Register for free to join our community of investors and share your ideas. You will also get access to streaming quotes, interactive charts, trades, portfolio, live options flow and more tools.

Have anyone experienced trading with Trading Station?any thoughts ?

Used to load up on these dead shells coming back to life continue to buy on Margins.

Wait on news, sell half to get my money out and hold free shares. No risk then. Ya can’t do that now.

There are many sub 500k floats out there.

Just no one taking their money maker company public. My last R/M is EVCI. TRRI.

Sitting on BDCM underwater by $9k

I used to hold a good 35-40 shells at any given time. Since Biden the R/M space has turned into a ghost town.

I think we will see foreign money pour into America.

so, what was the strategy when you bought the entire float?

Did that pump the price up, and you did a news release? Or were you trying a Carl Icahn thing, and do an activist investor turnaround?

I believe TD and Charles Schwab work in Europe

Guys does anyone know any broker for European citizens ? Except of interactive brokers

No. I just let E-trade do their thing.

Scottrade spoiled me. NITE was a beast.

Plus I’ve become way more long term in my plays, and set BIDs and ASK orders set to 60 day GTC orders and forget about it.

I get a low or high alert text that triggers, and I look in.

Nothing going on in this market anyways but food and Nat gas. Everyone talking about it, so I probably should avoid it too.

I’ve been buying 10oz silver bars with my casino money. I need to learn how to avoid that “ over spot price” scam.

thank you. I don't trade money I can't afford to lose. I have been doing it pretty consistently for about 10 years now.

Have you ever tried routing your orders through IEX? I recently found out about them, been thinking of trying it. I have always just had routing on default, "Smart" with TDA.

If so, have you noticed any difference?

E-trade is still $4.95 no share limit. 1 share or millions. It’s still $4.95 snd you can buy pink limited that I thought TDA, Fidelity, Schwabs of the world won’t allow. Pink limited was Sell Only-No Buy? That’s brutal on everyone.,

Nob brokers like Robin Hood wont even touch OTC stocks.

They want the new money to stocks.

I much prefer to play in the wild Wild West.

