Register for free to join our community of investors and share your ideas. You will also get access to streaming quotes, interactive charts, trades, portfolio, live options flow and more tools.

On Yahoo they have CBAI at .0016. I don't get it.

I'm not sure, when I get a divi from other stocks I just look in my acct....

Looks like trading now is finished....

how does it work now? i don't see a divi notice on finra.

CBAI: Company dissolved. CUSIP suspended by FINRA. Deleted symbol:

https://otce.finra.org/otce/dailyList?viewType=Deletions

Could be end_of_Fiscal_Year_clearance_sale!!!!!!!

Thanks for the recognition, but_what's_with_today's_throng_of_volume?!?!?!?

The number of shares that will reap the divi will not change....no matter who owns them. If the seller sold too soon, the buyer gets it...either way a divi will be paid on the amount of shares in the OS....

That way even if there is no dividend payment to them it is kept by the company anyway. This is only better for the current shareholders as the there will be less shares to pay out meaning bigger distribution payments in the future.

I also think it's CCEL selling.....who knows..

I highly doubt they are buying back shares that are way overpriced now...doesn't make sense.

They had been prohibited from buying more shares, not sure if that is still in effect.

Like I said previously, someone is going to be pissed off when the smoke clears....

I think at some point someone will pay for it. A clean shell with up to date filings is not easy to find in the OTC market. I don't know what price they sell for, but any extra money now is just bonus.

You think the shell will be sold/reverse merged?

The filings say the 26th is the closing day and 30th is payment day.

My brokerage account says “On 06/19/20, CBAI announced a regular irregular cash dividend of $0.0062 per share, payable on 06/30/20 to shareholders, with an ex-dividend date of 07/01/20.” That means anyone selling today and yesterday will not get the dividend (or any future) payment.

My question is will the buyers get the payment b/c it is not enough time to clear before tomorrow.

I think the company is buying back shares. That way even if there is no dividend payment to them it is kept by the company anyway. This is only better for the current shareholders as the there will be less shares to pay out meaning bigger distribution payments in the future. BTW share buybacks don’t need to be reported with sec filing. It doesn’t need to be made public.

Trips coming, .000 as Termite7 has said many times. It is just the BS Artist of CBAI who wants to keep everybody in the DARK as always.

Does anyone have something good to say about Sandberg or Snow Job???

GET OUT WHILE YOU CAN!!!! Myth...I think sandberg didn't pay the electric bill because we are still in the DARK.

not sure what is going on, but imo someone is going to be pissed off and soon.

They were supposed to close transfer book on Friday but didn't. I am confused.

none of this makes any sense....

shareholders of record as of the close on the 26th supposedly get the payout....correct me if I'm wrong but todays buyers won't ...

gonna be a rude awakening for someone...

any idea why this is still trading?

thanks, that explains the high volume yesterday, traders jockeying for the unknown...

I'm going to miss this 3 ring circus, at least the .062 beats .048...

https://finance.yahoo.com/news/cba-florida-inc-announces-initial-120000675.html

Myth, Accesswire said Cash Liquidating Distribution will be .0062. AND will stop trading.

It is funny that sandberg says .0062 and your post number has the 62 in it

and I believe RED Oak will eat the rest. It is all there for the shareholder to see. GL to all.

volume today, still no filing with the State..

.0062 sounds more like it. RUN WHILE YOU CAN.

That would explain why there was no huge short position here, something I also wondered about.....

From all I've read and observed --> I AGREE!

let me turn the light on for another minute....this seems to imply that trading of the stock will cease when the dissolution is officially file with the State of Florida, which as of one minute ago hasn't yet happened.

This was something I always wondered about, never having gone through this in my life. Maybe I'm wrong....

The proportionate interests of all of Shareholders will be fixed on the basis of their respective stock holdings at the close of business on the date the Articles of Dissolution are filed with the Florida Secretary of State as determined by the Board, which date is referred to herein as the “Final Record Date”. The Company intends to discontinue recording transfers of shares of the Common Stock on the Final Record Date, and thereafter certificates representing shares of Common Stock will not be assignable or transferable on the Company’s books except by will, intestate succession or operation of law. After the Final Record Date, any distributions made by the Company will be made solely to the Shareholders of record as of the close of business on the Final Record Date, except as may be necessary to reflect subsequent transfers recorded on the Company’s books as a result of any assignments by will, intestate succession or operation of law. Currently, the Company’s Amended and Restated Articles of Incorporation and its Tax Benefits Preservation Plan limit direct or indirect transfers of the Company’s Common Stock to the extent such transfers could affect the percentage of stock that is treated as being owned by a holder of our Common Stock that is in excess of 4.99% of the Company’s outstanding Common Stock.

https://www.sec.gov/Archives/edgar/data/1289496/000165495420004218/cbai_def14a.htm

I had to get off the boat and didn't want to wait the 4 years.

