Register for free to join our community of investors and share your ideas. You will also get access to streaming quotes, interactive charts, trades, portfolio, live options flow and more tools.

#ModernMeat Inc. (#CSE: $MEAT) Could Be The #BeyondMeat of #Canada

Modern Meat Inc. (MEAT. CN )

Canadian Securities Exchange: (MEAT)

Alert Price: $2.90

Float: 13.02M

We are coming off another profitable week of trading.

Last Tuesday's alert delivered over +110% in realistic profit, and we are looking to kickoff this week with some easy triple-digit profits

Our latest trade idea takes us north of the border to Canada, and is listed on the Canadian Securities Exchange.

Please turn your immediate attention to Modern Meat Inc. (MEAT. CN ).

Modern Meat (CSE: MEAT) Could Be The Beyond Meat (NASDAQ: BYND ) Of Canada

In May last year, California-based vegan food tech famous for its meatless burgers and sausages, became the first plant-based company to list IPO on the NYSE under the ticker symbol BYND , marking a watershed moment for the plant-based world.

Now, another vegan company has gone public, a true indicator that the fast-growing sector that had long been overlooked as a marginal trend is unstoppable at a global scale.

Another Canadian vegan startup commenced public trading on July 1, making them the latest plant-based publicly traded company. Modern Meat, a women-led vegan food tech, is listed on the CSE under the ticker MEAT.

Vancouver-based Modern Meat was founded in 2019 by Tara Haddad, and offers vegan meat substitutes such as burgers, meat crumbles, crab cakes and meatballs featuring clean non-GMO whole food ingredients such as pea protein, chickpea flour, mushrooms and brown rice. It also has a line of plant-based sauces and dips, and is sold across a number of grocery stores in 7 different cities in Canada as well as on e-commerce sites.

In a video announcement, CEO Tara Haddad said that its public launch comes as the plant-based market is experiencing explosive growth.

“With this increase in demand and the plant-based market growing so quickly, we have implemented an aggressive distribution strategy to expand to the US as well as eastern Canada so we will require this additional capital to fulfill our strategy.”

“In the coming months we are focusing on production and distribution and we are hoping to ten times production to keep up with demand,” added Haddad.

Beyond Mea now has its products available for purchase at dozens of major American fast-food chains and grocery stores across the country. Its products, which are designed to imitate chicken, beef and pork, have become a popular choice for those who aim to avoid eating meat.

Since going public in May 2019, Beyond Meat has partnered with Subway, KFC, Del Taco, Dunkin’ Brands and more. And its shareholders have seen massive returns.

If you invested $1,000 in Beyond Meat at IPO , that investment would be worth nearly $5,360 as of today, for a total return of around 436%!

You now have the opportunity to build a position in what could be the Beyond Meat of Canada at just $2.90 a share.

Modern Meat Inc. (CSE: MEAT) is a rare ground floor opportunity in a sector that is taking off like crazy.

The upside potential is massive, and we suggest that you take a closer look at this juicy opportunity listed on the CSE.

About Modern Meat

Modern Meat is an award winning Canadian food company based in Vancouver, British Columbia that offers a portfolio of plant-based meat products. Modern Meat recognizes the importance of providing consumers nutritious and sustainable meat alternatives without sacrificing taste. We are deliberate in choosing ingredients free of soy, gluten, nuts and GMO's. Their mission is to change the way food is produced and consumed for the benefit of people, animals and the environment by using only natural 100% plant-based ingredients.

The Demand For Modern Meat's Products Is Massive

Sells Out of Product 12 Consecutive Weeks and Continues to Move into New Production Facility

The Company has sold out of its products and has been at maximum capacity for 12 consecutive weeks to retailers and direct to consumer sales. The Company has been pleased with its initial launch of its line of Modern Burger, Crumble, Meatball, 'Crab' Cake and sauces.

"We are pleased by the overall reception of our product and recognize that there still is a significant gap in the market for nutritious and satisfying meat alternatives that do not contain soy, gluten, nuts, or GMO's. In the coming months, we will be rolling out new innovative sales techniques and be introducing our product to further vendors." states Loree Khan, Head of Canadian Sales and Distribution for the Company.

Modern Meat has also begun renovation of the new production facility with equipment purchases and interior renovations to fit Modern Meat's specific needs. The Company expects to quadruple its output post renovations and be able to support future development of its plant-based products.

"Since moving to the facility we have quickly begun customization of the kitchen space bringing in trades, contractors, and new equipment. When complete, we not only expect to expand our production capabilities, we will also be expanding our reach to new consumers," states Tara Haddad, CEO of the Company.

Prior to that, the Company "Sold-Out" of its online "ONE DAY" flash sale that allowed existing customers to order products pre-sale in an effort to introduce its line of plant-based meat alternatives to a broad audience including consumers, shareholders, and subsequent vendors. Modern Meat launched the flash sale to its e-commerce store, social media channels and newsletter subscribers.

The product sell-out was over and above the Company's current retail standing orders and based on remaining production capacity numbers.

"We are extremely pleased by the results of our flash sale and it further supports our belief that there is a gap in the market for nutritious meat alternatives," states Tara Haddad, CEO of Modern Meat. "For a company that is just over a year old, understandably most of this past year has been focused on market research, R&D and product development. Our retail sales have only started in the month of May and we have already found the demand is exceeding our expectations. We are confident that we will capture market share by striving to be a leader in producing a truly healthy 100% plant-based alternative to traditional protein sources that not only tastes fantastic, but is free of soy, gluten, nuts and GMOs."

Taking Canadian Retail By Storm

Modern Meat Continues Its Growth Through the Acquisition of Retail Locations

Modern Meat (CSE: MEAT) as signed a term sheet to acquire 1257189 BC Ltd. (the "Vendor"), which owns two of three Victoria's Health & Organic Bar Retail locations, both located in Vancouver, BC . Victoria's Health & Organic Bar has been in business for 18 years and has gathered a significant following in the Health and "Good for You" Community. Last year's gross sales from all locations, including the third store in North Vancouver, BC , totaled approximately $4.3 million, focusing only on Health-related products.

Modern Meat intends to renovate and rebrand the acquired stores under the brand "Modern Health and Wellness Bar." Stores will be converted to focus solely on vegan products and supplements, in addition to a significant increase in food services serving premade meals and expansive to-go vegan menu.

"The acquisition of Victoria's is an opportunity that allows Modern Meat to build itself as a leader in the health and nutrition market. Adding our own retail locations to the fold is yet another milestone for the company," states Tara Haddad, CEO of Modern Meat. "We are thrilled to acquire such an established brand and Company with a great reputation in the Health and "Good for You" Community. We will adapt the core principles that drove Victoria's success and implement Modern Meat's plant-based lifestyle values through Modern Health and Wellness Bar. We feel there is a huge gap in the plant-based health and supplement space and establishing retail locations which focus on the health and wellness lifestyle-oriented consumer aligns very well with our products."

"Modern Meat is more than a product, it is a lifestyle and culture," explains Campbell Becher, Director and Head of Finance and M&A for Modern Meat. "Our effort to establish our brand continues to gain momentum through this acquisition. Our goal is to build the Modern Meat lifestyle brand through awareness, expansion, and by developing long standing community and consumer relations. We expect the Modern Health and Wellness Bar channel to be a strong contributor toward our growth. We continue to explore opportunities that fit with our core principles and will help build our company brand, distribution, and revenue."

Modern Meat Doubles Retail Presence to over 50 Locations

In mid-August, the Company announced that since going public on June 30, 2020 it has expanded its reach significantly in British Columbia, by over doubling its retail presence and now being available in over 50 locations.

"I am very proud of our team and pleased with the work they have accomplished to get us to this point," said Tara Haddad, CEO of Modern Meat. "As demand for our plant-based meat alternatives continues to grow we intend to pursue expansion plans through accretive acquisitions in the sector and by developing our distribution channel nationally through major retail chains, specifically in Ontario. We also plan to invest in a new kitchen facility this quarter to give us additional production capacity to meet the considerable increase in market demand."