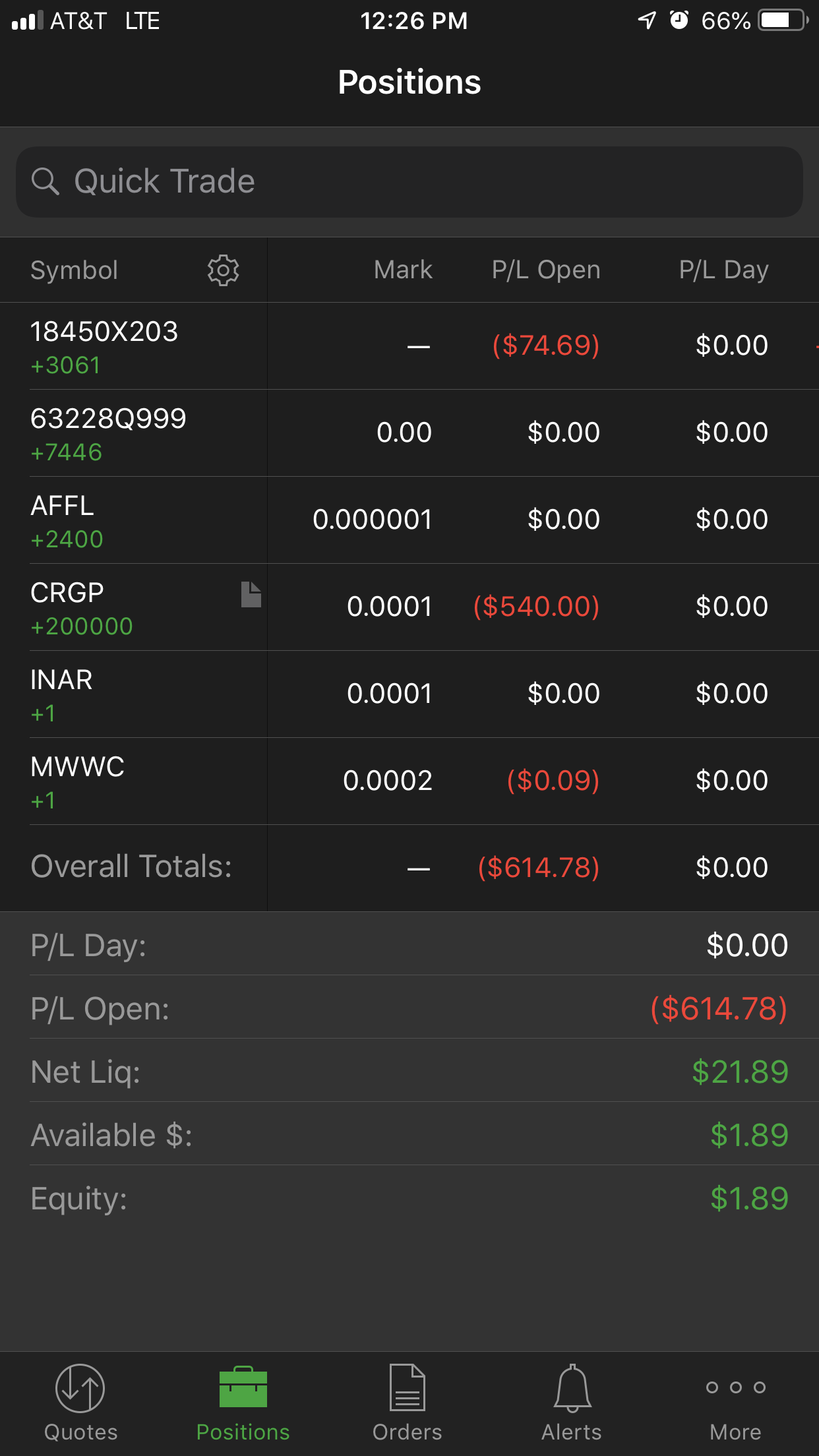

I view my play account with E-trade as my casino money account.

My LT 401k stuff is with Fidelity.

I’m not here using retirement or rent $

So keep that in mind. I can lose $30k and not keep me up at night.

That’s the biggest thing to know. Your risk tollerance on one hand and your tax exposure on the other. My CPA saved my butt this year.

It’s why I’m only buying in 2022. No selling. If possible. Build a quick paper tax loss too.

OTC is more of a game to me. Can I beat my Big boy investments? Crushed it under Trump. Biden is dead money.