I had some at .0019 God I miss the old days. I just want to say GL to all.

PS..I wonder if Sandberg & Snow job will get a bonus and don't worry, I'll get the light.

8k filed, everything they wanted they got.

Good luck to anyone who waited this out, I decided not to tie up the money for another 4 years. Anyone who followed Red Oak and CCEL in here was profitable, too bad they couldn't find a buyer of the company as a whole, not just assets.

that was a deal breaker...

last one turn the lights out please...

and again....

Cash? CASH?!?! What cash? Whose cash.....????

don't let CCEL out.....see how desperate they are..

I bet that's CCEL sitting on the ask......

I wonder if it was Tony M?

I left at .0084/85, there was too much opportunity in the other sectors with the markets down. Congrats, Tony for holding as long as you did. That goes for everyone. I hope you all get what you need to get out comfortably.

Thank you and goodbye

and that's what caused the selloff....

With the few shares I have to date I'm voting NO on all counts.

I expect to see a Form 4 filed very soon listing CCEL sales, unless it's someone else that reached their limit. If they are dumping, makes sense to make them drop the ask a lot more before loading any more.

To make any impact on the voting CCEL has to be on board to even have a chance of a shareholder revolt.

jmo

|

Followers

|

386

|

Posters

|

|

|

Posts (Today)

|

0

|

Posts (Total)

|

105534

|

|

Created

|

03/15/05

|

Type

|

Free

|

| Moderators | |||

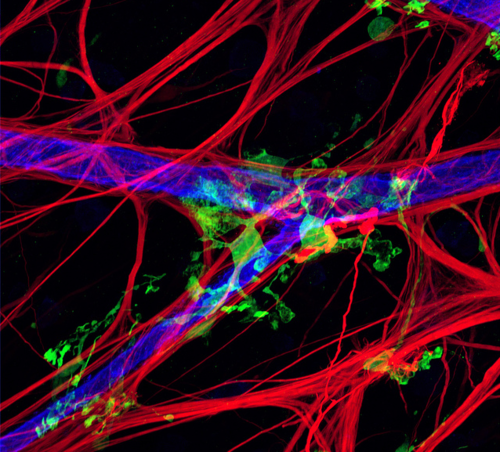

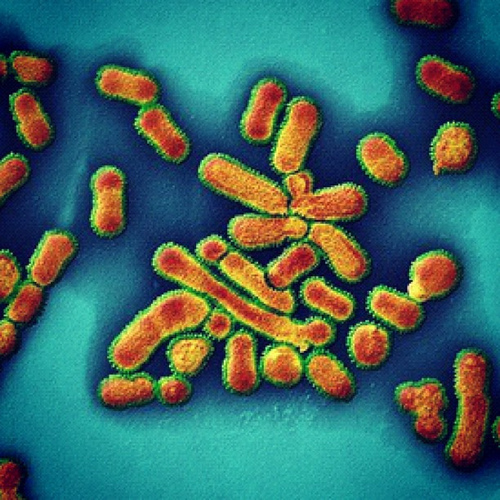

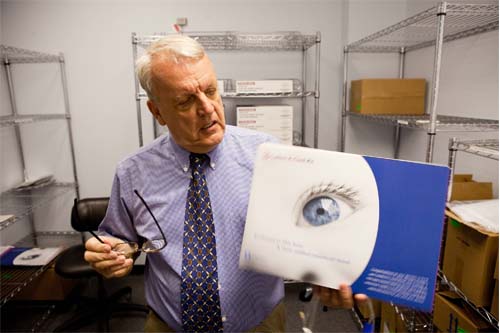

Cord Blood America, Inc.(CBAI), through its wholly owned subsidiary CorCell Companies, Inc., is engaged in the business of collecting, testing, processing and preserving umbilical cord blood, thereby allowing families to preserve cord blood at the birth of a child for potential use in future stem cell therapy.

