market" or "ATM" sales agreement with Cantor Fitzgerald & Co (the "ATM Sales Agreement"), the Company has now raised US$13m pursuant to the ATM Sales Agreement through the sale and issue of 597,963 shares in the Company (the "ATM Shares").

Following issue of the ATM Shares, the Company has a total number of shares in issue of 12,118,823 common shares of no par value each. Caledonia has no shares in treasury; therefore, this figure may be used by holders as the denominator for the calculations by which they determine if they are required to notify their interest in, or a change to their interest in, the Company.

As disclosed in the announcement on July 24, 2020, application was made to AIM for a block admission in respect of up to 800,000 new depositary interests representing the same number of shares in the share capital of the Company which will rank pari passu with the existing shares in issue.

Given that the Company has now raised the maximum amount of funds sought under the ATM Sales Agreement through the issue of the ATM Shares, the Company has cancelled the remaining portion of the block admission (202,037 depositary interests) effective as at September 7, 2020, representing the surplus shares that are not required to be sold and issued under the ATM Sales Agreement.

As previously mentioned, Caledonia expects to use the amount of net proceeds from the sales for investment in the construction of a solar power plant to supply electricity to Blanket Mine in Zimbabwe.

In accordance with AIM Rule 29 and Schedule 6 of the AIM Rules for Companies and in full satisfaction of the Company's obligation to make announcements of the utilisation of the block admission, the Company makes the following notification regarding its block admission facility:

(a) Name of company

Caledonia Mining Corporation Plc

(b) Name of the scheme

At the Market Sales Agreement

(c) Period of return

From July 27, 2020 to September 7, 2020

(d) Number and class of securities not issued under scheme

202,037 common shares of no par value each and an equal number of depositary interests

(e) Number of securities issued under scheme during period

597,963 common shares of no par value each

(f) Balance under the scheme of securities not yet issued at the end of the period

202,037 common shares of no par value each and an equal number of depositary interests

(g) Number and class of securities originally admitted and the date of admission

800,000 depositary interests in common shares of no par value - July 27, 2020

(h) Contact name(s) and telephone number(s)

Caledonia Mining Corporation Plc

Mark Learmonth

Maurice Mason

Tel: +44 1534 679 802

Tel: +44 759 078 1139

WH Ireland

Adrian Hadden/James Sinclair-Ford

Tel: +44 20 7220 1751

Blytheweigh

Tim Blythe/Megan Ray

Tel: +44 207 138 3204

3PPB

Patrick Chidley

Paul Durham

Tel: +1 917 991 7701

Tel: +1 203 940 2538

Note: This announcement contains inside information which is disclosed in accordance with the Market Abuse Regulation (EU) No. 596/2014.

Cautionary Note Concerning Forward-Looking Information

Caledonia Mining Corporation “gold miners are currently cream of the equity crop” say WHIreland

Article by: Darren Turgel 13th July 2020

https://www.directorstalkinterviews.com/caledonia-mining-corporation-gold-miners-are-currently-cream-of-the-equity-crop-say-whireland/412841166

Caledonia Mining Corporation plc (LON:CMCL) is the topic of conversation when WH Ireland’s Analyst Paul Smith caught up with DirectorsTalk for an exclusive interview.

Q1: With gold as high as it is and a solid production being delivered does this impact your forecast in any way?

A1: The current gold price – now above $1,800/oz for the first time since its last high in 2011 – is only good news for revenue, profit and cash generation from the mine. We will look to revisit our forecasts later in the year as the story of the inexorable gold price rise unfolds. We currently use a $1,685/oz gold price for 2020 and suffice it to say if the gold price remains above $1,800/oz for a sustained period we will have to provide an upward revision to our forecasts.

|

Followers

|

98

|

Posters

|

|

|

Posts (Today)

|

0

|

Posts (Total)

|

5874

|

|

Created

|

03/01/06

|

Type

|

Free

|

| Moderators | |||

[/chart]

Presentation welcome to CALVF -

CALVF's A target production rate of 100,000 oz per annum -

http://www.caledoniamining.com/blanket4test2.php

CALVF's BLANKET GOLD MINE Production Au 40,000 oz/year

http://www.caledoniamining.com/pdfs/CALPres05262011.pdf

http://www.caledoniamining.com/pdfs/CALPres05192011.pdf

http://www.caledoniamining.com/blanket2test2.php

http://www.caledoniamining.com/blanket3test2.php

CALEDONIA MINING CORP.

