Register for free to join our community of investors and share your ideas. You will also get access to streaming quotes, interactive charts, trades, portfolio, live options flow and more tools.

looking at the filings, BERI appears to be a disaster, so as tempting as it is at this price, I would stay away.

"NOTE 3 - DISCONTINUED OPERATIONS

Due to the loss of key personnel, continuing operating losses, negative cash flow, lack of adequate capital, limited

prospects for future growth, along with a desire to focus on our consulting, inventory management and linespace

transactions, management elected to discontinue the operations of its delivered fuel operations. The loss from the

delivered fuel business is presented separately on the interim consolidated statements of operations and

comprehensive loss as discontinued operations.

Discontinued operations consisted of the following for the three months ended May 31, 2023. We had no

discontinued operations for the three months ended May 31, 2024"

hmm. interesting pps w/ that capitulation. 2020 levels.

geez the price is now down to 5 cents near all time lows, the float of 10M is 10% of the outstanding of 114M, most locked up with insiders, granted we dont have profitability withe razor thin margins, but surely they must have a plan for that otherwise they'll never be profitable with sales/admin being largely fixed. All that said I would rate this as a buy at 5 cents. But at the same time looking back on the filings i dont like the prices they have given out in conversions. the dilution has gone from 47M to current 110M in approx 3 years, not terrible, meanwhile the market cap at times has spiked to around 50M while currently its at 6M, wow. So again I feel like this is as good a price to get into, granted the upside may not be what we saw in the last year, it certainly should be at least a double from here.

The problem is that I dont see a path to profitability I mean look at the margins on fuels, they are razor thin, how they ever going to make any money, they have the sales, but even the sales are not increasing. I do feel the price is back down to attractive levels, I'd buy maybe between 6 - 7 cents at this point just for a trade which could happen at any time.

I dunno….I see a willingness to clean up with little to no effort. I see no mentions on social media and I see no effort on the company’s behalf. BERI seems as likely to revisit .20+ as it does it’s lows again

Especially if they continue disclosing numbers that make a person’s head spin

So whether that selling weeks ago was a debt holder or tired open market money reacting to float growth…..it was a blatant over reaction. And let’s not act like the float isn’t still small. Really small

Or possibly some massively dilutive financing which seems more likely...

appears a major capitulation happened with record sell volume the last 2 days

wow this has completely collapsed, turned out in restrospect to be a great trade. Very tempting to get in now again if I had the free cash.

ok back down at old entry level. under radar indeed.

Marathon is big company surprised no movement on that news, people sleeping?

There use to be a lot of post from individual people now it’s non existent just a bunch of spam

From the company or from an individual?

Blue Earth Resources, Inc. (OTC PINK:BERI) and its wholly-owned subsidiaries, Fuel Trader Supply and Fuel Trader Resource Management, announced in a press release today the entry into a 10-Year Branded Jobber Contract with leading energy company Marathon Petroleum Corporation to resell its fuel and deliver Marathon's merchant services to branded retail convenience stores and fuel stations in the U.S. In turn, Blue Earth will receive revenue from fuel sales, merchant services, and fuel transportation.

Blue Earth Resources, Inc. procures refined fuels from refineries and wholesalers and distributes to both large retailers and single-site operators.

What happen to all the $Beri post on Twitter?

Blue Earth Resources Reports 8% Growth to $23.3 Million Revenue for its First Quarter Ended May 31, 2023

Increases in Rack and Bulk Fuel Sales Improved Margins

KNOXVILLE, TN / ACCESSWIRE / July 18, 2023 / Blue Earth Resources, Inc. (the "Company," "we," "our," or "us") (OTC PINK:BERI) and its wholly-owned subsidiaries, Fuel Trader Supply and Fuel Trader Resource Management, is pleased to announce its financial and operational results for its first quarter ended May 31, 2023. Blue Earth Resources filed its Quarterly Report on OTC Markets on July 16, 2023.