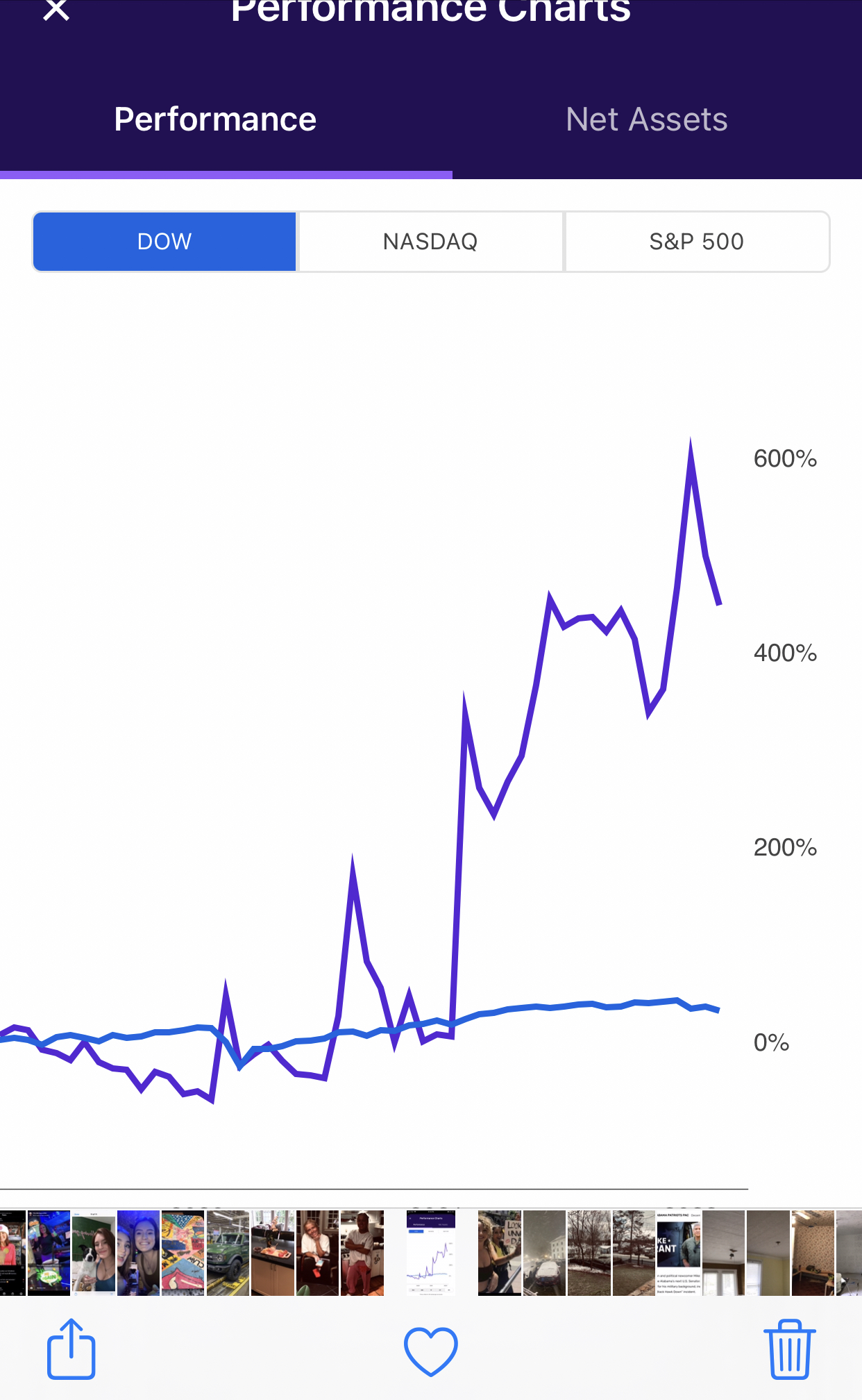

The bottom light blue sideways line is the Dow. Not too shabby. If I can maintain. That’s on $100k

do you pay "reg fees" with ETrade for OTC trades? I'm not actually sure what they are, but TDA charges a standard $6.95 commish for OTC, but on top of that, they charge "reg fees", which sometimes goes over $8.00 depending on the trade, so round trip I am often paying over $20

Not any more. When they killed the ability for us great unwashed yo buy OTCs on margin and short, it sort of killed that ride.

It’s a different environment.

I just load up on R/M shells and natural gas plays.

Biden has destroyed the R/M sector. No confidence for a company to go public now.

you bought up entire floats?

You do that now with E-Trade?

I was with ST since they started. I never had a problem eith my trading style.

After the buy out, TDA didn’t like my style and dumped me.

I went to E-trade.

ST and NITE were the champs looking back. They were not pussies like we see now.

I would buy up entire floats and sell entire floats. TDA could not hang. Since they do not own their own MM like NITE, I guess they were taking on too much cost. Taking days to clear my trades. I guess that’s why they severed their business relationship with me. They did the same to two of my trading pals.

All I knew up to that point was ST. And the old guard brokers holding my 401k. The Bear Sterns, Gifekity, and Goldman sacs. The $300 commission guys. The guys that would cry like a baby when you called in an order. God forbid if you wanted to buy an OTC. They would become a bitch on the phone. Make you feel like an idiot. The hood Ole days. Invest your money bend over and not say squat.