Modern Meat Products Now Being Sold In Canada's 5th Largest Grocery Retailer

Modern Meat Inc. (CSE: MEAT) products are now available in the frozen meat section and food service division of the popular Urban Fare grocery stores. Urban Fare is a subsidiary of the Overwaitea Food Group ( OFG ) which operates more than 160 stores under the banners of Save-On-Foods, Owerwaitea Foods , Urban Fare, PriceSmart Foods , PriceSmart Foods International and Bulkley Valley Wholesale. OFG is owned by the Vancouver-based Jim Pattison Group. Urban Fare has six locations, four located in downtown Vancouver and one each in Calgary and Kelowna.

Urban Fare will be offering all Modern Meat products specifically; Modern Meat Burgers, Crumble, 'Crab' Cakes and Meatballs. "As a local company, we are excited to partner with such a reputable and well-known food purveyor like Urban Fare. Having our products placed in the meat aisle as well as the hot cafeteria will give our company great exposure since most Urban Fare markets are strategically located in dense urban centers and feed many residents of high-rise condos and office towers," states Tara Haddad, CEO of Modern Meat. "As consumer preferences shift towards alternative proteins it is encouraging to see that retailers are including more nutritious plant-based options on their shelves."

"We are thrilled to announce a new retail partnership with Urban Fare," said Cassidy McCord, Director of Sales. "Offering our products in this premiere retail chain provides a gateway for Modern Meat and a stamp of approval into the OFG verticals of over 160 stores. Obtaining shelf space in other OFG stores is a goal we will be focusing heavily on in the coming months." OFG is the largest chain headquartered in BC and the fifth largest food retailer by grocery sales value in Canada.*

Protein ‘Shake-Up’ Could Push Faux Meat Market to $240 Billion

The alternative meat market is poised to rise to $240 billion over the next two decades as new technologies gain ground and consumers change their diets, according to Jefferies.

The great “protein shake-up” could see faux meat reach 9% share of the estimated $2.7 trillion global meat market by 2040, analyst Simon Powell forecasts, from less than 1% now. The size of the plant-based meat market has been one of the biggest debates in the food industry recently, with estimates ranging from between $10 billion and $40 billion to as high as $140 billion.

Plant-based meats, like the one produced by Modern Meat Inc. (CSE: MEAT), are currently leading the category and could see major growth in the years ahead.

Rising estimates for the faux-meat market are one way to justify the eye-popping valuations for its producers. Beyond Meat , for example, commands a valuation of $9.7 billion, or 110 times its 2018 sales. Its closely-held peer, Impossible Foods Inc., is valued at $1.52 billion, with revenues estimated at $110m in 2018, according to data compiled by PrivCo.

Modern Meat Inc. CSE: MEAT''s Chart Trending Bullish

We've done our very own chart analysis and see the potential for a big move from here!

The share structure also seems attractive to those looking for a ticker with tremendous upside potential!

Bullish Indicators:

Perfect retrace to the Fibonacci Golden pocket complete.

Strong sentiment and momentum within the sector sets up a rally back to the old highs

Bullish cross-over on the Stochastic

Momentum in strong uptrend

Bullish trend continues

The Bottom Line

Building a position in Modern Meat Inc. (CSE: MEAT) right now, could be like buying Beyond Meat at its $25 IPO price!

As you can see, their products are a hit with consumers, and they are expanding rapidly.

Modern Meat is operating in a sector that is still in its infancy, and by cementing themselves as a major player already the upside potential is just too attractive to ignore.By Viewing this Content, you Agree that you Have Read and are in Full Understanding of both our Disclaimer & Privacy Policy(*Remember to use a Stop-Loss Order to protect your gains, as well as limit possible losses.)

Best regards,

Bcci look at chart close to golden cross 50 100 and 200 all close to crossing company responded to me yesterday the are working diligently to get things done to become current with otc and that will remove stop sign.Also said that it will include there munchie magic element low float heavy shorts this could be in for a big big run share structure has been updated in last month munchie magic sounds like is going to be big

$KULR Tech Has Huge Potential in the #EV Sector (#ElectricVehicle)

KULR Technology Group Inc.(OTCQB: KULR )

Current Price: $1.16

Price Target: $5.00 (Litchfield Hills Research)

Float: 38.52M

KULR Technology Group develops, manufactures and licenses next-generation carbon fiber thermal management and safety technologies for batteries and electronic systems.

The company has been pulling together solid business relationships with companies that will use KULR products. Those companies, however need to execute on their production plans. For example,subsequent to the end of the quarter announced a supplier partnership with Drako Motors, maker of an electric Supercar and commercialized battery safety technology for Volta Energy’s Whispertech™ energy storage systems. It also announced it was awarded two new U.S. patents.

Both the growth of electric-motor based transportation and demand for increased safety of lithiumion batteries are key drivers for KULR . Semiconductor and other components that control current flow to the motors must manage considerable heat in the process. KULR has what we believe to be better and lighter materials for thermal management.

Attractive valuation. The company has been cutting costs and is targeting cash flow break-even by 4Q20.

Technical Analysis

- Bullish break from descending channel , which has

held as support on the back-test.

- Significant increase in buy-side volume .

- 7|12|20 Moving Averages have crossed bullishly

and are now providing strong rising Support.

- Huge upside Potential to Fibonacci & Horizontal

price targets.

Indicators In bullish uptrends.

By Viewing this Content, you Agree that you Have Read and are in Full Understanding of both our Disclaimer & Privacy Policy(*Remember to use a Stop-Loss Order to protect your gains, as well as limit possible losses.)

$WMT | #Walmart Hitting Some #Fibonacci #Resistance

Walmart has acted very much like a tech stock today and has helped power the DOW higher.

The stock generally acts well within the boundaries of Fibonacci so we see $150 as strong resistance

in the short term with the need for more TTOk news to drive it higher.

PLEASE DROP US A LIKE , IT IS VERY MUCH APPRECAITED

$UVXY | #Volatility & #Protection Should NOT Be Ignored

Maybe time to pay attention of what is happening within volatility in the Market.

It is obvious that traders have been taking on board some protection in recent days.

One popular way of doing so is the UVXY which has been battling to cross a critical pivot point @ $23.15.

Whichever means you prefer to use, protection and volatility should be on your watchlist.

$AMC Reopens 140 ore Theaters, On Watch for Wednesday

AMC announced that it intends to reopen 140 more theatres this week,

the stock has popped afterhours by as much as 14%.

High 30% short interest may fell some pressure tomorrow.

Possible long above previous pivot @ $7.12

Upside targets as per daily resistance levels

$TSLA | #Tesla --> Technical Supports Worked Perfectly

Its been quite a ride for TSLA investors this week, some register ringing finally happened,

but confluence of technical supports held=

1 - Mid channel support

2 - Anchored VWAP

3 - Fixed range POC (Redline)

No real need for panic until todays low is lost as support, but market is showing some signs that

a more sustained retrace is coming. Dont Be Greedy

PLEASE GIVE US A LIKE IF YOU FIND OUR CONTENT HELPFUL, THANK YOU.

