Register for free to join our community of investors and share your ideas. You will also get access to streaming quotes, interactive charts, trades, portfolio, live options flow and more tools.

$GNUS | #GenuisBrands Int Potential Continuation

Another stock that got hit while attempting to rally yesterday.

Indicators are positive but needs a volume spike.

Has a strong history of pump & dumps which maybe does scare of traders.

Needs to be traded with care, Targets =

$2.10 Fibonacci Resistance

$2.18 Horizontal and volume resistance

$2.45 Fibonacci & Horizontal price resistance

$2.81 Fibonacci Golden pocket

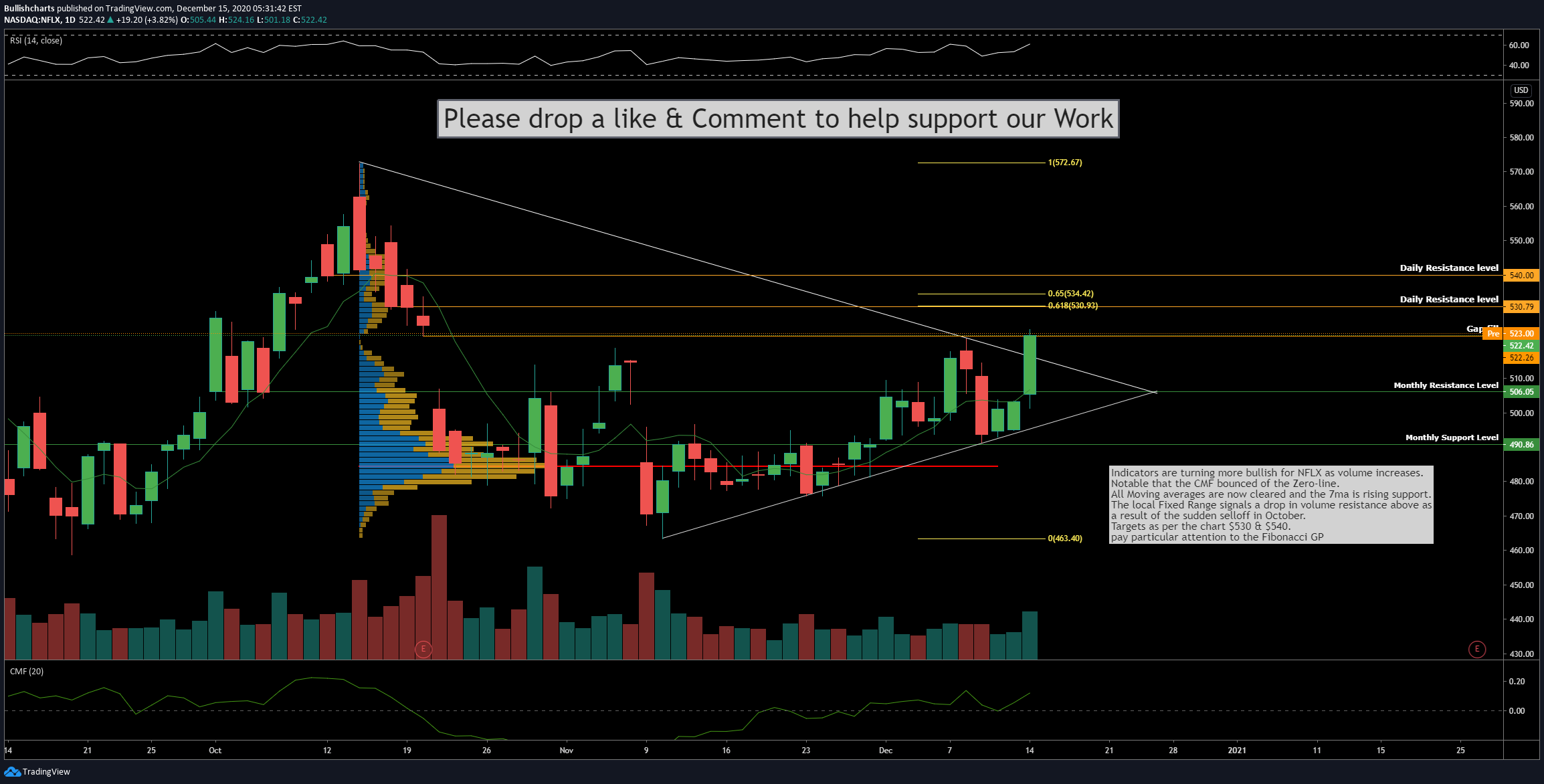

$NFLX | #Netflix $540 Short Term Target

Indicators are turning more bullish for NFLX as volume increases.

Notable that the CMF bounced of the Zero-line.

All Moving averages are now cleared and the 7ma is rising support.

The local Fixed Range signals a drop in volume resistance above as

a result of the sudden selloff in October.

Targets as per the chart $530 & $540.

pay particular attention to the Fibonacci GP

PLEASE GIVE US A LIKE IF YOU FIND OUR CONTENT HELPFUL, THANK YOU.

$TWTR | Bulls Need to break major Pivot at $53 in #Twitter

TWTR channel remains well respected , having held under back-test on Friday.

The 7ma may need to catch up for the stock to make its next move higher.

Volume remains impressive.

$53.00 is key Yearly candle Pivot point from 2015 to break.

$56.00 is next target.

$62-64 is of huge importance

$PURA | #Puration Inc Targets $26B #Hemp Market

Puration Inc.

(STOCK: PURA )

Current Price: $0.0997

Chart Analysis

Website | Recent News

About the Company

Puration , Inc. is a leading Texas-based, CBD-infused beverage provider. The Company’s flagship product, EVERx, which was introduced in 2017, targets the sports nutrition market. Puration plans to introduce new beverages as well as grow its product portfolio organically and through targeted acquisitions. The Company has spun off its cannabis cultivation segment to focus its efforts exclusively on its high-growth core CBD-infused beverage business.

PURA Hemp Lifestyle Brand Designed To Catalyze Entire Hemp Market Growth

PURA recently announced that the company is making major headway in the rollout of its new hemp lifestyle strategy, Farmersville Brands. The closing of the 72-acre land purchase contract where PURA will build the tangible centerpiece of its lifestyle strategy is anticipated to soon be complete. The centerpiece has already announced a hemp cultivation and extraction partnership with PAO Group , Inc. (Stock: PAOG ) and additional partnerships are in the works. PURA management anticipates the Farmersville Brands strategy to become the industry brand name catalyst advancing the entire hemp sector.

PURA's Chart Is Showing A Bullish Uptrend In The Making

Bullish Technical Indicators:

• Bullish downtrend break after bouncing off long-term horizontal support.

• RSI crossed above mid point.

• Momentum bullish uptrend after crossing zero-line histogram and MACD in bullish trajectory.

• Volume rising and buy side dominated.

The Bottom Line:

November has delivered a triple-whammy of great news for cannabis stocks: Several states legalized the use of recreational marijuana, Joe Biden's presidential victory could lead to more calls for decriminalization, and two leading cannabis companies reported better-than-expected results on Monday.

The timing for PURA's new hemp lifestyle brand strategy couldn't be better.

We see plenty of upside ahead for this rapidly growing company operating in a sector that is till in its infancy.By Viewing this Content, you Agree that you Have Read and are in Full Understanding of both our Disclaimer & Privacy Policy(*Remember to use a Stop-Loss Order to protect your gains, as well as limit possible losses.)

Regards

$PLTR | #Palantir Tech Trade Setup

PLTR has had some huge moves considering the weakness

in the market. Whether it be Investors or traders or it provides

a possible long opportunity in the days to come.

Need to be cautious of rejection at previous high.

Alert set for break above $11.05 for possible long to $12.00 - $12.50

#KULR Tech low-float tech play, with a $5 Price Target

KULR Technology Group Inc.

KULR Technology Group Inc.

(OTCQB: KULR )

Current Price: $1.34

Price Target: $5.00

(Litchfield Hills Research)

Float: 38.52M

Chart Analysis

CEO Interview with Small Cap Voice

KULR Technology Group, Inc. (OTCQB: KULR ) develops, manufactures and licenses next-generation carbon fiber thermal management technologies for batteries and electronic systems. Leveraging the company’s roots in developing breakthrough cooling solutions for NASA space missions and backed by a strong intellectual property portfolio, KULR enables leading aerospace, electronics, energy storage, 5G infrastructure, and electric vehicle manufacturers to make their products cooler, lighter and safer for the consumer. For more information, please visit http://www.kulrtechnology.com.

Company Highlights

Technology with roots in producing electronic and battery cooling solutions for NASA space missions and transitioning into mass market commercialization.

Key target markets include:

• Aerospace and Defense

• Battery Safety and Testing

• Utility Level Energy Storage

• 5G, Cloud Computing, and Consumer Products/Electronics

• Shipping and Logistics (packaging solutions)

• Electric Mobility

? Attractive and scalable business model with high gross margins (73%)

? Robust patent portfolio and 28 customer engagements across multiple industries

? Experienced management team with high insider ownership (+52%)

Passive Propagation Resistant ( PPR ) Lithium-Ion Battery Safety Solutions

? Formally launched a PPR battery design solutions for lithium-ion battery cooling and safety in 2020

? Design solution provides key features that prevents cell-to-cell thermal runaway propagation and risk of fire and explosion from exiting the battery enclosure

? KULR currently works with NASA’s Marshall Space Center and NASA’s Ames Research Center on designs for a crewed space mission

? KULR’s HYDRA Thermal Runaway Shield ( TRS ) technology deployed to the International Space Station - Product development engagements with medical device, electric aircraft, and electric vehicle makers, shipping and logistics solution provider and others

Space Qualified Thermal Interface Material (TIM) and Heat Sink Solutions for Next Generation, Consumer-Facing Mass Market Applications

? High thermal conductivity, low thermal resistivity TIMs and heat

sinks keep electronics and electrical products cooler allowing for

improved system performance

? Compliant, low contact pressure TIMs allow for greater electronic

and electrical product design flexibility and reliability

KULR Technology Provides Battery Safety Research and Testing Devices to Federal Aviation Administration

KULR's internal short circuit technology to be used in evaluating problems leading to passenger lithium-ion battery malfunctions that can cause smoke and fire incidents aboard aircrafts

KULR has supplied its internal short circuit (ISC) battery safety and testing device technology to the Federal Aviation Administration ( FAA ).