A Profitable Gold Miner! (CAL:TSE) (CALVF:US) (AIM,LONDON:CMCL)

http://www.caledoniamining.com/blanket.php

CALVF Production Cost Au $585.-- per ounce -

79th Minesite Forum - Caledonia Mining Corporation - Mark Learmonth -- 19/05/2011

http://www.youtube.com/watch?v=GsyJrcDDsEw

http://www.caledoniamining.com/pdfs/Pres_01282011a.pdf

http://www.caledoniamining.com/pdfs/Pres_01282011b.pdf

http://www.caledoniamining.com/pdfs/Pres_09102010.pdf

CALEDONIA MINING CORPORATION

Blanket Gold MineBackgroundLocated in the south-west of Zimbabwe Blanket Mine is wholly owned and operated by Caledonia, having been acquired from Kinross Gold Corporation in June 2006. The mine is 560 kms from Harare, the capital city and 150 kms from Bulawayo, the country's second largest city. The provincial capital of Matabeleland South, Gwanda town is 16 kms from the mine.Access to the mine is by an all-weather tarred road to Gwanda, which is linked to Bulawayo by a national highway. |  Blanket Gold Mine - Zimbabwe | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| The main railway line from South Africa passes through Gwanda. An airstrip on the outskirts of Gwanda caters for light aircraft.  Blanket mine has been producing gold since the time of the ancients. However recorded production started in 1904. Early workers tended to pick the native gold "eyes" from the pay shoots. Significant production milestones were in 1965 when Falconbridge acquired the property and immediately introduced a production culture commensurate with multinational corporations by increasing gold production to some 45 kgs/month on average and in 1993 when Kinross took over the property and built a CIL plant to add the treatment of the tailings pile to the run-of-mine ore. Gold production peaked at an average of 110 kg/month during the tailings treatment years from 1995. However tailings treatment is now completed. To date in excess of 1 million ounces of gold have been produced from the property. HistoryAfter being worked by the ancients before the 19th century, the Blanket claims were acquired by the Matabele Reefs and Estate Company who subsequently mined no less than 128 000t from 1906 to the end of 1911. From 1912 to 1916, the Forbes Rhodesia Syndicate mined some 23,000t. The period from 1917 to 1941 has no reliable records. It is possible the mine lay dormant as this was a period of geopolitical instability. In 1941, F.D.A. Payne resumed mining activities accounting for some 214,000t before selling the property to Falconbridge in 1964. |  | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| The property became a significant producer from 1965 when the then new owners, Falconbridge, introduced a production culture commensurate with multinationals producing some four million tonnes of ore up to the end of September 1993, when Kinross Gold Corporation, took over the property. Kinross immediately put into place a program of further increasing production by adding the treatment of the tailings dumps to the run-of-mine stream. By the end of 2005 the property had produced in excess of 1 million ozs of gold since records were kept. Caledonia Mining Corporation acquired the Blanket Mine effective as at April 1, 2006. Property GeologyThe geology consists of a basal felsic unit of no known mineralisation presence. | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| It is generally on this lithology type that the various tailings disposal sites are located. Above this unit are the ultramafics that include the banded iron formations hosting the eastern dormant cluster and the ore bodies of the nearby Vubachikwe complex. The active Blanket ore bodies are found in the next unit, the mafics. |  #1 Conveyor feeding the two Surface Primary Jaw Crushers | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| The tables below summarize the RESERVES AND RESOURCES at December 31, 2008 Cautionary Note to U.S. Investors - the United States Securities and Exchange Commission permits U.S. mining companies, in their filings with the SEC, to disclose only those mineral deposits that a company can economically and legally extract or produce. Caledonia uses certain terms in this website - and in some cases press releases - such as "measured", "indicated", and "inferred" "resources", which the SEC guidelines generally prohibit U.S. registered companies from including in their filings with the SEC. U.S. Investors are urged to consider closely the disclosure in our Form 20-F which may be secured from Caledonia, or on the SEC website at: http://www.sec.gov/edgar.shtml.

(i) 1 tonne = 1,000 kilograms = 2,204.6 pounds Some numbers may not add due to rounding Mr. David Grant, C. Geol., FGS, Pr. Sci. Nat., an independent consultant is the "Independent Qualified Person" for Blanket's reserves and resources as required by National Instrument 43-101 of the Canadian Securities Administrators. Mr Grant's Independent Report on Caledonia's acquisition of the Blanket Mine as required by NI 43-101 is available in the "Investor Centre-Technical Reports" section of this website. This report has also been filed on SEDAR and is available at www.sedar.com.

| |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|  |  |  |

|  |  |  |

|  |  |  |

|  |  |

|

Blanket Gold Mines -

has been producing gold since the time of the ancients time since

before King Solomon's Mines :

Blanket Gold Mines commenced the production ramp-up to

the targeted annualized rate of 40,000 ounces of gold

by the end of 2010.

http://www.caledoniamining.com/pdfs/01242011.pdf

http://www.caledoniamining.com/

Caledonia Mining Corporation (CAL)

Exchange: Toronto Stock Exchange

http://tmx.quotemedia.com/quote.php?qm_symbol=CAL

http://www.caledoniamining.com/overview.php

Golden Valley

http://www.docstoc.com/docs/32719706/EERSTELING-GOLD-MINING-COMPANY-LIMITED

Eersteling Gold Mine

Background

The 100% owned Eersteling Gold Mining Company Limited ("Eersteling") is located 36 km south of the city of Polokwane in Limpopo Province of the Republic of South Africa, 300 km north of Johannesburg.