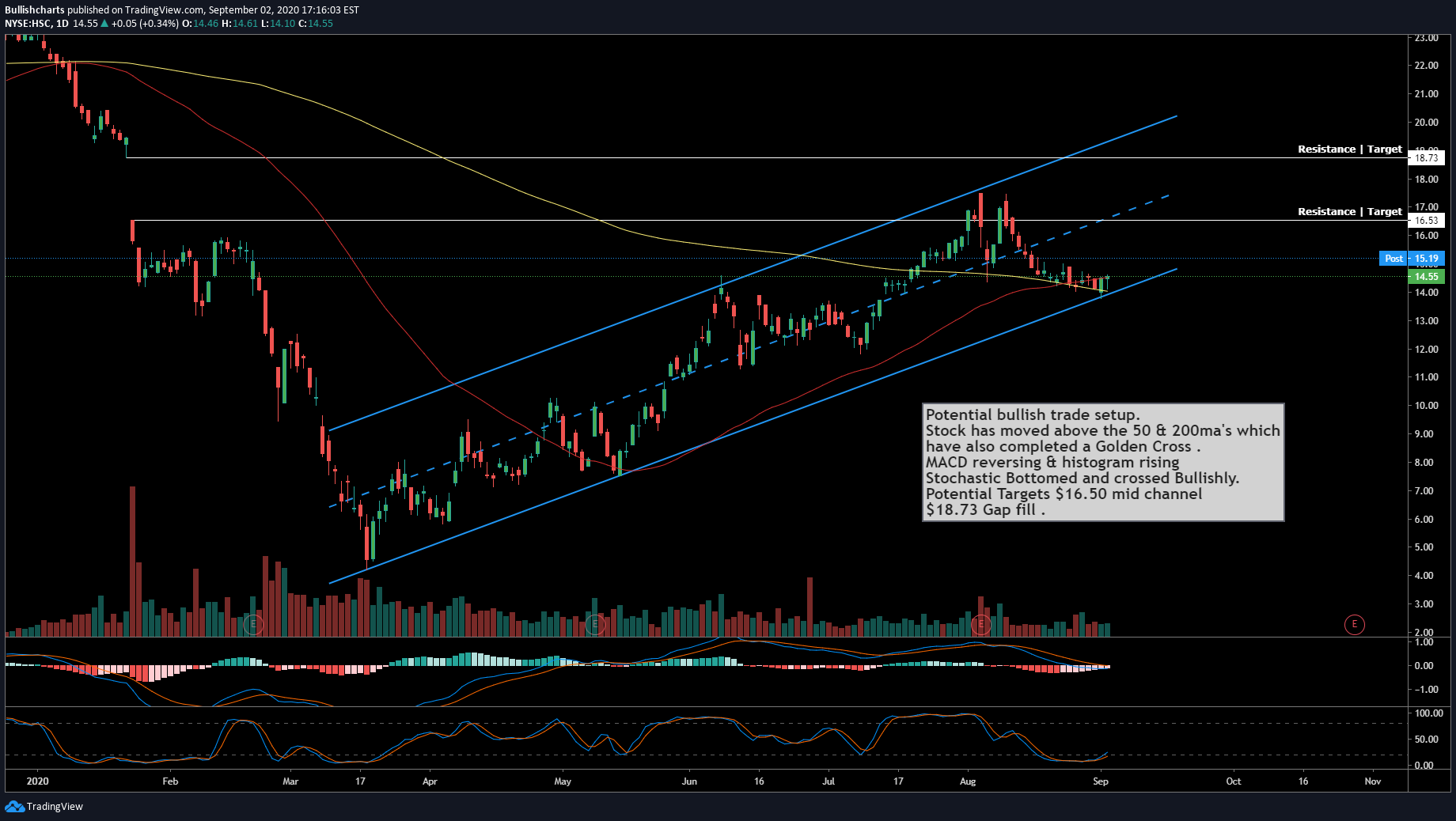

$HSC | #Harsco Corp - 25% Potential Gains

Potential bullish trade setup.

Stock has moved above the 50 & 200ma's which

have also completed a Golden Cross .

MACD reversing & histogram rising

Stochastic Bottomed and crossed Bullishly.

Potential Targets $16.50 mid channel

$18.73 Gap fill .

PLEASE GIVE US A LIKE IF YOU FIND OUR CONTENT HELPFUL, THANK YOU.

$MRNA | #Moderna Chart Review

MRNA has began to show signs of recovery or

maybe better phrased as seller exhaustion.

falling wedge forming & range tightening.

Rising 100ma now support.

POC Holding as support.

Fibonacci Golden Pocket (.618-.65) the perfect retrace

level has also held as support.

No need to rush in, awaiting falling wedge to break.

50ma then first target to consider'

PLEASE GIVE US A LIKE IF YOU FIND OUR CONTENT HELPFUL, THANK YOU.

$SDC | #SmileDirectClub Surges | Potential Targets

Monster breakout yesterday as a result of insider buying.

Possible Golden cross Imminent.

Indicators very bullish .

$10million inside buy a vote of confidence

Potential targets $11.00

If it can break through the 0.382 fib targets are

-$11.00 to gap fill

-$12.42 to .5 fib retracement level

$GS | Its Time For #Goldman To Shine! #GoldmanSachs

Potential change of sentiment and momentum may be coming

into the market which may see some HIOT money

looking for a safer home.

Indicators bullish and in reversal.

Volume increasing.

Golden Cross imminent

GS may be setting up a break from the current correction.

Potential Targets as per chart

$JAN | #JanOne Is Our Low-Float Nasdaq Listed Biotech Alert

JanOne Inc. (NASDAQ: JAN)

Alert Price: $7.63

Float: 1.38M

Please turn your immediate attention to JanOne Inc. (NASDAQ: JAN).

JAN could be the next pharma stock to take Wall St . by storm.

The company is focused on finding treatments for conditions that cause severe pain and bringing to market drugs with non-addictive pain-relieving properties. As a result, they hope to reduce the need for prescribing dangerous opioid drugs. Their first drug candidate (JAN101) is a treatment for Peripheral Arterial Disease (PAD), a condition that can cause severe pain and affects over 8.5 million people in the US alone.

The Company recently announced some exciting developments that could serve as a catalyst towards bringing its share price to levels not yet seen.

JAN has completed its initial engineering batch of JAN101. The JAN101 formulation is a patented sodium nitrite proprietary compound that demonstrated success in Phase 1 and Phase 2a trials for improving blood flow and vascular function, necessary in the treatment of Peripheral Artery Disease (PAD) and potentially for the treatment of Covid-19 vascular complications that is believed to be the cause of severe vital organ and tissue damage.

JAN has received authorization from the Food and Drug Administration (FDA) for the investigational new drug (IND) sponsorship transfer covering its sodium nitrite tablets and is currently preparing an investigator-initiated IND package for FDA submission, which it expects to submit in the coming weeks, as a potential treatment for certain aspects of bodily damage created by COVID-19. A pivotal phase 2b study for PAD is planned for early 2021.

The Bullish Case for JanOne (NASDAQ: JAN)

Has a razor thin float

A history of monster single day moves

Has tremendous upside

Trading well under book value of $8.71

52.97% Insider ownership

Expects to submit the investigational new drug (IND) for the treatment of Covid-19 vascular complications in the coming weeks and continues to advance plans to scale-up production of JAN101.

This is one of the most exciting opportunities we've seen in quite some time, we suggest that you act now, and add JAN to the top of your watchlist.

About JanOne

JanOne (NASDAQ: JAN) is focused on developing treatments for diseases that cause severe pain. By alleviating pain at the source, JanOne aims to reduce the need for opioid prescriptions to treat disease associated pain that can lead to opioid abuse. The company is also exploring solutions for non-addictive pain medications. Its lead candidate JAN101 is for treating peripheral artery disease (PAD), a condition that affects over 8.5 million Americans. JAN101 demonstrated positive results in a Phase 2a clinical trial, and Phase 2b trials are expected to begin in early 2021. JanOne is dedicated to funding resources toward innovation, technology, and education for PAD, associated vascular conditions and neuropathic pain. JanOne continues to operate its legacy businesses under their current brand names which are undergoing review to determine appropriate strategic alternatives. For more information, visit janone.com

Key Growth Drivers

Product Candidate: JanOne acquired an exclusive license to the worldwide right to TV1001SR, now known as JAN101, a twice-daily, orally dosed slow-release formulation. Over $13.5 million1 has been spent on the development in research and clinical work, excluding patent and Intellectual property expenses. Sodium nitrite is an approved drug for acute use and is on the list of The World Health Organizations list of 100 essential medications. Results from Phase 2a clinical trials support the use of sodium nitrite for the treatment and prevention of PAD and as a non-addictive treatment for Diabetic Neuropathy. While not a predetermined endpoint for the trial, subjects who participated in the trial also reported a reduction in pain as a result of the increased blood flow to the extremities and prompted a clinical study into diabetic pain where patients reported a significant reduction in pain.