According to data released by the FAA , since January 2017, an air/airport incident involving lithium batteries (smoke, fire, extreme heat, or explosion) has occurred on average about once every eight days. As the exclusive provider of ISC technology to the FAA , KULR's devices will address the alarming increase in smoke and fire incidents aboard an aircraft due to passengers' malfunctioning lithium-ion batteries.

Developed by researchers at NASA and the National Renewable Energy Lab (NREL), the ISC device reliably creates thermal runaway in lithium-ion battery trigger cells in controlled, laboratory conditions. Unlike most other evaluation methodologies that mechanically damage the battery exterior to activate the short, KULR's ISC device triggers a true internal short. This method makes it possible to accurately pinpoint and fix problems leading to battery malfunctions. KULR's ISC technology received the prestigious R&D100 Award in 2016 and was runner-up for NASA invention of the year in 2017.

"We're excited to provide the FAA's research and design engineers an advanced means to improve avionic battery safety," said Michael Mo, CEO of KULR . "Designing safer battery enclosures and systems is a key element in aviation sector safety and a cornerstone of what we do at KULR . The FAA's ISC order is just the latest example of KULR's ongoing effort to provide our technology to regulators and industry trade groups in order to educate consumers and enhance battery safety."

Last month, KULR participated in meetings of the United Nations Transport of Dangerous Goods Sub-Committee Informal Working Group to establish test methods and criteria by which lithium batteries could be more effectively regulated based on their inherent hazards. The Company also recently announced its membership into the Outdoor Power Equipment Institute ("OPEI"), further advancing its commitment to the safe design and manufacturing of lithium batteries.

KULR Partners with Airbus to Provide Battery Safety Solutions

Partnership with leading global aerospace company underscores KULR’s commitment to battery safety worldwide

KULR has partnered with Airbus Defense and Space to provide KULR’s passive propagation resistant ( PPR ) battery design solutions for ongoing research into lithium-ion battery testing and safety for flight applications. The electrical engineers at Airbus do research and develop safe battery solutions for defense, space, helicopter, and aircraft applications.

KULR’s PPR design combines HYDRA Thermal Runaway Shield ( TRS ), LYRA internal short circuit, and NASA’s Fractional Thermal Runaway Calorimeter cell analysis technologies to provide an integrated total solution for battery testing and safety. HYDRA TRS is a sleeve-like shield that surrounds and separates individual cells in multi-cell packs and contains carbon fiber core and liquid coolant. The unique combination and configuration of the shield passively draws intense heat of cell failures away from nearby cells while dousing the failed area in a cooling and fire-prevention liquid.

Though weight and volume of thermal management solutions are the most critical constraints in flight applications, KULR’ carbon fiber architecture offers superior mass and weight advantages.

“We are excited to work with Airbus to refine and enhance its battery safety research, an agreement that further demonstrates our commitment to battery safety in consumer and commercial applications,” said Michael Mo, CEO of KULR . “We believe our TRS technology can provide a lightweight and effective solution to mitigate thermal runaway propagation risk for Airbus’ high-performance batteries.”

KULR’s HYDRA TRS is proven by various government testing authorities to stop or mitigate the impacts of dangerous lithium-ion battery failures known as thermal runaway propagation. Last year, Leidos ( LDOS ) and NASA used KULR’s HYDRA TRS technology to safely ship to and store batteries aboard the International Space Station. In addition, NASA’s Marshall Space Flight Center (MSFC) recently awarded KULR a dual-use technology development agreement to build 3D printed battery systems for manned and robotic space applications.

Minimizing Thermal Runaway

KULR CEO speaks on electric car battery fires, safety solutions.

These batteries are the driving force behind the EV market and a potential threat to growth in that industry.

Lithium ion batteries power many items that are used in our daily lives, among them are your cell phone, laptops and electric vehicles.

These batteries are the driving force behind the EV market and a potential threat to growth in that industry.

Auto makers are still grappling with battery fire risk; lithium batteries that can overheat and become a fire.

"Lithium batteries are the foundation which these EVs are running on," said Michael Mo.

Mo is the CEO of KULR Technology group. Thermal management is its focus.

"They ( batteries) have an inherent risk called thermal runaway," said Mo.

Mo told On Your Side thermal runaway is contributing to a rash of electric car fires.

In fact, Hyundai and BMW recently issued recalls on some models.

Ford has delayed the introduction of its new plug in Hybrid Escape and an earlier this month the government launched an investigation into complaints about electric battery fires in GMs Chevy electric Bolts.

"We are at the early stages of this EV revolution, renewable energy evolution, and safety performance is a critical part of that," said Mo.

He said his company has developed thermal management technology is now being used by NASA on its MARS Rover 2020 program.

The California company is now providing battery safety and testing devices to the Federal Aviation Administration.

Its internal short circuit technology is being used to evaluate problems leading to passenger lithium-ion battery malfunctions that can cause smoke and fire incidents aboard aircrafts

"We are also working with electric car companies to deploy some of the Mars Rover technology," said Mo, " we are working on performance and safety of EVs ."

They're working on rechargeable energy storage systems and shields to minimize thermal runaway.

At the personal level Mo said If you own a plug in hybrid or all electric car don't panic.

He said follow the charging guidelines and keep your software updated.

According to published reports, by 2050 between 60 and 80% of global new car sales will be electric (this comprises battery, plug-in hybrid and fuel cells.)

And companies are pumping billions into the industry with a focus on electric vehicle ( EV ) batteries performance and safety.

KULR Listed As One Of Wall St . Reporter's "Next Super Stocks"

Wall Street Reporter, the trusted name in financial news since 1843, is highlighting companies which recently presented at its Next Super Stock & Investors Discovery Day livestream conference series

KULR Technology Group, CEO Michael Mo made his debut presentation at Wall Street Reporter’s “Investors Discovery Day” livestream conference and explained how KULR is addressing multi-billion dollar market opportunities in battery technologies, ranging from electronic devices, to electric vehicles and space exploration.

KULR recently announced that its innovative carbon fiber thermal management solutions will be used on the upcoming NASA-JPL 2020 Mars mission as part of the Mars Rover. KULR will provide crucial thermal management for vital components in the Rover as part of the SHERLOC (Scanning Habitable Environment with Raman & Luminescence for Organics & Chemicals) equipment. The KULR solution includes custom-designed phase change heat sinks designed to absorb and mitigate rapid temperature changes, keeping sensitive components such as lasers and sensors within desired temperature ranges to avoid signal distortion or other complications. During the 2020 Mars Mission, SHERLOC will be mounted on the rover's robotic arm and use spectrometers, a laser, and a camera to search for organics and minerals that may be signs of past microbial life.

Litchfield Hills Research Initiates KULR Technology Group with a "Buy" Rating and Slaps On $5.00 Price Target!

KULR reported 2Q20 results that were largely as expected, missing our EPS estimate by a penny due to rounding. The company reported an EPS loss of $0. 01 on $201,000 of revenue. We had been looking for an EPS loss of $0.00 on $200,000 of revenue.

Our 2021 estimates are unchanged

KULR Technology Group develops, manufactures and licenses next-generation carbon fiber thermal management and safety technologies for batteries and electronic systems.

The company has been pulling together solid business relationships with companies that will use KULR products. Those companies, however need to execute on their production plans. For example,subsequent to the end of the quarter announced a supplier partnership with Drako Motors, maker of an electric Supercar and commercialized battery safety technology for Volta Energy’s Whispertech™ energy storage systems.

It also announced it was awarded two new U.S. patents.

Both the growth of electric-motor based transportation and demand for increased safety of lithiumion batteries are key drivers for KULR . Semiconductor and other components that control current flow to the motors must manage considerable heat in the process. KULR has what we believe to be better and lighter materials for thermal management.

Attractive valuation. The company has been cutting costs and is targeting cash flow break-even by 4Q20.

Source: http://www.hillsresearch.com/wp-content/...

KULR Revenues Increase 257% on New Customer Growth and Service Projects

Second Quarter 2020 Summary Achievements:

Increased revenues by 257%, driven by two-fold increase in customer transactions

Reduced monthly operating expenses by 20%

Raised $758,000 from the issuance of common stocks, net of issuance expenses

Awarded patents on its NASA-grade Fiber Thermal Interface ( FTI ) and Thermal Runaway Shield ( TRS ) solutions

Established new partnerships and supply agreements to implement proprietary thermal heat technology into electric vehicles, energy storage and other commercial applications

Operational Highlights:

KULR was awarded a patent on its Fiber Thermal Interface ( FTI ), a NASA-grade high-performance thermally conductive carbon fiber material developed for a variety of different applications, including space, automotive and electronics.

KULR was also awarded a patent on its Thermal Runaway Shield, which reduces hazardous risks associated with thermal runaway in lithium-ion battery packs.

The Company partnered with Silicon Valley-based Drako Motors to use FTI for the thermal management system of Drako GTE, a new ultra-high-performance electric supercar.

Dave Harden, former Chief of Strategic Prioritization at the Pentagon, joined KULR’s advisory board.

Signed an agreement with Volta Energy Products to provide passive propagation resistant ( PPR ) technology for implementation in stationary energy storage modules from the grid.

Launched a PPR battery design solution for space applications, including both trigger and production cells, for lithium-ion battery testing and safety.

Its innovative carbon fiber thermal management solution was used on the Mars 2020 Perseverance Rover SHERLOC instrument.

Partnered with Hazmat Safety Consulting to work with industry and regulatory leaders on PPR battery safety technology due to increased focus and concern on improving public safety from battery fires.

Announced licensing agreement with Americase for use of KULR’s PPR technology and supply of core materials for Americase’s patent-pending battery bag.

Technical Analysis

Based on our own technical analysis , we see the potential for another big move from here.

