Register for free to join our community of investors and share your ideas. You will also get access to streaming quotes, interactive charts, trades, portfolio, live options flow and more tools.

Ironically, that's about how much cash I'm sitting on!!

I'm not jumping in anytime soon though.

A See's candy store I presume?

Warren Buffett has to feel like a kid in a candy store here today, with around $340 Billion to deploy

Pshawww! I made the list!

In the early 1980s, Mr. Rakesh Jhunjhunwala began his investment journey by investing in small stocks. However, he had a strong investment philosophy which was based on heavy market research and a long-term approach to investment. This made him identify undervalued companies with strong growth potential

No. Sorry fung. But I think bar1080 may have been 11th or 12th. 😎

Did you see fung_derf on the list?

Geez, not sure how safe Government securities will be in the future.

A number of good stocks, but huge operating earnings have also boosted BRK shares, not to mention the large cash pile of well over $300 Billion invested in Government securities mostly.

My guess is KO was one of the stocks that saved Warren, just as it has me.

Did you see fung_derf on the list?

Thanks PC. I was wondering whether WB moved up the list

"Saw a listing of the 10 wealthiest Americans yesterday and the change in their net worth this year. Warren Buffett was the only one in the green thus far this year. What a great testament to him and his wisdom."

Saw a listing of the 10 wealthiest Americans yesterday and the change in their net worth this year. Warren Buffett was the only one in the green thus far this year. What a great testament to him and his wisdom.

"The B shares came within just pennies of $500 this AM." Saw that. Nice!

People move into BRK [and gold] when they're worried. I never pay attention to price targets. All my stocks and funds have the ability to grow for ages and many have done just that. Brokerage price targets are usually ridiculously optimistic according to several studies I've read over decades. You'll never hear me (or Buffett) mention target prices.

The B shares came within just pennies of $500 this am. UBS upped its price target for BRK.B today to $557 from $536. that equates with $835.500 for the A shares.

Well, its 3%, but thats a bunch on this stock.

Yes it is! I'm sure KO has helped lately

LOL! Great positive report. Record corporate taxes paid to the US govt., which amounted to 5% of all corporate taxes paid in the US. Strong operating earnings and strong positive earnings and cash flow from the 189 operating units, in addition to the strong insurance underwriting profits and investment gains.

BRK trading at all-time highs this am.

Sure, they'll follow BRK which has a cap of 1 trillion dollars and 400,000 employees. About the country's 7th biggest corp.

"I wonder, when Warren is gone, how closely media will follow Berkshire trading decisions?"

Yeah. Warren and I have amassed about the same amount of cash lately.

I wonder, when Warren is gone, how closely media will follow Berkshire trading decisions? He carries a lot of weight.

That's some bottom fishing right there! I don't recall Warren doing that, but maybe??

American Funds has been dumping the shares.

" That's a fairly large starter position for CTZ. "

Meant to say, STZ

"Berkshire Hathaway built a position in Constellation Brands $STZ worth $1.2 Billion " That's a fairly large starter position for CTZ. Market cap about $32 billion.

fung: BRK annual report, which will detail all of the manufacturing, retail, service and other operations and operating units, and all of the significant revenue from those vast operations, will be out Saturday. Should be a great read.

Berkshire Hathaway Inc. News Release

06:30:00 AM ET, 02/18/2025 - Business Wire

OMAHA, Neb.--(BUSINESS WIRE)--Feb. 18, 2025--Berkshire Hathaway Inc.’s 2024 Annual Report to the shareholders will be posted on the Internet on Saturday, February 22, 2025, at approximately 8:00 a.m. eastern time where it can be accessed at www.berkshirehathaway.com. Concurrent with the posting of the Annual Report, Berkshire will also issue an earnings release.

The Annual Report will include Warren Buffett’s annual letter to shareholders as well as information about Berkshire’s financial position and results of operations. The Annual Report will also include information regarding Berkshire’s Shareholders Meeting to be held on Saturday, May 3, 2025 and related events.

Berkshire Hathaway and its subsidiaries engage in diverse business activities including insurance and reinsurance, utilities and energy, freight rail transportation, manufacturing services and retailing. Common stock of the company is listed on the New York Stock Exchange, trading symbols BRK.A and BRK.B.

View source version on businesswire.com: https://www.businesswire.com/news/home/20250218829862/en/

Marc D. Hamburg

402-346-1400

Source: Berkshire Hathaway Inc.

