Register for free to join our community of investors and share your ideas. You will also get access to streaming quotes, interactive charts, trades, portfolio, live options flow and more tools.

,,,,,,,ALI BABA STILL OWNS THIS?

Pros: sub $1 play - virtually no short intrest - senior management buy back - nice vol

Cons: ???

yup just bought a few here

0.27 hope this is bottom stop 0.265

Crazy. A lot of the sub dollar plays have been quick pumps

alibaba group holds 2.1million shares not much but something could have value here

If it Closes in .60s good chance at reversal and .80s by next week

Little early here.. I like it.. great chart, low float, bottom… gunna make some money on this one

Looking forward to CTK yearend results shortly. 3rd quarter 2020- Net revenue was US$105.7 million, an increase of 238% from US$31.3 million during the same period last year.

CooTek Announces up to US$15 million Share Repurchase Program

Date : 11/26/2018 @ 7:00AM

Source : PR Newswire (US)

Stock : Cootek Cayman (CTK)

Quote : 5.61 0.0 (0.00%) @ 7:05AM

CooTek Announces up to US$15 million Share Repurchase Program

Print

Alert

Cootek Cayman (NYSE:CTK)

Intraday Stock Chart

Today : Monday 26 November 2018

Click Here for more Cootek Cayman Charts.

SHANGHAI, Nov. 26, 2018 /PRNewswire/ -- CooTek (Cayman) Inc. (NYSE: CTK) ("CooTek" or the "Company"), a fast-growing global mobile internet company, today announced that the board of directors of the Company has approved a share repurchase program whereby CooTek is authorized to repurchase its class A ordinary shares in the form of American depository shares with an aggregate value of up to US$15 million during the 12-month period starting from November 30, 2018. The Company expects to fund the repurchases under this program with its existing cash balance.

The Company's proposed repurchases may be made from time to time on the open market at prevailing market prices, in privately negotiated transactions, in block trades and/or through other legally permissible means. The timing and extent of any repurchases will depend on market conditions, the trading price of the Company's ADSs and other factors, subject to applicable rules and regulations. The Company's board of directors will review the share repurchase program periodically, and may authorize adjustment of its terms and size.

"This share repurchase program reflects our confidence in the long-term business prospects of our company as well as our solid operating fundamentals and financial strength," commented Karl Zhang, CooTek co-founder and Chairman. "We will continue to focus on our strategy of building a global content delivery platform by investing in AI and big-data technologies to create long-term value for our shareholders."

About CooTek (Cayman) Inc.

CooTek is a fast-growing global mobile internet company. The mission of CooTek is to empower everyone to express themselves and enjoy relevant content seamlessly. The Company's user-centric and data-driven approach has enabled it to release appealing products to capture mobile internet users' ever-evolving content needs and helps it rapidly attract targeted users. Focusing on 5 verticals of fitness, news and short videos, healthcare, lifestyle and entertainment, CooTek has developed multiple rapidly growing content-rich portfolio apps with news feed to deliver relevant content.

Safe Harbor Statement

This press release contains forward-looking statements made under the "safe harbor" provisions of Section 21E of the Securities Exchange Act of 1934, as amended, and the U.S. Private Securities Litigation Reform Act of 1995. These forward-looking statements can be identified by terminology such as "will," "expects," "anticipates," "future," "intends," "plans," "believes," "estimates," "confident" and similar statements. CooTek may also make written or oral forward-looking statements in its reports filed with or furnished to the U.S. Securities and Exchange Commission, in its annual report to shareholders, in press releases and other written materials and in oral statements made by its officers, directors or employees to third parties. Any statements that are not historical facts, including statements about CooTek's beliefs and expectations, are forward-looking statements that involve factors, risks and uncertainties that could cause actual results to differ materially from those in the forward-looking statements. Such factors and risks include, but not limited to the following: CooTek's mission and strategies; future business development, financial conditions and results of operations; the expected growth of the mobile internet industry and mobile advertising industry; the expected growth of mobile advertising; expectations regarding demand for and market acceptance of our products and services; competition in mobile application and advertising industry; and relevant government policies and regulations relating to the industry. Further information regarding these and other risks, uncertainties or factors is included in the Company's filings with the U.S. Securities and Exchange Commission. All information provided in this press release is current as of the date of the press release, and CooTek does not undertake any obligation to update such information, except as required under applicable law.

