Register for free to join our community of investors and share your ideas. You will also get access to streaming quotes, interactive charts, trades, portfolio, live options flow and more tools.

$BRSE leadership coming through on everything they have promised , slow and steady progress.

$BRSE @BRSE_News Partnership with @DeliverZero will help bring an end to a solvable problem causing havoc on the environment and the bottom line of many Restaurants with very thin margins https://t.co/yz64IQSkuyhttps://t.co/r9WN8MX6A0$GRUB $DASH $NVDA #stockmarketअभ्यास…

— John Equi (@equijohn) June 23, 2024

$BRSE Progress this year

Acquisition complete ✅

Pink Current restored ✅

OTC Verified Profile ✅

Partnership with DeliverZero✅

One million orders reached ✅

25 Million in Sales reached ✅

New website launched ✅

Shell risk on OTC removed ✅

2024 has seen a great deal of progress , excited to see what happens next as the company continues to move towards the Uplist states in the press releases.

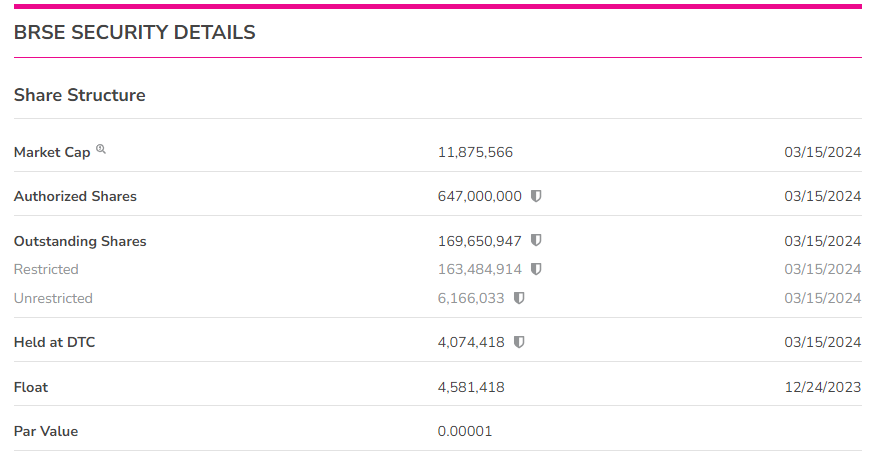

Float and free trading shares remains in tact as Restricted shares locked for years

Float 4,581,418

#smallcap $BRSE so far in 2024

— John Equi (@equijohn) June 24, 2024

Acquisition complete ✅

Pink current restored ✅

OTC Verified Profile ✅

Shell Risk Removed ✅

Strategic Partnership with @DeliverZero ✅

1 Million Orders reached ✅

25 Million in revenues reached ✅ @BRSE_News has achieved a great deal in…

Impressive Strategic Partner as $BRSE continues to make moves with an end goal of being an Uplist to the NYSE

https://www.linkedin.com/posts/deliverzero_broadside-enterprises-and-deliverzero-partner-activity-7209606885665050625-83s3?utm_source=share&utm_medium=member_android

$BRSE continuing to build a business , no long Shell or Shell risk on OTC , with Verified Profile which is a requirement for an Uplist .

Slow and steady progress

Broadside Enterprises, Inc. (OTC:BRSE) and DeliverZero Team Up to Tackle Food Delivery Waste https://t.co/JSZzVO9hOT $brse

— Broadside Enterprises, Inc. (OTC:BRSE) (@BRSE_News) June 20, 2024

The loss is upsetting , the executives should defer compensation until they can prove to be profitable

NET INCOME (LOSS) $ (133,079)

Not bad for a "company" that has had business activities for about 4 years now?

Had several locations (?) now 2 is it?

Previous customer reports were that the food was quite expensive, many were confused about looking for "burger bitch" or 'stoned & hungry" and ending up at Billingsley's..

How is the lawsuit coming along?

