Register for free to join our community of investors and share your ideas. You will also get access to streaming quotes, interactive charts, trades, portfolio, live options flow and more tools.

wtf is the matter with you guys( is that racist too?) assuming your gender?

Yikes, bad look right there. "I'm not racist, I just post a lot of racist things"

This you bro spreading this racist 💩? https://investorshub.advfn.com/boards/read_msg.aspx?message_id=175055909

Got some nuts for you right here

This kid Jake hustles me for 15k, then I'm insinuated to be and straight up called a monkey and yet somehow that's ok? Scrambling to somehow justify racist remarks and behavior that I am sure are in clear violation of posting rules. A normal response from a civilized human being with decency would have been to apologize for such a remark instead of looking to make excuses for it or worse yet calling it a game. What do you mean well played? I'm not playing any games.

Are you out of your mind?

On another note China is giving out money to the unfortunate and their economy is starting a boom!! It's no doubt we will be following!! Be prepared!!

Missed that comment-- Oh well! Now We wait for the "pinks"-- going to look for my peanuts- Good night!

Nah, you missed it!! That's his true colors coming through!! Remember when I made that morality comment saying did he feel for my ancestors he blew his top!!

no idea-- must be associated with some type of complex! The post was me eating peanuts!!! GEEZE

I had to double back!! Why would he associate a monkey with a so called African American person?? Just so happens I'm in Cali now and they routinely leave banana peels everywhere I go!! I didn't grow up around that so at first I didn't get it!!

YOU MADE it RACIST- it was not a racist comment. SMH

EXACTLY!

The last two posts should tell you the exact type of person we are dealing with,

Since the other Doe doe bird had enough sense not to address me with that foolishness I'll ignore him!! You two have no excuse on earth to be harassing someone half your age for this long!! It's clear this has nothing to do with investing!!

Well played!! I served that one right up for you!! I would never call you a monkey!! If he showed a video of a Doe doe bird I would have agreed!! Lol!!

Yes, none racists people and a person with adopted kids. You think we're animals, meanwhile we are simply trying to end racism and get humans treated as humans and not animals to be mocked. Thats so 1900's cartoon like, I thought we were past this sort of racism...

Got to remember, they are only pumping this to get exit liquidity. Check their posts post pump in other stocks, mocking people for believing them and buying their shares. They arent good people, them being racist doesnt shock me. If someone called my kid a monkey Id light them up.

Can't believe this person called me a monkey. Guessing that they just assumed that I was Caucasian. The other person who's posting racist material had no problem with taking down posts with information that pertained to Jake but yet he'll leave up racist posts without even a second thought or batting an eye. Y'all need Jesus.

The last two posts should tell you the exact type of person we are dealing with,

As someone with 4 African American family members I find it disgusting and racist as well. Fits in with Jakey pretty well.

Being a person of African American descent I find your comment calling me a monkey to be offensive, rude, disgusting, uncalled for and extremely racist,

Also if you're referring to Wally!! Don't insult the Monkey 🙊 LOL!!

Man, I was looking at that amazing background!! Never seen anything like it!!

I enjoy the figure it out side much more than never will side!!

Play stupid games, win stupid prizes

You clear one hurdle there's always one awaiting!! Jake is in the beginning stages of learning this game!! Once he figures this out he will come out on the other side much wiser and richer!!

Where is your fearless leader? Cat got his tongue? Oh, that is right, he is too busy BLASTING his other pubco's PPS with a 99.99% increase in the OS and UR shares 🤣

did the peanut gallery take the day off???

Aw come on man!! Brett Farve announced he has Parkinson's disease during a hearing about him stealing welfare funds!! Let's here it caped crusaders!! You guys want to fight crime right?? Lol!!

All Eyez on you Jake!! Can you handle the pressure?? If so you have a lot of lucrative years ahead of you!!

Almost October!! This has always been my time of the year!! 4th quarter has always been good to me!! Except when I was a Browns fan!! Lol!!

All publicity is good!! Just keep working!! Lol!!

