Register for free to join our community of investors and share your ideas. You will also get access to streaming quotes, interactive charts, trades, portfolio, live options flow and more tools.

Haven’t seen any merger of news with XPO logistics or Amazon….

still making a product. if it was worth nothing it would have diaapeard from our account, you never know

It’s on the brown market if you would like to follow it. If you like following shit.

might still be on grey market. havent followed it, not sure

my stocks sill show value. what does this mean?

my grand daughter cheched in on christmass on zoom to show her grangmother the present her boyfriend gave her. It was a pretty good looking bulova watch. I thought bulova was dead. are they going private? are they sill making watches. I still own a lot of their stock. maybe its worth something? any body know anything?

What was the after market reported "W" trade of 40,000,000 shares at .00788. At that price it must have occurred earlier during normal trading hours but the reporting held back till after the close?

Who made the trade- private entities, MM's stocking up, etc?

Meaning what ?????

This thing is heating up! Who work up the monster?!

Thanks, I will take a look! Talk to ya' again soon.

thanks TenTimes. cant respond privately WINR my focus now. gl

Your shares are gone! Just like all the receivables from the trucking companies he owned and closed down! RIP

If the shares have indeed gone from public to private this is what happens. I’ve had it happen twice to me and this will be the 3rd time.

How Does Privatization Affect a Company's Shareholders?

FACEBOOK

TWITTER

LINKEDIN

By CALEB SILVER

Updated Oct 5, 2019

An initial public offering (IPO) is a common occurrence. Private companies hold an IPO or go public by transferring portions of their ownership to purchasing parties by issuing equity or debt holdings to investors. However, the reverse scenario may also occur, where a public company transitions its public ownership to private interests.

In a public-to-private market transaction, a group of investors purchases the majority of a public company’s outstanding stock shares. This transaction effectively takes the company private by de-listing it from a public stock exchange. While companies may be privatized for a multitude of reasons, this event most often occurs when a company is substantially undervalued in the public market.

KEY TAKEAWAYS

With a public-to-private deal, investors buy out most of a company's outstanding shares, moving it from a public company to a private one.

The company has gone private as the buyout from the group of investors results in the company being de-listed from a public exchange.

Going from public-to-private is less common than the opposite, in which a company goes public, typically through an initial public offering (IPO).

The process of going private is easier and includes fewer steps and regulatory hurdles than the process of going public.

Typically, a company seen as undervalued in the market will opt to go private, although there can be other reasons such an action is taken.

Privatization

Taking a public company private is a relatively simple maneuver that typically involves fewer regulatory hurdles than private-to-public transitions. For example, a private group may offer to buy a company stipulating the price they are willing to pay for the company's shares. If a majority of the voting shareholders accept the offer, the bidder then pays the consenting shareholders the purchase price for every share they own.

For example, if a shareholder owns 100 shares and the buyer offers $26 per share, the shareholder nets a profit of $2,600 for relinquishing their position. This situation is typically favorable for shareholders because private bidders customarily offer a premium on the current market values of the shares.

Many well-known companies have de-listed from a major stock exchange at various points in their existence including Dell Inc., Panera Bread, Hilton Worldwide Holdings Inc., H.J. Heinz, and Burger King. Some companies de-list to go private, then return to the market as public companies with another IPO.

Privatization can be a nice boon to current public shareholders, as the investors taking the firm private will typically offer a premium on the share price, relative to the market value.

Interest in Privatization

In some cases, the leadership of a public company will proactively attempt to take a company private. TESLA is an example. On August 7, 2018, Tesla (TSLA) founder and CEO Elon Musk tweeted that he was considering taking the company private at $420 per share—a substantial boost from the stock’s then trading price.

After his announcement, shares spiked more than 10 percent, and trading was halted following the ensuing news frenzy. In a letter to employees, Musk justified his intentions, with the following message:

As a public company, we are subject to wild swings in our stock price that can be a major distraction for everyone working at Tesla, all of whom are shareholders. Being public also subjects us to the quarterly earnings cycle that puts enormous pressure on Tesla to make decisions that may be right for a given quarter, but not necessarily right for the long-term.

The Bottom Line

?While large public companies going private does not occur nearly as often as private companies going public, examples exist throughout market history. In 2005, Toys "R" Us famously went private when a purchasing group paid $26.75 per share to the company's shareholders.

