Register for free to join our community of investors and share your ideas. You will also get access to streaming quotes, interactive charts, trades, portfolio, live options flow and more tools.

They take BTC for payments. Gold and silver.

Apmex.com

Let me know if you can buy gold and silver with it? Nogh said ;) run along baby boomer. Clueless

Not 1. Add em to your ignore list

Trump is on board. We are going to a million one day.

Transfer? Shares? You don't seem to have a clue.

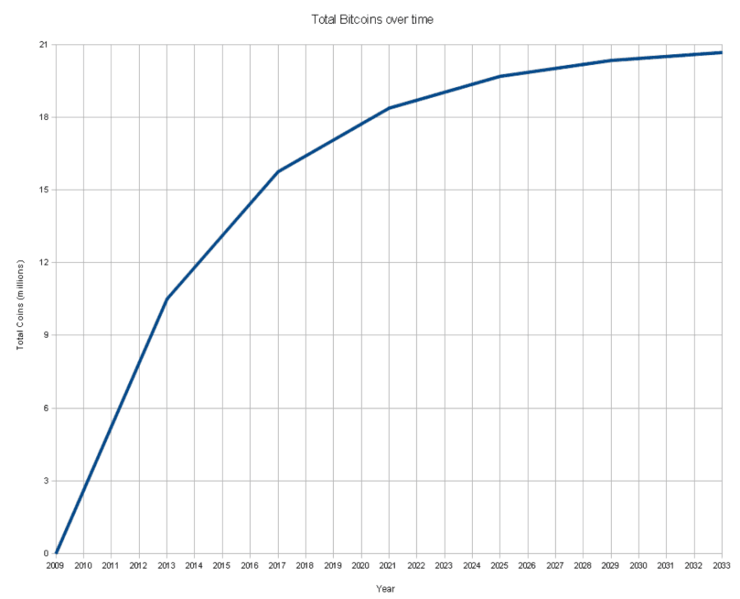

ap17, when government pension plans start publicly investing in BTC ETF's, we know crypto is here to stay. It is almost too funny how some still come back and say it is going to zero. Not going to happen anytime soon. There would have to be a superior crypto to replace Bitcoin which currently holds a 55% of all crypto's by market cap. And, there are thousands of crypto's that exist.

Thanks for posting relevant data that is important to digest for real analysts.

Bashers are funny. Always saying it going dump. Then 6-8 months later, bashers are excited to say I told to you so. Meanwhile, us smart people already made 🤑🤑

Hardly, just spoke too soon is all.

https://investorshub.advfn.com/uimage/uploads/2024/2/20/igejjgiphy.webp

How? Try transferring it if you hold it.

LoL SMH, you can't. The Elite holding Bitcoin and Ethereum are stuck with it.

It's a Paper Moon and a dead end.

Most real Brokers are avoiding Crypto and won't touch it.

WE’RE STILL EARLY 🌊

Despite the launch of the Ethereum ETFs this week…

We’re unlikely to see other crypto ETFs like Solana anytime soon. (at least from the likes of BlackRock)

That’s the latest out from Robert Mitchnick.

Robert Mitchnick

For those of you who don’t know Robert, he’s the Head of Digital Assets at BlackRock.

He’s also known on the streets as the man that orange-pilled Larry Fink. 👏

Speaking at Bitcoin 2024, Robert gave some insights into the Bitcoin ETFs.

And according to him, we’re still early…

BlackRock’s Bitcoin ETF has three main client segments:

Direct investors - small dollar retail to ultra high net worth investing on their own accord

Wealth advisory

Institutional

Out of those three, direct investors came storming out of the gates on launch day.

But we’re still waiting on the wealth advisory and institutional sectors to come online. (some have but it’s only a small percentage)

It takes a LONG time for these platforms to finish their due diligence.

Robert was asked when can expect these platforms to start offering the Bitcoin ETFs.

This is what he had to say:

“I won’t get into specific names and timelines obviously, but certainly this year is likely.”

Robert Mitchnick

Sounds like another wave of demand is coming. 🌊

Robert was then asked what are BlackRock’s clients currently interested in.

“Our client base today, their interest overwhelmingly is in Bitcoin first. And then somewhat in Ethereum, there’s definitely interest in ETH too. And there’s very little interest today beyond those two.”