Need the company to create awareness on these things , tree falling in the forest

And OTC removed shell risk.

1st quarter shows 536k in revenue. Starting out pretty good :)

$BRSE

Pink Current ✅

Verified Profile ✅

Verified Transfer Agent ✅

New website launched ✅

New LinkedIn profile page ✅

Float the same 4,581,418✅

Most shares restricted, not effecting the OS or Float ✅

Now that the company is pink current , I expect the rest of January's PR to come to fruition , including the uplisting to the OTCQB

Roaring Kitty should take a look at $BRSE Digital Hospitality AI based platform , incredibly low float, only 4,581,418

— John Equi (@equijohn) May 13, 2024

Pink Current , verified Profile , Verified Transfer agenthttps://t.co/vrsGPTVLY6https://t.co/k7zZ0wOiLEhttps://t.co/YULk8qzcit$GME $IGPK $NSAV $FNMA $CLNV pic.twitter.com/VKkZ34Euyn

$BRSE checking boxes , next update expected soon

$BRSE expecting updates on progress. Filings posted , news updated on OTC Markets Website , Pink Current restored , Verified Profile , Verified Transfer Agent , float still the best on the OTC for stocks trading under $1.00 a share at 4,581,418https://t.co/dmXMOS4TGG pic.twitter.com/hfw0DEezDA

— John Equi (@equijohn) May 7, 2024

$BRSE now pink current , would expect a shareholder update soon

Again , with the shares issued to multiple insiders , the only way they make money is to create a real business and increase the Price per share , they need that cookie jar full.

Also, those issues shares are restricted and won't be available to trade for quite some time

Float only 4,581,418

You make some good points

I would say nobody is selling either , so with a float so low , if nobody is selling , won't be any shares for the aforementioned to buy , thus a stalemate until the leadership can show it's more then just a pipe dream and that they actually have a plan to make a real company

Time will tell , but all those cookies in the cookie jar will be worthless to them if they can't make a real company

Lots of hands in the cookie jar yet nobody is buying it..

no bothers sisters uncles cousins family friends nada..

I wonder why not?

Only 2 locations many less than they thought they had last time I was here.

Potential Engine LLC newer created and did some shuffle of other companies around in or whatever.. Produced some dramatical garb.. and some pipe dreams..

The acquisition wasn't finalized until this year 2024 , new company and yes nobody is happy about the new shares , but even so not bad for an OTC company. And those shares will be restricted , Float and free trading shares remain under 7 million.

Will also be pink current by the end of the week which you said wouldn't happen

Besides a share printing press and Net Income: The Company recorded a Net Loss of $37,706 for the year ended December 31, 2023.

What is so great about it? And whether or not it will turn into a perpetual dilution machine would be the next question. Lots of hands in the cookie jar.

Authorized Shares

647,000,000

04/29/2024

Outstanding Shares

169,650,947

04/29/2024

Restricted

163,484,914

04/29/2024

Unrestricted

6,166,033

04/29/2024

Held at DTC

4,074,418

04/29/2024

Float

4,581,418

12/24/2023

Par Value

0.00001

Filings complete

Attorney letters filed

OTC Verified Profile

Real business

Confirmed revenues

Float 4,581,418

Shares under .07 , the best value on the OTC right now

$BRSE May could be the last month to get shares under .10

— John Equi (@equijohn) April 30, 2024

Verified profile indicating an Uplist soon , filings complete , attorney letters submitted

Real company , real revenues , real plan for the future

All that's left is for investors to get eyes on the low float gem… pic.twitter.com/PeKYR8AmM7

$BRSE under .10 is a great entry Point IMO , setting up for a other run after it's recent Acquisition

$BRSE Fresh gem, another really good one to watch out for

— Stock Picks NYC (@StockPicksNYC) April 8, 2024

•Change of control

•Alan Moore, Cheebo owner appointed as CEO

•Cheebo growing restaurant chain

•Aggressive marketing, even on Door $DASH and $GRUB Hub

•Tiny float only 4M held at DTC👀$SHAK $WING $GMPR $IVFH $GRPS… pic.twitter.com/mfb4A5xF9Q