#1 on the BOB-- so sad! TERRIBLE OTC markets

guessing we will have another zero vol day

Views picking up. When we get back to trading again, then this flies

Let's look at Jake's other ticker SONG. This is what Jake P. Noch calls adding shareholder value.

The same game plan is being implemented here with BCAP. Watch Jake P. Noch abuse 3a10 to massively dilute this stock in the near future with a very high probability of a reverse split once he dumps as much as he can just like he pretty much wiped out investors in SONG.

Jake P. Noch - BCAP CEO part 2

https://www.vice.com/en/article/v7gmvd/spotify-sues-self-described-music-prodigy-who-allegedly-ran-royalties-scam

Spotify Sues Self-Described 'Music Prodigy' Who Allegedly Ran Royalties Scam

Spotify says Jake Noch "[generated] hundreds of millions of fraudulent streams" and engaged in "title track parasitism" among other fraudulent practices on its platform.

JC

By Jelisa Castrodale

May 19, 2020, 4:38pm

Last November, the 20-year-old head of indie hip-hop label Sosa Entertainment filed a massive (and massively complicated) lawsuit against Spotify, alleging that the digital music service hadn't paid royalties on more than 550 million streams of its songs. According to Billboard, Sosa Entertainment founder Jake Noch also named his other company, PRO Music Rights, as a plaintiff in the lawsuit, and the co-plaintiffs sought millions of dollars in damages, asking for $150,000 for each infringement.

Noch's lawsuit accused Spotify of a number of transgressions, including unfair and deceptive business practices, willfully removing Sosa Entertainment's content, "obliterating" his expectations, and refusing to pay royalties. In a statement, Noch said that he was willing to "fight to the end" if it meant that Spotify would ultimately compensate the artists who were affected.

"I have a duty to see this through so that I can pay my artists what they are owed from Spotify," he said. "I know others feel the same way as I blaze this trail for the music community, who I know is behind me and roots for our success in bringing down Spotify."

Part of Noch's problems with the company started in the spring of 2017 when Spotify removed all of Sosa Entertainment's song's from its servers and "blanket banned" Noch and his companies from using the platform going forward. According to Noch—who describes himself as a "musical prodigy" in his lawsuit—Spotify informed him that the songs were removed because of "abnormal streaming activity," but the company didn't give him the opportunity to explain what could've caused the weird-looking streaming data. Noch has alleged that Spotify just "fabricated a reason" to kick him off the platform, in an attempt to avoid having to pay the royalties that he was due.

But in its own countersuit, filed on Monday, Spotify says no, it was just because of the abnormal streaming, and also because Noch allegedly "designed a scheme to artificially generate hundreds of millions of fraudulent streams" in order to game the system and rack up a ton of royalty payments.

"Starting in 2016, Noch designed a scheme to artificially generate hundreds of millions of fraudulent streams on songs he had seeded on Spotify’s online music-streaming service," the company's complaint reads. "Noch’s objective was plain: to manipulate Spotify’s system to extract undeserved royalties at the expense of hardworking artists and songwriters."

Billboard reports that Spotify removed Noch's content from its platform after being contacted by a whistleblower who claimed that Noch had instructed a bot farmer to create literally millions of fake accounts to stream songs from the Sosa Entertainment catalog. Spotify's own analysts became suspicious when one of Noch's records went from zero streams to 400,000 in under a week, while a second album racked up 749,000 streams in two days. (Spotify also apparently determined that 5,500 of the accounts that played the latter record supposedly all lived in the same American town—even though the town's total population was just around 10,000 people.)

The company has also accused Noch of "title track parasitism," which involves uploading songs with the same name and punctuation of legitimate hit songs. Spotify's legal filing identified two "AI-generated sound loops" that had been given the same name as then-popular tracks by DJ Snake and XXXTentacion.

"This was one of the most egregious fraudulent streaming operations from a single rights holder that Spotify had to deal with in its company’s history," Spotify wrote in its complaint. The company's countersuit is asking for compensation for a long list of Noch's alleged transgressions, including fraud, fraudulent concealment, breach of contract, indemnification, unjust enrichment and deceptive business practices.