Market Opportunity: In 2017, the global market for PAD was estimated at nearly $36.1 billion and is expected to grow at a compound annual growth rate ( CAGR ) of 7.6% to $52.0 billion by 2022, according to BCC Research.2

Patent Portfolio: The company has a portfolio of 30 worldwide patents and other intellectual property relating to sodium nitrite, the sustained release of sodium nitrite, and a provisional application to assist in the treatment of COVID-19 vascular complications. The patent portfolio presents diverse licensing opportunities and potentially royalty opportunities if JanOne intellectual property is used with other drug candidates.

Manufacturing underway: The company has a manufacturing agreement with CoreRx Inc. for the formulation and manufacturing of JAN101. CoreRx operates over 150,000 square feet of cGMP lab and manufacturing facilities, including six formulation suites, 18 manufacturing suites, and two analytical labs.

FDA 505 (b)(2) pathway: To streamline development and approval of the U.S. Food and Drug Administration (the “FDA”), the company expects to pursue FDA 505(b)(2) pathway for new drug approval as a result of an already approved acute use associated with JAN101.

Recent Highlights

In July 2020, several esteemed colleagues joined JanOne's Scientific Advisory Board

In July 2020, JanOne received confirmation from the FDA for the investigational new drug (IND) sponsorship transfer covering its sodium nitrite tablets previously held by Soin Neuroscience

In August 2020, JanOne engages CATO-SMS a world leading clinical research organization to assist in the development of JAN101 to Treat COVID-19 Vascular Complications

In August 2020, JanOne completes stable formulation of JAN101 in preparation for its first GMP manufacturing batch to support upcoming clinical trials

JAN Working Towards Treatment Of Covid-19

JanOne Advances its Potential Peripheral Artery Disease and Covid-19 Vascular Inflammation Treatment Towards Trial Readiness

Engineering batch for JAN101 complete and expectations are for GMP batch production to begin within 30 days

JAN has successfully completed its initial engineering batch of JAN101. The JAN101 formulation is a patented sodium nitrite proprietary compound that demonstrated success in Phase 1 and Phase 2a trials for improving blood flow and vascular function, necessary in the treatment of Peripheral Artery Disease (PAD) and potentially for Covid-19 vascular complications that is believed to be the cause of severe vital organ and tissue damage.

According to Dr . Tony Giordano, JanOne's chief scientific officer, "We are very fortunate to have had the foresight to initiate the manufacturing process this past February. Should we gain FDA approval for our Covid-19 study, we will be in a position to start patient trials immediately and still remain on track for our planned PAD Phase 2b trials to begin in early 2021."

The company expects to submit the investigational new drug (IND) for the treatment of Covid-19 vascular complications in the coming weeks and continues to advance plans to scale-up production of JAN101. The company has secured a partner for bottling and labeling, GMP batch production, including placebo batches. The company expects to deliver 250,000 doses within 30 days after start of manufacturing and have GMP batches of more than 20 million doses ready next year.

In various animal studies, JAN101 has demonstrated positive benefits that align with COVID-19 complications

Reduces kidney damage

Prevents tissue necrosis

Reduces thrombosis

Increases angiogenesis

The JAN101 COVID-19 Vascular Treatment Opportunity

As indicated in multiple human trials, our current sodium nitrate compound may be a successful treatment for the vascular complications experienced by COVID-19 patients

Shown to improve vascular function

Shown to reduce vascular complications such as thrombosis

Protects major organs from tissue damage due to poor blood flow

Inhibits inflammation, including mitigating the “cytokine storm”, a massive release of cytokine proteins that destroy endothelial cells (cells that protect the lining of vessel tissue)

Nitrite has proven to be well tolerated and safe

Peripheral Artery Disease Market Projected Be Valued At $52B By 2022

In the US alone, PAD affects nearly 12 million people, and if left untreated will lead to Critical Limb Ischemia with an annual cost of care estimated at $10 billion. 1 in every 20 adults over the age of 50 years, and 1 in every 4 adults over the age of 70 years are likely to develop PAD.

JAN's JAN101 is intended to address the 12 million Americans who suffer from PAD. In 2017, the global market for PAD was estimated at nearly $36.1 billion and is expected to grow at a compound annual growth rate ( CAGR ) of 7.6% to $52.0 billion by 2022

Growing number of patients suffering from peripheral artery disease across the globe and surge in population of ageing people across the European countries drive the growth of the global peripheral artery disease market.

Technical Analysis

We've done our very own chart analysis and see the potential for a big move from here!

JAN's share structure also seems attractive to those looking for a ticker with tremendous breakout potential!

Bullish Indicators:

Stock continues to run higher within a very bullish ascending channel , which remains perfectly respected.

20 moving average remains as support.

Stock has moved above VWAP

RSI is in bullish uptrend

Stochastic has bottomed and crossed bullishly.

The Bottom Line

JAN could be our next Nasdaq listed alert to run-up big.

The Company's razor thin float is a day traders dream come true.

JAN is in the midst of a major growth period, and has several bullish catalysts on the horizon.

Now may be the perfect time to take a closer look at JAN.

As always, we encourage you to do further research. Also, when you find yourself in a position to profit, it is often wise to do so.By Viewing this Content, you Agree that you Have Read and are in Full Understanding of both our Disclaimer & Privacy Policy(*Remember to use a Stop-Loss Order to protect your gains, as well as limit possible losses.)

$NIO Inc On The Road Too $20.00

Nice break to ATH on Tuesday , now lets see do we

get continuation or a back test.

Potential targets -

$19.00 Primary and local Fibonacci expansion levels

are in confluence so should provide resistance.

$20.00 is a key psychological target

PLEASE GIVE US A LIKE IF YOU FIND OUR CONTENT HELPFUL, THANK YOU.

$SPAQ | Gets the Dave Portnoy Treatment

Nice break this week in this volatile and indeed

speculative stock, with the help of some very active

stock influencers.

Potential targets short term as per resistance levels.

Indicators are bullish and volume increasing.

50&20 Moving Averages in support.

PLEASE GIVE US A LIKE IF YOU FIND OUR CONTENT HELPFUL, THANK YOU.

$URBN | #UrbanOutfitters Can Climb Much Higher

Earnings Beat Details

Urban Outfitters (NASDAQ:URBN) reports comparable retail segment sales fell 13% in Q2 vs. -28% consensus. By brand, comparable retail segment net sales increased 11% at Free People and decreased 8% at Urban Outfitters and 25% at the Anthropologie Group. Total retail segment sales were down 14% and wholesale segment sales were off 51%.

Gross margin was 29.6% of sales vs. 32.8% a year ago and the consensus mark of 21.3%. Operating margin was 8.6% of sales vs. 8.1% a year ago.

"I’m pleased to announce URBN produced solid revenues and profits for the second quarter driven by strength in the digital channel... Notably, all brands were profitable and enter the fall selling season with lean inventories and positive momentum," says CEO Richard Hayne

Source seekignaplha

$CRM | #Salesforce $279 Target

Having missed the pop post earnings , the next long entry will be above

the Fibonacci resistance at $248.00.

It could possibly set up a run to $276-$279.

Earnings were a huge beat and blow past all estimates.

PLEASE GIVE US A LIKE IF YOU FIND OUR CONTENT HELPFUL, THANK YOU.