$BRSE Float 4,581,418

Wholly owns the Cheebo Brand along with the newly acquired digital platform

$BRSE Along with the Digital Platform , they own 100% of the Cheebo Brand and dining experience https://t.co/y5omSCDg7K pic.twitter.com/1NJuDtB3Ck

— John Equi (@equijohn) April 4, 2024

$BRSE Float 4,581,418

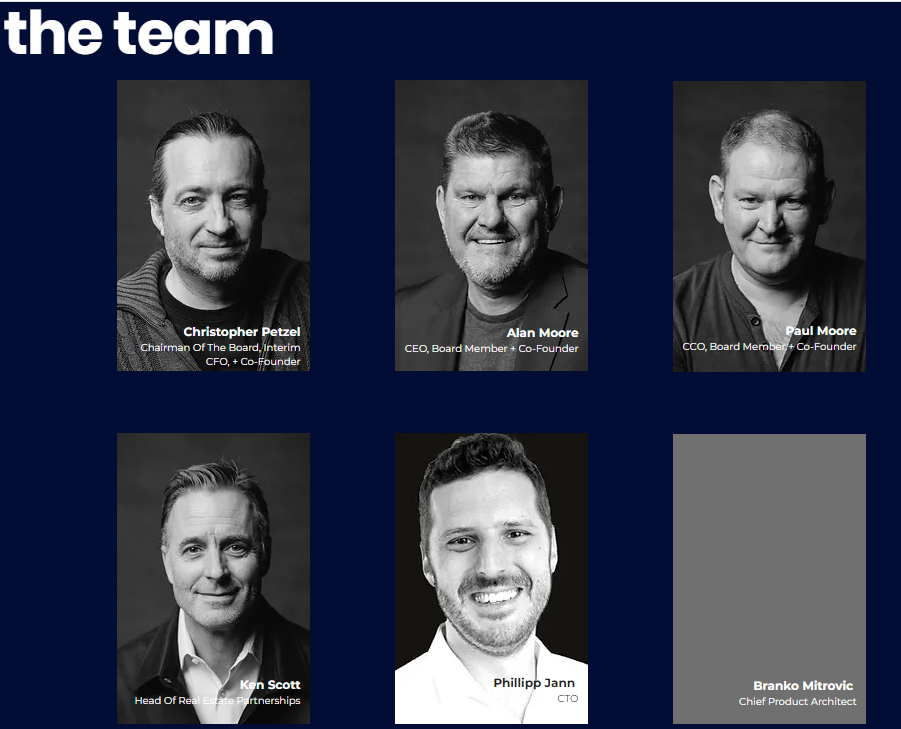

Newly acquired companies , New leadership team which will help with international expansion as they continue to grow the company , journey is just beginning

$BRSE .08 PPS

— John Equi (@equijohn) March 26, 2024

Float 4,581,418

Now unders the Broadside umbrella of companies after acquisitionhttps://t.co/Gzj1TlHZWPhttps://t.co/PpNOdSfhm3

The good news is zero Dilution after the reverse split , almost unheard of in the OTC Markets , seems like they finally got there act together , and have built something real

$BRSE .08 PPS

— John Equi (@equijohn) March 26, 2024

Float 4,581,418

Now unders the Broadside umbrella of companies after acquisitionhttps://t.co/Gzj1TlHZWPhttps://t.co/PpNOdSfhm3

I have held this company for years even after the reverse split

don't have many but this is the first time i have been up.

$BRSE Own of the newly Acquired companies , now falling under the Broadside Enterprises Inc Umbrella of companies

https://www.cheebo.com/

$BRSE Float 4,581,418

Company Leadership continuing to build the business post acquisition.

Alan Moore CEO Broadside Enterprises Incorporated

Calling all SoCal restaurateurs!

