Register for free to join our community of investors and share your ideas. You will also get access to streaming quotes, interactive charts, trades, portfolio, live options flow and more tools.

Looks like I have completed forks for awhile.

This one yellow will be added to my main board.

see

http://investorshub.advfn.com/boards/board.aspx?board_id=12981

FORK PROBABILITIES_SPX_1_TNA_1_TZA_1

.

Click below to view the video: Gives % Probabilities

.

http://www.medianlinestudy.com/researchexplained

.

01_FORK PROBABILITIES

.

02_SPX_1

.

03_TNA_1

.

04_TZA_1

***** Another new video

Andrews in real time SPY

http://www.medianlinestudy.com/andrewsrealtime

FORK PROBABILITIES

.

Click below to view the video: Gives % Probabilities

.

http://www.medianlinestudy.com/researchexplained

.

FORK PROBABILITIES PART 1

.

FORK PROBABILITIES PART 2

.

FORK PROBABILITIES PART 3

.

FORK PROBABILITIES PART 4

Thanks for posting your charts!

I use ThinkorSwim charts and only use pitchforks from time to time. It's great to take a peak at what you're seeing in your charts. :)

Great chart!

FORK PROBABILITIES

.

Click below to view the video: Gives % Probabilities

.

http://www.medianlinestudy.com/researchexplained

.

FORK PROBABILITIES PART 1

.

FORK PROBABILITIES PART 2

.

PART 3 and PART 4 coming soon.

I hope you enjoyed the free course on Andrews Median Lines. I hope you had time to look through the grains research as well.

I often get asked, "Does this method really work?" I asked myself that very question. This question led me to writing the research paper on grains. Some of the data is a bit difficult to understand upon first reading, so I put together a video describing the results from the grain study and how it changed how I looked at the method.

Click below to view the video:

http://www.medianlinestudy.com/researchexplained

Keep drawing the lines,

Greg Fisher

www.median-line-study.com

You are receiving this e-mail because you either purchased information or signed up for free information on our website. If you wish to unsubscribe to these chart updates, go to the "Manage my Subscription" link at the bottom of the page.

GLENO the "chart of the day" was inflation adjusted so a little different. It looks like the one you posted shows resistance above... fwiw... funny read > http://www.ritholtz.com/blog/2012/04/fed-access-for-all/

One huge fork rule you must adhere to

First have a down fork and up fork to establish trend reversal.

Thats not the major rule. The major rule is that your fork must

encapsulate price by about 99%. Now you don't need to go crazy over this rule but you must adhere to it or the fork is invalid. Now if price goes a tad out of the fork (1-2%) dont go anal.

The function of the fork is to point out inflection points.

A rule BT always talked about:

1- I dont like to buy till the stock breaks out of the down fork into the up fork.

Lastly reading a book is 10% of what you need to know. The other 90% is finding out it works in the real world. If reading a book was all you needed to know we would all be Bill Gates or Warren Buffett. Some of the stuff i mention here is not in any book.

T ~ Check out my chart :) It turned into a nice move.

http://investorshub.advfn.com/boards/read_msg.aspx?message_id=74283112

Thanks Trend1...I saw your new board the other day. I think it's great you are dedicating a board to Pitchforks and building an iBox around the subject. I've added it to my very long list.

I found this which I thought was good. Not sure if you already have it.

Hagopian's Rule

http://technical.traders.com/tradersonline/display.asp?art=5154

Should really be big then as we are below the bottom tine?? Hope so...

Treasury prices versus the Stock Market (S&P-500) . . .

notice the similarities to one-year ago . . .

The Stock Market moves inverse to the Treasury prices.

I actually use the ratio of the two as a guide.

I have drawn the Big Pitchfork against that ratio.

In the past, when the ratio has been around the lower tine,

there has been a Drop in the Stock Market of some sort soon after.

So, this would forecast a Down in the Stock Market is coming soon.

