Register for free to join our community of investors and share your ideas. You will also get access to streaming quotes, interactive charts, trades, portfolio, live options flow and more tools.

Bob Brinker's Market Outlook. Nobody has posted here about Bob Brinker, host of Moneytalk and editor of Marketimer, in some time.

Bob Brinker's October Stock and Bond Market Outlook New!!

I suppose interest in him is but a fraction of what it was in the past.

That is not surprising.

CNBC's Nielsen Ratings at 20 Year Lows which is Good news for us contrarians!

Burk,

You are correct that Bob Jr. is on Twitter, but he Twits as "Bob Brinker."

His dad Twits as Brinkerbob. Nice identity morph, Huh?

Math Junkie no longer defends Brinker's market-timing record like he did for so many years.

I'm sure it's rather difficult to explain the fact that Brinker's model portfolios remained fully invested and lost 50% in 2008.

Not many people can explain that without admitting Brinker joined the "church of buy and hold."

I cover all of this at Honey's Bob Brinker Beehive Buzz2. All are welcome to participate in the comments section of the Blog.

I haven't heard a peep from you in awhile.

I hope you are OK and busy flying planes.

Hopefully you did not do what I've warned for over a decade happens with those who trust market timers like Brinker.... they give up at the very worst time.

Did you give up on Brinker calling bottoms after bottoms all the way down from mid 1400s so you sold out after this post ( msg# 267 ) just days before the bear market bottomed at $676?

(OT) Hello Kirk - I read your post:

http://siliconinvestor.advfn.com/readmsg.aspx?msgid=25744273

and when I got to the part where you typed (I threw away a Libertarian vote second time in protest over his spending.) I thought since you've always been open minded(IMO)that you might find Mike Normans take on spending to be interesting, I don't want to put words in his mouth as that often does a injustice to someones thoughts or opinions, but if you take the time to follow his train of thought it may change the way you think in terms of spending, currencies, and deficits.

http://mikenormaneconomics.blogspot.com/

Brinker Fixed Income Advisor- 2009 Performance

Oddly, this return data for 2008 is not posted anywhere I can find on any of Bob Brinker's web sites. Probably not good for newsletter sales to post it.

Mark Hulbert says Brinker's "fixed income advisor" model portfolio #1 lost 21.7% last year, 2008.

Mark Hulbert says Brinker's "fixed income advisor" model portfolio #2 lost 11.5% last year, 2008.

Mark Hulbert says Brinker's "fixed income advisor" model portfolio #3 lost 5.2% last year, 2008.

==> The Total Bond Index Fund at Vanguard gained 5.1% last year, 2008.

Mark Hulbert says Brinker's "Fixed income only" portfolio in “Marketimer” lost 2.1% in 2008.

ALL FOUR of Brinker's fixed income ONLY portfolios lost money in an up year for fixed income, 2008.

Brinker's "Balanced" Model Portfolio #3 lost 23.9% in 2008. To put this in perspective:

Vanguard's GNMA fund had stellar performance in 2008 gaining 7.22%

The Total Bond Index Fund gained 5.05%.

Vanguard's Total Stock Market Index Fund lost 37.04% in 2008.

My "Free advice" balanced portfolio that I've been giving since the 1990s, half in Vanguard's Total stock fund and half in total bond fund averaged out to a loss of "only" 16% in 2008. This beat Brinker's balanced portfolio by about 8%!

Not only did Brinker's "Balanced portfolio #3" ride the bear market down from the top "fully invested." Its performance was far worse than low fee benchmarks such as half in total stock and half in total bond market funds from Vanguard.

Brinker's "Marketimer" model portfolio #1 lost 39.7% last year, 2008.

Brinker's "Marketimer" model portfolio #2 lost 37.4 last year, 2008.

Brinker's "Marketimer" model portfolio #3 lost 23.9 last year, 2008.

This is an excerpt of what Hulbert wrote about Brinker's performance:

"Brinker’s fund selections on average have lagged the market. The HFD reports an 8.7% annualized gain for his “Aggressive” portfolio, which is 0.6 percentage points per year less than what this portfolio would have made if each of its funds were invested in the DJ Wilshire 5000 during the times they were owned.

Please note: In late 2000, Brinker forecasted a several-month bear market rally and recommended an investment in the NASDAQ 100 Index, a trade that turned out quite unprofitably. However, because Brinker at the time of making this forecast chose not to make this trade part of his model portfolios (he did not tell his subscribers this little fact until weeks after the rally failed to materialize), his HFD record has not suffered as a result."

__ March 2009 by Mark Hulbert on Pg 4 of the April 2009 issue of "The Hulbert Financial Digest"

Brinker doesn't beat the market even with a handicap "Math Junkie" calculated lowered the total of P3 by 30% from what Brinker reports.