$ROKU Rising on Major Upgrade

ROKU get a BUY upgrade from Citi with a $180 price target.

Highly volatile stock that has struggled to clear $157 in the past, which

if cleared open up a move to $161 short term.

Upgrade details

Citi analyst Jason Bazinet initiated coverage of Roku with a Buy rating and $180 price target. Over the past few years, the market has valued an active Roku account at $330, higher than the $130 the economic value per account, Bazinet tells investors in a research note. The disparity reflects the market's view of active account economics improving augmented by account growth, says the analyst. Applying $330 of economic value per subscriber to his active account 2022 forecast of 70M suggests Roku's equity will be worth $160 at the end of 2021, $180 at the end of 2022 and $200 at the end of 2023.

thefly.com

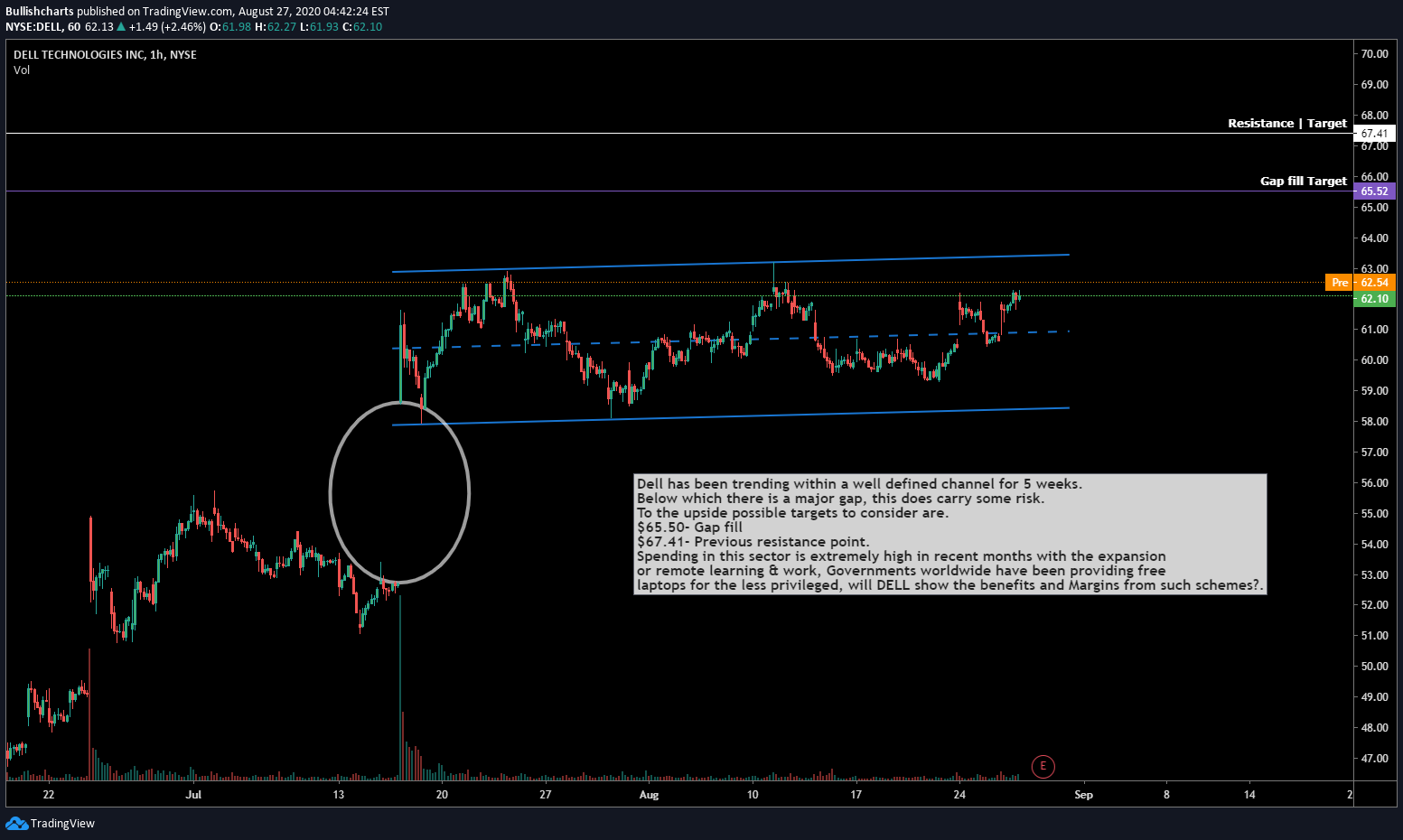

$DELL Earnings Analysis

Dell has been trending within a well defined channel for 5 weeks.

Below which there is a major gap, this does carry some risk.

To the upside possible targets to consider are.

$65.50- Gap fill

$67.41- Previous resistance point.

Spending in this sector is extremely high in recent months with the expansion

or remote learning & work, Governments worldwide have been providing free

laptops for the less privileged, will DELL show the benefits and Margins from such schemes?.

PLEASE GIVE US A LIKE IF YOU FIND OUR CONTENT HELPFUL, THANK YOU.

$PYPL | #Paypal $215 Short Term Target

PYPL gets a healthy upgrade to buy and a $285 price target from Mizuho.

Possible long entry on break above $205

upside target $210-$215 in the short term.

NACD cross imminent & Histogram approaching Zero-line.

RSi has worked off overbought conditions and has room to run

PLEASE GIVE US A LIKE IF YOU FIND OUR CONTENT HELPFUL, THANK YOU.

$SQ | #Square $180 Price Target, Upgraded to Buy

SQ has been trending perfectly within this channel since early april.

It has received a bullish upgrade to Buy today from Mizuho, lets see if it can

ignite the next step higher.

Potential long above $160

Upside Fibonacci Targets $170- $180

Mizuho initiated coverage of Square with a Buy rating and $225 price target.

PLEASE GIVE US A LIKE IF YOU FIND OUR CONTENT HELPFUL, THANK YOU.

$MSFT | #Microsoft $247 Fibonacci Target

Upon request I have taken a deeper look at potential targets for MSFT .

The most obvious level to consider now as resistance is @ $226 where 3 fib levels are in confluence .

RSI is uptrending and has room to run much higher.

MACD & Histogram also bullish

PLEASE GIVE US A LIKE IF YOU FIND OUR CONTENT HELPFUL, THANK YOU.

$GRWG | #GrowGeneration Reversal Trade

Momentum & speculation drove the stock of GRWG to $23 this month

before sufferings a 40% selloff.

Stifel has now initiated the stock with A buy RATING & $22 target

7&20ma's have crossed bullishly.

Potential targets $16.95 - $18.00

Upgrade details

Stifel analyst W. Andrew Carter initiated coverage of GrowGeneration with a Buy rating and $22 price target. The shares are currently undervaluing the company's "differentiated growth profile" as the leading specialty retailer of hydroponics, the potential value creation from the ongoing roll-up opportunity, and the scarcity value of pure-play investable opportunities for capitalizing on the growth of the U.S. cannabis category, Carter tells investors in a research note. The analyst estimates GrowGeneration can post 55% annual revenue growth through fiscal 2022.

Source theFly

$MRVL | #Marvell Tech Long Into Earnings

MRVL long trade into earnings .

Potential targets

$37.00 Fibonacci Golden Pocket

$39.00 Previous resistance

MRVL carries risk as it is reporting when the SMH is getting extended.

Indicators bullish with room to run.

PLEASE GIVE US A LIKE IF YOU FIND OUR CONTENT HELPFUL, THANK YOU.

$PLIN | #ChinaXiangtaiFoodCompany Today's Blockbuster Sales News Could Spark Rally!

China Xiangtai Food Co., Ltd. (NASDAQ: PLIN )

Alert Price: $1.07

Price Target: $6.70 (Goldman Small Cap Research)

Float: 9.8M

Earlier we told you that we've identified a low-float Nasdaq listed alert with monster gain potential.