Bullish Indicators:

Stock found support on strong historical daily support level , setting up a nice bounce out of the falling wedge

Indicators have reversed and in bullish uptrends.

Momentum indicates a bullish swing.

Stochastic bottomed and in reversal.

The Bottom Line

With its low-float and recent announcements, we believe that KULR is in for a huge week of trading.

The Company is in the midst of a major growth period, and we believe it has the potential to double in price from here.

KULR already has strong revenue growth, and is in possession of cutting edge technology in some of the fastest growing tech sectors.

With a analyst price target of $5.00, we believe that KULR is extremely undervalued at its current levels. By Viewing this Content, you Agree that you Have Read and are in Full Understanding of both our Disclaimer & Privacy Policy(*Remember to use a Stop-Loss Order to protect your gains, as well as limit possible losses.)

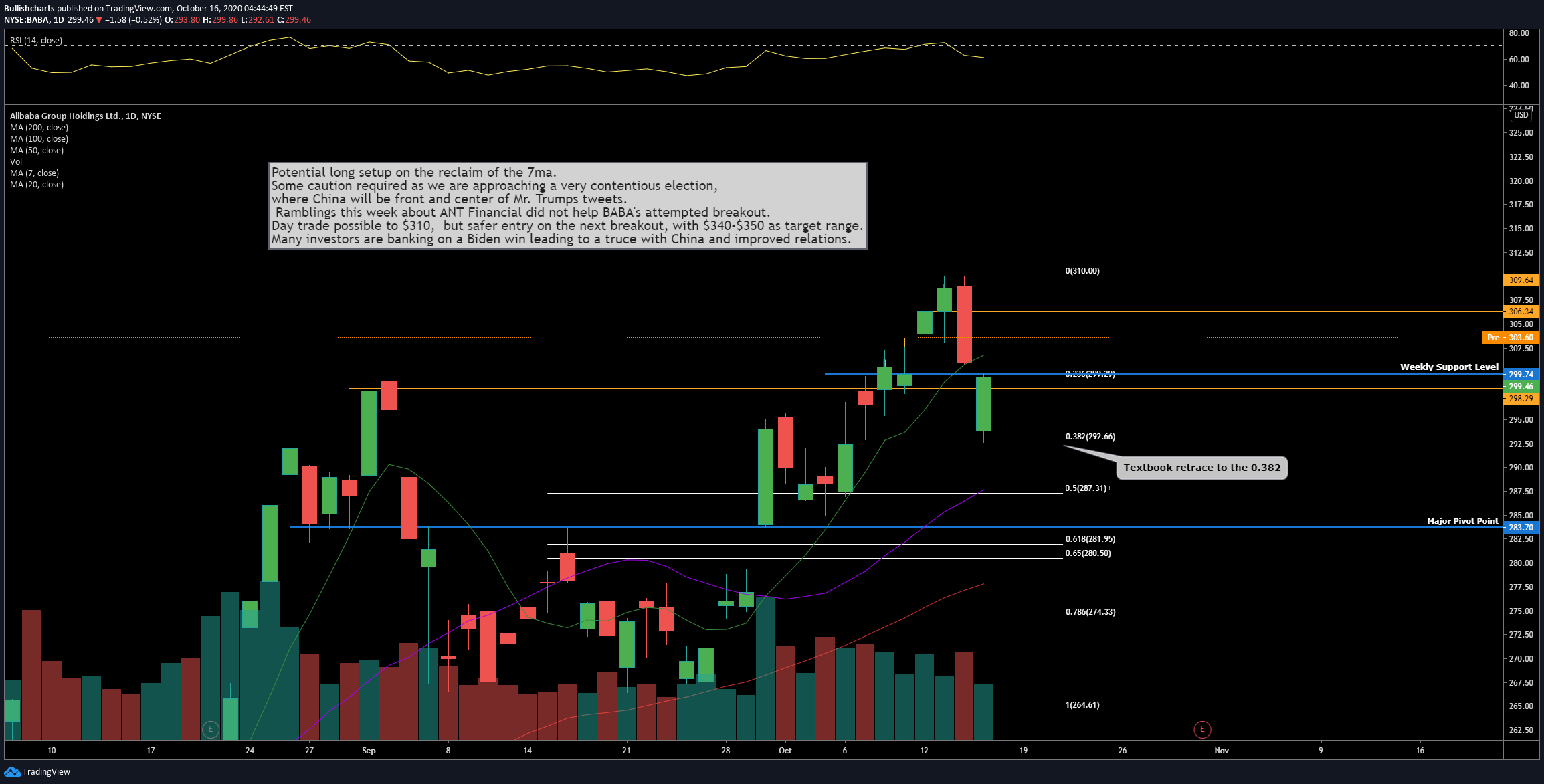

$BABA | #Alibaba Group Investors Hoping for a Biden Win?

Potential long setup on the reclaim of the 7ma.

Some caution required as we are approaching a very contentious election,

where China will be front and center of Mr. Trumps tweets.

Ramblings this week about ANT Financial did not help BABA's attempted breakout.

Day trade possible to $310, but safer entry on the next breakout, with $340-$350 as target range.

Many investors are banking on a Biden win leading to a truce with China and improved relations.

$BYND | #BeyondMeat is Back On the Menu

Beyond meat is back on the watchlist again.

Technically it has acted perfectly, the latest rejection took place at a level of

confluence between a Fibonacci extension of the march low and the .787 retracement of the entire

structure.

I have alerts set for $192 & $199 so as to get ready for a break above $200 setting up a run back

to the all time high. This is not a fad this is a food revolution and direct to consumer is now thriving

whereas in 2019/20 it depended on partnerships with diner restaurant chains.

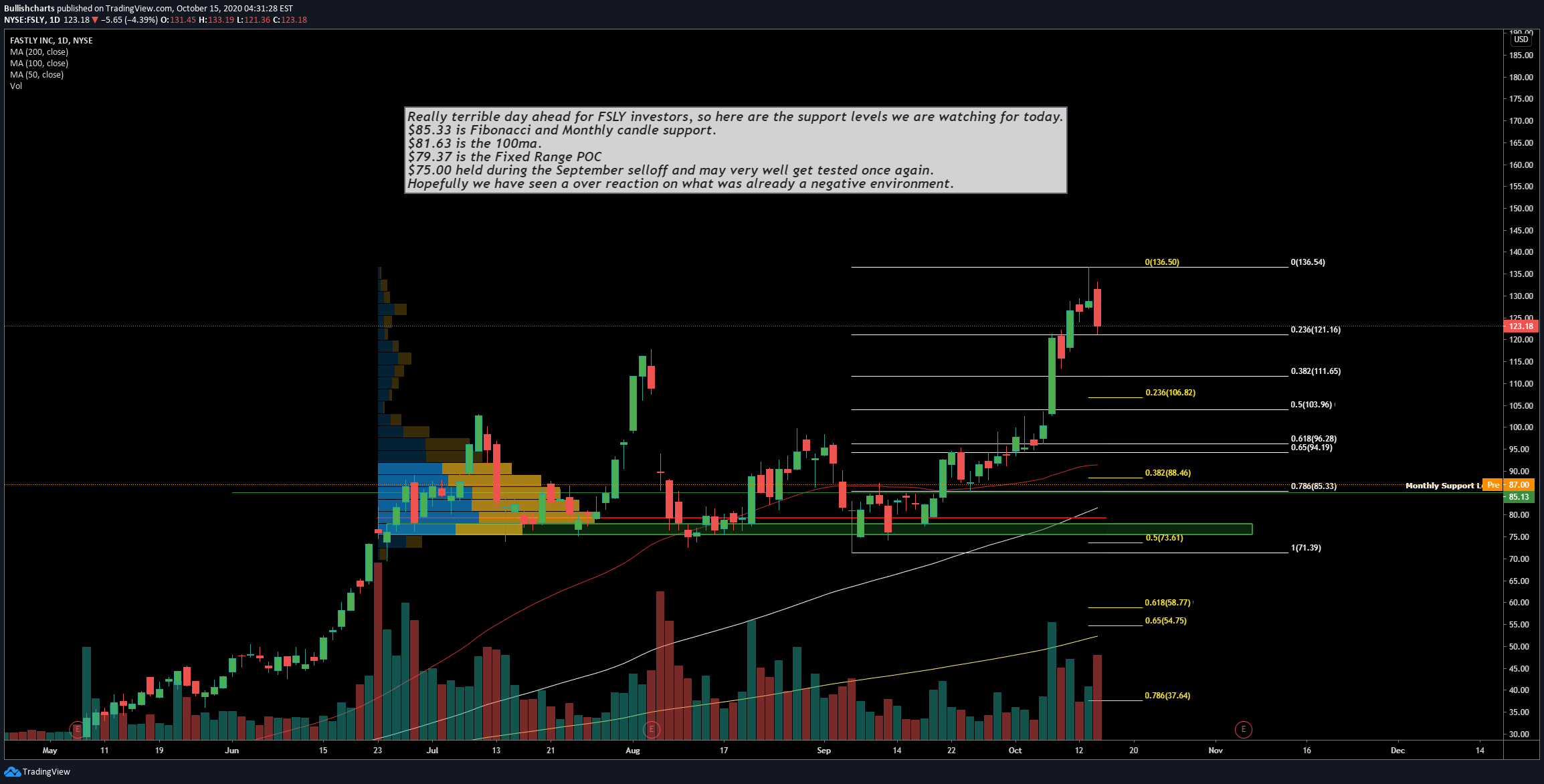

$FSLY Support Levels to Watch for Fastly Inc

Really terrible day ahead for FSLY investors, so here are the support levels we are watching for today.

$85.33 is Fibonacci and Monthly candle support.

$81.63 is the 100ma.

$79.37 is the Fixed Range POC

$75.00 held during the September selloff and may very well get tested once again.

Hopefully we have seen a over reaction on what was already a negative environment.

$DKNG | #DraftKings - insiders fuel 30% decline.

Selling continues and the stock is now down 30% from its highs.