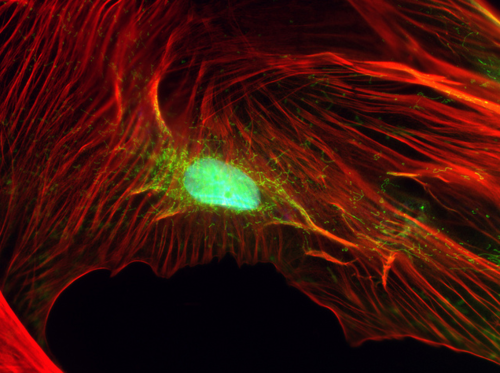

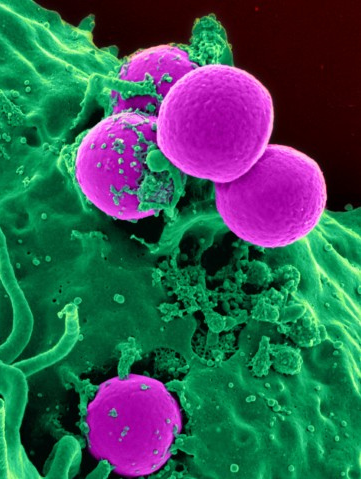

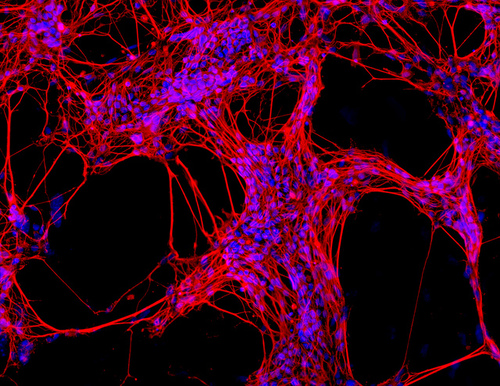

The umbilical cord which, at birth, traditionally has been thrown away, contains a rich store of stem cells. Cryogenically preserved umbilical cord stem cells have already been used to treat 75 major diseases, including leukemia, severe anemia, metabolic blood disorders and immune deficiencies. This list is guaranteed to grow as medical research learns more about the incredible healing power of stem cells.

There is uniformity in the belief that stem cells will play a key role in fighting disease as we move forward through this century. Some scientists are confident that stem cells will launch a new era in medicine, perhaps even curing some of our most intractable diseases.

CBAI offers extensive experience, with over 16 years in the cord blood banking industry, a proven processing model, technology and all the assistance our business to business clients need to grow their cord blood banking company without the additional cost of operating their own laboratory. CBAI is licensed in New Jersey, New York, California and Maryland and registered with the FDA. They are also a Clinical Laboratory Improvement Amendments (CLIA) certified laboratory.

Cord Blood America's state of the art laboratory is located minutes from McCarran International Airport in Las Vegas, NV; with approximately 3,300 inbound flights per week they are able to receive customer samples 24/7/365. Cord Blood America is a fully licensed cord blood bank that has processed more than 27,000 cord blood units since first opening in 1996. The 17,000-square-foot facility is equipped with the most advanced processing and storage technologies. The facility is under 24 hour surveillance with stringent restricted access protocols your client's cord blood unit will be kept at the correct temperature at all times thanks to our 24 hour monitoring system.The Tissue Bank Director had more than 25 years of experience in the stem cell field. A staff of highly experienced health professionals and technicians, working under the guidance and expertise of CBAI's Scientific/Medical Advisory Panel of industry leaders, offers both technical skill and unparalleled leadership. This unique combination of talents ensures that the laboratory remains on the cutting-edge of new cord blood advances, while guarenteeing the safety, integrity and viability of your customer's cord blood unit.

News

News  Partnerships

Partnerships  Company History

Company History  Executive Team

Executive Team Lab

Lab  SEC Filings

SEC Filings  Videos

Videos  Contacts

Contacts

| | ? | Total revenue for the second quarter was $0.75 million, a decrease of 5.9% from total revenue of $0.79 million for the second quarter 2016. |

| | | |

| | ? | Recurring storage revenue for the second quarter 2017 was $0.66 million, a decrease of 4.4% from recurring storage revenue of $0.69 million for the second quarter 2016. |

| | | |

| | ? | EBITDA for the second quarter 2017 was $0.20 million, an increase of 151.9% from EBITDA of $0.08 million for the second quarter 2016. |

| Volume | |

| Day Range: | |

| Bid Price | |

| Ask Price | |

| Last Trade Time: |