Berkshire Shifts Legal Work to Baker McKenzie from Charlie Munger’s Firm

https://www.barrons.com/articles/berkshire-hathaway-baker-mckenzie-munger-2bd55504

She is basic accounting and bookkeeping I assume. And, in today's corporate setting auditing is much more than financial auditing, which is handled by outside CPA firm, e.g. compliance auditing. She is neither CFO nor Comptroller/Controller.

Rebecca Amick BSBA but not a CPA apparently. Been there about 40 years. Why BRK can keep secrets.

University of Nebraska at Omaha.

BSBA Accounting

1974 - 1978

I knew that and was not just thinking of it when I responded to you.

Outside counsel. That one is (or was) easy: Munger, Tolles & Olson, Charlie's law firm.

I saw Marc Hamburg's name on a BRK doc recently. "Rebecca Amick is Auditing and principal accounting officer. Never heard of her. Will look her up.

Marc Hamburg, Senior Vice President. is CFO, Kerby Ham is Treasurer, Daniel Jaksich is VP and Controller, Rebecca Amick is Auditing and principal accounting officer, Mark Millard is VP and Director of Financial Assets. This is from the 2023 Annual Report. BRK uses outside counsel, and I am not certain who its primary law firm is.

I spent a lot of time tracking down a Berkshire Hathaway logo. Turned out BRK is one of very few major corps without one! Usually it is depicted as the company name in plain ole Times new roman font and in some shade of blue. The logo I show was created by me from text, not a graphic. No logo consulting company was used... as usual with Berkshire. They do everything cheaply.

Other questions: Who is BRK's Chief Finance Officer? Who is the Chief Legal Officer? Who is the Corp Secretary?

I went to a huge amount of trouble to write this summary of BRK when I re-did the webpage intros a few years: A few things are no longer completely accurate. In writing that, I read about 15 descriptions of BRK online. It's not easy to summarize BRK in two paragraphs.

------

"Berkshire Hathaway, which began in 1839 as a textile mill, neared collapse in 1962 when 32-year-old Warren Buffett started buying control in the belief the company could be saved. Buffett initially maintained Berkshire’s textile business, but by 1967, he was expanding into other investments. Berkshire bought stock in the Government Employees Insurance Company (GEICO) that now forms the core of its colossal insurance operations. Other early acquisitions included See's Candies, Blue Chip Trading Stamps and Dairy Queen. BRK moved from the OTC to the NYSE in 1988.

Today Berkshire is a combination of 66 wholly owned subsidiaries such as the BNSF Railroad and 47 passive minority investments, notably its huge stake in Apple. As of 2021, BRK has a market cap of >$600 billion and 360,000 employees. Berkshire Hathaway is the nation's 7th largest business."

--------

Yes. None of BRK's subsidiaries, units of divisions have any separate life or identity other than as part of BRK. BRK only invests passively in the other publicly traded companies. I am not sure what you are trying to say in claiming that BRK has private holdings. BRK is a publicly traded company and all of BRK is publicly traded. What you do not seem to understand is that all of these divisions, units and subsidiaries that are all fully operated by BREK are Berkshire Hathaway. Just read the annual report and see all of the sources of its vast revenue from manufacturing, insurance, retail and services, railroad operations, etc. There are no separate entities outside BRK, and it has to recognize all of the revenue and pay taxes on it. If BRK was only holding investments it would not have to recognize such huge operational revenue each year from its various divisions, units and subsidiaries.