Shit, ST would trade anything. Short snd buy on margins anything. CE stocks back then. No questions asked. Lose your shirt, screw you. It was great.

SEC has really gutted the OTC. I think they want it to go away

Look at how long it takes to get a symbol change?

SEC and these new soy boy brokers want us all on the big boards. Just my guess

Who did you end up switching to since TDA bought ScotTrade?

Any updates for OTC brokers in 2022? I am shopping for a new broker. TDA is good for blue chips, but $6.95 for the OTC sub-pennies I like to play

Hi guys, I need your opinion about

transfer an account that consists in otc stocks

from an account to another one.

The story is:

I passed years with Tradestation and I was pretty satisfied because they are good for trading otc stocks.

But since June they starts to go out of otc markets,

for me the conseguence was that many of my tickers will be not liquidable but only transferrable to another broker.

For this reason I called E*trade and asked them if was doable and they told me no problem to transfer my account, telling me no limitations about the shares type (nasdaq, nyse or otc).

Now however, trying to transfer my whole account from Tradestation, it appears that E*trade doesn't want my otc stocks.

For me it's unfair, and now I will ask to you if a broker exists that allows you to transfer inside it an account with otc stocks:

all my tickers, despite they are otc stocks, have a real market, liquidity/volatility and bid/ask ratio, so it's reasonable easy to can sell it at market.

Etrade killed my OTC L2 for reasons they can't explain. Trying out TDA and Thinkorswim. Noticed ToS doesn't display the full bid/ask stack of MMs on their L2 for OTC stocks. Can this be fixed?

No. As of an hour or so ago this stock certificate is worth over $22,000.

Any ideas of how to cash this. Willing to accept 75% of value????

Did you ever find a broker who would accept OTC stocks for transfer in?

Do any of you know a broker that allows buys for caveat emptor OTC stocks?

Etrade - No

Fidelity - No

Ameritrade - No

I want one that has no limitations if possible.

I’m unlucky I guess because I saw that they would allow to hold and sell and when I talked to a trader to try and place the sell order because I was unable to he said they the clearing company was not clearing my particular ticker which I thought was pretty crappy of them since it costed me about 10 grand at the time and they said right on there in November you would be able to sell.

eTrade will allow me to sell my CE but can’t buy... gl

Does anyone know of any brokerages that will trade caveat emptor penny stocks? I have held one forever that now has some volume and I am actually up 5,000$ on it but etrade will not let me sell it so I have to try and transfer it to another broker. I tried Fidelity as well but no luck either. It has volume so I know some brokerages are trading it.

Does anyone know of anyone who can accept a penny stock certificate. I have 2.8 million shares worth about $20,000 currently in electronic form with transfer agent.

Please private message me. Willing to accept 80 cents on the dollar

When did the brokers start charging finra fees as much as your trade commission?

When robinhood made them all start free commission trades?

Which is actually completely deceiving by the brokerages because none of them offer free OTCM trading. Except maybe the shaky newer online brokerages.

thx.

It's a load of BS it's profit driven and they'le never be forth coming about it.

When they gave me the same speech about how they felt like they were doing me a favor I said did you fly out to the company and do on site research? nope didn't think so. how can you justify telling me I don't know what I'm investing in if you know less than I do?

I asked 43 different ways if there was a workaround. Even the guy on the advanced elite team kind of had this disappointed sad notation to his voice when communicating with me about my concerns on these new changes. everything is going on deaf ears and nothing is being hurt at the top I used to be able to get to the top and now you can't they've put up a huge wall and are ignoring everybody's concerns. it's really ashame to watch a beloved firm go to the s******.

Agree, I started out with Scottrade and had to call the office often to trade restricted tickers... moving to eTrade solved that restriction problem... Over the years there’s only been a handful tickers eT restricted from buying... I didn’t think twice about it, figured if their restricting must be for a good reason... now their restricting CE for my own good? wtf

I saw this coming 100 miles away. I came here looking for options once JP was interested in Etrade and my oh frucks alarm began blarring...