For investor enquiries, please contact:

CooTek (Cayman) Inc.

Jean Zhang

Email: IR@cootek.com

Christensen

In China

Mr. Christian Arnell

+86-10-5900-1548

carnell@christensenir.com

In US

Ms. Linda Bergkamp

+1-480-614-3004

lbergkamp@christensenir.com

Cision View original content:http://www.prnewswire.com/news-releases/cootek-announces-up-to-us15-million-share-repurchase-program-300755029.html

SOURCE CooTek

CooTek AI Lab

Using AI to Better People’s Lives

Our Focus

Natural Language Processing

In order to predict what users are going to input, we laid the foundation for TouchPal Keyboard by building language models for over 110 languages. This allows us to establish the end-to-end procedures to process natural language data through data collection, pre-processing, model training, offline and online evaluation, and product integration. Due to the high volume of data, we have also created a robust and substantial engineering infrastructure for data storage, computation, model training, evaluation, and monitoring.

Natural Language Understanding

In addition to input prediction, we have invested our resources into natural language understanding to interpret the meaning behind user expressions in different scenarios and contexts. With natural language understanding, we created Talia, our AI assistant, along with the next generation AI keyboard that not only facilitates users’ input efficiency, but also prompts useful services and content.

Automatic Speech Recognition

Our Natural Language technology allows us to take a different approach towards ASR. Unlike existing third-party solutions that focus on generic speech recognition, our ASR system is trained to recognize users’ speech in a wide variety of domains such as shopping, searching, and chatting. We also tailor our system to understand user-defined words and strive to build an ASR system that works well in multiple languages and scenarios to meet user’s needs.

AI Case Study

Talia is TouchPal’s AI Assistant. Still very young, it has been integrated in TouchPal Keyboard, creating the paradigm of next generation keyboard. Talia serves as an observer, who does not interrupt what users are doing but offering help when she feels needed. Talia changes the keyboard from doing only one job, which is text entry, to being a traffic hub by understanding users’ needs and intentions, dispatching the traffic with such needs and intentions to back-end services hosted by third-parties and retrieving information, content, and services back to the users.

Smart

Reply

Dining

Recommendations

Weather

Forecast

Swift

Paste

Currency

Conversion

Advance your career by furthering the research, design, and implementation of AI technology and products to benefit a global audience.

See Opportunities

About Us

Key Products

AI Lab

Investors

Newsroom

Join Us

Contact Us

Policy

https://www.cootek.com/index.html?path=products

Keyboard

https://www.touchpal.com/?from=OfficialWebsite

TouchPal - Best Keyboard for Android Phones

TouchPal - Best Keyboard for Android Phones

Today we take a look at TouchPal, the best keyboard for Android phones that uses AI suggestions, curve typing &a...

https://www.cootek.com/index.html?path=products

Best App of 2015

700+ million users 158 countries 120+ languages

https://www.touchpal.com/?from=OfficialWebsite

AI is the biggest thing since the internet and CTK is AI

72-year-old Fidelity bets on the future with blockchain, virtual reality and AI

The 72-year-old financial services company is competing with Google, Facebook and Microsoft to recruit top talent from Silicon Valley.

The firm, which administers more than $7 trillion in customer assets, spends $2.5 billion a year on tech through Fidelity Labs and its Fidelity Center for Applied Technology.

The Boston-based private company is experimenting with blockchain, artificial intelligence and virtual reality — and is benchmarking itself against digital natives like Nvidia instead of brokerage firms like Charles Schwab.

“Fidelity is a sleeping giant,” says Rich Repetto, principal at Sandler O'Neill & Partners who covers its brokerage competitors. “Or at least they're not a well known giant as far as what they're actually doing.”

Kate Rooney | @Kr00ney

Published 7 Hours Ago Updated 4 Hours Ago

CNBC.com

A pedestrian passes a Fidelity Investments branch in New York.

Victor J. Blue | Bloomberg | Getty Images

A pedestrian passes a Fidelity Investments branch in New York.