100% interest in Eersteling gold mine located 36 kilometers from the town of Polokwane in the rolling terrain of the Northern Province of the Republic of South Africa.

As of the December 31, 2005, the company had a gold resource estimate of 597,500 tonnes in the Eersteling Mine property

Location of the Eersteling Gold Mine on the map

21

http://edgar.brand.edgar-online.com/EFX_dll/EDGARpro.dll?FetchFilingHtmlSection1?SectionID=6185226-977-370822&SessionID=_-RfHS0AHfsw027

Goedgevonden - South Africa

The Corporation holds prospecting rights over the Goedgevonden diamond bearing kimberlite pipe and surrounding area. This property is located approximately 20km north of the Stilfontein gold mine in the Klerksdorp district of the North West Province in South Africa and 200km south west of Johannesburg.

In April 2005 an application for conversion of these rights was submitted in terms of the Mineral and Petroleum Resources Development Act ("MPRDA") and the rights were granted in December 2006. An additional application for New Order Prospecting rights was submitted over an adjoining farm, Eleazar in June 2005. It is expected that this application will be granted shortly as soon as documentary proof of BEE participation has been presented.

Previous prospecting activities carried out in the mid 1970's on Goedgevonden indicate that the pipe is oval in shape and covers a surface area of approximately 0.27 hectares. This work also confirms that the pipe was drill intersected at a depth of 425 meters, and that further down-dip extensions remain undefined. Previous drilling reported an average diamond content of 35 to 45 carats per hundred tonnes of material ("cpht"), with one hole yielding 65 cpht. The Corporation has not completed the work necessary to estimate a resource in terms of NI 43-101 for the Goedgevonden property.

A preliminary drilling program conducted in 2002 consisted of 7", 8" and 12" diameter reverse circulation drill holes, followed by the collection of the drill samples and diamond recovery. Four holes were drilled in the centre of the pipe, three to a depth of 150 meters, and the other to 120 meters. The three remaining holes were drilled to delineate the pipe in more detail. All of the seven holes drilled entered the kimberlite at a depth of about 6 meters, and the four centrally-located holes were stopped whilst still in the kimberlite. A total of about 56 tonnes of drilling sample was collected and processed through a Van Eck and Lurie dense-media separation ("DMS") plant and wet Sortex machine. From the diamond recoveries it was confirmed that the Goedgevonden pipe was diamondiferous, and sufficient gem-quality diamonds were recovered to warrant a larger bulk sample. Geological interpretive work as well as detailed ground gravity and magnetometer surveys were completed during 2003 but there was no further exploration activity on this property as corporate resources were concentrated on the Corporation's other projects which were considered to be of higher priority in adding shareholder value.

Granting of the New Order Prospecting Rights (not yet signed) gives the Company security of tenure. Discussions are in progress with other parties with a view to realizing value by joint venture or disposal of the properties in the Goedgevonden Diamond Project.

Blanket has claims and exploration permits in the vicinity of the existing mine operations.

Blanket intends to undertake exploration on these areas to assess their suitability for further

development as potential satellite operations, feeding crushed ore into the existing

Blanket milling and CIL plant.

Blanket claim incl. many past gold producing gold mines operations ...

|  |  |  |

|  |  |  |

|  |  |  |

|  |  |  |

Higher target ;)

1 year chart of Copper, Gold and Molybdenum prices:

&Series1Name=Open&Series2Name=High&Series3Name=Low&Series4Name=Close&ChartType=F&ChartName=Weekly+OHLC&ChartDecs=2&Inst_Color=101)

&Series1Name=Open&Series2Name=High&Series3Name=Low&Series4Name=Close&ChartType=F&ChartName=Weekly+OHLC&ChartDecs=2&Inst_Color=101)

www.ivarkreuger.com/metalcharts.htm

www.ivarkreuger.com/metalcharts.htm

The super red banksters cults -

Rothschilds World Part 1 "Glen, Rush, Michael...Here's to you boy's"

http://www.youtube.com/watch?v=yhKHwrUA5SM&feature=related

| Volume | |

| Day Range: | |

| Bid Price | |

| Ask Price | |

| Last Trade Time: |