You may have to be a StockCharts.com Member to see the chart.

http://stockcharts.com/c-sc/sc?s=$USB:$SPX&p=W&yr=11&mn=0&dy=0&i=p58698183240&a=174280318&r=354

CHART BELOW . . .

.

Andrews' Pitchfork StockCharts

http://stockcharts.com/school/doku.php?st=pitchforks&id=chart_school:chart_analysis:andrews_pitchfork

Interesting.

Thanks

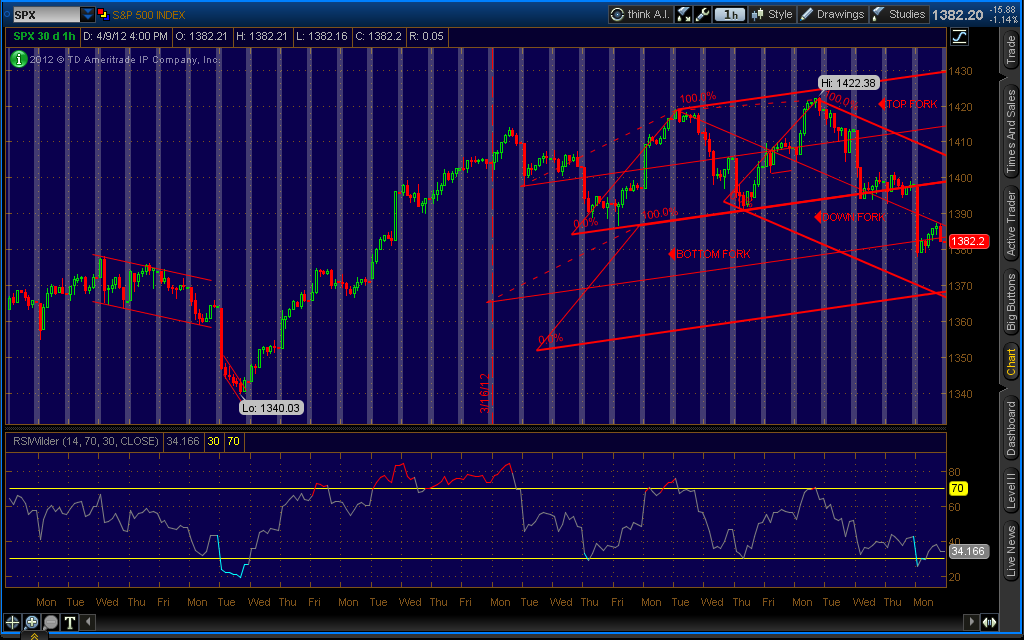

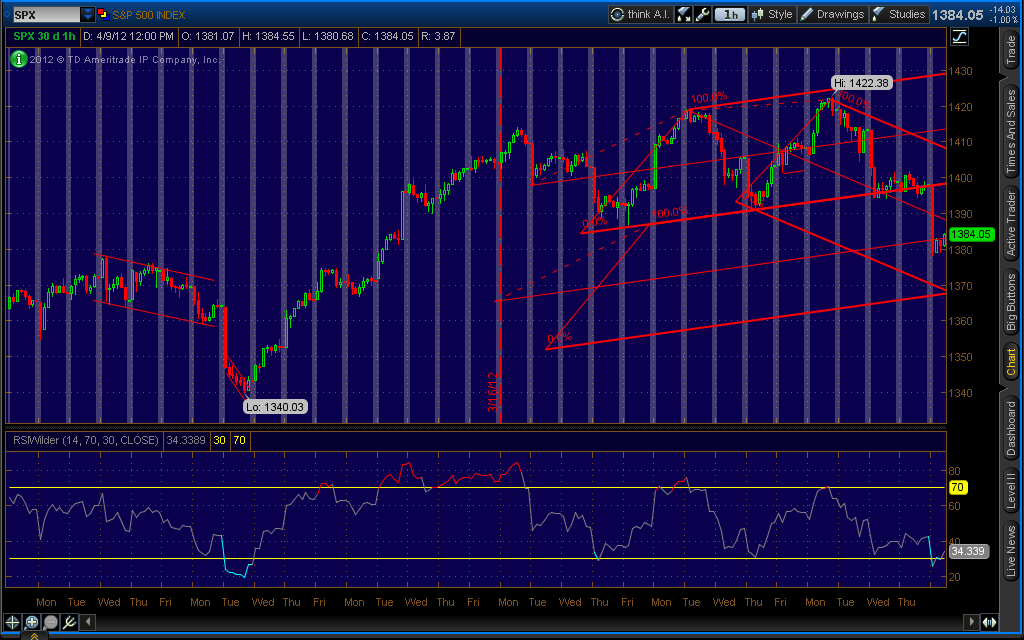

top of fork is supposed to be 1422.38 the pivot point

Question ?

My "current" under standing is that down forks

must start at pivot points.

H = 1422.38

Yet you start the fork at a Lower High back .....

Reasons ????

SPX fork synopsis

So break thru the bottom on the top fork and we go just below

the warning line (median line of the lower fork).

Just as andrews rules say.

Then we rally and fail at the median line of the down fork.

Why did i believe we would fail there.

1- We were in wave 4 up

2- returning to the median line is a magnet

Again draw symmetrical forks up and down and double forks when

you believe the first fork will fail.

I was to early precicting the wave 4 end.

What did it do wrong. A wave 4 is up down up.

I called the first up as the end of the 4.

So 1368 seems likely. FORK below

Thanks

Advise is always welcomed.

Do not use steep forks

Forks that point straight to the sky can not be used to trade on. Instead use double forks and up and down forks. Remember the

fork should give you decent exit and entry points and encapsulate price.

Rules

1 use RSI

2 Label p5 and p0 (p5 is generally 3 peaks)

2a P0 will count in 3's (abc) or 5's 5 wae

3 Add a double fork and down fork if fork breaks down

often you will go to median line or bottom of 2nd fork

4 Use the bottom or top of the candle for median line or fork top

or bottom.

5 FORKS are only one TA method you must use as many as you have mastered