"What are you doing here?" a young engineering student asked Vipin Mayar, the head of artificial intelligence initiatives at Fidelity Investments, at a MIT conference in San Francisco.

As Mayar recalled, "They were all just… surprised."

Fidelity executives are getting used to the confused looks and double-takes their company booth draws at Silicon Valley job fairs.

Although the 72-year-old, family-controlled firm is known for managing retirement plans and mutual funds, by many measures, Fidelity is a tech company. The firm is spending billions of dollars to compete in new technologies like blockchain, artificial intelligence and virtual reality. According to executives, Fidelity wants to measure itself against tech firms like Nvidia, not its more traditional Wall Street rivals like Charles Schwab.

Fidelity was doing fintech before fintech was cool, as CEO Abigail Johnson explained it during a panel presentation at the company's headquarters this month. Her grandfather, Edward C. Johnson, founded the company in 1946 and is still quoted as saying it's better to "take intelligent risks rather than follow the crowd."

Fidelity has notched a few industry firsts that could probably fall under Johnson's "intelligent risk" category.

In the 1960s, the firm bought its first mainframe computer, which took up the entire floor of an office building. In the 1970s, Fidelity was the first to sell retail mutual funds directly through a toll-free telephone line and had the first voice-activated computer response system for stock prices and yield quotes. In the 1980s, it rolled out Fidelity Money Line, the first nationwide electronic funds transfer for money market funds, and a voice-activated computer answering system.

Source: Fidelity Investments

Fidelity Labs & "FCAT"

Johnson's father, Edward Johnson III or "Ned," was CEO before her and in the 1990s decided there should be a group tasked with researching cutting-edge technology.

"That's how FCAT got going," Johnson said on stage at the company's Boston headquarters last Friday. "We've had that tradition for a long time."

So, along came Fidelity Center for Applied Technology, or FCAT, as employees call it. The group embraced what would prove to be a really intelligent risk: The internet. It was the first mutual fund company to have an online home page, and it had the country's first 401(k) plan sold and serviced online, a spokesperson for the company said.

Fidelity spends $2.5 billion on technology annually, including FCAT, another innovation center that came along 10 years later called Fidelity Labs and enterprise services. The innovation centers have become a place where employees can take risks, including the creation of a mobile app, a chatbot named Cora and the secretive blockchain efforts.

The firm certainly has the money to back a certain amount of risk-taking. Operating profits for FMR LLC, the parent company of Fidelity Investments, rose 54 percent last year, according to its most recent annual report. In 2017, revenues topped $18.2 billion, a 13.7 percent increase year over year. The firm closed the year with a record $6.8 trillion in investor assets under administration, up 19 percent from the year earlier. That total has since increased to more than $7 trillion.

Not every risk pans out, such as the failed financial app it developed for Google Glass and the Pebble smartwatch.

Fidelity tech

Source: Fidelity Investments

Fidelity tech

Failure is acceptable but they had to create a separate place to do it, far away from the retirement and other fund businesses.

"If you're running Fidelity.com, no one wants to hear 'we failed today,' or call a call center and hear 'oh sorry, they're out innovating,'" said Sean Belka, the head of Fidelity Labs. "We had to create a safe space, essentially for failure. That's what the labs is."

Johnson pointed out that financial services don't have a high "fun factor," which makes it hard for the average person to care about it. That's not obvious during a visit to the lab, where virtual reality headsets are strewn on tables and a corn-hole game sits in the corner. Groups of employees are intensely huddled in glass offices around white boards, with rainbow-colored post-its and inspirational quotes on the walls, as they try to develop technology to solve some of the world's less glamorous problems, like student debt.

They live by the "fail fast and fail early" mantra made popular in Silicon Valley. Executives say by failing early, they can move on without wasting time and money on projects that end up as duds. If the projects do seem promising, Fidelity runs test programs on their own associates before sending them out to customers.

Its student debt offering, which Hewlett Packard Enterprises will now offer to its own employees, came out of Fidelity Labs. It helps employees refinance debt, and can pull loans from multiple different vendors in real-time. The idea came from a realization that millennials care more about short-term needs than their retirement funds. Fidelity Labs was also the birthplace of something called bSolo, that helps gig economy workers pay quarterly taxes.