Insiders have dumped millions of shares in recent days to

compound the misery on retail traders.

The 50ma will be touched on Friday in conjunction with the

June Pivot Point , if that fails to ignite a recovery the Fibonacci Gp at

$41.00 is in play.

INSIDER SALES

MURRAY STEVEN JOSEPH Director Oct 09 Sale 50.83 1,545,924 78,579,317

Meckenzie Shalom Director Oct 09 Sale 50.83 6,949,088 353,222,143

Nada Hany M Director Oct 09 Sale 50.83 946,712 48,121,371

Salter John S. Director Oct 09 Sale 50.83 4,972,572 252,755,835

Moore Ryan R Director Oct 09 Sale 50.83 1,000,000 50,830,000

$AMZN | Key Support Holds For #Amazon

What was previous resistance held today as support.

We have the rising channel trendline & the Fibonacci .618 zone.

If those levels give up $322o is in play.

Above $3364 is a possible level to consider a entry, but care is

needed as the media and politicians are hunting big tech once again.

Inclusion in so many ETFS means 1 hurts all.

$CLKA | Low-Float #Luxury #Retail Play With Massive Upside Potential

Clikia Corp. (STOCK: CLKA)

Current Price: $0.85

Chart Analysis

Barchart.com Rating: BUY

Recent News

About Clikia Corp.

Clikia Corp. Stock: CLKA is an emerging leader in the global custom luxury goods marketplace.

The Next Big Name In Luxury Retail

In April 2020, our company experienced a change in control, pursuant to which Mr. Anil Idnani became our controlling shareholder and sole officer and director. Following such change-in-control transaction, in May 2020, we acquired all of the assets, including the going business, of Maison Luxe, LLC, a Delaware limited liability. Our wholly-owned subsidiary, Maison Luxe, Inc. , a Wyoming corporation, now owns the acquired assets and operates the acquired business of Maison Luxe, LLC. Currently, this constitutes the entirety of our company’s business operations. Our company’s newly elected sole officer and director, Mr. Anil Idnani, founded the recently acquired Maison Luxe business with the vision of offering highly desired luxury retail consumer items that are responsibly sourced and affordable to the end customer. Because of the dynamics and structure with the luxury retail industry, customers who desire luxury items are unable to avail themselves of such items, due to the unreliable nature of sellers and exorbitant prices. It is this void in the marketplace that Mr. Idnani identified as a business opportunity and established Maison Luxe to provide customers with the experience of purchasing luxury items as a standard. The business known as “Maison Luxe” was founded in January 2020, with the vision of becoming an industry leader in luxury retail. MaisonLuxe focuses its efforts primarily within the fine time pieces and jewelry segments both on a wholesale and B2C (business-to-consumer) basis.

Clikia Corp (STOCK:CLKA) Pivoting & Profiting

Clikia is undergoing a comprehensive pivot into a new marketplace presenting a new strategic vision, fueled by new leadership and a new thesis for driving shareholder value. This new strategic vision is unexplored territory to Clikia Corp and its stakeholders. But it is not new to the Company’s new leadership or the network that leadership has at hand.

We are already harnessing a robust network and extensive experiential assets that come with the bargain in this transition – including a great deal of experience centered in the rare custom luxury goods market. It is a peculiar niche business context with its own rules governing a unique microeconomic landscape.

For example, in the rare custom luxury goods market, traditional supply chains are irrelevant or nonexistent. Luxury purchases happen almost exclusively by appointment through networks inaccessible by normal channels of commerce. People willing to spend $50K on a watch cannot accomplish that transaction on Amazon.com. The watch they want isn’t a click away. It is a relationship away.

As a consequence, the rare custom luxury goods market is actually more resistant to economic cyclicality because the top 0.01% on the global wealth scale generally do not have consumer patterns impacted by the unemployment rate or changes in energy prices. The limiting factor is not demand, but supply.

Hence, the limiting factor for a company in this market space, such as our subsidiary, Maison Luxe, is our ability to produce a consumable supply of extremely high-end luxury goods for those who wish to purchase them and have access to the means to do so, as well as our ability to be the recipient of that interest when it arises. In both cases, we bring to the table network assets that suggest a promising outlook.

Our initial focus has been in the rare custom luxury watch and jewelry market, where we have a pre-built foundation of strong sourcing relationships, which has allowed us to amass very strong topline growth so far in 2020.

As we will confirm, CLKA has already seen seven-figure revenues so far this year, which represents an enormous expansion in sales over the Company’s prior model. And we expect that figure to grow, especially as the global economy reopens.

We have enormous room for growth in terms of both topline performance and margins. As we gain greater purchasing power to acquire goods in volume , we will expand our positioning and network of relationships and simultaneously lower our cost-of-goods-sold, widening margins in everything we do.

We have a number of exciting catalysts in gestation right now, including new wholesale duty-free supplier relationships, additional funding to augment our inventory of luxury goods, data affirming our continued topline growth this summer, and the initial steps toward potential expansion into new luxury goods categories and geographic end markets.

To that end, we have committed ourselves to the task of getting our message out to our current and prospective shareholders and to the public at large with complete transparency.

Clikia Corp (STOCK: CLKA) Establishes Amani Jewelers Subsidiary to Leverage Strong Relationships and Capitalize on the Rapidly Growing Lab-Grown Diamond

Clikia Corp (STOCK: CLKA) has formed a new wholly owned subsidiary, Amani Jeweler, to pursue growth and value creation in the rapidly growing lab-grown diamond marketplace.

Amani has already engaged overseas suppliers to provide samples for chemical vapor deposition lab-grown diamonds (“CVD diamonds”) along with ready-made jewelry. Once those samples have been received by the Company, Amani will make a determination and place a bulk wholesale supply purchase order with a supplier based on that evaluation.

Anil Idnani, CEO of Clikia, commented, “We have strong relationships with several top tier suppliers in the CVD diamond space overseas based on prior dealings, and we believe we will have very advantageous terms on bulk supplies for resale in tennis bracelets, earrings, bands, engagement rings, or anything else that requires big stones. This move will help Clikia begin its expansion into other product categories to significantly raise our total addressable market ceiling.”

Management notes that, once the order is received in the US, the Company plans to market and sell CVD diamond products on its online platform, which is under development. The Company has acquired the AmaniJewelers.com domain as well as the associated Instagram handle to market and sell its CVD diamond products

According to Marketwatch.com, the global lab grown diamond market is expected to flourish at a significant CAGR of 7.4% over coming years, growing into a $27.6 billion market in annual sales by the end of 2023.

High Demand for Synthetic Diamonds in Jewelry Industry

Increasing popularity and demand for synthetic diamond jewelries from price sensitive consumers is expected to drive the growth of the lab grown (synthetic) diamond market. Further, factors such as large scale availability, introduction of colored synthetic diamonds which can be used as gems in jewelry industry and similar appearance of lab grown diamonds as natural diamonds are some of the major growth drivers of lab grown diamonds.

Increasing Adoption of Lab Grown Diamond in End-Use Industries

Massive adoption and wide scale application of lab grown diamond in various end use industries such as electronics and others is one of the key growth drivers of global lab grown diamond market. Additionally, technological advancement in electronic industry is resulting in increased adoption of lab grown diamonds for conductors and wafer substrates due to its cost effectiveness and huge availability. These factors are anticipated to intensify the growth of the lab grown diamond market.

Strong Sales Numbers Paint a Bullish Outlook For Clikia Corp. (STOCK: CLKA)

Clikia Corp. Announces Multiple Large Purchase Orders Through Luxury Travel Retail Partner

The Company recently updated shareholders on sales activity related to the recent partnership between the Company’s wholly owned subsidiary, Maison Luxe, and Signet International Group (“Signet”) (signetinternationalgroup.com), a leading player in marketing and distributing luxury branded products to the cruise ship travel retail industry.

The Company recently completed and shipped an order related to this partnership for one thousand (1,000) luxury timepieces. It has already received another purchase order related to the partnership for another one thousand (1,000) luxury timepieces.

The Company anticipates continued and expanding demand through the channel of its partnership with Signet, and considers the luxury travel retail market to be a promising core long-term facet of its overall strategy in the rare custom luxury goods marketplace.

“While strong sales through this partnership represents only a small fraction of our overall revenue picture for the year, the addition of this channel into the luxury retail space has been, and looks set to continue to be, a big success,” commented Anil Idnani, CEO of Clikia and Founder of Maison Luxe. “Travel retail is a much bigger market opportunity than most people probably understand. Analysts put it above $100 billion in annual sales over coming years. Our target here is the luxury goods piece of that market. And Signet offers an avenue to capitalize on that growth opportunity.”

Clikia Corp (STOCK:CLKA) Subsidiary Maison Luxe Sees Blockbuster Q1. (1.4 Million In Sales)

Clikia Corp. Releases Core Q1 Performance Data for Maison Luxe Subsidiary, with $1.4M in Sales of Rare Luxury Goods

During the three months ended March 31, Maison Luxe booked total revenues of $1,390,725. On a gross basis, the Company saw profits during the quarter of $69,010, with net income (after fees, charges, and basic supplies) of $65,268.The Company also finished the quarter with total assets above $320K, mostly driven by accounts receivable and a limited strategic inventory of luxury goods on hand for future distribution.Anil Idnani, Clikia CEO and Founder of Maison Luxe, commented, “Q1 trends were strong. And we see continued strong growth ahead during the second half of the year. As recently announced, we are gaining traction with duty-free distributors and improving our market positioning and asset productivity with the establishment of a larger strategic inventory. We are also working on expansion through product category and geographic steps, and we look forward to providing further details on those themes in coming communications.”

Clikia Corp. (STOCK:CLKA) Filling An Important Need

Clikia Corp. Announces Luxury Goods Distribution Deal with AK and USVI Duty-Free Outlets, Initial $300k+ in Related Sales

The Company’s wholly owned subsidiary, Maison Luxe, has forged relationships with four (4) individual duty-free sellers, which have already made aggregate purchases in excess of $300,000 in custom luxury timepieces from the Company. These are ongoing distribution relationships.