Are you in the thick of launching a new restaurant or expanding your existing one? Struggling to secure funding and source essential kitchen equipment and smallwares? We may be able to help with equipment for rent or as your equipment partners! We have already done this for 2 locations in the past month and have 2 more in the pipeline.

If you're based in Southern California and need support bringing your culinary vision to life, don't hesitate to reach out! We'd be happy to discuss how we can help you.

#SoCalRestaurants #RestaurantStartup #EquipmentFinancing #KitchenEquipment

After using others tech & platforms & Flipdish ,

and "After helping legendary Hollywood neighborhood restaurant Cheebo go digital,"

CHEEBO'S closed.

https://www.deliverect.com/en-us/customers/byte-to-bite

If they had "Rapid Expansion n Los Angeles: Byte to Bite, conceptualized by Paul and Alan Moore, has experienced tremendous growth quickly. Starting with one restaurant in Hollywood, they now operate seven kitchens across Los Angeles, with plans to expand further into South Bay and Long Beach."

Then why only showing 3 of any & all locations actually open and available for pick-up or delivery NOW?

It also appears 1 of the 3 "locations" is showing it to be of another's digital dining company's ghost kitchen, as was noted in the previous video I posted,

which watching all the way through most all of the video was referring to CHEEBO Brands which actually many are finding to be somewhat of a deceptive practice and nuisance in a sense, with all the overzealous advertisement of "brands" for a few locations, and probably not appreciated much by other real businesses in the areas.

what i say about all the gossip on LinkedIn is lalala" real estate buyer in Indiana" because the appeared reality isn't adding up to what has been previously claimed. and ain't no real real estate in the BRSE purchase "deal"

I'm sure when all be told the bark was bigger than the BYTE and the BITE wasn't included.

That's why they have been using others tech mostly

because they have their own? right?

Is that Byte to Bite’s existing POS system, point of sale? or piece of shiit?

https://www.deliverect.com/en-us/customers/byte-to-bite

Unless they believe the can re-invent the wheel? or a better mouse trap of their own, in the FUTURE,

probably because they are Stoned & Hungry or trying to figure out why their other Brand Burger Bitch is closed.

Waiting for financials to see how much BRSE revenue it scratches off in fees from others revenue, and after expenses, salaries & taxes etc.

Only it it appears they have shrunk, not grown from previous claims of 10 & 12 "locations".

Maybe I will CHECK BACK ON JAN 22 and JAN 23 for more than 3 open LOCATIONS

when other real businesses are showing open at same locations.

https://cheebo.order-now.menu/order#/collection

11326 W Pico Blvd, Los Angeles, CA 90064 - OPEN

6363 Yucca Street, Los Angeles, CA 90028 - OPEN

1958 Colorado Blvd, Eagle Rock, CA 90041 - OPEN

--------------------------------------------------------------

CLOSED

Pick up at

700 Deep Valley Dr, Rolling Hills Estates, CA 90274

Closed until Jan 22

Pick up at

245 Pine Avenue, Suite 220, Long Beach, CA 90802

Closed until Jan 21

Pick up at

1505 Aviation Blvd, Redondo Beach, CA 90278

Closed until Jan 23

Pick up at

5439 Sepulveda Blvd, Culver City, CA 90230

Closed until Jan 23

Pick up at

3959 Wilshire Blvd, Suite B11, Los Angeles, CA 90010

Koreatown

Preorder only. Closed until Jan 23

7533 Sunset Blvd, Los Angeles, CA 90046

Closed until Jan 22

26861 Trabuco Rd, Suite D&E, Mission Viejo, CA 92691

Closed until Jan 22

Looks like Boomer has been drinking , making less sense then usual , but keep at it , LOL !!