Artificial Intelligence

The modern consumer is finicky with abundant, and often, cheaper options. Financial companies are turning to artificial intelligence to create a better experience.

"For them the experience they want is the last best experience they had that morning — not the last best experience in financial services," said Ram Subramaniam, head of brokerage and investment solutions for personal investing. "After somebody gets out of an Uber and had a fabulous experience, when they come to a financial company, the expectation is set."

Fidelity uses machine learning to improve the customer experience by trying to predict what they want without them even knowing. It can authenticate the identity of a customer calling, and figure out why they're calling, within a fraction of a second. The chatbot, Cora, also comes out of artificial intelligence, and Fidelity Brokerage's robo advisor uses some of the same proprietary tech.

Fidelity virtual reality

Source: Fidelity Investments

Fidelity virtual reality

Machines won't replace advisors, though. Despite the billions of dollars spent on tech, Johnson said their "core belief" is that financial services industry is not going to go 100 percent electronic.

Modern customers want convenience on an app but they still want to pick up the phone, or at least know they have someone they can contact other than a chatbot for financial planning. The company is using virtual reality for employee training. It created an in-house program that aims to teach employees how to handle situations with empathy and compassion. Associates walk through simulations, like entering the home of a grieving client, using a virtual headset.

Competing for talent

Fidelity employs 12,000 technologists, almost one-third of its workforce, but finding qualified workers can be especially tricky. According to one recruiter, 93 percent of all software engineers have jobs in what's very much "a candidate's market" heavily tilted to the Silicon Valley culture.

"A company like Fidelity has a traditional brand — they need to look different to attract a tech candidate. My question would be how are they going to do this?" said Melissa James, founder and CEO of recruitment platform Tech Connection and former recruiter for Google. She pointed out that candidates might be concerned about things as seemingly subtle as dress code. "That's what I think when I think of Fidelity. At Google, you can wear jeans and a t-shirt."

The "7th Floor Village" at the company's headquarters was designed to counter the staid reputation financial firms tend to have, transporting visitors from Boston's Seaport to Silicon Valley. The floor was redesigned a year ago to jibe with the working environment software engineers expect: open plan with no offices or assigned desks. People work at broad communal tables or standing desks, and bright colored couches are scattered about. Nearby, there is cold brew coffee on tap.

Fidelity headquarters

Source: Fidelity Investments

Fidelity headquarters

In over 72 years in business, Fidelity has collected an enormous amount of data, a fact it uses to lure talent from Amazon and Microsoft.

"Our projects are harder, more exciting and more interesting than a lot of the digital companies," Mayar, the head of AI, said. "We've got more data, and broader data, which drives better AI."

Pricing pressure

Executives acknowledge that a race to lower fees in the financial industry is here to stay.

Fidelity is moving to zero fees in some areas. Just a month after announcing it would become the first financial company to offer no-fee index mutual funds, Fidelity attracted roughly $1 billion into the two portfolios. It offers access to more than 260 other commission-free ETFs. On stock trading, the firm is betting that the quality of its brokerage services will resonate with customers more than the appeal of zero fees.

"Value is more than just price," Subramaniam said.

Fidelity is betting that some of these offerings that come with being one of Fidelity's 27 million customers are enough to keep millennials from jumping to zero-fee start-ups, like the mobile trading app Robinhood.

One advantage it has in this pricing war is its size. It's able to absorb some of the pressure because it has a "broad suite" of ways make money off its customer relationships, according to Devin Ryan, managing director and analyst at JMP Securities.

"Scale players like Fidelity are in a strong position because they have the capability to invest tens of thousands, or billions, in tech," Ryan said. "They're doing that partially because of the revenue backdrop. When times are good you invest — and times are good right now."

Blockchain and bitcoin

Fidelity recognized the potential in blockchain before it became the corporate buzzword of 2018. CEO Abby Johnson led the charge into cryptocurrency, one of the riskiest and most volatile asset classes of the past year.

"A few plus years ago, myself and a few other senior executives here were just curious about what was going on, particularly with bitcoin," Johnson said. "We started getting together to say 'we're got to understand this.'"