The Company is China Xiangtai Food Co., Ltd. (NASDAQ: PLIN ), and it deserves your immediate attention.

The world is changing rapidly.

This change is now affecting food supply chains.

As CNBC noted, “The meat supply chain is broken. Here’s why shortages are likely to last during the coronavirus pandemic”.

Through this dislocation, some companies might be presented with significant growth opportunity.

China Xiangtai Food Co., Ltd. (NASDAQ: PLIN ) could be one of those companies.

The Company:

Has A Razor Thin Float

A History Of Monster Single Day Moves

Has Tremendous Upside

Just Released Blockbuster Sales News

Just minutes ago, the Company announced that its controlled subsidiary Chongqing Ji Mao Cang Feed Co., Ltd. ("JMC") has completed approximately USD 5 million in sales of soybean meal between within one week. The Company entered into a purchase contract (the "Contract") with China Grain Reserve Corporation's ("Sinograin") Zhenjiang Branch to sell 12,000 tons of soybean meal to Sinograin. Soybean meal is produced by the residue after oil extraction and is used in food and animal feed as a protein supplement.

Ms . Zeshu Dai, Chairwoman and Chief Executive Officer of the Company commented, "We are pleased to generate such significant sales in one week's time and expects to maintain a stable sale to Sinograin in the future. Sinograin are very selective in choosing their suppliers and we are proud to be considered as their long-term business partner. By leveraging JMC's expertise in animal feed raw material and formula solutions and the Company's commercial strength, we are confident that this approach will be successful in expanding into the southwest China market and creating value for our shareholders."

Today's blockbuster news could spark a major rally for this low-float alert!

That being said, we suggest that you act now, and add PLIN to the top of your watchlist.

About China Xiangtai Food Co., Ltd

Headquartered in Chongqing, China, China Xiangtai Food Co., Ltd, is a food company primarily engaged in pork processing. The Company's operations span key sections of the pork processing value chain, including slaughtering, packing, distribution, and wholesale of a variety of fresh pork meat and parts. Primarily focused on pork products, the Company also offers other fresh and processed products, including beef, lamb and poultries. Through the recent acquisition of Chongqing Ji Mao Cang Feed Co., Ltd, the Company has also expanded into the business of feed raw material and feed formula solutions. Through its core values, the Company is committed to maintaining the highest standards of food safety, product quality, and sustainability to provide high-quality, nutritious, and tasty food in a responsible manner through its portfolio of trusted brands.

We offer two main series of our products, namely the processed series and the fresh series.

We purchase live hogs through distributors who purchase hogs from well-known big hog farms located in different cities in southern China. We use an automated standard modern production line to slaughter the hogs and pack the fresh pork and byproducts. We deliver the fresh pork to local distributors who then resell the fresh pork to smaller wholesalers and retail vendors. Main products from the processed series include shredded meat, sliced meat, meat stuffing, pickled meat, lamb and offal, sausage, bacon, steamed meat, breaded chicken and spicy meat.

We also purchase fresh pork, beef, lamb, chicken, duck, and rabbit meat from local farmers. We process fresh pork, beef, lamb, chicken, duck, and rabbit meat into processed products. We sell fresh pork and processed meat products to both wholesale and retail markets. Main products from the fresh series include fresh pork and byproducts, beef, lamb, chicken, duck and rabbit meat.

Maintaining the highest industry standards for food safety, product quality and sustainability is one of our core values. We have food circulation permit and national industrial production certificate. Our operations comply with international standards and we have obtained a series of certifications, such as ISO9001, ISO22000 and HACCP. We have strict quality control systems in each segment of our value chain, from production through sales and distribution.

We have more than 200 employees. In our slaughterhouse and processing facility, we have a standardized and automatic production line for hog slaughtering and meat packing. We also have meat processing rooms and standardized freezers to process and store processed meat product. Our slaughtering plant in Linshui Industrial Park, Sichuan Province covers an area of 27,000 square meters. Our processing factory in Fuling, Chongqing, covering an area of 8,000 square meters. We have 6 registered trademarks in PRC .

We are committed to provide consumers with high-quality, nutritious and tasty products through our portfolio of trusted and well-known brands and to driving consumption trends, while setting a high industry standard in product quality and food safety.

For more information, please visit ir.plinfood.com/

PLIN Launches Hot Pot Restaurant Business

The Company aims to open 200 hot pot franchisees by the end of 2021

Earlier this month, the Company announced that it plans to launch a hot pot franchise business and plans to open its first location in Chongqing by August 31, 2020. The launch will allow the Company to integrate its existing industry resources and leverage its strength to provide consumers with a farm-to-table experience.

The Company plans to expand the hot pot chain by applying a franchise model and increase the number of restaurants to 200 by the end of 2021. All restaurants will be operated under Company's own brand "Xiangtai Fresh Beef Hot Pot". The Company plans to recruit a team of seasoned restaurateurs with more than 20 years of professional experience to manage and operate the franchise chain.

Ms . Zeshu Dai, Chairwoman and Chief Executive Officer of the Company commented, "We are excited about the launch of our hot pot restaurant franchise. We hope to meet the robust demand by supplying fresh and flavorful meat products on the retail level, thus creating additional revenue channels. Being competitive in the hot pot business requires high quality food supplies and extensive food industry experience, which are our strengths. We believe PLIN has tremendous potential and this new business will position the Company to create long-term value."

Xiaohui Wu , the President and Director of China Xiangtai Food , is Featured in a New Interview at SmallCapVoice.com

Plans to Increase Revenue and Profits from Internal Operations

Mr. Xiaohui Wu called in to SmallCapVoice.com, Inc. to go over the business model and markets served by his Company. In addition, Mr. Wu provided his personal comments on the recent news and upcoming events for the Company.

In the interview, Mr. Wu expanded on how the Company is handling the pork shortages in China, their continued path to vertical integration, how they are taking advantage of rising pork prices, and what direction the Company will take for the remainder of 2020. Recently, the Company announced that they have entered into a lease agreement (the "Agreement") to expand hog breeding business in Guangxi Province. Pursuant to the Agreement, the Company has agreed to rent a 2,500-square-meter hog breeding farm (the "Farm") with four hog breeding houses in Guangxi for five years until May 7, 2025.

Regarding the recently announced expansion into the hog breeding business, Mr. Wu stated, “This is really a particularly important development for our company since the goal of our company is to increase revenue and profits from our internal operations. Right now, the price of pork is extremely high making the hog breeding business especially profitable. This is just another sign of our commitment to vertical integration and expanding internal operations.”

PLIN Is An Award Winning Company

Earlier this monrth, PLIN was awarded the First Class Award of 2020 Excellent Chongqing International Food Enterprise Recommendation (the "Award") by Preferred Merchant (www.shouxuan18. cn ), an enterprise information integration and marketing platform that ranks enterprises in different industries and conducts strict field investigations and real-time monitoring of enterprises.

The Award aims to build a quality international food market, to lead the development of the international food industry, to enhance competitive advantages of international food companies, to cultivate a good market environment, to set up industry standards, and to promote a sustainable, steady and vigorous development of the Chinese international food industry. Also, the Award provides consumers with authoritative guidance and assistance, resulting in more rational consumption choices and saving time and energy for consumers.

"We are excited to win the Award. The recognition from Preferred Merchant reinforces our growing footprint locally, where we continue to increase our products offerings, ensure our products' quality, and attract more customers. The Award highlights the commitment and passion of our team to build an industry benchmark that meets consumers' needs for healthy and high-quality food," said Ms . Zeshu Dai, Chairman and Chief Executive Officer of the Company.

Ms . Dai continued, "Every year we receive multiple awards, and every one of them demonstrates the PLIN's exceptional reputation and market position. We are honored to receive the Award from Preferred Merchant and we believe it can help improve PLIN's branding awareness and expand our business."