Damn, most 20-year-olds can only dream of being dragged that hard by an international streaming service. A musical prodigy, indeed.

Jake P. Noch - BCAP CEO part 1

https://www.vice.com/en/article/v7gmvd/spotify-sues-self-described-music-prodigy-who-allegedly-ran-royalties-scam

Spotify Sues Self-Described 'Music Prodigy' Who Allegedly Ran Royalties Scam

Spotify says Jake Noch "[generated] hundreds of millions of fraudulent streams" and engaged in "title track parasitism" among other fraudulent practices on its platform.

JC

By Jelisa Castrodale

May 19, 2020, 4:38pm

Last November, the 20-year-old head of indie hip-hop label Sosa Entertainment filed a massive (and massively complicated) lawsuit against Spotify, alleging that the digital music service hadn't paid royalties on more than 550 million streams of its songs. According to Billboard, Sosa Entertainment founder Jake Noch also named his other company, PRO Music Rights, as a plaintiff in the lawsuit, and the co-plaintiffs sought millions of dollars in damages, asking for $150,000 for each infringement.

Noch's lawsuit accused Spotify of a number of transgressions, including unfair and deceptive business practices, willfully removing Sosa Entertainment's content, "obliterating" his expectations, and refusing to pay royalties. In a statement, Noch said that he was willing to "fight to the end" if it meant that Spotify would ultimately compensate the artists who were affected.

"I have a duty to see this through so that I can pay my artists what they are owed from Spotify," he said. "I know others feel the same way as I blaze this trail for the music community, who I know is behind me and roots for our success in bringing down Spotify."

Part of Noch's problems with the company started in the spring of 2017 when Spotify removed all of Sosa Entertainment's song's from its servers and "blanket banned" Noch and his companies from using the platform going forward. According to Noch—who describes himself as a "musical prodigy" in his lawsuit—Spotify informed him that the songs were removed because of "abnormal streaming activity," but the company didn't give him the opportunity to explain what could've caused the weird-looking streaming data. Noch has alleged that Spotify just "fabricated a reason" to kick him off the platform, in an attempt to avoid having to pay the royalties that he was due.

But in its own countersuit, filed on Monday, Spotify says no, it was just because of the abnormal streaming, and also because Noch allegedly "designed a scheme to artificially generate hundreds of millions of fraudulent streams" in order to game the system and rack up a ton of royalty payments.

"Starting in 2016, Noch designed a scheme to artificially generate hundreds of millions of fraudulent streams on songs he had seeded on Spotify’s online music-streaming service," the company's complaint reads. "Noch’s objective was plain: to manipulate Spotify’s system to extract undeserved royalties at the expense of hardworking artists and songwriters."

Billboard reports that Spotify removed Noch's content from its platform after being contacted by a whistleblower who claimed that Noch had instructed a bot farmer to create literally millions of fake accounts to stream songs from the Sosa Entertainment catalog. Spotify's own analysts became suspicious when one of Noch's records went from zero streams to 400,000 in under a week, while a second album racked up 749,000 streams in two days. (Spotify also apparently determined that 5,500 of the accounts that played the latter record supposedly all lived in the same American town—even though the town's total population was just around 10,000 people.)

The company has also accused Noch of "title track parasitism," which involves uploading songs with the same name and punctuation of legitimate hit songs. Spotify's legal filing identified two "AI-generated sound loops" that had been given the same name as then-popular tracks by DJ Snake and XXXTentacion.

"This was one of the most egregious fraudulent streaming operations from a single rights holder that Spotify had to deal with in its company’s history," Spotify wrote in its complaint. The company's countersuit is asking for compensation for a long list of Noch's alleged transgressions, including fraud, fraudulent concealment, breach of contract, indemnification, unjust enrichment and deceptive business practices.