The sellers are located in duty-free ports in Alaska, the US Virgin Islands, and Colorado. The Company is currently in talks to expand both in terms of volume of timepieces and in product category, to include fine jewelry. Management believes the establishment of additional funding will allow the Company to expand its own inventory and widen margins through volume sourcing, where possible. This will open up access to additional duty-free sellers in ports where the Company has already established relationships and a reputation for credibility, quality, and reliability.

“The idea is to grow a brand that sources retail markets with responsibly sourced and priced watches,” remarked Anil Idnani, CEO of Clikia and Founder of Maison Luxe. “That’s typically nearly impossible to find. This is now more the case than ever due to a supply shock as factories shut down or halt production of luxury goods. However, demand hasn’t dropped at all this year despite the health crisis and resulting economic turbulence. The result is rising prices on inventory we have in-house.”

According to Statista, in 2018, the global duty-free and travel retail sales market did approximately $76 billion in total sales. That number is expected to grow to more than $125 billion by 2023.

As discussed above, the Company has already booked over $300,000 in sales from these relationships, which represents just a small fraction of the Company’s overall sales so far in 2020. But management anticipates continued and growing orders and sales through this network of relationships, as well as the establishment of additional distribution relationships, during the second half of the year.

CLKA's Chart Showing Strong Bullish Uptrend

Bullish Technical Indicators

Strong bullish uptrend

Stock has reclaimed the 7 & 20 MA's as support, signaling a bullish swing in momentum

Histogram rising & MACD crossover complete

Bullish crossover & reversed into uptrend

The Bullish Case For Clikia Corp. (STOCK:CLKA)

Substantial Market Opportunity

According to Statista, in 2018, the global duty-free and travel retail sales market did approximately $76 billion in total sales. That number is expected to grow to more than $125 billion by 2023.

According to Marketwatch.com, the global lab grown diamond market is expected to flourish at a significant CAGR of 7.4% over coming years, growing into a $27.6 billion market in annual sales by the end of 2023.

Subsidiary Maison Luxe Sees Blockbuster Q1. (1.4 Million In Sales)

Rated BUY On Barchart.com

The Bottom Line:

CLKA has already seen seven-figure revenues so far this year, which represents an enormous expansion in sales over the Company’s prior model. And we expect that figure to grow, especially as the global economy reopens.

We are anticipating a huge move CLKA this week, and suggest that you add it to your watchlist and consider building a position.

By Viewing this Content, you Agree that you Have Read and are in Full Understanding of both our Disclaimer & Privacy Policy(*Remember to use a Stop-Loss Order to protect your gains, as well as limit possible losses.)

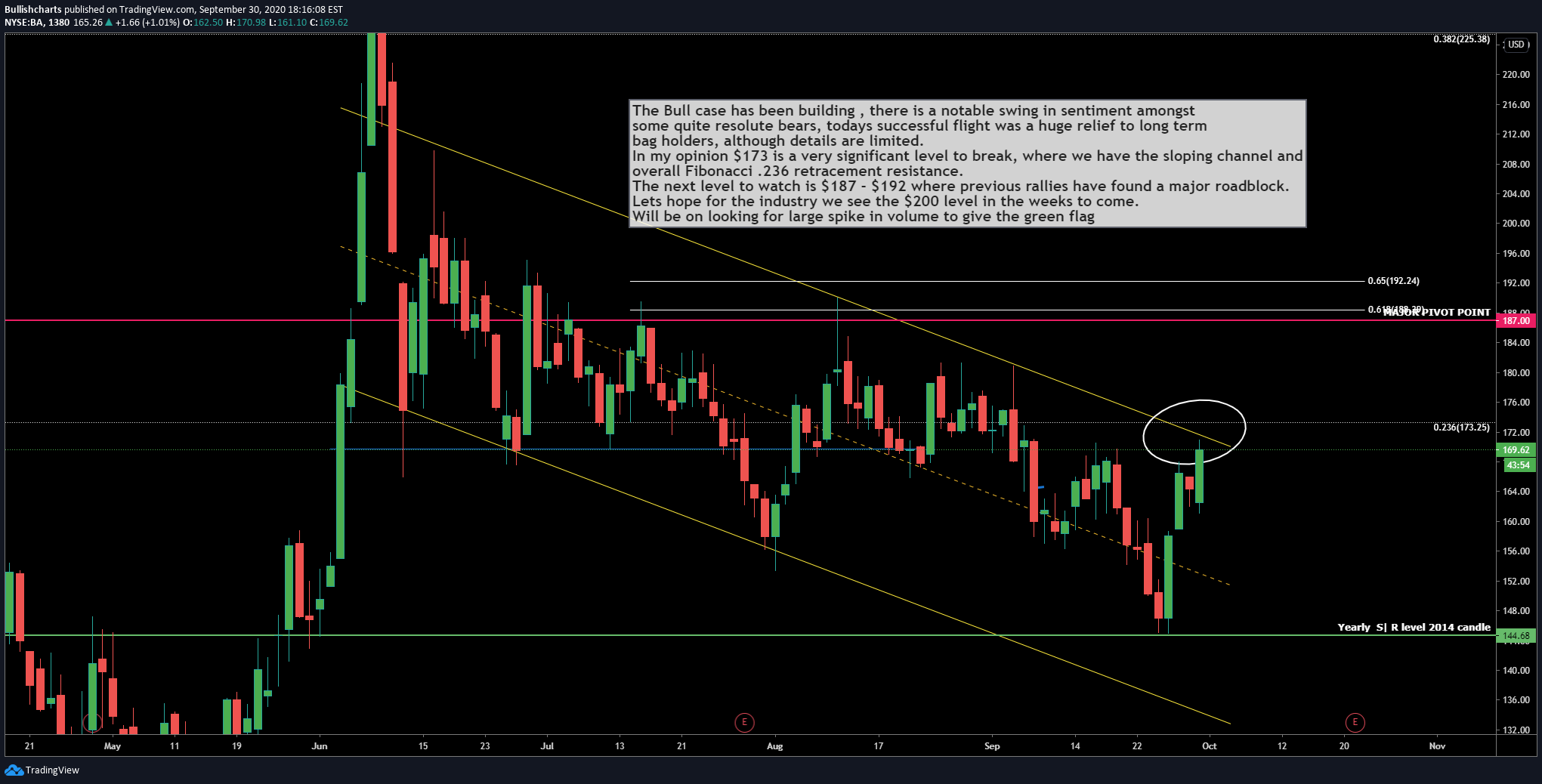

$BA | #Boeing Bears May Need To Jump Soon.

The Bull case has been building , there is a notable swing in sentiment amongst

some quite resolute bears, todays successful flight was a huge relief to long term

bag holders, although details are limited.

In my opinion $173 is a very significant level to break, where we have the sloping channel and

overall Fibonacci .236 retracement resistance.

The next level to watch is $187 - $192 where previous rallies have found a major roadblock.

Lets hope for the industry we see the $200 level in the weeks to come.

Will be on looking for large spike in volume to give the green flag.

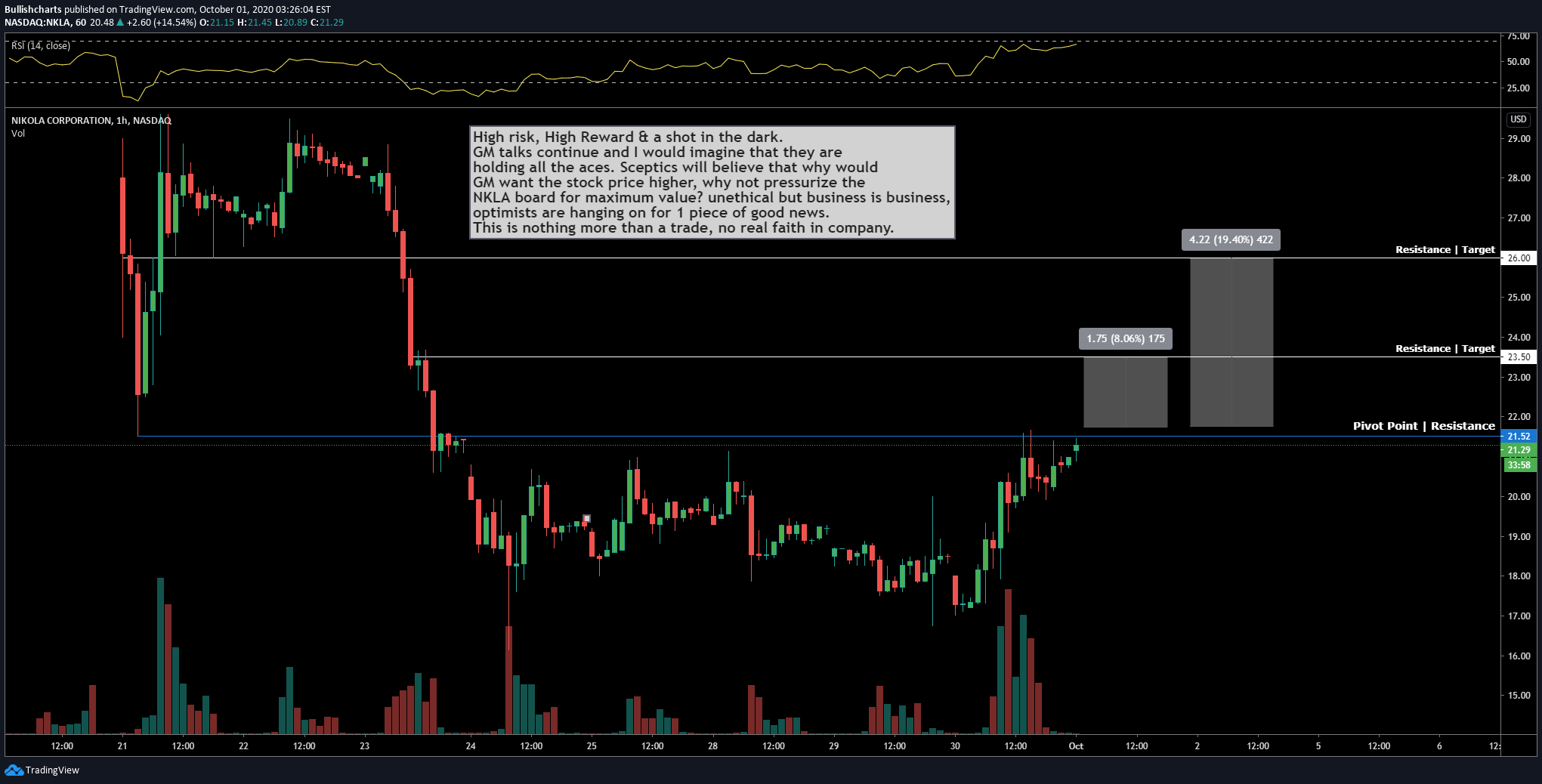

$NKLA - Potential Break Above Pivot #Nikola

High risk, High Reward & a shot in the dark.