Key Financial Highlights First Quarter Ended May 31, 2023 Compared to Prior Year Period

Revenue increased 8% to $23.3 million

Gross profit increased 196% to $0.5 million

Gross margin increased 150 basis points to 2.35%

Operating loss increased 180% to $0.8 million

Net loss increased to $3.2 million (including $2.4 million of interest expense)

Adjusted EBITDA loss increased 53% to $0.3 million

Management Commentary

Scott M. Boruff, Chief Executive Officer of Blue Earth Resources, commented, "We are very pleased with our start to our fiscal year 2024. We shifted toward slightly higher margin business, which resulted in revenue growth of 8% and much improved gross profit by nearly 200% to $0.5 million. This is important as we will continue to focus on improving margin and believe profitability is well within our sight as we look to at least double revenue in our fiscal year 2024. We have a healthy pipeline of BP locations and our own BluePetro retail units expected to open over the coming months."

Boruff, continued, "With all of our data points are trending positively, highlighted by growth in our volumes and customers, both leading to an increase in revenue, we are looking to improve our capital market positioning over the remainder of the year. This includes becoming an SEC reporting and compliant company, plans on an uplist to a major national exchange and increasing our visibility and awareness with more proactive and effective investor communication and relations."

Financial Results for First Quarter Ended May 31, 2023

Revenue for the first quarter ended May 31, 2023 increased by $1.6 million, or 8%, to $23.3 million, compared to $21.7 million for the first quarter ended May 31, 2022. This increase was primarily due to increases in fuels sales - rack and bulk;

Gross profit for the first quarter ended May 31, 2023 increased by $0.4 million, or 196%, to $0.5 million, compared to $0.2 million for the first quarter ended May 31, 2022. The corresponding gross margin for the first quarter ended May 31, 2023 increased by 150 basis points to 2.35%, compared to 0.85% for the first quarter ended May 31, 2022;

Operating expenses for the first quarter ended May 31, 2023 increased by $0.9 million, or 187% to $1.3 million, compared to $0.5 million for the first quarter ended May 31, 2022. Of note,

Loss from operations for the first quarter ended May 31, 2023 increased by $0.5 million, or 180%, to $0.8 million, compared to $0.3 million for the first quarter ended May 31, 2022;

Net loss for the first quarter ended May 31, 2023 increased by $2.9 million to $3.2 million for ($0.03) per share, compared to $0.2 million for ($0.00) per share for the first quarter ended May 31, 2022. The increase in net loss was primarily due to $2.4 million of interest expense;

Adjusted EBITDA for the first quarter ended May 31, 2023 increased by $0.2 million, or 53%, to $0.3 million, compared to $0.2 million the first quarter ended May 31, 2022. Adjusted EBITDA calculations back-out non-cash expenses, such as depreciation and amortization, amortization of debt issue costs, stock-based compensation and shares issued for services;

Cash and cash equivalents totaled $1.1 million at May 31, 2023, a decrease of $0.5 million compared to $1.6 million at February 28, 2023; and

The Company had $13.6 million in short-term borrowings at May 31, 2023.

Non-GAAP Financial Measures

The Company has provided in this release certain non-GAAP financial measures, including Adjusted EBITDA, to supplement the consolidated financial statements, which are prepared in accordance with generally accepted accounting principles in the United States ("GAAP"). The Company Adjusted EBITDA is defined as net income (loss) adjusted to exclude interest expense (income), net, provision for income taxes, gain on extinguishment of term debt, depreciation and amortization expense, other expense, net and stock-based compensation expense.

Management uses these financial metrics internally in analyzing the Company's financial results to assess operational performance and to determine the Company's future capital requirements. The presentation of this financial information is not intended to be considered in isolation or as a substitute for the financial information prepared in accordance with GAAP. The Company believes that both management and investors benefit from referring to these financial metrics in assessing our performance and when planning, forecasting and analyzing future periods. The Company believes these financial metrics are useful to investors and others to understand and evaluate the Company's operating results and it allows for a more meaningful comparison between the Company's performance and that of competitors. Our use of Adjusted EBITDA has limitations as an analytical tool, and you should not consider this performance measure in isolation from or as a substitute for analysis of our results as reported under GAAP. Some of these limitations are that Adjusted EBITDA does not reflect: cash capital expenditures for assets underlying depreciation and amortization expense that may need to be replaced or for new capital expenditures; interest income (expense), net; other income, net; the potentially dilutive impact of stock-based compensation; gain on the extinguishment of term debt; and the provision for income taxes. Other companies, including companies in our industry, may calculate Adjusted EBITDA differently, which reduces its usefulness as a comparative measure.