AI based Eco System in their PR , but hey keep trying boomer LOL

https://www.prnewswire.com/news-releases/broadside-enterprises-inc-otc-brse-acquires-digital-food-service-platform-302034583.html

$BRSE

So, are we "official" officials of Broadside Enterprises Inc. yet?

or posing or proposing we are "official" officials while we "release" official information as Broadside Enterprises Inc. ? just wondering.

equijohn are you the BRSE buy & sell bag man?

Seems you previously had a bit of the future yet to be announced future AI?

Change menu by "voice" instead of "push buttons"?

Christopher Petzel

https://opencorporates.com/officers?q=Christopher+Petzel+&utf8=%E2%9C%93

revoke or suspend merge or form, revoke or suspend merge or form,, rinse & repeat?

Also from Alan Moore

Potential Entertainment

Dec 1993 - Apr 2021 27 years 5 months

Downtown Los Angeles

Over the last two decades Potential has become a successful owner, operator and consultant in the international Hospitality, Entertainment & Leisure industries. We have recently added a Production division, with a key team of seasoned professionals, to produce single stream film, television and music content; whilst exploring and developing multi-stream content with tie-ins to our Hospitality, Entertainment & Leisure projects and properties. At Potential we specialize in creating tailor made innovative and sustainable solutions for Hospitality, Entertainment , Leisure and Production properties. Our team prides itself in knowing what is truly required to take a concept from an idea to reality and are proud to be are a ‘one stop shop’ with an in-house skill set capable of turning concepts and dreams into successful sustainable businesses.

California

POTENTIAL ENTERTAINMENT, LLC (201402710360)

01/23/2014 Suspended - FTB/SOS Limited Liability Company - CA CALIFORNIA DANA DELMAN

Nevada

POTENTIAL ENTERTAINMENT, LLC

Format Entity date Date:02/09/2006

Last filing 02/11/2022

Entity Status :Revoked

ALAN MOORE

Nevada

POTENTIAL ENTERTAINMENT HOLDINGS, LLC

Last filing 12/21/2009

Formation Date:07/06/2009

Entity Status: Permanently Revoked

ALAN MOORE

POTENTIAL ENTERTAINMENT, LLC

https://opencorporates.com/companies/us_ca/201402710360

Is this how it is supposed to work?

Suspended or revoked in 1 state and then form in another ,or Puerto Rico

Appears Alan and Christopher Petzel have something in common?

BRSE Verified Profile 12/2023

of record

Securities Counsel

Law Offices of Christopher Flannery

4 Hillman Drive

Suite 104

Chadds Ford, PA 19317

https://www.otcmarkets.com/stock/BRSE/profile

--------------------------

But Cross Defendant Attorney

DELMAN DANA appears to be quite capable in other areas as well.

https://unicourt.com/case/ca-la23-mid-atlantic-capital-associates-a-canadian-corporation-vs-broadside-enterprises-inc-a-delaware-corporation-et-al-665584

-------------------------------------------------

Broadside Enterprises, Inc. (OTC:BRSE) ("Broadside" or the "Company") has acquired Potential Engine, LLC, the digital food service platform of Byte to Bite Industries, Inc. ("Byte to Bite") from Byte to Bite's senior secured noteholders,

Potential Engine, LLC,

Petzel "created" formed a corporation Potential Engine LLC formed in Puerto Rico

https://opencorporates.com/companies/pr/504125-1511

POTENTIAL ENGINE LLC

Company Number 504125-1511

Native Company Number 504125

Source

Puerto Rico Corporation search

https://rceweb.estado.pr.gov/en/search/

Additional

BBOS LLC

Company Number 504125-1511

Native Company Number 504125

https://opencorporates.com/companies/pr/504125-1511

$BRSE Broadside Legal Counsel

I am sure they are well aware of any SEC requirements , as the company , continues to work towards getting OTC Current and as stated in the PR works towards unlisting to the OTC QB

https://www.linkedin.com/company/delman-vukmanovic-llp/

https://finance.yahoo.com/news/broadside-enterprises-inc-otc-brse-110000369.html?.tsrc=rss

As Broadside Enterprises Inc. is a Delaware Corporation officially,

any added "official" officials would need to be added there,

and in Company disclosures, then reflected in company profile at otcmarkets when updated.