This price was more than double the stock's $12.02 closing price on the New York Stock Exchange in January 2004. This example shows that shareholders are often well-compensated when they relinquish their shares to private concerns.

your shares will show in your trading account under an identifier number and no value. it will remain that way until either you ask your broker to declare them worthless and remove them or the company files a Form 10 to become a public company again. your only other option is to sell them in a private transaction.

so what the hell happens to our shares? They just sit indefinitely?

for whatever it may be worth... that company is now a private company. shareholders are still shareholders. there is now no public market to sell those shares.

He may have some company but our paper is only good for the toliet

BULOVA TECHNOLOGIES GROUP, INC. has an active Florida corporate registration. All the other corporate entities associated with Bulova/Stephan Gurba are inactive.

Apparently he still has his hand in our pie, although I do not know how much longer.

And not one word from Gurba himself on the matter.

Respondents BCI Holding Inc., Bulova Technologies Group, Inc., and Omni Bio

Pharmaceutical, Inc. (collectively, “Respondents”), issuers with classes of securities registered

with the Commission, each failed to file an answer in response to an order instituting

proceedings (the “OIP”) alleging that they did not file required periodic reports.1

Respondents

again failed to respond to the Division of Enforcement’s motion for default or to an order to

show cause why they should not be found in default.2

We now find Respondents to be in default,

deem the allegations of the OIP to be true, and revoke the registrations of their securities....

B. Respondents failed to answer the OIP, respond to the Division’s motion for default,

or respond to a show cause order.

Respondents were each properly served with the OIP, but none answered it

It appears its done. And not one word from Gurba himself on the matter. No style, no apology.

BTGI registration revoked:

https://www.sec.gov/litigation/opinions/2020/34-89606.pdf

lazar does not take over revoked stocks. ever.

No but don't know that would matter to Lazar. Not saying BTGI will resurrect BUT there is a chance. I hope so since I own 600,000 shares at well over 1 cent.

are you aware that the ticker symbol no longer exists? it's been revoked.

Thanks for sharing the information. However, are you aware of Lazar? He involves himself in companies like this, cleans them up, gets them current, and then sells the shell. Had one (QUTR) that was dead for years. It is now worth around 20 times what it was when he took it over. Hope and pray and keep an eye on it...he may do the same here.

Unfortunately, its currently only bought/sold on the Gray Market. Until this company can actually trade on an exchange again, the majority of shareholders just stand by and continue to wait.

It would be nice if Gurba actually would let people know what the current status/intention actually is, but I guess that would be asking too much from him given its legal situation (what is the legal situation, anyway?).

Wish someone knew and would tell us...but Life is better than Dead.

Another 3.6 M shares traded today, all at .003. Is someone just buying on a frivolous hunch, or does Gurba have something in play that can actually benefit the long-suffering shareholders of the Old BTGI?

Apparently someone painted the tape at the close with a 25,000 sh buy at .0003. How come?

https://ccmspa.pinellascounty.org/PublicAccess/CaseDetail.aspx?CaseID=18558746

Anyone got 8million he can borrow for this one?

Appreciate the information. Thanks for looking into it.

Doesn't look good for BTGI CEO Stev-O. Has more lawsuits, than new Tom Brady fans in Tampa...

Stephen Gurba, former CEO of Bulova Technologies Group, filed a complaint Dec. 19 in Pinellas County Circuit Court against Ronald Damico, alleging his golfing partner intentionally made false and defamatory statements to harm the plaintiff's reputation.

According to the complaint, Gurba suffered personal distress, humiliation and professional and personal damages because Damico purposely told Bellair Country Club members that Gurba was a thief, a criminal and had caused a fraudulent satisfaction of mortgage to be filed.

Gurba seeks trial by jury and damages in excess of $15,000. He is represented by attorney Craig A. Huffman of Securus Law Group PA in Tampa.