Goldman Small Cap Research Slaps On $6.70 Price Target. Over +525% In Upside Potential

Analyst Rob Goldman from Goldman Small Cap Research, released a complete research report on the company with a $6.70 target.

Conclusion: PLIN has announced major initiatives which should substantially increase the Company’s financial performance and drive the stock toward our $6.70 price target, which reflects 13x our upwardly revised FY21 operating income forecast in our basic (non-roll up) P&L model.

PLIN closes accretive, complementary acquisition. In a matter of weeks, PLIN not only executed a highly profitable and accretive complementary business acquisition but closed on a major joint venture which provides the Company with unrivalled positioning through vertical integration. The acquisition in particular enables PLIN to expand the southwest market in China but also add roughly $70 million, or a 70% rise in annualized sales.

New, 10-year JV bolsters integration. Meanwhile, the recently announced a 10-year joint venture with Chongqing Fengjie County Rural Ecological Agriculture Development Co., Ltd. ("FEA") increases PLIN’s vertical integration by immediately adding hog breeding capabilities. Pork is a major food staple in China and PLIN is a leading provider throughout the food chain.

New forecasts, price target under review, more deals in the offing. Given the recent events, we have raised key forecasts and our price target is under review for a potential upgrade as well. Plus, it appears additional business development opportunities are in the offing later this year, enabling PLIN to establish a stronghold in this sector. Publicly traded pork companies such as Hormel are near year highs as this category serves as a popular defensive group during these difficult economic and market conditions. As a US-traded pure play on this sector in China, PLIN could follow a similar path.

Technical Analysis

We've done our very own chart analysis and see the potential for a big move from here!

The share structure also seems attractive to those looking for a ticker with tremendous upside potential!

Bullish Indicators:

Bullish break from down-trending channel while also reclaiming the 20 moving average as support.

Indicators also in reversal after bottoming.

Indicators bottomed and signaling a bullish reversal.

The Bottom Line

PLIN could be our next Nasdaq listed alert to run-up big.

The Company is in the midst of a major growth period, and has several bullish catalysts on the horizon.

Now may be the perfect time to take a closer look at PLIN

As always, we encourage you to do further research. Also, when you find yourself in a position to profit, it is often wise to do so.By Viewing this Content, you Agree that you Have Read and are in Full Understanding of both our Disclaimer & Privacy Policy(*Remember to use a Stop-Loss Order to protect your gains, as well as limit possible losses.)

Best Regards,

$LB | #LimitedBrands Beats Estimates, Targets To Watch

Short interest 8.6%

Earnings Details

L Brands shares rose in after-hours trading after the retailer reported better-than-expected results for the second quarter.

The Columbus, Ohio-based company has faced headwinds in recent years as the strength of its Bath & Body Works business couldn’t overcome the sagging sales of its Victoria’s Secret chain. Throw in the effects of the coronavirus pandemic, which caused L Brands (ticker: LB ) to close many of its stores in accordance with stay-at-home orders, and the outlook became even drearier.

But results during the last quarter were better than feared, as most of its stores in North America have reopened. Revenue came in at $2.3 billion—a 20% drop from a year earlier—but better than the $2.2 billion Wall Street expected.

When adjusted for a noncash impairment charge of its Victoria’s Secret brand and other restructuring costs, LBrands posted earnings of 25 cents a share, well ahead of the 42 cent loss the Street had forecast. Without the adjustments, the company posted a loss of 18 cents a share, compared with earnings of 14 cents a share a year earlier.

Source Barrons

$CVAC | #Curevac Potential Continuation Targets

Stock gapped up today as a result of a sizeable contract from the EU.

Technically the stock found support on the Fibonacci Golden Pocket (.65-.618).

Was somewhat surprising that there was no follow through in the afternoon session,

but lets see will tomorrow bring more gains.

7&12 moving averages support and holding above the VWAP

PLEASE GIVE US A LIKE IF YOU FIND OUR CONTENT HELPFUL, THANK YOU.

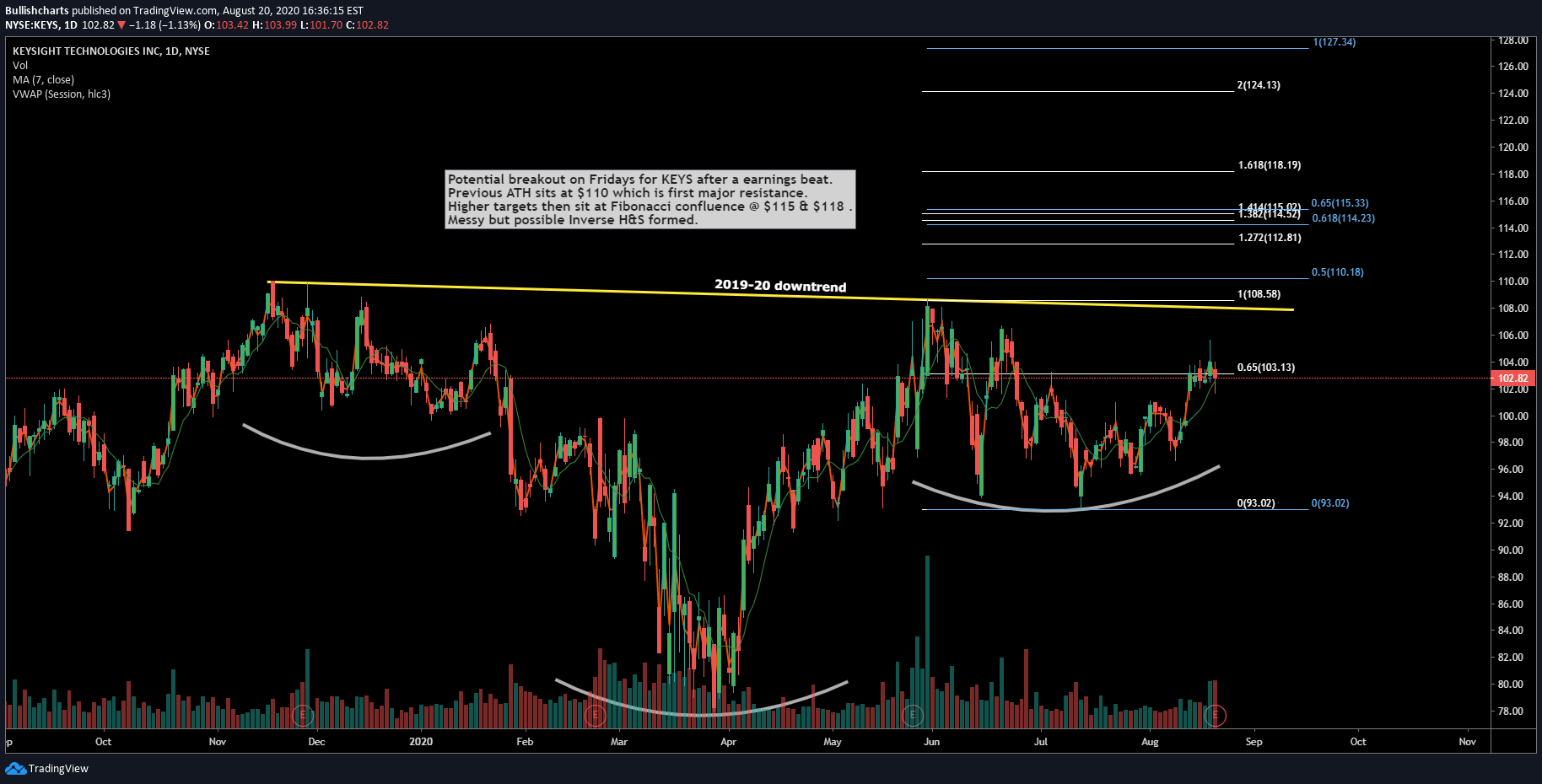

$KEYS | #Keysight Technologies Breakout Targets

Potential breakout on Fridays for KEYS after a earnings beat.