Because of these limitations, you should consider these financial metrics along with other financial performance measures, including total revenues, subscription revenue, deferred revenue, net income (loss), cash and cash equivalents, restricted cash, net cash used in operating activities and our financial results presented in accordance with GAAP.

About Blue Earth Resources, Inc. (OTC:BERI)

Blue Earth Resources, Inc. procures refined fuels from refineries and wholesalers and distributes it to both large retailers and single site operators. Our solution represents lower risk and more stable pricing to our vendors and customers. In addition, our custom branding services include imaging, design and consultation services to assist with custom branding. Blue Earth Resources, Inc. is headquartered in Knoxville, Tennessee.

For additional information, please visit: https://berifuels.com

Forward-looking Statements:

Certain statements contained herein are forward-looking statements including, but not limited to, statements that are predictions of or indicate future events, trends, plans, or objectives. Undue reliance should not be placed on such statements because, by their nature, they are subject to known and unknown risks and uncertainties. Forward-looking statements are not a guarantee of future activities and are subject to many risks and uncertainties. Due to such risks and uncertainties, actual events may differ materially from those reflected or contemplated in such forward-looking statements. Forward-looking statements can be identified by the use of the future tense or other forward-looking words such as "believe," "expect," "anticipate," "intend," "plan," "should," "may," "will," "continue," "strategy," "position," "opportunity," statements regarding the "flexibility" of the Company or the negative of any of those terms or other variations of them or by comparable terminology.

Investor Contacts:

Scott M. Boruff, CEO

investorrelations@berifuels.com

888-462-2374

ClearThink IR

nyc@clearthink.capital

SOURCE: Blue Earth Resources, Inc.

View source version on accesswire.com:

https://www.accesswire.com/768385/Blue-Earth-Resources-Reports-8-Growth-to-233-Million-Revenue-for-its-First-Quarter-Ended-May-31-2023

this turned out to be a huge winner for me by trading the large swings and buying low, thru beginning of 2023 when I have cleared my position, and I did this even missing a portion of the big upswings, which confirms again that you dont need to be perfect with your entry and exit points, but importantly to buy heavier at perceived bottoms.

Going forward, given a bear market, I would be a buyer in the .15 to .25 range, with larger quantity towards the lower part of the range as always. I like what they are doing and they should be successful.

Yup

Looking forward to it happening

BERI

Added 5k here at .19....willing to wait for this one.

kt

Waiting to free up some $$ and I'll be looking to add much more. Already have a very nice position, but this could become a real gem.

continuing to buy in relatively small quantity and currently bidding .211, I think that that is a very good price to pickup shares.

yeah that makes sense thanks, if it goes to the low 20s I would also buy more.

You're not alone, just not worth posting about till we hear more from the company. They're being quiet, but I think we'll see a Nas listing announced, so I'm not going anywhere. I bought more on this pullback, if it drops lower it's just a better buy.

whats going on here, people were just ultra bullish but posting has all but dried up. I just took out the 5364 shares at .251 on the ask, which immediately moved up to 32 cents, we'll see what happens but this is dissapointing that everyone was cheerleading and now I am the only one left, as I was the only one at the start when it was down at 8 cents not long ago.

volume and interest seems to have dropped off here, but I do like the price if it can drop into the low twenties, these pennies have a way of making such moves.

16 thousand shares traded today, something needs to jump start BERI .

Oil prices rising due to OPEC production cuts. A little news from these guys will do good.

Company is being quiet, but they are growing fast. Nas is coming, just a matter of when???

nice fill at .255, hmm this is definitely coming down lower than I had expected, though low enough where I was prepared. Sure we could see 20 cents I guess, make sure you have those GTC orders in

Wowza!!! Look at them spreads, wide open.

Who knows, not going to make any predictions moving forward. I am holding for some before Nasdaq listing and the rest after they debut. I am in no hurry to sell at this juncture.