The curiosity led them to start bitcoin "mining," at a location in New Hampshire when the crypto's price was around $180.

Flash forward to December of last year when bitcoin rose to almost $20,000, "behold — the price goes up and all the sudden we're making money, which was never the intent," Johnson said. She did not specify how much bitcoin has been mined, or how much money Fidelity made.

There's clear interest in the topic by Fidelity employees. Its blockchain club for employees called "bits and blocks," hosts seminars, office hours and meet ups, now has roughly 2,600 members.

The company has an arrangement with Coinbase that allows Fidelity customers to check their cryptocurrency balances on the Fidelity mobile app. In 2015, it started facilitating charitable donations in bitcoin.

Many other potential uses for bitcoin and cryptocurrencies have been scrapped by now or "put on the shelf," Johnson said. "We're trying to listen to the marketplace."

In the meantime, Katie Chase, the head of strategy for Fidelity Center for Applied Technology and head of the Blockchain Incubator (which is a part of FCAT), is exploring uses for both private blockchain and enterprise blockchain. Chase could not comment specifically on the projects but said she's seen massive interest from clients and partners, as well as their own employees.

"It's still very nascent. All of the stuff that you're reading about, if you dig under the covers is still in the proof of concept stage," Chase said. "We tried to apply blockchain to some use cases where we learned a lot but the technology isn't mature enough to solve these problems."

For now, the group is more focused on what some of those barriers are, she said. They're looking at how to "tokenize" physical items, like a piece of art for example, or how to use blockchain in the supply chain space.

"Those are on the shelf, but we think they'll eventually come off," Chase said.

Fidelity will be well-equipped when they do. She used the example of Pebble watch, a failure by retail standards but something that paid off for Fidelity. Her group had created an app for the smartwatch, which shut down three years after raising millions through a crowdfunded kickstarter campaign.

When the Apple Watch finally came to market, Fidelity was ready. It used the app developed for Pebble to quickly go live on Apple's new product.

"We were not betting that the Pebble watch is the next big thing — but in case we have people wearing these things on their wrist, we wanted to be there too," she said. "It gave us the learning for when the smart watch did go to mass market, and we were able to be there."

Private company

This would all be much harder to do if Fidelity had to answer to shareholders. If its long-term side projects fail, or bitcoin goes to zero, it doesn't have to answer questions about it posed by analysts during quarterly conference calls. And most importantly, executives say, its retirement and mutual funds won't be affected.

The separate tech incubators have allowed the company to take risks, even when markets aren't in a historic bull run. Sean Belka of Fidelity Labs has worked at public companies he says are "quicker to change directions during different cycles."

"There's a staying power around being able to invest for the long term. It gives us the opportunity to invest over all economic cycles," Belka said. "If you look at FCAT, it's survived not just the 2008 crisis but the dot com crisis."

Although most of its brokerage peers are also spending big on technology, Fidelity has managed to fly under the radar, according to one analyst who covers its competitors. Richard Repetto, principal at Sandler O'Neill & Partners pointed out there's less scrutiny on Fidelity's spending, investments and returns and, compared to a public company, it doesn't really have to share what it's working on.

"Fidelity is a sleeping giant," Repetto said. "Or at least they're not a well known giant as far as what they're actually doing."

Kate Rooney

https://www.cnbc.com/2018/09/28/fidelity-the-tech-company.html

https://www.cootek.com/

Artificial Intelligence

TouchPal Smart Input, which is also called TouchPal Keyboard, combines an artificial intelligence engine with the artificial intelligence assistant, Talia. With the cutting-edge deep learning technology, users will be able to experience better support when com

CooTek Proposes Terms For $57 Million U.S. IPO

Sep. 21, 2018 11:03 AM ET | About: CooTek (CTK), Includes: GOOG

Donovan Jones

Donovan Jones

IPOs, tech, alternative investments, CEO VentureDeal.com

MARKETPLACEIPO Edge

(6,360 followers)

Summary

CooTek has filed proposed terms to sell $57 million of ADSs representing Class A shares in a U.S. IPO.

The firm is a mobile app developer expanding its focus from keyboard input software to AI-driven digital assistant technologies.

CTK has grown rapidly and has a successful investor base which is supporting the IPO.