GM talks continue and I would imagine that they are

holding all the aces. Sceptics will believe that why would

GM want the stock price higher, why not pressurize the

NKLA board for maximum value? unethical but business is business,

optimists are hanging on for 1 piece of good news.

This is nothing more than a trade, no real faith in company.

$FERL - Low Float Bottomed Chart Bounce Play

Fearless Films, Inc. (OTCQB: FERL)

Alert Price: $0.0394

Float: 18.65M

Technical Analysis

Fearless Films, Inc. (OTCQB: FERL) should be at the top of your trading screen!

The company could become a big name in streaming content, and currently the stock is trading at less than 4 cents per share.

FERL is an independent full-service production company is the branchild of award-winning actor/ producer Victor Altomare along with award-winning writer and director Goran Kalezic.

The service scope specializes in short film and feature film production in addition to script writing, copywriting, fulfillment and distribution.

All work created by the company is a unique idea, embodied in the life by talented operators, editors and designers. The company can also realize any task associated with video production.

Movie fans will recognize Victor from the Great Chameleon, Graveyard Story and the Last King. On television you may have seen him in series such as the My Cicco show, Blue murder or documentaries such as Mob Stories, to name a few.

Highlights of Victor's voice talent credits include the acclaimed Resident Evil: Outbreak series, including Resident Evil: Outbreak file # 2.

Streaming is a sector that has been seeing impressive growth due to the coronavirus pandemic. As more people stay at home, the televisions are turned on and many are watching streaming services.

The Bullish Case For FERL

The linear to streaming TV pivot was already happening at a robust pace globally before the novel coronavirus pandemic emerged. This pandemic has just accelerated an already strong trend, which will persist long after the pandemic dies down.

There remains ample room for streaming TV adoption rates to grow. Today, only about 25% of all internet households globally are subscribed to a streaming TV service. By comparison, the U.S. streaming TV household penetration rate is close to 100%. That 75 points of separation implies a huge global growth opportunity for streaming service providers.

Almost 70% of U.S. households still pay for pay-TV. That number will drop to zero over time. As it does, that implies a huge opportunity for incumbent streaming services to raise prices, and new streaming services to gain traction.

Streaming TV services are subscription services, meaning the Covid-19 demand surge doesn’t just equal a one-time boost in one-off sales. It equates to a multi-year boost in annually recurring revenues.

The World Is Streaming More Than Ever Now!

According to a study conducted by OnePoll on behalf of Tubi, which surveyed 2,000 Americans with access to a streaming service, the average person is now streaming eight hours of content per day!

COVID-19 has also helped Netflix sail to over $500 a share and the streaming giant has been reporting record subscriber growth.

Companies like Netflix as well as Amazon and Hulu are spending upwards of $40 billion towards new original content, creating massive opportunities for companies like FERL to meet the demand of these industry powerhouses.

FERL announced at the end of June that it has closed a non-brokered private placement offering of up to 6,666,668 shares priced at $0.15 per common share for gross proceeds of $1M!

The proceeds of the Offering will be used to support the operations of the company, including brand building and film production. FERL plans to begin production on its next film during this year!

CEO Victor Altomare has stated, "The growth of streaming media has created rising demand for quality entertainment properties. Fearless Films was founded with the idea of producing quality entertainment with project budgets under $6 million. The Great Chameleon is an example of this strategy in action. We plan to advance a number of new projects that are promising and designed to meet the needs of new-era film distribution platforms."

It was in April that FERL confirmed its ownership of full rights to The Great Chameleon and it is the first production by Fearless Films. This film forms the cornerstone of the Company's library of intellectual property!

With a stellar rating on IMDB, The Great Chameleon is a bawdy comedy with dramatic overtones in which the FBI secretly releases master of disguise con man Joe Murky (Victor Altomare) from prison to track down his abducted niece.

With the assistance of his long-time cohort and eccentric make-up artist Max; Joe Murky, aka: Great Chameleon will reach into his whole bag of tricks with his off-the-wall style of disguises as he nears his target. All the while, Murky is hampered by the overzealous parole officer Curry, who has a personal vendetta against him. The Great Chameleon is a crime story with plentiful laughs, and a fun-to-watch experience.

The film has streaming distribution through Amazon Video (UK) and is also available for rent or purchase on Amazon Video, along with Google Play, iTunes, YouTube, and Microsoft XBox platforms. Imageworks Entertainment International, the agent for the film, recently obtained US distribution via Amazon US.

The Great Chameleon is now available on a number of streaming platforms. It is available on Amazon US and UK, Google YouTube, Xbox and iTunes.

It was in the fall of 2019 that FERL signed a Letter of Intent with Altomare to acquire the rights to up to twelve movies from a library held by Altomare, who is also the President of Fearless Canada, the Company's operating subsidiary.

Under the terms of the LOI, the acquisition price and consideration for each film will be negotiated separately and payable in cash and shares of the Company, subject to negotiation of the Definitive Agreements and the obtention of mutually satisfactory independent appraisals of the value of each film.

FERL recently completed an agreement to acquire Only Minutes, a significant addition to the company's growing library of media titles!

Only Minutes was written and directed by Goran Kalezic. The movie premiered at the Fort Lauderdale International film festival where it was the winner of the Critic's Choice award. It has also been featured in the Hollywood Film Festival.

Goran Kalezic is a writer and director, known for Only Minutes, The Great Chameleon (2012), The Bartender (2005) Audience Favoured at Indyfest and Bag the Wolf (2000). He is also the author of Dostoevsky's Anarchists: A Screenplay Adaptation of Dostoevsky's Demons (2018).

Only Minutes is a story about a man attempting to exact revenge on his bank. Its cast includes Victoria Snow, known for her work on In The Dark (2019), Incorporated (2016) and Slasher (2016); Lazar Rockwood, known for Witchblade (2000 and 2001) and Antigone (2012); and Peter Schindelhauer, known for his work on X-Men (2000), RoboCop (2014) and X-Men: Dark Phoenix (2019).

The Company has agreed to acquire the film in an all-stock transaction which is expected to close during the third quarter of 2020.

The film will join The Great Chameleon and The Lunatic as part of the Company's growing content library and complements the company's strategy of building an inventory of high-quality films that will be supplemented with new in-house productions.

It was earlier in June that FERL announced that it had completed an agreement to acquire the acclaimed The Lunatic, a film whose rights were held by Mr. Altomare.

The Lunatic was produced by Victor Altomare and directed by Robert Longo. The movie premiered at the Montreal Film festival as an official selection, won the bronze award in Houston Film Festival, and was also awarded at the Yorkton Short Film Video festival.

The Lunatic stars Victor Altomare, who portrays a murderer who feigns insanity in order to avoid electrocution, along with Lazar Rockwood (known for Witchblade and Antigone), Jennifer Dale (received Earle Grey Award recognizing her lifetime achievements in the Canadian entertainment industry), and boxing great George Chuvalo (who twice fought against Muhammad Ali for the heavyweight championship).

FERL also announced recently that it is in discussion with a significant Los Angeles-based film production company to partner on the production of scripts.

This production partnership will be of great benefit in sourcing locations, talent and facilities due to their long experience in film production. These discussions are preliminary and will require formal contracts once agreement has been reached on final details.

Mr. Altomare stated, "Fearless Films was founded with the idea of producing quality entertainment with project budgets under $6 million. Partnering on the development of scripts is a logical next step for the Company as it allows our creative content to reach market sooner than if we had gone it alone."

FERL has additionally announced in June that it has acquired FilmOla.com to add additional revenue and distribution.

FilmOla is an online marketplace where content is showcased and updated instantly to a trusted global community of viewers, reaching new audiences and new markets 24/7.

The platform is also launching an online- social media platform for film and movie junkies to connect. FilmOla earns revenue from advertising and online affiliate programs. FilmOla leverages affiliate marketing to drive revenue to the media channel by connecting viewers interested in film and movie content.

EMarketer forecasts that cord-cutting will grow to 76 million households in 2023 from 46 million in 2019. The company also suggests that pay-TV household numbers will fall from 86.5 million last year to 72.7 million households in 2023.

According to nocable. org , in 2018, there were almost 171 million subscriptions to streaming services, which increased by 6.9% in 2019 to 182.5 million. OTT services such as Netflix , Hulu, Youtube TV and Sling lead the way here and are still expected to headline a list of streaming services that will net a total 191.5 million subscribers in 2020.

How big has the streaming market become? Streaming device maker Roku went bonkers last year and skyrocketed nearly 400%!

There is plenty of interest in online viewing and the proof is in the pudding with Roku's performance in 2019.

More and more people are saying goodbye to their expensive cable bills and are cutting the cord and signing up for streaming services.

The global entertainment market — consisting of theatrical and home entertainment — has surpassed $100 billion in revenues for the first time in history, with earnings reaching $101 billion in 2019, according to a new report released by the Motion Picture Association.

FERL announced that it has negotiated an agreement for the extinguishment of its 2019 Convertible Note from the holder of the Note. The transaction is contingent on the Company delivering shares to the holder. If fully executed, the transaction will extinguish all of the remaining $76,500 in debt related to the Note.