Flagship 7533 W Sunset Blvd, Los Angeles, CA 90046

Says permanently closed

https://www.bing.com/search?q=7533%20W%20Sunset%20Blvd&form=ANNNB1

CHEEBO our Locations

https://cheebo.com/en/location

Eagle Rock has been open,

Was Saturn Cafe NeLA, 1958 Colorado Blvd

The food on demand conferences in Las Vegas are held in May;

Last was May of 2023- next is may of 2024

https://foodondemand.com/food-on-demand-conference/may-2023/

https://foodondemand.com/past-events/

700 Deep Valley drive Rolling Hills estates?

https://cheebo.order-now.menu/order#/collection

700 Deep Valley Dr, Rolling Hills Estates, CA 90274

Cheebo - Palos Verdes is Closed - Preorder only. Closed until Jan 22 5:00 AM

Getting Zoomed here?

Time will tell

$BRSE Co General Council Litigation

https://www.linkedin.com/in/dana-delman?utm_source=share&utm_campaign=share_via&utm_content=profile&utm_medium=android_app

$BRSE another Member of the New Team , making his announcement about Joining Broadside on LinkedIn in , and more impressive is the folks congratulating him, again speaking to the impressive network of connections this Broadside Team Has.

https://www.linkedin.com/posts/headstandken_im-happy-to-share-that-im-starting-a-new-ugcPost-7153061134198018049-cqbN?utm_source=combined_share_message&utm_medium=member_android

When i meditated on it, FLOP came to mind.

Now several new members of the "Team" ?

Will they be working for free? Or drawing salaries or?

Working? Will mean earnings per share.

Not claims of future activities or fancifully worded website mixing digital dining as if it were some kind of "production".?

Now, good luck with it because I truly believe you are going to need it.

Is it working? Flagship location?

7533 W Sunset Blvd

Yelpers report this location has closed.

https://www.yelp.com/biz/cheebo-los-angeles#reviews

After further review, it was not a merger with Byte to Bite Industries,

POTENTIAL ENGINE LLC

Company Number 504125-1511

Native Company Number 504125

This agreement and plan of merger (the “Agreement”) is entered into this 30th day of December,

2021, between POTENTIAL ENTERTAINMENT, LLC, a Nevada limited liability company (“PE-NV”),

and POTENTIAL ENGINE LLC a Puerto Rico limited liability company (“PE-PR” and as the survivor

of the merger provided for in this Agreement, the “Surviving Company”). PE-NV and PE-PR are referred

to collectively in this Agreement as the “Parties,” or, singly, as a “Party.

By: Byte to Bite Industries, Sole and Managing Member

Christopher Petzel

Chairman

----------------------------------

WHY appearing to be so much more than adequate activity?

Shell Game?

BBOS LLC

Company Number 504125-1511

Native Company Number 504125

https://opencorporates.com/companies/pr/504125-1511

----------------------------------------------------------------

Source

Puerto Rico Corporation search

https://rceweb.estado.pr.gov/en/search/

--------------------------------------------------

Working for Byte to Bite Industries

https://www.glassdoor.com/Overview/Working-at-Byte-to-Bite-Industries-EI_IE8104501.11,34.htm

Sep 27, 2023

Private Contractor

Pros

THERE ARE NO PROS TO WORKING FOR THIS COMPANY!

Cons

PLEASE, DO NOT WORK HERE, especially as a contractor! Company also goes by Slab Co and Inside Edge Financial. Like the previous review stated and is true, checks paid to you do bounce, a lot! I had to ask for pay basically ALL the time! Employer does not pay on time! A lot of people quit because of all these reasons! DO NOT WASTE YOUR TIME! This site didn’t give me an option to not select any stars. I wouldn’t give this company any stars at all! You’re welcome in advance!