This idea was discussed in more depth with members of my private investing community, IPO Edge. Start your free trial today »

cootek ipo

Quick Take

CooTek (CTK) intends to raise $57 million in an IPO of ADSs representing underlying Class A shares, per an amended registration statement.

The company provides smartphone keyboards and more recently an AI-powered virtual digital assistant, Talia.

CTK has a top tier investor base, support for the IPO, and strong results in recent periods with prospects for continued growth in the near future.

Company & Technology

Shanghai, China-based CooTek was founded in 2008 to develop and maintain smartphone keyboards for iOS, Android and Windows platforms.

Management is headed by Co-Founder and CEO Michael Jialiang Wang, who was previously a Product Manager at Microsoft R&D Group in China.

CooTek has developed TouchPal, a virtual keyboard for smartphone devices. The keyboard supports 85 different languages and operates in more than 200 countries with more than 132 million daily active users [DAU].

Below is a brief overview video of TouchPal Keyboard Pro with AR Emojis:

(Source: TouchPal)

Investors in CooTek include Qiming Venture Partners, Sequoia Capital, SIG China Investments and others.

The company generates revenue primarily through mobile advertising.

Sales and marketing expenses as a percentage of net revenues have dropped as revenues have sharply increased, as the figures below indicate:

Sales & Marketing Expenses vs. Revenue

Period

Percentage

Through 2Q 2018

52.4%

2017

54.0%

2016

85.2%

CooTek prices initial public offering

Sep. 28, 2018 4:32 AM ET|About: CooTek (CTK)|By: Niloofer Shaikh, SA News Editor

CooTek (NYSE:CTK) has priced its initial public offering of 4.35M American Depositary Shares ("ADSs"), each representing 50 Class A Ordinary Shares of the Company, at $12.00 per ADS for a total offering size of $52.2M.

The ADSs are expected to begin trading today on the New York Stock Exchange under the ticker symbol "CTK".

The underwriters have been granted an over-allotment option to purchase up to 652,500 additional ADSs.

Cootek (Cayman) Inc. (CTK) will issue 4.35 million shares between $12 and $14 Friday on the New York Stock Exchange. Founded in 2008, the Shanghai tech company has more than 170 patent applications and grants for its mobile apps and AI products, including the TouchPal Keyboard and TouchPal Phonebook.

|

Followers

|

2

|

Posters

|

|

|

Posts (Today)

|

0

|

Posts (Total)

|

25

|

|

Created

|

09/29/18

|

Type

|

Free

|

| Moderators | |||

| Company Name | COOTEK(CAYMAN)INC. |

| Company Address | BUILDING7, NO.2007 HONGMEI ROAD XUHUI DISTRICT SHANGHAI 201103 |

| Company Phone | 862164856352 |

| Company Website | www.cootek.com |

| CEO | Michael Jialiang Wang |

| Employees (as of 6/30/2018) | 385 |

| State of Inc | -- |

| Fiscal Year End | 12/31 |

| Status | Filed (8/16/2018) |

| Proposed Symbol | CTK |

| Exchange | NYSE |

| Share Price | 12.00-14.00 |

| Shares Offered | 4,350,000 |

| Offer Amount | $70,035,000.00 |

| Total Expenses | $3,419,220.00 |

| Shares Over Alloted | 652,500 |

| Shareholder Shares Offered | -- |

| Shares Outstanding | 4,350,000 |

| Lockup Period (days) | 180 |

| Lockup Expiration | -- |

| Quiet Period Expiration | -- |

| CIK | 0001734262 |

Our mission is to empower everyone to express themselves and enjoy relevant content seamlessly. We are a fast-growing mobile internet company. Sophisticated big data analytics and proprietary AI capability are the backbone of our business. Our global portfolio of mobile applications serves a