I have tried Forks in the past but have never stuck with it..So I may give it another go ...just to see how it works along with my CCI system..Hope som real fork guru shows up here and helps us out...

glen

Classic fork as in the video.

This video should give a solid background on the methods of Dr. Alan Andrews.

Please click on the link below to access the free 30-minute video course on Andrews methods of technical analysis of the markets:

VIDEO

Please click on the link below to access my 77-page research report on Andrews methods:

http://www.median-line-study.com/support-files/ml_research_ebook.pdf

Best regards,

Greg Fisher

www.medianlinestudy.com

Thanks

PS: I am just learning about pitchforks and mid lines.

|

Followers

|

3

|

Posters

|

|

|

Posts (Today)

|

0

|

Posts (Total)

|

64

|

|

Created

|

04/08/12

|

Type

|

Free

|

| Moderators | |||

Andrews' pitchforks and the price failure rule.

http://www.futuresmag.com/2011/06/01/andrews-pitchforks-and-the-price-failure-rule?page=2

Andrews' Pitchfork StockCharts

http://stockcharts.com/school/doku.php?st=pitchforks&id=chart_school:chart_analysis:andrews_pitchfork

This video should give a solid background on the methods of Dr. Alan Andrews.

Please click on the link below to access the free 30-minute video course on Andrews methods of technical analysis of the markets:

VIDEO

Please click on the link below to access my 77-page research report on Andrews methods:

http://www.median-line-study.com/support-files/ml_research_ebook.pdf

Best regards,

Greg Fisher

www.medianlinestudy.com

Hagopian's Rule

http://technical.traders.com/tradersonline/display.asp?art=5154

Click below to view the video: Gives % Probabilities

http://www.medianlinestudy.com/researchexplained

| Volume | |

| Day Range: | |

| Bid Price | |

| Ask Price | |

| Last Trade Time: |