If you can't be on the buy side how can you audit a company? nevada law 78.125 says I'm entitled to audit a company but you can't audit if you can't build positions to then hold management accountable. should be argued in court to fight these restrictions by various brokers I simple haven't the capital to allocate to addressing big brother over my shoulder.

Nobody needs a baby sitter! eh hem Etrade you listening? If somebody does or think they do then ?? they should stick with higher tiered securities in higher quality exchanges regarding transparency for your incompetence or simply put laziness in doing your homework.

Morgan Stanley what's happing to eTrade... pay 4.95 trade can't have an OTC scanner? My understanding eTrade was using Trade Ideas or similar... I may go with iHub trader Alerts till decide on a subscription... eTrade pissing me off can't buy CE stocks now... now scanner is gone...

Please let me know what you find.

This is all is use. Not sure wtf they are thinking

eTrade Pro no longer supports/has a scanner... best option Trade Ideas? Any thoughts on a good OTC scanner...

Is that still an issue?

"Serious problems with INTERACTIVE BROKERS, I cannot buy most of the OTC PINKS companies and they have blocked part of my portfolio accusing me of "sharp" "

Many of us are looking for brokers who will let us buy OTC and grey sheet stocks with our Mother screwing with us, including CE Caveat Emptor stocks, as the Big 4, as of Jan 31st, will all no longer allow the purchase of Caveat Emptor stocks

(2 already have gotten totally absurd),

even ones that are not on grey sheets but that have been taken over by court order as custodial stocks, for Instance, that are current with the State SOS sites...would be blocked from buying.

We are looking for a good Broker that allows the OTC PINK to be negotiated in EUROPE without restrictions, specifically for Spain or France, currently it is working with INTERACTIVE BROKERS but they have many restrictions, they do not allow companies such as PUGE, XNNHQ, ZAAG etc ...

It is very serious, I have been accumulating PUGE for a year, this Monday I reached 0.0040 a 4,000% and IB did not let me sell a single share because it was restricted, losing the opportunity to obtain a benefit of more than $ 10,000

Hello all. I have a question. I have traded off and on for a few years on OTC and penny stocks. I would like to get more into this and would like information about margin accounts and day trading. As of now once I sell a stock, I have to wait three days for that money to be used again. I know there are those of you who are able to jump in and out of stocks quickly (without the three day wait). If anyone has any advice or can point me in the right direction I would greatly appreciate it.

This is terrible, it is time to change broker.

Thank you very much for the information.

Corner of Berkshire & Fairfax Message Board.

https://www.cornerofberkshireandfairfax.ca/forum/general-discussion/i-am-done-with-interactive-brokers!/10/

"Just a heads up for folks on the forum that use Interactive Brokers for some of their business - they have a new policy where they will lock you out from trading any security you own more than 1% of the outstanding shares of. When you tell them you are not an affiliate of the issuer, a compliance analyst at IB will perform due diligence to verify you are not an affiliated person. Then they will unlock your accounts to trade that security for a period of 2 weeks. Then you have to do it all over again. Every two weeks - unless you transfer the shares out to another broker.

Some companies are quite small and 1% of the shares is nothing. These also tend to be the least liquid securities to trade. The kind of securities you need to be unlocked for trading at all times in order to take advantage of momentary liquidity and price changes."

"Yes, it’s fucking terrible. To make it worse, on top of the 1% rule they seem to select positions arbitrarily, e.g. I also got restricted from trading in some securities where I own far, far less than 1%. I also hear from people that they can trade some stocks in one account but not in another. All seems quite a clusterfuck and if they keep this up I’ll probably have to move a significant part of my account elsewhere."

"The poor compliance guy I spoke to yesterday (David) sounded like he had been being screamed at by customers all day. He kept expecting me to blow up on him or something. I felt bad for the guy.. He couldn't even tell me where the cut-off of ownership was - all he would say is "something like 3/4 to 1% of shares outstanding." The main issue I'm dealing with I'm at 3% of shares outstanding and that's not close where I can sell a few over two weeks time and have them leave me alone.