Hey Math

I haven't heard from you in a long time on SI. Are you still around? I hope all is well.

Kirk

And now Bob Jr. has become a CFP, apparently thinking it's easier just to take money from stupid subscribers to his "Fixed Income Newsletter" than it is to work an honest job.

He's on twitter...

Bob putting in a lot of time lately.....poor guy worked again 3/14,15 and 3/21,22......he'll need to take off next weekend I'm sure....we shall see.

Yep, he blew another one......pretty quick he'll do like he did with his stock calls and eliminate macro market calls also......I guess then they'll call him Jenny May Brinker! LOL

Tired of missing all his bottom calls. Ha ha.

Brinker worked again last weekend......poor guy must be getting tired.

I don't know how it be correct when we've already broken below his call level....and he never did issue a sell on it...

He's been absolutely horrrrrrrrrrrrrible.....no other way to describe it..

He's had one call...2000...and that was only a partial "lighten up" call...everything else has stunk...

An ape throwing darts would have been much more accurate...

And yet he rails agains the church of buy and hold folks...while he rakes in money from his newsletter subscribers...

Shameful, really.....he's wrong again this time, too..he thought he saw a double bottom...hahaha....

Poor guy worked again this weekend 2/28 and 3/01.......he must be getting exhausted. LOL

Brinker on last weekend 2/21 and 22

So you're not counting the 2003 call as correct?

He works 80 hour weeks he once said. I'd say that's a little too much for one "sorta" correct call back in 2000 and about 5 blown calls since then.

Just thought I would start keeping track of how much time poor Bobby takes off......Flannigan on air today.

Yes, forced to take a side, I'd say he will be. What I am wondering is if it is the "final" bear market bottom. He seems to think it is.

If I were a betting man, I would guess Brinker probably nails this one. I'm not sure I would view following Brinker's advice as a problem nearly as much as just the uncertainty of the markets in general. I remain optomistic but the possibility that this market craters and takes a long time to rebound is certainly a viable alternative....I bailed on Brinker's newsletter after his QQQQ fiasco but I still have a lot of respect for his opinion.

I mean, he'll probably be right, but....it's a good thing he's not always been right really..he's as human as everyone else.

very much aware of that.

today will be the last email alert I get from BB. my subscription expires and will not be renewed.

He also sent out buys three other times higher than the current level.

;)

You can only cry wolf so many times and have people believe you.

Brinker sent out a buy today for S&P in low 800's

Just a FYI

My record, not the topic here and not something I brought up, beats the market significantly but with the market down so much, it is like wining the one legged man ass kicking contest lately since I am down from the top.

Kirk out

#board-1574

Kirk,

From everything I've read about your record, your record certainly is very good either.

Am I missing something? Did you do some "off the record" trades?

Don't spin this now!!!

You know I don't normally promote market timing, but....

There are three people I think have exceptional records for the past decade or more besides my own:

A friend of mine has an amazing record you can follow for free at Trading Futures with Groundzero" at http://www.facebook.com/board.php?uid=10599630106 and http://www.facebook.com/board.php?uid=10599630106#/group.php?gid=10599630106

I tracked him for over a year and he was amazing. You seem to enjoy tracking people with a good short term trading record so maybe you will want to follow him and see if his luck/skill continues. He was short for most of the decline and makes money on most of the up and down rallies. He's more amazing than Zev was in his day...

Be warned, I don't invest my own money in it but do pay attention to the signals for taking profits or buying the major declines. But given his success, I wish I had!

Sy Harding also has a great record with his "Seasons in the Sun" strategy http://www.facebook.com/board.php?uid=2267714264#/topic.php?uid=2267714264&topic=3235&post=49729#post49729

and of course, Warren Buffett did great avoiding both the internet and housing/debt bubbles safely in US Treasuries. He is now long:

Friday, October 17, 2008

Warren Buffett Buy Signal

http://kirklindstrom.blogspot.com/2008/10/warren-buffett-buy-signal.html

Kirk out

#board-1574

Yes Kirk I am very disappointed in Bob Brinker.

I took his News Letter for one reason.

So he would give a SELL Signal.

Bob Brinker DID not give a SELL SIGNAL.

PS: I No longer take his news letter.

PS2: I no longer moderate Bob Brinker Board.

PS# I no longer ....Bob Brinker any thing.....