BERI, what will it do on Monday ? crazy action on Friday jumping back and forth between .0035 and .0042 .

BERI had a great move today, there is absolutely no reason to sell this short of 200 million market cap. Will there be continuation? TBD.

BAA BAA .43 0n the ask as back up we go

They lured the sheep in again and sent them to the slaughter house. Lol

I added at .325, feel the same way.

these always pull back, every time, did i think it would come down this far, hmm, yes I guess I did and was right, could it go down further, certainly, anyway bought at .355 and will buy at .31, .27, etc. if it comes down to those levels, there is no way to know one way or another if it will but its possible

People chasing other tickers. Who knows they may get lucky, I am waiting for a dip to mid 20's high 20's to double down if they want to continue selling.

Yes, a nice news like starting their own refinery, or when they anticipate Nasdaq listing and earnings projections for next year with acquisitions.. But special meetings are geared towards capital structure of the stock amongst other things, such as, stock compensation to the board usually.

special meeting oct 14 at 9am in Knoxville . maybe we can get some good news and stop this madness. BERI

He says that about all his stocks

|

Followers

|

21

|

Posters

|

|

|

Posts (Today)

|

0

|

Posts (Total)

|

1223

|

|

Created

|

09/29/10

|

Type

|

Free

|

| Moderators | |||

We procure fuel from refineries and wholesalers, providing to them a more predictable demand, and more predictable pricing.

We distribute fuel to both large retailers and single site operations, and provide to them a more stable supply of fuel, with less fluctuation in price.

To both, we represent lower risk, and more stable pricing.

In addition, our custom branding services division provides imaging, logistics, design and consultation services to assist you to embark on your own custom brand.

We are committed to offering a premiere experience of top tier fuel brands. We’re spearheading this unique initiative in the fuel distribution market, and we’re excited to meet you!

We broker wholesale energy products for supply and distribution. Our brokered products include many grades of refined fuels such as gasoline, diesel, kerosene, biofuels, ethanol, and AVGAS.

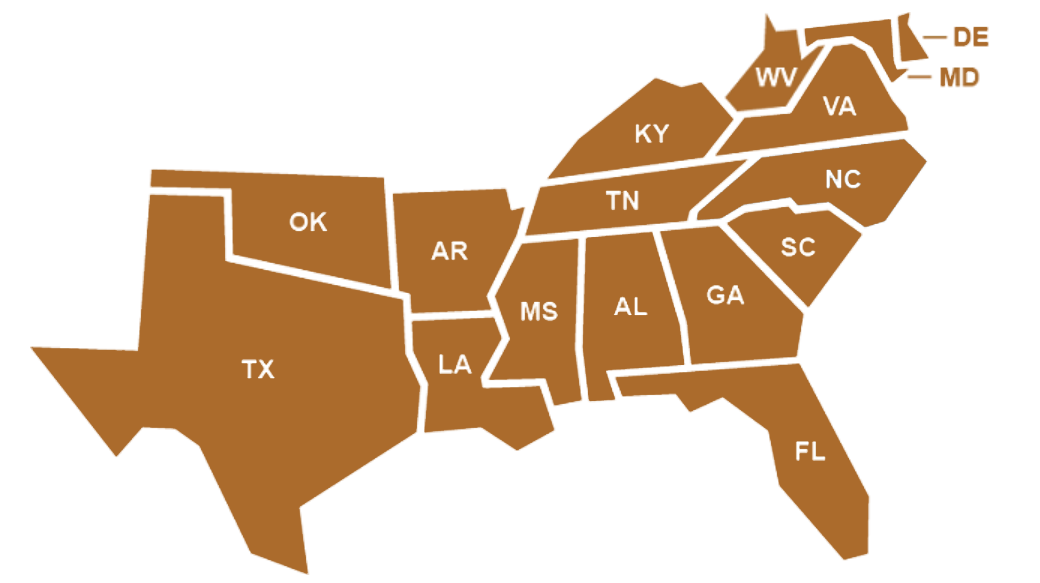

We market our services in the southern United States along multiple supply points within the pipeline and rail systems.