We'll see how this policy evolves after they've had to do this dance every two weeks in perpetuity for a while. Its not like I'm magically going to transform into an affiliated person next month."

INTERACTIVE BROKERS, is restricting the negotiation to a large part of pennystocks, I think that they are not acting with transparency, they allow you to open the position but then they block you saying that they have to study if you are an "affiliate" and they do not allow you to close the position.

Serious problems with INTERACTIVE BROKERS, I cannot buy most of the OTC PINKS companies and they have blocked part of my portfolio accusing me of "sharp"

Anyone else have happened ? I am filing a lawsuit, due to this incident I have not been able to close positions and now I am handicapped!

What is strange is that this week INTERACTIVE BROKERS @IBKR sponsors @Investors_Hub

I once had an account with choicetrade and they charged about 3000 usd for book shares of a otcbq stock. now they do not take them anymore.

the company I have book shares in has the intention to uplist and doing a R/S as well. the question is, will they take the shares after the R/S (when they would be at 5.00-7.00 dollar but s till on the otc? or do we have to wait for uplisting, which can take some more time?

I called them last year, but have yet to get up the courage to call again as it seemed they charged a very large commission and something like 2k just to open the account...that could have changed or I could be remembering it incorrectly. I likely will have to call them next week. The stock I have is about to undergo a 100 to 1 reverse split so it will go rom 2 cents to 2 dollars so maybe they can get off the pink sheets and then I can get it into a regular account (symbol is krbf). I have a very large position so solving this problem would be a great help. I even tried up in Canada by calling Haywood and they no longer take pink sheet transfers.

thanks. I did not find any yet. Alpine Securities is at the end better than nothing.do you know what they charge?

I have the same question as the last post, a broker to take electronic transfer of a 2 cent stock position of size...hope someone can help. So far I found Alpine Securities will but they are extremely expensive. So hopefully someone knows something more reasonable.

hi guys. does anyone know what broker would take book shares (electronical certificates) from otc companies? I tried E-trade, interactive brokers, choicetrade - nothing. they don´t take it (anymore)

thanks a lot for some help

Anyone have any idea why E*TRADE Pro Level 2 stopped showing quotes for OTC stocks? I contacted them and they told me it’s not guaranteed for OTC but it’s been working forever.

Pls can anybody explain to me this 20% liquidity rule

STOCK BLOWING MONEY ON BLOATED OS TICKERS! STOP WASTING MONEY WITH SUB PENNY $VNUE DUMP IT AND BY $RMSL A TRUE LOW O/S DOLLAR STOCK WITH LOW FLAT LOW OS. WHILE YOU STUCK WITH A STOCK THAT WILL NEVER SEE A PENNY WE WILL WILL BE IN THE DOLLAR RANGE SOON!

I need a OTC broker that I can us for after hour trading, hidden limit & sell orders, & has set fees as I normal buy millions of shares every trade, any ideas what would be a good one for me?

Nothing.

They no longer wanted a relationship with me.

Like when Twitter shuts down your profile. Your screwed with zero reasoning.

Doesn’t matter now. I set up wire transfers from TDA to my Etrade and used a $20k block to sell and buy all my shares to myself.

The remainig shears and old dividend positions unconverted with no market, TDA will probably take possession of my property. Even if it has no value. Bastards.

I’m done with TDA.

If I used this account t for big board positions, no problem.

But this is my casino play account from way back.

Brokers will not transfer micro caps.

FNHI had me up $85k this week.

$135k post R/S fun few days.

It settled back down.

Wish my stink’n Intel would run like that

What did the letter say?

|

Followers

|

76

|

Posters

|

|

|

Posts (Today)

|

0

|

Posts (Total)

|

841

|

|

Created

|

04/09/09

|

Type

|

Free

|

| Moderators | |||

PUMP your favorite broker(s) and tell us why we should use them!

BASH the crummy ones and tell us why we should not use them!