Robert Mitchnick

Solana maxis, time to look away…

Robert expanded on the point he made above, stating that Bitcoin and Ethereum are the 2 dominant crypto assets.

Beyond that point, there really is nothing of considerable size.

“I don’t think we’re going to see a long list of crypto ETFs. If you look at Bitcoin today, it’s 55% of the market. Ethereum is at 18%. The next plausible investable asset is at like 3%. There’s just nothing close to being at that threshold of track record, maturity, liquidity etc that BTC and ETH have.”

Robert Mitchnick

It doesn’t sound like BlackRock is interested in launching a Solana ETF anytime soon.

Robert also explained how he differentiates BTC and ETH to clients:

“We don’t view BTC and ETH as competitors. Bitcoin is trying to be a global monetary alternative, as a potential global payment system. Ethereum isn’t really trying to be that. ETH is trying to do a bunch of different applications. So really they’re more compliments than they are competitors.”

Robert Mitchnick

It’s a ‘rising tide lifts all boats’ kind of situation.

At their core, Bitcoin and Ethereum aren’t competing with each other.

They serve completely different use cases.

The launch of the Ethereum ETFs has been a huge benefit to the crypto industry as a whole.

HERE THEY COME 🚀

BREAKING: Jersey City to invest in Bitcoin ETFs, the latest pension to dive into crypto

Bitcoin

Here’s something we weren’t expecting.

Steven Fulop, mayor of Jersey City, announced that he plans to allocate part of the city’s pension fund to the Bitcoin ETFs. 👀

In a July 25 Twitter post, Mayor Fulop explained his reasoning for this decision:

“The question on whether Crypto/Bitcoin is here to stay is largely over + crypto/Bitcoin won. Jersey City pension fund is in process of updating paperwork to the SEC to allocate % of the fund to Bitcoin ETFs.”

Steven Fulop

Continuing on, Fulop mentions:

“I’ve been a long time believer (through ups/downs) in crypto but Broadly, beyond crypto I do believe blockchain is amongst the most important new technology innovations since the internet.”

Steven Fulop

Although Mayor Fulop did not explicitly state the exact percentage the fund would invest into Bitcoin, he did say it would be “similar to the Wisconsin Pension Fund (2%)”.

eb tweet

Now if you can remember all the way back to early May of this year, you would recall the big news surrounding the Wisconsin pension fund.

They were the first US pension fund to officially invest into the Bitcoin ETFs.

At the time, their investment totalled $164 million out of the funds $156 billion in assets.

Although this may not sound like much at first glance, make no mistake…

This is HUGE news.

And is only the beginning of institutional adoption.

BlackRock’s head of digital assets explains why we’re still early in the next section.

New highs as soon as mt gox is fully liquidated.

It’s a make-or-break moment—will Bitcoin soar to new heights or fizzle out early this cycle? The next few moves could decide its fate.

HERE COME THE SUN☀️BITCOIN 🏤🏦 XRP✊

"Don't "F" this up".......

VacEck Places $52.4 Million Price Tag On Bitcoin ; https://ih.advfn.com/stock-market/COIN/BTCUSD/crypto-news/94260180/vaceck-places-52-4-million-price-tag-on-bitcoin

🎺✊😎👍💰💰💰💰💰ROCK YOUR BABY BITCOIN XRP🏦

BITCOIN 💃🕺 AT THE HOP☝️🤑 XRP 🏦 of 🇺🇸

BITCOIN STRATEGIC RESERVE ASSET 🚀

BREAKING: Wyoming Sen. Lummis plans to announce legislation for Strategic Bitcoin Reserve at Nashville conference

Bitcoin

We’ve got some HUGE breaking news for you today.

Senator Cynthia Lummis plans to propose that the Federal Reserve hold Bitcoin as a strategic reserve asset.

Just as they hold gold and other foreign currencies.

According to Fox Business, Lummis plans to make this announcement on Saturday at the Bitcoin 2024 conference.

The timing of this is intentional, as Donald Trump is scheduled to talk at the conference on Saturday at 2pm.

Lummis is hoping Trump will endorse the bill and the idea behind it.