"We negotiated this agreement as a means of reducing future potential dilution from the Convertible Note. We believe that this will provide the Company with the flexibility to raise new equity capital at potentially more beneficial terms, allowing us to continue to support our film production and media library expansion where we believe that shareholder value is ultimately created" stated Victor Altomare, CEO .

FERL also said this month that it will apply to list its share on a stock exchange in Canada, in addition to its current listing on the OTCQB market.

The Company has decided to take this step to access a wider pool of capital as well as to increase liquidity options for its shareholders.

FERL's Recent Developments Could Spark A Bullish Reversal

Acquired the film script Dead Bounty, another significant addition to the company's growing portfolio of films and intellectual property

Announced that it will be applying to list its shares on a stock exchange in Canada, in addition to its current listing on the OTCQB market. The Company has decided to take this step to access a wider pool of capital as well as to increase liquidity options for its shareholders.

Closed a private placement at $0.15, which is about 50% away from where it sits now and a 22% premium to the Company's 20-day volume-weighted average trading price. That’s a strong statement buy the investors behind this money.

Agreed to acquire the award winning film Only Minutes, a significant addition to the company's growing library of media titles in an all-stock transaction. The purchase price was not revealed. The transaction is expected to close during the third quarter of 2020.

Acquired FilmOla.com to add additional revenue and distribution. FilmOla is set to capitalize on the global movie and film industry; the global entertainment market hit $100 billion for the first time in 2019 as streaming kept making huge gains, according to the Motion Picture Association's annual snapshot.

FERL Could See A Nice Bounce From Here

Based on our very own technical analysis , we the potential for a big move from these levels.

Bullish Indicators

Stochastic bottomed and reversal imminent

Momentum remains in strong uptrend

Bullish divergence

The Bottom Line

Streaming is a monstrous arena that gives FERL a massive market to cater to!

The upside is almost too big to ignore!

Start your research on the company right away at: www.fearlessent.com

Millions upon millions of people are streaming and FERL is aiming to capitalize! By Viewing this Content, you Agree that you Have Read and are in Full Understanding of both our Disclaimer & Privacy Policy(*Remember to use a Stop-Loss Order to protect your gains, as well as limit possible losses.)

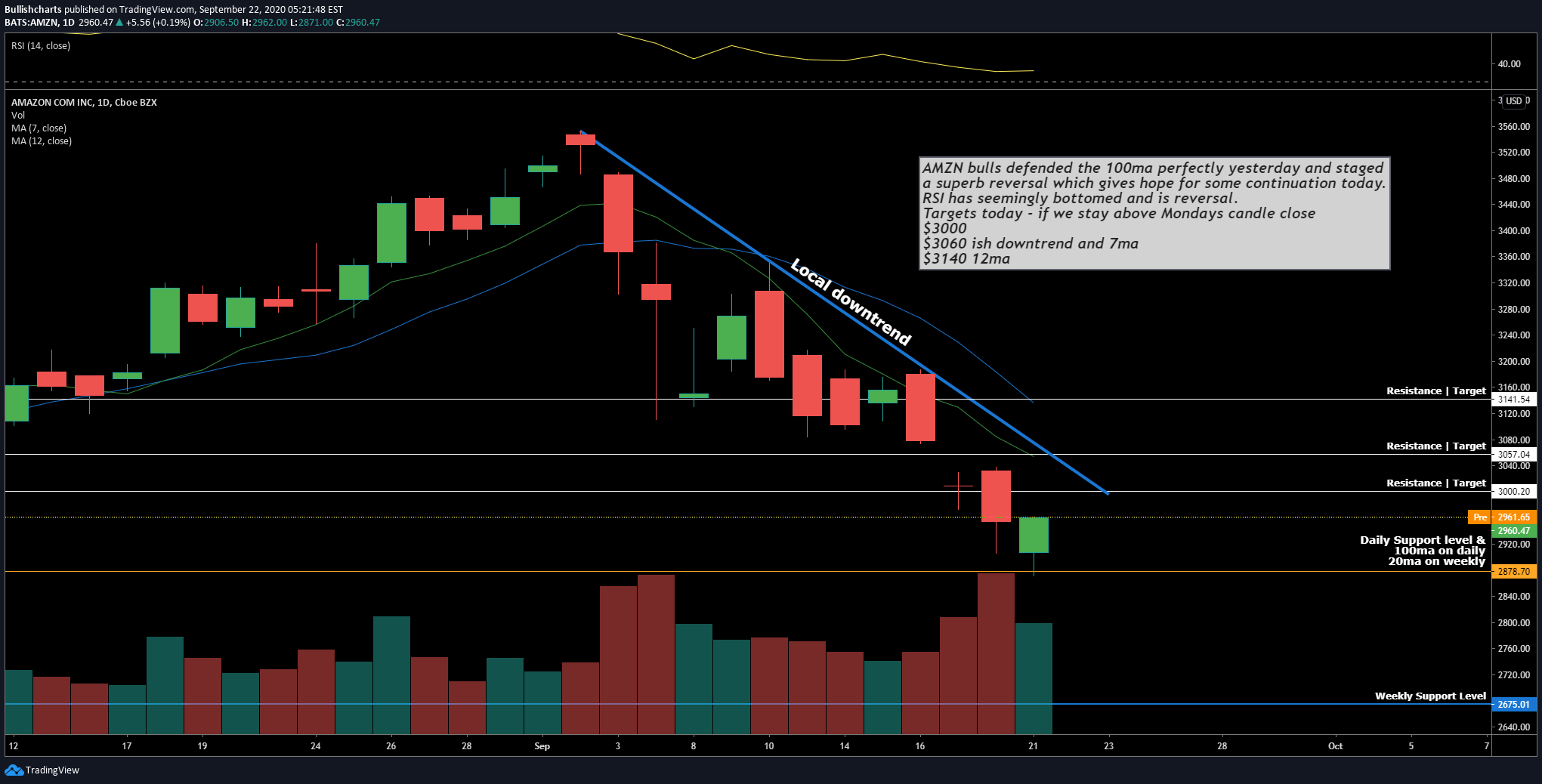

$AMZN | #Amazon Reversal Trade Targets

AMZN bulls defended the 100ma perfectly yesterday and staged

a superb reversal which gives hope for some continuation today.

RSI has seemingly bottomed and is reversal.

Targets today - if we stay above Mondays candle close

$3000

$3060 ish downtrend and 7ma

$3140 12ma

$ROKU Breakout Targets

Shorts once again got caught on the wrong side of the trade on Monday

as the company announced the contract with Comcast.

Still over 7% in short interest can add more fuel as momentum and possible

upgrades in the days to come entice new investors.

It is never plain sailing in this stock so you have to be prepared for considerable pullback.

Targets to consider for continuation.

$200 - Key psychological target| resistance

$208- Fibonacci levels in confluence

$249 - Longer term breakout to Fibonacci resistance

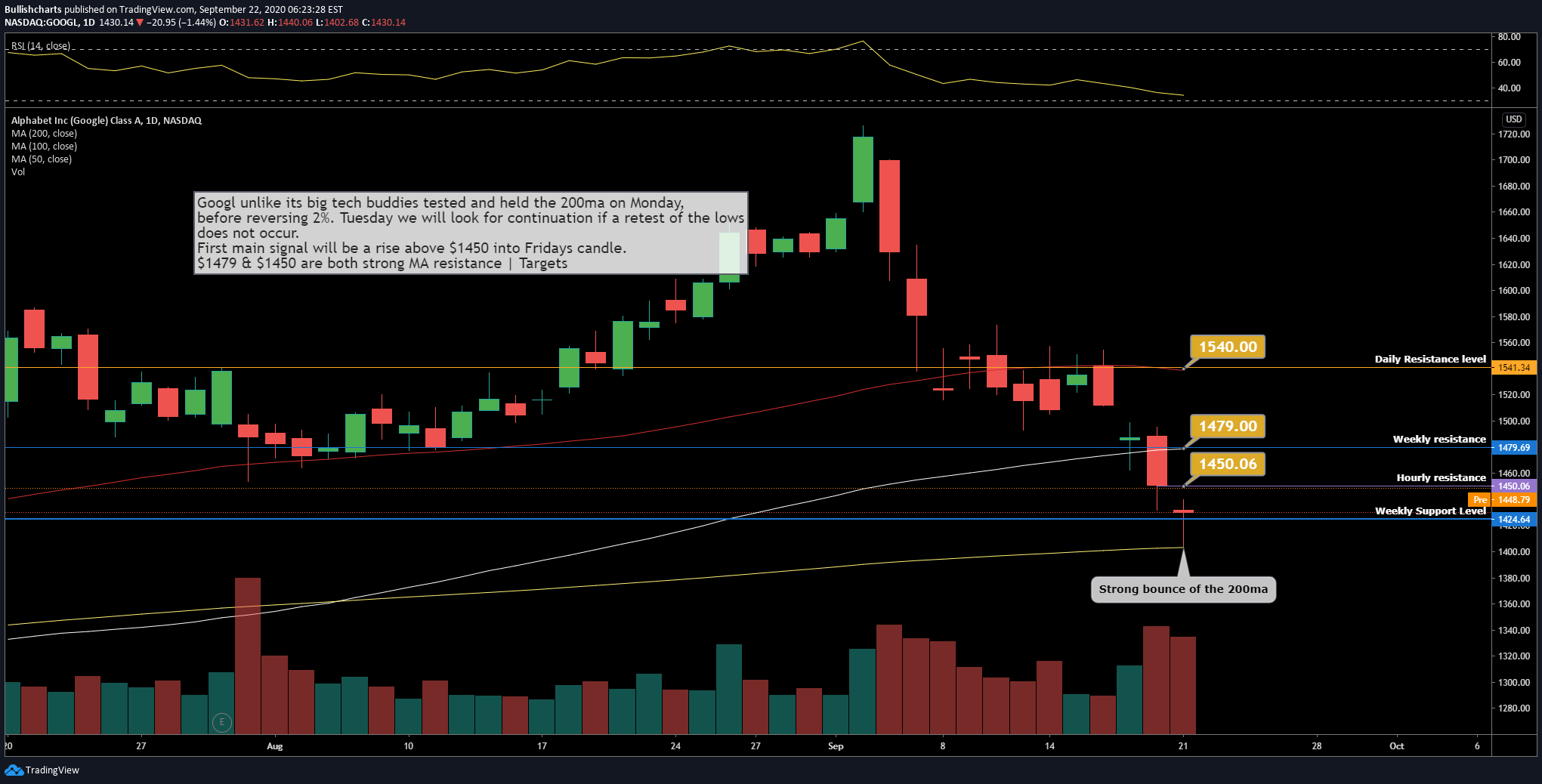

$GOOGL | #Google & Fang Stocks Back in Favor

Googl unlike its big tech buddies tested and held the 200ma on Monday,

before reversing 2%. Tuesday we will look for continuation if a retest of the lows

does not occur.