The brokerages are based on a five thumb rating system. Please note that I bear sole responsibility for the opinions provided of these brokerages represented in the table below. I encourage you to quibble if you feel a rating is unjustified (either positively or negatively).

PLEASE NOTE WELL: The reviews in the table below are as unbiased as humanly possible. The thumb ratings are a sum of feedback from my own personal use, friends and associates comments, and other research I've done online. None of these brokerages are compensating me in any way.

ALSO REMEMBER: These ratings are in the context of the broker's usefulness for OTC trading. Many of the brokers that are unacceptable for OTC trading are great for big board issues. So everything posted about these brokers on this board are run through the filter of how it works for trading OTC stocks!

5 Thumbs = Out of this World Incredibly Awesome WOW

4 Thumbs = Truly Excellent

3 Thumbs = Acceptable but not writing home about it

2 Thumbs = Unacceptable and shoddy

1 Thumb = Truly Poor

| Brokerage Name | Trading Cost | Executions | Customer Service | Trading Platforms / Software | Online Buying Restrictions | Other Fees | Market Maker Routes | Other Notes | Actual User Reviews |

| Overall Rating for OTC Trading:

|

$7.95-$14.95 online trading Broker assisted = mor |

Provides some of the worst executions for BB and Pink Sheets issues of any major broker.

|

Better not to call unless emergency situation! Most of the customer service reps have zero understanding of the OTC investors' needs and desires. |

Etrade has one of the best trading platforms around...the Power Etrade Pro platform absolutely rocks. Too bad everything else about Etrade is horrible for OTC folks. |

Certainly not as aggressive as Scottrade is in restricting some issues to call in orders only. But still above average in the number of issues it restricts. |

There is a crazy $40 per month inactivity fee. There are some other ones but certainly not bad. |

Very poor selection of routes, and you can only choose other routes if you have the Power Etrade Pro status (which you have to achieve through # of trades or through monthly fees). |

I have personally used E*trade over a period of several years and would never recommend them if you plan to trade OTC issues. | Link #1 |

| Overall Rating for OTC Trading:

|

They charge % commissions on low priced stock. Will average you about $15-20 per trade (one way). |

One of Scottrade's best features is the quality of their executions. They use NITE primarily. | Probably the best customer service in the business. Local branches. Native English speaking sharp people. Friendly, fast, and professional. | The Scottrader Elite platform is a very solid trading platform. You have to qualify for it though through balance amount or pay a monthly fee.

| Absolutely ridiculous. Scottrade has lost a ton of good business because of their idiotic and dictatorial rules about restricting online buying of certain issues. This alone is enough to make the real OTC pro have at least one other brokerage account besides Scottrade. | Reasonable. | Terrible selection of routes. |

I have personally used Scottrade. I would only recommend them as your primary OTC broker if you do not plan to trade actively (i.e. less than 2 trades per week). | |

| Overall Rating for OTC Trading: | $9.99 per trade which is high for trading OTC | Executions are very good! | Pretty hard to beat TDA for customer service | Good platform and decent charting tools | They do restrict some OTC's but are by far better than Scottrade which is horrible | Link #1 | |||

| Overall Rating for OTC Trading: |

Maximum share size is 999,999. When playing triple zero stocks this could amount to quite a bit more in commission. | ||||||||

| Overall Rating for OTC Trading: | |||||||||

| Overall Rating for OTC Trading:

|

Extremely reasonable trading costs as low as $2.95 per trade for high volume traders. If you have a decent sized balance you can call and negotiate a lower price. Average cost is about $7-8 per trade. | Not the greatest executions, but certainly acceptable. To buy, I've found NITE or UBSS to be the most effective. To sell, I've found NITE, HDSN, or DOMS to be the best. | Informed, capable, and professional customer service is the norm. | They offer the DAS Trader Pro platform. This is an industry standard and you'll find it at several of the more "professional" discount brokerages. | They very rarely restrict issues to online buying. | Since Speedtrader clears through Penson, you can get nickeled and dimed when trading OTC issues. This is standard with Penson though, and any brokerage you use that clears through them will have at least some hidden fees imposed by Penson. | Fantastic selection of free or extremely low priced market maker routes. |