Pinellas County Circuit Court case number 18-8333-C

https://ccmspa.pinellascounty.org/PublicAccess/Search.aspx?ID=300&NodeID=11000%2c11100%2c23001%2c11101%2c11102%2c11103%2c11104%2c11105%2c11106%2c11107%2c11108%2c11114%2c11109%2c23002%2c23003%2c11110%2c11111%2c11112%2c11113%2c11200%2c11201%2c11202%2c11203%2c11204%2c11205%2c11206%2c11207%2c11208%2c23004%2c11209%2c11210%2c11300%2c11301%2c11302%2c11303%2c11304%2c11305%2c11400%2c11410%2c11411%2c11412%2c11450%2c11451%2c11452%2c11453%2c11600%2c11601%2c11602%2c11603%2c11604%2c12000%2c12100%2c12101%2c12102%2c12103%2c12104%2c12105%2c12106%2c12107%2c12108%2c12109%2c12110%2c12111%2c12113%2c12112%2c12114%2c12200%2c12201%2c12202%2c12203%2c12204%2c12205%2c12206%2c12207%2c12208%2c12209%2c12300%2c12310%2c12311%2c12312%2c12320%2c12321%2c12322%2c12400%2c14000%2c14100%2c14200%2c14300%2c14400%2c14500%2c14600%2c13000%2c13100%2c13200&NodeDesc=Pinellas+County.

Thanks...been in it for some time. Might get something out of it. Hopefully it's a Lazer play.

Will check court cases. Sold shell? or Low on CASH and up to another rinse and repeat with a promotion. all Speculation. Will do some DD.

Any idea why this company is so active? Thought it was dead due to the lawsuit.

"There are only 56.72 million shares available for public trading."

Have 10 Million

SECURITY DETAILS

Share Structure

Market Cap Market Cap

574,091

06/18/2020

Authorized Shares

5,000,000,000

03/13/2020

Outstanding Shares

2,870,455,244

03/13/2020

Restricted

1,119,488,952

03/13/2020

Unrestricted

1,750,966,292

03/13/2020

Held at DTC

1,734,820,782

03/13/2020

Float

Not Available

If the hedgies were dumping their shares now into the public float, it would show up in the numbers. There are only 56.72 million shares available for public trading.

Understand?

Most shares are currently restricted. After their restriction is lifted, they will continue to wait to see if the company turns itself around with the Brazilian Expansion. Like everyone else, they want to maximize their profit. If the share price reacts positively, they will stick around longer. They are not impulsive penny flippers like some.

I guess it depends on which party is being sued for the most money. But seriously, why are shares still trading after, what, 4-5 years of complete shutdown?

There must an MM still able to buy at .0001 and sell at .0002. Living proof that the greater fool theory is alive and well.

The last thing any company in their right mind will want is to be connected to BTGI!

That‘s what I ask.. I did not see why the link was posted about someone not listed In any discussions on this site??

|

Followers

|

292

|

Posters

|

|

|

Posts (Today)

|

0

|

Posts (Total)

|

46070

|

|

Created

|

11/13/02

|

Type

|

Free

|

| Moderators | |||

Bulova Technologies Group Inc. (BTGI) is the MOST UNDERVALUED

stock in America!

Soon it will be the Number 1 Penny Stock in America!

Summary, Highlights, DD & Speculation for Bulova Technologies Group, Inc. (BTGI)

CEO Stephen Gurba Radio Show Interview October 16, 2017

LINK: https://upticknewswire.com/featured-interview-ceo-stephen-gurba-of-bulova-technologies-inc-otcpink-btgi/

CEO says New RECORD revenues of $25 MILLION forecast for FY2017 and they will be profitable!