First main signal will be a rise above $1450 into Fridays candle.

$1479 & $1450 are both strong MA resistance | Targets

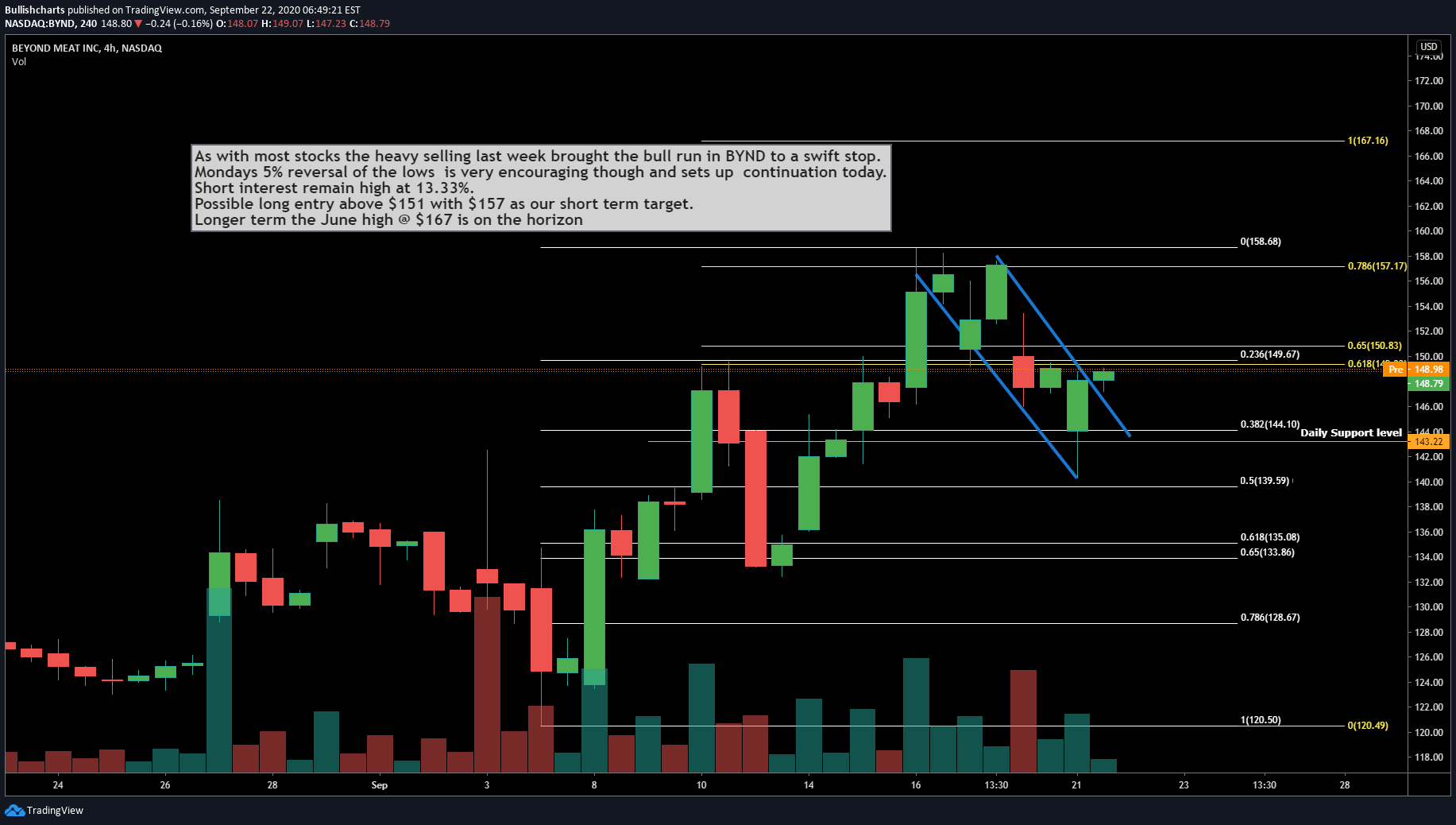

$BYND | Long Above $151 In #BeyondMeat

As with most stocks the heavy selling last week brought the bull run in BYND to a swift stop.

Mondays 5% reversal of the lows is very encouraging though and sets up continuation today.

Short interest remain high at 13.33%.

Possible long entry above $151 with $157 as our short term target.

Longer term the June high @ $167 is on the horizon

$PAOG | #Goldman #SmallCap #Research Gives $0.015 PT +350% Upside #PAOGroup

PAO Group Inc .

(STOCK: PAOG )

Current Price: $0.0031

Goldman Small Cap Research Price Target:

$0.015

Float: 620M

About The Company

PAO Group , Inc. is an emerging cannabis and CBD company targeting growth via two tracks. The Company is in the early stages of developing a cannabis extract-based therapy to treat various respiratory diseases and illnesses, PAOG also owns a growing cannabis cultivation operation focused on hemp cultivation.

Investment Highlights:

Conclusion: PAO Group currently trades above its 50-day and 200 day moving averages. This bullish status, along with its recently updated financials reporting, should prompt the shares to reach new levels. Moreover, a review of the financials lends us greater confidence in the Company’s R&D financing capabilities and the achievement of key milestones. Thus, we have now introduced a 12-month target of $0.015, a nearly 5x return from current levels

Future Developments: This emerging CBD Pharma company is set to evolve from a promising preclinical firm toward a Phase I development path entity. PAOG has multiple shots on goal as it seeks to treat two major respiratory diseases that each represent billions in potential market sizes.

Next steps include engaging a CRO to initiate the process for potential FDA approval of RespRx, its COPD treatment, representing an estimated $14.1B market by 2025. We expect this application to be fast-tracked, given that the use of CBDs to treat this disease is novel and based on a natural (and likely safer) product.

Price Target/ Higher Valuation: By running concurrent development programs resulting in two IND filings within the next year, we believe that such events could support a $20M valuation, or a $0.015 price target. This targeted valuation is in line with IND-filling stocks. Moreover, with no long term debt on the books, PAOG has significant funding flexibility to continue on its R&D paths.

The Bullish Case For PAOG

Substantial Multi-Billion Dollar Market Opportunity

This emerging CBD Pharma company is set to evolve from a promising preclinical firm toward a Phase I development path entity. PAOG has multiple shots on goal as it seeks to treat two major respiratory diseases that each represent billions in potential market sizes.

Market analyst Goldman Small Cap Research slapped on a 12-month target of $0.015, a nearly 5x return from current levels.

The Bottom Line:

PAO Group currently trades above its 50-day and 200 day moving averages. This bullish status, along with its recently updated financials reporting, should prompt the shares to reach new levels. Moreover, a review of the financials lends us greater confidence in the Company’s R&D financing capabilities and the achievement of key milestones.

This emerging CBD Pharma company is set to evolve from a promising preclinical firm toward a Phase I development path entity. PAOG has multiple shots on goal as it seeks to treat two major respiratory diseases that each represent billions in potential market sizes.

By running concurrent development programs resulting in two IND filings within the next year, we believe that such events could support a $20M valuation, or a $0.015 price target.

If you’re looking for a growth/ground floor opportunity in the multi-billion dollar CBD sector, PAOG if the opportunity you've been waiting for!By Viewing this Content, you Agree that you Have Read and are in Full Understanding of both our Disclaimer & Privacy Policy(*Remember to use a Stop-Loss Order to protect your gains, as well as limit possible losses.)

$CRWD | #Crowdstrike Chart Review

CRWD has retraced to the local Fib Golden pocket and has had a small unconvincing bounce.

20ma momentum indicator remains as vital support.

Bulls need to reclaim the $132 level as support.

Bears will look to break $124 setting up a test of $117-$114 once again for support.

Indicators remain bearish

Valuation is a issue.

$DOCU | #DocuSign #Bulls Should Be Concerned

Not a good close on Friday for DOCU , volume actually increased as selling supply was high.

Strong rejection off the 50ma.

Support levels to watch on Monday

$196.45 is weekly horizontal support

$191.00 is major volume shelf support, below

that level and capitulation is on the cards

For the optimists the 50ma must be reclaimed.

$LEN | #Lennar Corp Long into Earnings

Lennar is Bullish coming into earnings .

Stock has back-tested the breakout level as support and bounced on high volume .

20ma is also now support.

Longs into earnings have defined risk at $71.00

Possible upside targets $85-$88

Daily Chart Analysis on NYSE & NASDAQ

$NVDA | #Nvidia - Weekly Chart Review

Decisive week ahead for NVDA , speculation that the deal to buy ARM is almost done,

may bring some much needed momentum.

Bulls need to hold $468 and reclaim the 20ma and $505.

Stochastic does look to have bottomed while the

RSI is sitting on long term uptrend support.

If market remains bearish expect the 50ma to get tested.

$APT | #AlphaProTech Potential Reversal

Potential reversal opportunity in APT .

Indicators have bottomed and in reversal

Volume increasing.

20ma now resistance, alert set for break above.

Potential targets

-$16.00 100ma & horizontal resistance

-$17.50

Downside support at the 200ma.

Volatile and speculative stock so care needed.

| Volume | |

| Day Range: | |

| Bid Price | |

| Ask Price | |

| Last Trade Time: |