TREND1 Board

http://beta.investorshub.advfn.com/boards/board.aspx?board_id=12981

IBOX now has SPX 30 minute, Daily, Weekly, Monthly charts in real time

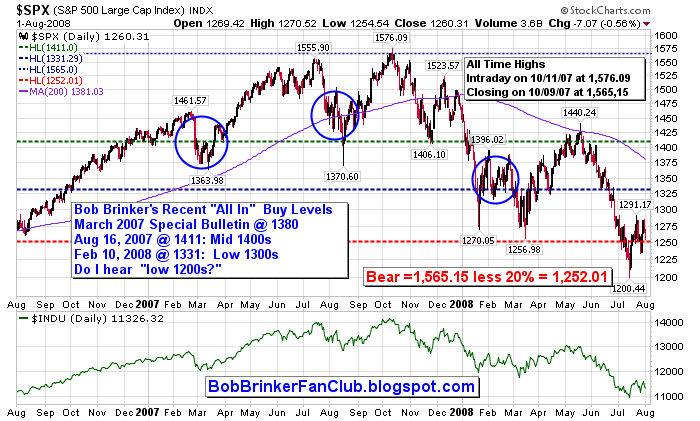

I warned you years ago. The chart below is worth thousands of words... but first a few from Brinker for the record:

Bob Brinker wrote in the January 2008 Marketimer with S&P500 @ 1468.36:

“In summary, the Marketimer stock market timing model indicates that conditions are favorable for the market as we enter 2008."

And

"We expect the S&P Index to achieve new record highs this year and to reach the 1600’s range in the process. “

The S&P500 was just in the 800's Bob....

and put up with quite a bit of your nonsense when I tried to warn you.....

Kirk out

#board-1574

I agree. I think he will experience a huge decline in subscribers....

Agree 100%

Bob Brinker has a big zero rating with me.

Will drop his news letter.

PS He can be replaces by the 320 DMA on a Daily Chart . IMHO.

Not only did he miss the move from 1576 to 839, but he was looking for "mid 1600's at least" about a year ago...

To say he missed the "downtrend"when the decline from top to bottom has so far been almost 50% is like saying Abraham Lincoln had a "disappointmg" evening at the Ford theatre!!!!!

Bob Brinker on the radio Today admitted he missed calling this down trend.

It's Bernanke's fault, or how about George Bush?

Or how about the harvest moon?

TREND1:

Now that oil has fallen so much and stocks continue falling what's Mr. Brinker excuse?

Now TREND1 has only one active board

http://beta.investorshub.advfn.com/boards/board.aspx?board_id=12981

BOB Brinker now considers price of oil a key indicator.

You may want to look at DOY BOARD

MACROSHARES OIL DOWN TRADEABLE = DOY

Looks very interesting.

Have added to my Favorites

http://beta.investorshub.advfn.com/boards/board.aspx?board_id=12677

I just finished a study comparing Brinker and Hohrback

see posts 1160 to 1166 plus

at board below

http://investorshub.advfn.com/boards/board.asp?board_id=11081

Steve

I read your post history.

It shows you do not like Brinker.

It shows you like Kirk the news letter writer

Hey! That's OK with me.

it's a free country and I pay $185 per year for Bob Brinker's

news letter and it is AOK for me.

And I feel he has called this correction right on. IMHO.

Bob Brinker called this correction "Right On". IMHO

At least so far.

Test of Jan 22 lows.

Was it a success ?????

Look to the right 52LDATE

Most are Jan 22

Only Financials has new low Mar 10

.

Update 6/9/09

I am looking for return data for the "Brinker Fixed Income Advisor." I have data from Mark Hulbert but nothing from the Brinkers

They don't publish a table of return data by year for either Marketimer or "Brinker Fixed Income Advisor" so I'd like to make one here. If you have the data, send it to me and I'll add it here.

2008 Data

Mark Hulbert says Brinker's "fixed income advisor" model portfolio #1 lost 21.7% last year, 2008.

Mark Hulbert says Brinker's "fixed income advisor" model portfolio #2 lost 11.5% last year, 2008.

Mark Hulbert says Brinker's "fixed income advisor" model portfolio #3 lost 5.2% last year, 2008.

Brinker's "Marketimer" model portfolio #1 lost 39.7% last year, 2008.

Brinker's "Marketimer" model portfolio #2 lost 37.4% last year, 2008.

Brinker's "Marketimer" model portfolio #3 lost 23.9% last year, 2008.

Vanguard's Total Bond fund made 5.1% last year, 2008

https://personal.vanguard.com/us/funds/snapshot?FundId=0084&FundIntExt=INT#hist=tab%3A1a

Vanguard's Total Stock Market fund lost 37.0% last year, 2008

https://personal.vanguard.com/us/funds/snapshot?FundId=0085&FundIntExt=INT#hist=tab%3A1a

| Volume | |

| Day Range: | |

| Bid Price | |

| Ask Price | |

| Last Trade Time: |