Advice to Management

YES! JUST SHUT DOWN!

-----------------

Don’t work here it should be negative stars

Anonymous Employee

Pros

The pay WAS good at first. Learned a lot at first as well. I guess you can say you can also currently learn from them by watching them fail so your business will not fail.

Cons

Never get a raise. Hours are long. They expect you to be on call ALL the time. No work life balance. Micromanagers. They have done a last ditch effort of saving themselves the financial burden by convincing some of their managers to take over to be “owners” of locations and be “independent” operators. They are not very much independent and are very shady with money. They make promises they can’t keep and they did something with my taxes where I have not received my refund when I filed in March and it is now June. Did I mention paycheck continually bouncing? Claiming it is because something fraudulent happened to their account… still 6 months later checks are bouncing.

Advice to Management

Just shut down. There’s no point in staying open anymore. You all made horrible business decisions. You can barely hang onto a life raft

Looks like Christopher has put together a Quality team

CTO

https://www.linkedin.com/in/philippjann?utm_source=share&utm_campaign=share_via&utm_content=profile&utm_medium=android_app

Chief Product Architect

https://www.linkedin.com/in/branko-mitrovi%C4%87-ewasoft?utm_source=share&utm_campaign=share_via&utm_content=profile&utm_medium=android_app

Seems Petzel put a company together and wants it public. Sounds legit. Seems it’s proven to work. Wants to expand worldwide. Isn’t this the point of companies? Why is everything a scam to you? Dumps or selling of shares won’t come for awhile. Restrictions and all.

Source regarding associated pending lawsuits

MID ATLANTIC CAPITAL ASSOCIATES, A CANADIAN …

WebJan 20, 2012 · Case docket: MID ATLANTIC CAPITAL ASSOCIATES, A CANADIAN CORPORATION VS BROADSIDE ENTERPRISES, INC., A DELAWARE CORPORATION, ET

https://www.docketalarm.com/cases/California_State_Los_Angeles_County_Superior_Court/21STCV10662/MID_ATLANTIC_CAPITAL_ASSOCIATES_A_CANADIAN_CORPORATION_VS_BROADSIDE_ENTERPRISES_INC._A_DELAWARE_CORPORATION_ET_AL/

Petzel "created" formed a corporation Potential Engine LLC formed in Puerto Rico

https://opencorporates.com/companies/pr/504125-1511

and merged in BytetoBite Industries Inc formed in Wyoming

30 N Gould Street Suite 1364 Sheridan, Wyoming, 82801, United States

Doing business in CA as Cheebo

https://www.cheebo.com/en/location

With other associated Petzel hits on LLC's in CA

Advertised Locations

https://cheebo.order-now.menu/order#/collection

Some not appearing open for days at a time.

Ordering powered by Flipdish

https://www.flipdish.com/us/

Competition is the likes of doordash, grubhub and several others etc.

Also using according to 1 source

https://www.crunchbase.com/organization/byte-to-bite-industries/technology

Website Tech Stack by BuiltWith

Active Technology

Byte to Bite Industries is actively using 4 technologies for its website, according to BuiltWith. These include SPF, Google Apps for Business, and Stripe.

As opposed to https://www.kontactless.io/

Los Angeles, California, United States

Kontactless is a software development firm that develops mobile solutions for digital menus, ordering, and payments for restaurants.

Claiming "future" AI projects using "voice" " & customer info accumulation etc.