Damn, most 20-year-olds can only dream of being dragged that hard by an international streaming service. A musical prodigy, indeed.

https://www.billboard.com/pro/spotify-indie-label-streaming-fraud-millions-fake-accounts-countersuit/

Spotify Countersues Indie Label, Alleging Massive Streaming Fraud & Millions of Fake Accounts

Spotify has countersued indie label Sosa Entertainment and its founder Jake Noch, alleging massive streaming fraud, unjust enrichment and the creation of millions of fake accounts to generate…

In November 2019, indie hip-hop label Sosa Entertainment and its founder, 20-year-old Jake Noch, filed a lawsuit against Spotify that alleged the streaming service failed to pay royalties on over 550 million streams of its music. The suit, which was also brought on behalf of Noch’s PRO Pro Music Rights (which was later removed), sought $150,000 in statutory damages for each infringement, and alleged that Spotify removed its music not because it detected “abnormal streaming activity,” as the service claimed, but because it was trying to dodge paying royalties on the streams.

Now, Spotify has fired back with a countersuit alleging that Noch “designed a scheme to artificially generate hundreds of millions of fraudulent streams” in order to “manipulate Spotify’s system to extract undeserved royalties at the expense of hardworking artists and songwriters.” The filing, which is supported by screenshots of messages allegedly between Noch and a “bot farmer” and charts that show streams on Noch’s music go from zero into the hundreds of thousands in a matter of days, also alleges that Noch directed the bot farmer to create millions of fake accounts and changed the names of songs in his catalog to closely resemble those of established hit songs, like XXXTentacion’s “SAD!” and DJ Snake’s “Taki Taki.”

Spotify has countersued indie label Sosa Entertainment and its founder Jake Noch, alleging massive streaming fraud, unjust enrichment and the creation of millions of fake accounts to generate…

BY DAN RYS

In November 2019, indie hip-hop label Sosa Entertainment and its founder, 20-year-old Jake Noch, filed a lawsuit against Spotify that alleged the streaming service failed to pay royalties on over 550 million streams of its music. The suit, which was also brought on behalf of Noch’s PRO Pro Music Rights (which was later removed), sought $150,000 in statutory damages for each infringement, and alleged that Spotify removed its music not because it detected “abnormal streaming activity,” as the service claimed, but because it was trying to dodge paying royalties on the streams.

Now, Spotify has fired back with a countersuit alleging that Noch “designed a scheme to artificially generate hundreds of millions of fraudulent streams” in order to “manipulate Spotify’s system to extract undeserved royalties at the expense of hardworking artists and songwriters.” The filing, which is supported by screenshots of messages allegedly between Noch and a “bot farmer” and charts that show streams on Noch’s music go from zero into the hundreds of thousands in a matter of days, also alleges that Noch directed the bot farmer to create millions of fake accounts and changed the names of songs in his catalog to closely resemble those of established hit songs, like XXXTentacion’s “SAD!” and DJ Snake’s “Taki Taki.”

Indie Hip-Hop Label Files Suit Against Spotify Over Catalog Takedown

Noch, who lists himself as the chief executive of Sosa and Pro Music Rights, as well as a handful of additional music companies, has quite the proud litigious history, having released several press releases touting lawsuits against Spotify, Apple, Google, YouTube, Amazon, SoundCloud, Pandora, Deezer, iHeartRadio and more. Pro Music Rights claims a database of some 2 million tracks, including more than 23,000 by various artists using some form of the name “LEGATO,” like LEGATO_DIMY, LEGATODE45, LEGATODI001, LEGATOGILL2002 and LEGATOKAL999, to name a few.

According to Spotify’s counterclaim, filed Monday (May 18), the service first detected artificial streaming activity on Noch’s content in March 2016 and eventually banned his music from the service, before extending that ban to all content related to Noch. Noch then tried to “smuggle” the content back onto the service using slightly different names and created millions of fake accounts to stream that music.

In June 2016, a whistleblower contacted Spotify with screenshots that purported to show Noch directing the person to create millions (direct quote: “i need millions”) of fake accounts. And while Spotify had identified the fraud a few months prior, the company had already paid a small amount of royalties to Sosa and Noch — royalties that otherwise would have gone to legitimate songwriters with songs being streamed by legitimate fans. According to the complaint, for one of Noch’s albums that jumped from zero streams to more than 400,000 in just days, 99% of its streams came from Spotify’s ad-supported free tier and from accounts registered to male users in the United States, a pattern that was also found for other works.