Previous ATH sits at $110 which is first major resistance.

Higher targets then sit at Fibonacci confluence @ $115 & $118 .

Messy but possible Inverse H&S formed.

PLEASE GIVE US A LIKE IF YOU FIND OUR CONTENT HELPFUL, THANK YOU.

$AAPl | #Apple Targets/Resistances @ $500 & $515 Hit

Its seems just a matter of hours before the $500 level is hit by AAPL , what it does then

will have a huge impact for the market.

RSI is at 74 so has room to run higher.

Fibonacci targets to consider $486 & $515.

PLEASE GIVE US A LIKE IF YOU FIND OUR CONTENT HELPFUL, THANK YOU.

$MOBL | #MobileIron Exploring Potential Sale Up 12% Afterhours.

MobileIron is working with a financial adviser to explore options, including a possible sale, Bloomberg's Liana Baker reports, citing people familiar with the matter. The company has not made any final decision and could decide to stay independent, Baker notes. Shares of MobileIron surged 10% in after-hours trading following the new

Source - https://thefly.

$XERS | #Xeris Pharma On Breakout Watch

Alert set for a break above the 200ma and $5.00 level.

Highly speculative with high Risk| Reward .

Company profile

Xeris Pharmaceuticals , Inc.is a pharmaceutical company, which develops and commercializes ready-to-use, liquid-stable injectables. It offers XeriSol and XeriJect formulation technologies. Its products include Gvoke Pre-Filled Syringe and Gvoke HypoPen. The company was founded by Steven Prestrelski and John Kinzell in 2005 and is headquartered in Chicago, IL.

PLEASE GIVE US A LIKE IF YOU FIND OUR CONTENT HELPFUL, THANK YOU.

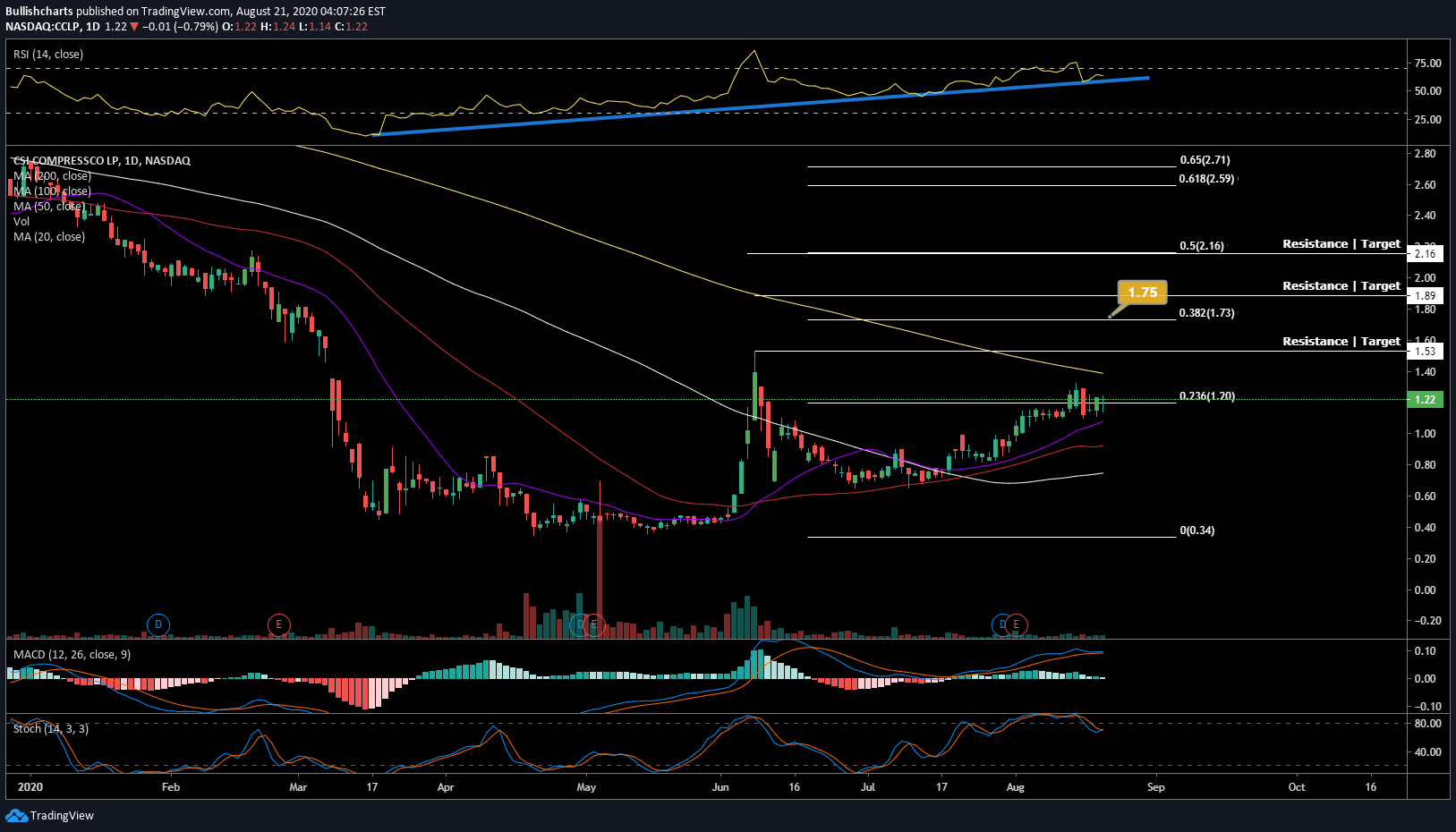

$CCLP | #CSICompressco Upside Targets High R/R

CSI Compressco LP engages in the provision of compression services and equipment for natural gas and oil production, gathering, transportation, processing, and storage. It offers compression services, new equipment sales, and aftermarket services. The company was founded on October 2008 and is headquartered in The Woodlands, TX .

$ADSK | #Autodesk Earnings Bullish Targets

Stock enters earnings within a 3 month congestion channel phase, with indicators all turning bullish .

Potential Targets

$273.50 is measured channel move (100% of current channel)

$260-266 Local Fibonacci expansion target zone.

PLEASE GIVE US A LIKE IF YOU FIND OUR CONTENT HELPFUL, THANK YOU.

$PANW | #PaloAlto Earnings Targets

Potential targets for continuation in Palo Alto.

Confluence of Fibonacci expansion & extension levels provide

reasonable resistance levels.

$284.50 & $294.50

Stock is somewhat extended & well above support in the $250 zone,

so care is needed and no certainties, stock has history of violent selloffs

in the past.

PLEASE GIVE US A LIKE IF YOU FIND OUR CONTENT HELPFUL, THANK YOU.

$OSUR | #Orasure Tech Reversal Trade

The stock has retraced and bounced perfectly of the Fibonacci Golden pockets once again.

Fridays seen increased volume and bullish price action.

50 & 100 Moving Averages support once again

Alert set for break above $15.25 for long into huge gap.

Stochastic and RS bottomed and reversing.

Speculative and high risk

PLEASE GIVE US A LIKE IF YOU FIND OUR CONTENT HELPFUL, THANK YOU.

$CCL | #Carnival Corp Bullish Inverse H&S

Potential Inverse H&S forming, will look for surge in volume

upon breakout above neckline.

Upside Targets $17.56-$18.16 to Fibonacci retrace levels.

Volume resistance declines greatly and set up a potential run to $19-$20 as

long as the market rotation continues.

Previous rallies have been short lived so take care with increased exposure.

| Volume | |

| Day Range: | |

| Bid Price | |

| Ask Price | |

| Last Trade Time: |