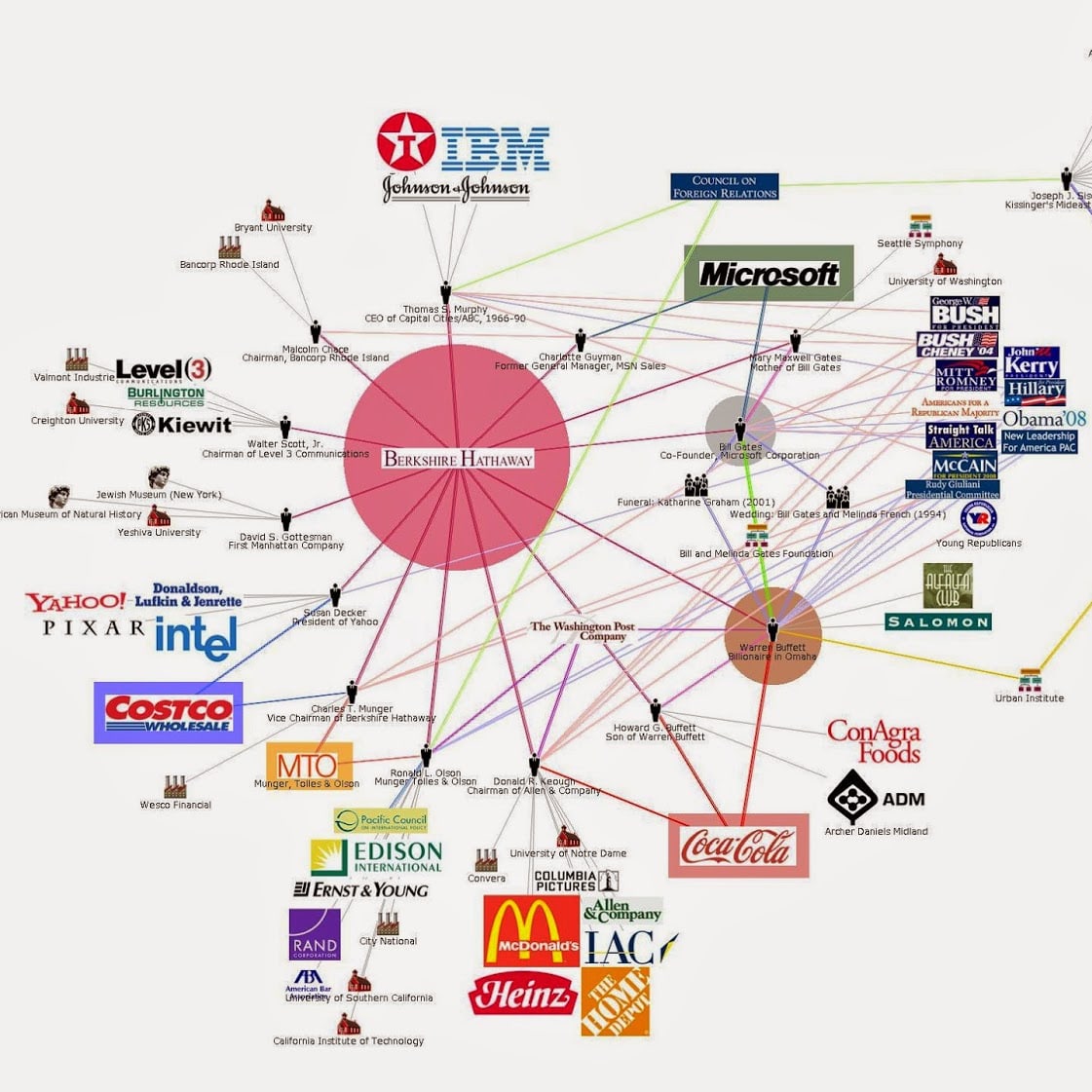

The chart you put at the bottom of your post was a chart of then BRK Board members and their other corporate and Board affiliations. BRK does not own or have investments in all of those companies.

I do understand what you are saying, but honestly, its semantics. I chose Apollo Group as a random example, but what's the difference? They both own publicly traded stock in companies and wholly owned in private holdings, they both instruct the companies how they want to be run. My daughter once worked for one of these companies that was owned by a VC, and they had to answer to them monthly.

The difference is perhaps in the taxation.

I do see how if you wish to say Berkshire produces all these products vs saying Apollo owns them, but is there really a difference?

Among the most notable companies currently owned by Apollo are Claire’s, Caesars Entertainment Corporation, Norwegian Cruise Line, Novitex Enterprise Solutions, Racksapce, and CORE Media Group.

Total AUM:

USD 455 billion

Headquarters:

New York, United States

For more than 30 years, Private Equity has been a cornerstone of Apollo’s equity platform. Our tenured team works in partnership with management teams to build stronger businesses. Recognizing one size does not fit all, Apollo Private Equity is focused on providing bespoke, innovative capital solutions to Apollo-managed funds’ portfolio companies. Our flexible and vast platform enables us to add value throughout the lifecycle of an investment.

We are responsible stewards of capital and are proud of our commitment to sustainability and demonstrated ability to generate attractive returns for our investors.