And Senator Lummis has been teasing a big announcement on Twitter this week, posting the following:

Lummis

Notice the ??

The US adopting Bitcoin as a strategic reserve asset would be MASSIVE.

“Classifying the world’s largest cryptocurrency as a strategic reserve asset would be the firing gun in the ‘Bitcoin Space Race’…If the United States – the wealthiest country in the world and the home of global capital – began accumulating bitcoin on its balance sheet, other countries would have powerful incentives to do the same."

Sam Lyman, director of public policy at Riot Platforms

But it’s only an idea for now.

Once this bill has been created it would require the support of the president and Congress.

Which is no easy feat.

In other news…

Rumours have been circulating recently that Kamala Harris would make an appearance at Bitcoin 2024 this weekend.

Well, safe to say that rumour has now been put to bed.

It’s not happening.

David Bailey, CEO of Bitcoin Magazine confirmed it with the following post:

David Bailey

This conference is shaping up to be a juicy one…

It sounds like there’ll be some BIG announcements coming out of it.

HBAR absolutely is in the portfolio!

Rwa's? Where you at? Ondo? Hbar?

Hedera is prob the most under rated tokanization projects. Tradefi?

I would love some leads, I'm always looking tokanization of rwa coins no doubt. Xdc is actually pretty sick. Tia

Since I only have 1 post allowed a day, I must say that was quite a violent reaction off of 63k holy smokes

Once mt gox is liquidated watch out. Won't be surprised you see a 30%-40% up day in the future. And I own zero btc. I'm a few steps ahead in the world of tokenization.

We should rally big this late month into August..

The more I think about it It could be anti climatic after Trumps speaks at Bitcoin Conference Looks like Kamala Harris declined the invite to speak at the Conference. I'm Bullish Thinking a test of 60K level before new all time highs.

Have buy orders in at 60k

$BTC

Six ! Six ! Six ! Six ! Six !.......Yes back UP we go !

https://investorshub.advfn.com/boards/read_msg.aspx?message_id=174779587

Six ! Five ! Five ! Five ! Five !.......Go USA Go !

Super Bitcoin Monkey Goal-post !.......Six ! Six ! Six ! Six !........... Six ! Six ! Six !

66,666

.

|

Followers

|

704

|

Posters

|

|

|

Posts (Today)

|

39

|

Posts (Total)

|

60069

|

|

Created

|

01/07/13

|

Type

|

Free

|

| Moderators dshade Strategyone trunkmonk nowwhat2 | |||

BITCOIN ALERT

* Important Note About © & Anonymity ===>

"... A lot of people mistakenly believe that Tor Onion Networking is "all about anonymity" - which is incorrect, since it also includes:

...none of which are the same as "anonymity", but all of which are valuable qualities to add to secure communications. ... "

Bitcoin git repository (mirrors upstream branches+tags) is now available through a TorV3 hidden service at===>

http://nxshomzlgqmwfwhcnyvbznyrybh3gotlfgis7wkv7iur2yj2rarlhiad(.)onion/git/bitcoin.git

https://gitlab.com/bitcoin

While we love Bitcoins here, and believe they will continue to ascend to new heighs!!! We will soon be offering stock and smart contract

suggestions that we beileve could grow much like Bitcoins have!!Please keep in mind that Bitcoins were on my watch list when

they were trading for just pennies! Feel free to boardmark here & sign up for our email list!

*****

============================================

X-\(((-_-)))/-X

===========================================

Resources * NEWS * TRADE GROUPS + CRAZY FUN ZONE ::::>>>> https://www.fsf.org/resources/

________________________________________________________________________________________________________________________

Disclaimer:

Bitcoins are a volatile market in the early stages. It is risky investment money into Bitcoin, stocks, and any investments mentioned here! Nobody here is a finanical adviser.

Never buy, sell or hold based on anything said by myself or anyone here.

Always do your own DD and research!!!!! I take no responsibility for your gains nor losses!!!!

XXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXX

(((((~*~THE ORIGINAL~*~))))))

100% GRASSROOTS SUPPORT

<3<3 Spread da BTC Love!! ====> weee

| Volume | |

| Day Range: | |

| Bid Price | |

| Ask Price | |

| Last Trade Time: |