Clears through Penson. | |

| Overall Rating for OTC Trading |

$2.50 per trade is tough to beat! Low commissions are the claim to fame for Just2Trade. | Very good on the executions. They have GTC for OTC's | Always prompt and helpful via email or phone. | They have a basic trading platform and a L2 which services the big boards only at no extra cost. Nothing fancy but the price is right. | NO restricted stocks!!!! | | Everthing routed thru ETMM | Excellent bang for your buck! Clears through Legent. I think right now, to trade both OTC, Nasdaq and options, its one of better ones out there. | |

| Overall Rating for OTC Trading:

| $4.50 per trade and you get 10 freebies if you have 25 executions within that month. Also if you maintain a $25,000 balance you automatically get 10 freebies per month |

|

Customer service is not the best compared to others. |

They use asp.net software. not dynamic. not good for day trading. |

No restriction for most of the stocks |

No hidden fees |

PERT/NITE |

Their trading platform is very basic and is not dyanamic. Trading platform jams up during trading hours making you feel helpless. Stay away. Zecco is the worst we have out there. You are paying for your trades in other ways besides money with Zecco! Frustration, time, etc. | |

| Overall Rating for OTC Trading: | |||||||||

| Overall Rating for OTC Trading: | $7.95 per trade with a minimum $500 to open a cash account | ||||||||

| Ovrerall Rating for OTC Trading: | |||||||||

| Overall Rating for OTC Trading: | |||||||||

| Overall Rating for OTC Trading: | |||||||||

| Overall Rating for OTC Trading: | |||||||||

| Overall Rating for OTC Trading: | commissions are ridiculous. You will loose more than you make.. 10$ comission plus other fees. Just for round trip you are paying close to 30$. | fast | Forget it | DAS | No rest | lots of them. Stay away. not for retail customers.... | few routes... bu they suck | On the whole, i would give them a one star.... | |

| Overall Rating for OTC Trading: | Post R/S shares appear and are fully tradeable extremely quickly. | LINK#1 | |||||||

| Overall Rating for OTC Trading: | |||||||||

| Overall Rating for OTC Trading: | |||||||||

| Overall Rating for OTC Trading: | |||||||||

| Overall Rating for OTC Trading:

|

Initial cost is not too bad but they will really kill you in extra fees that "the MMs charge us." Don't use TradeKing if you plan to trade OTC issues, period. |

Selling OTC shares was a real challenge with these guys. |

Completely unacceptable. Rude, unprofessional, quick-tempered, fast-talking jerks on the take IMO! |

They don't have much to offer in the way of trading platforms for OTC investors. |

I found this to be acceptable. |

Outrageous hidden fees for buying OTC issues. They accused me of trading "foreign" stocks when I had purchased HMGP. |

No choices. You buy and sell their way or no way. |

I personally used TradeKing for about 2 years. I signed up because of a sign-up bonus. I found the customer service to be rude, impatient, and unhelpful. They tried to charge me several hundred dollars months after I made a few OTC trades because they said these fees were being imposed on them by the market makers. Bunch of baloney IMO. | LINK#1 |

| Overall Rating for OTC Trading: | Self clearing. | ||||||||

| Overall Rating for OTC Trading: | |||||||||

| Overall Rating for OTC Trading: | |||||||||

| Overall Rating for OTC Trading: | |||||||||

| Overall Rating for OTC Trading: | |||||||||

| Your Broker Here! | ??? | ??? | ??? | ??? | ??? | ??? | ??? | ??? | ??? |

| Please post or PM to me others to add to this growing list!

Full Service Brokers If you are a broker that caters to OTC investors, by all means tell us about your service!!!

| |||||||||

| Volume | |

| Day Range: | |

| Bid Price | |

| Ask Price | |

| Last Trade Time: |