AI Overview

Berkshire Hathaway is a diversified holding company that primarily invests in a wide range of publicly traded companies across various sectors, while Apollo Holdings, part of Apollo Global Management, focuses on alternative asset investments like private equity, often targeting distressed companies or those requiring restructuring, making their investment strategy more actively involved and focused on specific opportunities compared to Berkshire's buy-and-hold approach.

Key Differences:

Investment Strategy:

Berkshire Hathaway takes a long-term, buy-and-hold approach to investing in publicly traded companies across diverse industries, while Apollo Holdings actively seeks out distressed or undervalued companies to invest in through private equity strategies, often involving debt restructuring or operational improvements.

Public vs. Private Investments:

Berkshire Hathaway primarily invests in publicly traded companies, while Apollo Holdings primarily focuses on private equity investments, which are not readily available to the general public.

Focus on Insurance:

A significant part of Berkshire Hathaway's business is derived from its large insurance operations, which generate "float" that is used for further investments, while Apollo Holdings does not have a major insurance component.

Leadership and Reputation:

Berkshire Hathaway is widely recognized for its leadership under Warren Buffett, known for his value investing philosophy, while Apollo Global Management is known for its expertise in distressed investing and complex financial transactions.

fung: This should get you started toward developing a better understanding of Berkshire Hathaway's units, production operations, and all of its units and subsidiaries in which its 400,000+ employees work. But you should also read its entire Annual Report, the new one of which should be out in the coming weeks in advance of the annual meeting in May.

https://www.bing.com/images/search?q=Berkshire+Hathaway+Org+Chart&form=IARSLK&first=1

There is a very well-developed plan in place for when that unfortunate event comes to pass. Greg Abel will take over as CEO and Howard Buffett will become non-executive Chairman, and most investors feel the company will not skip a beat. Berkshires 400,000+ employees will continue to show up for work and perform just like they were prior to the unfortunate passing. And, the publicly traded companies in which BRK has passive investments, e.g. KOK, AAPL, BAC, AXP, etc. will continue to function and kick off profits and dividends for their investors. And Ted Weschler and Todd Combs, who were hand-picked and brought in by Warre Buffett years ago to help with the investing, (each was a top money manager with similar style to Buffett) will handle the investments in outside companies.

Many believe the stock price will appreciate upon the event, and other believe it will take a hit. If BRK shares fall significantly upon his passing many will be huge buyers that day, IMO, including yours truly.

My biggest concern though has always been, what happens when Warren passes?

With all due respect fung, that is BS. BRK has all kinds of various divisions and subsidiaries that produce a wide variety of products. You simply do not seem to understand that.

OK. I still stand by my point that Berkshire Hathaway is an investment company and not a production company.

I think you're arguing semantics.

My biggest concern though has always been, what happens when Warren passes?

Of course he and Charlie had stayed healthy much longer than I expected.

None of BRK's wholly owned operating companies and divisions are a separate or standalone public or a private company any more. They are all just part of Berkshire Hathaway and report to its executives and are overseen by the Board of Directors of BRK. Apollo is not in any way comparable or similar to BRK.

They both own companies both public and private wholly.

Yep, most Ihubbers think BRK consists of two *really* old guys sitting around betting on stocks based on hunches, whims and silly charts.

LMFAO! Absolutely not. Apollo is an asset management company more akin to a hedge fund. They also loan money to companies. Other than BRK's stock investments they own and operate everything outright. You really do not have a clue as to what BRK is. You should do come DD and read its annual report.

So, you are saying Berkshire Hathaway is on par with this corporation?

https://www.apollo.com/

Fung: what else do you think a corporate subsidiary or operating division is? BRK does not just own these operations. It operates them, and in every case the managers and CEO's report directly to Warren Buffet or another corporate officer in Omaha. And, BRK's some of the corporate officers, e.g. Ajit Jain, Greg Abel and Todd Combs, are actually CEO's or managers in some of these operating divisions. In a typical year, the majority of BRK's revenue and earnings come from the manufacturing, services and retail division, as opposed to the railroad, energy and insurance divisions. The fact that these operating companies and divisions retain their brand and names does not change the fact that they do not exist in any form other than as an operating division or subsidiary of Berkshire Hathaway. As International Dairy Queen states on its website, it is a Subsidiary of Berkshire Hathaway. All of the revenue and earnings from the Dairy Queen operations are Berkshire Hathaway's revenue and earnings and are reported as such by BRK. It is really pretty simple, and it is a very large collection of profitable operation divisions and companies, including the world's largest jewelry retailer and the world's largest home furnishings retailer. And, all of the revenues and earnings are BRK's revenue and earnings, unlike a separate company in which BRK simply has an investment, but which is not part of BRK.