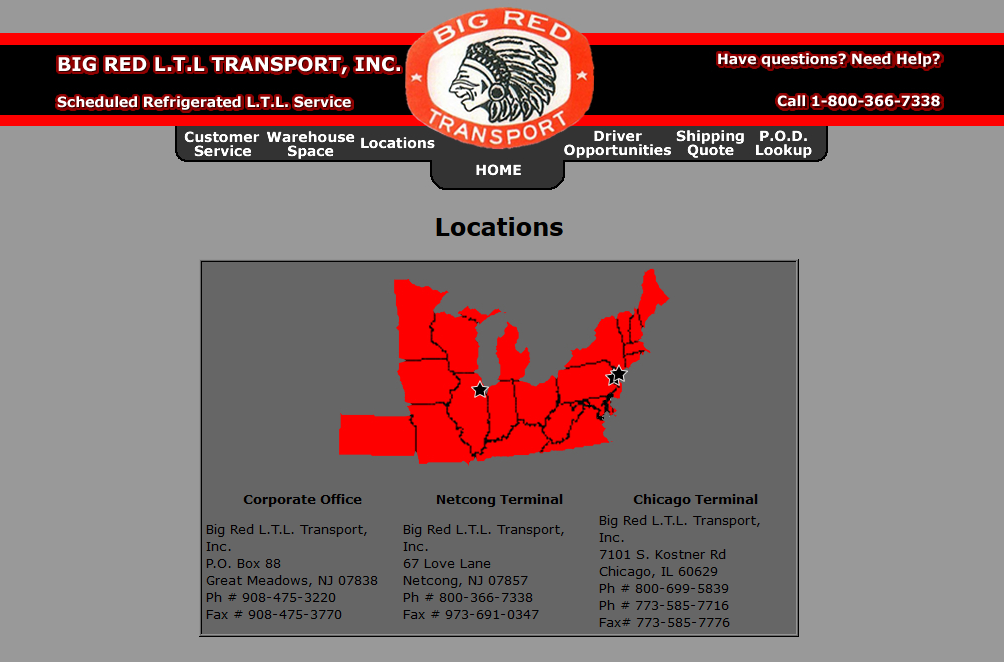

CEO says BT Twiss Transport and Big Red LTL Transport to generate $40 MILLION in REVENUES in FY2018 for BTGI !!!

CEO says there will BE another Trucking Company Acquisition coming in FY2018

Projected additional annual revenues: $$$???

BT Twiss Transport: 100+ Trucks and 120+ Trailors

Big Red LTL Transport: 45 Trucks and 60 Trailors

BT-Twiss Transport is a full service Truckload and LTL freight shipping company. We specialize in the transportation of Frozen, Chilled and Dry goods to and from anywhere within the Continental United States.

CEO says Bulova Technologies Machinery Division will be sold off in 2018 to help reduce company debt and free up cash flow.

Stephen L. Gurba – President, CEO and Chairman of the Board

Mr. Gurba has over 35 years of experience in the design, development, production, and management of complex systems for both the defense ammunition industry as well as commercial products. His experience has included responsibility for companies with sales of up to $300 million annually and employing as many as 2000 employees. Mr. Gurba has previously held the position of Senior Vice President of General Defense Corporation, Vice President of Marketing for Olin Ordnance, President of Valentec International Corporation, President and CEO of National Manufacturing Corporation, and President, CEO and Owner of Bulova Technologies LLC. He currently holds the position of President and CEO for Bulova Technologies Group Inc. In this position, he has responsibility for both the Defense and Commercial Operations of the Company. Mr. Gurba holds a Bachelor of Arts in Math and Science from William Paterson College and a Masters and Doctoral degree in Business Management from Century University.

Craig Schnee – General Counsel

Mr. Schnee has served as a Senior Executive for Mr. Gurba’s Management Team for more than two decades, holding currently the position of General Counsel of the Parent Company. He holds a J.D. from the University of Virginia, and an MBA from the University of Pennsylvania’s Wharton School.

Michael Perfetti – Chief Financial Officer

Mr. Perfetti has over 30 years of experience in operations and financial reporting in various industries and companies ranging from a Division of a Fortune 500 company to start-up companies. Most recently he was Division President & CFO at L-3 Communications, Scandia Technologies Division.

Francis (Frank) H. Taylor III

Mr.Taylor serves as President of BT Twiss Transport LLC. Mr. Taylor is a long time valued member of the Bulova management team, having previously held the positions of president of BT Europe LLC and General Manager of BT Manufacturing. Mr. Taylor holds a B.S. in Business with a finance concentration from Rutgers University.

Anthony Pelliccio

Mr. Pelliccio serves as Director of Logistics and Customer Service. Mr. Pelliccio holds a B.S. in Management. Mr. Pelliccio was honorably discharged from the United States Marine Corps. Prior to joining the Bulova management team, Mr. Pelliccio held sales and marketing positions with several Fortune 500 companies.

| Volume | |

| Day Range: | |

| Bid Price | |

| Ask Price | |

| Last Trade Time: |