Distributing fuel in the southern states, we can optimize the logistics supply chain to ensure a timely delivery and fit your needs while minimizing risk.

A happy customer comes from a strong customer relationship. We’re reaching out to you.

sales@berifuels.com

311 S Weisgarber Rd.

Knoxville TN 37919

888-462-2374

| Blue Earth Resources, Inc. Acquires Fuel Trader Supply and Fuel Trader Resource Management |

|

| Knoxville, TN, Sept. 19, 2022 (GLOBE NEWSWIRE) -- via NewMediaWire -- Blue Earth Resources Inc. ("BERI") today announces the acquisition of a 100% interest in Fuel Trader Supply, LLC ("FTS"), a Florida limited liability company, and simultaneously acquired a 100% interest in an FTS affiliate, Fuel Trader Resource Management , Inc. ("FTRM"), a corporation organized under the laws of the Commonwealth of Puerto Rico, a territory of the United States of America. The purchase was procured by a combination of cash and shares of BERI common stock. BERI will retain its headquarters in Tennessee and will continue maintaining the offices of FTS and FTRM in Florida and Puerto Rico. William R. Eaton was instrumental in the purchase as he owned or controlled 100% of the outstanding equity interest of both FTS and FTRM. In addition to continuing to lead both wholly owned subsidiaries, Mr. Eaton will serve as Chief Operating Officer and a member of the Board of Directors of BERI. Other existing officers of both FTS and FTRM will continue to serve in their same positions. Scott M. Boruff, Chief Executive Officer, stated, "Fuel Trader has long been a trusted strategic partner of ours. The synergies of products and staff will significantly enhance our opportunities to serve our customers. The two companies have shared a close relationship since BERI commenced operations in Tennessee, and we will combine their product lines with ours to bring the best of each to the industry." FTS is a leading supplier of bulk gasoline and diesel products within the Colonial and Plantation pipeline systems. FTS has long standing supply relationships that allow best execution pricing by sourcing and comparing prices from any major US refiner or trading house. The ability to aggregate purchases and service its diverse customer base provides the company a unique competitive advantage. This results in a full suite offering in an end-to-end economies of scale procurement solution. FTS reported total operating revenues of $142,041,375 at December 31, 2021, its most recently completed year-end. FTRM offers full-service bulk fuel inventory management solutions, to include consulting services for the sourcing, logistics, and risk management needs of clients in the petroleum industry. In addition to consulting for clients, FTRM provides futures execution, hedging strategies, and customized supply options through FTS. Since 2014 FTRM has also implemented and developed a shipping program that manages line space capacity on the Colonial Pipeline System. FTRM is a member of the National Futures Association, the Commodity Futures Trading Commission, and a guaranteed introductory broker for RJ O'Brien, Inc. RJ O'Brien is a registered Futures Commission Merchant with the Commodity Futures Trading Commission, a member of the National Futures Association, and a clearing member on all major U.S. futures exchanges. FTRM reported total operating revenues of $1,021,518 at December 31, 2021, its most recently completed year-end. Will Eaton, Chief Operating Officer, further stated, "The acquisition is very friendly and is more like a merger, allowing us to combine resources across multiple entities, while also keeping the established Fuel Trader and Blue Earth brands. We will be able to substantially increase our consolidated revenues while simultaneously reducing our outflows. Integrating the companies will allow us to take advantage of the inefficiencies in the supply eco system and capture additional margin from end to end. I am excited to work more intimately with the team at BERI as we have long standing relationships that span back over decades." In connection with the acquisition, BERI has a firm written commitment with EF Hutton, a division of Benchmark Investments, LLC, to act as lead underwriter, deal manager and investment banker for an anticipated public offering of the Company's equity, debt and/or equity derivative instruments. In addition, BERI engaged Carmel, Milazzo & Feil, LLP to advise and represent BERI in an anticipated Form S-1 registration statement filing and potential listing on a national securities exchange. The acquisition was approved unanimously by BERI's Board of Directors. About Blue Earth Resources, Inc. Statements Regarding Forward-Looking Information Contact |

| Volume | |

| Day Range: | |

| Bid Price | |

| Ask Price | |

| Last Trade Time: |