You can want to classify it however you wish, but owning a company is different than making a product yourself.

I can give you thousands of examples but it seems moot.

LOL!...I guess if the desire is to feel superior to the norm, this is the place to be!

LMAO! They are all subsidiaries, or operating companies and divisions of BRK. BRK has passive stock investments in AAPL, BAC, AXP, etc., but the divisions and operations to which I referred are all subsidiaries or operating divisions operated by BRK. You obviously do not understand BRK or its operations. When BRK acquires a manufacturer or other company outright and merges it in, it is no different than when one bank acquires another and merges in all operations. Berkshire may make Peanut Butter parfaits in its Dairy Queen operations. All of the revenue and earnings of every one of those operating companies inure to BRK as its own operating earnings. You should do some DD and read the annual report.

and a whole host of other wholly owned operating companies

One reason I'm on IHUB is I enjoy observing monumentally dumb investing. For that, IHUB hits the motherlode.

"I'd say 90% are either idiots or scammers looking for idiots" Yes, nicely put.

Not true fung. BRK operating divisions and companies produce all kinds of products from manufactured homes, running shoes (Brooks), high tech airplane parts, medical devices, underwear and apparel (Fruit of the Loom), paints (Benjamin Moore & Co.), candies (See's), cowboy boots (Tony Lama), chemicals and industrial lubricants (Lubrizol), carbide metal cutting tools, agricultural systems, plumbing and refrigeration supplies, carpet and flooring products (Shaw), building insulation and industrial and mechanical insulation (Johns Manville), bricks and concrete block (ACME), high quality kitchen products (Pampered Chef), RV's, buses and boats, including the Jimmy Buffett themed Pontoon boat (Forest River) to name just a few, and a whole host of other wholly owned operating companies in the manufacturing sector. Marmon Holdings alone (wholly owned subsidiary of BRK) is comprised of 11 diverse business groups and more than 100 autonomous manufacturing and services businesses. Not to mention Pilot/Flying J truck stops, which are a wholly owned operating division of BRK, as well as NetJets, the automotive group, which owns 105 new vehicle franchises through 82 Dealerships in the US, and BRK Home services Real Estate Business.

It is totally inaccurate to claim that Berkshire Hathaway does not produce anything.

IHUB is NOT a good sample of intelligent investors.

I'd say 90% are either idiots or scammers looking for idiots

|

Followers

|

45

|

Posters

|

|

|

Posts (Today)

|

2

|

Posts (Total)

|

1221

|

|

Created

|

06/27/06

|

Type

|

Free

|

| Moderators bar1080 Prudent Capitalist | |||

Berkshire Hathaway, Inc NYSE: Symbols BRK-A Class A shares BRK-B Class B shares | Berkshire Hathaway, which began in 1839 as a textile mill, neared collapse in 1962 when 32-year old Warren Buffett started buying control in the belief the company could be saved. Buffett initially maintained Berkshire’s textile business, but by 1967, he was expanding into other investments. Berkshire bought stock in the Government Employees Insurance Company (GEICO) that now forms the core of its colossal insurance operations. Other early acquisitions included See's Candies, Blue Chip Trading Stamps and Dairy Queen. BRK moved from the OTC to the NYSE in 1988. Today Berkshire is a combination of 66 wholly owned subsidiaries such as the BNSF Railroad and 47 passive minority investments, notably its huge stake in Apple. As of 2021, BRK has a market cap of >$600 billion and 360,000 employees. Berkshire Hathaway is the nation's 7th largest business. |

Useful Links Berkshire Subsidiary Companies Buffett's Famous Annual Letters BRK Portfolio Tracker CNBC Buffett Archive http://www.BerkshireHathaway.com/ Buffett's office in Omaha. His desk has no computer Headquarters Address 3555 Farnam Street Omaha, NE 68131 a | |

| |

| Volume: | 1,087 |

| Day Range: | 786761.00 - 807838.43 |

| Last Trade Time: | 7:00:00 PM EDT |

| Volume | |

| Day Range: | |

| Bid Price | |

| Ask Price | |

| Last Trade Time: |