large global user base, comprised of an average of 132.6 million DAUs across more than 240 countries and regions in June 2018, compared to an average of 75.6 million DAUs in June 2017, representing 75.3% year-on-year growth. Our super app, TouchPal Smart Input, is an intelligent input method for mobile devices and generates a massive, diverse set of user interaction data. We employ proprietary AI and big data analytical technologies both to process such data and a large amount of multi-language content that we source and organize from the internet, and to develop advanced multilingual natural language processing and semantic understanding technologies. These technologies enable us to obtain in-depth user insights and identify market opportunities, which set the foundation for developing content-rich mobile applications that deliver relevant content for five selected verticals including fitness, lifestyle, healthcare, news and short videos, and entertainment. We have also built a rich library of user profiles and interests that allows us to grow our user base effectively. TouchPal Smart Input boasts an advanced multilingual language model that supports more than 110 languages and offers an effective and enjoyable typing experience on mobile devices. Named one of the Google Play Best Apps of 2015, TouchPal Smart Input has high popularity and superior engagement among mobile internet users around the world. In June 2018, it reached 125.4 million DAUs on average and was launched 72 times per day per active user on average. TouchPal Smart Input's distinctive feature is that it operates across virtually all other mobile applications such as social network apps, e-commerce apps and browsers. Building upon user insights accumulated through our TouchPal Smart Input, we have formulated a systematic approach to developing a global product portfolio, through which we deliver relevant content and grow our global user base. In addition to TouchPal Smart Input, we have launched a portfolio of 15 other mobile applications as of June 30, 2018 and most of them are content-rich applications. These content-rich applications are targeting five selected verticals with large addressable global markets, including fitness, lifestyle, healthcare, news and short videos, and entertainment. Those mobile applications reached 9.4 million MAUs and 2.9 million DAUs on average in December 2017 and 22.2 million MAUs and 7.3 million DAUs on average in June 2018. Most of our global portfolio applications have achieved high user ratings ranging from 4.5 to 4.7 out of 5 on Google Play Store. Our user-centric and data-driven approach has enabled us to release appealing products to capture mobile internet users' ever-evolving content needs and help us rapidly attract targeted users. For example, by leveraging our data analytics capabilities, we have identified an increasing number of users who are interested in fitness-related topics and content. To capture the business opportunity presented by this trend, we developed two fitness mobile applications, HiFit and ManFIT. We have also built a profile of target users based on our user insights. We believe that this approach has allowed us to effectively grow our user base. Through HiFit and ManFIT, we deliver rich content such as workout videos to our users based on their profiles. We believe that potential users matching such profile are more likely to be interested in these applications. We continue to improve our AI capabilities and, in March 2018, launched Talia, an AI-powered virtual personal assistant that understands everyday conversations and delivers relevant content to users in multiple scenarios. Talia is integrated seamlessly with our TouchPal Smart Input. Talia automatically offers services to users in a variety of usage scenarios, such as content recommendations, web searches and weather forecasts. We have a proven and scalable monetization capability in mobile advertising. We leverage our in-depth user insights to deliver targeted and engaging advertisements that are relevant to users across our various mobile applications. The effective price per impression and the number of our average daily impressions delivered on our global portfolio products increased by approximately 36% and 537%, respectively, from the first half of 2017 to the first half of 2018. We generate revenues primarily from mobile advertising. Our net revenues grew rapidly from US$11.0 million in 2016 to US$37.3 million in 2017, representing 238.5% year-on-year growth. Our net revenues grew rapidly from US$9.1 million for the six months ended June 30, 2017 to US$50.3 million for the same period of 2018, representing 451.7% year-on-year growth. Our net loss decreased from US$30.7 million in 2016 to US$23.7 million in 2017 due to our revenue growth and operating leverage. We recorded net income of US$3.5 million for the six months ended June 30, 2018, compared to net loss of US$16.2 million for the same period of 2017. We generated gross profit of US$17.2 million in 2017, compared to gross loss of US$9.1 million in 2016, implying an improvement of gross profit margin from negative 82.8% in 2016 to 46.2% in 2017. We recorded gross profit of US$42.2 million for the six months ended June 30, 2018, as compared to gross loss of US$1.1 million for the same period of 2017, implying an improvement of gross profit margin from negative 11.6% for the six months ended June 30, 2017 to 84.0% for the same period of 2018. Of our total advertising revenue generated from our global portfolio products, our TouchPal Smart Input contributed substantially all in 2016, approximately 71% in 2017 and 33% in the six months ended June 30, 2018, and our other global portfolio products contributed approximately 29% in 2017 and 67% in the six months ended June 30, 2018. --- Our principal executive offices are located at Building 7, No. 2007 Hongmei Road, Xuhui District, Shanghai, 201103, People's Republic of China. Our telephone number at this address is +86 21 6485 6352. Our registered office in the Cayman Islands is located at offices of Maples Corporate Services Limited, PO Box 309, Ugland House, Grand Cayman, KY1-1104, Cayman Islands. Our main website is www.cootek.com. Our agent for service of process in the United States is Puglisi & Associates, located at 850 Library Avenue, Suite 204, Newark, Delaware 19711.