According to source

https://www.cbinsights.com/company/byte-to-bite-industries

Total Raised

$5.35M

Additional Info related to "Brands" a depiction of CHEEBO in video @ 1:09

$BRSE getting eyes on this low float Gem

Float - 4,581,418

$BRSE - Broadside Enterprises buys Potential Engine https://t.co/KccFvFGxVD

— Seeking Alpha Market News (@MarketCurrents) January 16, 2024

$BRSE with early morning Press Release outlining the recent Acquisition and plans for the future

Broadside Enterprises, Inc. (OTC: BRSE) Acquires Digital Food Service Platform $brsehttps://t.co/oUkgy3YZqi

— Broadside Enterprises, Inc. (OTC:BRSE) (@BRSE_News) January 16, 2024

$BRSE

Float updated 12 24 2023

4,581,418

Unrestricted shares

6,166,033

https://www.otcmarkets.com/stock/BRSE/security

New website Launched

https://www.broadsideenterprises.com/

New Team comprised of professionals with international experience and digital expertise

Four year Revenues $25 million plus

Rebranded company Twitter active again

https://x.com/BRSE_News?t=HntHZTgDD661wYp0oKAycg&s=09

Company Profile updated to reflect the recent Acquisition

https://www.otcmarkets.com/stock/BRSE/profile

Company Profile Verified 12/23

A company profile must remain verified for OTCQB and OTCQX

https://www.otcmarkets.com/glossary#verified-profile

Everything is lining up for $BRSE , three years in the making and just the beginning

Company Linked in page created

https://www.linkedin.com/company/broadsideenterprises/

An angry boomer for sure

It’s like Christopher is Santa and Casper is the Grinch ![]()

We envision a world where every brick-and-mortar restaurant can seamlessly become a multi-brand powerhouse, thriving in the digital age.

A world without clunky self-interested middleware.

Just one operator-aligned platform uniting a curated portfolio of own-ip digital restaurant brands crafted for specific dayparts, demographics, and local appetites.

Think beyond delivery. picture Cheebo's vibrant energy, alongside Stoned + Hungry's late-night cravings and Welders' artisanal grilled cheese magic, all powered by the same kitchen, staff and software, optimized for both in-store and digital orders.

A symphony to be orchestrated by AI. From seamless website and social media ordering to intelligent kitchen display systems, streamlined at every step, maximizing ROI and delighting guests.

Data as your secret weapon, guiding marketing and operational efficiency. An ecosystem isn't just about streamlining in the present – it's about unlocking untapped potential.

Think beyond just adding extra brands. we envision catering partnerships fueled by data insights, marketing campaigns informed by guest preferences, and a future where kitchens become a profit-generating data hub.

We seek to empower communities, not exploit them. partner with local heroes, share our expertise while nurturing unique neighborhood flavors. potential engine as a catalyst, fostering diverse, vibrant food scenes across the land.

This isn't about speed, it's about precision. our goal is to cut through the cacophony of middlemen. We have designed the infrastructure and mapped the journey.

Now, we roll up our sleeves and continue to build, brick by brick, brand by brand to create a future where local hospitality reigns supreme.

Join us, and step into the spotlight. Your stage awaits.

maximize mouthfuls, minimize mayhem. multiply profits, simplify operations.

Potential Engine: the orchestrator of omni-channel restaurant magic

Forget the discordant digital din. Potential Engine isn't just another virtual brand mess; it's the maestro of a multi-channel revenue symphony.

Onboarding, customization, service, operations – imagine it as a grand opening, curtain call, standing ovation, and encore, all flawlessly orchestrated. We can integrate with existing kitchens, or help you build out a dream restaurant from scratch, brick by delectable brick.

Multi-brand brilliance? Potential Engine unlocks a culinary kaleidoscope. We target breakfast cravings, late-night hunger pangs, and every gourmet whim in between, catering to diverse palates and evolving trends – all perfectly prepared in an optimized kitchen, leveraging the existing supply chain.

But Potential Engine is more than just serving up delectable dishes. We're the stage crew, lighting technicians, and performance marketing maestros behind your success. We don't just hand over the script, we help sell out every show.

Here's the backstage pass to the magic:

Now Under the Broadisde Umbrella of companies

https://youtu.be/E8CpVd_EvPU?si=zwAQvvshyC5nlpIr

| Volume | |

| Day Range: | |

| Bid Price | |

| Ask Price | |

| Last Trade Time: |