Noch then changed distributors and changed the names of some of his companies in order to dodge Spotify’s fraud detection systems, with slightly different artist names, song titles and cover artwork. In one section of the complaint, attorneys wrote that “analysts at Spotify found that 5,500 ‘users’ streaming one of the Sosa albums ‘originated’ from a small American town with a total population of 10,000. For that album, the stream count jumped from zero to 749,000 streams in a span of only two days… This pattern is highly anomalous and not at all correlated to any possible pattern of genuine streaming activity.”

In another example from the complaint, in what the filing calls “title track parasitism,” Noch and Sosa uploaded tracks called “SAD!” with the same punctuation as the XXXTentacion hit, and “Taki Take,” shortly after the similarly-named DJ Snake song reached the top 20 of the Billboard Hot 100. Some of the tracks that Noch and Sosa would release on Spotify were AI-generated sound loops.

In all, Spotify’s counterclaim seeks relief for fraud, fraudulent concealment, breach of contract, indemnification, unjust enrichment and deceptive business practices. As another line in the complaint reads, “This was one of the most egregious fraudulent streaming operations from a single rights holder that Spotify had to deal with in its company’s history.”

After the publication of this story, Noch provided a comment to Billboard which reads, in part, “Spotify’s claims are laughable… I also greatly look forward to the day we get to go to court, and I hope that all of Spotify’s shareholders will pay close attention to these cases… Time will prove that we are right.”

Top of the boards!!

he's going to apply the same concept here to make this a public trading FIRM where USA will be allowed to trade Expert Market again.

If you can't comprehend how big this is, then you wouldn't understand what it is to be a trader/investor. It will change OTC forever back to Stop Sign stocks where traders are free to buy/sell any OTC Tier they want. Major USA brokerages will soon follow suit. This can be bigger than a TSNP run. It will give freedom of choice back to the individual investor.

The only small island that child Brick God Sosa will be inhabiting is Terminal Island.

https://www.bop.gov/locations/institutions/trm/

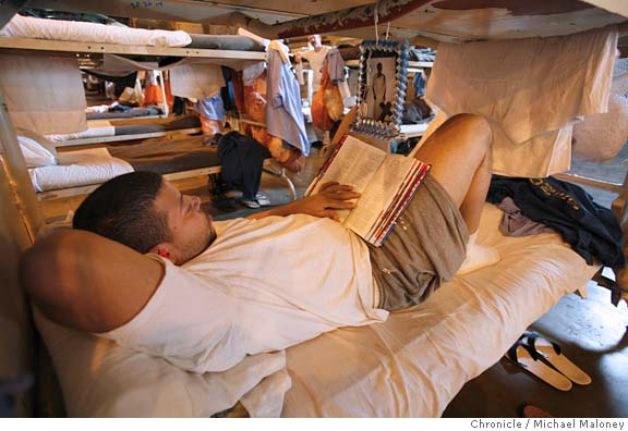

A young, small-boned, lithe, effeminate kid like Shaky Jake will be very popular in prison. Moreso if he shaves his ass. And I have no doubt that Shaky Jake is destined for Federal prison, just like Justin(e) Costello, David Russell Foley, Tovy Pustovit, Jim Bolt, Rufus Paul Harris, and other pennyscammers who thought they knew more than they did.

It's all about timing!! The market really isn't doing well enough to get the results we want!!

The game is to keep the ticker on their brains!!

and NO VOLUME-- so FUNNY!

LOL we are #1- too bad many cannot buy!

Top of the boards!! Good job fellas!! Nothing much to add!! Rates were cut so I'm looking for all markets to do well in the next few months!! Are you Prepared??

|

Followers

|

615

|

Posters

|

|

|

Posts (Today)

|

7

|

Posts (Total)

|

161828

|

|

Created

|

03/05/07

|

Type

|

Free

|

| Moderators getmoreshares Lime Time | |||

| Volume | |

| Day Range: | |

| Bid Price | |

| Ask Price | |

| Last Trade Time: |