CooTek, a Shanghai-based internet company that is best known for a mobile keyboard application, has filed for its IPO in the U.S.

The company has amassed an impressive 132 million DAUs (at a 75% y/y growth rate), which is only just shy of Snap's DAU count but at a much faster growth rate.

Though based in China, CooTek's applications are available to users across 240 countries.

Building on its success in keyboard apps, CooTek has ventured into other applications, launching a smart AI-driven assistant earlier this year.

CooTek is still in the early stages of monetization, but growing rapidly. The company generated $48.5 million of revenue in the first half of 2018, at a staggering 5.5x growth rate.

A couple of China-based technology companies are prepping for U.S. IPOs this week, and one of the fastest-growing and most exciting of them is CooTek (CTK). The company labels itself as an internet company that spans a wide variety of applications, though it's best known for an application called TouchPal Smart Input, which is an "intelligent input method for mobile devices."

CooTek's China-based domicile is fairly misleading - the company has produced a global product, with downloads in over 240 countries. In 2015, TouchPal Smart Input was named one of the best apps in the Google Play store, according to the company's IPO documents. Building on that strength, CooTek has expanded horizontally into a host of other mobile applications, with one of the most promising - an AI-based virtual assistant - launching earlier this year in March 2018. Its ambition, obviously, is to become a large internet conglomerate with a variety of revenue-generating applications.

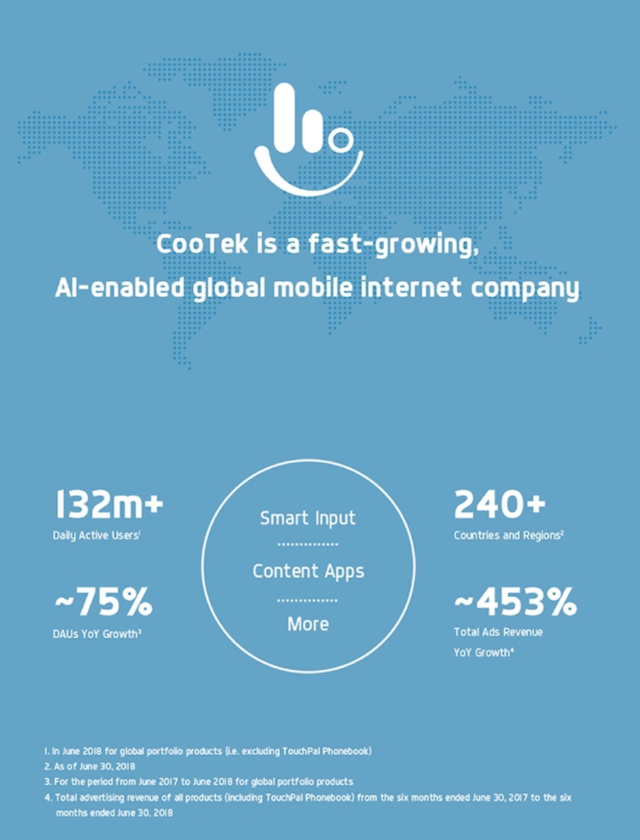

CooTek is still a young company, having been founded only in 2008 - but it has since reached a massive user base. The company reported 132 million DAUs as of June 2018, at a 75% y/y growth rate, as shown in the IPO infographic below:

Figure 1. CooTek IPO cover sheet Source: CooTek F-1 filing

Source: CooTek F-1 filing

| Volume: | - |

| Day Range: | |

| Last Trade Time: |

| Volume | |

| Day Range: | |

| Bid Price | |

| Ask Price | |

| Last Trade Time: |